Industry News

Timely Reporting of Workers’ Compensation Claims Lower Overall Costs

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Leading into 2022, it is important for employers to examine their workplace injury reporting practices. Specifically, employers should report all injuries including medical-only workplace injuries to their workers’ compensation insurance company. Best practices dictate all claims should be reported within the first 24 hours in order to improve treatment to the injured worker and reduce the overall cost of the claim to the employer.

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Leading into 2022, it is important for employers to examine their workplace injury reporting practices. Specifically, employers should report all injuries including medical-only workplace injuries to their workers’ compensation insurance company. Best practices dictate all claims should be reported within the first 24 hours in order to improve treatment to the injured worker and reduce the overall cost of the claim to the employer.

A recent conversation with an underwriting manager highlighted the fact that some employers are choosing to pay for occupational clinic visits rather than filing a claim, assuming that small medical-only claims will negatively impact the Experience Modification Factor (X-mod) and ensuing workers’ compensation premiums. However, in actuality claims of $250 or less do not impact the X-mod. Not only are employers legally required to report workplace injuries, but those small claims can easily turn into something bigger, if not reported in a timely manner. Further, the reporting of all incidences can assist a company in identifying trends and root causes thereby allowing for proactive measure to be taken. Rancho Mesa’s proprietary Key Performance Indicator (KPI) dashboard helps track these trends and compare a company’s performance to that of their industry. Request a KPI dashboard for your company.

Why then does reporting lag result in higher claim costs? An insurance carrier’s ability to investigate a claim, determine compensability, and identify fraud may be hindered as details of the incident fade, witnesses may no longer be available or key evidence may not be preserved. According to Liberty Mutual, a 29-day delay in reporting an injury can lead to a 33% increase in lost time, 52% higher average claim cost, and 152% increase in litigation rates. This makes sense when one considers that a delay in seeking treatment could cause an employee’s condition to worsen, extending recovery time and temporary disability payments.

Lastly, an employer paying a medical bill will pay much more than a workers’ compensation carrier would pay for that same bill as insurance companies negotiate a reduced fee schedule for occupational injuries. Bottom line, failure to report workplace incidents in a timely manner can put any organization and its employees at risk for no benefit. Contact Rancho Mesa to learn more about our Risk Management Center and how our free trainings and webinars can improve your reporting practices.

2022 Construction Dual Wage Thresholds - An Early Look

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There are 16 construction workers’ compensation class code pairs in California, each set up as dual wage classifications. The purpose of these “split” class codes allows the Workers’ Compensation Insurance Rating Bureau (WCIRB) and California insurers to better predict future risk and underwrite with more accuracy.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There are 16 construction workers’ compensation class code pairs in California, each set up as dual wage classifications. The purpose of these “split” class codes allows the Workers’ Compensation Insurance Rating Bureau (WCIRB) and California insurers to better predict future risk and underwrite with more accuracy.

To illustrate the dual wage threshold, consider a seasoned laborer with years of safety training, exposure awareness, and familiarity with jobsite protocol. This employee is going to be less of a safety risk compared to an apprentice who is still learning his or her trade, the safety techniques and all of the skill associated with a trade. As one might imagine, statistics consistently show a much higher probability of an injury occurring with an apprentice versus a seasoned veteran or journeymen. So, having a dual wage threshold allows carriers to generate pricing based on the employees’ experience and likelihood of having an injury.

Exploring how this can directly impact rates and pricing, the 2021 roofing dual wage class codes of 5552 and 5553 is a great example.

Class code 5552 is defined as roofers who make less than $27 per hour. The average California worker’s compensation insurance base rate for this class code is $40 per $100 of payroll. Class code 5553 includes roofers who make $27 or more per hour. This class code’s average California workers’ compensation insurance base rate is $20 per $100 of payroll. In this example, the workers’ compensation premium base rate is half the cost for a more experienced employee over someone with less experience.

It is crucial for any roofing contractor to be mindful of this wage threshold data knowing that the delta in the 2022 recommended increase represents a staggering 61% gap between the two base rates.

Additionally, the WCIRB has continued to increase wage thresholds. This is to keep up with inflation of the US dollar, the increase in minimum wage and the demand for labor, among other factors.

Dual Wage Classification Thresholds by Year

Shown below are the wage thresholds for all dual wage classifications. For information about these classifications, see the California Workers' Compensation Uniform Statistical Reporting Plan—1995, effective September 1, 2021.

| Classifications | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | 5027 | 5140 | 5183 | 5185 | 5201 | 5403 | 5446 | 5467 | 5474 | 5484 | 5538 | 5552 | 5632 | 6218 | 6307 | 6315 |

| 5028 | 5190 | 5187 | 5186 | 5205 | 5432 | 5547 | 5470 | 5482 | 5485 | 5542 | 5553 | 5633 | 6620 | 6308 | 6316 | |

| 9/1/2022 | $32 | $34 | $31 | $32 | $32 | $39 | $38 | $36 | $31 | $36 | $29 | $29 | $39 | $39 | $39 | $39 |

| 9/1/2021 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2021 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2020 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2019 | $27 | $32 | $26 | $27 | $25 | $32 | $34 | $32 | $26 | $29 | $27 | $25 | $32 | $31 | $31 | $31 |

| 1/1/2018 | $27 | $32 | $26 | $27 | $25 | $32 | $34 | $31 | $26 | $29 | $27 | $25 | $32 | $31 | $31 | $31 |

| 1/1/2017 | $27 | $30 | $26 | $27 | $24 | $30 | $33 | $31 | $24 | $27 | $27 | $23 | $30 | $30 | $30 | $30 |

© 2021 Workers' Compensation Insurance Rating Bureau of California. All Rights Reserved.

WCIRB’s 2022 RECOMMENDATION:

The Bureau is considering raising the hourly wage threshold for all 16 dual wage classification pairs with some codes seeing as much as a $5.00 increase. The average delta between the lower advisory rate and higher advisory rate is 48%.

