Industry News

Trends Shaping the 2025 Insurance Marketplace and What’s on the Horizon for Rancho Mesa

As we enter the New Year, Rancho Mesa's Alyssa Burley sat down with President Dave Garcia to review the past year. They analyzed the state of the commercial insurance marketplace, reflected on Rancho Mesa’s accomplishments, and discussed what’s to come in 2025.

As we enter the New Year, Rancho Mesa's Alyssa Burley sat down with President Dave Garcia to review 2024. In the episode, Dave shares insight on the state of the commercial insurance marketplace, reflects on Rancho Mesa’s accomplishments, and discusses what’s to come in 2025.

Alyssa Burley: You’re listening to Rancho Mesa’s StudioOne™ podcast, where each week we break down complex insurance and safety topics to help your business thrive.

I’m your host, Alyssa Burley, and today I’m joined by Dave Garcia, President of Rancho Mesa, and we’re going to discuss the state of the insurance marketplace and a little bit about what’s new at Rancho Mesa.

Dave, welcome to the show.

Dave Garcia: Good morning, Alyssa. I'm excited to be back in StudioOne™.

AB: Well we're happy that you're here.

Now, in a few days, Greg Garcia and I are doing an episode where we’ll discuss the auto and workers’ compensation marketplace specifically for the landscape and tree care industries. But, I want to get your take on the state of the commercial insurance marketplace as a whole.

So with regards to the typical commercial lines like property, auto, general liability and excess, are you forecasting the hardening marketing to continue and if so, what can business owners do to mitigate the market trends?

DG: Yeah, you know, Alyssa, one of the principles that we operate on here is that we're just going to tell the truth and not just tell the audience or people what they want to hear. So the truth really is that the insurance marketplace is continuing to remain hard, and it doesn't seem like any time in the foreseeable future we're going to see any real decline in that. So I think it's important that we get together and really strategize on what are some of the things businesses can do to try to mitigate this, because I would say across the lines, property auto, general liability, and then excess coverage, the arrows are all still indicating upward movement.

AB: All right. So what do you think the workers' compensation market will do in 2025?

DG: So we track the WCRB, the Workers' Compensation Insurance Rating Bureau. They publish some information quarterly that gives some really good insightful market trends. And this last quarter, we noticed for the first time in 15 years that the average cost of workers' compensation in California has risen. And it's a composite rate, so it's taken all the premium and it's taken all the all the rates and blending them as if they're one. And for the first time it showed an increase. And this is something that I think I've been anticipating.

I'm fortunate to sit on a couple of National Workers' Compensation Carrier Councils and kind of being behind the curtain with them, seeing some of the trends coming, it's coming to fruition now. So I do feel like the Workers' Compensation Market is going to show signs of hardening, but not dramatically like the other lines have done. So it looks like the average increases in the two to three percent range, which most businesses could absorb.

And what that means is that there's still going to be some rate decreases for certain businesses, but those that are not really managing their safety program well, their experience modifications are trending upward, they could see significant rate increases. So it's time to really start to address those issues.

AB: So what are some of the things that people can do to help mitigate this?

DG: Yeah, so I think it's a time, and we would always encourage this ongoing, is really to take a look at your safety programs and try to tighten them up in any areas where maybe there's some insufficiencies. And you may be listening and saying, “Well, I'm not really sure. I think mine's pretty strong. Where do I begin?”

And I would start with working with your insurance consultant, your broker, and the carriers that you're with and asking them what are the areas that they feel like you could use some help. We do a number of things here that we would encourage different people to take a look at and have access to. So for us, we do 60 or so different workshops throughout the year, directed specifically to areas in all lines of insurance that are causing problems relative to workers' compensation.

I think it's time to really evaluate both the services that you receive from your broker as well as the services that you can be receiving from the insurance carrier. It's very varied. The common denominator that many people choose to make decisions on is a simply price and not value. And I think in most people's personal lives, they value value over price sometimes. And that's not to say that the more expensive it is, the better it is. That's not always the case, but to true value to your dollar. So it could be the same price, but the value is just much greater.

So I would look at looking at evaluating, having your broker ask the questions about services the carrier can provide in workers' compensation, like do they offer nurse triage? Do they have any re-employability programs? Do they actually produce a medical cost containment report? What are loss control services like? Are there any loss sensitive options? Things like that, where if you're not aware of those things, you're probably not accessing those things, and that's going to drive up claim costs. And the whole goal is to lower claim costs, because that's what will protect you as the market starts to rise. So ask your broker about accident year loss ratios of carriers. If they're unfamiliar with that term, call us and we'll explain the differences.

But that's a trend that we're seeing that's rising. That is more of an actual number. And for the last four years, the carrier's accident year combined ratios are above 100%. And what that means is currently they're at 107. So that means for every dollar in premium they're collecting, they're paying out $1.07 in costs, and any business understands that's not going to be sustainable. And the only way to correct that is to lower costs or increase revenue, which in the carrier's case is premium. So I think it's time to really roll up your sleeves, get your broker to roll up their sleeves, and get to work and see if you can't help mitigate some of these exposures.

AB: Yeah, absolutely. And I appreciate you explaining all of that and where you see the market changing in 2025. So let's talk about Rancho Mesa and what everyone can expect in 2025.

DG: Wow, my favorite subject other than my family.

AB: You get to talk about us.

DG: Yeah, exactly. So don't ask me about my family because we'd be talking for like two days. But Rancho Mesa is my second family and I'm super excited really to just be a part of us. We just had a fantastic year. It was just unbelievable. Really strong results, tremendous growth. We're looking to add the right people, more people, but the right people. I'm just super excited about some of the other services that we're being able to bring to our clients. Our Safety One platform, so that's our online safety platform, as well as our safety app that we use for our clients in their fields. Both of those have been added tremendous more capabilities this year. We're really excited about that and we're looking forward to seeing, you know, where it goes from here. So those are the kinds of things that just, I'm excited to see what 2025 holds for us.

AB: Yeah, and I'm glad you brought up Safety One. We've added functionality and streamlined processes over the last 12 months, and I know that we'll continue to onboard more and more clients, and it's only going to get better and better.

DG: Yeah, and I think that's just a great tool. You know, we use that tool in several different ways. One way it's certainly going to improve the safety programs of the clients that use it, there's no question about that. But what it also does when we go to negotiate their terms in the marketplace, we point to the tools that they're using, the trainings that they've completed, we have all that at our fingertips now. And it's our job really to negotiate in our client's behalf, but we need substance. We don't need cotton candy. We need substance that we can take to the carrier and fight for those scheduled credits to keep these costs down. So SafetyOne™ and the SafetyOne™ app are just huge components of us being able to do that.

AB: Yeah, absolutely. So what else do you want to share with our listeners?

DG: Well, let me tell you, we had to delay this podcast a little bit today because exciting news, we're growing, as I mentioned earlier, and we're taking on more space here in the building. So we're now going to take over the remainder of the floor and that contract was just signed a week or so ago and the construction, the demolition of that space has started. And as I said, we had to stop the podcast for a minute while they were hammering away in there. So we're going to add about an additional 5,500 square feet or put us real close to 20,000. So I'm super excited about that, not because of the numbers, but because what it means and the capabilities that that extra space and more people are going to be able to allow us to offer to our clients moving forward. So just keep looking for updates, we're going to be posting pictures as the progress of the new space develops. And then we'll probably have a second open house when we can show it off a little bit. So that's really exciting.

