Industry News

Experience Mod KPI Provides Trend Analysis, Opportunity Assessment, and Vital Management Tools

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

In January 2021, we launched the Safety Key Performance Indicator (KPI) Dashboard to provide a tool for our customers to use as a bridge between their experience mod and safety performance.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

In January 2021, we launched the Safety Key Performance Indicator (KPI) Dashboard to provide a tool for our customers to use as a bridge between their experience mod and safety performance.

Our primary goals were to:

Eliminate surprises

Simplify concepts

Track performance

Highlight the positive and negative trends

Benchmark safety performance against industry competitors

An experience mod above 100 can limit a landscape company’s ability to be awarded jobs or maintain contracts, increase insurance premiums, and have other significant financial implications.

Our dashboard is a tool companies can use to strategically manage the underlying components that directly impact the experience mod and help project future experience mod deviations. Rancho Mesa can help interpret the results and provide insights to help improve your performance.

Not a Rancho Mesa client but interested in seeing what your dashboard looks like? Complete our new KPI Dashboard quick form, to see how your company measures up.

California’s Landscape Industry Prepares for Ex-Mod Changes

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

For the first time in several years the Expected Loss Rate for class code 0042 has increased from $2.38 to $2.42, a 2% increase.

Bottom line, although very minimal, this should help bring the experience mod down.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

For the first time in several years the Expected Loss Rate for class code 0042 has increased from $2.38 to $2.42, a 2% increase.

Bottom line, although very minimal, this should help bring the experience mod down.

This information will impact any landscape company who has a policy effective date of September 1, 2021 and beyond.

Based on a couple of projection comparisons, we have seen an impact of 1 to 4 points come off the experience mod for landscape companies.

Landscape companies working with Rancho Mesa with policy effective dates after 9/1/2021 will see updated information on their KPI Dashboard, at the next review.

For landscape companies not working with Rancho Mesa, you can request a custom KPI Dashboard today by reaching out to Drew Garcia.

Four Factors that Shape your Risk Profile

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

How do you differentiate your company from your local competitors? Product, customer service, delivery, etc. The same can be said for your risk profile and insurance costs. Why are my insurance rates high when my competitors are low? This article breaks down four factors that influence your risk profile and impact pricing.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

How do you differentiate your company from your local competitors? Product, customer service, delivery, etc. The same can be said for your risk profile and insurance costs. Why are my insurance rates high when my competitors are low? Here are four factors that influence your risk profile and impact pricing:

FREQUENCY OF CLAIMS

The frequency is the number of workers’ compensation claims you average.

Calculation – # of claims / basis

Evaluate – How often are you having workers’ compensation claims and how does that compare to other landscape companies in your region or state? If frequency is high, a line can be drawn to conclude that your high frequency will lead to more lost time or severe injuries.

Action – If you are having a frequency issue, you need to assess:

Injury Type (back, hand, wrist, knee…)

Root Cause (lifting, punctures, slips…)

Implement corrective actions to help mitigate the risks associated with your claims.

Take it to the next level and evaluate “near misses.” Treat a “near miss” as if it were a claim and strategize a corrective action to prevent it from happening in the future.

Use our Risk Management Center to assign a training to the foremen or supervisor and injured employee to help prevent this from occurring in the future.

Indemnity (Lost Time) Claims

Indemnity is the number of lost time claims your company experiences.

Calculation – # of lost time claims / basis

Evaluate – How often are you having indemnity claims that result in lost time and how does that compare to other landscape companies in your region or State?

Action – If you are having an Indemnity issue, you need to assess:

Injury Type (back, hand, wrist, knee…)

Root Cause (lifting, punctures, slips…)

Implement corrective actions to help mitigate the risks associated with your claims.

Establish a “return-to-work” program which allows your injured employees an opportunity to come back to work on limited duty.Improve accident investigation, documentation, and claim reporting protocols to equal best practices.

Experience Rating

Your experience rating is a combination of your loss data and total payroll when compared to your industry typically over a three year period. Your experience rating will either credit or debit your workers’ compensation premium accordingly.

Calculation – Project your Experience Modification (XMOD) 6 months early at your Unit Stat filing.

Evaluate – Determine the impact changes in your Expected Loss Rate (ELR) and Primary Threshold will have on your next XMOD.

Action – Controlling your frequency of claims and number of indemnity claims will lower your Experience Modification.

Operations

Heavier operations would include hardscape construction, tree trimming, and snow removal in which generally heavier machinery and product is used, thus a higher exposure to injury. Compare these types of landscape operations to a lighter exposure such as landscape maintenance, mowing, edging and pruning.

Calculation – Determine the percentages of your operations that fall into the various landscape work areas.

Evaluate – Identify the exposures that are unique to each area of your operations.

Action – Implement safety programs catered to your exposures that will mitigate risk and help protect your employees. Although your operations might be heavier, you have the ability to implement tactics to reduce or prevent the claims from happening, thereby subjectively and objectively making your risk profile more appealing.

We have seen 100% landscape construction firms achieve industry low experience XMODs and the markets most aggressive rates. Don’t wait for the injury to occur; be proactive and stop the claim before it transpires.

Your risk profile has already been created whether you know it or not. The opportunity for you to own it and improve it is always available.

With one click of the mouse, you can see how you stack up against your competitors through our Key Performance Indicator (KPI) dashboard, today.

Contact me to get a customized KPI dashboard at (619) 937-0200 or drewgarcia@ranchomesa.com.

