Industry News

Excess/Umbrella Rates Experiencing Alarming Price Jump

Author, Sam Clayton, Vice President of the Construction Group, Rancho Mesa Insurance Services, Inc.

As if the 2020 business landscape has not already been challenging enough, a hard market for excess/umbrella is occurring at a concerning rate, resulting in rising premiums, limited capacity and a restriction in terms and conditions.

Author, Sam Clayton, Vice President of the Construction Group, Rancho Mesa Insurance Services, Inc.

As if the 2020 business landscape has not already been challenging enough, a hard market for excess/umbrella is occurring at a concerning rate, resulting in rising premiums, limited capacity and a restriction in terms and conditions.

A hard market can be defined by a decrease in limit and underwriting capacity, and an increase in rate and premium. While other lines of liability are seeing single-digit increases, excess/umbrella pricing is experiencing 20-30% jumps, depending on the risk. This significant increase is the result of several factors including:

Social inflation

Nuclear judgements

Third-party litigation financing

Natural and man-made catastrophes

Increase in severe distracted driving incidents

In addition to these premium increases, insurance carriers are reducing their capacity. Previously a carrier might have been comfortable in offering higher limits such as $25 million on a risk and now they are limiting their lead limits to $5 or $10 million dollars, which then require a business, in need of higher limits, to seek additional participation from other carriers to meet their needs. This creates both the need to “stack” limits and at the same time make sure policy terms stay consistent.

The area most often overlooked are new restrictions in the terms and conditions. Some to be mindful of include:

Communicable Disease Exclusions

Wildfire Exclusions

Higher Retention Limits

Now more than ever is the time for contractors to be meeting with their broker to put proactive steps in place to minimize the impacts of this hardening market. As the construction group leader here at Rancho Mesa, if you have questions or need help in navigating these turbulent times, please reach out to me at (619) 937-0167 or email at sclayton@ranchomesa.com.

Bond Companies Thoroughly Track Status of Construction Projects

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

When the bond company approves a performance and payment bond for our contractor clients, they want to keep track of the project until completion - at which time the liability for the bond is no longer on their books. One tool they use to track a construction project is the Work In Progress Report (WIP) which the bonding company analyzes on a quarterly or six-month basis to track the profitability of the project on a percentage of completion basis. When the bond company sees that a project is 100% complete on the WIP or Completed Contract Report, they will mark the bond file as “closed,” once the warranty period has expired.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

When the bond company approves a performance and payment bond for our contractor clients, they want to keep track of the project until completion - at which time the liability for the bond is no longer on their books. One tool they use to track a construction project is the Work In Progress Report (WIP) which the bonding company analyzes on a quarterly or six-month basis to track the profitability of the project on a percentage of completion basis. When the bond company sees that a project is 100% complete on the WIP or Completed Contract Report, they will mark the bond file as “closed,” once the warranty period has expired.

Additionally, several bond companies will also use a Contract Bond Status Inquiry Form to track the projects. This form is mailed to the obligee (i.e., the owner or general contractor on the bonded project) and requests project information is completed on the form, then returned to the bond company via mail, email, or fax. The questions posed on the form include, “Is the contract completed, and if so, what was the completion date and final contract amount?” In the event the contract is on-going, the form requests a percentage of completion or approximate dollar amount of the work completed to date. The form also asks the owner if they are aware of any unpaid bills for labor or material on the project.

The final area of the status inquiry form provides space for the obligee to fill in remarks. This can be a good or bad thing for the contractor. We have seen responses from owners and general contractors that range from “great subcontractor – excellent to work with” to “I will never hire this contractor again.” Other times, this area is left blank.

While the primary goal of the status inquiry is to understand if a project is closed or remains open, the remarks section will grab the bond underwriters attention (positive or negative) and that will become part of their underwriting analysis, going forward.

If you would like more information on how the contract bond status inquiry might influence the underwriting of your bond program, feel free to reach out to me at (619) 937-0165 or mgaynor@ranchomesa.com and ask any questions to ensure your bond program is getting the proper attention.

Strengthen Your Risk Profile During COVID-19

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 continues to have a stronghold on the US economy and it is likely that we will see the impact for many years to come. While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. Understand that this recommended rate increase comes against a backdrop of record profits in workers’ compensation prior to COVID-19. There are also three COVID-19 presumption Bills (AB 196, AB 644, and SB 1159) that could create presumptions that cases of COVID-19 are a compensable consequence of work, which will likely cause additional turmoil in the marketplace.

With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Improve the Safety Program

Now is not the time to take your focus off of safety in the workplace. In fact, I would argue that there should be even more focus on safety. Some items to focus on relating to a safety program include:

Update your Injury and Illness Protection Program (IIPP) and have it reviewed by a labor attorney.

Establish a safety committee consisting of ownership, supervisors, managers, your insurance broker, and insurance company (i.e., loss control representative). This will assist with identifying workplace hazards, discussing claims or near misses that have occurred and creating safety meeting topics that can be discussed at future employee safety meetings.

Ensure that safety meetings are occurring at least every 10 working days, but preferably weekly. Using safety topics identified by the safety committee, managers can pinpoint proper trainings for employees.

Update Employee Handbook

With employment requirements, policies and procedures continually changing, it’s easy to fall behind on new regulations like adding an Emergency Paid Sick Leave Policy or Expanded Family and Medical Leave Policy, in your employee handbook. Rancho Mesa offers access to a living handbook builder through the RM365 HRAdvantage™ portal. By creating a living employee handbook through the portal, updating the document with new policies is as easy as reviewing and approving the suggested changes provided by experienced human resources professionals.

