Industry News

Work-Related Automobile Accidents and Their Correlation With Workers’ Compensation Claims

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

In California, motor vehicle accidents are among the leading cause of severe injuries on a daily basis. From a risk management perspective, a company’s fleet safety program has a primary goal of keeping employees safe while driving which lowers the amount of annual auto premiums paid.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

In California, motor vehicle accidents are among the leading cause of severe injuries on a daily basis. From a risk management perspective, a company’s fleet safety program has a primary goal of keeping employees safe while driving which lowers the amount of annual auto premiums paid.

What is not typically discussed when talking about fleet safety is the impact a work-related auto incident has on a workers’ compensation policy and experience modification. This article will discuss some of those impacts.

EXPERIENCE MODIFICATION IMPACT

When broken down, workers’ compensation premiums are driven by many factors. A main factor for pricing is the experience modification. Experience modifications are a measure of safety for a company when compared to others in the same field. Workers’ compensation claims adversely affect experience modifications.

Typically, business owners invest time, energy and resources into their safety program in the form of personal protective equipment (PPE), stretching before labor, tailgate meetings and job hazard analysis. But, the “big claim” businesses are doing so much to avoid could come from an auto incident. A heavy dose of fleet safety training should be mixed into the safety topic agenda, tailgate meetings and discussions regarding minimal driving record requirements for employees to drive on behalf of a company.

Businesses in California are required to offer no-fault workers’ compensation insurance which means it doesn’t matter who is at fault, the injury will be covered by a worker’s compensation carrier.

When a work-related auto accident occurs and there is an injury involved with an employee, the experience modification will be affected adversely based on the incurred cost of the claim as well as the loss ratios.

SUBROGATION

If another party is at fault regarding a workers’ compensation claim, the insurance carrier who is tending to the claim can subrogate and try to recoup the paid amount from the responsible party.

The issue workers’ compensation carriers deal with regarding subrogating auto claims is that the California minimum required auto liability limit is only $5,000. This amount would not cover most injuries suffered by an employee in an auto accident. Also, there is a high percentage of drivers who are uninsured which makes subrogation impossible in a claim scenario.

Overall, subrogation is pretty difficult in this specific area of workers’ compensation. The best defense is to avoid auto incidents as much as possible.

MULTIPLE EMPLOYEE IN ONE VEHICLE

Especially with gas prices soaring, carpooling to jobsites can be a popular method of getting employees from one location to the next. Regardless of fault, this could create multiple workers’ compensation injuries at once. Multiple workers’ compensation claims will adversely affect experience modifications, loss ratios and DART rates.

These factors should be considered when creating a car pool scenario for employees travel from jobsite to jobsite.

Important factors to consider if you do utilize carpooling to jobsites could be:

Does the driver meet out company standards with his or her driving record?

Is the vehicle’s maintenance up to date? (e.g., tires, windshield wipers, etc.)

Are there multiple high wage earners traveling in the same vehicle?

TEMPORARY DISIBILITY COST ON THE RISE

With a major labor shortage occurring in California, wages have risen in order to attract and retain labor and highly qualified employees. A severe motor vehicle accident which creates a worker’s compensation claim could adversely affect an employer’s experience modification because two-thirds of the amount of the injured workers’ pay is a larger dollar amount on average than it has been in the past.

This could create a larger claim because of the amount of temporary disability being paid while an employee is hospitalized or unable to come back to work with or without restrictions.

FLEET SAFTEY CONTROLS

When budgeting for an overall safety program, business owners should factor in the multitude of impacts that an auto claim can have on a business. Controls like GPS/telematics, drug testing kits, MVR pull programs, and vehicle maintenance programs are examples of investing in fleet safety.

Fleet safety programs can save lives, save money and can create a stronger culture of safety throughout a business.

Rancho Mesa’s Risk Management Center has a searchable safety library with fleet safety materials that can be used to train employees. Register online for Rancho Mesa’s Fleet Safety webinar on May 26, 2022 from 9:00 am PDT – 10:00 am PDT. Or, contact me at khoward@ranchomesa.com or (619) 438-6874 if you have questions about your auto policy.

OSHA Proposes to Expand Electronic Form Submission Requirements

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

The Occupational Safety and Health Administration (OSHA) recently released a proposed rule that would increase electronic reporting requirements for businesses summiting OSHA logs.

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

The Occupational Safety and Health Administration (OSHA) recently released a proposed rule that would increase electronic reporting requirements for businesses summiting OSHA logs.

Currently, establishments with 250 or more employees, regardless of classification, and establishments with 20-249 employees, classified in certain high hazard industries, must electronically submit their Form 300A Summary to OSHA, annually.

The proposed rule changes would declare that only those in the classified high-hazard industries with 100 or more employees will be required to submit their Form 300A Summary electronically to OSHA. It would also require that Forms 300 and 301 be submitted electronically by these companies, when previously these two forms were to be kept confidential and only available to OSHA upon request.

Classified high hazard establishments with 20-99 employees would still only be required to submit the 300A Summary electronically to OSHA and would not need to electronically submit the 300 and 301 forms.

Under the proposed rule, OSHA would update the industries that are classified as high hazard and need to submit the data electronically.

OSHA has also proposed that company names be included on the electronic submissions. This, along with the injury and employee information that is included on the 300 and 301 forms, raises privacy concerns because this information would be available for public view via the Freedom of Information Act (FOIA).

The comment period for the public to voice their concerns ends on May 31, 2022. Information on how to submit comments on the proposed rule can be on the Federal Register.

Cal/OSHA Releases Final COVID-19 ETS

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

On Wednesday, April 6, 2022, Cal/OSHA released its third and final version of its COVID-19 Emergency Temporary Standard (ETS) that was approved by the Standards Board at its April 21, 2022 meeting. The revised standard is expected to remain in effect from May 6, 2022 through December 31, 2022.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

On Wednesday, April 6, 2022, Cal/OSHA released its third and final version of its COVID-19 Emergency Temporary Standard (ETS) that was approved by the Standards Board at its April 21, 2022 meeting. The revised standard is expected to remain in effect from May 6, 2022 through December 31, 2022.

The third revision removes some language and requirements. Most notably:

Requirements of the ETS are the same for vaccinated and unvaccinated employees, and the definition for “fully vaccinated” has been removed.

California Department of Public Health's (CDPH) guidance governs exclusion and return-to-work criteria for those with a close contact, and when face coverings are required.

The “light test” for face coverings has been removed.

Self-administered and self-read testing is now acceptable to return to work when it includes independent verification like time-stamped photography.

A new definition for “returned case” has been added to identify those who have returned to work per the requirements in the ETS and did not develop COVID-19 symptoms.

Cleaning and disinfection procedures have been removed.

Requirements for physical distancing (except when there is a major outbreak) and barriers have been removed.

Cal/OSHA has revised several documents that may be helpful for employers:

What Employers and Workers Need to Know About COVID-19 Isolation and Quarantine

Revisions to the COVID-19 Prevention Emergency Temporary Standards

Rancho Mesa has revised its COVID-19 Prevention Program template based on the April 6, 2022 proposed revised ETS language. Download a copy of the template from within the Risk Management Center, or from the link below.