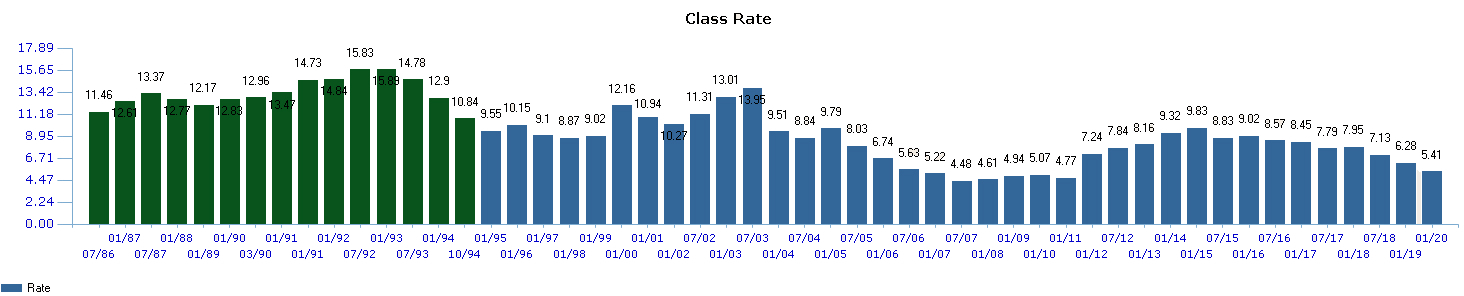

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

Safe Cloud Computing for Contractors

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Even prior to the COVID-19 pandemic, many construction companies were utilizing some form of cloud-based systems to effectively streamline business operations and increase accessibility of information. While hosting sensitive data in the cloud has many benefits like shared access to data, applications and storage, there are some risks contractors should take into account before relinquishing their data to the cloud.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Even prior to the COVID-19 pandemic, many construction companies were utilizing some form of cloud-based systems to effectively streamline business operations and increase accessibility of information. While hosting sensitive data in the cloud has many benefits like shared access to data, applications and storage, there are some risks contractors should take into account before relinquishing their data to the cloud.

A leading provid//er of Cyber Liability insurance, CNA references three key risks companies utilizing cloud technology need to be aware of in an recent article, “Cloud computing 101: Getting clear about the cloud.” CNA explains data protection, data loss/disruption and inappropriate access are risks business take on in exchange for the benefits of cloud computing.

Data Protection

Protecting data is essential for any organization. Customers’ personal and payment information may be stolen by hackers once the data is stored in the cloud or even while in transit. So, your data in the cloud must be secured through encryption to prevent the data from being usable if stolen. As the cloud customer, the company should manage the encryption keys to ensure only authorized users can decrypt the data.

Data Loss / Disruption

You may be thinking about moving your data to the cloud as a way to protect it from electrical outages, fire, flood and other natural disasters. However, your cloud hosting provider can be left inoperable due to similar calamities. Before hosting your data in the cloud, review your host’s back-up and redundancies to ensure there will be a copy of your data available if something should happen to the host’s servers. Have a plan in place to help navigate your most critical information in the event something like this occurs.

Inappropriate Access

When storing data in the cloud, it is imperative the company ensures stringent and complex user authentication. This may mean passwords are changed frequently or two-factor authentication is deployed to ensure hackers can’t find their way to your data. When you manage a large user-base, the risk rises. Ensure former employees no longer have access to your data by changing security rights or disabling their account. Complex user authentication can be an effective deterrent to keep those who should not have access to your information from finding their way into your network.

Assuming your information is safe and secure in the cloud is misleading. Be proactive in protecting your information and round out your risk management program with a strong cyber liability program that can fulfill your cloud based risk needs.

For more information about the CyberOne™ program, contact Rancho Mesa.

Article edited 4/19/2021.

Landscape Companies with Low Experience MODs Do These 5 Things

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

The XMOD/EMR is a unique number assigned to a business that is made up of their historical loss figures and audited payroll information vs. the same information for companies involved in the company’s same industry. Generally, if your business has experienced more claim activity than the industry average, you will have a XMOD/EMR above 1.00. The opposite is true; if you have had less claim activity, your XMOD/EMR will be below 1.00. The XMOD/EMR impacts the rates you pay for workers’ compensation by crediting (XMOD/EMR below 1.00) or applying a surcharge (XMOD/EMR above 1.00).

Here are the 5 best practices used by landscape companies who have an XMOD/EMR) below 1.00.

1. An Aggressive Return to Work Program

If you heard our podcast episode with Roscoe Klausing of Klausing Group, you will hear him coin the phrase an “aggressive return to work program” which was a key component to his company, of more than 70 employees, going 3 years without a lost time accident.

Aggressively finding a way to help bring an injured employee back on modified work restrictions has long been proven to provide positive outcomes for everyone involved. Benefits of bringing an employee back on modified duties include:

Eliminating temporary disability payments from the claim cost.

Lower the dollar amount of medical treatments.

Reduce the overall cost of the claim.

Lower the potential impact the claim would have on your XMOD/EMR.

Improve injured employee morale.

2. Timely Reporting and Accident Detail

It is critical to constantly remind your front line supervisors and employees that they must report all injuries no matter the severity as soon as possible. Studies have shown that work related injuries reported with the first 5 days have a dramatically lower average claim cost and litigation rates than those reported after 5 days.

