Industry News

Fleet Management: Driver Behavior Counts

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

When you give the car keys to your teenager for the first time, you wish you were sitting in the back seat controlling how they drive. Unfortunately, you have very limited control and the consequences of poor driving can be disastrous. It’s time to think of your employee drivers in a similar manner; these principles apply to your company’s fleet management program.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

When you give the car keys to your teenager for the first time, you wish you were sitting in the back seat controlling how they drive. Unfortunately, you have very limited control and the consequences of poor driving can be disastrous. It’s time to think of your employee drivers in a similar manner; these principles apply to your company’s fleet management program.

To gain some sense of control, you regularly perform fleet inspections and driver trainings. You also hire and manage according to driving records, which provides a picture of the employee’s past driving history. Though, if you are honest with yourself, you too have driven over the speed limit many, many times before you received your speeding ticket. So, a driving record is not the only way to gauge a driver’s behavior.

If you had an effective and efficient way to impact your driver’s behavior before a ticket or accident occurs, you would feel more confident about managing your fleet.

There are Global Positioning Systems (GPS) that can monitor some of the problem behaviors like speeding; however, the onus is on you (the employer) to analyze the information then act on it. Another problem with this type of system is willful negligence. What happens if you have the data, know of a problem, but don’t act? This could cause a major problem when an accident occurs because you knew of a driver’s poor behavior but did nothing specifically to correct it.

The insurance industry is in a commercial auto claims crisis. The cost of vehicle repairs have increased and whether you employ safe drivers or not the price to insure a vehicle is skyrocketing. Simply, the claims have exceeded the premiums collected and the carriers are trying to recover the loss. So, steering driver behavior is more important than ever for your bottom line.

To the degree you can control auto claims created by your employee drivers, the better your premiums will be. Fewer claims equal lower premiums — simple as that. Claims are caused from poor driving behavior. Improve drivers’ behavior on any given day, and you’ll reduce the number of accidents.

But, how do you do that? Logistically, you can’t physically ride along with every employee to ensure they are driving safely, and offer real-time corrective guidance when they make mistakes.

As mentioned, there are GPS devises that measure driver behavior and performance. The devices will consolidate the information; but, it is up to the employer to analyze and act on the information.

Ask yourself, do I have enough time to consistently review this information and implement the correct plan of action? Do I have the resources available to manage this process?

If you are unsure and would like to learn about automated ways to track, manage and correct behaviors likes seatbelt usage, speeding, harsh braking, acceleration and corning, join us at our upcoming Fall workshop, “Driver Behavior is What Counts” and learn how to effectively and efficiently improve your fleet management practices and reduce premiums using smart technology.

In the meantime, if you have any questions, please contact Sam Clayton at (619)937-0167.

Time To Renew Your Bond Line of Credit

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

The majority of Rancho Mesa’s contractor clients have a fiscal year, end of December 31, for their company financial statements. During March, April, and May we collect a variety of financial information from our contractors to update the bonding company. The underwriting items we request include the 12/31 CPA financial statement, along with the work in progress and closed contract schedules. We also request an updated bank letter, account receivable/account payable schedules, and a personal financial statement from the owner.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

The majority of Rancho Mesa’s contractor clients have a fiscal year, end of December 31, for their company financial statements. During March, April, and May we collect a variety of financial information from our contractors to update the bonding company. The underwriting items we request include the 12/31 CPA financial statement, along with the work in progress and closed contract schedules. We also request an updated bank letter, account receivable/account payable schedules, and a personal financial statement from the owner.

Once this information is collected, submitted to, and reviewed by the bond company, they may follow up with questions or require additional information to explain what has been submitted. They will also ask the bonding agent to request single bond and aggregate bond program “parameters” based on the contractor’s estimate of work over the next 12 months. This information forms the basis for the bond agent’s line of authority that the bond company will provide to the bond agent.

The line of authority provides the agent with approval to execute the bid, payment, and performance bonds for their contractor client within the negotiated single and aggregate limits. The bond agent line of authority also includes certain conditions that would fall outside the agent’s authority to approve the bond request; therefore, the agent would need to submit the request to the bond company for approval. Some of the conditions that fall outside automatic approval include:

a.) a bid spread in excess of 10% between the first and second bidder.

b.) a project located outside the contractors’ normal geographic area for work.

c.) the contractor taking over work of a defaulted contractor, etc.

The agent line of authority is an efficient way for the bond agent to service their contractor client accounts without requiring approval from the bond company for every project. Upon receipt of a new bond request, the agent will review the project information to ensure it falls within their authority, and then they will execute the bid or performance bond and deliver the bond to their client. The line will usually expire on April 30th of the following year – which restarts the process to collect the financial information for the bond company to renew the agent’s line for another year.

