Industry News

Recommended Strategies to Open Capacity for your Bond Program

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Most of our contractor bond accounts are provided a single bond/aggregate capacity program to determine the size of projects they can bid and the amount of capacity that is available in the program for future projects. The most effective way to ensure you have available capacity for an upcoming bid is to communicate with your bond agent well in advance of the bid date to ensure the project will be approved by the bond company. On certain occasions, an upcoming project may put you over the top of your approved capacity. This is the time your agent must work hard on your behalf to represent to the bond company why this project makes sense to add to the program.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Most of our contractor bond accounts are provided a single bond/aggregate capacity program to determine the size of projects they can bid and the amount of capacity that is available in the program for future projects. The most effective way to ensure you have available capacity for an upcoming bid is to communicate with your bond agent well in advance of the bid date to ensure the project will be approved by the bond company. On certain occasions, an upcoming project may put you over the top of your approved capacity. This is the time your agent must work hard on your behalf to represent to the bond company why this project makes sense to add to the program.

Here are several useful strategies to make this happen:

1. Prepare a work in progress schedule on a quarterly basis and provide updates as work progresses to give your bond agent the best estimate of your cost to complete as of a certain period. This is important because the bond company will allow additional runoff to subtract from your current backlog to free up capacity prior to the actual start date of the new project.

2. When submitting your bid request, include a job cost breakdown on the new project and list the percentage of labor, materials, equipment, subcontractors, overhead and profit. Provide additional explanation of any key elements (for example, if a certain subcontracted trade represents a large portion of the project) and risk transfer protocols used to pre-qualify this particular subcontractor.

3. Have a status report completed by the owner whenever a bonded project is completing. Your agent can provide you this document. The bond company uses this information to remove that project from your backlog.

4. Have a discussion with your bank to determine if they can increase your line of credit to ensure available cash in support of anticipated costs during the initial few months of the new project.

5. Consider loaning personal money to the company for a short time period to provide additional working capital or equity. The loan may need to be subordinated to the bond company to ensure it is not paid back until certain conditions are met.

Both your agent and the bond company only generate income when they issue bonds to support your projects. Therefore, all parties involved want to try and find a way to allow you to add good projects to your bonded backlog.

If you would like more information to discuss additional ways to increase your bond capacity, please contact me at (619) 937-0165 or mgaynor@ranchomesa.com.

Umbrella vs. Excess Liability: The Key Differences Contractors Need to Know

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

When reviewing insurance requirements that contractors receive from municipalities and/or general contractors, two lines of coverage that are often misunderstood are umbrella and excess liability. These terms are commonly interchangeable in the contract, but have subtle differences. In addition, the limits required by contracts are increasing significantly.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

When reviewing insurance requirements that contractors receive from municipalities and/or general contractors, two lines of coverage that are often misunderstood are umbrella and excess liability. These terms are commonly interchangeable in the contract, but have subtle differences. In addition, the limits required by contracts are increasing significantly.

Excess vs. Umbrella

An excess liability policy has two primary functions: it provides excess limits above the underlying liability insurance limits and replaces underlying insurance limits as aggregate limits are exhausted; the excess policy will be subject to the same coverage terms, conditions and exclusions as the underlying policies. This is what is called follow-form.

A commercial umbrella liability policy has three primary functions: it provides excess limits above the underlying liability insurance limits; replaces underlying insurance limits as aggregate limits are exhausted; and offers broader coverage than primary policies for certain losses which would be subject to an SIR or self-insured retention.

Why are they important?

A commercial umbrella or a properly structured excess policy will sit above a contractor’s existing policy’s general liability, auto liability and employers’ liability limit. This protects contractors from large unexpected losses that can have devastating financial impact on the company.

With the dramatic rise in costs of insurance claims the last few years, either from social inflation or third-party litigation funding, multi-million dollar settlements are becoming more frequent. For example, if one of your employees is in an auto accident that causes severe bodily injury to multiple people, the legal and medical costs incurred could very easily exhaust your primary auto liability limit very quickly. Umbrella or excess policy limits would be available cover those losses.

So, when reviewing a contract, pay close attention to the umbrella or excess insurance requirements, and ensure that you understand the subtle differences of how they can impact your bottom line if there is a claim.

To learn more about these specific coverages and how they can be incorporated into your current insurance program, reach out via email to sclayton@ranchomesa.com or (619) 937-0167.

Stand Out Among the Crowd with a Surety Prequalification Letter

In advance of a project bid, some owners and general contractors will want to pre-qualify the subcontractors to ensure they can handle a project of a certain size. A simple and efficient way to accomplish this would be to have the surety agent that supports the contractor’s bonding program prepare a surety prequalification letter.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

In advance of a project bid, some owners and general contractors will want to pre-qualify the subcontractors to ensure they can handle a project of a certain size. A simple and efficient way to accomplish this would be to have the surety agent that supports the contractor’s bonding program prepare a surety prequalification letter.

As opposed to a bid bond, which carries a 10% penalty if the contract is awarded and the subcontractor does not provide the final bond, a surety prequalification letter (also known as a bondability letter) is less formal and does not carry any guarantee.

The letter will typically include some or all of the following items:

The name and A.M. Best rating of the bond company that issues bonds for the account. It will also confirm that the bond company is included in the U.S. Treasury List of Certified Companies and licensed in the state where the project will take place. The letter may include a reference to how long the contractor has been supported by this particular bond company.