Continue Your Risk Management Education and Certifications

With many businesses slowing during COVID-19, consider filling that down time with required accreditations and continued education courses. Some examples include:

Anti-harassment Training: By the end of 2020, businesses with 5 or more employees are required to provide Anti-harassment training to all employees. Owners, supervisors, and management are required to complete the two-hour course, while all other employees must complete a one-hour course. Rancho Mesa offers free online Anti-harassment training for both supervisors/managers and employees. The courses can be accessed by computer, tablet, and a smart phone.

Continued education or achieving professional designations: It’s also a good time to consider working on continued education courses such as renewing forklift certifications, OSHA trainings, as well as any professional designations. To reinvest your efforts in continued education, now, while business is still slow due to COVID-19, could position your business to hit the ground running when the economy opens up again.

Safety Star Certification – With underwriting guidelines tightening and worker’s compensation premiums expected to increase due to COVID-19, Rancho Mesa’s RM365 Advantage Safety Star Program™ can build your risk profile and differentiate your business from others. The program is designed for supervisors, foreman, safety coordinators, upper management, administrators, and directors of human resources. To earn the Safety Star certification in Construction Safety, you must complete the required Incident Investigation and Analysis online module plus at least two other modules of your choice from the approved list. This certification is also a marketing tool your broker can use to show your commitment to safety.

Proactively improving your safety program, employee handbook, and continuing education during the pandemic will allow you to hit the ground running once COVID-19 restrictions are lifted. It can also position your business to mitigate increasing premiums with the ever tightening workers’ compensation marketplace.

If you need any assistance in implementing a sound risk management program, please reach out to me at (619) 937-0174.

Choosing the Right Classcode: A Guide to Distinguishing Tree Trimming from Landscape Work

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are…

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are:

What is the difference between the two class codes?

I’ve always only used 0106-Tree Trimming, is it possible for me to use 0042-Landscape Gardening as well?

How can I differentiate which specific operations are considered landscape gardening and which are considered tree trimming?

When more than one classification applies to operations that are closely related, it is important to understand the boundaries of each classification. Let’s take a look at how the California Workers’ Compensation Insurance Rating Board (WCIRB) defines both class codes:

0106 Tree Pruning, Repairing or Trimming

This classification applies to pruning, repairing or trimming trees or hedges when any portion of the operations requires elevation, including but not limited to using ladders, lifts or by climbing. This classification includes clean-up, chipping or removal of debris; stump grinding or removal; and tree spraying or fumigating that are performed in connection with tree pruning, repairing or trimming. This classification also applies to the removal of trees that retain no timber value.

0042 Landscape Gardening

This classification applies to the construction, maintenance, repair or installation of landscape systems or facilities designed for public or private gardens or other areas in order to aesthetically, architecturally, horticulturally or functionally improve the grounds within or surrounding a structure or a tract or plot of land. This classification includes the preparation and grading of plots or areas of land for the installation of landscaping; pruning, repairing or trimming trees or hedges when none of the operations at a particular job or location require elevation, including but not limited to using ladders, lifts or by climbing; or chipping operations performed in connection with landscape gardening. This classification also applies to spraying or spreading lawn fertilizers or herbicides, or weed abatement for fire hazard control purposes.

According to these definitions, a tree company may be able to use the 0042 landscape class code at specific times. However, when any of the operations are off the ground, that payroll would be classified in tree trimming 0106. Also, any type of work that is associated with the tree trimming (e.g., clean-up, chipping, stump grinding, etc.) will also be included as 0106. Here is a quick real-world example that will help to clarify.

A tree company has 10 employees that worked on a specific job to trim a large Eucalyptus tree. There were only two workers that actually climbed and trimmed the tree, and all the rest of the employees worked on the ground to clean up the limbs and branches that were being cut and fell from the tree. All 10 employees must be classified into the 0106 class code because the ground crew operations were in connection with the tree trimming, where the climbers were operating off of the ground.

The next day, on a completely different job site, the same tree company with 10 employees worked on a new job to trim a handful of 8 ft Japanese maple trees. For this job, all of the work was performed from the ground and there was never a point where any of the workers operated from elevation (e.g., ladders, lifts, climbing, etc.). Three of the workers trimmed with pole saws from the ground, while the other seven employees cleaned-up the debris and used the chipper. All 10 of the employees could be classified into the 0042 landscape class code because there was never a time where a worker left the ground to trim.

Properly documenting and maintaining valid records is critical in order for your company to utilize both class codes properly. Without proper documentation, you could be setting your company up for a large additional premium owed at audit.

Stay tuned to my follow up article and podcast as I share how to prepare for and execute a successful audit when both of these two class codes are applicable to your operations.

Court Agrees Temporary COVID-19 Standards Are Not Needed

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

As a volunteer labor union group that works to improve the lives of the U.S. workforce, the AFL-CIO wants OSHA to issue a temporary worker safety standard addressing the risks of COVID-19 in the workplace. However, an Emergency Temporary Standard is authorized by OSHA under certain limited conditions. It must be determined that workers are in danger of exposure to toxic substances or agents that can be physically harmful. Plus, a temporary standard then serves as a proposed permanent standard.

The D.C. Circuit Court denied the lawsuit against OSHA due to the fact that government officials are learning new information about COVID-19 weekly, if not daily. An appropriate response to the union’s concern is not a fixed rule, at this time. And, a standard specific to COVID-19 would likely not need to become a permanent standard in the future.

Furthermore, the U.S. Department of Labor states, "We are pleased with the decision from the D.C. Circuit, which agreed that OSHA reasonably determined that its existing statutory and regulatory tools are protecting America's workers and that an emergency temporary standard is not necessary at this time.”

While a new standard to combat COVID-19 isn’t necessary because of existing standards, OSHA has provided many resources for employers to assist in maintaining worker safety. Their “Guidance on Preparing Workplaces for COVID-19” provides information on the virus, how it could affect a workplace, steps employers can take to reduce the risk to employees, and additional services and programs available to employers. The “Guidance on Returning to Work” offers steps for reopening, applicable OSHA Standards, and a frequently asked questions section. In addition, employers can find news updates and resources on OSHA’s COVID-19 webpage.

