Industry News

Understanding the Importance of Your Workers’ Compensation Unit Stat Filing Date

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Imagine you are a landscaping company owner and your workers’ compensation policy just renewed January 1st. You are probably thinking, now what? Well, the next date that should be on your radar is June 30th, your unit stat date.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Imagine you are a landscaping company owner and your workers’ compensation policy just renewed January 1st. You are probably thinking, now what? Well, the next date that should be on your radar is June 30th, your unit stat date. Each unit stat date varies and with the actual filing taking place approximately 180 days from when the workers’ compensation policy was placed. The unit stat date is when all workers’ compensation claim activity is frozen, along with audited payroll information, and sent to the rating bureau so the experience modification (XMOD) can be calculated.

As a reminder, your XMOD is determined by comparing your loss experience and historical payroll to others with similar class codes. The XMOD is derived from three years of audited payroll and losses suffered over those years.

If a particular claim is closed after your unit stat date, that claim will impact your next XMOD at the total incurred value before the unit stat date. Therefore, if you have a claim that can either be closed or reserves reduced, it is critical that this is done ahead of the unit stat date. Staying up to date with your claims adjuster and insurance professional ahead of the filing can quite literally save you points on your XMOD, which in turn can help to reduce your worker’s compensation annual premium.

Using one of the metrics on our proprietary KPI Dashboard, our clients are able to track the number of days until their unit stat date. Combining this KPI tool with our dedicated workers’ compensation claim advocate services at prescheduled claims reviews throughout the policy year helps to close the claims or mitigate claim costs in advance of the filing. This strategy can dramatically lower overall insurance costs.

If you have any questions about the unit stat or would like me to put together a custom KPI dashboard for your team, you can contact me at ggarcia@ranchomesa.com.

WCIRB 2024 Construction Dual Wage Threshold Increases Approved

The California Insurance Commissioner Lara has approved an increase in hourly wage thresholds for all 16 construction dual-wage classifications.

California Insurance Commissioner Ricardo Lara has approved an increase in hourly wage thresholds for all 16 construction dual-wage classifications.

The increases range from $1 to $4 depending on the classification and will go into effect for policyholders on their workers’ compensation policy renewal date on or after September 1, 2024. The chart below outlines the proposed increases for each classification.

| Dual Wage Classifications | Existing Threshold | Proposed Increase |

Proposed Threshold |

| 5027/5028 Masonry | $32 | $3 | $35 |

| 5190/5140 Electrical Wiring | $34 | $2 | $36 |

| 5183/5187 Plumbing | $31 | $1 | $32 |

| 5185/5186 Automatic Sprinkler | $32 | $1 | $33 |

| 5201/5205 Concrete Work | $32 | $1 | $33 |

| 5403/5432 Carpentry | $39 | $2 | $41 |

| 5446/5447 Wallboard Installation | $38 | $3 | $41 |

| 5467/5470 Glaziers | $36 | $3 | $39 |

| 5474/5482 Painting Waterproofing | $31 | $1 | $32 |

| 5484/5485 Plastering or Stucco | $36 | $2 | $38 |

| 5538/5542 Sheet Metal Work | $29 | $4 | $33 |

| 5552/5553 Roofing | $29 | $2 | $31 |

| 5632/5633 Steel Framing | $39 | $2 | $41 |

| 6218/6220 Grading/Land Leveling | $38 | $2 | $40 |

| 6307/6308 Sewer Construction | $38 | $2 | $40 |

| 6315/6316 Water/Gas Mains | $38 | $2 | $40 |

In light of the ongoing labor shortage within the construction industry, employers have been making a concerted effort to retain their workforce. This includes providing more comprehensive benefits packages, including higher wages, and merit-based bonuses when appropriate. As a result, these new wage classification increases may prompt employers to consider extending further salary increases to their employees, with the aim of reducing workers' compensation premiums.

To better understand these changes and plan for the impact this will have on your company, please call us at 619-937-0164 and ask to speak to a member of our construction group.

Return to Work Programs: Best Practices for Handling Workers’ Comp Claims

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

How do you handle the situation when a great employee is injured but not quite ready to return to full duty? We do all that we can to prevent injuries and make sure once they do happen our employees are taken care of quickly and properly. The one true variable we have in our control, after a claim has been filed, is how to accommodate employees that are injured but not able to return to normal duties until deemed fully recovered.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

How do you handle the situation when a great employee is injured but not quite ready to return to full duty? We do all that we can to prevent injuries and make sure once they do happen our employees are taken care of quickly and properly. The one true variable we have in our control, after a claim has been filed, is how to accommodate employees that are injured but not able to return to normal duties until deemed fully recovered.

Your experience modification rate (X-MOD) is a very important component in your premiums and potentially securing bids in states like California. Every company has a primary threshold that is unique to the company. This is a dollar amount per claim that, once the medical, permanent disability, and temporary disability surpasses this threshold, has no further impact to your X-MOD. Carriers have medical review teams set in place to ensure that the medical portion of each claim is as low as possible, permanent disability is dictated by the treating doctor, so the only portion of each claim we have control over is how the temporary disability will be handled. Sometimes, even that is out of our control if an injured employee is not able to work in any capacity.

Ideally, your workers’ compensation doctor will quickly give you work restrictions and you will be able to determine if you have any available work within those restrictions. The bigger question is what to do with these employees if they are not fit for regular duty? Is it best to let the carrier handle the temporary disability portion of the claim, have the employee come back and work in your office doing odd jobs, or utilize companies like ReEmployAbility or carrier programs where they can work at any number of nonprofit organizations? Temporary disability mismanagement can add up very quickly and lead to a small claim turning into a claim that heavily impacts your X-MOD.

Making sure your employee feels valued and that they have a job to come back to is a great way to keep claims cost down and employee morale high. When employees sit at home waiting to recover, they may feel helpless and uncertain about their future, are exposed to countless commercials about injured workers and lawyers that claim they can make them rich. Keeping them at work, in some capacity, where progress can be seen and communication continues is beneficial for both the employee and the employer.

The intricacies of how to handle claims is something you hope to never need to be good at as an employer, which is why it is so important to have a broker and claims advocate on your side to help navigate the process with you.

This is a complex topic and if you would like to discuss further or talk about any other insurance needs, I can be reached at (619)438-6900 or you can email me at ccraig@ranchomesa.com.

Focus on Frequency with a Small Work Comp Deductible

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Economies of scale create leverage for landscape businesses as they grow. The Bureau of Labor Statistics (BLS) 2022 table of incident rates notes that the landscape industry has an incident rate of 3.4 per 100 full time employees. Landscape is classified by BLS under Administrative and Support and Waste Management and Remediation Services; this sub class has an incident rate of 1.9. The average for all other industries is 3.0.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Economies of scale create leverage for landscape businesses as they grow. The Bureau of Labor Statistics (BLS) 2022 table of incident rates notes that the landscape industry has an incident rate of 3.4 per 100 full time employees. Landscape is classified by BLS under Administrative and Support and Waste Management and Remediation Services; this sub class has an incident rate of 1.9. The average for all other industries is 3.0.

With frequency typically being high for the landscape industry, it’s important to continue to focus on ways to minimize injury, prevent severity and focus on return to work opportunities when an injury does arise.

While commercial auto, general liability, and umbrella have been stuck in a hard market, workers’ compensation has relatively been in a soft market. Combined ratios for private insurance carriers on workers’ compensation was published at 87% in 2021 and 84% in 2022, according to the National Council on Compensation Insurance (NCCI) State of the Line Report. This impact on carrier profitability has led to decreased pressure on rates for landscape employers across the country.