The other thing that I'm looking forward to doing is kind of a kooky idea, of course, it came from me, so it's a really kooky idea. But I'd like to introduce a new podcast series next year called Dave's Dugout. And so, you listen to different radio shows or you watch a sports show on TV and right before the commercial they give you that little teaser like, "So you got to stick around so you can hear what this is all about." So I'm not going to really tell you much about Dave's Dugout today. Just understand that it's going to be something I'm really excited about and we will be producing a short Dave's Dugout podcast introduction shortly that you'll be able to tune into and get an idea of what I'm talking about there. But trust me, it's going to be a lot of fun. And I think it'll be an area where I'll certainly learn and grow from, and maybe some of the audience will do the same. So super pumped about that.

AB: Yeah, I can't wait to hear that.

DG: Yeah, I know. It's like the present under the tree that hasn't been unwrapped yet. And hopefully it's the one that everybody's excited about, not the one that goes out to the curb the day after Christmas, because it's not a present anybody wants.

AB: Well, something that I do want to mention that I'm kind of proud of this last year is about six months ago, we introduced our OneofOne™ recognition program within Rancho Mesa. And essentially what that does is it allows coworkers to acknowledge the work that their teammates are doing in the office when they go above and beyond. We have QR codes scattered throughout the office where people can scan that code. They can, you and acknowledge different people, write up a little scenario, what the situation was. And then we get to post it. We get to shoot it out on teams to everybody in the company so that they can know what their coworkers are doing and how they're supporting each other. And I think we're at like 70% in the last six months of our employees have been recognized. And those are just the people that we've documented, you know that there's a lot more people behind the scenes that are, you know, going above and beyond just helping out their co-workers. So I think that that's something that's pretty cool and not everybody does that.

DG: No, I'm really with you and behind you 100% on that. I thought it was a great idea. And the great thing about it is we're not good here at participation trophies or employee of the month where you just kind of rotate it around because, you know, who hasn't wanted this month. This is really coming from the people. And it could be the same person, it doesn't, you can be repetitive. And what it's really begun to highlight is, I'm finding out things that people are doing at different areas of the company that, unless they just happen to be walking by and talking to them that moment, I wouldn't know. And now it gets pushed out. And what I really see it doing is it's encouraging other people to try to create those OneofOne™ moments. And as the audience probably knows, we actually trademarked that word. We made OneofOne™ all one word because that's really what we're culturally trying to accomplish; provide OneofOne™ interactions between co-workers and clients and friends and vendors and different people. So to see it come to life like that has been super exciting. So I'm looking forward to seeing how many more we get in 2025 for sure.

AB: Yeah, I'm looking forward to it as well and all the exciting things that we'll be doing. Dave, thank you for joining me in StudioOne™.

DG: Yeah, me too. So Alyssa, thank you for having me today here in StudioOne™ I'm super excited about 2024 but I'm really optimistic and excited to see what 2025 has to offer. So thank you for having me in StudioOne™ today.

Actual Impact of Auto Claims to Your Bottom Line?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In two previous articles/podcasts, we explored “below the surface” impacts from payroll inflation and lost time workers’ compensation claims. We provided detail on how these can negatively impact a business’s productivity and profitability and what companies can do to mitigate those impacts. Today, let’s look at another area where you need a keen awareness to really understand all the impacts.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In two previous articles/podcasts, we explored “below the surface” impacts from payroll inflation and lost time workers’ compensation claims. We provided detail on how these can negatively impact a business’s productivity and profitability and what companies can do to mitigate those impacts. Today, let’s look at another area where you need a keen awareness to really understand all the impacts.

What is the true impact an auto accident can have on areas of your business? For discussion, let’s consider an accident where your driver is at fault and also injured. This type of accident is much like an octopus in that it is going to touch many areas of your insurance program.

First, there is the damage to your auto, obviously this will be covered under the physical damage portion of your policy.

Second, you will have the physical damage and potential bodily injury to the third party whom your driver hit. This would fall under the auto liability portion of your policy. Additionally, if the other party or parties are severely injured it could penetrate your initial layer of liability insurance requiring your umbrella/excess policy to respond. As a side note, in my 35 years in the insurance industry, the largest claims that we see are predominately in auto due to the potential of severe bodily injury.

Third, given that your driver was injured, this claim will trigger your workers compensation policy to provide coverage for both the indemnity and medical costs of their injuries.

Fourth, the claims will impact your loss ratios in both your automobile insurance and workers compensation, causing the potential for future premium increases.

Fifth, this claim will also cause your Experience Modification to rise, which again will cause the potential for future premium increases as well as potentially, if you’re a contractor, eliminate you from bidding on certain work.

Sixth, replacing the injured driver may mean having to hire someone new which will increase payroll and lead to additional training time and a loss of productivity.

I’m sure your head is spinning and you’re probably wondering “all this, from one accident?” What should I do? Thankfully there are several things you can do to mitigate this before the accident occurs. Consider the following:

Do you have a formal fleet safety program in place? If not, work with your trusted advisor to get one in place. If you would like us to help you with that contact our client services team to set up a time to review our trainings and fleet safety resources with you.

Do you have a distracted driving policy in place for your drivers? This is by far the leading cause of auto accidents and while many are at low speeds, they can still be very costly. High speed distracted driving accidents can be catastrophic.

Are you participating in the DMV Pull Program? If not, this is a valuable tool that will provide you with information on your drivers’ experience regardless if the infraction or incident occurred as a part of work or outside of work. Most auto insurance carriers will view this as a subjective credit on your premium rating. You can do this very inexpensively and direct via the DMV website.

Are you using any telematics tools, like GPS, speed and breaking tracking, cameras (both forward facing and rear facing)? These devices are again viewed as a subjective credit by insurance carriers.

Once an accident occurs, are you completing a thorough accident investigation report with a description of the accident, witness statements, pictures, police report (if available) and then reviewing the data to determine root cause and possible changes to your fleet safety program?

As you’ve seen, the key to mitigating this type of claim is to keep it from occurring, which is easier said than done. Accidents will still happen. While you may not be the “at fault’ party in many of the accidents, reducing the likelihood of your driver being at fault starts with your commitment to a strong fleet safety program. If you need help in creating this fleet safety program, please contact our client services team to get started.

Once you have a strong program in place and you feel more in control of your vehicle safety performance there are other cost saving programs that you would be eligible to consider. We discussed those in other articles where we explore Performance Based Insurance Programs.

I hope you find this information useful and that you are able to take away an idea or two that might improve your operations. To learn more best practice techniques, contact us or reach out to me directly at dgarcia@ranchomesa.com.

Is Now the Time for a Performance-Based Insurance Program?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the three preceding articles in this series, we took a deep dive into some areas where a business’s productivity and profitability could be impacted by various factors emerging in the insurance marketplace. In the course of those articles, we also examined some tools, strategies and ideas that a company might implement to help manage and mitigate those impacts. Today, we will look at a way to exert the most control over your insurance program and premium outcome through performance-based insurance programs.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the three preceding articles in this series, we took a deep dive into some areas where a business’s productivity and profitability could be impacted by various factors emerging in the insurance marketplace. In the course of those articles, we also examined some tools, strategies and ideas that a company might implement to help manage and mitigate those impacts. Today, we will look at a way to exert the most control over your insurance program and premium outcome through performance-based insurance programs.