Is Your Business Safe From a Business Email Compromise Claim?

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Cybercrimes are at an all-time high. News sources report cybercrimes almost on a daily basis with most of the press relating to company breaches and cyber extortion. However, one of the biggest cyber threats that is often overlooked is Business Email Compromise (BEC).

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Cybercrimes are at an all-time high. News sources report cybercrimes almost on a daily basis with most of the press relating to company breaches and cyber extortion. However, one of the biggest cyber threats that is often overlooked is Business Email Compromise (BEC).

BEC is a type of email cybercrime scam in which an attacker targets a business to defraud the company. BEC attacks use real or impersonated business email accounts to defraud employees. In 2020, BEC scammers made over $1.8 billion – far more than any other type of cybercrime.

In this type of cybercrime, the scammer sends an email that looks like it came from someone the recipient knows, like a superior or co-worker, and asks them to do perform a task. For example, the email may request:

A change to a vendor’s mailing address so future payments are sent to the scammer and not to the actual vendor.

An employee to purchase gift cards for a charity auction or employee rewards and then asks for the serial numbers on the cards so the scammers can use them without ever having the physical card.

A client is sent an email with wire instructions for payment of an invoice that appears to come from your company, but instead it is for the scammer’s bank account.

BEC scams use a variety of impersonation techniques. The following 3 techniques tend to be the most common:

A spoofed email address or website often has a slight variation from the legitimate address or URL. At a quick glance, the spoofed email address may fool victims into thinking it’s authentic. However, upon a closer look, an “L” might be switched out for a “I” or an “0” for an “o.”

Phishing emails appear to come from a trusted sender in order to trick the victim into providing personal or confidential information like account numbers, usernames, personal identification numbers, passwords or answers to security questions. Then, the information is used to gain access to networks, accounts, and other data.

Cyber criminals can infiltrate a company’s network using malicious software and gain access to networks and legitimate emails, often getting information about billing and invoices. This type of cybercrime is often unnoticed until it is too late.

For ways on how to protect your business from BEC claims, Rancho Mesa recommends first starting with a Cyber Liability policy. A comprehensive Cyber Liability policy will not only respond to BEC claims, but it can also provide coverage for other cybercrimes such as cyber extortion, cyber breach, and network security. If you have an interest in obtaining a Cyber Liability policy please feel free to reach out to me at 619-937-0174 or jhoolihan@ranchomesa.com.

WCIRB Proposes Expected Loss Rate Decrease for Landscape Industry

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) has proposed a 2% decrease (from $2.42 to $2.37) in the expected loss rate for the landscape class code 0042.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) has proposed a 2% decrease (from $2.42 to $2.37) in the expected loss rate for the landscape class code 0042.

The proposed $2.37 would impact Experience Modifications (ExMod) for all workers’ compensation policies that take effect on or after September 1, 2022.

The expected loss rate is used to calculate each company’s individual ExMod within the industry. A decrease in the rate would generate lower expected losses and lower primary thresholds. So, the lower number puts pressure on the ExMod to increase. Whereas, an increase in the expected loss rate would help provide some potential ExMod relief.

The proposed decrease would impact the lowest possible ExMod for landscape companies by increasing it about 5% or 2 to 3 ExMod points.

So, landscapers need to implement effective safety programs to ensure losses don’t exceed the new lower expected loss rate for the industry.

To help landscape businesses manage their individual ExMod, Rancho Mesa introduced the KPI Dashboard in January 2021 to provide insights that help organization leaders stay informed and prepare for future changes like these.

If you’re not a Rancho Mesa client, and are a landscape business in California, we would welcome the opportunity to forecast your ExMod to help you better prepare. Contact me to request your customized KPI Dashboard.

Wearable Technology Is the Future of Jobsite Safety

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

The future is here and construction companies are starting to adopt wearable technology for their workers to reduce and prevent injuries from occurring on their jobsites. Wearable technology can be defined as any device that construction workers wear on his/her body. Since the construction industry accounts for nearly half of all fatal work injuries, this new type of personal protective equipment (PPE) is going to look radically different in the years ahead and should reduce both fatal and non-fatal injuries on jobsites worldwide. Below is an overview of five technologies in use today or soon to be in use in the near future.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

The future is here and construction companies are starting to adopt wearable technology for their workers to reduce and prevent injuries from occurring on their jobsites. Wearable technology can be defined as any device that construction workers wear on his/her body. Since the construction industry accounts for nearly half of all fatal work injuries, this new type of personal protective equipment (PPE) is going to look radically different in the years ahead and should reduce both fatal and non-fatal injuries on jobsites worldwide. Below is an overview of five technologies in use today or soon to be in use in the near future.

Smart Watches

Many people wear smart watches daily, but the powerful sensors in smart watches can provide significant benefit to the construction industry. These devises can monitor vital signs like heart rate and step counts to prevent overexertion. They can also detect falls, which is a leading cause of serious injury on a jobsite and provide an immediate alert to site and emergency personal. In addition, smart watches allow employees hands free communication.

Smart Hard Hats

Hard hats are a vital piece of PPE on every jobsite. But, these aren’t your fathers’ hard hat. By adding a sensor band around the inside of a hard hat, employers will be able to detect fatigue, prevent mircosleeps (when sudden moments of sleep occur in a fatigued individual) and proximity sensing. Proximity sensing will alert both workers and equipment operators of a potential collision and prevent serious injuries. In addition, the outside rim of the smart hard hat is equipped with a ring of LED lights that allow for visibility from a quarter mile away. This feature is especially useful for any contractors performing work at night.

Clip-Ons

Clip-ons are not part of the usual construction PPE but are proving to be very helpful. A clip-on can identify zone-based worker locations and detect free falls. With a direct line of communication, workers can immediately report injures by pushing a button.

Smart Boots

Steel toe boots are already an essential for construction workers, but in the next few years the soles in these boots will be capable of detecting shocks and falls sustained by workers, track the location of the workers more accurately and will recharge themselves by walking in them.

Smart Vests

Highly visible vests are a staple on jobsites. These new vests can track body temperature and will alert workers when a break in the shade or a drink of water is necessary to prevent heat-related illnesses. The built-in sensors can also alert workers when they are nearing or entering a hazardous area. If used in conjunction with GPS equipped equipment, they can detect nearby equipment and slow them down to avoid any safety issues.

The future of construction safety will include some form of smart device that alerts the wearer and/or the safety manager when it detects a hazard. While these wearables are not a replacement for traditional PPE and best practices, they can help prevent hazards created by human error. As they are deployed across jobsites, we’ll be able to prevent workplace injuries before they happen.

For questions about managing your jobsite risk, contact me at sclayton@ranchomesa.com or (619) 937-0167.