If you would like a better understanding of how the bond line of authority affects your bond program, please contact Matt Gaynor, at (619) 937-0165.

OSHA Amends Electronic Submission Requirements to Exclude Forms 300 & 301

Author, Lauren Stumpf, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

OSHA published a final rule through the Federal Register on January 25, 2019 stating, “To protect worker privacy, the Occupational Safety and Health Administration (OSHA) is amending the recordkeeping regulation by rescinding the requirement for establishments with 250 or more employees to electronically submit information from OSHA Forms 300 and 301.”

Author, Lauren Stumpf, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

OSHA published a final rule through the Federal Register on January 25, 2019 stating, “To protect worker privacy, the Occupational Safety and Health Administration (OSHA) is amending the recordkeeping regulation by rescinding the requirement for establishments with 250 or more employees to electronically submit information from OSHA Forms 300 and 301.”

All establishments with 250 or more employees, unless specifically exempted by section 14300.2 of title 8 of the California Code of Regulations, and establishments with 20 to 249 employees in the specific industries listed in Appendix H of Cal/OSHA's emergency regulations are still required to electronically submit the OSHA Form 300A (Summary of Work-Related Injuries and Illnesses).

The requirement to keep and maintain OSHA Forms 300, 300A, and 301 for five years is not changed by this final rule. This final rule becomes effective on February 25, 2019.

The deadline to electrically submit the 2018 Form 300A is March 2, 2019.

Rancho Mesa has put together a 6-minute tutorial video on how to generate the electronic Form 300A data file from the Risk Management Center, that can be uploaded to the ITA website for reporting the data.

For questions about how to track the injury and illness data in the Risk Management Center, contact Alyssa Burley at (619) 438-6869.

Sources:

https://www.osha.gov/recordkeeping/

https://www.dir.ca.gov/dosh/calosha-updates/log300-reporting.html

https://www.federalregister.gov/documents/2019/01/25/2019-00101/tracking-of-workplace-injuries-and-illnesses

Cause of Concerns for Contractors: Implementation of Aerial Lift Standards

Author, Casey Craig, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Beginning December 2019, standards for using and renting aerial lifts will drastically change, globally. As a result, contractors are concerned they will not be prepared for the changes which could lead to loss of production and fines.

Author, Casey Craig, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Beginning December 2019, standards for using and renting aerial lifts will drastically change, globally. As a result, contractors are concerned they will not be prepared for the changes which could lead to loss of production and fines.

Since the use of aerial lifts is becoming more frequent, the new standards were approved by the American National Standards Institution (ANSI) in an effort to align the United States and the rest of the world with having globally accepted safety standards. Canada published its standards last May and the United States is following suite with the release of the ANSI A92 .20 (equipment responsibilities), .22 (safe use), .24 (training). Further details can be found in Scaffold & Access Industry Association’s (SAIA) copy of the standards.

Moving forward, “Aerial Work Platforms” (AWP) will be referred to as “Mobile Elevating Work Platforms” (MEWP). The new standards are meant to address ongoing problems with:

Effect of Wind on a Load

MEWP’s may be rated one of two ways; for interior use only or for exterior use, but those will have a maxim height limitation without consideration to the length the arm can be extended.

Platform Capacity

The new equipment will automatically shut off if it exceeds the specified weight limit. Thus, in some cases, it may be necessary to use two lifts to do a job safely.

Chassis Tilt

Understanding the terrain where the lift will be working will be vital. Most equipment has been rated for firm or level ground, but new machinery will also take into account the tilt of the machine and will shut off if it is unsafe.

Manufacturers are already taking heed and changing their product designs to accommodate the new requirements. Aside from the changes to the machinery, contractors will need to evaluate who is trained to operate the MEWPs.

Operators will need to be trained in how to use the machinery and walk their job sites to look for problems before using the lift.

Supervisors must know how the machine works, its functionality, how much it weighs and how much weight it can handle, so that they are not relaying poor information to the operator.

Additionally an occupant riding in an aerial lift (i.e., MEWP) must have a general understanding of how the machine works so if there is a problem they can safely get back down.

Previously, operators were only required to know how high the lift being used would need to go. As of December 2019, the operator will also need to know the terrain where the aerial lift will be operated, the load weight, and the lift’s reach under load for the job. When renting equipment it is likely the rental industry will issue a supplemental application to pre-qualify each job.