I’ve written about these programs before in "Increasing Your Productivity and Profitability Through Your Insurance Program," "What is the True Cost of a Lost Time Workers’ Compensation Claim?" and "How is Payroll Inflation Impacting Your Workers' Compensation Premium." So, in lieu of diving into all of them, let’s review a few of them briefly and then spend a little more time with “are they right for you now?”

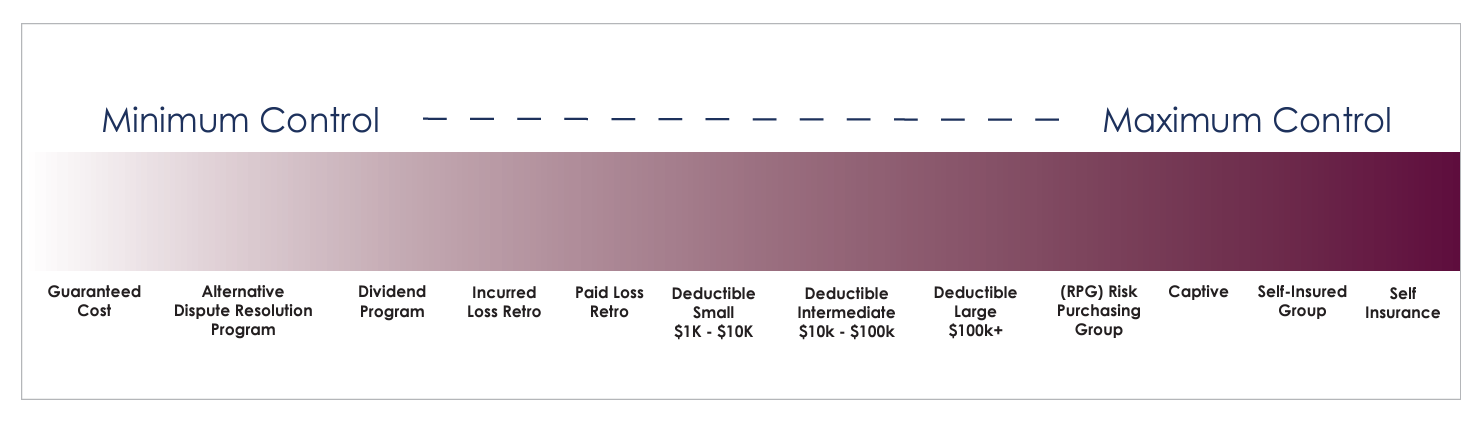

Beyond guaranteed cost programs, where policyholders pay a set premium and then claims are covered up to the policy limit, there are a wide range of performance-based insurance programs that can apply to a single line of coverage, like workers’ compensation, or multiple lines of coverage that can also include most notably general liability and automobile. Rancho Mesa has created a Workers’ Compensation Continuum document that lists many of these programs. As you move from right to left on the continuum, business owners increase control as well as risk. So, a wise strategy would be to evaluate as many programs as seem to fit your tolerance and readiness for that additional exposure.

Are you confused, yet? You are not alone, which is why it is even more important to start the process with a trusted advisor (your insurance broker) who is both familiar with and skilled in putting these programs in place. A properly skilled and educated advisor will be able to walk you through each option and present it in a way that makes your understanding of it easy to comprehend. If you do not fully understand both the benefits and the risk, we recommend pausing before moving forward, and take ample time for the best decision possible.

As someone who owns and operates a business, I like the idea of the “bet on yourself” model which always makes me feel more in control of the outcome. I cannot emphasize enough how confident you need to be in the ability to control your claims in order for these programs to work for you. That is why in the previous three articles, we talked so much about what you can do to improve your safety programs and more importantly your safety culture. Once you have the right team in place, have reached the point where you have control of your claims, and want more control over your premiums and pricing, then it may to time to move into the performance-based insurance program world.

If my forecast of a hardening workers’ compensation market as early as late 2022 or early 2023 is accurate, then getting started now in putting the right team together should be a priority. Follow these three steps to prepare:

Review your existing safety programs.

a. Look for ways to improve them based on loss trends and industry benchmarks.

Evaluate your claims history over the last five years.

a. Look for the root causes that are driving the losses.

Identify someone internally to be your safety director.

a. Consistently demonstrate upper management’s support of their efforts to the company and make sure you provide them with tools necessary to accomplish their goals.

Finally, in closing, choose a trusted insurance advisor who understands your industry, your operations and is very familiar with performance-based programs. There are good trusted advisors out there, so if you are currently with one, then give them the time they need to help you get better.

If you want to learn more about performance-based programs and would like to talk with us about the opportunity to be your trusted advisor, contact us and our team that specializes in your industry will reach out to you. If you would like to speak with me directly, email me at dgarcia@ranchomesa.com.

I hope you found this series helpful in making your 2022 the most productive, profitable and safe year ever.

How is Payroll Inflation Impacting Your Workers' Compensation Premium?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Inflation is rampant everywhere from consumer goods like groceries and gasoline to increased housing costs to labor. Today, I want to talk with you about the specific impact that payroll inflation is having on the workers’ compensation marketplace and ultimately on your premium cost.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Inflation is rampant everywhere, from consumer goods like groceries and gasoline to increased housing costs and labor. Today, I want to talk with you about the specific impact that payroll inflation is having on the workers’ compensation marketplace and ultimately on your premium cost.

Any and all businesses have felt the impact of increased payrolls both to retain existing employees and also to attract new ones. For the sake of discussion, let’s use an inflation wage percentage of 6.5%.

On the surface, this 6.5% wage increase is hard enough to manage on profit and loss statements, but below the surface there is also a deeper impact on businesses that for many will catch them unaware.

The two areas I want to talk about are:

The impact the wage increase has on temporary disability claim amounts.

The financial impact that higher wages will have on workers’ compensation carrier P&L’s.

First, temporary disability claim amounts are generally equal to 2/3 of the average weekly earnings of the injured employee. This payment does have a minimum and maximum amount, but for our discussion we will assume the injured worker falls somewhere in between.

So, if the injured worker’s average weekly wage increases by the 6.5%, the disability payment will follow suit. This 6.5% will have several negative impacts. The higher cost of the claim will have a negative impact to the business’ Experience Modification Rate (EMR).

This can be significant to a business since it will not only directly affect the future year’s premium but if the business is a contractor, an elevated EMR can potentially limit pre-qualification approval from many builders.

This is so critical to a business success that here at Rancho Mesa we developed a proprietary Key Performance Indicator (KPI) Dashboard that has the capability to tell our clients the actual claim amount per point of experience modification so they can plan accordingly.

An additional consequence of the claim costs increasing is that a company’s individual loss ratio (claim amounts/premium) with their workers’ compensation carrier will increase. Suffice to say as the loss ratio increases, future premiums will need to increase to offset those higher claim costs. Ideally, to continue to receive the most aggressive pricing, we like to see our clients’ loss ratios stay below 30% so these potential inflation increases need to be understood and addressed proactively.

Shifting gears, let’s look at the impact of payroll inflation on the insurance carrier as a business and what impacts it may have on you the business owner as well.