Two measurable statistics for you to keep an eye on are:

The lag time between when an injury is reported to you from an employee.

The amount of time it takes you to report this information to your insurance carrier.

By conducting a thorough accident investigation at the time of injury and providing a report to your insurance claim professional, you will speed up the claims process and lower costs. Eliminating the time delays caused by the claim professional waiting for details or additional information is critical in making sure your injured employee is on the fast track to recovery. To assist the landscape industry in completing this necessary step, Rancho Mesa has created a free, fillable, carrier approved accident investigation report for use by the landscape industry.

3. Communication

Keeping in constant communication with employees who are injured is vital to a positive outcome. At times, the workers’ compensation process can seem slow. Some injuries will take longer than others. This can lead injured employees to feel frustrated and uncertain. Make sure you are addressing their concerns and checking in on them, frequently.

4. Know the Basic Principles Behind the XMOD/EMR

You do not need to know the XMOD/EMR formula, but you should have an understanding of the basic concepts that leads to XMOD/EMR inflation.

You should know when your claim information will be sent to your rating bureau for next year’s XMOD/EMR calculation and make sure you are familiar with the status of each claim before the information is locked.

If your rating bureau uses a Primary Threshold or Split Point, it is good to understand how this number impacts claim cost and each claim’s impact on the XMOD/EMR.

Know your lowest possible XMOD/EMR, this would be all your payroll with zero claims. The points between your lowest possible XMOD/EMR and your current XMOD/EMR are the controllable points.

Know the policy years that are used to calculate the XMOD/EMR.

5. Relationship With Your Carrier and Claims Professional

The carrier claims professional who handles your injuries can have a huge impact on the outcome of the claim. If you are fortunate enough to have a dedicated claim adjuster assigned to your company, make it a point to call and introduce yourself before the first claim occurs. The adjuster should have a very good understanding of:

Your attitude and policy regarding return to work programs.

The level of accident information they will receive from you.

Who will be your company’s main contact throughout the claim process?

Consider these five best practices when handling your workers’ compensation claims to keep your XMOD/EMR under control and your workers’ compensation costs low.

How COVID-19 Might Create a Non-Owned Auto Liability Gap

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

As landscape businesses continue to adapt operating protocol due to COVID – 19, they may also be creating new risk. Newly formed “work from home” policies for the office staff and direct reporting to job sites for workers in the field can create more of a non-owned auto liability exposure.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

As landscape businesses continue to adapt operating protocol due to COVID-19, they may also be creating new risk. Newly formed “work from home” policies for the office staff and direct reporting to job sites for workers in the field can create more of a non-owned auto liability exposure.

In the event someone is using their personal vehicle for the benefit of the company and were to be involved in an accident, the liability might fall partially or completely on the employer. A non-owned vehicle is not owned, leased, rented, hired, or borrowed by the company.

In order to ensure you have non-owned auto liability, you would want to confirm that you have symbol 9 under the liability portion of your Commercial Auto Insurance Liability Policy, found in the declarations page. You should confirm that you have non-owned liability coverage with your insurance agent, broker, or carrier.

Your company should establish driver qualification requirements that must be maintained and met for each driver. It is best practices that you run motor vehicle reports annually, at minimum, for all drivers including those with non-owned driving exposure. For those states where it’s available, contact the Department of Motor Vehicles and inquire about a Pull Program where they’ll notify you of any violation on any driver that you have set up in the program. It is also best practices to have those employees who drive non-owned company vehicles for business use to increase their personal auto policy limits at minimum to $100,000 per person, $300,000 per occurrence and $100,000 property damage. If using a combined single limit, $300,000 should be required at minimum.

Work Comp Unit Stat: The Meeting That Saves You Money

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) defines the process of receiving loss and payroll information by classification as the Unit Statistical Report. The information is reported to the WCIRB by insurance carriers at specific intervals based on your company’s policy effective date. The information is valued for the first time 18 months after the inception of your policy and every 12 months thereafter.

A policy that incepts in January 2020 will be valued for the first time in July of 2021 (18 month mark). This information will remain in your XMOD calculation for the valuations at 30 months and 42 months.

Once this information has been received by the WCIRB, from the respective carriers, it cannot be altered or changed until the following year’s unit stat. Thus, you may have a positive outcome on an existing open claim (reserve reduction or closure) but not see the benefit until the following year. Revisions to the XMOD once published are limited to a few circumstances; more information about revisions can be found here.

The loss information, sent to the WCIRB from the insurance carriers, will be evaluated at the paid (closed claim) or reserved (open claim) amounts. Typically, a claim that has been open for longer than 18 months signifies severity, litigation, lost time, permanent disability, or a combination of the group. For this reason it is absolutely critical that as a part of your risk management process you execute a

pre-unit stat meeting.

When should I schedule my Unit Stat meeting?

What should I do at this meeting?

Who needs to be involved?

How will this meeting save me money?

As a client of Rancho Mesa, we build this meeting into your annual service plan and take care of engaging the parties who need to be involved for the betterment of your XMOD.

Ready to learn more about Unit Stat? Join us for a complimentary 25-minute webinar where we will discuss the process in greater detail and take time for Q&A.

Still not sure if further learning is necessary, ask yourself these questions:

Have you ever been surprised by your XMOD being higher than you would have thought?

Have you ever had an XMOD above 1.00?

Has your XMOD ever caused your premium to increase?