Actual Impact of Auto Claims to Your Bottom Line?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In two previous articles/podcasts, we explored “below the surface” impacts from payroll inflation and lost time workers’ compensation claims. We provided detail on how these can negatively impact a business’s productivity and profitability and what companies can do to mitigate those impacts. Today, let’s look at another area where you need a keen awareness to really understand all the impacts.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In two previous articles/podcasts, we explored “below the surface” impacts from payroll inflation and lost time workers’ compensation claims. We provided detail on how these can negatively impact a business’s productivity and profitability and what companies can do to mitigate those impacts. Today, let’s look at another area where you need a keen awareness to really understand all the impacts.

What is the true impact an auto accident can have on areas of your business? For discussion, let’s consider an accident where your driver is at fault and also injured. This type of accident is much like an octopus in that it is going to touch many areas of your insurance program.

First, there is the damage to your auto, obviously this will be covered under the physical damage portion of your policy.

Second, you will have the physical damage and potential bodily injury to the third party whom your driver hit. This would fall under the auto liability portion of your policy. Additionally, if the other party or parties are severely injured it could penetrate your initial layer of liability insurance requiring your umbrella/excess policy to respond. As a side note, in my 35 years in the insurance industry, the largest claims that we see are predominately in auto due to the potential of severe bodily injury.

Third, given that your driver was injured, this claim will trigger your workers compensation policy to provide coverage for both the indemnity and medical costs of their injuries.

Fourth, the claims will impact your loss ratios in both your automobile insurance and workers compensation, causing the potential for future premium increases.

Fifth, this claim will also cause your Experience Modification to rise, which again will cause the potential for future premium increases as well as potentially, if you’re a contractor, eliminate you from bidding on certain work.

Sixth, replacing the injured driver may mean having to hire someone new which will increase payroll and lead to additional training time and a loss of productivity.

I’m sure your head is spinning and you’re probably wondering “all this, from one accident?” What should I do? Thankfully there are several things you can do to mitigate this before the accident occurs. Consider the following:

Do you have a formal fleet safety program in place? If not, work with your trusted advisor to get one in place. If you would like us to help you with that contact our client services team to set up a time to review our trainings and fleet safety resources with you.

Do you have a distracted driving policy in place for your drivers? This is by far the leading cause of auto accidents and while many are at low speeds, they can still be very costly. High speed distracted driving accidents can be catastrophic.

Are you participating in the DMV Pull Program? If not, this is a valuable tool that will provide you with information on your drivers’ experience regardless if the infraction or incident occurred as a part of work or outside of work. Most auto insurance carriers will view this as a subjective credit on your premium rating. You can do this very inexpensively and direct via the DMV website.

Are you using any telematics tools, like GPS, speed and breaking tracking, cameras (both forward facing and rear facing)? These devices are again viewed as a subjective credit by insurance carriers.

Once an accident occurs, are you completing a thorough accident investigation report with a description of the accident, witness statements, pictures, police report (if available) and then reviewing the data to determine root cause and possible changes to your fleet safety program?

As you’ve seen, the key to mitigating this type of claim is to keep it from occurring, which is easier said than done. Accidents will still happen. While you may not be the “at fault’ party in many of the accidents, reducing the likelihood of your driver being at fault starts with your commitment to a strong fleet safety program. If you need help in creating this fleet safety program, please contact our client services team to get started.

Once you have a strong program in place and you feel more in control of your vehicle safety performance there are other cost saving programs that you would be eligible to consider. We discussed those in other articles where we explore Performance Based Insurance Programs.

I hope you find this information useful and that you are able to take away an idea or two that might improve your operations. To learn more best practice techniques, contact us or reach out to me directly at dgarcia@ranchomesa.com.

Is Now the Time for a Performance-Based Insurance Program?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the three preceding articles in this series, we took a deep dive into some areas where a business’s productivity and profitability could be impacted by various factors emerging in the insurance marketplace. In the course of those articles, we also examined some tools, strategies and ideas that a company might implement to help manage and mitigate those impacts. Today, we will look at a way to exert the most control over your insurance program and premium outcome through performance-based insurance programs.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the three preceding articles in this series, we took a deep dive into some areas where a business’s productivity and profitability could be impacted by various factors emerging in the insurance marketplace. In the course of those articles, we also examined some tools, strategies and ideas that a company might implement to help manage and mitigate those impacts. Today, we will look at a way to exert the most control over your insurance program and premium outcome through performance-based insurance programs.

I’ve written about these programs before in "Increasing Your Productivity and Profitability Through Your Insurance Program," "What is the True Cost of a Lost Time Workers’ Compensation Claim?" and "How is Payroll Inflation Impacting Your Workers' Compensation Premium." So, in lieu of diving into all of them, let’s review a few of them briefly and then spend a little more time with “are they right for you now?”

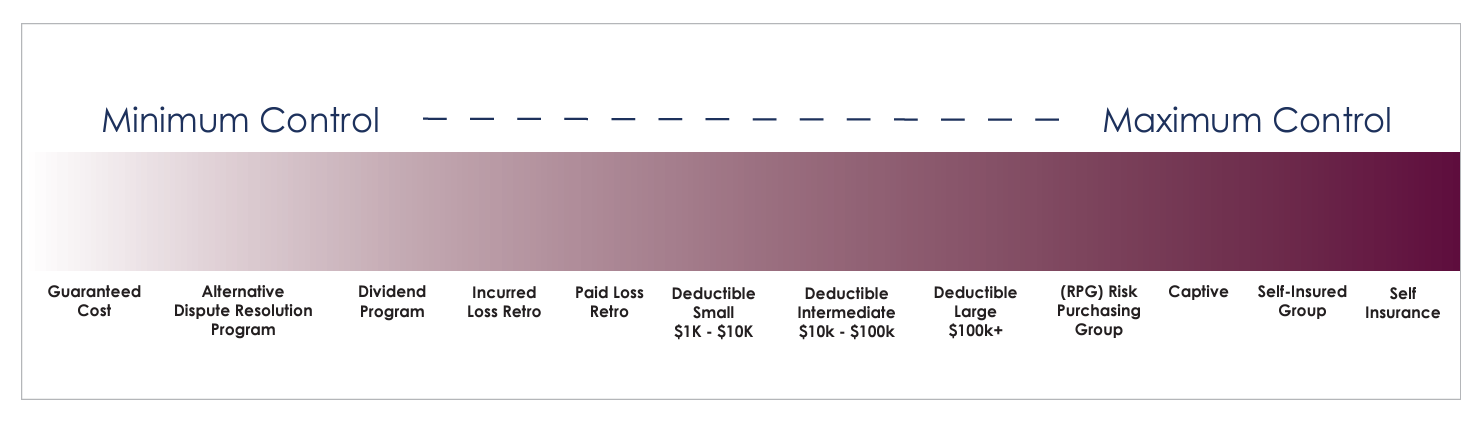

Beyond guaranteed cost programs, where policyholders pay a set premium and then claims are covered up to the policy limit, there are a wide range of performance-based insurance programs that can apply to a single line of coverage, like workers’ compensation, or multiple lines of coverage that can also include most notably general liability and automobile. Rancho Mesa has created a Workers’ Compensation Continuum document that lists many of these programs. As you move from right to left on the continuum, business owners increase control as well as risk. So, a wise strategy would be to evaluate as many programs as seem to fit your tolerance and readiness for that additional exposure.