Top 5 Cyber Threats for Contractors

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Equipment and material theft as well as jobsite vandalism are exposures that unfortunately contractors have become accustomed to over the years. Over the last decade, however, the construction industry has seen a new threat arise and its name is Cybercrime.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Equipment and material theft as well as jobsite vandalism are exposures that unfortunately contractors have become accustomed to over the years. Over the last decade, however, the construction industry has seen a new threat arise and its name is Cybercrime. While the contracting community is likely familiar with this term, many mistakenly feel as though they are immune to this threat. With minimal personal identifiable information on hand, few, if any, payments accepted through credit card and storage of data in the cloud, what is their true exposure? Below are five REAL cyber threats contractors are facing on a daily basis:

Ransomware entails encrypting company data so that it cannot be used or accessed, and then forcing the company to pay a ransom, typically in Bitcoin, to unlock the data. This type of cyber threat has grown tremendously in the last few years and is one of the most lucrative types of attacks.

Phishing involves the attempt to obtain sensitive information by getting employees to click a hyperlink or open an attachment in a phishing email. This could allow malware to install on a system, or take an employee to a fake website where they could enter sensitive personal or business information. Phishing scams can ultimately lead to employees being tricked into sending money via wire transfer to a bank account controlled by a cyber-criminal.

Malware Attacks encompasses a variety of cyber threats such as viruses and worms that are created to gain access to networks, steal data, or destroy data on computers. Malware usually comes from spam e-mails or malicious website links.

Password Attacks are big threats facing businesses with employees who use weak or easily guessed passwords. Using weak passwords for multiple logins can allow unauthorized users to access information through your company’s secured network.

Insider Threats is a risk to an organization that is caused by current and/or former employees and business associates. These people can access critical information and/or data through your company which can cause harmful effects through greed, carelessness, or ignorance.

Now, more than ever, companies need a strong Cyber Prevention Plan in place. This would include:

Identifying your company’s most valuable information and where this information is located on your network.

Establishing Best Practice controls and procedures that consider both internal and external threats.

Communicating cyber security measures to the entire company and help your employees understand the threats your organization faces, and their role in protecting the company’s assets.

Adding a strong Cyber Liability Policy to your Risk Management Portfolio

To learn more about implementing a strong Cyber Prevention Plan and our CyberOne program, reach out to Sam Clayton at sclayton@ranchomesa.com or call 619-937-0164.

Edited 4/19/2021.

Why Am I Now Required to Bond Such Small Construction Projects?

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

I received an email from a large Subcontractor client last week requesting performance and payment bonds in the amounts of $87,000 and $133,000, respectively. This client has completed projects in excess of $5,000,000 in the past and was surprised that the general contractor they were working with was requiring such a small amount to be bonded back.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

I received an email from a large Subcontractor client last week requesting performance and payment bonds in the amounts of $87,000 and $133,000, respectively. This client has completed projects in excess of $5,000,000 in the past and was surprised that the general contractor they were working with was requiring such a small amount to be bonded back.

I explained the potential reasons for why the general contractor may require such a small bond.

One reason might be with the financial uncertainty created by the COVID-19 pandemic, the prime contractor/general contractors’ bond company is looking to transfer some of the risk from the bond they provide to their prime contractor. They may set a certain limit (for example, all subcontracts over $100,000) to require the subcontractor to bond back to the prime contractor.

A second reason might be that the prime contractor has not used a certain subcontractor in the past and wants the protection of a bond to help offset the risk. The general contractor might have selected this subcontractor based on “price” and wants the third party prequalification that the performance and payment bond provides.

A third example could be that the trade this subcontractor supports is critical to the success of the project and the general contractor is using every tool they can to manage the risk.

Overall in 2020, we have seen an increase in the number of prime contractors requiring a bond for a small subcontract.

The good news for the subcontractor that rarely requires bonding is that the qualification process for a small subcontractor bond is relatively easy. A number of highly rated bond companies provide programs for bonding projects up to $400,000 (sometimes higher) based on the credit scoring of the subcontract company owner.

If you would like more information on how a professional bonding agent can assist in putting a single bond or a bond program in place for your company, feel free to reach out to me at (619) 937-0165 to ensure your company is getting the proper attention.

California Workers' Comp Carriers React to Commissioner's COVID-19 Amendment Approval

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

The amendments address accounting for employees whose job duties have changed to clerical work, which is typically a less expensive workers’ compensation insurance classification than the jobs they were performing prior to Governor Newsom’s March 19, 2020 Stay-at-Home Executive Order. It also excludes payroll for furloughed employees who are not working, but collecting a paycheck. It creates a way to identify COVID-19 cases within the California workers’ compensation system and excludes the cases from the Experience Modification Rate (XMOD) calculation.

When asked about the amendments scheduled to take effect July 1, 2020, Margaret Hartmann, Senior Vice President and Chief Marketing Officer at Berkshire Hathaway Homestate Companies, California’s second largest workers’ compensation insurance carrier, said “Lara’s approval of the WCIRB [Workers’ Compensation Insurance Rating Bureau] proposal was not surprising. These are not unreasonable, at least from the perspective of ratemaking and predicting future experience of employers once COVID passes.”

Bryan Anderson, Senior Vice President at The Zenith explained the WCIRB’s amendments to the California Unit Statistical Reporting Plan and XMOD calculation were “not likely to change under any normal circumstances but the Bureau made these recommendations to address the unique pandemic situation that California (and the world’s) businesses find themselves in."

Another industry leader Paul Zamora, ICW Group’s Senior Vice President for Workers’ Compensation Underwriting said, “We support Commissioner Lara’s decision to approve the recommended changes by the WCIRB. We believe the rule modifications accurately reflect changes in exposures created by COVID-19 and will provide the appropriate relief needed by California businesses.”