Proposed Dual Wage Threshold Increases

| Dual Wage Classifications | Existing Threshold | Proposed Increase | Proposed Threshold | Low Wage Advisory Rate | High Wage Advisory Rate | % Difference From Low Wage Rate |

| 5027/5028 Masonry | $28 | $4 | $32 | $8.18 | $4.21 | -48.50% |

| 5190/5140 Electrical Wiring | $32 | $2 | $34 | $3.76 | $1.45 | -61.40% |

| 5183/5187 Plumbing | $28 | $3 | $31 | $5.31 | $2.36 | -55.60% |

| 5185/5186 Automatic Sprinkler | $29 | $3 | $32 | $4.57 | $1.00 | -57.30% |

| 5201/5205 Concrete Work | $28 | $4 | $32 | $6.64 | $1.95 | -36.30% |

| 5403/5432 Carpentry | $35 | $4 | $39 | $10.03 | $4.23 | -55.10% |

| 5446/5447 Wallboard Installation | $36 | $2 | $38 | $5.42 | $4.50 | -55.10% |

| 5467/5470 Glaziers | $33 | $3 | $36 | $7.62 | $2.65 | -59.30% |

| 5474/5482 Painting Waterproofing | $28 | $3 | $31 | $8.09 | $3.10 | -46.40% |

| 5484/5485 Plastering or Stucco | $32 | $4 | $36 | $9.98 | $4.34 | -37.40% |

| 5538/5542 Sheet Metal Work | $27 | $2 | $29 | $5.07 | $2.52 | -50.30% |

| 5552/5553 Roofing | $27 | $2 | $29 | $21.05 | $8.14 | -61.30% |

| 5632/5633 Steel Framing | $35 | $4 | $39 | $10.03 | $4.50 | -55.10% |

| 6218/6220 Grading/Land Leveling | $34 | $5 | $39 | $5.10 | $2.93 | -42.50% |

| 6307/6308 Sewer Construction | $34 | $5 | $39 | $6.98 | $2.84 | -59.30% |

| 6315/6316 Water/Gas Mains | $34 | $5 | $39 | $4.18 | $3.70 | -11.50% |

This recommendation, if approved by the insurance commissioner, would become effective September 1, 2022.

With the continuing labor shortage in the construction arena, employers have been doing everything possible to retain employees by offering richer benefits plans, pay increases and merit bonuses, when applicable. These recommended wage classification increases could potentially push employers to extend additional pay raises to employees in an effort to minimize workers’ compensation premiums.

It is best for contractors who utilize any of the 16 dual wage classification pairs to be aware of the potential increases and to do the math to see if it makes sense to consider raises prior to your 2022-2023 September 1st workers’ compensation renewal.

Rancho Mesa predicts that this info will become a major factor in payroll decisions based on overhead cost management and recommend this as a topic for discussion early so that our clients, prospects and listeners can prepare.

To discuss how the proposed dual wage threshold increases may affect your business, contact me at (619) 438-6874 or khoward@ranchomesa.com.

Top Five Workers’ Compensation Claims That Impact a MEP’s Bottom Line

Author, Amber Webb, Account Executive, Rancho Mesa Insurance Services, Inc.

If you are an MEP contractor who wants to impact both your productivity and profitably, then the following is crucial for your success. Our MEP Group at Rancho Mesa understands the importance of identifying the top five workers’ compensation claims that impact your industry while providing pertinent resources to help mitigate that risk.

Author, Amber Webb, Account Executive, Rancho Mesa Insurance Services, Inc.

If you are a Mechanical, Electrical & Plumbing (MEP) contractor who wants to impact both your productivity and profitably, then the following is crucial for your success. Our MEP Group at Rancho Mesa understands the importance of identifying the top five workers’ compensation claims that impact your industry while providing pertinent resources to help mitigate that risk. By working with leading workers’ compensation carriers and the Occupational Safety and Health Administration (OSHA), we identified the top 5 workers’ compensation claims affecting the MEP industry:

Cut/Puncture/Scrape/Lacerations

Slip/Falls from both same level and ladders/scaffolding

Strains from lifting/handling/pushing/pulling

Struck by object/Foreign Body in Eye

Motor Vehicle Accident (injured employee)

With employee safety at the forefront of your operations, understanding where the claims are likely to come from and then having the support and tools in place to address those concerns is vital to your long term success. When injuries occur on the job, it impacts not only the life of the injured worker and their family but will directly impact the productivity and profitability of the project.

For our clients to proactively mitigate these exposures, we provide them with access to specific trainings related to these top MEP claims and OSHA citations from our Risk Management Center Library. Our Client Services team then works closely with our clients to customize their trainings while meeting their specific risk management needs.

If you are not already a Rancho Mesa client, and would like a free trial of our Risk Management Center, please complete the form or contact Amber Webb at (619) 486-6562 or awebb@ranchomesa.com.

A Deep Dive into Workers’ Comp Claims in the Landscape Industry

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ compensation premiums typically represent one of the largest overhead expenses for landscape companies. Premium costs are driven by the number and severity of claims a company has had over a five-year period. Thus, fewer claims often equate to a lower premium paid for workers’ compensation insurance.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ compensation premiums typically represent one of the largest overhead expenses for landscape companies. Premium costs are driven by the number and severity of claims a company has had over a five-year period. Thus, fewer claims often equate to a lower premium paid for workers’ compensation insurance.

The National Institute for Occupational Safety and Health (NIOSH) takes a closer look at the landscape industry, detailing where claim frequency is increasing and decreasing.

When analyzing the claims data, a couple of areas stand out as contributors to higher premiums.

Most notably, 50% of all serious claims occur during the first year of an employee’s tenure. Employees under the age of 34 are also more susceptible to a serious claim occurrence. Therefore, it is best to provide new hires with immediate and comprehensive safety training when they first start and continue to emphasize a safety culture throughout their tenure to minimize claims. As employees gain experience, they become more likely to take safety seriously.

The data also shows that loading and unloading trucks and trailers causes roughly 20% of all serious claims. This includes loading and unloading materials, tools, and equipment. Although a seemingly simple task, it’s often overlooked, yet statistics confirm that improved attention to safety when performing these tasks can significantly reduce serious claims.

The industry has seen a considerable decline in claims from overexertion injuries such as back sprains and disc disorders which were once a large contributor to higher premiums. The improvement of lifting techniques and implementation of programs such as Rancho Mesa’s Mobility & Stretch/A.B.L.E. Lift Program, have played a key role in reducing these claims. Programs such as these ensure employees are lifting properly while also stretching their muscles before they begin work.

Reducing workers’ compensation claims should be a top priority for any landscape company. Not only does it protect employees from harm but it also can benefit the company’s bottom line. As an added resource to reducing workers’ compensation claims, Rancho Mesa encourages landscape businesses to take advantage of available safety trainings for new and experienced employees, implement safety measures for loading and unloading trucks, and utilize the Mobility & Stretch/A.B.L.E. Lift Protocol.

In order for you to take your safety program to another level, sign up and receive our weekly safety training tailgate talks specifically designed for the landscape industry.

To start a conversation about how Rancho Mesa can assist your company, contact me at (619) 438-6905 or ggarcia@ranchomesa.com.

Pure Premium and How It Impacts Your Company

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted.. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

There are different rates generated for different classifications based on exposure and projected losses. The premium company’s pay for workers' compensation begins with multiplying the insurer's rate for the assigned classification(s) by the payroll developed in each classification. Workers' compensation rates are applied per $100 of payroll.