Like all things cyclical, it is expected that the workers’ compensation market will reverse and begin to harden.

As the market hardens, landscape employers operating in the middle market (i.e., businesses with an annual workers’ compensation premium between $300,000 and $1,500,00) should consider a small workers’ compensation deductible to tackle the high likelihood of frequency.

Small deductibles vary by carrier from $1,000 to $25,000. Collateral might be required and the ability to apply an aggregate to the policy will also vary by carrier.

A small deductible allows the landscape company an opportunity to take the predicable layer of injury cost while still transferring severity to the insurance carrier.

As your company grows and/or market conditions change, consider a small workers’ compensation deductible to maximize your insurance program.

To discuss implementing this strategy for your business, contact me at (619) 937-0200 or drewgarcia@ranchomesa.com.

WCIRB Files for Workers’ Comp Rate Increase

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Earlier this month, the Workers’ Compensation Insurance Rating Bureau (WCIRB) recommended a nominal .9% increase in the advisory pure premium rates. The reason given, increased loss development for medical costs and higher claims adjustment expenses. This recommendation is now sent to the California’s Insurance Commissioner Ricardo Lara for approval. If approved, the increase in rates then take effect September 1, 2024.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Earlier this month, the Workers’ Compensation Insurance Rating Bureau (WCIRB) recommended a nominal .9% increase in the advisory pure premium rates. The reason given, increased loss development for medical costs and higher claims adjustment expenses. This recommendation is now sent to the California’s Insurance Commissioner Ricardo Lara for approval. If approved, the increase in rates then take effect September 1, 2024.

Recognizing that a .9% increase is not very significant and in 2023 the WCIRB requested a similar increase which ultimately was denied by Commissioner Lara, the message remains clear that workers’ compensation rates have probably bottomed out.

This does not mean every business will see an increase. There will still be reductions in some class codes pure premium rates and pricing will be more tied to Experience Modification Rate (EMR) decreases and an individual company’s claims experience. For distressed accounts, companies whose EMR is increasing and have had poor claim experience, will likely see an increase in their rates.

In order to stay ahead of this, we recommend companies review their key performance indicators (KPIs) that measure and compare a company’s frequency and severity of claims to their peers within the same governing class code. These metrics allow a company to identify trends, design programs that will address specific training needs, and project claims costs that will ultimately impact their EMR.

In addition, we recommend working closely with your claim advocate to assist in monitoring open workers’ compensation claims, and identify any open claims under your company’s primary threshold that could be closed prior to your unit stat filing that can impact your EMR.

If you would like to learn more about the pure premium rate’s impact by class code or evaluate your specific KPIs, I can be reached at (619) 937-0167 or via email at sclayton@ranchomesa.com.

Dual Wage Thresholds Set to Increase Again

Author, Matt Gorham, Account executive, Rancho Mesa Insurance Services, Inc.

In an effort to keep up with wage inflation, California’s Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended increases to all 16 construction dual wage thresholds, which, if approved, would impact policies beginning on September 1, 2024 and could drive up insurance premiums for those unaware.

Author, Matt Gorham, Account executive, Rancho Mesa Insurance Services, Inc.

In an effort to keep up with wage inflation, California’s Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended increases to all 16 construction dual wage thresholds, which, if approved, would impact policies beginning on September 1, 2024 and could drive up insurance premiums for those unaware.

Dual wage thresholds help carriers evaluate risk of employee injury by correlating average hourly wage with experience on the job. The general notion is that employees with more experience command higher wages and are less likely to get injured at work, while employees with less experience are paid a lower wage, are less familiar with safety and jobsite protocols, and therefore more likely to be injured at work. This difference in risk leads to a difference in cost for insurance premiums, with higher paid employees costing their employers comparatively less in premium.

Using the base rate of $31 or more per hour from one carrier, consider the example of a plumber: a plumber earning $30 per hour will cost their employer $9.31 per $100 of payroll, while a plumber earning $31 per hour will cost their employer $4.35 per $100 of payroll. That is roughly a 47% higher cost in premium per $100 for an employee earning 3% less per hour.

Since the last time the WCIRB suggested an increase to the dual wage thresholds in December 2021, inflation and labor shortages have continued to drive up wages in the construction industry. According to the St. Louis Fed, average hourly earnings in construction have increased from $33.60 to $37.53 – more than 11% in that time. While wages are going up, the experience of employees is not keeping pace, leaving insurance carriers exposed. To address this disparity, the proposed threshold increases from the WCIRB range from $1 for plumbing, automatic sprinkler, concrete work, and painting/waterproofing to $4 for sheet metal/HVAC work.

To get ahead of this proposed change, business owners should consider whether it is more beneficial to award employees with raises or to pay more in insurance premiums. With increased overhead costs likely coming either way and quality employees already in short supply, not only could strategic raises offer relative savings, they could strengthen the loyalty from your team.

While this proposed change still needs final approval by the insurance commissioner, it is expected to have a major impact on wages and potentially premiums within the construction industry.

To evaluate the impact of the proposed dual wage threshold increase on your business, contact me at (619) 486-6554 or mgorham@ranchomesa.com.

WCIRB Proposes 2024 Construction Dual Wage Threshold Increase

The Workers' Compensation Insurance Rating Bureau (WCIRB) has proposed an increase in hourly wage thresholds for all 16 construction dual-wage classifications.

The increases range from $1 to $4 depending on the classification and if approved will go into effect for policyholders renewing September 1, 2024 and thereafter. The chart below outlines the proposed increases for each classification.

The Workers' Compensation Insurance Rating Bureau (WCIRB) has proposed an increase in hourly wage thresholds for all 16 construction dual-wage classifications.

The increases range from $1 to $4 depending on the classification and if approved will go into effect for policyholders renewing September 1, 2024 and thereafter. The chart below outlines the proposed increases for each classification.

| Dual Wage Classifications | Existing Threshold | Proposed Increase |

Proposed Threshold |

| 5027/5028 Masonry | $32 | $3 | $35 |

| 5190/5140 Electrical Wiring | $34 | $2 | $36 |

| 5183/5187 Plumbing | $31 | $1 | $32 |

| 5185/5186 Automatic Sprinkler | $32 | $1 | $33 |

| 5201/5205 Concrete Work | $32 | $1 | $33 |

| 5403/5432 Carpentry | $39 | $2 | $41 |

| 5446/5447 Wallboard Installation | $38 | $3 | $41 |

| 5467/5470 Glaziers | $36 | $3 | $39 |

| 5474/5482 Painting Waterproofing | $31 | $1 | $32 |

| 5484/5485 Plastering or Stucco | $36 | $2 | $38 |

| 5538/5542 Sheet Metal Work | $29 | $4 | $33 |

| 5552/5553 Roofing | $29 | $2 | $31 |

| 5632/5633 Steel Framing | $39 | $2 | $41 |

| 6218/6220 Grading/Land Leveling | $38 | $2 | $40 |

| 6307/6308 Sewer Construction | $38 | $2 | $40 |

| 6315/6316 Water/Gas Mains | $38 | $2 | $40 |

In light of the ongoing labor shortage within the construction industry, employers have been making a concerted effort to retain their workforce. This includes providing more comprehensive benefits packages, including higher wages, and offering merit-based bonuses when appropriate. As a result, these proposed wage classification increases may prompt employers to consider extending further salary increases to their employees, with the aim of reducing workers' compensation premiums.