The changes were expected by California’s workers’ compensation insurance carriers as a mechanism to adjust employers’ insurance rates, since COVID-19 claims aren’t necessarily an indicator of a company’s safety record.

“Under normal situations,” Anderson explained, “workers’ compensation covers only those occupational illnesses that are created from the work environment. In this instance, that understanding changed with the Governor’s Executive Order requiring employers to accept compensability for Covid-19 claims unless they can prove they are not work-related.”

Hartmann added, “This is clear cost-shifting to the industry, which we expected. The combination of a broad WC presumption, possible additional legislation extending these presumptions past July 5th, excluding COVID from ratemaking and XMODs, means that the insurance industry will absorb the lion’s share of COVID costs that can be assigned to WC.”

Zamora points out “it’s imperative that business owners understand the rule changes and adopt new practices, particularly with respect to the record keeping criteria associated with two of the changes. By adopting new record keeping procedures to apply to the new rules, policyholders will have the necessary audit documentation to realize the full value of Commissioner Lara’s decision.”

This means employers should start documenting employees’ hours worked under each class code, now, and not wait until a final audit.

“Hopefully, these measures will play a small part in helping California employers as they try to recover from the devastating impacts of this pandemic,” Hartmann concluded.

“I think this solution is a testament to the strength and objectivity of the Bureau, the companies it represents and to the integrity of the Workers’ Compensation Industry in California,” said Anderson.

Gene Simpson, CompWest’s Vice President of Underwriting and Marketing, added, “To confront the challenges presented by the COVID-19 pandemic to California employers, regulatory authorities, insurance carriers and employers must work together on effective solutions.”

While the amendments should reduce workers’ compensation premium costs for California businesses in the short-term, only time will tell how lower revenues and higher costs due to COVID-19 claims will impact California’s workers’ compensation insurance premiums in the future.

For a greater understanding of these changes and how they will impact your company, please contact our team at (619) 937-0164.

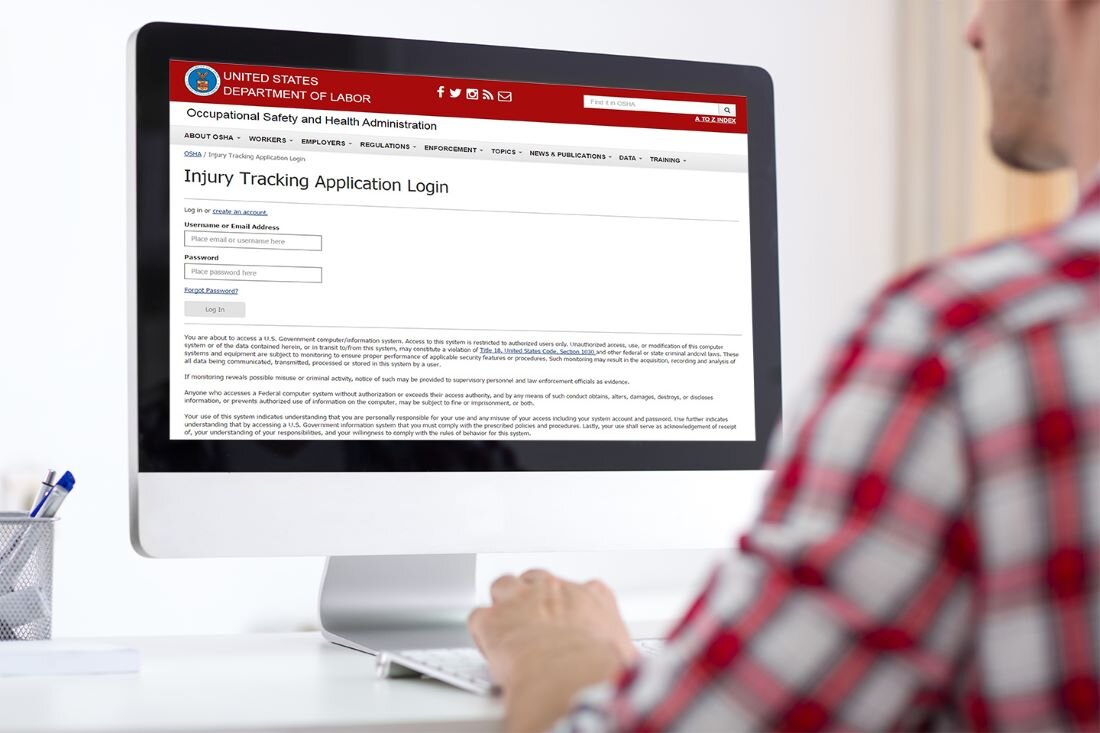

OSHA Recording Requirements for COVID-19 Cases

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

California’s Division of Occupational Safety and Health (better known as Cal/OSHA) has released information for employers on the subject and it appears they are using their existing criteria for determining the recordability of an employee COVID-19 case.

According to Cal/OSHA, “California employers that are required to record work-related fatalities, injuries and illnesses must record a work-related COVID-19 fatality or illness like any other illness.” To be recordable on the 300, 300A and 301 forms, the COVID-19 case must be work-related and result in one of the following:

Death.

Days away from work or transfer to another job.

Medical treatment beyond first aid.

Loss of consciousness.

A significant injury or illness diagnosed by a physician or other licensed health care professional.

The criteria that most employers may have a hard time determining is if the COVID-19 illness is actually work-related. Cal/OSHA addresses this in its Frequently Asked Questions webpage. First, the employer must determine if there was “an event or exposure in the work environment [that] either caused or contributed to” the COVID-19 case.

In order to determine if a case is work-related, employers should consider factors like:

The type and duration of contact the employee had at work with other people including co-workers and the general public.