Machines built before the new standards will be grandfathered in and will not have to be updated. However, this could cause issues for contractors if they work on job sites that require the most current safety specifications. This could limit the use of older machinery.

While these standards will not take effect until December of this year, there is still a lot to be learned and will require proactive planning by all contractors to insure compliance. There are still many unanswered questions including exactly how involved OSHA will be in enforcing these new rules. Rancho Mesa will be providing updates regularly to assist you through these changes.

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 438-6900.

Ensuring CA Sexual Harassment and Abusive Conduct Training is SB 1343 Compliant

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In September 2018, former California Governor Jerry Brown approved Senate Bill 1343 (SB 1343) which expanded the requirements for Sexual Harassment and Abusive Conduct Prevention training within California workplaces.

In order for the Sexual Harassment and Abusive Conduct Prevention training to be compliant, it must meet the following requirements. The training must:

Editor’s Note: This article was originally published on February 7, 2019 and has been updated for accuracy on September 12, 2019.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In September 2018, former California Governor Jerry Brown approved Senate Bill 1343 (SB 1343) which expanded the requirements for Sexual Harassment and Abusive Conduct Prevention training within California workplaces.

“An employer who employs 5 or more employees, including temporary or seasonal employees, [is required] to provide at least 2 hours of sexual harassment training to all supervisory employees and at least one hour of sexual harassment training to all nonsupervisory employees by January 1, 2020, and once every 2 years thereafter, as specified,” according to SB 1343.

On August 30, 2019, approved Senate Bill 778 extends the training deadline set in Senate Bill 1343 from January 1, 2020 to January 1, 2021. The changes made by SB 778 not only extends the due date to January 1, 2021, but also addresses concerns about supervisory employees and clarifies when temporary workers must be trained. Read about these changes here.

Ensuring the Training is in Compliance

In order for the Sexual Harassment and Abusive Conduct Prevention training to be compliant, it must meet the following requirements. The training must:

Be administered in a classroom setting, through interactive E-learning, or through a live webinar. E-learning training must provide instructions on how to contact a trainer who can answer questions within two business days.

Be conducted by an eligible trainer:

Attorneys who have been members of the bar of any state for at least two years and whose practice includes employment law under the Fair Employment and Housing Act or Title VII of the federal Civil Rights Act of 1964;

Human resource professionals or harassment prevention consultants with at least two years of practical experience in:

Designing or conducting training on discrimination, retaliation, and sexual harassment prevention;

Responding to sexual harassment or other discrimination complaints;

Investigating sexual harassment complaints; or

Advising employers or employees about discrimination, retaliation, and sexual harassment prevention.

Law school, college, or university instructors with a post-graduate degree or California teaching credential and either 20 hours of instruction about employment law under the FEHA or Title VII.

Explain the following topics:

The definition of sexual harassment under the Fair Employment and Housing Act and Title VII of the federal Civil Rights Act of 1964;

The statutes and case-law prohibiting and preventing sexual harassment;

The types of conduct that can be sexual harassment;

The remedies available for victims of sexual harassment;

Strategies to prevent sexual harassment;

Supervisors’ obligation to report harassment;

Practical examples of harassment;

The limited confidentiality of the complaint process;

Resources for victims of sexual harassment, including to whom they should report it;

How employers must correct harassing behavior;

What to do if a supervisor is personally accused of harassment;

The elements of an effective anti-harassment policy and how to use it;

“Abusive conduct” under Government Code section 12950.1, subdivision (g)(2).

Discuss harassment based on gender identity, gender expression, and sexual orientation, which shall include practical examples inclusive of harassment based on gender identity, gender expression, and sexual orientation.

Include questions that assess learning, skill-building activities to assess understanding and application of content, and hypothetical scenarios about harassment with discussion questions.

SB 1343 compliant trainings will be made available later this year via the California Department of Fair Employment and Housing (DFEH) website. However, employers can hire eligible qualified trainers to conduct the trainings at their convenience.

The DFEH has made available a sexual harassment and abusive conduct prevention toolkit, that includes a sample Sexual Harassment and Abusive Conduct Prevention training, certificate of completion and other resources for employers to use in conjunction with an eligible trainer.

Other training options include the online Anti-Harassment training Rancho Mesa offers to all of its clients’ supervisors and employees throughout the country in response to California’s Senate Bill 1343 (SB 1343) and Senate Bill 1300 (SB 1300).

For questions about this training requirement or to learn how to enroll your supervisors and employees, register for the “How to Enroll Supervisors and Employees in the Online Anti-Harassment Training” webinar or contact Rancho Mesa’s Client Services Department at (619) 438-6869.