Single and aggregate bonding limits for the contractor to determine if they have ample surety credit to qualify for the particular project. The letter may also include information regarding the amount of surety credit currently available within the program limits. It is important that the surety agent and contractor discuss the project size in advance to ensure the letter conveys that the contractor has sufficient available capacity for the particular project.

A paragraph where the surety agent recommends their particular contractor client for this project noting that they have not had any problems with past bonded projects schedules, budget, and workmanship.

The letter may sometimes include the premium rates for the client contractor if that information has been requested by the owner/general contractor that requested the letter.

The final paragraph of the letter will have wording that notes “this is issued as a bonding reference letter” and should not be considered as a bid or performance bond. Additional underwriting of the contractor may be needed if the owner desires a more formal document such as a bid bond.

If you would like more information, or to discuss the client-broker-carrier relationship, please contact me at (619) 937-0165 or mgaynor@ranchomesa.edu.

The Solution for Distracted Driving: An Effective Fleet Safety Program

Contractors have seen significant increases in commercial auto rates over the last few years. Because of this, it is imperative for companies to implement a written fleet safety program.

The fleet safety program must detail leadership’s expectation of what is required to be a driver for the company and the consequences if the policies are not followed.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Contractors have seen significant increases in commercial auto rates over the last few years. Because of this, it is imperative for companies to implement a written fleet safety program.

The fleet safety program must detail leadership’s expectation of what is required to be a driver for the company and the consequences if the policies are not followed.

For both the fleet safety program and driver training to be effective and successful, companies should be constantly discussing the policies with all of their employees, not just the employees assigned to a company vehicle.

One topic that should be at the forefront of your driving training program is distracted driving.

Distracted driving is the leading cause of most vehicle collisions and near collisions. According to the National Traffic Safety Administration (NHTSA), nearly 80% of collision and 65% of near collisions involve some form of distracted driving.

There are 3 types of distracted driving:

Visual – An example would be taking your eyes off the road.

Manual – An example would be taking your hands off the wheel.

Cognitive – An example would be taking your mind off driving.

Many of these crashes occur in company vehicles during the working hours and can cause serious problems for both the driver and the company. If the employee is injured, he/she will likely be eligible for workers’ compensation. The company’s auto insurance would pay for damage to the vehicle and potential lawsuits brought on by the bodily suffered by a third party. The quick glance at a cell phone while driving could cost a company hundreds of thousands of dollars.

In order to protect your company from these types of losses, the company’s leadership must make a fleet safety program a priority. Have a written cell phone policy. Require employees to put their phone on do not disturb while they are driving, which blocks calls and text messages while their car is in motion. And, train drivers using the SafetyOne™ Distracted Driving online course. Not only can an effective fleet safety program minimize further insurance increases, but most importantly you could save a life.

To learn the essential points of a fleet safety program and defensive driving skills, register for our Fleet Safety Webinar.

For questions about how your fleet safety program affects your commercial auto premiums, contact me at sclayton@ranchomesa.com or (619) 937-0167.

Using Rancho Mesa’s KPI Dashboard to Improve Your Workers’ Compensation Program

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape business leaders can now provide their management team with resources to better support their workers’ compensation program. Rancho Mesa offers its landscape, lawn care and tree care customers an industry specific Workers’ Compensation Key Performance Indicator (KPI) that can be used to help benchmark a company’s experience modification rate (i.e., Ex-Mod, Experience Mod), and the underlying performance trends that can help stakeholders stay informed.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape business leaders can now provide their management team with resources to better support their workers’ compensation program. Rancho Mesa offers its landscape, lawn care and tree care customers an industry specific Workers’ Compensation Key Performance Indicator (KPI) that can be used to help benchmark a company’s experience modification rate (i.e., Ex-Mod, Experience Mod), and the underlying performance trends that can help stakeholders stay informed.

The KPI is an easy to read one-page document made up of dials and dashboards so that the business leaders can easily absorb the most critical pieces of information.

Three Use cases

Landscape businesses can use the KPI to help set annual leading indicator goals. These goals, like the completion of a certain number of toolbox talks, safety observations, and online trainings can all be tracked in Rancho Mesa’s SafetyOne™ Platform. By using the lagging information provided in the KPI, any business can then set goals to address corrections that the KPI discloses.

The Ex-Mod can be used as a pre-qualification tool for bidding new work or maintaining certain contracts. With the KPI dashboard, landscape businesses will always know their current, 10 previous, and estimated future Ex-Mods.

Underlying information such as frequency and severity rates can easily be understood through the StatTrack™ portion of the KPI dashboard. These rates are viewed as trends and allows the business to make timely corrections.

Empower your leadership team to better understand your workers’ compensation program by providing them with the tools they need to effectively make a difference.

Learn more about the KPI Dashboard on Rancho Mesa’s Mod Doctor webpage.

Governor Signs PAGA Reform

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

On July 1st, California Governor Gavin Newsom signed legislation to reform the Private Attorney’s General Act (PAGA). The legislation was enacted to help ensure workers retain a strong tool to resolve labor claims and receive fair compensation, while reducing shakedown lawsuits that hurt employers and employees.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

On July 1st, California Governor Gavin Newsom signed legislation to reform the Private Attorney’s General Act (PAGA). The legislation was enacted to help ensure workers retain a strong tool to resolve labor claims and receive fair compensation, while reducing shakedown lawsuits that hurt employers and employees.

The legislation signed was Assembly Bill 2288 (AB 2288) and Senate Bill 92 (SB 92). Newsom was quoted as saying, “This reform was decades in the making and it’s a big win for both workers and businesses. It streamlines the current system, improves worker protections, and makes it easier for businesses to operate.”