With the implementation of physical distancing and other controls within the workplace, what is the likelihood of exposure?

Did the employee come in contact with anyone showing signs and symptoms of COVID-19, while working?

These considerations will help an employer determine whether or not the COVID-19 case is work-related and thus recordable. According to Cal/OSHA, it is best practices to err on the side of recordability when in doubt about how an employee was exposed to COVID-19.

If it is determined that an employee’s illness was work-related, yet, for a variety of reasons testing or the results from a test is unavailable and the employee has been determined to have COVID-19, “an employer must make a recordability determination” as to whether or not to record the case. While a positive COVID-19 test result would trigger recordability by the employer, a positive test is not always necessary to record the case in the OSHA logs.

Keep in mind, the above information is for OSHA recording of work-related COVID-19 cases only, which may be different from guidance for workers’ compensation claims.

Cal/OSHA states that “Governor Newsom’s Executive Order N-62-20 addresses eligibility for workers’ compensation benefits... The Order does not alter employers’ reporting and recording obligations under Cal/OSHA regulations.”

Rancho Mesa’s Risk Management Center offers employers the ability to track their COVID-19 cases electronically and generate the applicable OSHA 300, 300A and 301 forms along with an incident report and First Report of Jury (Form 5020).

To learn more about the Risk Management Center, contact our Clients Services Department at (619) 438-6869.

Commissioner Lara Approves WCIRB Proposed Amendments Addressing COVID-19

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follow…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follows:

New COVID-19 Rule: Clerical Office Employees

Part 3, Section III, General Classification Procedures, was amended to add Rule 7, Coronavirus Disease 2019 (COVID-19), to permit during a statewide California COVID-19 stay-at-home order the following: The division of an employee’s payroll between Classification 8810, Clerical Office Employees, and a non-standard exception classification when the employee’s work is exclusively clerical in nature and the non-standard exception classification does not include Clerical Office Employees. This amendment will conclude 60 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rule: Basis of Payroll

Part 4, Section IV, Exposure Information, Rule 1, Classification Code, and Rule 4, Exposure Amount, were amended to report payments excluded from remuneration pursuant to new Rule 7, Coronavirus Disease 2019 (COVID-19). Payments made to an employee while the employee is performing no duties of any kind in service of the employer are to be excluded from payroll when the payments are equal to or less than the employee’s regular rate of pay. This amendment will conclude 30 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rules: Claims Reporting

Part 4, Section V, Loss Information, Rule B, Loss Data Elements, Sub rule 4, Catastrophe Number, was amended to add Catastrophe Number 12 for the reporting of COVID-19 claims. Appendix III, Injury Description Codes, Section B, Nature of Injury (Positions 3-4), and Section C, Cause of Injury (Positions 5-6), were amended to add a Nature of Injury code and a Cause of Injury code for COVID-19 claims. This amendment includes claims with an accident date after December 1, 2019, reported on a Unit Statistical Report due on or after August 1, 2020, and reported with a Catastrophe Number 12.

Exclusion of COVID-19 Claims from Experience Modification

Section VI, Rating Procedure, Rule 2, Actual Losses and Actual Primary (Ap) Losses, was amended to specify that all claims directly arising from a diagnosis of Coronavirus Disease 2019 (COVID-19) shall not be reflected in the computation of an experience modification.

For a greater understanding of these changes and how they will impact your company please contact our team at (619) 937-0164.

Nonprofits Eligible for Free Digital Advertising

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

To help avoid a decrease in private donations due to the Coronavirus pandemic, nonprofit leaders have turned their attention to a powerful tool used to increase website traffic and online donations: Google’s Ad Grant Program.

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

According to the Blackbaud Institute, charitable giving creeped up by only 1% in 2019… But online giving increased 6.8% last year and increased 10% over the last three years! To help avoid a decrease in private donations due to the Coronavirus pandemic, nonprofit leaders have turned their attention to a powerful tool used to increase website traffic and online donations: Google’s Ad Grant Program.

Consider how many organizations spend thousands of dollars each month on Google Ads to gain website traffic, market share, and online customers.

Now consider that Google Ad Grants provide up to $10,000 per month (maximum of $329/day) of free advertising on Google search result pages to eligible nonprofit organizations. The result: high-quality, converting traffic.

Marketing consultant Reese Harris, founder of Ree-Source, Inc, adds “Whether you are driving donations, increasing brand awareness, or amplifying engagement, the Google Ad Grant Program is essential for any nonprofit organization. We encourage all nonprofits to include this strategy in their marketing and outreach.”

To make this a successful strategy, most nonprofits should make use of Geo-Targeting. In other words, your ads should only show to searchers in locations that are important to your organization.

It’s also important to track and measure the results of your campaign. That’s the beauty…this is the internet, not a billboard! Google will provide you with a behind the scenes pass to view exactly which of your keywords attract converting traffic and which keywords aren’t working.

Google Ad Grants is an amazing tool nonprofit leaders can use to increase awareness, web traffic, and engagement. Regardless of your web-marketing experience, the learning and adjusting is an ever-evolving process that promises to deliver. Good luck!

Rancho Mesa understands the importance of every dollar that is raised by nonprofits through advertising efforts, donor relations and fundraisers. That is why we offer the risk management tools your organization needs to minimize costly risks and manage insurance costs, so more of your funds can serve your mission.