Are you confused, yet? You are not alone, which is why it is even more important to start the process with a trusted advisor (your insurance broker) who is both familiar with and skilled in putting these programs in place. A properly skilled and educated advisor will be able to walk you through each option and present it in a way that makes your understanding of it easy to comprehend. If you do not fully understand both the benefits and the risk, we recommend pausing before moving forward, and take ample time for the best decision possible.

As someone who owns and operates a business, I like the idea of the “bet on yourself” model which always makes me feel more in control of the outcome. I cannot emphasize enough how confident you need to be in the ability to control your claims in order for these programs to work for you. That is why in the previous three articles, we talked so much about what you can do to improve your safety programs and more importantly your safety culture. Once you have the right team in place, have reached the point where you have control of your claims, and want more control over your premiums and pricing, then it may to time to move into the performance-based insurance program world.

If my forecast of a hardening workers’ compensation market as early as late 2022 or early 2023 is accurate, then getting started now in putting the right team together should be a priority. Follow these three steps to prepare:

Review your existing safety programs.

a. Look for ways to improve them based on loss trends and industry benchmarks.

Evaluate your claims history over the last five years.

a. Look for the root causes that are driving the losses.

Identify someone internally to be your safety director.

a. Consistently demonstrate upper management’s support of their efforts to the company and make sure you provide them with tools necessary to accomplish their goals.

Finally, in closing, choose a trusted insurance advisor who understands your industry, your operations and is very familiar with performance-based programs. There are good trusted advisors out there, so if you are currently with one, then give them the time they need to help you get better.

If you want to learn more about performance-based programs and would like to talk with us about the opportunity to be your trusted advisor, contact us and our team that specializes in your industry will reach out to you. If you would like to speak with me directly, email me at dgarcia@ranchomesa.com.

I hope you found this series helpful in making your 2022 the most productive, profitable and safe year ever.

How Higher Average Pay Can Lead to Work Comp Savings

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Wage thresholds have increased consistently in the past decade. This has pushed owners to give sizable raises every few years to maximize employee compensation, but also reducing insurance cost. The experience modification (MOD) and payrolls are key factors in developing a company’s net rates for workers’ compensation, but average wage per hour represents a big differentiator for most carriers and can lead to even more savings.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Wage thresholds have increased consistently in the past decade. This has pushed owners to give sizable raises every few years to maximize employee compensation, but also reducing insurance cost. The experience modification (XMOD) and payrolls are key factors in developing a company’s net rates for workers’ compensation, but average wage per hour represents a big differentiator for most carriers and can lead to even more savings.

Paying your most competent employees above the wage threshold leads to less fraudulent claims, longer tenured employees, and a happier workplace, not to mention the benefit of a drastic cut in net rates for that class code. The gap that is sometimes felt is when there are employees that have the same job description and are earning 30-40% less. Managing payroll inflation is always critical for businesses but let’s think about what this can do to the employees bringing the average pay down for your company. Consider:

More fraudulent claims as the employee has less to lose if they are terminated or laid off;

Resentment toward employees that are doing same job but making more;

Employees are more likely to move to another company to get raises;

Likelihood to miss more time when injured, leading toward higher temporary disability pay which typically can lead to a higher XMOD.

Insurance companies and their underwriters look closely at average salary per employee when they receive a submission with the renewal documentation.

The higher the average pay, the more aggressive they can be with potential scheduled credits in most cases. Obviously, the employer must be selective with who receives a raise and how much but also understand what potentially positive impacts there can be when giving raises in order to hit those thresholds.

And, perhaps just as important is partnering with a broker that specializes in your industry and knows how to properly benchmark you with like organizations. This consistently leads to more productive discussions with underwriters that lead to more scheduled credits. The happier your workforce is, the less claims you tend to see and that translates to long-term savings.

If you have any questions about how you compare to your industry or would like to discuss any other insurance related topic, do not hesitate to reach out to 619-937-0164 or email me directly at ccraig@ranchomesa.com.

Construction Law and the Future of the Industry With Carlin Law Group

Rancho Mesa's Director of Surety Matt Gaynor interviewed Kevin Carlin of Carlin Law Group on Wednesday, March 23, 2022 to learn about his background, where he started his law career, and current hot topic’s in the construction industry. Kevin is a well-respected construction attorney here in Southern California who represents a number of Rancho Mesa clients.

Rancho Mesa's Director of Surety Matt Gaynor interviewed Kevin Carlin of Carlin Law Group on Wednesday, March 23, 2022 to learn about his background, where he started his law career, and current hot topics in the construction industry. Kevin is a well-respected construction attorney here in Southern California who represents a number of Rancho Mesa clients.

One topic of discussion centered on payment disputes.

MG: Are you seeing a lot of payment disputes right now?

KC: No, as your listeners know, the construction economy is on fire right now as there has been a ton of money sloshing around as a result of low interest rates and stimulus. While there are a few payment lawsuits going on right now, contractors seem to be more focused on getting the next job rather than chasing the money they are owed on the last job. Most of my cases right now seem to involve demands for defense and indemnity on large complex public, commercial and hospitality projects. These cases are highlighting how important, and frightening, indemnity language in prime contracts and subcontracts is, and how important it is to have good insurance. Most contracts contain indemnity language where if you are 1% at fault, you agree to pay 100% of the liability. Most people in the construction industry do not know about this or appreciate this risk because it’s never a problem until it’s a problem. These are the risks that make it so important to have the right coverages and policies of insurance, which is where you guys come in.

Listen to the full episode to learn more about Kevin and the Carlin Law Group.

Preventing Stress Claims

Author, Jack Marrs, Associate Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

Specializing in non-profit insurance has opened my eyes to how difficult it is for some non-profit employees to deal with the stress related to their jobs. It’s the nature of the work. Helping people through difficult situations can be rewarding for an employee, but it can also be emotionally draining when they become invested in their clients to the point where it can lead to burnout.

Author, Jack Marrs, Associate Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

Specializing in non-profit insurance has opened my eyes to how difficult it is for some non-profit employees to deal with the stress related to their jobs. It’s the nature of the work. Helping people through difficult situations can be rewarding for an employee, but it can also be emotionally draining when they become invested in their clients to the point where it can lead to burnout.

Employees can suffer from emotional and mental illness as a result of their working environments, which can lead them to file workers’ compensation claims. Depending on the nature of the non-profit’s mission, employees may witness a variety of disturbing realities that the general public isn’t used to experiencing.

Since psychiatric injuries are based on an employees' personal experience, it’s much more difficult for physicians to verify these types of claims. Plus, these conditions can also develop from multiple stressors in an employee’s professional and personal life like when they are dealing with a death, going through a divorce, or filing for bankruptcy. So, it’s hard to determine what percentage of the claim is work-related and what percentage is caused by outside factors.