Rancho Mesa predicts that this information will become a major factor in payroll decisions based on overhead cost management and recommend this as a topic for discussion early, so that our clients and prospects can prepare.

Implementing Technology and Other Safety Tactics to Protect Your Fleet

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

One of the most important practices for any landscape professional is fleet safety. Whether you have 10 trucks or 100, the exposure and risk remain the same. Explore a prior podcast episode, Episode #251, in which I delve into compelling statistics that shed light on the increasing frequency and severity of auto accidents each year.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

One of the most important practices for any landscape professional is fleet safety. Whether you have 10 trucks or 100, the exposure and risk remain the same. Explore a prior podcast episode, Episode #251, in which I delve into compelling statistics that shed light on the increasing frequency and severity of auto accidents each year.

Here are a few ways landscape professionals can improve their fleet safety:

1. GPS/Telematics Systems

A written fleet safety program is a must have for every organization, but how can you take that a step further? Some landscape professionals are turning to technology and installing GPS tracking systems in all of their trucks. These systems have the capabilities of tracking speeding, hard breaking, sharp turning, proper seat belt usage and other metrics. Not to mention, if a truck were ever stolen, they have the capabilities to track down and locate the stolen vehicle.

I was at the National Association of Landscape Professionals’ (NALP) ELEVATE conference a few weeks back in Dallas and spoke with a landscaper who uses GPS on their trucks. I asked how they use the data that is collected. Their response was that each month they sit down and look at the data. They identify any glaring issues and work to get them resolved. For example, if a certain driver has been tracked speeding multiple times, they will sit that driver down and explain the importance of not speeding. They may even have them do a specific driver training course to help that individual become a better driver. Having GPS is a great start to improving fleet safety, but actually using the data collected and being proactive with that data is what the elite landscape company do.

2. Regular routine maintenance checks on vehicles

GPS tracks a vehicle while it’s driven, but what can be done before the vehicle even hits the road to help prevent accidents? Routinely checking vehicles and performing maintenance on them can really have a impact on fleet safety. For example, regularly checking tire pressure, making sure oil changes are up to date, inspecting the brakes and monitoring tire wear are a few things that every landscape company should do to keep their vehicles running in tip top condition.

3. Company Roll Out Procedure

Implementing a mandatory company roll-out check can have a significant impact. I have actually seen a few of these performed in person and it’s impressive. As the trucks leave the yard to head out for the day’s work, the driver signals both blinkers, flashes the headlights, cleans the windshield and mirrors, and performs a small brake check, all the while, an inspector is outside making sure all signals are working before the truck heads out.

Finally, if a trailer is being used, check to make sure the trailer is properly hitched and the equipment in the trailer is tied down or stored securely. Taking time and performing these checks will certainly help prevent auto accidents in the future.

If you would like more information on putting together or updating your Fleet Safety program, reach out to me at ggarcia@ranchomesa.com or (619) 438-6905.

Pure Premium Increase for Landscape (0042) in Consecutive Years

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

When my baseball career ended in 2021, it was time for me to do something new with my life. For me the decision was easy and one that I am very grateful for. My dad, Dave Garcia started Rancho Mesa 25 years ago and throughout the years he and many others have contributed into what Rancho Mesa is today, a 16-time National Best Practices Agency. I was fortunate enough to get an opportunity to join such an amazing organization.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

In September 2022, the Workers’ Compensation Insurance Rating Bureau (WCIRB) recommended a 9% increase in the pure premium rate for landscape class code 0042. Effective September of 2023, a 4% increase was recently approved, totaling 13% over the two-year span.

Pure Premium Rates arise from losses sustained and payroll submitted to the WCIRB from all workers’ compensation insurance companies. Per the California Department of Insurance (CDI), “Pure Premium Rates” are defined as “the cost of workers' compensation benefits and the expense to provide those benefits.” The WCIRB evaluates each individual class code and determines what the recommended rates will be for the upcoming year. This recommendation is made to the CDI who ultimately needs to reject or approve the recommendation. Once the pure premium rates are approved, each workers’ compensation insurance carrier will apply their individual least common multiple (LCM) which is an adjustment to the pure premium rate that takes into consideration business expenses and profit for the carrier, thus creating their individual base rates for each class code.

What does this all mean? The claim activity and claim cost as a whole have been increasing over the last two years for landscapes companies in California. This may signal the beginning of a hardening workers’ compensation market resulting in higher premium cost.

What can be done to help combat these potential increases in premium? An increased attention to safety practices to reduce claims, a robust return to work program to mitigate cost of existing claims, proactive claim management, and consistent, documented safety training are a few of the ways that will help a landscape business remain best in class.

Take control of your future costs and look to your existing risk management partners to help you accomplish your goals. For Rancho Mesa landscape clients, we do this through our customized and proprietary programs and tools, including:

Key Performance Indicator (KPI) for workers’ compensation

These pure premium changes will take place on workers’ compensation insurance renewals after September of this year. Don’t be caught by surprise or unprepared. We are here to help you proactively navigate through this. If you have any questions, want to learn more about our programs and tools, please feel free to reach out to me at ggarcia@ranchomesa.com or 619-438-6905.

California Insurance Commissioner Leaves Workers’ Comp Rates Flat

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Ricardo Lara released a statement that he is rejecting the Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommended 7.6% increase in the workers’ compensation pure premium rates as well as the add-on to cover COVID-19 claim costs. The Commissioner also rejected a more modest 2.8% increase recommended by the Department of Insurance’s actuaries and the 1.4% decrease recommended by an independent actuary for the public members of the Bureau’s governing committee.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Ricardo Lara released a statement that he is rejecting the Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommended 7.6% increase in the workers’ compensation pure premium rates as well as the add-on to cover COVID-19 claim costs. The Commissioner also rejected a more modest 2.8% increase recommended by the Department of Insurance’s actuaries and the 1.4% decrease recommended by an independent actuary for the public members of the Bureau’s governing committee.

Commissioner Lara’s decision was based on California’s still recovering economy. With businesses trying to recover to pre-pandemic levels and the uncertainty still of COVID-19 disruptions, the Commissioner decided to keep the benchmark rate of $1.45 per $100 of payroll. Keep in mind that the pure premium rate is only advisory as the Commissioner does not have rate setting authority over workers’ compensation rates. In fact, the rate level of $1.45 is actually 18% lower than the industry filed average pure premium rate of $1.77 as of January 1, 2022.

“We’re working hard to get California back to business as usual as people return to work,” said Lara. “This year’s rate is on par with normal, pre-pandemic levels while still reflecting the long-term benefits of workers’ compensation reform passed by the State Legislature and signed by the Governor to reduce costs.”

With signs of a hardening market such as increased carrier combined ratios, increased cost on indemnity claims, medical inflation, and future costs of COVID-19 claims, it will be interesting to see how carriers will respond to this decision. Now, more than ever, it is critical to work with your broker and carrier to improve your risk management program so that your business is positioned well for the future.

If you are interested in how this process works and how it can improve your bottom line, please reach out to me at (619) 937-0174 or jhoolihan@ranchomesa.com. In the meantime, Rancho Mesa will keep close tabs on what the future holds and communicate updates regularly.

