Is Now the Time for a Performance-Based Insurance Program?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the three preceding articles in this series, we took a deep dive into some areas where a business’s productivity and profitability could be impacted by various factors emerging in the insurance marketplace. In the course of those articles, we also examined some tools, strategies and ideas that a company might implement to help manage and mitigate those impacts. Today, we will look at a way to exert the most control over your insurance program and premium outcome through performance-based insurance programs.

I’ve written about these programs before in "Increasing Your Productivity and Profitability Through Your Insurance Program," "What is the True Cost of a Lost Time Workers’ Compensation Claim?" and "How is Payroll Inflation Impacting Your Workers' Compensation Premium." So, in lieu of diving into all of them, let’s review a few of them briefly and then spend a little more time with “are they right for you now?”

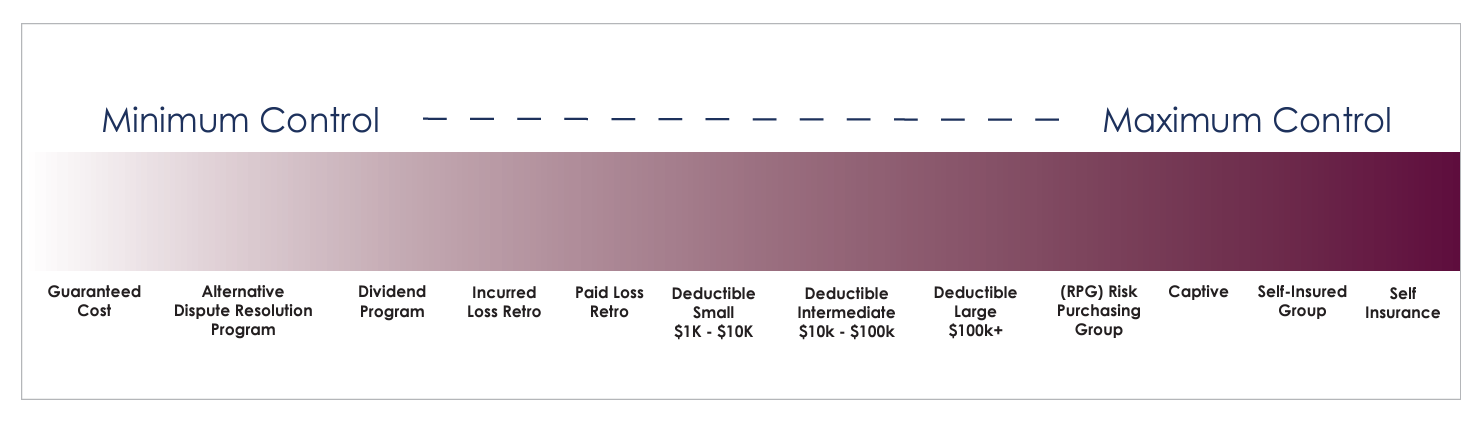

Beyond guaranteed cost programs, where policyholders pay a set premium and then claims are covered up to the policy limit, there are a wide range of performance-based insurance programs that can apply to a single line of coverage, like workers’ compensation, or multiple lines of coverage that can also include most notably general liability and automobile. Rancho Mesa has created a Workers’ Compensation Continuum document that lists many of these programs. As you move from right to left on the continuum, business owners increase control as well as risk. So, a wise strategy would be to evaluate as many programs as seem to fit your tolerance and readiness for that additional exposure.

Are you confused, yet? You are not alone, which is why it is even more important to start the process with a trusted advisor (your insurance broker) who is both familiar with and skilled in putting these programs in place. A properly skilled and educated advisor will be able to walk you through each option and present it in a way that makes your understanding of it easy to comprehend. If you do not fully understand both the benefits and the risk, we recommend pausing before moving forward, and take ample time for the best decision possible.

As someone who owns and operates a business, I like the idea of the “bet on yourself” model which always makes me feel more in control of the outcome. I cannot emphasize enough how confident you need to be in the ability to control your claims in order for these programs to work for you. That is why in the previous three articles, we talked so much about what you can do to improve your safety programs and more importantly your safety culture. Once you have the right team in place, have reached the point where you have control of your claims, and want more control over your premiums and pricing, then it may to time to move into the performance-based insurance program world.

If my forecast of a hardening workers’ compensation market as early as late 2022 or early 2023 is accurate, then getting started now in putting the right team together should be a priority. Follow these three steps to prepare:

Review your existing safety programs.

a. Look for ways to improve them based on loss trends and industry benchmarks.

Evaluate your claims history over the last five years.

a. Look for the root causes that are driving the losses.

Identify someone internally to be your safety director.

a. Consistently demonstrate upper management’s support of their efforts to the company and make sure you provide them with tools necessary to accomplish their goals.

Finally, in closing, choose a trusted insurance advisor who understands your industry, your operations and is very familiar with performance-based programs. There are good trusted advisors out there, so if you are currently with one, then give them the time they need to help you get better.

If you want to learn more about performance-based programs and would like to talk with us about the opportunity to be your trusted advisor, contact us and our team that specializes in your industry will reach out to you. If you would like to speak with me directly, email me at dgarcia@ranchomesa.com.

I hope you found this series helpful in making your 2022 the most productive, profitable and safe year ever.