The key elements of the PAGA reform include:

Reform of Penalty Structure

Increases the amount of allocated penalty money that goes to employees from 25% to 35%.

It caps the penalty for employers who quickly take steps to fix policies and practices, and make workers whole, after receiving a PAGA notice. It also reduces the penalty for employers that act responsibly to take steps proactively to comply with the labor code before receiving a PAGA notice.

Creates a new penalty ($200 per pay period) if an employer acted maliciously, fraudulently, or oppressively.

Reduces the maximum penalty where the alleged violation was brief or where it is a wage statement violation that did not cause confusion or economic harm to the employee (i.e. misspelling of company name or forgetting to add “Inc.” on the pay statement).

Penalties for employers who pay weekly are adjusted to meet other employers who pay on a biweekly or monthly basis. Previously, such employers were penalized at twice the amount because the penalties were accrued on a per pay period basis.

Reducing and Streamlining Litigation

Expands which labor code sections can be cured to reduce the need for litigation and make employees whole quickly.

It protects small employers by providing a more robust right to cure process through the state labor department (Labor and Workforce Development Agency) to ultimately reduce claim costs.

For larger employers, it provides an opportunity for early resolution.

Codifies that a court may limit both the scope of claims presented at trial to ensure cases can be managed effectively.

Improving Measures for Injunctive Relief and Standing

It incentivizes or provides injunctive relief to employers to implement changes in the workplace to remedy labor law violations.

It requires employees to personally experience any alleged violation prior to filing a claim.

Strengthening State Enforcement

The administration will pursue a trailer bill to give the California Department of Industrial Relations (DIR) the ability to expedite hiring and filling vacancies to ensure effective and timely enforcement of employee labor claims.

PAGA claims have wreaked havoc on employers for decades. In fact, since 2013, there have been nearly $10 billion in court case awards. Unfortunately, due to significant attorney fees, only a small portion of these awards go to the workers. PAGA claims have impacted every type of business in California, including non-profits, family-run businesses, and even local governments. This PAGA reform should help change the long-term success of workers and businesses moving forward.

While coverage for PAGA violations is limited at best from Employment Practices Liability policies, employers should review their wage and hour policy with their risk advisor and employment law attorney to mitigate the impact of potential fines.

To discuss your company’s potential exposure to PAGA claims , contact me at (619) 937-0174 or jhoolihan@ranchomesa.com.

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

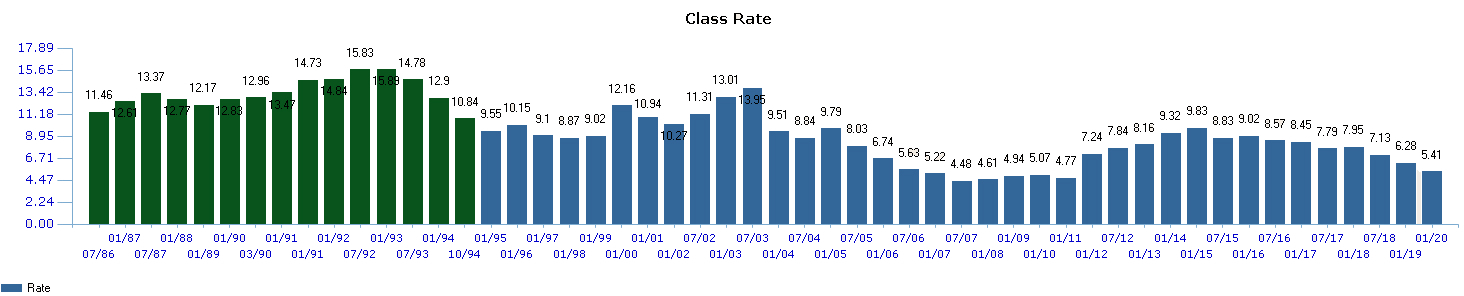

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

Landscape Companies with Low Experience MODs Do These 5 Things

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

The XMOD/EMR is a unique number assigned to a business that is made up of their historical loss figures and audited payroll information vs. the same information for companies involved in the company’s same industry. Generally, if your business has experienced more claim activity than the industry average, you will have a XMOD/EMR above 1.00. The opposite is true; if you have had less claim activity, your XMOD/EMR will be below 1.00. The XMOD/EMR impacts the rates you pay for workers’ compensation by crediting (XMOD/EMR below 1.00) or applying a surcharge (XMOD/EMR above 1.00).

Here are the 5 best practices used by landscape companies who have an XMOD/EMR) below 1.00.

1. An Aggressive Return to Work Program

If you heard our podcast episode with Roscoe Klausing of Klausing Group, you will hear him coin the phrase an “aggressive return to work program” which was a key component to his company, of more than 70 employees, going 3 years without a lost time accident.

Aggressively finding a way to help bring an injured employee back on modified work restrictions has long been proven to provide positive outcomes for everyone involved. Benefits of bringing an employee back on modified duties include:

Eliminating temporary disability payments from the claim cost.

Lower the dollar amount of medical treatments.

Reduce the overall cost of the claim.

Lower the potential impact the claim would have on your XMOD/EMR.

Improve injured employee morale.

2. Timely Reporting and Accident Detail

It is critical to constantly remind your front line supervisors and employees that they must report all injuries no matter the severity as soon as possible. Studies have shown that work related injuries reported with the first 5 days have a dramatically lower average claim cost and litigation rates than those reported after 5 days.

Two measurable statistics for you to keep an eye on are:

The lag time between when an injury is reported to you from an employee.