Proposal to Include COVID-19 Claims in EMR Calculation is Denied

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

It appears the COVID-19 pandemic has finally entered an endemic stage and most companies have fully re-opened and/or are offering their employees some type of a hybrid work schedule. With this being the case, the California Workers’ Compensation Insurance Rating Bureau (WCIRB) proposed to amend the rule that excludes COVID-19 claims from the calculation of experience modifications for only claims with incident dates from December 1, 2019 through August 31, 2022.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

It appears the COVID-19 pandemic has finally entered an endemic stage and most companies have fully re-opened and/or are offering their employees some type of a hybrid work schedule. With this being the case, the California Workers’ Compensation Insurance Rating Bureau (WCIRB) proposed to amend the rule that excludes COVID-19 claims from the calculation of experience modifications for only claims with incident dates from December 1, 2019 through August 31, 2022. In addition, the WCIRB proposed that effective September 1, 2022, any new COVID-19 claims occurring after this date would be factored into the calculation of an employer’s experience modification rate.

The WCIRB’s rationale for this recommendation was that current circumstances have greatly changed since the rule to exclude COVID-19 claims from the experience rating were initially adopted in 2020. COVID-19 is no longer a temporary short-term phenomenon and the risk of infection will be present in the general population for the foreseeable future.

With workplace safety standards in place, personal protective equipment and vaccinations available, employers who are diligent in protecting their employees would in turn have a lower experience modification than less safety-conscious employers in the same industry.

Fortunately, in late June 2022, this change was not approved by Commissioner Lara, but employers should still actively try to prevent the spread of COVID-19 within the workplace by having a written COVID-19 prevention program in place and follow the requirements set by the state and local health department.

While employers don’t have to worry that COVID-19 cases will affect their experience modification rate, they should still be concerned about the effects on their employees and bottom line. Having employees miss work because of COVID-19 puts extra strain on other employees and can effect productivity, and thus profitability.

Rancho Mesa has updated its COVID-19 Prevention Program Template designed for California businesses. Request your COVID-19 Prevention Plan template online or contact me at sclayton@ranchomesa.com or (619)937-0167.

WCIRB Approves 2022 Construction Dual Wage Threshold Increase

The Workers' Compensation Insurance Rating Bureau (WCIRB) has approved the recommended increase in hourly wage thresholds for all 16 construction dual wage classifications. The increases range from $2 to $5 depending on the classification and will go into effect for policyholders renewing September 1, 2022 and thereafter. The chart below outlines the increases for each classification.

The Workers' Compensation Insurance Rating Bureau (WCIRB) has approved the recommended increase in hourly wage thresholds for all 16 construction dual wage classifications.

The increases range from $2 to $5 depending on the classification and will go into effect for policyholders renewing September 1, 2022 and thereafter. The chart below outlines the increases for each classification.

| Dual Wage Classifications | Existing Threshold | Approved Increase |

Approved Threshold |

| 5027/5028 Masonry | $28 | $4 | $32 |

| 5190/5140 Electrical Wiring | $32 | $2 | $34 |

| 5183/5187 Plumbing | $28 | $3 | $31 |

| 5185/5186 Automatic Sprinkler | $29 | $3 | $32 |

| 5201/5205 Concrete Work | $28 | $4 | $32 |

| 5403/5432 Carpentry | $35 | $4 | $39 |

| 5446/5447 Wallboard Installation | $36 | $2 | $38 |

| 5467/5470 Glaziers | $33 | $3 | $36 |

| 5474/5482 Painting Waterproofing | $28 | $3 | $31 |

| 5484/5485 Plastering or Stucco | $32 | $4 | $36 |

| 5538/5542 Sheet Metal Work | $27 | $2 | $29 |

| 5552/5553 Roofing | $27 | $2 | $29 |

| 5632/5633 Steel Framing | $35 | $4 | $39 |

| 6218/6220 Grading/Land Leveling | $34 | $5 | $39 |

| 6307/6308 Sewer Construction | $34 | $5 | $39 |

| 6315/6316 Water/Gas Mains | $34 | $5 | $39 |

With the continuing labor shortage in construction, employers have been doing everything possible to retain employees by offering richer benefits plans, pay increases and merit bonuses, when applicable. These approved wage classification increases could potentially push employers to extend additional pay raises to employees in an effort to minimize workers’ compensation premiums.

Rancho Mesa predicts that this information will become a major factor in payroll decisions based on overhead cost management and recommend this as a topic for discussion early, so that our clients and prospects can prepare.

Understanding the Impact of MEP Contractors’ Dual Wage & Total Temporary Disability

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

What is a dual wage threshold? According to the Workers’ Compensation Insurance Rating Bureau (WCIRB), in California there are sixteen (16) construction operations that are divided into two separate classifications based on the hourly wage of the employee. There are different advisory pure premium rates for the low wage employee and the high wage employee.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

What is a dual wage threshold? According to the Workers’ Compensation Insurance Rating Bureau (WCIRB), in California there are sixteen (16) construction operations that are divided into two separate classifications based on the hourly wage of the employee. There are different advisory pure premium rates for the low wage employee and the high wage employee. For mechanical, electrical and plumbing (MEP) contractors, the class codes used are all included in the recently approved increase which will go into effect September 1, 2022. The table below outlines the changes for the MEP class codes by year.

| Classifications | 9/1/2021 - Current | 9/1/2022 - Proposed |

| 5140/5190 | $32 | $34 |

| 5183/5187 | $28 | $31 |

| 5538/5542 | $27 | $29 |

© 2021 Workers' Compensation Insurance Rating Bureau of California. All Rights Reserved.

Why does this matter to MEP contractors? The higher wage employee’s workers’ compensation rate is significantly less (on average 46% less) than the lower wage employee. Therefore, if a company has any employees that are currently just barley in the high wage classification, this would drop those employees into the low wage classification and the employer would pay the higher workers’ compensation rate on those individuals. Depending on how many employees an employer has in this situation, it may be advantageous for the employer to calculate if it makes more sense to give those impacted employees a raise to push them back up into the high wage classification or keep them in the new low wage classification. It should be noted and understood that this change will not impact the employer until their next renewal after September 1, 2022. So while most employers will have time to evaluate the impact, it is crucial to begin the evaluation sooner rather than later.

As with any form of wage inflation, an increase in wages, to keep an employee in the higher wage category will increase the claim costs of a total temporary disability claim if they are injured on the job. While increases in wages are necessary, they will also impact the total cost of the claim, which then can increase the company’s experience modification rating (XMOD).

To mitigate this increase and reduce the likelihood of a lost time claim, employers can take several actions:

Review and update their existing safety programs.

Revisit their hiring practices.

Develop a sustainable return-to-work program.

What should employers do next?

Work with your trusted insurance advisor and run a needs/benefit analysis on increasing employee wages.

Understand your numbers.

What is your primary threshold and why does it matter?

What is my claim cost per point of XMOD?

How does my frequency of claims compare to the MEP industry?

How does my lost time claim average compare to other MEP contractors?

If you would like assistance understanding how these and other data points impact your company, request a proprietary Key Performance Indicator (KPI) dashboard that puts this information at your fingertips.

You still have time to be proactive, do not let these critical changes catch you by surprise!

Is Now the Time for a Performance-Based Insurance Program?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the three preceding articles in this series, we took a deep dive into some areas where a business’s productivity and profitability could be impacted by various factors emerging in the insurance marketplace. In the course of those articles, we also examined some tools, strategies and ideas that a company might implement to help manage and mitigate those impacts. Today, we will look at a way to exert the most control over your insurance program and premium outcome through performance-based insurance programs.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the three preceding articles in this series, we took a deep dive into some areas where a business’s productivity and profitability could be impacted by various factors emerging in the insurance marketplace. In the course of those articles, we also examined some tools, strategies and ideas that a company might implement to help manage and mitigate those impacts. Today, we will look at a way to exert the most control over your insurance program and premium outcome through performance-based insurance programs.