Workplace stress can trigger mental and physical illnesses and injuries, so identifying and correcting stressful situations early, can prevent costly health care costs and workers’ compensation claims.

Managers should periodically check in with their employees to see how they are doing with regards to their workload, relationships with clients, co-workers and vendors, etc., but also their personal lives. If there is an issue in the workplace, it can be addressed quickly before it causes extreme stress to the employee. If something is happening at home, it could be affecting their productivity and performance on the job. And, the employer may be able to refer their employee to resources to assist them as they deal with whatever stressors are in their personal lives. This also helps to establish if the stress felt by the employee is work-related or personal.

Employers can reduce workplace stress by ensuring effective communication from supervisors to employees. Whether the communication is about job duties and expectations, career growth within the organization, or a traumatic event and relevant resources to help employees cope, being transparent with employees can relieve some stress caused by not knowing what’s to come.

Stress claims take a tremendous toll on both employees working for non-profits and the organizations themselves. Rancho Mesa provides an extensive library of training offered through our Risk Management Center and the RM365 HRAdvantage™ Portal. These trainings can be easily accessed and allow for our non-profit clients to be proactive in mitigating the severe impact of stress claims.

Contact me at jmarrs@ranchomesa.com or (619) 486-6569 to learn more about these options.

Signing Up for Safety

Author, Greg Garcia, Account Executive, Landscape Group, Rancho Mesa Insurance Services, Inc.

There are many tips, ideas, and systems involved in creating a safe culture in the landscape industry. The most common practice landscape companies implement with regards to safety are regular safety meetings.

Author, Greg Garcia, Account Executive, Landscape Group, Rancho Mesa Insurance Services, Inc.

There are many tips, ideas, and systems involved in creating a safe culture in the landscape industry. The most common practice landscape companies implement with regards to safety are regular safety meetings.

For these meetings to be effective, you need to ask yourself three questions:

What should be discussed during these safety meetings?

How often do we really need to have these meetings?

Where can I find content for these meetings?

Let’s take a look at each question in more detail.

What should be discussed in these safety meetings? The easy answer is we will just talk about an accident that has recently occurred. That seems like a good approach, but it’s more of a reactive approach than proactive. Make no mistake about it, it is very important to go over safety regarding a previous incident, and take the necessary steps to help prevent that incident from happening again. However, a great safety culture includes a more proactive approach by covering safety topics before an incident occurs. Examples of good topics for safety meetings include something as simple as “Operating a Leaf Blower” to more pressing issues like “Handling Medical Emergencies and Jobsite Injuries.”

Secondly, how often do we need to hold these meetings? The quick answer as often as possible, but we recommend weekly safety meetings as they are the best way to create and change culture for the better. Weekly meetings build consistency. And, these good habits create a safety first culture by emphasizing safety and showing your employees that their wellbeing is a top priority. Plus, OSHA requires safety meetings at least every ten working days, so scheduling them weekly ensures you are meeting that requirement.

Finally, and what seems to be the most important question, is where can I find content for these safety meetings? Rancho Mesa wants to help provide that content. We publish a weekly landscape specific safety tailgate email. These emails arrive in your inbox every Tuesday and range from proper equipment use like “Avoiding Mower-Related Injuries,” to specific injury topics such as “Preventing Heat-Related Illness.” Our 52-week tailgate topics are not only landscape specific, but they correspond to the seasons, as well. So, you will not be receiving a topic on Heat Illness in the middle of winter, instead that topic is more likely to come out in the summer months. There are both English and Spanish versions of these tailgate topics that can be downloaded. These safety emails are something that our clients are taking full advantage of, and is a great way to take the burden of finding landscape specific safety topics off your plate, every week.

In an effort to serve and support the overall health and safety of the landscape community, we offer these trainings without charge to any landscape company that is interested in receiving them. Sign up to receive these trainings every week.

If you have any questions or would like more assistance in developing your safety program, contact me at 619-438-6905 or email me at ggarcia@ranchomesa.com.

Artisans Captive – Risk Control Workshop Recap

Author, Amber Webb, Account Executive, Rancho Mesa Insurance Services, Inc.

On January 20th and 21st of 2022, Captive Resources hosted the Artisans Captive Risk Control Workshop at The US Grant in San Diego, CA. The workshop was intended for all Artisans’ risk and/or safety mangers, human resources, claims managers, supervisors, owners, brokers and any others who wished to attend.

Author, Amber Webb, Account Executive, Rancho Mesa Insurance Services, Inc.

On January 20th and 21st of 2022, Captive Resources hosted the Artisans Captive Risk Control Workshop at The US Grant in San Diego, CA. The workshop was intended for all Artisans’ risk and/or safety mangers, human resources, claims managers, supervisors, owners, brokers and any others who wished to attend.

The workshop began with a brief introduction to the members of Captive Resources and Zurich Insurance Group, along with quick summaries of each of their responsibilities. Then, immediately following was an overview of how the captive is operated and how each member company can earn points which ultimately contribute towards the calculation of their year-end dividend. The group was able to hear from Rich McElhaney from The Real Cost of Safety, as the keynote speaker on the 20th. His story was captivating and eye opening to just how quick something can go wrong on a jobsite without the proper safety protocols in place. He stressed the importance of getting supervisors and employees to report their near misses. Each time a near miss is reported, it gives the company an opportunity to do a training and possibly make changes to their safety policies and procedures to avoid future incidents. Reporting near misses also gives companies a chance to look at areas where trends are taking place and make the appropriate adjustments.

The first day of the workshop ended with dinner and a tour of the USS Midway. This was a great time for member companies to network and chat about what each other are doing with regard to their risk control and safety programs.

The second day of the workshop on the 21st, we all met early for breakfast which also allowed for more networking and learning about different member companies. Immediately after breakfast, we all broke out into our different session groups to learn about specific topics. The first session focused on the, “Do’s & Don’ts of Accident Investigation.” In this session, we went over a twelve-step process for what to do when there is an accident on the job. We were given several great tips for what to do and what not to do. One recommendation was to take pictures of all four corners of your vehicle, then all four sides and repeat for all other vehicles at the scene. The presenter also encouraged not using the phrase, “no comment” if the media becomes involved. Instead, showing empathy and compassion while still not commenting can lead to a better outcome while the investigation is still ongoing. Another takeaway from this session was the importance of reviewing all of your policies to ensure they do not stress productivity over safety. Then, make sure to train your employees to understand that their wellbeing is top of mind, while actually enforcing a safety culture.

The second session we attended was “Driver Safety: Lucky vs. Good” where we learned that the highest auto expenses result from rear end accidents. Also, according to the Bureau of Labor Statistics’ national census of fatal injuries released in December of 2021, transportation incidents have the most workplace fatalities, followed by falls and struck by objects. We also learned with new vehicle technology, such as high-intensity headlights, forward automatic braking, forward collision alert, lane departure warning and rear vision cameras, employers can help reduce vehicle crashes. The speaker went on to explain the importance of utilizing the data given by fleet analytics to help with reducing collision and use as a tool for focusing on trends happening within your fleet.