One of the measurements workers’ compensation carriers look to and monitor for their financial health and well-being is their combined ratio. As a general rule, combined ratios measure dollars collected in premium divided by claims costs and overhead. A good combined ratio indicating a profitable and strong company would be in the low 90%’s.

So, logically speaking, if a carrier is experiencing an increase in temporary disability claims costs and an internal payroll inflation of the same 6.5%, which direction will their combined ratios be going? Obviously, it will be going up, so what are they to do? The most likely choice would be to raise premiums to help offset those increases – unfortunately we know who pays those premium increases.

Now that we understand the impacts that payroll inflation will have on workers’ compensation, what can you do as a business to help mitigate them. The answers are easier than you might think.

This first step is to help reduce the likelihood of claims occurring, thereby reducing the impact of the increase to temporary disability claims on your company.

Conduct a thorough review of your current safety program and look for ways to improve it. How often are you meeting? Are the trainings current and specific to your needs? Is there a tracking system in place where these trainings are documented? At Rancho Mesa, our Client Services Group works closely with our client teams, drawing from our library of over 3,000 specific trainings to help you create meaningful trainings specific to your needs.

Should a claim occur, what are the steps to help mitigate the impact:

Report the claim timely – the quicker your insurance carrier is aware of the claim the better the claim outcome.

Select a carrier that offers “nurse triage” so that in addition to reporting the claim quickly you are able to have an assessment of the injury without going to a clinic and potentially reducing the need for a lost time claim.

If you have implemented all of the above but still have a lost time claim, offer modified work to meet the injuries work restrictions. By offering modified duty, you are able to either pay the injured workers whole salary or a portion of it which eliminates the temporary disability cost from the claim and/or will dramatically reduce the cost. In addition to these claim cost savings, statistics will show when modified duty is offered the potential for litigation is reduced saving even further potential costs.

To create an active and sustainable safety program, look to your trusted advisor (insurance broker) and see what services they have that can assist you.

Do they have a client services team that can provide industry specific trainings, workshops, webinars, certification programs to take your safety program to the next level?

Are you having regular claims meetings with them to review performance, spot trends, look for root causes?

What tools are there to assist you in reviewing your claim data?

Are they able to provide industry benchmarking?

Do they have an in-house workers’ compensation claims advocate to assist you with your open claims to create a better outcome?

Payroll inflation is now a reality and not likely to subside any time soon. As we have shared though, there are proactive steps all businesses can take to help mitigate the impact on your workers’ compensation program today and in the future.

If you are looking for assistance in managing through this or have any additional questions, please reach out to us or email me at dgarcia@ranchomesa.com.

Be informed, be proactive, and implement a plan to make your 2022 the best year ever.

What is the True Cost of a Lost Time Workers’ Compensation Claim?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

There are many insurance professionals that have tried to quantify the real cost of indemnity or lost time claims, using multipliers anywhere from 2 to 4 times the claim amount in an effort to determine what the real cost of a claim will be to a company. While this may be true, it remains subjective to many. Let me help you understand the ways this type of claim will impact you and then you can decide the real impact to your business.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

There are many insurance professionals that have tried to quantify the real cost of indemnity or lost time claims, using multipliers anywhere from 2 to 4 times the claim amount in an effort to determine what the real cost of a claim will be to a company. While this may be true, it remains subjective to many. Let me help you understand the ways this type of claim will impact you and then you can decide the real impact to your business.

Let’s assume a claim where the injured worker will be out for 2 to 3 months and the claim’s total incurred amount (which is the combination of paid dollars and reserves) is $50,000. This claim can and will impact your business.

The first direct hit will be your experience modification (X-Mod). While a claim in your current term is delayed a year before going into the calculation, you’ll feel the effects of the remaining 3 years. So, assume the claim is in your 2022-2023 policy year, claims from that year will not go into your 2023-24 policy year but will be in the next three policy terms, 2024-2025, 2025-2026 and 2026-2027.

Each company develops their own “primary threshold,” a term used to describe the maximum incurred loss or cap that any one claim can impact the experience modification. It’s confusing to many policyholders, but this amount regularly changes year-to-year for most companies, as it is derived by the Workers’ Compensation Insurance Rating Bureau (WCIRB) based on the payrolls and class codes a particular business uses and reports.

To simplify this for our clients, we developed a proprietary Key Performance Indicator (KPI) Dashboard that calculates client’s individual Primary Threshold, also detailing how many points to the X-Mod it would add giving them a true indication as to the cost of the claim as it pertains to the X-Mod. Request a personalized KPI for your company.

Now that we understand the impact to the X-Mod, what other areas will be impacted? The next most obvious is the workers compensation carrier’s loss ratio. Adding claim dollars will negatively skew percentages and undoubtedly cause an increase in premium of some amount at renewal.

While the impact to the X-Mod and loss ratio are easy to understand, they are really just the tip of the iceberg. Let’s go below the surface and look at other ways this claim will impact your business.

Losing an employee for any length of time is impactful, but losing the employee for a month or two would likely require the business to fill that person’s job and responsibilities within the company. In many cases this means trying to hire someone new to the organization.

Without going into great detail, the business is likely going to experience additional payroll and benefit costs, training, and likely a decrease in expertise which will most certainly impact the productivity of that particular job.

I think we can all now understand how a lost time claim affects the X-Mod, loss ratio, and a business’s productivity and profitability, both immediately and into the future.

So, what can I do to avoid this or at least minimize the impact should a lost time injury occur? The great news is that in many instances you can prevent these injuries from ever happening or at least reduce the frequency of them occurring. Start with these strategies and enlist your insurance broker for their guidance in the process:

Perform a complete overview of your safety program.

Make changes in training that address your specific needs.

Increase awareness and accountability of those employees responsible for the implementation of your safety program – consider adding this as an area of their annual performance appraisal.

Identify new employees so that your experienced people can mentor them in training or in watching how they are performing. Statistics show that new employees (defined as less than 6 months) have the highest percentage of injuries. New hires in construction can wear different colored hard hats, gloves, vests or even a sticker on their clothing, anything that might let the crew leader know who might need a little more oversight.

Choose the right workers compensation carrier. In general, look for a carrier that offers in-house claims handling, loss control services, can show you statistically both their performance in closing claims vs. the industry, claim costs vs. the industry, medical cost containment performance, length of time doing business in the state you are in. These are just a few items to consider that can result in the best claim outcome should one occur.

Choose the right insurance advisor (broker). Are they a specialist within your industry? What client services do they offer pertaining to trainings you need? Do they offer workshops, webinars and safety certifications? Do they have an experienced workers compensation claim advocate in house to assist you in both understanding your claims and mitigating costs? What tools do they have to help you benchmark yourself against your industry? Can they help you identify trends and root causes?

We’ve seen how one lost time claim can have a negative rippling affect for your company in both your productivity and your profitability. It may feel overwhelming in how to understand and fix your issues with all the other areas of your business that you have to be involved with. It really doesn’t have to be, it’s just time to look at who you choose to work with from your carrier to your broker differently.

Contact us via our website or reach out to me directly at dgarcia@ranchomesa.com.

Increasing Your Productivity and Profitability Through Your Insurance Program

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

“What?” You’re probably asking yourself; “Did I read that wrong? How can my insurance program improve the productivity and profitably of my company?” Trust me, I understand your confusion.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

“What?” You’re probably asking yourself; “Did I read that wrong? How can my insurance program improve the productivity and profitably of my company?” Trust me, I understand your confusion.