I’ve written about these programs before in "Increasing Your Productivity and Profitability Through Your Insurance Program," "What is the True Cost of a Lost Time Workers’ Compensation Claim?" and "How is Payroll Inflation Impacting Your Workers' Compensation Premium." So, in lieu of diving into all of them, let’s review a few of them briefly and then spend a little more time with “are they right for you now?”

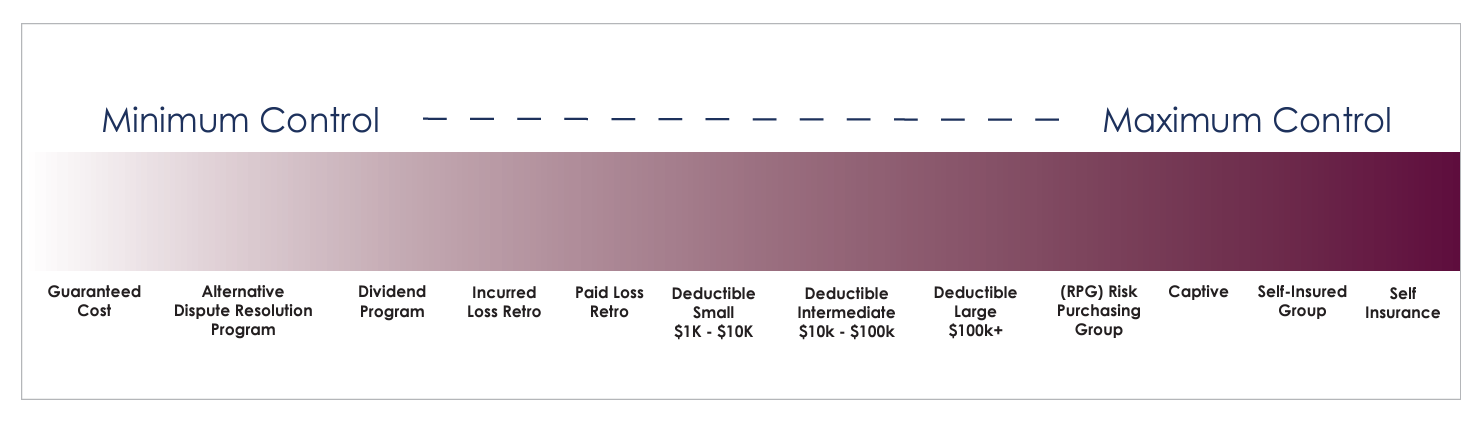

Beyond guaranteed cost programs, where policyholders pay a set premium and then claims are covered up to the policy limit, there are a wide range of performance-based insurance programs that can apply to a single line of coverage, like workers’ compensation, or multiple lines of coverage that can also include most notably general liability and automobile. Rancho Mesa has created a Workers’ Compensation Continuum document that lists many of these programs. As you move from right to left on the continuum, business owners increase control as well as risk. So, a wise strategy would be to evaluate as many programs as seem to fit your tolerance and readiness for that additional exposure.

Are you confused, yet? You are not alone, which is why it is even more important to start the process with a trusted advisor (your insurance broker) who is both familiar with and skilled in putting these programs in place. A properly skilled and educated advisor will be able to walk you through each option and present it in a way that makes your understanding of it easy to comprehend. If you do not fully understand both the benefits and the risk, we recommend pausing before moving forward, and take ample time for the best decision possible.

As someone who owns and operates a business, I like the idea of the “bet on yourself” model which always makes me feel more in control of the outcome. I cannot emphasize enough how confident you need to be in the ability to control your claims in order for these programs to work for you. That is why in the previous three articles, we talked so much about what you can do to improve your safety programs and more importantly your safety culture. Once you have the right team in place, have reached the point where you have control of your claims, and want more control over your premiums and pricing, then it may to time to move into the performance-based insurance program world.

If my forecast of a hardening workers’ compensation market as early as late 2022 or early 2023 is accurate, then getting started now in putting the right team together should be a priority. Follow these three steps to prepare:

Review your existing safety programs.

a. Look for ways to improve them based on loss trends and industry benchmarks.

Evaluate your claims history over the last five years.

a. Look for the root causes that are driving the losses.

Identify someone internally to be your safety director.

a. Consistently demonstrate upper management’s support of their efforts to the company and make sure you provide them with tools necessary to accomplish their goals.

Finally, in closing, choose a trusted insurance advisor who understands your industry, your operations and is very familiar with performance-based programs. There are good trusted advisors out there, so if you are currently with one, then give them the time they need to help you get better.

If you want to learn more about performance-based programs and would like to talk with us about the opportunity to be your trusted advisor, contact us and our team that specializes in your industry will reach out to you. If you would like to speak with me directly, email me at dgarcia@ranchomesa.com.

I hope you found this series helpful in making your 2022 the most productive, profitable and safe year ever.

How Higher Average Pay Can Lead to Work Comp Savings

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Wage thresholds have increased consistently in the past decade. This has pushed owners to give sizable raises every few years to maximize employee compensation, but also reducing insurance cost. The experience modification (MOD) and payrolls are key factors in developing a company’s net rates for workers’ compensation, but average wage per hour represents a big differentiator for most carriers and can lead to even more savings.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Wage thresholds have increased consistently in the past decade. This has pushed owners to give sizable raises every few years to maximize employee compensation, but also reducing insurance cost. The experience modification (XMOD) and payrolls are key factors in developing a company’s net rates for workers’ compensation, but average wage per hour represents a big differentiator for most carriers and can lead to even more savings.

Paying your most competent employees above the wage threshold leads to less fraudulent claims, longer tenured employees, and a happier workplace, not to mention the benefit of a drastic cut in net rates for that class code. The gap that is sometimes felt is when there are employees that have the same job description and are earning 30-40% less. Managing payroll inflation is always critical for businesses but let’s think about what this can do to the employees bringing the average pay down for your company. Consider:

More fraudulent claims as the employee has less to lose if they are terminated or laid off;

Resentment toward employees that are doing same job but making more;

Employees are more likely to move to another company to get raises;

Likelihood to miss more time when injured, leading toward higher temporary disability pay which typically can lead to a higher XMOD.

Insurance companies and their underwriters look closely at average salary per employee when they receive a submission with the renewal documentation.

The higher the average pay, the more aggressive they can be with potential scheduled credits in most cases. Obviously, the employer must be selective with who receives a raise and how much but also understand what potentially positive impacts there can be when giving raises in order to hit those thresholds.

And, perhaps just as important is partnering with a broker that specializes in your industry and knows how to properly benchmark you with like organizations. This consistently leads to more productive discussions with underwriters that lead to more scheduled credits. The happier your workforce is, the less claims you tend to see and that translates to long-term savings.

If you have any questions about how you compare to your industry or would like to discuss any other insurance related topic, do not hesitate to reach out to 619-937-0164 or email me directly at ccraig@ranchomesa.com.

How is Payroll Inflation Impacting Your Workers' Compensation Premium?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Inflation is rampant everywhere from consumer goods like groceries and gasoline to increased housing costs to labor. Today, I want to talk with you about the specific impact that payroll inflation is having on the workers’ compensation marketplace and ultimately on your premium cost.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Inflation is rampant everywhere, from consumer goods like groceries and gasoline to increased housing costs and labor. Today, I want to talk with you about the specific impact that payroll inflation is having on the workers’ compensation marketplace and ultimately on your premium cost.