The amount of time it takes you to report this information to your insurance carrier.

By conducting a thorough accident investigation at the time of injury and providing a report to your insurance claim professional, you will speed up the claims process and lower costs. Eliminating the time delays caused by the claim professional waiting for details or additional information is critical in making sure your injured employee is on the fast track to recovery. To assist the landscape industry in completing this necessary step, Rancho Mesa has created a free, fillable, carrier approved accident investigation report for use by the landscape industry.

3. Communication

Keeping in constant communication with employees who are injured is vital to a positive outcome. At times, the workers’ compensation process can seem slow. Some injuries will take longer than others. This can lead injured employees to feel frustrated and uncertain. Make sure you are addressing their concerns and checking in on them, frequently.

4. Know the Basic Principles Behind the XMOD/EMR

You do not need to know the XMOD/EMR formula, but you should have an understanding of the basic concepts that leads to XMOD/EMR inflation.

You should know when your claim information will be sent to your rating bureau for next year’s XMOD/EMR calculation and make sure you are familiar with the status of each claim before the information is locked.

If your rating bureau uses a Primary Threshold or Split Point, it is good to understand how this number impacts claim cost and each claim’s impact on the XMOD/EMR.

Know your lowest possible XMOD/EMR, this would be all your payroll with zero claims. The points between your lowest possible XMOD/EMR and your current XMOD/EMR are the controllable points.

Know the policy years that are used to calculate the XMOD/EMR.

5. Relationship With Your Carrier and Claims Professional

The carrier claims professional who handles your injuries can have a huge impact on the outcome of the claim. If you are fortunate enough to have a dedicated claim adjuster assigned to your company, make it a point to call and introduce yourself before the first claim occurs. The adjuster should have a very good understanding of:

Your attitude and policy regarding return to work programs.

The level of accident information they will receive from you.

Who will be your company’s main contact throughout the claim process?

Consider these five best practices when handling your workers’ compensation claims to keep your XMOD/EMR under control and your workers’ compensation costs low.

COVID-19’s Impact on the Non-Profit Insurance Marketplace

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Rate Increases

With many businesses completely shut down and sales way off projections, insurance companies are experiencing lower annual premiums while still needing to pay out for claims. Certain lines of coverage, in particular Employment Practices Liability and Workers’ Compensation are starting to see a significant uptick in claim frequency, which will likely cause rate increases to manage these unexpected costs.

Carriers not writing any new business

Some carriers have placed a moratorium on quoting any new accounts until they can fully assess the damage on longer term exposure of COVID-19. This translates to less options for non-profit risks at renewal.

Carriers Limiting or Excluding Coverage

Many carriers are starting to increase deductible levels, lower available Umbrella limits, and eliminate certain coverage territories for certain property as a way to limit their exposure to claims. Working closely with your broker to plan for these potential gaps at your pre-renewal meeting is critical for you and your management team.

Audited Policies

In many industries, General Liability policies are audited, annually. In the non-profit space, final audits are rarely performed. In order to better account for the loss of revenues due to the shelter-in-place restrictions, many carriers will be conducting end of year audits. This could severely impact those organizations that have not been properly accounting for their exposure, as they will most likely have their revenues, employee counts, and client counts verified at the end of the policy term. Again, developing a plan now with your broker is an important part of your renewal cycle and can help maximize what potentially could be return premiums at final audit.

Looking ahead, non-profits will need to make sure they are partnered with a broker who is proactive and knowledgeable about the marketplace, so that they can stay ahead of these changes and avoid financial hardship as much as possible.

Rancho Mesa offers tools like the Risk Management Center, RM365 HRAdvantage™ portal, RM365 Advantage Safety Star Program™, weekly newsletters and Safety & Risk Management Podcast to assist our clients with successfully managing their risk and improving their marketability to carriers.

Contact Rancho Mesa Insurance Services at (619) 937-0164. to discuss your non-profit’s insurance needs.

COVID-19 Business Shutdown: What Coverage Gaps Exist with Vacant Properties

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In response to the COVID-19 pandemic and ensuing shelter in place restrictions, many non-essential businesses have been shuttered for several weeks. As those businesses deal with the massive revenue and employee losses, building owners must be cautioned to review their property policies closely for vacancy provisions and exclusions.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In response to the COVID-19 pandemic and ensuing shelter in place restrictions, many non-essential businesses have been shuttered for several weeks. As those businesses deal with the massive revenue and employee losses, building owners must be cautioned to review their property policies closely for vacancy provisions and exclusions.

Vacancy clauses can create exceptions from coverage if the property in question is vacated or unoccupied for a defined period of time (most often 60 days but often shorter). For example, there are some policies that will not provide coverage if a property sits vacant more than that fixed number of days but applies to only certain types of losses like vandalism, theft, or water damage. Additional limitations can include a reduction of losses by 15% or more for more typical covered causes of loss like a building fire and certain losses can be excluded altogether once a property is vacated depending on the insurance company’s form. Finally, there are still other policies that will, in fact, provide coverage for any types of losses but stipulate that the policyholder must inform them that the property has been vacated.

What qualifies as vacant or unoccupied? Some policies define these very specifically while others are broad and ambiguous, offering little comfort at the time of loss. Rather than wait until after a loss when coverage might still be in jeopardy, take the initiative now to contact your broker if your property is vacant or partially occupied as a result of the COVID-19 pandemic. Communicating with the insurance company will help clarify definitions and interpretations and allow you to plan appropriately for the potential of a property loss.