The webinar can be viewed on-demand by clicking the link below.

Autonomous Mowing – Are you Covered?

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Autonomous mowing is becoming more common in commercial and residential landscape management. As the market begins to adapt and utilize this technology it creates a very unfamiliar and unique exposure for you and your General Liability carrier.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Autonomous lawn mowing is becoming more common in commercial and residential landscape management. As the market begins to adapt and utilize this technology it creates a very unfamiliar and unique exposure for you and your general liability carrier.

Commercial General Liability Policies should be written specific to your type of operations, including the coverages needed to protect your landscape company in the event of claim. The insurance marketplace has a general understanding of the common exposures that face a landscape contractor; from installation, to maintenance, and chemical application. Policies are written on the basis of annual sales or field payroll. When automated mowing is offered as a service from the contractor, the insurer would need to charge a premium to pick up the exposure. If the policy is written on a payroll basis then a direct premium will not be charged for the automated mowing operations, as there is no payroll associated with the mowers performance. The policy could also be written on a sales basis with clarification of estimated sales between autonomous mowing vs. the remainder of your operations to the insurance underwriter, so the appropriate rate can be charged. In either case, it is very important that the underwriting carrier has a clear understanding of your operations in order to determine the final pricing.

Whenever you have a change in your operations, such as the use of autonomous mowing, it is critical that you notify your insurer so they can properly assess the exposure and acknowledge that coverage would extend in the event of a claim.

Here are a few questions we use to help negotiate with the insurance marketplace when autonomous mowing is a part of the operations:

How quickly will the blades disengage if the unit was picked up while moving?

If the mower was to bump into someone/something will it divert the other way?

What is the set back of the blades from the perimeter of the mower?

How does it maintain its boundaries?

Will it be left on site?

What time of day will it run?

How is it powered?

Who has control of the mower while it is on?

How can the mower be turned off?

Do not let the carrier find out about your autonomous mowing operations at audit, or worse at the time of a claim.

Finally, consider coverage for the machine itself if it were to be stolen, damaged, or totaled. Adding the mower to your Commercial Inland Marine policy will provide coverage for the equipment. The valuation of this coverage would be detailed in the policy. Be sure to communicate where the mowers will be stored while not in use and the security functions installed on the device to protect against theft.

For more information or questions you might have about this topic or landscape insurance in general please contact the Drew Garcia at (619) 937-0200.

CAL/OSHA Emergency Rule Adopted for Wildfire Smoke

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Author, Steve Hamilton, Loss Control Supervisor, Berkshire Hathaway Homestate Companies.

On Thursday, July 17 2019, the California Occupational Safety & Health Standards Board voted to adopt an emergency standard requiring employers to take action when air quality particulate matter measures greater than 150 and when there is reasonable expectation that employees will come in to contact with wildfire smoke.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Author, Steve Hamilton, Loss Control Supervisor, Berkshire Hathaway Homestate Companies.

On Thursday, July 17 2019, the California Occupational Safety & Health Standards Board voted to adopt an emergency standard requiring employers to take action when air quality particulate matter measures greater than 150 and when there is reasonable expectation that employees will come in to contact with wildfire smoke.

While this may seem new to many employers, it is technically an extension of regulations currently in place including the respiratory protection standards for employees and the need to address identified hazards in the workplace. As an employer it is critical that you follow the hierarchy of controls to ensure your employees’ safety in the field. If possible, eliminate the hazard by shutting down the workforce for the day. Employees should remain indoors until particulate levels fall to acceptable. If this is not possible, try to limit the workday by rotating employees who must work outdoors, remaining cognizant of the hazards in the air and allowing employee’s time to recover in appropriate indoor areas. If neither of these options are possible, consider providing N95 respiratory protection masks.

Please remember that any type of respiratory protection provided to employees must also be accompanied by applicable training, pulmonary exams, communication on proper usage/storage and others. Links to the applicable programs can be found at this address along with sites to help you monitor air quality: https://www.dir.ca.gov/dosh/Worker-Health-and-Safety-in-Wildfire-Regions.html

This site has additional training resources in English and Spanish, handouts on proper usage of N95 masks and the history of the standard as it has been submitted. Cal/OSHA wants you to have the resources you need to effectively address the risk potential.

At this point, the regulation is on its way to the Office of Administrative Law for approval and if deemed compliant, it will go into effect 10 days after it is received. This would mean the regulation could go into effect before August.

An advisory committee will meet August 27, 2019 to begin work on a permanent version of the regulation.

If you have any questions about ways to enhance regulatory compliance, please reach out to your local resources including your insurance agent, workers’ compensation insurance safety professionals, and Cal/OSHA Consultation.

Top 5 Free Safety Apps for Landscape Contractors

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Mobile devices have become an invaluable tool for many people, on the job. They provide access to contacts, email and applications (i.e., apps) that can make work a lot simpler and safer for landscapers. We researched the top apps that boost worker safety. In no particular order, here are the top 5 free safety applications for the landscape industry.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Mobile devices have become an invaluable tool for many people, on the job. They provide access to contacts, email and applications (i.e., apps) that can make work a lot simpler and safer for landscapers. We researched the top apps that boost worker safety. In no particular order, here are the top 5 free safety applications for the landscape industry.

OSHA-NIOSH Heat Safety Tool

This app allows workers and supervisors to monitor the heat index for any jobsite. By utilizing the apps features any user can get a reminder about the proper safety precautions and proactive measures that should be taken under the given conditions. It is available in both English and Spanish (to access Spanish, set phone language to Spanish).