Pulling directly from the WCIRB website, “The WCIRB submits advisory pure premium rates to the California Department of Insurance (CDI) for approval. Insurer rates are usually derived from the advisory pure premium rates developed by the WCIRB and approved by the Insurance Commissioner. Advisory pure premium rates, expressed as a rate per $100 of payroll, are based upon loss and payroll data submitted to the WCIRB by all insurance companies. These rates reflect the amount of losses an insurer can expect to pay in benefits due to workplace injuries as well as the cost for adjusting and settling workers' compensation claims. Pure premium rates do not account for administrative and other overhead costs that an insurer will incur and, consequently, an insurer's rates are typically higher than the pure premium rates.” (WCIRB).

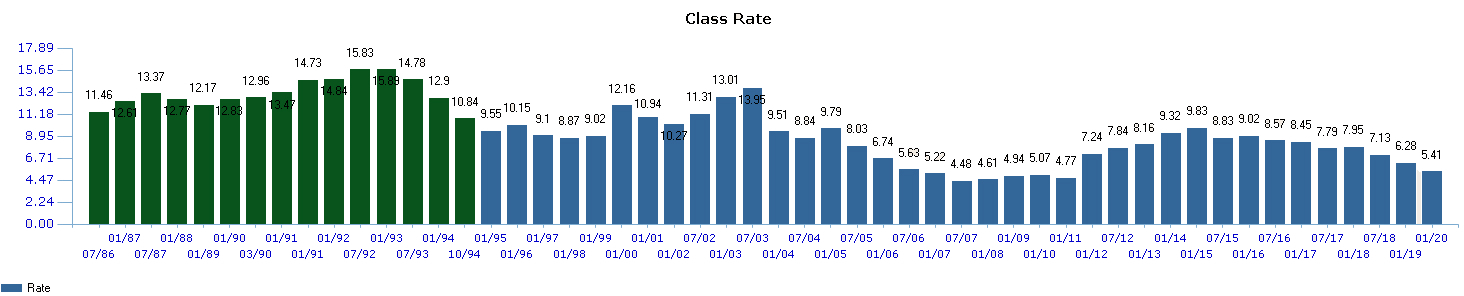

Of note, new pure premium rates were just released in September. Each carrier’s individual experience with all respective class codes also has an impact on these rates. Workers’ compensation has been in a soft market for the past several years with the expectation that rates will gradually start increasing. Following the change in pure premium rates is a great indication of where the marketplace is heading an effective way to better understand future costs that your company may be expecting.

With this in mind, engaging a broker that specializes in your industry and prepares you accordingly for the renewal process is a critical step in controlling workers compensation costs. Part of this process begins with understanding pure premium rates and how they ultimately will impact your MOD, carrier base rates, and your renewal pricing.

To discuss the current market or how your XMOD is affecting your workers’ compensation premium, contact me at (619) 438-6900 or ccraig@ranchomesa.com.

ADR Workers' Compensation Programs Reduce Litigation

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Workers’ compensation rates have fallen steadily over the last ten years, but businesses in California still pay the highest rates in the country. In addition, California has the highest frequency of permanent disability clams, the highest medical cost per claim and the highest litigation rates per claim.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Workers’ compensation rates have fallen steadily over the last ten years, but businesses in California still pay the highest rates in the country. In addition, California has the highest frequency of permanent disability claims, the highest medical cost per claim, and the highest litigation rates per claim.

To mitigate the friction within the workers’ compensation system, California and several other state legislatures in the early 1990s developed legislation that would permit unions and management to jointly develop an Alternative Dispute Resolution (ADR) program or “carve-out” agreement that resolves disputes outside the state workers’ compensation system with benefits that are at least equal to the benefits required by the Labor Code.

ADR is an alternative to the traditional approach to workers’ compensation claims. With ADR, an injured worker will report the injury and then use the services of a neutral ombudsmen hired by the union trust who is knowledgeable in workers’ compensation law to quickly determine if the injury is work related. The ombudsmen will recommend to the injured worker the appropriate treatment and other benefits owed within the carve-out agreement.

Union ADR provides employers with flexibility to manage the overall cost for their workers’ compensation program by promoting voluntary agreement early on with the injured worker on effective medical treatment to reduce litigation over the scope of medical treatment. ADR can also provide an accelerated claims resolution, faster medical treatment and potentially quicker return to work for the injured employee.

This process limits litigation with the services of an ombudsman and, if needed, mediation and arbitration procedures designed to resolve the claim quickly and appropriately. Since this is a very specialized arena, workers’ compensation carriers typically have a separate claims division that are well versed in the nuances of ADR claims.

To find out if your workers’ compensation carrier offers ADR programs or to learn more, I can be reached at 619-937-0167 or sclayton@ranchomesa.com.

Performance-Based Workers’ Compensation Programs – Are Retros In Your Future?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance-based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

While we have previously discussed several of these programs in detail (i.e., captives and deductibles), another option that is often overlooked; Retrospective Rating Plan (retros), could possibly be the right next step for many businesses to explore.

Typically, these plans begin to make sense once a company’s annualized premiums exceed $500,000. They contain many elements and variables that must be analyzed and understood before inception, including:

maximum, basic, and minimum premiums

required letters of credit (LOC)

loss cost factor (LCF)

losses based on incurred or paid

potential return of premium

number and frequency of recalculation of the premium/losses

recapture of premium in future calculation if claims develop

claim buyouts

Are you a candidate for a performance based program?