The final keynote speaker was Sean Bott and he spoke on the “Safety Dance: Creating the Courage to Connect on Site through Three Simple Steps.” His session was not only comedic, but also entertaining. He was able to teach us the 3 steps of meaningful connection; 1) Interrupting, 2) Introducing and 3) Inquiring. We have to start by interrupting people’s defenses and fears and can do this simply by a genuine compliment, a smile, a wave, etc. Then, once the walls are down, we are able to introduce ourselves while slowly saying our name with a pause between our first and last name, all while using the triple nod technique. He also encouraged us to smile and even throw in a wave during this process of introduction. Finally, we were taught to inquire in a clear and meaningful way to get to know the other person on a deeper level. He related these skills back to how employers interact with their employees on all levels, but specifically when it comes to safety. He suggested that we all combine these three skills to make others feel seen, heard, felt and valued. He displayed the value in bringing the human element to safety and reminding the group that the ultimate goal is to make sure all employees go home safely.

Overall, this workshop was very informative with some fun mixed in and ample time for networking to get to know the other companies involved in the Captive. As a Rancho Mesa broker attending with several of our clients, it allowed us to see the value of not only this workshop, but the additional benefits of being a member of the Artisans Captive and what it offers.

For those interested in learning more about Captives and their potential place within your organization, we will be hosting an informational Captive workshop for the Artisans Captive on April the 28th. Register online, today.

If you have any questions or would like to discuss this option further, you can contact me at awebb@ranchomesa.com or call me at (619) 486-6562.

Nonprofits Insurance Alliance® Discusses Their Mission

On February 8th, 2022 Sam Brown, Vice President of Human Services Group, welcomed Nonprofits Insurance Alliance® (NIA) founder, president, and CEO Pamela E. Davis to Rancho Mesa’s StudioOne® podcast. Pamela shared how she turned a graduate school project and a vision for insuring nonprofits into $250 million in written premium. Sam and Pamela discuss how a nonprofit specialist broker serves clients, and how NIA provides cost-saving tools tailored for nonprofit leaders and brokers.

On February 8th, 2022 Sam Brown, Vice President of Human Services Group, welcomed Nonprofits Insurance Alliance® (NIA) founder, president, and CEO Pamela E. Davis to Rancho Mesa’s StudioOne® podcast.

Pamela shared how she turned a graduate school project and a vision for insuring nonprofits into $250 million in written premium.

Sam and Pamela discuss how a nonprofit specialist broker serves clients, and how NIA provides cost-saving tools tailored for nonprofit leaders and brokers.

Listen to the full interview below.

How is Payroll Inflation Impacting Your Workers' Compensation Premium?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Inflation is rampant everywhere from consumer goods like groceries and gasoline to increased housing costs to labor. Today, I want to talk with you about the specific impact that payroll inflation is having on the workers’ compensation marketplace and ultimately on your premium cost.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Inflation is rampant everywhere, from consumer goods like groceries and gasoline to increased housing costs and labor. Today, I want to talk with you about the specific impact that payroll inflation is having on the workers’ compensation marketplace and ultimately on your premium cost.

Any and all businesses have felt the impact of increased payrolls both to retain existing employees and also to attract new ones. For the sake of discussion, let’s use an inflation wage percentage of 6.5%.

On the surface, this 6.5% wage increase is hard enough to manage on profit and loss statements, but below the surface there is also a deeper impact on businesses that for many will catch them unaware.

The two areas I want to talk about are:

The impact the wage increase has on temporary disability claim amounts.

The financial impact that higher wages will have on workers’ compensation carrier P&L’s.

First, temporary disability claim amounts are generally equal to 2/3 of the average weekly earnings of the injured employee. This payment does have a minimum and maximum amount, but for our discussion we will assume the injured worker falls somewhere in between.

So, if the injured worker’s average weekly wage increases by the 6.5%, the disability payment will follow suit. This 6.5% will have several negative impacts. The higher cost of the claim will have a negative impact to the business’ Experience Modification Rate (EMR).

This can be significant to a business since it will not only directly affect the future year’s premium but if the business is a contractor, an elevated EMR can potentially limit pre-qualification approval from many builders.

This is so critical to a business success that here at Rancho Mesa we developed a proprietary Key Performance Indicator (KPI) Dashboard that has the capability to tell our clients the actual claim amount per point of experience modification so they can plan accordingly.

An additional consequence of the claim costs increasing is that a company’s individual loss ratio (claim amounts/premium) with their workers’ compensation carrier will increase. Suffice to say as the loss ratio increases, future premiums will need to increase to offset those higher claim costs. Ideally, to continue to receive the most aggressive pricing, we like to see our clients’ loss ratios stay below 30% so these potential inflation increases need to be understood and addressed proactively.

Shifting gears, let’s look at the impact of payroll inflation on the insurance carrier as a business and what impacts it may have on you the business owner as well.

One of the measurements workers’ compensation carriers look to and monitor for their financial health and well-being is their combined ratio. As a general rule, combined ratios measure dollars collected in premium divided by claims costs and overhead. A good combined ratio indicating a profitable and strong company would be in the low 90%’s.

So, logically speaking, if a carrier is experiencing an increase in temporary disability claims costs and an internal payroll inflation of the same 6.5%, which direction will their combined ratios be going? Obviously, it will be going up, so what are they to do? The most likely choice would be to raise premiums to help offset those increases – unfortunately we know who pays those premium increases.

Now that we understand the impacts that payroll inflation will have on workers’ compensation, what can you do as a business to help mitigate them. The answers are easier than you might think.

This first step is to help reduce the likelihood of claims occurring, thereby reducing the impact of the increase to temporary disability claims on your company.

Conduct a thorough review of your current safety program and look for ways to improve it. How often are you meeting? Are the trainings current and specific to your needs? Is there a tracking system in place where these trainings are documented? At Rancho Mesa, our Client Services Group works closely with our client teams, drawing from our library of over 3,000 specific trainings to help you create meaningful trainings specific to your needs.

Should a claim occur, what are the steps to help mitigate the impact:

Report the claim timely – the quicker your insurance carrier is aware of the claim the better the claim outcome.

Select a carrier that offers “nurse triage” so that in addition to reporting the claim quickly you are able to have an assessment of the injury without going to a clinic and potentially reducing the need for a lost time claim.

If you have implemented all of the above but still have a lost time claim, offer modified work to meet the injuries work restrictions. By offering modified duty, you are able to either pay the injured workers whole salary or a portion of it which eliminates the temporary disability cost from the claim and/or will dramatically reduce the cost. In addition to these claim cost savings, statistics will show when modified duty is offered the potential for litigation is reduced saving even further potential costs.

To create an active and sustainable safety program, look to your trusted advisor (insurance broker) and see what services they have that can assist you.

Do they have a client services team that can provide industry specific trainings, workshops, webinars, certification programs to take your safety program to the next level?

Are you having regular claims meetings with them to review performance, spot trends, look for root causes?