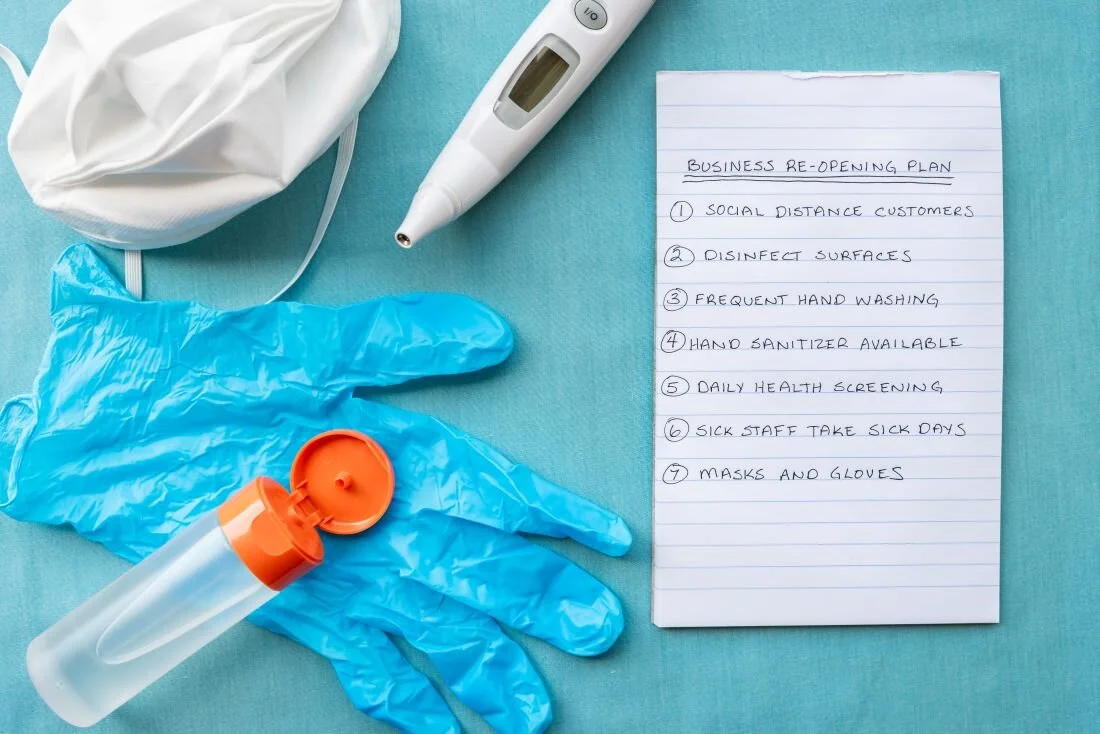

Critical Elements of a COVID-19 Safety Plan

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

The Centers for Disease Control and Prevention (CDC) recommends having a written COVID-19 Safety Plan in place. Check with your local city or county for specific Safety Plan (aka Safe Reopening Plan) requirements. A well implemented plan will assist in keeping its employees and the public safe. A Safety Plan should have three critical elements; purpose, responsibilities, and safety procedures. Below is a brief explanation of these three critical elements:

Purpose: A safety plan should provide the purpose for why it is in place.

What is Covid-19? Explain the effects of the virus and how it can spread to others.

Control Measures: Train personnel on ways of minimizing exposure of Covid-19.

Personal Protective Equipment: Maintaining recommended supplies, such as respirators, eye protection, gloves, and hand sanitizer.

Compliance: Making sure your business is in compliance with local, State, and Federal emergency response and health agencies.

Responsibilities: A Safety Plan should also provide specific responsibilities for management and staff, such as:

Training and informing all on safety procedures relating to COVID-19.

Implementing a plan across all personnel.

Monitoring the application of the plan.

Safety Procedures: A Safety Plan should have mandatory procedures in place that all personnel are trained on and are strictly adhered. A few examples include:

Practicing good hygiene.

Stop handshaking, use noncontact methods of greeting.

Guidelines on how to properly disinfect surfaces like doorknobs, tables, desks, and handrails.

Creating a COVID-19 Safety Plan which explains its purpose, the responsibilities of all personnel, and safety procedures will go a long way in minimizing COVID-19 exposure. It will also have a positive effect on employee and public moral as it shows you are doing your part to stop the spread of the virus.

As your business designs a formal COVID-19 Safety Plan, Rancho Mesa can assist you with a plethora of related safety resources available in both English and Spanish. Visit www.ranchomes.com/covid-19 for a list of available resources.

Resources:

COVID-19 Safety Plan/Return-to-Work Plan Resources

San Diego County Safe Reopening Plan Template

Imperial County Sample Agency COVID-19 Response Plan (4.27.20)

Riverside County Safe Reopening Guidelines 05212020

COVID-19’s Impact on the Non-Profit Insurance Marketplace

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Rate Increases

With many businesses completely shut down and sales way off projections, insurance companies are experiencing lower annual premiums while still needing to pay out for claims. Certain lines of coverage, in particular Employment Practices Liability and Workers’ Compensation are starting to see a significant uptick in claim frequency, which will likely cause rate increases to manage these unexpected costs.

Carriers not writing any new business

Some carriers have placed a moratorium on quoting any new accounts until they can fully assess the damage on longer term exposure of COVID-19. This translates to less options for non-profit risks at renewal.

Carriers Limiting or Excluding Coverage

Many carriers are starting to increase deductible levels, lower available Umbrella limits, and eliminate certain coverage territories for certain property as a way to limit their exposure to claims. Working closely with your broker to plan for these potential gaps at your pre-renewal meeting is critical for you and your management team.

Audited Policies

In many industries, General Liability policies are audited, annually. In the non-profit space, final audits are rarely performed. In order to better account for the loss of revenues due to the shelter-in-place restrictions, many carriers will be conducting end of year audits. This could severely impact those organizations that have not been properly accounting for their exposure, as they will most likely have their revenues, employee counts, and client counts verified at the end of the policy term. Again, developing a plan now with your broker is an important part of your renewal cycle and can help maximize what potentially could be return premiums at final audit.

Looking ahead, non-profits will need to make sure they are partnered with a broker who is proactive and knowledgeable about the marketplace, so that they can stay ahead of these changes and avoid financial hardship as much as possible.