Any and all businesses have felt the impact of increased payrolls both to retain existing employees and also to attract new ones. For the sake of discussion, let’s use an inflation wage percentage of 6.5%.

On the surface, this 6.5% wage increase is hard enough to manage on profit and loss statements, but below the surface there is also a deeper impact on businesses that for many will catch them unaware.

The two areas I want to talk about are:

The impact the wage increase has on temporary disability claim amounts.

The financial impact that higher wages will have on workers’ compensation carrier P&L’s.

First, temporary disability claim amounts are generally equal to 2/3 of the average weekly earnings of the injured employee. This payment does have a minimum and maximum amount, but for our discussion we will assume the injured worker falls somewhere in between.

So, if the injured worker’s average weekly wage increases by the 6.5%, the disability payment will follow suit. This 6.5% will have several negative impacts. The higher cost of the claim will have a negative impact to the business’ Experience Modification Rate (EMR).

This can be significant to a business since it will not only directly affect the future year’s premium but if the business is a contractor, an elevated EMR can potentially limit pre-qualification approval from many builders.

This is so critical to a business success that here at Rancho Mesa we developed a proprietary Key Performance Indicator (KPI) Dashboard that has the capability to tell our clients the actual claim amount per point of experience modification so they can plan accordingly.

An additional consequence of the claim costs increasing is that a company’s individual loss ratio (claim amounts/premium) with their workers’ compensation carrier will increase. Suffice to say as the loss ratio increases, future premiums will need to increase to offset those higher claim costs. Ideally, to continue to receive the most aggressive pricing, we like to see our clients’ loss ratios stay below 30% so these potential inflation increases need to be understood and addressed proactively.

Shifting gears, let’s look at the impact of payroll inflation on the insurance carrier as a business and what impacts it may have on you the business owner as well.

One of the measurements workers’ compensation carriers look to and monitor for their financial health and well-being is their combined ratio. As a general rule, combined ratios measure dollars collected in premium divided by claims costs and overhead. A good combined ratio indicating a profitable and strong company would be in the low 90%’s.

So, logically speaking, if a carrier is experiencing an increase in temporary disability claims costs and an internal payroll inflation of the same 6.5%, which direction will their combined ratios be going? Obviously, it will be going up, so what are they to do? The most likely choice would be to raise premiums to help offset those increases – unfortunately we know who pays those premium increases.

Now that we understand the impacts that payroll inflation will have on workers’ compensation, what can you do as a business to help mitigate them. The answers are easier than you might think.

This first step is to help reduce the likelihood of claims occurring, thereby reducing the impact of the increase to temporary disability claims on your company.

Conduct a thorough review of your current safety program and look for ways to improve it. How often are you meeting? Are the trainings current and specific to your needs? Is there a tracking system in place where these trainings are documented? At Rancho Mesa, our Client Services Group works closely with our client teams, drawing from our library of over 3,000 specific trainings to help you create meaningful trainings specific to your needs.

Should a claim occur, what are the steps to help mitigate the impact:

Report the claim timely – the quicker your insurance carrier is aware of the claim the better the claim outcome.

Select a carrier that offers “nurse triage” so that in addition to reporting the claim quickly you are able to have an assessment of the injury without going to a clinic and potentially reducing the need for a lost time claim.

If you have implemented all of the above but still have a lost time claim, offer modified work to meet the injuries work restrictions. By offering modified duty, you are able to either pay the injured workers whole salary or a portion of it which eliminates the temporary disability cost from the claim and/or will dramatically reduce the cost. In addition to these claim cost savings, statistics will show when modified duty is offered the potential for litigation is reduced saving even further potential costs.

To create an active and sustainable safety program, look to your trusted advisor (insurance broker) and see what services they have that can assist you.

Do they have a client services team that can provide industry specific trainings, workshops, webinars, certification programs to take your safety program to the next level?

Are you having regular claims meetings with them to review performance, spot trends, look for root causes?

What tools are there to assist you in reviewing your claim data?

Are they able to provide industry benchmarking?

Do they have an in-house workers’ compensation claims advocate to assist you with your open claims to create a better outcome?

Payroll inflation is now a reality and not likely to subside any time soon. As we have shared though, there are proactive steps all businesses can take to help mitigate the impact on your workers’ compensation program today and in the future.

If you are looking for assistance in managing through this or have any additional questions, please reach out to us or email me at dgarcia@ranchomesa.com.

Be informed, be proactive, and implement a plan to make your 2022 the best year ever.

What is the True Cost of a Lost Time Workers’ Compensation Claim?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

There are many insurance professionals that have tried to quantify the real cost of indemnity or lost time claims, using multipliers anywhere from 2 to 4 times the claim amount in an effort to determine what the real cost of a claim will be to a company. While this may be true, it remains subjective to many. Let me help you understand the ways this type of claim will impact you and then you can decide the real impact to your business.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

There are many insurance professionals that have tried to quantify the real cost of indemnity or lost time claims, using multipliers anywhere from 2 to 4 times the claim amount in an effort to determine what the real cost of a claim will be to a company. While this may be true, it remains subjective to many. Let me help you understand the ways this type of claim will impact you and then you can decide the real impact to your business.

Let’s assume a claim where the injured worker will be out for 2 to 3 months and the claim’s total incurred amount (which is the combination of paid dollars and reserves) is $50,000. This claim can and will impact your business.

The first direct hit will be your experience modification (X-Mod). While a claim in your current term is delayed a year before going into the calculation, you’ll feel the effects of the remaining 3 years. So, assume the claim is in your 2022-2023 policy year, claims from that year will not go into your 2023-24 policy year but will be in the next three policy terms, 2024-2025, 2025-2026 and 2026-2027.

Each company develops their own “primary threshold,” a term used to describe the maximum incurred loss or cap that any one claim can impact the experience modification. It’s confusing to many policyholders, but this amount regularly changes year-to-year for most companies, as it is derived by the Workers’ Compensation Insurance Rating Bureau (WCIRB) based on the payrolls and class codes a particular business uses and reports.

To simplify this for our clients, we developed a proprietary Key Performance Indicator (KPI) Dashboard that calculates client’s individual Primary Threshold, also detailing how many points to the X-Mod it would add giving them a true indication as to the cost of the claim as it pertains to the X-Mod. Request a personalized KPI for your company.

Now that we understand the impact to the X-Mod, what other areas will be impacted? The next most obvious is the workers compensation carrier’s loss ratio. Adding claim dollars will negatively skew percentages and undoubtedly cause an increase in premium of some amount at renewal.

While the impact to the X-Mod and loss ratio are easy to understand, they are really just the tip of the iceberg. Let’s go below the surface and look at other ways this claim will impact your business.

Losing an employee for any length of time is impactful, but losing the employee for a month or two would likely require the business to fill that person’s job and responsibilities within the company. In many cases this means trying to hire someone new to the organization.

Without going into great detail, the business is likely going to experience additional payroll and benefit costs, training, and likely a decrease in expertise which will most certainly impact the productivity of that particular job.

I think we can all now understand how a lost time claim affects the X-Mod, loss ratio, and a business’s productivity and profitability, both immediately and into the future.

So, what can I do to avoid this or at least minimize the impact should a lost time injury occur? The great news is that in many instances you can prevent these injuries from ever happening or at least reduce the frequency of them occurring. Start with these strategies and enlist your insurance broker for their guidance in the process:

Perform a complete overview of your safety program.