What tools are there to assist you in reviewing your claim data?

Are they able to provide industry benchmarking?

Do they have an in-house workers’ compensation claims advocate to assist you with your open claims to create a better outcome?

Payroll inflation is now a reality and not likely to subside any time soon. As we have shared though, there are proactive steps all businesses can take to help mitigate the impact on your workers’ compensation program today and in the future.

If you are looking for assistance in managing through this or have any additional questions, please reach out to us or email me at dgarcia@ranchomesa.com.

Be informed, be proactive, and implement a plan to make your 2022 the best year ever.

What is the True Cost of a Lost Time Workers’ Compensation Claim?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

There are many insurance professionals that have tried to quantify the real cost of indemnity or lost time claims, using multipliers anywhere from 2 to 4 times the claim amount in an effort to determine what the real cost of a claim will be to a company. While this may be true, it remains subjective to many. Let me help you understand the ways this type of claim will impact you and then you can decide the real impact to your business.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

There are many insurance professionals that have tried to quantify the real cost of indemnity or lost time claims, using multipliers anywhere from 2 to 4 times the claim amount in an effort to determine what the real cost of a claim will be to a company. While this may be true, it remains subjective to many. Let me help you understand the ways this type of claim will impact you and then you can decide the real impact to your business.

Let’s assume a claim where the injured worker will be out for 2 to 3 months and the claim’s total incurred amount (which is the combination of paid dollars and reserves) is $50,000. This claim can and will impact your business.

The first direct hit will be your experience modification (X-Mod). While a claim in your current term is delayed a year before going into the calculation, you’ll feel the effects of the remaining 3 years. So, assume the claim is in your 2022-2023 policy year, claims from that year will not go into your 2023-24 policy year but will be in the next three policy terms, 2024-2025, 2025-2026 and 2026-2027.

Each company develops their own “primary threshold,” a term used to describe the maximum incurred loss or cap that any one claim can impact the experience modification. It’s confusing to many policyholders, but this amount regularly changes year-to-year for most companies, as it is derived by the Workers’ Compensation Insurance Rating Bureau (WCIRB) based on the payrolls and class codes a particular business uses and reports.

To simplify this for our clients, we developed a proprietary Key Performance Indicator (KPI) Dashboard that calculates client’s individual Primary Threshold, also detailing how many points to the X-Mod it would add giving them a true indication as to the cost of the claim as it pertains to the X-Mod. Request a personalized KPI for your company.

Now that we understand the impact to the X-Mod, what other areas will be impacted? The next most obvious is the workers compensation carrier’s loss ratio. Adding claim dollars will negatively skew percentages and undoubtedly cause an increase in premium of some amount at renewal.

While the impact to the X-Mod and loss ratio are easy to understand, they are really just the tip of the iceberg. Let’s go below the surface and look at other ways this claim will impact your business.

Losing an employee for any length of time is impactful, but losing the employee for a month or two would likely require the business to fill that person’s job and responsibilities within the company. In many cases this means trying to hire someone new to the organization.

Without going into great detail, the business is likely going to experience additional payroll and benefit costs, training, and likely a decrease in expertise which will most certainly impact the productivity of that particular job.

I think we can all now understand how a lost time claim affects the X-Mod, loss ratio, and a business’s productivity and profitability, both immediately and into the future.

So, what can I do to avoid this or at least minimize the impact should a lost time injury occur? The great news is that in many instances you can prevent these injuries from ever happening or at least reduce the frequency of them occurring. Start with these strategies and enlist your insurance broker for their guidance in the process:

Perform a complete overview of your safety program.

Make changes in training that address your specific needs.

Increase awareness and accountability of those employees responsible for the implementation of your safety program – consider adding this as an area of their annual performance appraisal.

Identify new employees so that your experienced people can mentor them in training or in watching how they are performing. Statistics show that new employees (defined as less than 6 months) have the highest percentage of injuries. New hires in construction can wear different colored hard hats, gloves, vests or even a sticker on their clothing, anything that might let the crew leader know who might need a little more oversight.

Choose the right workers compensation carrier. In general, look for a carrier that offers in-house claims handling, loss control services, can show you statistically both their performance in closing claims vs. the industry, claim costs vs. the industry, medical cost containment performance, length of time doing business in the state you are in. These are just a few items to consider that can result in the best claim outcome should one occur.

Choose the right insurance advisor (broker). Are they a specialist within your industry? What client services do they offer pertaining to trainings you need? Do they offer workshops, webinars and safety certifications? Do they have an experienced workers compensation claim advocate in house to assist you in both understanding your claims and mitigating costs? What tools do they have to help you benchmark yourself against your industry? Can they help you identify trends and root causes?

We’ve seen how one lost time claim can have a negative rippling affect for your company in both your productivity and your profitability. It may feel overwhelming in how to understand and fix your issues with all the other areas of your business that you have to be involved with. It really doesn’t have to be, it’s just time to look at who you choose to work with from your carrier to your broker differently.

Contact us via our website or reach out to me directly at dgarcia@ranchomesa.com.

Increasing Your Productivity and Profitability Through Your Insurance Program

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

“What?” You’re probably asking yourself; “Did I read that wrong? How can my insurance program improve the productivity and profitably of my company?” Trust me, I understand your confusion.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

“What?” You’re probably asking yourself; “Did I read that wrong? How can my insurance program improve the productivity and profitably of my company?” Trust me, I understand your confusion.

I’ve been working in the insurance industry for 35 years and this is a premise I heard about, but thought was impossible, until I dug a little deeper. Once I did, I was able to share this concept with my clients over the years and it changed how they approached this vital part of their businesses.

I have examined four current insurance issues facing you and your companies, and share the steps needed to make this premise a reality. To do this I will inspect each issue in some depth and help you build a foundation of understanding so that you can begin to increase your productively and profitability through your insurance program.

I will be covering the following topics:

“What is the True Cost of a Lost Time Workers’ Compensation Claim?”

“How Payroll Inflation is Impacting Your Workers Compensation Premium?”

“Is Now the Time for a Performance-Based Insurance Program?”

I hope you find this information as a pathway to improve both your productivity and profitability in 2022.

California Prepares to Restore COVID-19 Paid Sick Leave

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

On January 25, 2022, California Governor Gavin Newsom announced he had made a deal with legislative leaders on a framework that would provide up to two weeks of supplemental paid sick leave to those who are unable to work due to COVID-19, quarantining or experiencing side effects from the vaccine. As of February 7, 2022, the California legislature passed the bill and we are waiting for the governor to sign it into law.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

On January 25, 2022, California Governor Gavin Newsom announced he had made a deal with legislative leaders on a framework that would provide up to two weeks of supplemental paid sick leave to those who are unable to work due to COVID-19, quarantining or experiencing side effects from the vaccine. As of February 7, 2022, the California legislature passed the bill and we are waiting for the governor to sign it into law.

Previously, the federal government’s Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which expired September 30, 2021, had provided supplemental sick pay for workers.