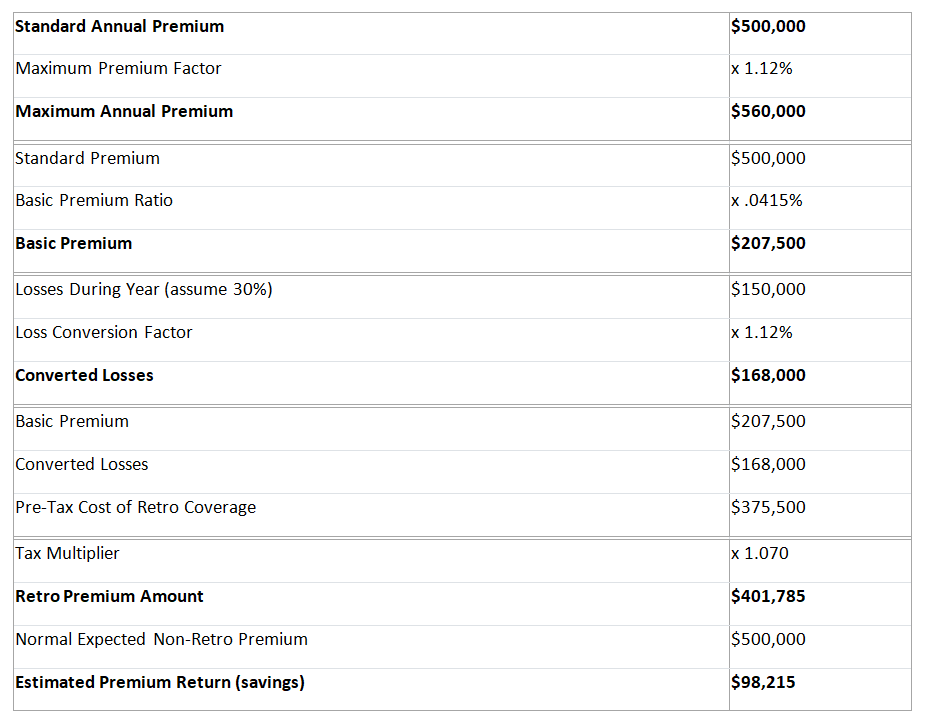

Example of a Retro Workers’ Compensation Program

Assumes a $500,000 premium with a 30% incurred loss ratio

If you would like us to create a performance model for you and your team members to evaluate, contact Rancho Mesa at (619) 937-0164 or via our website. Or, complete our performance based insurance spreadsheet and submit to Alyssa Burley at aburley@ranchomesa.com

How to Choose a Workers’ Compensation Carrier Partner

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Many years ago, when I was a young producer, one workers’ compensation carrier legend pulled me aside and told me never to forget that a workers’ compensation decision is not a one-year decision, but at least a 4-year decision. Of course, policies are only written on a one-year basis but what he was teaching me was that the carrier you choose will handle all the claims you have through your Experience Modification cycle. So, evaluating and recommending a workers’ compensation partner for my clients just became a much more thorough analysis of many critical factors beyond just the premium.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Many years ago, when I was a young producer, one workers’ compensation carrier legend pulled me aside and told me never to forget that a workers’ compensation decision is not a one-year decision, but at least a 4-year decision. Of course, policies are only written on a one-year basis but what he was teaching me was that the carrier you choose will handle all the claims you have through your Experience Modification cycle. So, evaluating and recommending a workers’ compensation partner for my clients just became a much more thorough analysis of many critical factors beyond just the premium.

I understand and want to acknowledge that competitive pricing is very important, yet other than price, most business owners are not sure what to look for when comparing carriers. All businesses should consider the following in their evaluation of a workers’ compensation carrier:

What is the A.M. Best rating of the carrier?

How long have they been in the State workers’ compensation marketplace?

What is their premium volume within the State?

What “in-house” services does the carrier provide? Two services for special consideration are:

The Claims Department

Loss Control Service

How does their medical cost containment numbers compare to the industry averages?

How does their claim closing rates compare to the industry average?

Are the following services available?

Telemedicine

Nurse Triage

For any businesses that pay above $250,000 in annual premium, should consider these additional questions:

Does the carrier offer a dedicated indemnity claims examiner for your business?

Does the carrier offer Claim Review Meetings?

Does the carrier offer a Client Services coordinator?

Does the carrier offer on-line claim status information?

What loss sensitive programs do they offer?

Further, for any businesses that are exploring loss sensitive programs (usually above $400,000 in annual premium) like deductible workers’ compensation, they should evaluate the following:

What are the terms of the letter of credit required?

Is there a Loss Conversion Factor (LCF)?

Is a Loss Fund required?

How are Allocated Loss Adjustment Expenses (ALAE) handled?

Is there a policy deductible aggregate?

Are there any claims handling charges?

Are there Medical Cost Containment charges?

Since many of the concepts and terms above require a deeper understanding and explanation, listen to my podcast episodes where I examine this topic in greater detail.

Also, consider attending one or both of my live webinars that cover this topic and afford you the opportunity to ask questions. Register for our Thursday April 1, 2021 webinar where I will focus on businesses with annual premiums below $400,000, and/or register for my Thursday April 8, 2021, webinar where I will deal specifically with deductible workers’ compensation. Both webinars will be 30 minutes in length.

If you would prefer to speak with me directly, I can be reached at (619) 937-0170 or email me at dgarcia@ranchomesa.com.

I wish you all a safe and profitable 2021.

2021 Insurance Game Plan

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As we come to the end of 2020, the most challenging year most of us have ever experienced, where COVID-19, wild fires and other natural disasters took their toll emotionally, physically, mentally and financially on all of us we can only hope for a brighter 2021.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As we come to the end of 2020, the most challenging year most of us have ever experienced, where COVID-19, wild fires and other natural disasters took their toll emotionally, physically, mentally and financially on all of us, we can only hope for a brighter 2021.

The insurance industry did not escape the impact of COVID-19 and the natural disasters, either. Insurance companies, along with their reinsurance companies, suffered catastrophic losses as a result. As with many industries, there will be lagging actions that will take place in 2021 to help these companies in their efforts to recover.

While there really isn’t a line of insurance that wasn’t impacted, the lines of insurance that suffered the greatest losses and impacts include:

Property

General Liability

Excess/Umbrella

Workers’ Compensation

EPLI

Cyber Liability

Surety

Employee Benefits

For this article, I will limit my discussion to the property and casualty lines and leave surety and employee benefits to another day.

To offset these losses, I anticipate any number of steps insurance companies will take as we move into 2021. But, let me just touch on those that I think will have the greatest impact and need for attention to business owners in 2021.

Let’s review these and I will try and give you a small sampling of the implications for each action.

Non-renewing policies

Carriers in many cases will not offer renewal terms.

Reducing coverage limits and terms

Increasing deductibles, lowering aggregate limits particularly in the excess/umbrella marketplace.

Add new exclusions

Businesses will start to see “communicable disease” exclusions added to various lines of insurance.

Increase underwriting information needed

A higher emphasis on information particularly as it relates to a business’s policies and procedures to mitigate COVID-19.

Raise premiums

This is the ultimate consequence and one we are all anticipating to see beginning in early 2021.

To many businesses, this will seem daunting and hopeless - one more hurdle to overcome to keep their businesses going. However, there are proactive steps you can take to mitigate these circumstances and have a strong year despite the adversity.

I’m a firm believer in being pro-active and not re-active. Following are steps you can take to meet this challenge head on:

Meet with your insurance advisor 90-120 days from your renewal date.

Understand the specific challenges you will be facing.

Create a strategy on how to approach the insurance marketplace to ensure the most cost effective and comprehensive risk management program.

Review and enhance your existing safety program. Rancho Mesa offers our RM365 Advantage Safety Star™ certification program. This is a comprehensive web-enabled training course designed to enable your employees from supervisory to front-line workers to be trained and certified in safety best practices. The insurance marketplace already places a high value on these types of safety trainings and certifications, so this will help your company’s productivity through fewer claims but also position you in a more favorable position in the marketplace.