Make changes in training that address your specific needs.

Increase awareness and accountability of those employees responsible for the implementation of your safety program – consider adding this as an area of their annual performance appraisal.

Identify new employees so that your experienced people can mentor them in training or in watching how they are performing. Statistics show that new employees (defined as less than 6 months) have the highest percentage of injuries. New hires in construction can wear different colored hard hats, gloves, vests or even a sticker on their clothing, anything that might let the crew leader know who might need a little more oversight.

Choose the right workers compensation carrier. In general, look for a carrier that offers in-house claims handling, loss control services, can show you statistically both their performance in closing claims vs. the industry, claim costs vs. the industry, medical cost containment performance, length of time doing business in the state you are in. These are just a few items to consider that can result in the best claim outcome should one occur.

Choose the right insurance advisor (broker). Are they a specialist within your industry? What client services do they offer pertaining to trainings you need? Do they offer workshops, webinars and safety certifications? Do they have an experienced workers compensation claim advocate in house to assist you in both understanding your claims and mitigating costs? What tools do they have to help you benchmark yourself against your industry? Can they help you identify trends and root causes?

We’ve seen how one lost time claim can have a negative rippling affect for your company in both your productivity and your profitability. It may feel overwhelming in how to understand and fix your issues with all the other areas of your business that you have to be involved with. It really doesn’t have to be, it’s just time to look at who you choose to work with from your carrier to your broker differently.

Contact us via our website or reach out to me directly at dgarcia@ranchomesa.com.

2022 Workers' Compensation Expectations for CA Landscape Industry

Rancho Mesa's Alyssa Burley and Drew Garcia, Vice President of the Landscape Group set the stage for insurance expectations in 2022.

Transcript

Alyssa Burley: Welcome back, everyone. My guest is Drew Garcia, Vice President of the Landscape Group with Rancho Mesa. Today, we're going to set the stage for insurance expectations for 2022. Drew, thank you for joining us.

Drew Garcia: Alyssa, thanks for having me.

AB: Since you specialize in the landscape industry, what do you see for the insurance marketplace, for these companies as we move into 2022?

DG: Great question, and I think a lot of companies are always wondering this each year as they come up for renewal. So what I want to do is just, I'll give you a little insight to all the lines of insurance that most landscape companies are going to be renewing in 2022.

And this is basically what we do at a pre renewal, very low level. But I'll start with work comp, which has been a soft market now for four or five years where there's been pressure for rates to continue to go down as a group, as a whole.

And each company's obviously individually underwritten by a carrier, and they're looking at the losses for that particular company. But in general, the work comp market has been soft and that's led to, you know, general decreases for most businesses over the last four or five years.

We think that trend is going to continue in 2022, and we'll see if there's any change in 2023. But for the foreseeable future through this policy period, we do believe that the work comp market is going to stay relatively soft, and that just means rates are going to stay down as a whole.

Again, there could be some individual things that you're experiencing as a landscape business that's causing your pricing to increase, whether that's your ex mod or you've got claims in the current year that haven't gone into the mod calculation or you've changed operations, things like that could impact your own pricing.

But as a group, we feel like the market's going to stay relatively soft. And I'm going to share a little detail that we do individually, myself and Greg, who helps me here with the landscape group at Rancho Mesa. We track a lot of industry data and then we use that when we're having our conversations with our customers.

So one thing we like to pull is we measure every contractor that has a C-27 license in California. There's about 5,465 of those companies that have work comp policies, and that's businesses that are landscape companies that only carry that license. They don't also have other licenses so strictly landscape, which helps us keep our data clean when we're looking at it. So there's 5,465 of those companies, 125 carriers, insurance carriers for work comp, right? At least one policy for all of those companies.

So there's 125 insurance carriers writing at least one landscape policy. Now there's only 25 carriers that have more than 20 policies, so we really start to limit down, you see carriers become niche when trying to write a particular business, in this case, landscape. Of those 125, only 25 of them have more than 20 policies. So there's probably a little bit of an appetite there that's aligning for those carriers. And then when we really might it down, there's only ten carriers they have more than 150 policies, and those are the bulk of the businesses of the insurance carriers riding the business or writing work comp policies for landscape companies in California. The top five are going to be familiar names, Berkshire Hathaway, Insurance Company of the West, State Fund, Markel and then Am Trust.

Those are the top five carriers in terms of market share writing those 5,465 C-27 license landscape companies that have work comp policies. So a little bit of an insight into the market and what carriers are interested in writing business or work comp policies for landscape companies.

And then when we look at the numbers, we always like to watch the pure premium rate for the 0042 class code and just a quick refresher on pure premium. Every year the bureau, the rating bureau, will recommend a rate that the carriers should charge per $100 in payroll for every particular class code to strictly just cover claim costs. So, this rate doesn't include carrier overhead or expense. So, that number went from $4.93 last year to $4.57 this year, effective September the first of 2021. That's a 7% decrease, and when you're watching that recommendation come from the bureau to the insurance carriers, what happens next is insurance carrier’s base rates come down a little bit. Normally, the rates should come down a little bit on the base rate side, and last year, the average base rate for an insurance carrier, which is the rate that they're going to start at when they're going to underwrite a landscape business, and that rate is going to be different for every insurance carrier. The average rate that they started at was $9.92. That's down to $9.52 on average. So 4% down on the base rate for work comp carriers. Again, those are indicators to us that the market is still soft.

There's still plenty of carriers trying to write the business and that, we should see rates stay relatively down for 2022 as a whole. Again, we talked about the individual aspect of underwriting, but as a whole, those are good indicators that the market still is pretty soft.

And I'm going to share my screen really quick. This is a factor here that nobody really talks about. But California is so diverse with how work comps are handled throughout the state. So there's individual territory factors that most carriers apply when they're underwriting based on where you're doing your business and the reason why they use territory factors is because the claim outcomes, the claim activity can be higher in certain areas than in others. So the screen that you're looking at right now shows Berkshire Hathaway's territory factors based on 2021 and then 2022. And what I did is you can see, based by zip code, I've got different colors indicating the severity of territory factors that could be applied depending on where you're doing your business. So the lighter colors that you're seeing, the more yellow, lighter yellow that you see, those are the preferred areas and then the heavier, darker red that's going to be where maybe there's some territory debits that increase, and most carriers are using something like this when they're underwriting and looking at the business, but you can see some movement in some of the color from last year to this year. You can see San Diego's lightened up a little bit as a territory, so rates are probably a little bit more favorable in San Diego.

But there really is always been some heavy focus on L.A., Orange County, Riverside County, San Bernardino, where carriers really look at implying a debit on territories just because of claim outcomes and claim activity in those in those particular regions.

And then San Jose in Northern California, those have always been generally lighter intel. There's a less territory factor that that happens up there based on better claim activity and claim outcomes that are associated with the zip codes up in that area.

So I wanted to share that, I'll pull that screen down. And then now exiting work comp kind of just highlighting a couple of the other lines of insurance that we think are going to be impacted in 2022. And we've talked about it for many years with our customers, but the auto market is still very difficult.

And if you're a landscape maintenance company, you have a heavy fleet and a lot of vehicles. So it's really important for you to continue to monitor your cost per unit. And we wrote that article a few weeks back, measuring your cost per unit at each renewal so you can kind of see where your insurance has gone over the years. And so landscape companies really need to pay attention to their cost per unit because we do believe there's still more pressure on the auto market for rates to continue to increase. There's a lot of things that Rancho Mesa provides, and so many of our landscape companies are taking advantage of our Fleet Safety trainings that we have in the Risk Management Center and client services on our end has done a great job when we've had claimed activity with our customers to recommend certain driver trainings, you know, as a result of those claim outcomes - or those accidents that have occurred.