California’s proposed employee COVID-19 paid sick leave law would retroactively apply to employers of more than 25 employees from January 1, 2022 through September 30, 2022.

The law would replace wages for:

People who are unable to work or telecommute because they either have COVID-19 or have symptoms and are seeking a diagnosis,

Individuals caring for a child or family member who is required to quarantine or self-isolate, and,

People experiencing vaccine-related side effects.

With the recent wave from the Omicron variant, employees are wondering if and when they will be paid. The proposed law would allow employers to be reimbursed for wages paid to employees who need to stay home due to COVID-19 and prevent the further spread of the virus to co-workers.

The governor announced employers would likely be reimbursed for wages through business tax credits and funding through a small business COVID-19 relief grant program.

Providing a state-sponsored mechanism for employee COVID-19 supplemental sick pay should be welcomed by California employers and employees who may otherwise be tempted to file COVID-19 workers’ compensation claims as a way to replace some wages. Keeping non-work-related COVID-19 cases out of the workers’ compensation system benefits everyone involved by keeping costs, and ultimately premiums, down.

Visit Rancho Mesa’s COVID-19 page for the latest Cal/OSHA COVID-19 Prevention Program Template, articles, podcasts and other resources.

For questions about your workers’ compensation insurance, contact me at khoward@ranchomesa.com or (619) 438-6874.

Revised 2022 COVID-19 Prevention Program Template Now Available

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa has revised its written COVID-19 Prevention Program Template based on the Emergency Temporary Standards (ETS) adopted by California’s Department of Industrial Relations Occupational Safety & Health Administration (Cal/OSHA) in December 2021 and effective as of January 14, 2022.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa has revised its written COVID-19 Prevention Program Template based on the Emergency Temporary Standards (ETS) adopted by California’s Department of Industrial Relations Occupational Safety & Health Administration (Cal/OSHA) in December 2021 and effective as of January 14, 2022.

To access the revised template, clients can access the editable version from the Risk Management Center, or request to download the PDF, below.

The template is designed to assist organizations in the development of a COVID-19 Prevention Program that is specific to their organization and locations. Rancho Mesa highly recommends organizations using this template also consult their state’s Occupational Safety & Health Administration and local Public Health Department for specific requirements for their area as requirements can vary from state to state and municipalities. For example, California’s Department of Public Health’s recent guidelines supersede some of the requirements in the ETS.

A discussion on the differences between the previous version and the current version can be found in Ep. 162

Remember, this template alone is not enough to be in compliance. It must also be adapted to each organization and specific locations, as well as implemented. Organizations’ programs may require additional information if the company provides employee housing.

For current COVID-19 information, visit www.RanchoMesa.com/covid-19.

Your Commercial Vehicle May Require a Motor Carrier Permit

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

When a company has vehicles on the road, it’s important to understand all the commercial vehicle requirements in order to stay in compliance.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

When a company has vehicles on the road, it’s important to understand all the commercial vehicle requirements in order to stay in compliance.

We recently had a client purchase a new medium-sized truck from a commercial dealership. A few weeks later, an employee driving that new vehicle was pulled over by the California Highway Patrol and fined for not carrying a Motor Carrier Permit (MCP). Our client immediately contacted Rancho Mesa confused by the citation. They have other similar trucks that they have been on the road for many years and never received a citation like this. To avoid a similar situation, it’s essential to understand the MCP and the types of drivers and vehicles that are required to carry one.

The MCP provides proof that the motor carrier is legally operating on California highways. In order to get a MCP, the Department of Motor Vehicles (DMV) verifies that the motor carrier has complied with all the requirements for both registration and insurance. It includes specific information about the motor carrier (e.g. name, mailing address, USDOT number, California Carrier Identification number (CA #), and effective/expiration dates of the permit. MCP terms only last 12 months, so make sure not to miss the deadline.

There are many drivers/companies that are required to have MCPs. If your drivers fall under any of these scenarios, they must have a MCP:

Any person, business or entity who is paid to transport property in their motor vehicle regardless of the vehicle’s size, type or weight. This applies to for-hire carriers.

Any person, business or entity operating a motor vehicle with Gross Vehicle Weight Rating of 10,001 pounds or more. This applies to businesses transporting their own property (i.e., private carrier).

Operators of any vehicle or a combination of vehicles transporting hazardous materials.

Operators of a combination or a motor truck and trailer, semitrailers, pole or pipe dollies, auxiliary dollies, and logging dollies that exceed forty feet in length when coupled together. For purposes of an MCP, a “trailer” excludes camp trailers, utility trailers, and trailer coaches.

While there are many scenarios where a MCP is required, there are still some instances where the MCP is not. A MCP is not needed for:

Vehicles operated by household goods and/or passenger carriers.

Vehicles operated by household goods carriers to transport used office, store, and institutional furniture, and fixtures when operated under a household goods carrier permit.

Pickup trucks with gross vehicle weight rating of fewer than 11,500 pounds, an unloaded weight of fewer than 8,001 pounds, and equipped with a box-type bed not going over 9 feet in length when operated in non-commercial circumstances.

Utility trailers, camp trailers, or trailer coaches.

Vehicles providing transportation of passengers only, a passenger stage corporation transporting baggage and express upon a passenger vehicle incidental to the transportation of passengers.

Vehicles used only for personal use and are 10,000 pounds gross vehicle weight rating or less.

Two-axle daily rental trucks with a gross vehicle weight rating of than 26,001 pounds when operated in a non-commercial use.

Vehicles that are exempt from vehicle registration fees. These includes all publicly-owned vehicles, special construction equipment, special mobile equipment, and any other vehicle used primarily off highway and not required to be registered.

Motor trucks or two-axle truck tractors with a gross vehicle weight of less than 26,001 pounds, when operated singly or when used to tow a camp or utility trailer, a trailer coach, a fifth-wheel travel trailer, or a trailer designed to transport a watercraft, and is never operated commercially.

There are potential fines for not carrying a MCP when its required. If a motor carrier caught operating with a suspended MCP, they could be fined up to $2,500, charged with a misdemeanor and/or receive up to three months in jail. The CHP may also find it necessary to impound the vehicle.

It is important to know the classification of your vehicle prior to purchase in order to determine whether a MCP filing is required.

Manufactures classify their truck based on the Gross Vehicle Weight Rating government guidelines. The GVWR indicates the maximum truck weight plus what it is able to carry fully loaded. That includes the truck’s own weight plus the fuel, cargo, passengers, and even the trailer tongue. Typically, ¾ and 1 ton trucks are referred to as “heavy duty,” though they are technically classified as light duty vehicles. MCP’s are typically required when your vehicle falls into the medium classification (GVWR 10,001-26,000).

Do your due diligence ahead of purchasing the vehicle in order to know the specific licensing and permitting requirements. Also, consider working closely with an insurance broker who can assist with the required insurance coverages and documents needed during the application process.

Rancho Mesa Insurance has extensive experience helping business owners with fleets of all sizes. If you need assistance with your commercial insurance needs, please contact me at (619) 937-0174 or via email at jhoolihan@ranchomesa.com.