I’ve been working in the insurance industry for 35 years and this is a premise I heard about, but thought was impossible, until I dug a little deeper. Once I did, I was able to share this concept with my clients over the years and it changed how they approached this vital part of their businesses.

I have examined four current insurance issues facing you and your companies, and share the steps needed to make this premise a reality. To do this I will inspect each issue in some depth and help you build a foundation of understanding so that you can begin to increase your productively and profitability through your insurance program.

I will be covering the following topics:

“What is the True Cost of a Lost Time Workers’ Compensation Claim?”

“How Payroll Inflation is Impacting Your Workers Compensation Premium?”

“Is Now the Time for a Performance-Based Insurance Program?”

I hope you find this information as a pathway to improve both your productivity and profitability in 2022.

The Field Guide to Navigating Your Insurance in 2022

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns? During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns?

During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

COVID-19’s impacts included:

The loss of income/revenues

Labor shortages

Health concerns

Relocation of labor forces

As the year comes to a close, we now have some answers but even more questions about what challenges 2022 will bring. Below are a few remaining questions that create uncertainty.

Will Property, Auto, General Liability, Excess, Cyber, and EPL insurance continue to see pressure? The short answer is yes.

What can I do today as a business owner to prepare and better mitigate these increases?

Start your renewal process a minimum of 120 days away from your expiration date. Learn more about the pre-renewal process in our article, “3 Reasons Your Pre-Renewal Meeting is Key to your Success.”

Be willing to meet and discuss your particular situation, needs and goals.

Choose a broker that specializes in your industry and can negotiate with the marketplace from a position of expertise.

Evaluate the services that you receive from your broker’s agency to assure they align with your specific risk management needs. Are they proactive or reactive?

Where is the Workers’ Compensation Industry Going in 2022 and Beyond?

What is expected of Workers’ Compensation in 2022? The short answer is that this market will remain soft.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) has asked for a modest decrease in overall rates and most carriers’ filings have reflected that recommendation. However, these are averages and many industries will find these decreases harder to come by.

What is expected of Workers’ Compensation in 2023? There are several leading indicators that present early signs of a hardening market. Here are a few:

Wage inflation for most businesses. This will lead to higher temporary disability payments to injured workers thus increases in overall claim amounts.

Wage inflations within insurance carrier’s personnel. This will cause a rise in their overhead costs and then a subsequent rise in their combined ratios which will impact their bottom line.

The likely inclusion (September 2022 and beyond) of COVID claims in the Experience Modifier Rating formula (X-Mod). While this is not yet official, approval appears likely.

Preparing for the hard workers’ compensation market starts today with our checklist.

We will explore those at length in a series of articles beginning in January 2022. Subscribe to our newsletter to receive those articles. For now, here are a few tips:

Utilizes a Workers’ Compensation Gap Analysis and Opportunity Assessment (through the Risk Management Center).

Benchmark your performance to industry standards to look for areas of improvement. Learn more about Rancho Mesa’s KPI.

Choose your workers’ compensation carrier wisely. Learn more about selecting a carrier in the article, “How to Choose a Workers’ Compensation Carrier Partner.”

Have you ever considered performance-based programs? If not, maybe it’s time to bet on yourself. Watch the “Deductible Workers’ Compensation: Understanding performance-based insurance programs” webinar.

With workers’ compensation premiums representing a significant line item on many profit and loss statements, staying up to date on the rapidly changing environment should be a priority for all businesses. And, preparing for the expected rate increases is more important than ever with inflationary costs already choking profitability for so many operations. Our series of articles starting in January will help in this education process and allow you to better understand steps you can take now to weather this building storm.

Incorporating a clear strategy as it relates to your insurance portfolio is perhaps more critical than ever leading into 2022. With pricing increases across all lines of coverage becoming more and more common, managing this line item on your financials should be a proactive process with your broker. Start that dialogue now and develop the right plan to design and coordinate the most comprehensive and competitive program possible.

Performance-Based Workers’ Compensation Programs – Are Retros In Your Future?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance-based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

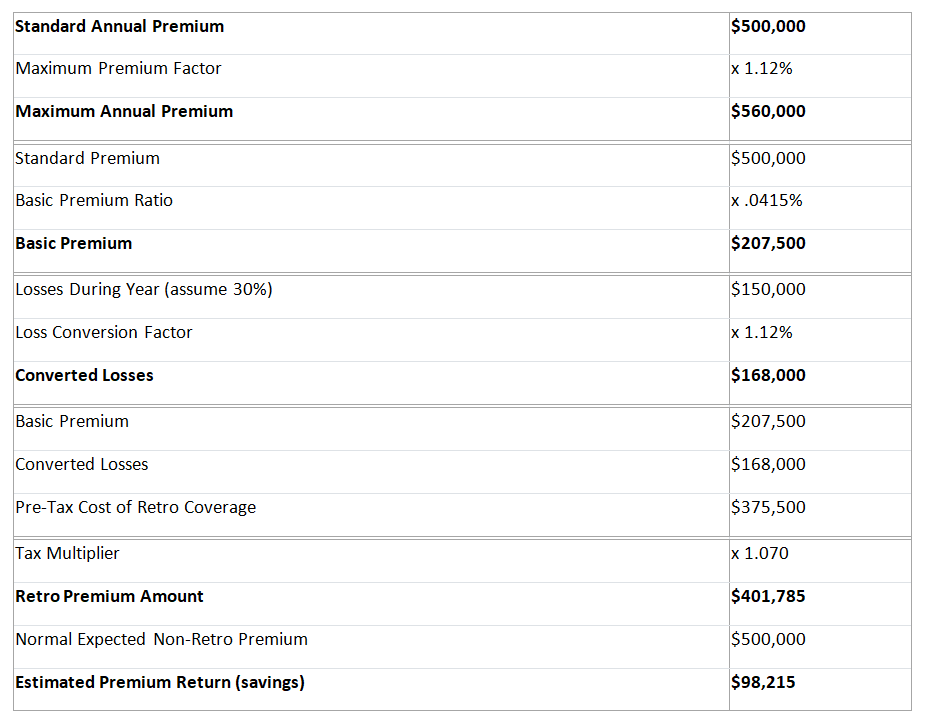

While we have previously discussed several of these programs in detail (i.e., captives and deductibles), another option that is often overlooked; Retrospective Rating Plan (retros), could possibly be the right next step for many businesses to explore.

Typically, these plans begin to make sense once a company’s annualized premiums exceed $500,000. They contain many elements and variables that must be analyzed and understood before inception, including:

maximum, basic, and minimum premiums

required letters of credit (LOC)

loss cost factor (LCF)

losses based on incurred or paid

potential return of premium

number and frequency of recalculation of the premium/losses

recapture of premium in future calculation if claims develop

claim buyouts

Are you a candidate for a performance based program?