While this continues to be an unprecedented time, several insurance companies are now sending notices to policyholders that they will not consider a building to be vacant for the days during any period of occupancy that changed as a result of the government stay-at-home order or similar directive to COVID-19. Take time now to review your policies with your broker, learn more about your specific vacancy provision and whether your insurance carrier will waive some or all of this provision during this window of time.

Subscribe to our weekly newsletter and podcast to stay informed about what’s happening in the insurance industry during this pandemic.

Frustrated You’re Not Getting Paid on a Bonded Project?

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Getting paid on time by project owners is essential! As construction companies attempt to collect their account receivables, a frustration builds as the overdue payments stretch from 60, to 90, to over 120 days. You might have already paid certain suppliers or subcontractors, and now your cash flow is getting stretched because your receivable has been delayed. If this is a bonded project – you do have an additional avenue of recourse to collect.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Getting paid on time by project owners is essential! As construction companies attempt to collect their account receivables, a frustration builds as the overdue payments stretch from 60, to 90, to over 120 days. You might have already paid certain suppliers or subcontractors, and now your cash flow is getting stretched because your receivable has been delayed. If this is a bonded project – you do have an additional avenue of recourse to collect.

You should first obtain a copy of the bond from the owner, municipality, or general contractor on the project. On a public works project this should not be difficult to obtain.

The next step is to work with your bond agent on the best way to contact the bonding company with your claim. Some bond companies will request you send an email to their claims department. Otherwise, your agent will have the bond company claim department address to ensure your claim goes to the proper area to receive attention. At Rancho Mesa, we have prepared letters that you can use as a sample to provide the bond company the proper information so your claim is not delayed.

The bond company should respond to you (usually within 20 days) and have you fill out their claim form and provide the backup documentation required to support your claim. They will then check with their insured to find out if the claim is legitimate and why payment has not been made.

If you would like a better understanding of how your professional bonding agent can assist you in filing a bond claim on a construction project, please feel free to contact me to ensure you are getting the proper direction to collect your money.

3 Reasons Your Pre-Renewal Meeting Is the Key to Your Success

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

Business leaders across the country head into each year with questions regarding the upcoming business insurance renewal process. Owners and officers alike rely on their insurance broker to help them navigate these uncertainties. What should a best practice renewal process look like?

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

Business leaders across the country head into each year with questions regarding the upcoming business insurance renewal process. Owners and officers alike rely on their insurance broker to help them navigate these uncertainties. Why should owners and officers expect a pre-renewal meeting?

Discuss important changes to your business

Between 120 and 90 days prior to the insurance renewal, expect your broker to produce a renewal packet designed to facilitate a face-to-face conversation. This important exchange is the perfect setting to update insurance applications, discuss additional coverages and explore any changes to the business. Without this crucial meeting, changes within your business may not be reflected in the documentation presented to the insurance carrier. And, that can be costly.

“When I met with Rancho Mesa three months prior to our insurance renewal, we game-planned a strategy to address a changing market as well as potential new programs and exposures,” comments Florence Andres, Director of Human Resources for North County Lifeline. “I feel comfortable that our broker strives to understand our business and mission. Every year, important decisions are made and questions are answered.”

Create a target premium and renewal strategy

In addition to application updates, it’s important to discuss a detailed review of losses, the current carrier’s performance and changes in the marketplace that will affect the renewal terms. During this meeting, the two parties agree on a proactive plan to approach the marketplace, target the renewal pricing and agree to a meeting 3 to 4 weeks prior to the renewal date to insure no last minute surprises.

How is this possible? By using industry benchmarking like Rancho Mesa’s StatTrac™ program, we are able to compare our client’s performance to their industry peer group.

“Benchmarking a client’s claims performance over five years provides important insight,” reflects Dave Garcia, Rancho Mesa’s President. “In addition to helping us set aggressive renewal pricing objectives, it also assists us in discovering underlining trends and root causes that help us create the appropriate service plan moving forward to correct those areas of need.”

Prepare for the hardening market

As we enter into a hardening property and casualty insurance market with the potential for escalating premiums, the need for a formal renewal meeting, done well in advance of the policy expiration date, should be expected by all business owners and officers. With the marketplace leading to increasing rates, higher retentions, and lower limit options, leaving an underwriter’s interpretation to chance is not an option. Your broker must paint an accurate picture of your company for the underwriter in a way that justifies the appropriate pricing.

If you have questions about the hardening insurance market or wish to learn more about Rancho Mesa and our “Above and Beyond” approach to customer satisfaction, please call me at (619)937-0175 or sbrown@ranchomesa.com.

What Employers Need to Know Before a Serious Injury Occurs in the Workplace

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Timely reporting of an employee’s work-related serious injury, illness or death can pose a challenge to the employer. As of January 1, 2020, these incidents (including any hospitalizations, unless the injured worker is admitted for medical observation or diagnostic testing) must be reported immediately to Cal/OSHA. Immediately means as soon as practically possible but not longer than 8 hours after the employer knows or, with diligent inquiry, would have known of the serious injury, illness or death.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Timely reporting of an employee’s work-related serious injury, illness or death can pose a challenge to the employer. As of January 1, 2020, these incidents (including any hospitalizations, unless the injured worker is admitted for medical observation or diagnostic testing) must be reported immediately to Cal/OSHA. Immediately means as soon as practically possible but not longer than 8 hours after the employer knows or, with diligent inquiry, would have known of the serious injury, illness or death.