Benchmark your company’s safety performance to your industry and see which areas you are outperforming your peers and areas that need your attention. Rancho Mesa offers a benchmarking report we call StatTrac™ to our clients or to other companies who want to see where they stack up.

To close, let me reassure you there is light at the end of the tunnel for 2021. Be proactive; start 90-120 day out from your renewal; don’t let insurance issues sneak up on you; attack them head on and I believe you can make 2021 a great year for you and your company.

If you have any questions or want any help in devising a plan and you are a construction company, please reach out to Sam Clayton, our Construction Group Leader at sclayton@ranchomesa.com. If you are in the human services industry, schools, non-profit, healthcare, assisted living, etc., please reach out to Sam Brown, our Human Services Group Leader. And finally, we can be reached at (619) 937-0164 or at our website, www.ranchomesa.com.

I really believe there is no limit to what you can do – best of luck in 2021.

A Tree Care Company’s Guide to the Annual Workers’ Compensation Audit

Author, Rory Anderson, Account Executive, Tree Care Group, Rancho Mesa Insurance Services, Inc.

The premium for your workers’ compensation policy is based on the type of work you do, and the amount of payroll incurred. By maintaining proper payroll records, segregating the wages earned by your employees, you may reduce the cost of your workers’ compensation insurance. The final audit is the process that calculates the last premium due. It compares the estimated payrolls to actual wages paid during the policy year. The audit may result in a refund or additional premium due. Workers’ compensation audits also determine if the classification codes quoted at inception accurately reflect the scope of work performed during the policy period. Insurance carriers charge more premium for higher risk operations, like tree trimming.

Author, Rory Anderson, Account Executive, Tree Care Group, Rancho Mesa Insurance Services, Inc.

The premium for your workers’ compensation policy is based on the type of work you do, and the amount of payroll incurred. By maintaining proper payroll records, segregating the wages earned by your employees, you may reduce the cost of your workers’ compensation insurance. The final audit is the process that calculates the last premium due. It compares the estimated payrolls to actual wages paid during the policy year. The audit may result in a refund or additional premium due. Workers’ compensation audits also determine if the classification codes quoted at inception accurately reflect the scope of work performed during the policy period. Insurance carriers charge more premium for higher risk operations, like tree trimming.

In my last article, we looked at how it may be possible for a tree care company to use the 0042 landscape classification code at specific times, if they are trimming hedges or trees from the ground. We noted, however, that when any of the tree care company’s operations are off the ground, at any elevation, that payroll would be classified in 0106 tree trimming. Also, any type of work that is associated with the tree trimming (e.g., clean-up, chipping, stump grinding, etc.) would also be included as 0106.

The basis of premium is the payroll earned during the policy period. Payroll includes regular wages, salaries, overtime, bonuses, vacation pay, sick pay, commissions, cash payments, and other substitutes for money. Summarizing and segregating wages allows for the possible reduction of exposures and lower premium charges. Consider the following for potential adjustments at final audit:

If employees are engaged in both landscape construction/maintenance work, and tree trimming, you can segregate wages between operations and utilize both classifications. Earnings can be split by classification if time cards are maintained showing hours worked by activity, and payroll reports summarize hours and wages earned for each class. Segregation is based on records of actual hours worked; you cannot split earnings by percentages or projected bid calculations.

The wages for miscellaneous employees can be split by class if timecards segregate earnings by type of work performed. If no segregation is maintained, payroll will be assigned to the highest rated class.

Premium overtime is excludable if records document the hours and remuneration earned for regular hours and overtime hours. This includes earnings paid over and above the straight time earnings. If overtime is paid at one and one-half times the regular rate of pay, 1/3 of the total overtime pay can be excluded. If double time is paid, ½ of the overtime pay is excludable.

California allows the exclusion of deductions which are part of a Section 125 Cafeteria Plan. This might include medical, dental, and vision premiums. If these deductions are summarized by employee and by classification, they can be excluded from the workers comp wages.

Severance pay and tips are excludable. Maintain severance agreement letters documenting final payment agreements.

Depending on the type of entity insured, the earnings of sole proprietors, partners, and corporate officers may be excludable. Talk with your agent regarding qualifications and endorsements which can be issued as adjustments to your policy.

Workers’ compensation exposures may include costs for additional earnings paid outside of payroll. This could include bonuses, flat auto allowances, cash payments, casual labor, and subcontractors who could be considered employees. If subcontractors are hired, be sure to use licensed contractors who operate their own business. Always obtain and keep copies of the certificates of insurance from subcontractors to confirm independent coverage.

To prepare for final audit, maintain proper payroll records segregating and summarizing wages earned by your employees. The Auditor will:

Advise you on which reports to prepare for final audit. This typically includes payroll records and summaries, quarterly payroll tax reports, general ledger, cash disbursements, and/or 1099 reports.

Assist you in identifying cost saving measures. They will help to recognize and explain how to take advantage of all potential credits, such as premium overtime, severance, Cafeteria 125 plan deductions, etc.

Ask for a description of the business, and the job duties of employees to verify classification assignments.

Review all findings and suggestions, and address any additional questions you may have.

For questions about your annual audit, contact me at (619) 486-6437 or randerson@ranchomesa.com

Safety Programs Can Reduce Workers’ Compensation Premiums

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

As California business owners continue incurring costs as they work their way through the maze of ever-changing COVID-19 regulations and protocols, prioritizing critical elements of your internal safety program can directly lower your insurance costs. Refocusing on key areas below will help present an effective, detailed submission to the marketplace that will lead to talking points with an underwriter for schedule credits and ultimately, lower rates and premiums.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

As California business owners continue incurring costs as they work their way through the maze of ever-changing COVID-19 regulations and protocols, prioritizing critical elements of your internal safety program can directly lower your insurance costs. Refocusing on key areas below will help present an effective, detailed submission to the marketplace that will lead to talking points with an underwriter for schedule credits and ultimately, lower rates and premiums.

Employee Benefits

Workers’ compensation underwriters pay close attention to employee benefit plans from a submission they are reviewing to quote. A deeper dive will create inquiries on overall employee participation, employer’s contribution to the plan, and whether established “wellness” plans are made available. High participation and contribution can show underwriters that employees value the benefits being offered and that the employer is investing in their most important asset, the employees. Lastly, industry professionals commonly link reduced fraudulent workers’ compensation claims to more robust, supported employee benefit programs.