Example of a Retro Workers’ Compensation Program

Assumes a $500,000 premium with a 30% incurred loss ratio

If you would like us to create a performance model for you and your team members to evaluate, contact Rancho Mesa at (619) 937-0164 or via our website. Or, complete our performance based insurance spreadsheet and submit to Alyssa Burley at aburley@ranchomesa.com

How to Choose a Workers’ Compensation Carrier Partner

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Many years ago, when I was a young producer, one workers’ compensation carrier legend pulled me aside and told me never to forget that a workers’ compensation decision is not a one-year decision, but at least a 4-year decision. Of course, policies are only written on a one-year basis but what he was teaching me was that the carrier you choose will handle all the claims you have through your Experience Modification cycle. So, evaluating and recommending a workers’ compensation partner for my clients just became a much more thorough analysis of many critical factors beyond just the premium.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Many years ago, when I was a young producer, one workers’ compensation carrier legend pulled me aside and told me never to forget that a workers’ compensation decision is not a one-year decision, but at least a 4-year decision. Of course, policies are only written on a one-year basis but what he was teaching me was that the carrier you choose will handle all the claims you have through your Experience Modification cycle. So, evaluating and recommending a workers’ compensation partner for my clients just became a much more thorough analysis of many critical factors beyond just the premium.

I understand and want to acknowledge that competitive pricing is very important, yet other than price, most business owners are not sure what to look for when comparing carriers. All businesses should consider the following in their evaluation of a workers’ compensation carrier:

What is the A.M. Best rating of the carrier?

How long have they been in the State workers’ compensation marketplace?

What is their premium volume within the State?

What “in-house” services does the carrier provide? Two services for special consideration are:

The Claims Department

Loss Control Service

How does their medical cost containment numbers compare to the industry averages?

How does their claim closing rates compare to the industry average?

Are the following services available?

Telemedicine

Nurse Triage

For any businesses that pay above $250,000 in annual premium, should consider these additional questions:

Does the carrier offer a dedicated indemnity claims examiner for your business?

Does the carrier offer Claim Review Meetings?

Does the carrier offer a Client Services coordinator?

Does the carrier offer on-line claim status information?

What loss sensitive programs do they offer?

Further, for any businesses that are exploring loss sensitive programs (usually above $400,000 in annual premium) like deductible workers’ compensation, they should evaluate the following:

What are the terms of the letter of credit required?

Is there a Loss Conversion Factor (LCF)?

Is a Loss Fund required?

How are Allocated Loss Adjustment Expenses (ALAE) handled?

Is there a policy deductible aggregate?

Are there any claims handling charges?

Are there Medical Cost Containment charges?

Since many of the concepts and terms above require a deeper understanding and explanation, listen to my podcast episodes where I examine this topic in greater detail.

Also, consider attending one or both of my live webinars that cover this topic and afford you the opportunity to ask questions. Register for our Thursday April 1, 2021 webinar where I will focus on businesses with annual premiums below $400,000, and/or register for my Thursday April 8, 2021, webinar where I will deal specifically with deductible workers’ compensation. Both webinars will be 30 minutes in length.

If you would prefer to speak with me directly, I can be reached at (619) 937-0170 or email me at dgarcia@ranchomesa.com.

I wish you all a safe and profitable 2021.

SB 1159 Is Now Workers’ Compensation Law

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later. Additionally, these rules will continue, unless modified, until January 2023. So, SB 1159 may be around for a while.

If an “outbreak” occurs, for the presumption of the claim to rest with the employer (meaning it will be presumed the person testing positive for COVID-19 contracted it at work and is therefore eligible for workers’ compensation benefits), there are several factors that need to be meet for that to occur.

If the employer has fewer than 100 employees and 4 employees test positive, or if the employer has more than 100 employees and 4% of their total employees test positive, during a 14-day period at an employer’s specific location, the COVID-19 case is presumed to be work-related. Thus, the 4/4/14 rule. When in doubt, call your workers’ compensation carrier and discuss the specific situation. They will help you determine whether or not it is a workers’ compensation claim.

Rob Darby, President of Berkshire Hathaway Homestate Companies, the second largest writer of workers’ compensation insurance in California and I discuss SB 1159 in a recent StudioOne™ Safety and Risk Management Network podcast episode “SB 1159 Impacts Workers' Comp Market.” A week before Governor Newsom signed the bill, Rob and I discussed the impacts of the bill to get an early insight. Take a listen - I think you will find it useful.

Now comes possible confusion with SB 1159. What is considered an outbreak? What is the definition of a specific location?

Outbreaks

The section of the law (Labor Code 3212.88) applies to any employee other than frontline workers and healthcare workers who test positive during an “outbreak” at the employer’s place of business, if the employer has 5 or more employees.

COVID-19 is presumed work-related if an employee worked at the employer’s place of business at the employer’s direction on or after July 6, 2020 and both the following elements are met:

The employee tested positive for COVID-19 within 14 days after working at the employer’s location.

The positive test occurred during an “outbreak” at the employer’s specific location.

An “outbreak” is defined as a COVID-19 occurrence at a specific employment location within a 14-day period AND meets one of the following:

If an employer has 100 employees or less at a specific location and 4 or more employees test positive for COVID-19;

If an employer has more than 100 employees at a specific location and 4% of the employees test positive for COVID-19;

The local public health department, State California Department of Public Health or Occupational Safety and Health Administration (Cal/OSHA) or school superintendent orders the specific place of employment to close due to risk of COVID-19 infection.

A specific location or place of employment is a building, store, facility or agricultural field where an employee performs work at the employer’s direction. An employee’s home is not considered a specific place of employment unless the employee provides home health care services to a client at the employee’s home. An employee may have more than one specific place of employment, if they worked in multiple locations within the 14-day period before their positive test.

There is a 45-day timeframe to determine if a positive COVID-19 case meets the above standard.

Outbreak Reporting Requirements

When an employer knows or reasonably should know that an employee has tested positive for COVID-19, they must report the incident to their workers’ compensation carrier. They should be prepared with the following information to give the carrier.

The fact that an employee has tested positive, regardless if work-related or not.

Employers should not include any personal information regarding the employee who tested positive for COVID-19 unless the employee asserts it is work-related or files a claim form.

The date the specimen was collected for the employee’s COVID-19 test.

The specific address or location of the employee’s place(s) of employment during the 14-day period preceding the date the test specimen was collected.

The highest number of employees who reported to work at the specific location(s) in the 45-day period before the last day the COVID-19 positive employee worked there.

It best practices to follow all local, state and federal guidelines for safe workplaces. However, even with the best intentions and precautions, COVID-19 may accidentally spread to employees. Again, when in doubt, report an employee COVID-19 case to your workers’ compensation carrier and allow them to determine how to proceed.

For questions about SB 1159 and how it with affect your organization’s workers’ compensation, contact your broker or reach out to Rancho Mesa at (619) 937-0164.