Monitoring the employee’s status at a hospital can be difficult if the employer has not put in place procedures and policies that will authorize a healthcare provider to disclose information that is covered by the Health Insurance Portability and Accountability Act (HIPAA). For example, the employer must follow-up with the hospital providing care to the injured employee to determine if the incident must be reported to Cal/OSHA. The employer will need to know if the employee has been moved from the emergency room and admitted to the hospital for in-patient treatment.

Ensuring policies and procedures are developed and implemented to restrict the use and disclosure of protected health information (PHI), are important elements of HIPAA compliance. If health information is used for purposes not permitted by the HIPAA Privacy Rule, or is deliberately disclosed to individuals not authorized to receive the information, there are possible penalties for the covered entity or individual responsible.

HIPAA permits PHI to be used for healthcare operations, treatment purposes, and in connection with payment for healthcare services. It can be argued that employers need this information to comply with State and Federal OSHA laws. Information may be disclosed to third parties for said purposes, provided an appropriate relationship exists between the disclosing covered entity (i.e., the hospital) and the recipient’s covered entity or business associate (i.e., the employee or employer). A covered entity can only share PHI with another covered entity if the recipient had previously or currently has a treatment relationship with the patient. The PHI has to relate to that relationship. In the case of a disclosure to a business associate, a Business Associate Agreement must have been obtained. Disclosures must be restricted to the minimum necessary information that will allow the recipient to accomplish the intended purpose of use.

Prior to any use or disclosure of health information that is not expressly permitted by the HIPAA Privacy Rule, one of two steps must be taken:

A HIPAA authorization must be obtained from a patient, in writing, permitting the covered entity or business associate to use the data for a specific purpose not otherwise permitted under HIPAA.

The health information must be stripped of all information that allows a patient to be identified.

Employers may consider obtaining signed business associate agreements or HIPAA authorizations from their employees before any injury or accident occurs. This will ensure they are able to get the appropriate protected medical information from the hospitals so they can report “serious injury or illness” accurately and timely to Cal/OSHA.

Therefore, it is extremely important for employers to learn the existing laws and new changes to these laws and have a plan of action in place to address these concerns before the next serious injury, illness, or death occurs.

Currently, reporting to Cal/OSHA can be made by telephone or e-mail. With these reporting changes, Cal/OSHA has also been directed to establish an on-line mechanism for reporting these injuries. It is always important to document when these incidents are reported to Cal/OSHA. Until an online mechanism is established, use of e-mail would be such method for documentation. Monitoring of the Cal/OSHA website for implementation of the on-line mechanism of reporting is also suggested.

For more information on how to report serious injuries and illnesses to Cal/OSHA, please reference “Cal/OSHA Updates: AB 1804 Changes How Injuries and Illnesses Are Reported.”

For more information about what is considered a serious injury or illness under Cal/OSHA, please reference “Cal/OSHA Updates: AB 1805 Changes Definition of Serious Injury or Illness.”

Fire, Earthquakes, Leaks, Oh My! Property Insurance Market Continues to Worsen

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

Many of our clients have opted for alternative options to the standard insurance programs most are accustomed to purchasing to cover their property. These alternative approaches are allowing our clients to save money while still insuring their property to a level that they feel comfortable.

The 2018 California Wildfires brought unprecedented destruction and loss to the region. The total value of insurance claims is estimated to exceed $13 billion. While some have theorized that Pacific Gas & Electric (PG&E) will reimburse insurance companies as a result of its negligence to maintain trees and equipment that caused the destructive wild fires, many believe this will not be the case.

The total damages expected to fall on PG&E exceeds $30 billion, most of which will go towards municipalities before it goes to the insurance companies. This is omitting any lawsuits that have yet to be filed. Also, much of what PG&E will be required to pay will come from…its insurance policy.

Alternative Options to the Standard Market

Many of our clients have opted for alternative options to the standard insurance programs most are accustomed to purchasing to cover their property. These alternative approaches are allowing our clients to save money while still insuring their property to a level that they feel comfortable.

Many of these options are backed by the state of California and allow the client to have key coverage for fires, water leaks, vandalism, etc. while saving, in many cases, 60-80%. There is no limit to property size and geographic location on these alternative programs.

For more information about alternatives to standard insurance programs for property coverage, please contact Rancho Mesa Insurance Services at (619) 937-0164.

Managing the Inherent Risks of Personal Vehicle Use Within Your Company

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While costs associated with auto liability continue rising across the country, there are risks within existing fleet safety programs that often get overlooked. If your business allows employees to use personal vehicles to conduct business even just occasionally, you could be exposing your firm to considerably more risk.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While costs associated with auto liability continue rising across the country, there are risks within existing fleet safety programs that often get overlooked. If your business allows employees to use personal vehicles to conduct business, even just occasionally, you could be exposing your firm to considerably more risk. You can ignore this potential gap in coverage or closely examine the exposure while simultaneously developing a risk mitigation plan.

Review and Examine Liability Coverage

Before developing any guidelines, we encourage clients to identify those drivers that are using personal vehicles. Again, the pool here should include regular and non-regular drivers who are using personal vehicles. Once that list is finalized, request current declaration pages and/or certificates of insurance showing coverage periods and limits. As you examine this information, ensure that coverage is in force and pay close attention to the limits as many state minimum coverage requirements will be much lower than typical commercial auto policy limits (Example: $10,000 to $15,000 for bodily injury). Working to develop company standard minimum limits for personal use of vehicles is something you can establish with and through recommendations from your broker partner and carrier.