Rancho Mesa offers tools like the Risk Management Center, RM365 HRAdvantage™ portal, RM365 Advantage Safety Star Program™, weekly newsletters and Safety & Risk Management Podcast to assist our clients with successfully managing their risk and improving their marketability to carriers.

Contact Rancho Mesa Insurance Services at (619) 937-0164. to discuss your non-profit’s insurance needs.

COVID-19 Business Shutdown: What Coverage Gaps Exist with Vacant Properties

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In response to the COVID-19 pandemic and ensuing shelter in place restrictions, many non-essential businesses have been shuttered for several weeks. As those businesses deal with the massive revenue and employee losses, building owners must be cautioned to review their property policies closely for vacancy provisions and exclusions.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In response to the COVID-19 pandemic and ensuing shelter in place restrictions, many non-essential businesses have been shuttered for several weeks. As those businesses deal with the massive revenue and employee losses, building owners must be cautioned to review their property policies closely for vacancy provisions and exclusions.

Vacancy clauses can create exceptions from coverage if the property in question is vacated or unoccupied for a defined period of time (most often 60 days but often shorter). For example, there are some policies that will not provide coverage if a property sits vacant more than that fixed number of days but applies to only certain types of losses like vandalism, theft, or water damage. Additional limitations can include a reduction of losses by 15% or more for more typical covered causes of loss like a building fire and certain losses can be excluded altogether once a property is vacated depending on the insurance company’s form. Finally, there are still other policies that will, in fact, provide coverage for any types of losses but stipulate that the policyholder must inform them that the property has been vacated.

What qualifies as vacant or unoccupied? Some policies define these very specifically while others are broad and ambiguous, offering little comfort at the time of loss. Rather than wait until after a loss when coverage might still be in jeopardy, take the initiative now to contact your broker if your property is vacant or partially occupied as a result of the COVID-19 pandemic. Communicating with the insurance company will help clarify definitions and interpretations and allow you to plan appropriately for the potential of a property loss.

While this continues to be an unprecedented time, several insurance companies are now sending notices to policyholders that they will not consider a building to be vacant for the days during any period of occupancy that changed as a result of the government stay-at-home order or similar directive to COVID-19. Take time now to review your policies with your broker, learn more about your specific vacancy provision and whether your insurance carrier will waive some or all of this provision during this window of time.

Subscribe to our weekly newsletter and podcast to stay informed about what’s happening in the insurance industry during this pandemic.

CA Governor Issues Executive Order Making Workers’ Compensation Benefits More Readily Available to Essential Workers

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

The Executive Order states “any COVID-19-related illness of an employee shall be presumed to arise out of and in the course of employment for purposes of awarding workers’ compensation benefits if all of the following requirements are satisfied:

a. The employee tested positive for or was diagnosed with COVID-19 within 14 days after a day that the employee performed labor or services at the employee’s place of employment at the employer’s direction;

b. The day referenced in subparagraph (a) on which the employee performed labor or services at the employee’s place of employment at the employer’s direction was on or after March 19, 2020;

c. The employee’s place of employment referenced in subparagraphs (a) and (b) was not the employee’s home or residence; and;

d. Where subparagraph (a) is satisfied through a diagnosis of COVID-19, the diagnosis was done by a physician who holds a physician and surgeon license issued by the California Medical Board and that diagnosis is confirmed by further testing within 30 days of the date of the diagnosis.”

Insurance companies have 30 days from the date of a COVID-19 diagnosis to rebut with evidence.

According to the Executive Order, the presumption pertains only “to dates of injury occurring through 60 days following the date of this Order.”

The order establishes a rebuttable presumption that any essential workers infected with COVID-19 contracted the virus on the job. It is important to understand the order shifts the burden of proof from the injured worker and now requires employers or insurance companies to prove the employee didn’t get sick at the place of work.

Prior to the change, it was difficult to prove workers’ compensation claims related to a COVID-19 infection.

Rancho Mesa’s Response

In response to the Executive Order and other proposed rule changes, Rancho Mesa President David Garcia interviewed Berkshire Hathaway Homestate Companies President Rob Darby on the impact to California businesses and the workers’ compensation market. Berkshire Hathaway is one of the largest workers’ compensation insurance companies in California.

Read Governor Newsom’s Executive Order on Cal/Gov website.

Please contact your Rancho Mesa broker with questions specific to your business.

Update Your Handbook with Ease Using the RM365 HRAdvantage™ Handbook Builder

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

The RM365 HRAdvantage™ portal offers an easy-to-follow process to build a company handbook from scratch. Choose from a single state or multi-state based handbook with the ability to include your own custom policies. The RM365 HRAdvantage™ portal helps keep your handbook up to date and compliant by sending alerts when policies change or need to be included.

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

The RM365 HRAdvantage™ portal offers an easy-to-follow process to build a company handbook from scratch. Choose from a single state or multi-state based handbook with the ability to include your own custom policies. The RM365 HRAdvantage™ portal helps keep your handbook up to date and compliant by sending alerts when policies change or need to be included.

Once your handbook is complete, you can easily rearrange your table of contents and distinguish between required, best practices and custom policies within your handbook. Policies in your handbook are chosen based on your state and employee count. Have a question about a policy or requirement and can’t find it in the portal? Reach out to one of our HR experts through the portal via messaging or phone.

Almost every day, the powers are announcing new guidelines and procedures for COVID-19 safety. With the help of the RM365 HRAdvantage™ portal, you can access a number of forms, fact sheets and posters for COVID-19 health and safety. We’ve made it easy to access these resources by linking them to the homepage. Find materials such as, sample work from home policies, sample telecommuting agreements and furlough letters. Simply click on ‘Comply’ in the menu bar and the COVID-19 link under ’Popular Tools’.

With so many of us working from home or under strict guidelines, now is the perfect time to review, modify or build your company handbook. Ready to get started building your handbook? Register for the “RM365 HRAdvantage Handbook Builder Tutorial” webinar today!