Commissioner Lara Approves WCIRB Proposed Amendments Addressing COVID-19

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follow…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follows:

New COVID-19 Rule: Clerical Office Employees

Part 3, Section III, General Classification Procedures, was amended to add Rule 7, Coronavirus Disease 2019 (COVID-19), to permit during a statewide California COVID-19 stay-at-home order the following: The division of an employee’s payroll between Classification 8810, Clerical Office Employees, and a non-standard exception classification when the employee’s work is exclusively clerical in nature and the non-standard exception classification does not include Clerical Office Employees. This amendment will conclude 60 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rule: Basis of Payroll

Part 4, Section IV, Exposure Information, Rule 1, Classification Code, and Rule 4, Exposure Amount, were amended to report payments excluded from remuneration pursuant to new Rule 7, Coronavirus Disease 2019 (COVID-19). Payments made to an employee while the employee is performing no duties of any kind in service of the employer are to be excluded from payroll when the payments are equal to or less than the employee’s regular rate of pay. This amendment will conclude 30 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rules: Claims Reporting

Part 4, Section V, Loss Information, Rule B, Loss Data Elements, Sub rule 4, Catastrophe Number, was amended to add Catastrophe Number 12 for the reporting of COVID-19 claims. Appendix III, Injury Description Codes, Section B, Nature of Injury (Positions 3-4), and Section C, Cause of Injury (Positions 5-6), were amended to add a Nature of Injury code and a Cause of Injury code for COVID-19 claims. This amendment includes claims with an accident date after December 1, 2019, reported on a Unit Statistical Report due on or after August 1, 2020, and reported with a Catastrophe Number 12.

Exclusion of COVID-19 Claims from Experience Modification

Section VI, Rating Procedure, Rule 2, Actual Losses and Actual Primary (Ap) Losses, was amended to specify that all claims directly arising from a diagnosis of Coronavirus Disease 2019 (COVID-19) shall not be reflected in the computation of an experience modification.

For a greater understanding of these changes and how they will impact your company please contact our team at (619) 937-0164.

Special COVID-19 Workers' Compensation Filing and Executive Order Imminent

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would:

Exclude COVID-19 claims from the experience rating formula.

Exclude from premium calculations payroll paid to employees who are continuing to be paid while not working.

Allow the assignment of Classification 8810 on a temporary basis to employees who are now working from home whose temporary duties meet the definition of a clerical office employee.

Each of these changes will have their own nuances and it remains to be seen how exactly their implementation, auditing and tracking will be put into practice.

Separately, but equally important, Governor Newsom is considering an executive order that would create a “conclusive presumption” that COVID-19 illnesses and deaths sustained by “essential workers” are work related and therefore covered under workers’ compensation policies. The potential scope and impact of the order are not yet known, but on April 20, 2020, the WCIRB released a projection that the annual cost of COVID-19 claims on “essential critical infrastructure” workers, under a conclusive presumption, ranges from $2.2 billion to $33.6 billion.

These decisions, should they be implemented, will create significant disruption in the workers’ compensation marketplace and to all insurable businesses in California. As these decisions are rendered, Rancho Mesa will continue to provide resources and implementation strategies to help businesses adjust through these uncertain times. If you have questions or want to discuss this in greater detail please reach out to your broker or account manager.

Potential Workers’ Compensation Changes Due to COVID-19 Claims

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are:

Experience Rating Calculations

Dave Bellusci, Chief Actuary at the WCIRB, indicated that they are “leaning toward excluding COVID-19 claims from the calculation.” This would entail setting up new nature of injury and cause of injury codes that would identify these claims.

They are also leaning towards excluding the payrolls for workers who are not working because of the pandemic and shelter-in-place orders but who are still receiving all or a portion of their salaries or are being paid through sick leave benefits.

Class Code Classifications

Those sheltered-in-place workers who are being paid and either not working their customary jobs or not working at all has created a question about how that payroll should be classified for premium purposes. Should that payroll be classified in its usual class code or be adjusted into another class code such as clerical or a code specific to COVID-19. These are all questions being considered.

Any potential changes like these in question would be temporary and require that employers document how the employees in question were not working their customary jobs during this time and were performing clerical functions.

Our Answer

Rancho Mesa is collaborating with several regional and national workers’ compensation carriers on a form that will be able to capture this information for businesses affected by these new work restrictions. Accurate and accessible documentation will help both businesses and their workers’ compensation carrier make the necessary adjustments at audit.

At this point, these are only preliminary responses that are being discussed. While nothing has been passed into law, it seems highly likely that the WCIRB and the Insurance Commissioner will agree on some type of new legislation. When and if this occurs, we will provide full details and specific strategies to assist.

If you want to be kept informed of any changes and are not currently on our weekly newsletter list, please subscribe to our email distribution list.

Distracted Driving, Not Just an Automobile Insurance Issue, Bad News for Workers Compensation Too

Author, David J Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

I’ve written at length on the negative effects distracted driving is having on the automobile insurance industry and its impact on the rise in accidents, claim costs, and increases to your automobile premiums. But, have you considered its effects on your Experience Modification Rate (EMR) and ultimately workers’ compensation cost?

Author, David J Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

I’ve written at length on the negative effects distracted driving is having on the automobile insurance industry and its impact on the rise in accidents, claim costs, and increases to your automobile premiums. But, have you considered its effects on your Experience Modification Rate (EMR) and ultimately workers’ compensation cost?

When one of your employees is injured in an automobile accident while working on your behalf, Arising out of Employment (AOE) / Course of Employment(COE) their sustained injury will be covered by your workers’ compensation policy, regardless of fault.

“Regardless of fault?!”

When a third party is deemed at fault and the injuries to your employee(s) have been settled, your workers’ compensation insurance carrier may “subrogate” their costs to the carrier representing the at fault driver. Now, here is the realty – studies have shown that 14.7% (4.1 million) of all California drivers are uninsured, while another large percentage of drivers hold the California minimum limits of $15,000/$30,000. What this means is that even if subrogation is a possibility, the likelihood of a “full” recovery is not probable. Thus, all the costs of the injury to your employee(s) will likely be the sole responsibility of your workers’ compensation carrier and this claim cost negatively affects your EMR and loss ratios for years to come.

What can you do?

You can implement a strong fleet safety program that includes a policy pertaining to distracted driving. When your employee is involved in a motor vehicle accident, adherence to your company’s accident investigation protocol is crucial. Documentation will prove pivotal for your carrier if subrogation becomes a possibility.

For our clients, through RM365 Advantage, we have a number of resources: fleet safety programs that can be customized, fleet safety training topics, fillable and printable accident investigation forms, archived fleet safety workshop videos, and more, in both English and Spanish. You can access this through our RM365 Advantage Risk Management Center or contact our Client Services Coordinator Alyssa Burley at aburley@ranchomesa.com.

If you are not a current client of Rancho Mesa, we encourage you to reach out to your broker for assistance or email Alyssa Burley to get additional information or to ask any questions.

Independent Contractor Classification Changes Expected to Impact Construction Industry

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services.

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services. Under the new test, a worker is considered to be an independent contractor only if all three of the following factors are present:

- The worker must be free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- The worker must perform work that is outside the usual course of the hiring entities business;

- The worker must be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

These new factors have major implications for contractors, or any business for that matter, where previously they had classified a worker as an independent contractor and now have to classify them as an employee. This will impact several lines of insurance, but most critically workers' compensation, general liability and employee benefits.

Workers' Compensation

Currently, if an employee is classified as an independent contractor, they would not be subject to any workers' compensation premium nor workers' compensation benefits. If their status should change to employee, they now would be entitled to workers' compensation benefits and would have their payroll accounted for in the employer’s premium. In addition, based on the work being performed, this may change the employer’s risk profile, creating negative underwriting consequences in the workers' compensation carrier marketplace, resulting in coverage not being offered or higher premiums.

General Liability

The impact to general liability insurance is very similar to that of workers' compensation. Additional payroll or sales will need to be accounted for as the employer will become directly responsible for the work being performed without the benefit of any hold harmless agreement or other risk transfer methods. This could potentially change the risk profile of the employer’s operations, which could result in the employer needing to provide additional underwriting information.