Hiring with Auto Exposure in Mind

Just as many managers do when hiring employees who will drive company vehicles, consider requiring the same guidelines for potential new hires who may use their own vehicles. These guidelines may include a current Motor Vehicle Report (MVR) which allows you to review accidents and track behavior. You may also enroll drivers in the Employer Pull Notice (EPN) Program which notifies businesses when employees have any type of driving activity in or out of the workplace. Lastly, be prepared with documented steps to take when your drivers exhibit unsafe driving behavior. This can include additional training, a suspension, or even termination depending on the frequency.

Written Expectations and Usage Guidelines for Drivers

Vehicle use agreements have become commonly used documents for employers. Depending on the layout, usage guidelines can help establish clear expectations and encourage real buy-in from the employee. As a reference point, Rancho Mesa offers an example of a usage guideline form available within the Risk Management Center.

Creating and Maintaining a Culture of Safety

Evaluating your respective safety programs is a process that takes time. Many employers are unfamiliar where to even start and perhaps which areas of their operation pose the greatest risk to their business’ financial health. With auto liability, in general, the potential for direct loss can impact balance sheets of all sizes. Part of our role as commercial insurance brokers is tying in years of experience seeing these gaps within programs, like personal vehicle use. We recommend first how to mitigate them and then tailor an insurance program that further reduces or eliminates the exposure. The points listed above represent only the start to your process in revamping your Fleet Safety Program. Call or email Rancho Mesa Insurance for a complete “all lines” safety review and coverage audit. Your company’s financial future could depend on it.

Skilled Labor Shortages Prompt Subcontractors to Provide Performance Guaranty

Author, Andy Roberts, Account Executive, Surety Division, Rancho Mesa Insurance Services, Inc.

The construction industry is currently booming. According to a survey conducted by the AGC of America, and a recent article written by Rancho Mesa’s Kevin Howard, the industry shows no signs of slowing down, as 80% of contractors predict growth in 2020. While that’s great news for the industry, we are starting to see some trends that can cause some issues for contractors.

Author, Andy Roberts, Account Executive, Surety Division, Rancho Mesa Insurance Services, Inc.

The construction industry is currently booming. According to a survey conducted by the AGC of America, and a recent article written by Rancho Mesa’s Kevin Howard, the industry shows no signs of slowing down, as 80% of contractors predict growth in 2020. While that’s great news for the industry, we are starting to see some trends that can cause some issues for contractors.

With an abundance of work, contractors are finding it more difficult to find the skilled labors required to complete a project on schedule. This is causing more and more general contractors, who historically didn’t require their subcontractors to provide a bond, to now require their subcontractors to bond back to them on contracts over a certain amount.

Bonding back is when a general contractor requires a subcontractor to obtain a performance and payment bond, even though the general contractor is already carrying a bond for the entire project. The bonds from the subcontractor operate in the same way as the bonds that the general contractor provided to the project owner, but now the general contractor has a performance guaranty from the subcontractor. This gives the general contractor an avenue to pursue recourse, should the subcontractor default or fail to perform up to the standards required by the contract, which is something that can happen if the subcontractor is having issues finding enough skilled labor.

Furthermore, this can present a problem for subcontractors who aren’t accustomed to bonding. They would need to get a bonding program put into place in order to work with a general contractor that they may have a long relationship with, who they previously never required a bond back. This makes it very important for subcontractors to have the discussion with the general contractor about potential bond requirements. An upfront conversation with the general contractor can help you avoid getting into a situation where you win a bid, but don’t have the ability to meet the bond requirement.

Fortunately, for contractors that are new to bonds or maybe don’t bond frequently, there are a variety of programs that the different sureties offer, whether it be credit-based, or a more traditional program. We can help navigate those programs and find the solution that works best for their company’s bonding needs.

If you have additional questions or would like to explore all the different options that each surety offers, please contact Andy Roberts at (619) 937-0166.

2020 Promises Growth for Contractors but With a Twist

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

Based on a recently published survey from the Associated General Contractors of America, 80% of contractors predict growth in 2020…but there is a twist. There is a major labor shortage.

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

Based on a recently published survey from the Associated General Contractors of America, 80% of contractors predict growth in 2020…but there is a twist. There is a major labor shortage.

The current California Unemployment Rate, is a staggeringly low 3.9% compared to an unbearable 12% during the 2008 recession. As Californians, this statistic is music to our ears. However, for construction owners, the demand to hire skilled workers from an extremely shallow workforce pool has created a need for Best Practices hiring strategies paired with enhanced methods of retaining employees.

As a 13-consecutive year Best Practices Agency, Rancho Mesa provides resources to equip our clients with strategies and methods to enhance human resources strategies. These efforts lead to broader protection from insurable risk.

We are excited to partner with Equal Parts Consulting on February 6, 2020 for a seminar that will equip businesses with the needed methods for this economic environment. Attendees can look forward to the following topics and discussions below:

Strategies and best practices to create an easy to implement hiring process that aligns with your company’s culture.

Effective ways to assess and evaluate talent to ensure they are aligned with your company purpose, values, and culture.

Uncover some of the most important things your business can do to attract and retain the right talent for your culture.

Our goal is to help our contractor clients map out a game plan that will help retain talent, search for needed key employees and create a successful 2020 and beyond. Please feel free to contact me with any questions, at (619) 438-6874.

Work Comp Unit Stat: The Meeting That Saves You Money

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) defines the process of receiving loss and payroll information by classification as the Unit Statistical Report. The information is reported to the WCIRB by insurance carriers at specific intervals based on your company’s policy effective date. The information is valued for the first time 18 months after the inception of your policy and every 12 months thereafter.