Formal Safety Program

Developing a formal, documented Injury and Illness Prevention Program (IIPP) is truly just a baseline for managing risk for any business. The IIPP must be a living, changing document that contemplates random/periodic inspections, regular meeting intervals, safety orientation for new employees, and detailed investigative reports performed by field and management. Your program can be compared to a book that sits on the shelf and develops dust. Or, if you are focused on best practice techniques, it can be used as a tool for education, training, and risk mitigation. It should change as your company changes and incorporate the safety priorities instilled from the top down. Additionally, incorporating safety programs like Rancho Mesa’s RM365 Advantage Safety Star™ training program for foreman and supervisors help make your safety program go to the next level and really stand out in the insurance marketplace. Dynamic IIPPs stand out in a workers’ compensation submission process. They provide much needed detail to simple Yes/No questions on a supplemental application and show just how important safety is to the organization that is being underwritten.

Return to Work Program

Companies of all types will share that they support a return to work program when their injured employee is cleared for modified duty. That support needs to be taken a few steps further to improve your program. Create job descriptions for potential modified positions. Identify and engage with specific doctors within your network and ensure that these job descriptions are on file. This process can often help expedite employees back to the field, warehouse, office, etc. and ultimately lower temporary disability payments which can lower claim reserves. Use Rancho Mesa’s RM365 HRAdvantage™ portal to generate job descriptions and manage employee’s modified duty in the Risk Management Center.

Hiring Practices

Developing “gates” in the hiring process are often overlooked as too expensive or time consuming. But, the costs of bad hiring decisions can linger for years, impacting your bottom line and employee morale. Employers must strongly consider pre-employment physicals and drug testing, typically performed post interview and before an offer is made. As the Compliance Director for Current Consulting Group LLC, Andrew Current said, “The average cost of a pre-employment drug test is $45. The average turnover cost for an entry level employee is $6,600.” There is added benefit with workers’ compensation underwriters who view pre-employment checks as key controls to minimizing claim frequency and severity. Take advantage of the New Employee Onboarding Checklist and other resources in the RM365 HRAdvantage Portal.

Website Development

Most, if not all, workers’ compensation underwriters begin their review process by accessing the company in question’s website to learn more about their operation, exposures, risks, etc. Therefore, seeing your website through this same filter and utilizing your broker as an additional soundboard of information, consider these possible edits and/or redesign of your website:

Add a “Safety” link or tab, allowing space for sharing your company’s philosophy on managing risk.

Include a section on any safety awards or recognition that you may have received.

Remove any pictures on your website that might create confusion or concern about your operation as it relates to safety and risk.

Include examples of safety protocol that are unique to your operation (e.g. proper use of machinery, ladder usage, cleanliness of operating areas, etc).

Like any potential internal investment, companies must always balance whether the time and resource commitment will ultimately benefit their company. Many of the above recommendations require minimal resources and can pay huge dividends in consistently securing the most competitive workers’ compensation pricing, often a significant line item on a profit and loss statement. You may find cost savings in areas you did not know were possible that can help your business survive and remain profitable in these difficult times.

To discuss how your company’s safety program can affect your workers’ compensation premium, contact me at (619) 937-0172 or dfrazee@ranchomesa.com.

Risk Management and the Virtual Workforce

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Cyber Crime

Prior to the pandemic, the FBI would routinely receive 1,000 cybersecurity complaints, daily. Since the COVID-19 outbreak began, the number of complaints has increased to 3,000 to 4,000 every day according to Tonya Ugoretz, deputy assistant director of cyber division of the FBI in a webinar hosted earlier this year. The most commonly targeted industries are health care, manufacturing, financial services, and public sector organizations. Stated plainly, cyber criminals are successfully exploiting weak virtual cybersecurity and poor execution on the part of remote employees.

Brett Landry of Landry IT, recently stated that 85% of employees circumvent “acceptable use” policies when using a company owned device, reinforcing the need for increased employee training.

Mr. Landry highly recommends employers update security patches on all devices, adopt a higher standard for password security, utilize two-factor authentication, and train employees how to recognize phishing and social engineering efforts.

How will a cyber liability insurance policy respond to this new threat?

Important questions to ask:

Will my policy cover a remote exposure?

Will my policy cover incidents involving personal devices?

Is Social Engineering covered?

Will my policy respond if an employee does not follow company procedures?

Workers’ Compensation

Allowing employees to work from home has resulted in some employees moving out of state. When this occurs, the employer should report the new working address to the insurance company to ensure the workers’ compensation insurance policy will cover an injury. In some cases, the insurance company can add the new location. If not, then the employer may need to purchase a separate workers’ compensation policy for that employee’s new state.

In an effort to manage the risk of employee injury, employers should design and implement work-from-home policies. Effective policies will clearly define work hours, communicate standards for a home office, train employees on ergonomics, reinforce work and safety rules, and remind employees of the claim reporting process. Establishing the above expectations may help employees avoid injury and legal disputes over compensability.

Directors & Officers Liability

Remember that a Directors & Officers Liability policy protects individuals from personal losses if sued for their role as a director or an officer of a company and not indemnified by the company. While a move to a virtual workforce doesn’t inherently put a board member at risk, big changes to company policy can result in missteps if employees do not receive proper communication and training. Ultimately, directors and officers are held accountable if company policies are not followed, highlighting the need for diligent execution of important company changes.

Rancho Mesa supports clients in developing employee manuals, work-from-home policies, and 2021 changes to labor law. Please contact me at (619) 937-0175 to discuss how Rancho Mesa can support your business or mission.

COVID-19 Workers Comp Surcharge Coming to California

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

If approved, this new COVID-19 surcharge will vary by industry and have a minimum of $0.01 and hit a maximum of $0.24 per $100.00 of payroll. The industries with less of a COVID-19 exposure can expect a lower surcharge. While industries with a higher exposure can expect a greater increase. The additional surcharge my not seem like a lot, but multiplied by a company’s payroll, it can be significant to a company’s bottom line. Additionally, this surcharge will apply to all California employers, regardless if they had any COVID-19 illnesses.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) approved the surcharge after growing concerns that the number of COVID-19-related workers’ compensation claims will continue to increase. It’s been estimated this year that 11% of all workers’ compensation claims in California have been COVID-19 related. The surcharge will help the insurance carriers mitigate the growing cost of the claims that could not have been anticipated when rates were calculated for 2020 policies. Even though COVID-19 claims will not be included in California’s companies’ Experience Modification Rates (i.e., XMOD, EMR), carriers will look to a number of variables in order to adequately price for an individual company’s premium. Those will include:

Overall claims experience

COVID-19 claims experience

The COVID-19 protocols and practices that are in place

Rancho Mesa, California union employer groups, as well as several carriers including the State Compensation Insurance Fund (State Fund), oppose the surcharge idea. Our feeling, as well as many of the others, is that most carriers are now underwriting specifically for COVID-19 by evaluating the businesses’ COVID-19 claim history and safe guards. Thus, there is no need for an additional surcharge.