Red Cross First Aid

This app provides access to information on how to properly handle first aid emergencies. It is available in both English and Spanish.

Chemical Safety Data Sheets - ICSC

This concise app offers searchable information on substances, delivered in a simple manner. It is only available in English.

NIOSH Sound Level Meter

This app quickly monitors the level of noise exposure in order to judge and evaluate if further testing is needed. It is available in both English and Spanish.

NIOSH Ladder Safety

This interactive ladder safety application is used to assist the worker in positioning a ladder at an optimal angle. It is available in both English and Spanish.

There are many applications employers can use on devices to help improve their safety program, formalize trainings, and consolidate information.

If you use an application (with or without a fee), we would like to hear about it, so we can share with all of our safety-minded clients. Please send your feedback to Alyssa Burley, aburley@ranchomesa.com.

Pollution Liability for Landscape Contractors

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Most Landscape Contractors believe their exposure to pollution is limited to the herbicides, pesticides, and fertilizers they apply. In order to provide some limited coverage for this it is common to see the Herbicide/Pesticide Endorsement added to the Commercial General Liability Policy. Although the endorsement extends some coverage, Contractor’s Pollution Liability would help fill the gaps created by the General Liability Policy for all of the landscape contractor’s pollution exposures.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Most landscape contractors believe their exposure to pollution is limited to the herbicides, pesticides, and fertilizers they apply. In order to provide some limited coverage for this it is common to see the Herbicide/Pesticide Endorsement added to the Commercial General Liability Policy. Although the endorsement extends some coverage, Contractor’s Pollution Liability would help fill the gaps created by the General Liability Policy for all of the landscape contractor’s pollution exposures.

Remember, General Liability Policies do not provide coverage for pollution. Contractors Pollution is protecting your environmental liability, and in today’s world the awareness to preserve the environment has never been stronger. A landscape contractor’s exposure to environmental liability is considered “high” and classed as “high” along with drilling, subsurface, site/dirt work, paving, mechanical and electrical contractors to name a few.

Landscape contractor operations are almost exclusively performed outdoors in the environment which is the result of the high exposure. Beyond herbicide, pesticide, chemical applications and the property damage or bodily injury that may arise from such operations, other material exposures would include but are not limited to; fuel, oil, fumes, hydraulic fluids, silica, foundry sand, manure, dust, waste, water, natural gas, propane and mold.

The Herbicide Pesticide Endorsement is an essential piece to any landscape contractor’s insurance program; however, a Contractors Pollution Liability policy is the best way to transfer your environmental exposure. Not all pollution policies are the same: capacity, coverage, exclusions and deductibles need to be examined. Making sure you have a policy that fits your operations and your exposure is critical.

For questions about which policies may match your company’s risk, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Higher Workers' Compensation Premiums Linked to New Employee Injuries

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Based on Rancho Mesa Insurance Services’ client’s information, we have been able to identify that the majority of work-related injuries occur within the first year of employment. During the first year, the majority of these claims occur in the first six months. Having a system for onboarding and training new hires is a critical component to dealing with the heightened risk of injury during this time period.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Based on Rancho Mesa Insurance Services’ clients’ information, we have been able to identify that the majority of work-related injuries occur within the first year of employment. During the first year, the majority of these claims occur in the first six months. Having a system for on-boarding and training new hires is a critical component to dealing with the heightened risk of injury during this time period.

New Hires Effect Risk Exposure

During the workers’ compensation underwriting process, companies are commonly asked if their payroll will continue to grow, stabilize, or decline. Underwriters can assume that with growing payrolls, the company will be hiring new employees. New employees will likely increase the probability of work-related injuries. Underwriters must take this information into consideration when justifying a premium that will cover the company’s complete risk exposure.

Mitigating the Increase in Premium

It is extremely beneficial for the owner and insurance broker to relay the measures that their company has committed to train, manage, and track new hires. If you are looking for a way to improve your safety efforts, consider focusing on proper new employee onboarding and training to minimize the potential impact claims can have on your company.

Please reach out to Rancho Mesa’s Client Services Coordinator Alyssa Burley at (619) 438-6869 to learn more about the Risk Management Center and how you can improve your safety training.

2019 Expected Loss Rates Published in California’s Updated Regulatory Filing – X-MOD Impact Inevitable for 0042 Class Code

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay for all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

Under most circumstances, when you hear the word decrease as associated with insurance its a good thing, but in the case of the ELR, a decrease will have a negative impact on your Experience MOD (X-MOD). In simple terms, if your losses stay the same and the ELR for your industry is down 15%, your X-MOD is going to go up.

At 15%, the landscape class code accounts for one of the largest swings in the 2019 regulatory filing for all industries. This only reinforces the importance of mitigating claim frequency, superior carrier claims handling, internal claims advocacy, claim cost consolidation efforts, and a proven system to keep all of these aspects running constantly. Fortunately, Rancho Mesa has a system in place today and it is a proven success.

Don’t be caught off guard in 2019; have a plan and always anticipate for the future. Let Rancho Mesa help manage your landscape insurance needs. For more information, call (619) 937-0164.

Focus on preventing Back Injuries: Introducing Rancho Mesa’s A.B.L.E Lift Protocol and the “Field” Mobility & Stretch Program

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services.