A policy that incepts in January 2020 will be valued for the first time in July of 2021 (18 month mark). This information will remain in your XMOD calculation for the valuations at 30 months and 42 months.

Once this information has been received by the WCIRB, from the respective carriers, it cannot be altered or changed until the following year’s unit stat. Thus, you may have a positive outcome on an existing open claim (reserve reduction or closure) but not see the benefit until the following year. Revisions to the XMOD once published are limited to a few circumstances; more information about revisions can be found here.

The loss information, sent to the WCIRB from the insurance carriers, will be evaluated at the paid (closed claim) or reserved (open claim) amounts. Typically, a claim that has been open for longer than 18 months signifies severity, litigation, lost time, permanent disability, or a combination of the group. For this reason it is absolutely critical that as a part of your risk management process you execute a

pre-unit stat meeting.

When should I schedule my Unit Stat meeting?

What should I do at this meeting?

Who needs to be involved?

How will this meeting save me money?

As a client of Rancho Mesa, we build this meeting into your annual service plan and take care of engaging the parties who need to be involved for the betterment of your XMOD.

Ready to learn more about Unit Stat? Join us for a complimentary 25-minute webinar where we will discuss the process in greater detail and take time for Q&A.

Still not sure if further learning is necessary, ask yourself these questions:

Have you ever been surprised by your XMOD being higher than you would have thought?

Have you ever had an XMOD above 1.00?

Has your XMOD ever caused your premium to increase?

The webinar can be viewed on-demand by clicking the link below.

Generating Your Employee Handbook Is Easier Than Keeping a New Years Resolution

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

When business owners are asked if their employee handbooks are up to date, they typically shrug and say “It’s something we have been meaning to tackle.” It is hard to blame them when it often feels as though a newly revised employee handbook quickly requires an update due to changes in employment laws! There is a significant need for an easy to use option where employers can have an up to date handbook throughout the year and, have it generated at no cost. Rancho Mesa provides that solution.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

When business owners are asked if their employee handbooks are up to date, they typically shrug and say “It’s something we have been meaning to tackle.” It is hard to blame them when it often feels as though a newly revised employee handbook quickly requires an update due to changes in employment laws! There is a significant need for an easy to use option where employers can have an up to date handbook throughout the year and, have it generated at no cost. Rancho Mesa provides that solution.

As the California workplace climate changes, it is imperative that business owners have solutions before problems arise. Employee lawsuits against their employers are on the rise and Rancho Mesa clients must be prepared for the possible, if not inevitable. While updating an employee handbook can be one of the easiest obligations to neglect, skipping this task can have serious repercussions.

When laws and protocols change over time, it can be difficult making sure your employee handbook is up to date. Make sure it clearly communicates:

What is expected of your employees.

What are your company policies.

What rules are in place.

At Rancho Mesa, we have taken the time to understand our clients’ needs and if there is a solution available, we try to accommodate. We provide a free option for our clients, to help them compose a compliant handbook that is:

State and federal compliant.

Handbook is fully customizable with optional policy update alerts. If a law were to change right after completing your handbook, you would receive an email with the change and have the option to add it to your handbook.

Live HR support to assist with company specific question.

Please reach out to Alyssa Burley at aburley@ranchomesa.com with any questions you may have about the employee handbook builder option through the RM365 HRAdvantage™ portal. If you have any questions pertaining to your insurance needs, please call (619) 934-0164.

Have You Met With Your Bond Company This Year?

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

In the world of surety bonding, the various financial information the bond underwriter will analyze includes the Balance Sheet, Income Statement, A/R & A/P Aging, Bank Line of Credit, Work In Progress Schedule, and the owner’s personal financial statement. This is to determine the level of single project and aggregate program credit line to support the contractor’s bonding.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

After a recent meeting between a Rancho Mesa contractor client, the bond company that supports our contractor, and Rancho Mesa as the contractor’s agent, the bond manager sent me an email stating, “now that I have met with [your client], we are willing to increase their aggregate surety line of credit by $10,000,000. Thank you for setting up the meeting.”

In the world of surety bonding, the various financial information the bond underwriter will analyze includes the Balance Sheet, Income Statement, A/R & A/P Aging, Bank Line of Credit, Work In Progress Schedule, and the owner’s personal financial statement. This is to determine the level of single project and aggregate program credit line to support the contractor’s bonding. These items all represent “objective” processes the bond company will use to make their credit decision.

However, it is also important to introduce the bond company to several “subjective” processes to include in their decision making. During a direct meeting between the contractor and the bond underwriter, you may uncover positive items that might make the difference between a yes or no response for a project. Examples might include:

Relationships with a certain municipality or a general contractor (in the case of a subcontractor client).

Various production schedules that could enhance the profit on a particular project.

Equipment savings unknown to the underwriter, etc.

As a home office contract bond underwriter in the late 1980s, I was invited by an agent and our branch underwriter to fly to Atlanta and meet with a certain contractor before deciding whether to support a large project that would require a bond. After walking though the jobsite with the client and reviewing the various estimating schedules for this particular project, I came back with a sense that the contractor could support a higher level of bonding beyond what our analysis of the financial numbers would have allowed. Therefore, we approved the bid for bonding. Although the contractor client came in third on that specific project, we had laid the groundwork for a much larger program of support going forward.

We recommend that you schedule to meet your bond company on an annual or bi-annual basis. If you would like a better understanding of how this meeting might increase your bond line of credit, feel free to contact me, Matt Gaynor, at (619) 937-0165 to discuss ways to ensure your bond program is efficient as possible.