In the next few weeks, we will release a follow up article that will highlight the best practices employers can implement now to minimize the COVID-19 impact to their organization and 2021 workers’ compensation renewal pricing.

For questions about workers’ compensation and the COVID-19 surcharge, contact me at (619) 937-0167 or sclayton@ranchomesa.com.

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

SB 1159 Is Now Workers’ Compensation Law

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later. Additionally, these rules will continue, unless modified, until January 2023. So, SB 1159 may be around for a while.

If an “outbreak” occurs, for the presumption of the claim to rest with the employer (meaning it will be presumed the person testing positive for COVID-19 contracted it at work and is therefore eligible for workers’ compensation benefits), there are several factors that need to be meet for that to occur.

If the employer has fewer than 100 employees and 4 employees test positive, or if the employer has more than 100 employees and 4% of their total employees test positive, during a 14-day period at an employer’s specific location, the COVID-19 case is presumed to be work-related. Thus, the 4/4/14 rule. When in doubt, call your workers’ compensation carrier and discuss the specific situation. They will help you determine whether or not it is a workers’ compensation claim.

Rob Darby, President of Berkshire Hathaway Homestate Companies, the second largest writer of workers’ compensation insurance in California and I discuss SB 1159 in a recent StudioOne™ Safety and Risk Management Network podcast episode “SB 1159 Impacts Workers' Comp Market.” A week before Governor Newsom signed the bill, Rob and I discussed the impacts of the bill to get an early insight. Take a listen - I think you will find it useful.

Now comes possible confusion with SB 1159. What is considered an outbreak? What is the definition of a specific location?

Outbreaks

The section of the law (Labor Code 3212.88) applies to any employee other than frontline workers and healthcare workers who test positive during an “outbreak” at the employer’s place of business, if the employer has 5 or more employees.

COVID-19 is presumed work-related if an employee worked at the employer’s place of business at the employer’s direction on or after July 6, 2020 and both the following elements are met:

The employee tested positive for COVID-19 within 14 days after working at the employer’s location.

The positive test occurred during an “outbreak” at the employer’s specific location.

An “outbreak” is defined as a COVID-19 occurrence at a specific employment location within a 14-day period AND meets one of the following:

If an employer has 100 employees or less at a specific location and 4 or more employees test positive for COVID-19;

If an employer has more than 100 employees at a specific location and 4% of the employees test positive for COVID-19;

The local public health department, State California Department of Public Health or Occupational Safety and Health Administration (Cal/OSHA) or school superintendent orders the specific place of employment to close due to risk of COVID-19 infection.

A specific location or place of employment is a building, store, facility or agricultural field where an employee performs work at the employer’s direction. An employee’s home is not considered a specific place of employment unless the employee provides home health care services to a client at the employee’s home. An employee may have more than one specific place of employment, if they worked in multiple locations within the 14-day period before their positive test.

There is a 45-day timeframe to determine if a positive COVID-19 case meets the above standard.

Outbreak Reporting Requirements

When an employer knows or reasonably should know that an employee has tested positive for COVID-19, they must report the incident to their workers’ compensation carrier. They should be prepared with the following information to give the carrier.

The fact that an employee has tested positive, regardless if work-related or not.

Employers should not include any personal information regarding the employee who tested positive for COVID-19 unless the employee asserts it is work-related or files a claim form.

The date the specimen was collected for the employee’s COVID-19 test.

The specific address or location of the employee’s place(s) of employment during the 14-day period preceding the date the test specimen was collected.

The highest number of employees who reported to work at the specific location(s) in the 45-day period before the last day the COVID-19 positive employee worked there.

It best practices to follow all local, state and federal guidelines for safe workplaces. However, even with the best intentions and precautions, COVID-19 may accidentally spread to employees. Again, when in doubt, report an employee COVID-19 case to your workers’ compensation carrier and allow them to determine how to proceed.

For questions about SB 1159 and how it with affect your organization’s workers’ compensation, contact your broker or reach out to Rancho Mesa at (619) 937-0164.

The Importance of Timely Workers’ Compensation Claims Reporting

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Best Practices would demand that all claims get reported within 24 hours, if at all possible. By doing this, it provides the best possible outcome and will impact the claim in several positive ways:

Reducing Fraudulent Claims

One of the biggest frustrations in the workers’ compensation industry for most employers are the number of fraudulent claims that find their way into the system. Immediate accident investigation, witness statements and pictures followed by reporting the claim to the carrier within 24 hours of the injury, will give the employer and the carrier the best opportunity to deny a claim. The insurance carrier only has 90 days from the date of injury (not from the date reported) to deny a claim. This shortens that time-frame and allows more fraudulent claims into the system.

Lowering Litigation Rates

Another area employers find both frustrating and costly are the number of litigated claims that occur within the workers’ compensation system. Litigated claims on average will add 30% to 35% to the ultimate cost of a claim. While there are many ways employers can impact this area, perhaps the most controllable is the timely reporting of any injury. To further support this, it has been proven that the litigation rate for claims goes up 300% if the claim is reported 5 or more days after the injury occurred.

Identifying Claim Trends Early

By not reporting all claims or by reporting them late, employers can develop unreliable data in their effort to identify claim trends and root causes. Without this information, businesses in all sectors run the risk of a severe injury occurring from an area that could have been addressed if all claim data was accurate and analyzed.

When an injury occurs, do a thorough accident investigation that details all events that caused the injury and immediately call your workers’ compensation carrier. This one habit alone will help you lower claim costs and manage your EMR.

To learn more about this process, including benchmarking and analytics that can help control your loss ratio and lower premiums, please reach out to me, Casey Craig at (619) 438-6900 or ccraig@ranchomesa.com.

Workers’ Compensation Claim Advocacy: Distinguishing Good from Great

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

As the new normal continues evolving through this pandemic, advocates are needed across all industries and sectors. Businesses and their employees exposed to the risk of workers’ compensation injuries and illnesses need the highest level of advocacy now, more than ever.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

As the new normal continues evolving through this pandemic, advocates are needed across all industries and sectors. Businesses and their employees exposed to the risk of workers’ compensation injuries and illnesses need the highest level of advocacy now, more than ever.

Like so much of what we experience in our daily interactions, establishing a baseline of competence in any field has varying levels of effectiveness. That is, there are good claim advocates and then there are great ones; high-level claim liaisons that can make organizations more knowledgeable and stronger.

What are the characteristics that make up the great ones? And, what should you expect with their involvement in your workers’ compensation program?

The first pre-requisite for any workers’ compensation claim advocate is experience. Ideally, having multiple years working as a claim adjuster and managing a case load for an insurance company is vital. While this creates a solid base, stopping here can limit the effectiveness for employers in other critical areas. In order to begin to go from good to great you should expect your advocate to have one or more of the following experiences to offer the broadest perspective possible for your team:

Background with return-to-work programs, in development, implementation and management.