Physical work is demanding on our bodies. As the employer, what are you doing to help your employees prepare for the day’s work? Collectively, the most severe injuries come from the lower back by way of strain or sprain as a result of lifting. It’s not always the heavier objects causing the injuries. In many cases, early morning “light” lifts or movements can quickly cause a strain or sprain.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services.

Mobility & Stretch Program and ABLE Lift Protocol flyers.

Physical work is demanding on our bodies. As the employer, what are you doing to help your employees prepare for the day’s work? Collectively, the most severe injuries come from the lower back by way of strain or sprain as a result of lifting. It’s not always the heavier objects causing the injuries. In many cases, early morning “light” lifts or movements can quickly cause a strain or sprain. Eliminating lifting exposures is the ultimate solution to limiting back strains; however, it is not always possible. Interactively training your employees to accurately lift material with proper technique is a preventive approach you can implement today to limit your businesses lifting exposure.

Following the success of our “Truck” Mobility and Stretch Program, Rancho Mesa is excited to announce, in conjunction with Collin Dawson CPT., A.B.L.E. “Lift” Protocol to help physically train your employees to execute proper lift decision making and establish the correct physical eliminates it takes to perform a lift. Not all lifts are the same, each one contains different variables, but the same simple body positioning and lift techniques are relevant no matter the exposure.

Our “Truck” Mobility and Stretch Program was highly received and ultimately implemented by many of our clients. Over the past nine months we have worked to address the need for a Mobility and Stretch Program to be lower back specific, but with the ability to perform the exercises without the support of a truck or wall.

We knew the Mobility and Stretch Program would be beneficial. We were surprised to see the amount of clients willing to incorporate this program and ultimately are very pleased with the results, almost one year in. We challenged Collin to create another program that could be performed in a group setting without sacrificing the main purpose of the routine, which is to flex and strengthen the core muscles surrounding the back while providing total body activation. Our “Field” Mobility and Stretch Program does just that, but also provides some opportunity for participants to slowly begin to establish a better center of balance and body awareness, which can be practically applied to the work day and life. We hope this program will be just as well received.

Register for October 25, 2018 webinar where we will detail A.B.L.E. Lift and the recently developed “Field” Mobility and Stretch Program. Only those who attend the webinar will receive the following:

A PDF Mobility and Stretch Program branded to your company (upon request, 10-15 business days to process) “Truck” and “Field” Series

PDF version of A.B.L.E. Lift (8.5x11 and Poster Size)

Recognition on Rancho Mesa website for your participation in the workshop

30-minute complimentary phone assessment with Collin Dawson about these programs and further implementation strategies.

And remember, “Only lift if you are A.B.L.E.”!

How To Lower Your Experience MOD by Understanding Your Primary Threshold

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

How do I decrease my MOD to lower my workers compensation premium?

A few factors can be addressed to reduce the workers' compensation premium. The most important is the primary threshold. Each individual employer has their own primary threshold that is determined by the class of business they operate and the amount of field payroll they accrue over a three year period. The primary threshold is the point at which any claim maximizes its negative impact on the MOD. You must be sensitive to this number because any open claim with paid amounts under the threshold, provides an opportunity to save points to the MOD. Once a claim exceeds paid amounts over your threshold, it no longer can negatively impact your MOD. However, you would still want to monitor and manage these claims to ensure your injured employee is being provided attentive care and to maintain knowledge of your loss experience.

Example

You’re a landscaping company and your primary threshold is $33,000. The most any claim can affect your MOD is $33,000 and the most points that any claim can add to your MOD is 13.

You have a claim open for $40,000 with paid amounts of $10,000 and reserved amounts of $30,000.

This claim will go into the calculation at $40,000 (Paid + Reserved) but because the total amount succeeds the primary threshold of $33,000, it will only show up on the rating sheet totaling $33,000 of primary loss and contribute 13 points to your MOD.

It would behoove you to analyze and monitor this open claim, because it has paid out amounts well below your primary threshold of $33,000.

If this same claim closes for a total paid amount of $22,000, the closed claim would go into your MOD at $22,000 with 8 points contributing to the MOD.

The difference between a $40,000 claim and a $22,000 claim is 5 points to your MOD, or, 5% to your premium!

Knowing your primary threshold is the most important piece of information when managing your XMOD. Fortunately, Rancho Mesa can help you manage your experience MOD by tracking your primary threshold and maintaining the other critical elements that go into establishing a sustainable low experience MOD.

For more information about lowering your experience MOD or a detailed analysis of your current MOD please reach out to Rancho Mesa.

Below is an example worksheet for Landscapers to determine the primary threshold.

| Annual Landscape Payroll | 2018 Primary Threshold | Max Points to MOD | Lowest MOD |

|---|---|---|---|

| $100,000 | $5,500 | 53 | .84 |

| $250,000 | $10,000 | 38 | .75 |

| $500,000 | $15,500 | 30 | .65 |

| $1,000,000 | $22,000 | 21 | .56 |

| $1,500,000 | $26,000 | 17 | .51 |

| $2,000,000 | $30,000 | 14 | .47 |

| $2,500,000 | $32,000 | 12 | .45 |

| $3,000,000 | $35,000 | 11 | .42 |

| $5,000,000 | $41,000 | 8 | .36 |

| $10,000,000 | $40,000 | 5 | .30 |

Ask the Expert: Insurance Questions from the Lawn and Landscape Industry

Author, Drew Garcia, NALP National Program Director, Rancho Mesa Insurance Services, Inc.