Employee Benefits

Since 1099 contract workers are not employees and are considered self-employed, they do not show on the Quarterly Wage and Withholding Report (DE9 and DE9C) to the State of California. Because of this status, they typically cannot enroll in a group health insurance plan. Many workers who are now classified as independent contractors will be considered employees in the eyes of the state and will be eligible for group benefit offerings from their employer.

Employers may need to reevaluate their group size to ensure that they remain compliant with the Affordable Care Act (ACA). Employers with 50 or more full-time employees working a minimum of 30 hours per week, and/or full-time equivalents (FTEs) must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to age 26, or be subject to penalties.

While these changes are new and just beginning to take affect, we believe your best strategy moving forward is to consult with your trusted advisors in legal, accounting and risk management. This will have a significant impact to the construction industry throughout California and we intend to take a leadership role in helping those companies with concerns and questions. So, please reach out to our Rancho Mesa Team to help you navigate these changes. Contact Alyssa Burley at aburley@ranchomesa.com for assistance.

Berkshire Hathaway Homestate Companies and Rancho Mesa Participate in Nationally Renowned LANDSCAPES 2017

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Berkshire Hathaway Homestate Companies and Rancho Mesa Insurance Services NALP Program Team

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

The group consisted of Senior Vice President Margaret Hartmann, NALP Assistant Director of Underwriting Valerie Contreras, NALP Program Underwriter Davis Cooper, NALP Client Services Coordinator Emily Docuyanan, and NALP Senior Loss Control Specialist Steve Hamilton from BHHC, and agency Principal Dave Garcia and NALP Program Director Drew Garcia from RMI.

Davis Cooper, NALP Program Underwriter, Berkshire Hathaway Homestate Companies

The BHHC and RMI group participated in a multitude of event programs as speakers, ambassadors, and audience. BHHC and RMI championed four breakfast table topics, a breakout education session based on risk mitigation and cost savings, and took time to speak with association members about the program within National Association of Landscape Professionals' (NALP) booth at the expo.

NALP Program Board Presentation

Sam Steel, NALP Safety Advisor & Steve Hamilton, BHHC

Membership Meeting

“The event was a great success," said Dave Garcia. "It’s amazing to see so many like-minded people dedicated to improving themselves and their companies while building upon the professionalism this industry holds as standard. We are so proud to be a part of this amazing industry and look forward to a long lasting partnership with NALP for years to come.”

NALP Group

Davis Cooper and Drew Garcia at the booth

Davis Cooper speaking with attendees at the booth

I really enjoyed connecting with NALP members and learning about their individual companies. LANDSCAPES provides an environment for motivated industry professionals to share ideas, learn, and form long lasting relationships. The overwhelming commonality is this identified desire for industry veterans to give back to the community that helped them succeed. It’s easy to build off that energy and puts into perspective that our Work Comp Program is providing the level of specialized attention this industry deserves. I'm excited to keep the momentum going while constantly looking for ways to improve our product so that we can provide more to lawn and landscape professionals.

For more information about the NALP Workers' Compensation Program, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Workers' Compensation Dual Wage Thresholds Increases for Construction Classes in 2018

Author David J. Garcia, C.R.I.S., A.A.I., President Rancho Mesa Insurance Services, Inc.

In an effort to keep you informed, so that you can begin to plan your 2018 budget, we wanted to let you know of a potential change in the dual wage classes, for many but not all, the dual wage construction class codes.

Author David J. Garcia, C.R.I.S., A.A.I., President Rancho Mesa Insurance Services, Inc.

Updated September 15, 2017 The Workers’ Compensation Insurance Rating Bureau has confirmed the following increases for the 2018 dual wage construction classifications. |

Originally published on May 12, 2017.

In an effort to keep you informed, so that you can begin to plan your 2018 budget, we wanted to let you know of a potential change in the dual wage classes, for many but not all, the dual wage construction class codes.

The Workers’ Compensation Insurance Rating Bureau is proposing increases in the wage threshold for ten different construction industry dual wage classifications and is likely to recommend an increase in an eleventh, by the time it releases its 2018 regulatory filing, next month. The proposed increases range from $1.00 to $2.00 per hour, to keep the thresholds in line with wage inflation. See the chart below for the actual changes.

Dual Wage Thresholds

| Classification | Current Threshold | Recommended Threshold | Threshold Difference | Last Changed |

|---|---|---|---|---|

| 5027/5028 Masonry | $27 | $27 | $0 | 2013 |

| 5190/5140 Electrical Wiring | $30 | $32 | $2 | 2014 |

| 5183/5187 Plumbing | $26 | $26 | $0 | 2014 |

| 5185-5186 Automatic Sprinkler Installation | $27 | $27 | $0 | 2009 |

| 5201-5205 Concrete or Cement Work | $24 | $25 | $1 | 2009 |

| 5403/5432 Carpentry | $30 | $32 | $2 | 2016 |

| 5446/5447 Wallboard Application | $33 | $34 | $1 | 2016 |

| 5467/5470 Glaizers | $31 | $31/further study | $1 | 2016 |

| 5474/5482 Painting/Waterproofing | $24 | $26 | $2 | 2009 |

| 5484/5485 Plastering or Stucco Work | $27 | $29 | $2 | 2014 |

| 5538/5542 Sheet Metal Work | $27 | $27 | $2 | 2009 |

| 5552/5553 Roofing | $23 | $25 | $2 | 2009 |

| 5632/5633 Steel Framing | $30 | $31 | $1 | 2016 |

| 6218/6220 Excavation/Grading/Land Leveling | $30 | $31 | $1 | 2014 |

| 6307/6308 Sewer Construction | $30 | $31 | $2 | 2014 |

| 6315/6316 Water/Gas Mains | $30 | $31 | $2 | 2014 |

Rancho Mesa will keep you informed should the proposed 2018 change go into effect. If you have any questions, please give us a call at (619) 937-0164.

Your Rancho Mesa Team - RM365 Advantage

Uninsured and Underinsured Motorists Coverage - Are Your Limits Adequate? - Be Careful!

Author, David J. Garcia, A.A.I., CRIS, Rancho Mesa Insurance Services, Inc.

Earlier in the year, we published the article "Commercial Auto Premiums Are Rising - What’s Driving the Increases?," which addresses how insurance companies are all experiencing adverse loss experience within their commercial automobile books of business. The result of these mounting losses is causing a dramatic rise in commercial Auto premiums for most policyholders.

Author, David J. Garcia, A.A.I., CRIS, Rancho Mesa Insurance Services, Inc.

Earlier in the year, we published the article "Commercial Auto Premiums Are Rising - What’s Driving the Increases?," which addresses how insurance companies are all experiencing adverse loss experience within their commercial automobile books of business. The result of these mounting losses is causing a dramatic rise in commercial Auto premiums for most policyholders.

As a result of this trend, we are seeing many carriers and brokers reducing coverage limits and terms on certain lines of automobile coverage. This represents a major concern for any business owner that has any size fleet of vehicles. Reducing limits and/or modifying terms of coverage simply transfers more claim exposure directly to the business owner. And, unfortunately, in many cases, business owners are unaware of the change or ill informed.