Experience from being a workers’ compensation administrator for a self-insured employer with the State of California and Department of Industrial Relations

Obtaining years of training in diagnosing and treating industrial injuries from occupational medicine, orthopedic surgical, spinal surgical and pain management physicians.

Providing years of training to workers compensation physicians on treatment and disability management of work injuries and preparing med-legal reports and addressing permanent impairment ratings, causation, apportionment, contribution and all other issues.

Or the very rare experience of suffering a work injury, requiring surgeries and rehab, concern for losing one career and starting over in another, and going through the entire workers compensation process through settlement

Secondly, using these technical experiences in review and oversight of claims is both tangible and measurable. That includes:

Ensuring the accuracy of claim statuses and plan of actions.

Recognizing when claim reserves are adequate or inflated.

Pushing for claim closures in the most efficient and cost-effective resolutions.

Forming a deep, consultative bond that elevates a claim advocate to that of a trusted partner.

The final component in establishing a superior workers’ compensation advocate is building strong, respectful relationships with adjusters and employers. This requires the most experienced advocate creating a “partnership environment” that allows for continual open dialogue, which very often expedites the entire claim process. The most effective of these professionals build this environment through direct communication with the adjuster(s), supervisors, and even claim department managers. That information is then thoroughly and simply shared with employers in regular intervals through formal claim reviews, safety committee meetings, and/or pre-renewal meetings involving the broker.

As a 35-year industry veteran of the claims management field, I proudly serve the Rancho Mesa team with a core commitment to providing great contributions to the claims management process. These contributions are predicated on bringing my extensive knowledge and experiences from all sides of the workers’ compensation claim process, to my advocacy role for you, my client… the employer.

CA Governor Issues Executive Order Making Workers’ Compensation Benefits More Readily Available to Essential Workers

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

The Executive Order states “any COVID-19-related illness of an employee shall be presumed to arise out of and in the course of employment for purposes of awarding workers’ compensation benefits if all of the following requirements are satisfied:

a. The employee tested positive for or was diagnosed with COVID-19 within 14 days after a day that the employee performed labor or services at the employee’s place of employment at the employer’s direction;

b. The day referenced in subparagraph (a) on which the employee performed labor or services at the employee’s place of employment at the employer’s direction was on or after March 19, 2020;

c. The employee’s place of employment referenced in subparagraphs (a) and (b) was not the employee’s home or residence; and;

d. Where subparagraph (a) is satisfied through a diagnosis of COVID-19, the diagnosis was done by a physician who holds a physician and surgeon license issued by the California Medical Board and that diagnosis is confirmed by further testing within 30 days of the date of the diagnosis.”

Insurance companies have 30 days from the date of a COVID-19 diagnosis to rebut with evidence.

According to the Executive Order, the presumption pertains only “to dates of injury occurring through 60 days following the date of this Order.”

The order establishes a rebuttable presumption that any essential workers infected with COVID-19 contracted the virus on the job. It is important to understand the order shifts the burden of proof from the injured worker and now requires employers or insurance companies to prove the employee didn’t get sick at the place of work.

Prior to the change, it was difficult to prove workers’ compensation claims related to a COVID-19 infection.

Rancho Mesa’s Response

In response to the Executive Order and other proposed rule changes, Rancho Mesa President David Garcia interviewed Berkshire Hathaway Homestate Companies President Rob Darby on the impact to California businesses and the workers’ compensation market. Berkshire Hathaway is one of the largest workers’ compensation insurance companies in California.

Read Governor Newsom’s Executive Order on Cal/Gov website.

Please contact your Rancho Mesa broker with questions specific to your business.

Special COVID-19 Workers' Compensation Filing and Executive Order Imminent

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would:

Exclude COVID-19 claims from the experience rating formula.

Exclude from premium calculations payroll paid to employees who are continuing to be paid while not working.

Allow the assignment of Classification 8810 on a temporary basis to employees who are now working from home whose temporary duties meet the definition of a clerical office employee.

Each of these changes will have their own nuances and it remains to be seen how exactly their implementation, auditing and tracking will be put into practice.

Separately, but equally important, Governor Newsom is considering an executive order that would create a “conclusive presumption” that COVID-19 illnesses and deaths sustained by “essential workers” are work related and therefore covered under workers’ compensation policies. The potential scope and impact of the order are not yet known, but on April 20, 2020, the WCIRB released a projection that the annual cost of COVID-19 claims on “essential critical infrastructure” workers, under a conclusive presumption, ranges from $2.2 billion to $33.6 billion.

These decisions, should they be implemented, will create significant disruption in the workers’ compensation marketplace and to all insurable businesses in California. As these decisions are rendered, Rancho Mesa will continue to provide resources and implementation strategies to help businesses adjust through these uncertain times. If you have questions or want to discuss this in greater detail please reach out to your broker or account manager.

Work Comp Unit Stat: The Meeting That Saves You Money

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) defines the process of receiving loss and payroll information by classification as the Unit Statistical Report. The information is reported to the WCIRB by insurance carriers at specific intervals based on your company’s policy effective date. The information is valued for the first time 18 months after the inception of your policy and every 12 months thereafter.

A policy that incepts in January 2020 will be valued for the first time in July of 2021 (18 month mark). This information will remain in your XMOD calculation for the valuations at 30 months and 42 months.

Once this information has been received by the WCIRB, from the respective carriers, it cannot be altered or changed until the following year’s unit stat. Thus, you may have a positive outcome on an existing open claim (reserve reduction or closure) but not see the benefit until the following year. Revisions to the XMOD once published are limited to a few circumstances; more information about revisions can be found here.

The loss information, sent to the WCIRB from the insurance carriers, will be evaluated at the paid (closed claim) or reserved (open claim) amounts. Typically, a claim that has been open for longer than 18 months signifies severity, litigation, lost time, permanent disability, or a combination of the group. For this reason it is absolutely critical that as a part of your risk management process you execute a

pre-unit stat meeting.

When should I schedule my Unit Stat meeting?

What should I do at this meeting?

Who needs to be involved?

How will this meeting save me money?

As a client of Rancho Mesa, we build this meeting into your annual service plan and take care of engaging the parties who need to be involved for the betterment of your XMOD.

Ready to learn more about Unit Stat? Join us for a complimentary 25-minute webinar where we will discuss the process in greater detail and take time for Q&A.

Still not sure if further learning is necessary, ask yourself these questions:

Have you ever been surprised by your XMOD being higher than you would have thought?

Have you ever had an XMOD above 1.00?

Has your XMOD ever caused your premium to increase?

The webinar can be viewed on-demand by clicking the link below.