Drew Garcia answers common insurance questions for the landscape industry.

Author, Drew Garcia, NALP National Program Director, Rancho Mesa Insurance Services, Inc.

How can I control and/or lower my experience rating?

Without getting into detail about the formula or governing insurance bodies, here are some key items to focus on in order to lower your experience rating (i.e., experience modification, MOD), no matter your jurisdiction.

Frequency vs. Severity (Proactively Track and Eliminate the Claim Before it Happens)

Analyze your work related injuries and near misses to search for trends that will help to prevent similar claims from occurring. Your rating will typically see more of a negative impact with multiple claims (frequency) as opposed to one large loss (severity). Frequency drives the probability for more claims to occur in the future which would make your company a higher risk to insurer.

Return to Work (Make it Mandatory)

All claims may potentially impact the experience rating in one way or another, with frequency having a large role in the mathematical formula. Another key part of managing claim costs is the focus on reducing indemnity expenses on every claim. By returning an employee to work you eliminate any claim cost that would have been allocated to temporary disability. The savings you will see on your experience MOD is remarkable. If you need help creating a return to work program, reach out to your workers compensation insurance carrier for guidance. If you decide to implement any of these strategies going forward, implement a mandatory Return to Work program.

Example:

An injured employee will earn $400 a week on temporary disability and is estimated to need three months of recovery. The claim closes three months later with a total incurred claim cost of $4,800 in indemnity (wages) and $2,000 in medical, equaling $6,800.

With a Return to Work program, the injured employee is right back to work on modified duty and earns no temporary disability. The claim closes for $2,000. Not only will the claim have less of an effect on your experience MOD, but you will also have constant communication with the injured employee, which keeps them feeling part of the team, boosts their morale, and perhaps expedites the length of the injury.

Carrier Analytics (Save a $1 Today That Will Cost You $5 in the Future)

Who is handling your insurance claims? When you purchase workers compensation insurance, you are buying a company’s ability to handle claims and how those claims are handled will determine your experience MOD, your cost, and your bottom line for years to come. Carrier benchmarking reports are becoming critical in helping to evaluate the impact each carrier will have on your claim experience. You should place your insurance with a carrier who has a history of writing policies for your specific industry and a proven track record of closing claims faster than the industry, and for less money, because that money is what drives your modifier through the roof.

What are your thoughts on a safety incentive program?

I would suggest safety recognition as opposed to safety incentive, here’s why. An incentive program might keep employees from reporting work related injuries in fear that they might “ruin” a streak of consecutive days without an injury. You do not want to make an employee fearful of reporting an injury. OSHA and the Department of Labor have started to enforce these “dis-incentive” programs in a more visible way.

Safety recognition would mean identifying an employee who has successfully executed your company’s standard safety requirements or has gone above and beyond to better the company’s safety culture. A type of recognition could be handing out raffle tickets to employees who have executed standard safety protocol and having a monthly drawing for prizes.

What is the key to having a safe company? We have all the safety programs; we do tailgates every week; and, we still have claims, routinely!

In one word, the companies that experience the best safety records all share this common trait, communication. You can have all the compliance based safety programs in place but without superior communication they will lack true execution. Proactively communicating with your team in the field, every day, is what it takes. Safety must become a common attribute employees think of when they talk about your company. It takes participation and “buy-in” on all levels from ownership to employee. Employees must understand the exposures and job hazards associated with their work, but, the culture you are trying to create within your company should generate excellent decision making, like employees who think:

- “I probably shouldn’t lift this alone.”

- “That slope looks wet."

- “I should pick this up before someone steps on it.”

You cannot buy a good safety company. Like anything in life, it is earned. With a concentrated effort, you can establish a solid safety program that becomes routine and everyone in your company will benefit from it.

Berkshire Hathaway Homestate Companies and Rancho Mesa Participate in Nationally Renowned LANDSCAPES 2017

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Berkshire Hathaway Homestate Companies and Rancho Mesa Insurance Services NALP Program Team

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

The group consisted of Senior Vice President Margaret Hartmann, NALP Assistant Director of Underwriting Valerie Contreras, NALP Program Underwriter Davis Cooper, NALP Client Services Coordinator Emily Docuyanan, and NALP Senior Loss Control Specialist Steve Hamilton from BHHC, and agency Principal Dave Garcia and NALP Program Director Drew Garcia from RMI.

Davis Cooper, NALP Program Underwriter, Berkshire Hathaway Homestate Companies

The BHHC and RMI group participated in a multitude of event programs as speakers, ambassadors, and audience. BHHC and RMI championed four breakfast table topics, a breakout education session based on risk mitigation and cost savings, and took time to speak with association members about the program within National Association of Landscape Professionals' (NALP) booth at the expo.

NALP Program Board Presentation

Sam Steel, NALP Safety Advisor & Steve Hamilton, BHHC

Membership Meeting

“The event was a great success," said Dave Garcia. "It’s amazing to see so many like-minded people dedicated to improving themselves and their companies while building upon the professionalism this industry holds as standard. We are so proud to be a part of this amazing industry and look forward to a long lasting partnership with NALP for years to come.”