Surety Tightens Due to COVID-19 Pandemic

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Before COVID-19, the construction industry had been enjoying one of the longest economic booms that this county has seen in recent memory. And, even though construction has been deemed essential, the industry is already seeing some effects from the pandemic, ranging from delayed material supplies, projects being shut down, and late or non-payments from project owners.

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Before COVID-19, the construction industry had been enjoying one of the longest economic booms that this county has seen in recent memory. And, even though construction has been deemed essential, the industry is already seeing some effects from the pandemic, ranging from delayed material supplies, projects being shut down, and late or non-payments from project owners. Additionally, we are now starting to see some of the effects of the pandemic reach into the surety world, as some bond companies are beginning to limit their appetite and tighten their underwriting guidelines.

While some bonding companies have continued business as usual, others have made changes to their policies, with some opting to remove accounts that do not have frequent bond needs and others opting to not accept any new business submissions. While most surety carriers will not react this drastically, we anticipate them tightening their underwriting guidelines, and it is important for contractors to know that there are other options out there that might be a better fit for their bond program. This is where partnering with a Best Practices surety broker is of great benefit to a contractor.

At Rancho Mesa, we have access a variety of high quality surety markets, while also possessing a deep understanding of what different bond companies value when they are underwriting bond requests. As the markets begin to tighten, this type of knowledge becomes even more important. Certain markets will be a fit for some contractors while others will not, and selecting the wrong market can lead to financially sound contractors not receiving the level of surety credit that they need or deserve.

For more information, or for any questions regarding your surety needs, please contact Andy Roberts at (619) 937-0166 or aroberts@ranchomesa.com.

Employee Handbook Builder Adds Two New COVID Policies

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

If you are a Rancho Mesa client who has utilized the Living Handbook builder within the RM365 HRAdvantage™ portal, you may have noticed email notifications alerting you of the latest legislation policy changes. When a new government policy goes into effect or an existing policy needs to be revised, the HR portal will give you the option to update your handbook(s).

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

If you are a Rancho Mesa client who has utilized the Living Handbook builder within the RM365 HRAdvantage™ portal, you may have noticed email notifications alerting you of the latest legislation policy changes. When a new government policy goes into effect or an existing policy needs to be revised, the HR portal will give you the option to update your handbook(s).

The RM365 HRAdvantage™ portal has recently added two new policies to its Living Handbook builder. Thesetemporary policies apply to private employers with fewer than 500 employees and are effective from April 1, 2020 through December 31, 2020. The policies are:

Emergency Paid Sick Leave Policy (COVID-19)

Expanded Family and Medical Leave Policy (COVID-19)

To ensure that your handbook stays up-to-date, login to the RM365 HRAdvantage™ portal and accept these policies. They will then be automatically added to your handbook. If you are not receiving the automated notifications, check the “Subscribe to email alerts for this handbook” box on the ‘Handbook Settings’ screen.

If you are working with an outdated employee handbook and want to quickly build a new compliant Living Handbook, learn more by watching our Living Handbook tutorial.

Special COVID-19 Workers' Compensation Filing and Executive Order Imminent

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would:

Exclude COVID-19 claims from the experience rating formula.

Exclude from premium calculations payroll paid to employees who are continuing to be paid while not working.

Allow the assignment of Classification 8810 on a temporary basis to employees who are now working from home whose temporary duties meet the definition of a clerical office employee.

Each of these changes will have their own nuances and it remains to be seen how exactly their implementation, auditing and tracking will be put into practice.

Separately, but equally important, Governor Newsom is considering an executive order that would create a “conclusive presumption” that COVID-19 illnesses and deaths sustained by “essential workers” are work related and therefore covered under workers’ compensation policies. The potential scope and impact of the order are not yet known, but on April 20, 2020, the WCIRB released a projection that the annual cost of COVID-19 claims on “essential critical infrastructure” workers, under a conclusive presumption, ranges from $2.2 billion to $33.6 billion.

These decisions, should they be implemented, will create significant disruption in the workers’ compensation marketplace and to all insurable businesses in California. As these decisions are rendered, Rancho Mesa will continue to provide resources and implementation strategies to help businesses adjust through these uncertain times. If you have questions or want to discuss this in greater detail please reach out to your broker or account manager.

Potential Workers’ Compensation Changes Due to COVID-19 Claims

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are:

Experience Rating Calculations

Dave Bellusci, Chief Actuary at the WCIRB, indicated that they are “leaning toward excluding COVID-19 claims from the calculation.” This would entail setting up new nature of injury and cause of injury codes that would identify these claims.

They are also leaning towards excluding the payrolls for workers who are not working because of the pandemic and shelter-in-place orders but who are still receiving all or a portion of their salaries or are being paid through sick leave benefits.

Class Code Classifications

Those sheltered-in-place workers who are being paid and either not working their customary jobs or not working at all has created a question about how that payroll should be classified for premium purposes. Should that payroll be classified in its usual class code or be adjusted into another class code such as clerical or a code specific to COVID-19. These are all questions being considered.

Any potential changes like these in question would be temporary and require that employers document how the employees in question were not working their customary jobs during this time and were performing clerical functions.

Our Answer

Rancho Mesa is collaborating with several regional and national workers’ compensation carriers on a form that will be able to capture this information for businesses affected by these new work restrictions. Accurate and accessible documentation will help both businesses and their workers’ compensation carrier make the necessary adjustments at audit.

At this point, these are only preliminary responses that are being discussed. While nothing has been passed into law, it seems highly likely that the WCIRB and the Insurance Commissioner will agree on some type of new legislation. When and if this occurs, we will provide full details and specific strategies to assist.

If you want to be kept informed of any changes and are not currently on our weekly newsletter list, please subscribe to our email distribution list.