So, we've been happy with how we're helping our customers manage the auto side and then really everyone should watch out on the excess or the umbrella layer of their insurance that's really taking its toll and we've seen rate increases coming on that line in particular. A lot of carriers are limiting their capacity, so a lot of carriers usually go up to 10 million for that limit. But now it seems five is the most that any one carrier wants to go to.

So if you carry more than 5 million, you're probably going to need to stack that with multiple carriers to achieve that limit, which could be different than what you've seen in the past, and also watch out for wildfire exclusions. A lot of excess of reinsurance carriers are trying to apply a wildfire exclusion to landscape companies in California, which would be a detriment to your policy if you have it. So always pay attention for that. You can also look out for that wildfire exclusion on your general liability policy. Those are new things that are potentially coming to the liability side. There are still carriers out there that don't offer that exclusion, so you would want to make sure that you're aligned with a carrier that's doing that. But for the general liability property inland marine policies, we think rates are staying relatively flat.

So we don't see a lot of movement coming there. More of the pressures coming on the auto and excess lines. And I think we'll see that for the next couple of years, there should be should remain some pressure on those lines.

That basically wraps it all up for us, covers the basic lines that most companies are looking at. And again, kind of an overview, but hopefully it gives some insight to business as they're moving into 2022, what to expect and where to focus their attention when it comes to their renewal.

AB: Drew, if listeners have questions about their workers compensation insurance, what's the best way to get in touch with you?

DG: Email, they can email me at drewgarcia@ranchomesa.com, call my office (619) 937-0200, and then I'd also encourage them just to check out our website, we've got a ton of content that we've created, all designed for landscape companies to help them better manage their risk. And we have, you know, different tools that aren't really available online that we'd be happy to introduce to companies and let them use to better manage their risk.

AB: Drew, thank you so much for joining me in StudioOne™.

DG: Thanks for having me, Alyssa.

The Field Guide to Navigating Your Insurance in 2022

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns? During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns?

During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

COVID-19’s impacts included:

The loss of income/revenues

Labor shortages

Health concerns

Relocation of labor forces

As the year comes to a close, we now have some answers but even more questions about what challenges 2022 will bring. Below are a few remaining questions that create uncertainty.

Will Property, Auto, General Liability, Excess, Cyber, and EPL insurance continue to see pressure? The short answer is yes.

What can I do today as a business owner to prepare and better mitigate these increases?

Start your renewal process a minimum of 120 days away from your expiration date. Learn more about the pre-renewal process in our article, “3 Reasons Your Pre-Renewal Meeting is Key to your Success.”

Be willing to meet and discuss your particular situation, needs and goals.

Choose a broker that specializes in your industry and can negotiate with the marketplace from a position of expertise.

Evaluate the services that you receive from your broker’s agency to assure they align with your specific risk management needs. Are they proactive or reactive?

Where is the Workers’ Compensation Industry Going in 2022 and Beyond?

What is expected of Workers’ Compensation in 2022? The short answer is that this market will remain soft.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) has asked for a modest decrease in overall rates and most carriers’ filings have reflected that recommendation. However, these are averages and many industries will find these decreases harder to come by.

What is expected of Workers’ Compensation in 2023? There are several leading indicators that present early signs of a hardening market. Here are a few:

Wage inflation for most businesses. This will lead to higher temporary disability payments to injured workers thus increases in overall claim amounts.

Wage inflations within insurance carrier’s personnel. This will cause a rise in their overhead costs and then a subsequent rise in their combined ratios which will impact their bottom line.

The likely inclusion (September 2022 and beyond) of COVID claims in the Experience Modifier Rating formula (X-Mod). While this is not yet official, approval appears likely.

Preparing for the hard workers’ compensation market starts today with our checklist.

We will explore those at length in a series of articles beginning in January 2022. Subscribe to our newsletter to receive those articles. For now, here are a few tips:

Utilizes a Workers’ Compensation Gap Analysis and Opportunity Assessment (through the Risk Management Center).

Benchmark your performance to industry standards to look for areas of improvement. Learn more about Rancho Mesa’s KPI.

Choose your workers’ compensation carrier wisely. Learn more about selecting a carrier in the article, “How to Choose a Workers’ Compensation Carrier Partner.”

Have you ever considered performance-based programs? If not, maybe it’s time to bet on yourself. Watch the “Deductible Workers’ Compensation: Understanding performance-based insurance programs” webinar.

With workers’ compensation premiums representing a significant line item on many profit and loss statements, staying up to date on the rapidly changing environment should be a priority for all businesses. And, preparing for the expected rate increases is more important than ever with inflationary costs already choking profitability for so many operations. Our series of articles starting in January will help in this education process and allow you to better understand steps you can take now to weather this building storm.

Incorporating a clear strategy as it relates to your insurance portfolio is perhaps more critical than ever leading into 2022. With pricing increases across all lines of coverage becoming more and more common, managing this line item on your financials should be a proactive process with your broker. Start that dialogue now and develop the right plan to design and coordinate the most comprehensive and competitive program possible.

Wage Inflation’s Impact On Workers’ Compensation

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Following up on a great article by fellow construction team member Kevin Howard, about anticipated wage threshold increases coming in 2022, I wanted to highlight the building problems resulting from substantial hourly wage increases.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Following up on a great article by fellow construction team member Kevin Howard, about anticipated wage threshold increases coming in 2022, I wanted to highlight the building problems resulting from substantial hourly wage increases.

I specialize in painting, drywall and plastering contractors and have been asking my clients over the past few months about the health of their business and any new challenges. The most common answer: there is a substantial amount of work to bid on, but a labor shortage limits the possibility of growth.

Paying an employee higher wages creates new issues. Employees tend to inform co-workers when they get a raise. Employees may also try to leverage another company’s higher wage into a raise. The combination of a labor shortage and overpaying employees may result in hyperinflation, leading these employees to believe their value has skyrocketed.

Tying back into Kevin’s article, it is easy to see why these thresholds need to be increased. The wage threshold is meant to separate historically safer employees from newer employees who are less safety conscious. These increases in payroll are pushing less skilled employees into the higher wage category, resulting very likely in higher claim frequency as they are historically less experienced and safety conscious on the jobsite. This is leading to a smaller gap in workers’ compensation rates between the above and below class codes for each industry.

For example, a painter had a separation of 56% from 5474 to 5482 (painters making above or below $28) for their 2021 renewal. For 2022, they are only looking at a 46% difference. From the carrier perspective, more losses are expected in the 5482 (above $28) than the previous year, leading to a rate increase in that class code. I wish I could say that this was industry specific, but from conversations with multiple underwriters, most industries are dealing with these same employment issues and have struggled to find meaningful solutions.

It is possible these dual wage threshold increases will help restore balance by bringing the less skilled employees back into the proper class code, securing the lower rates in the over class code. Employers have shared that these threshold increases are hurting them, but should assist with workers’ comp savings for the truly elite seasoned workers. Carriers have these thresholds to help you differentiate experience from inexperience.

This is a developing issue that we are trying to stay ahead of. The time is now to meet with someone who specializes in your industry and help you formulate a strategy for 2022 to mitigate these impacts and improve your profitably. To schedule a time to talk or meet with me or you can call me directly at 619-438-6900.