NALP Group

Davis Cooper and Drew Garcia at the booth

Davis Cooper speaking with attendees at the booth

I really enjoyed connecting with NALP members and learning about their individual companies. LANDSCAPES provides an environment for motivated industry professionals to share ideas, learn, and form long lasting relationships. The overwhelming commonality is this identified desire for industry veterans to give back to the community that helped them succeed. It’s easy to build off that energy and puts into perspective that our Work Comp Program is providing the level of specialized attention this industry deserves. I'm excited to keep the momentum going while constantly looking for ways to improve our product so that we can provide more to lawn and landscape professionals.

For more information about the NALP Workers' Compensation Program, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

NALP Announces 2017 Safety Award Recipients

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Rancho Mesa would like to congratulate all 263 National Association of Landscape Professionals (NALP) members who achieved recognition for their safety efforts in 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Rancho Mesa would like to congratulate all 263 National Association of Landscape Professionals (NALP) members who achieved recognition for their safety efforts in 2017.

"The National Association of Landscape Professionals Safety Recognition Awards Program is designed to reward landscape industry professionals who consistently demonstrate their commitment to safety, and reflects the dedication of these individuals and their companies to creating and maintaining safe work environments," according to the NALP website.

Companies are evaluated in the following categories:

- No vehicle accidents

- No injuries or illness

- No days away from work

We would like to encourage all professional lawn and landscape companies to partake in NALP’s safe company program because participation as a group will continue to evolve and strengthen safety within the industry as whole.

I’m looking forward to supporting the association and these individual achievements in Louisville on October 19th at the annual awards ceremony.

On behalf of Rancho Mesa, congratulations to the participants!

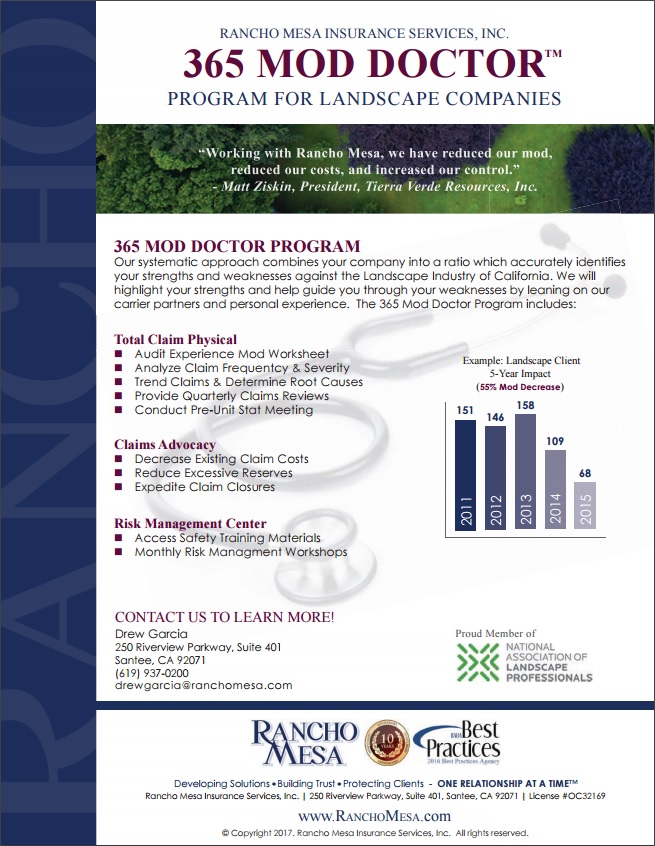

Control your Experience MOD through the MOD Doctor Process.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Successfully maintaining low and predictable workers' compensation costs is a product of establishing a routine that constantly “checks and balances” your all-encompassing insurance program. Our "MOD Doctor" technique lays out a road map so we can guide you throughout the year to gain more control, become more efficient, and ultimately drive down your insurance cost; at no extra expense. What can you expect from this process?

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Successfully maintaining low and predictable workers' compensation costs is a product of establishing a routine that constantly “checks and balances” your all-encompassing insurance program. Our MOD Doctor™ technique lays out a road map so we can guide you throughout the year to gain more control, become more efficient, and ultimately drive down your insurance cost; at no extra expense. What can you expect from this process?

Audit Experience MOD Worksheet. Our team analyzes your experience MOD worksheet to ensure the information is accurate with payrolls, claim information, and class codes.

Analyze Claim Frequency, Severity, and Trends. It’s important to analyze your company’s loss information and specifically look for trends in order to prevent further claim activity with similar causes. Furthermore, we compare your loss experience against the landscape industry, in your state, to determine whether you are outperforming or underperforming your industry.

Claims Meetings. The largest companies maintain claim review meetings on a consistent basis. We bring this service to you and adjust the frequency of the meeting to fit your needs. It’s important to have updated information on your open claims, without sacrificing your time or your employee’s time tracking down this data.

Pre-Unit Stat. Your experience MOD is calculated on claims information which is sent into the governing bureau roughly six months into your policy period. Knowing this information, we can accurately project your MOD six months in advance giving you the information you need to begin budgeting for future work,while considering where your insurance cost will be headed.

Claims Advocacy. Our team is your advocate in helping to seek information on your claims, both in the current year and in the past. Our goal through this process is to decrease existing claim costs, reduce excessive reserves, and expedite claim closure, all while considering your unit stat date.

Risk Management Center. We know maintaining up to date and accurate information for tailgate topics, safety procedures, and incident tracking is important. The Risk Management Center streamlines these functions by making them accessible to our clients online.

Contact our Rancho Mesa staff to learn more about how the MOD Doctor can help you control your workers' compensation costs.