Rancho Mesa Insurance will continue to monitor training options as they become available.

California SB 1343 Expands Sexual Harassment Training Requirements

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc,

On September 30, 2018, California Governor Jerry Brown, approved Senate Bill 1343 (SB 1343), which expands rules for required sexual harassment prevention training for businesses.

Currently, employers with 50 or more employees must provide supervisors with sexual harassment prevention training every two years. By January 1, 2020, employers with 5 more employees must provide at least 2 hours of sexual harassment prevention training and at least 1 hour of training to non-supervisory employees. The trainings are required every 2 years.

Editor’s Note: This article was originally published on November 15, 2018 and has been updated for accuracy on September 12, 2019.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc,

On September 30, 2018, California Governor Jerry Brown, approved Senate Bill 1343 (SB 1343), which expands rules for required sexual harassment prevention training for businesses.

According to the passing of Senate Bill 778, approved on August 30, 2019, by January 1, 2021, employers with 5 more employees must provide at least 2 hours of sexual harassment prevention training and at least 1 hour of training to non-supervisory employees every 2 years.

The bill requires “the Department of Fair Employment and Housing (DFEH) to develop or obtain 1-hour and 2-hour online training courses on the prevention of sexual harassment in the workplace, as specified, and to post the courses on the department’s Internet Web site. The bill also requires the department to make existing informational posters and fact sheets, as well as the online training courses regarding sexual harassment prevention, available to employers and to members of the public in specified alternate languages on the department’s Internet Web site.” However, the DFEH currently does not have the required training materials available, as of yet.

Rancho Mesa offers free Anti-Harassment training to all of its clients’ supervisors and employees throughout the country in response to California’s Senate Bill 1343 (SB 1343) and Senate Bill 1300 (SB 1300). The deadline for this training is January 1, 2021, according to Senate Bill 778.

Until the DFEH releases its supervisor and employee sexual harassment prevention trainings, Rancho Mesa recommends devising a training schedule/plan for your supervisors and employees in order to meet the January 1, 2021 deadline.

Resources:

legislature.ca.gov: SB-1343 Employers: sexual harassment training: requirements

legislature.ca.gov: SB-778 Employers: sexual harassment training: requirements

For questions about this training requirement or to learn how to enroll your supervisors and employees, register for the “How to Enroll Supervisors and Employees in the Online Anti-Harassment Training” webinar or contact Rancho Mesa’s Client Services Department at (619) 438-6869.

Cal/OSHA Issues Electronic Filing Requirement For 2017 OSHA 300A Form

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In April 2018, federal OSHA announced all affected employers are required to submit injury and illness data (i.e., Form 300A data) via the Injury Tracking Application (ITA) online portal by July 1, 2018, even if the employer is covered by a state plan like those in California, Maryland, Minnesota, South Carolina, Utah, Washington or Wyoming.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In April 2018, federal OSHA announced all affected employers are required to submit injury and illness data (i.e., Form 300A data) via the Injury Tracking Application (ITA) online portal by July 1, 2018, even if the employer is covered by a state plan like those in California, Maryland, Minnesota, South Carolina, Utah, Washington or Wyoming.

Cal/OSHA then issued a statement in May 2018, advising affected employers “to comply with federal OSHA’s directive to provide Form 300A data covering calendar year 2017," even though it was not a Cal/OSHA requirement.

“On November 1, 2018,” according to the Cal/OSHA website, “the Office of Administrative Law approved the emergency action. This means that the employers in California described below are now required to submit Form 300A data covering calendar year 2017 by December 31, 2018. These employers should follow the instructions posted at federal OSHA's ITA website:

Check Appendix H for your industry. It includes industries like: Construction; Community/Nursing/Residential Care facilities; Community Food/Housing Relief Services; and many more.

All employers with 250 or more employees, unless specifically exempted by section 14300.2 of title 8 of the California Code of Regulations

Employers with 20 to 249 employees in the specific industries listed in Appendix H of the emergency regulations.”

This emergency action by the Office of Administrative Law brings Cal/OSHA’s requirements up to the federal OSHA’s minimum standards, with one difference. Federal OSHA required affected employers covered by state plans to submit the 2017 Form 300A data electronically by July 1, 2018, while this new action requires affected California employers to submit the data by December 31, 2018.

Since the Federal OSHA deadline has already passed, it is recommended that all affected employers in California who have not already submitted the 2017 Form 300A data via the ITA, submit it as soon as possible, but no later than December 31, 2018.

Next year, the deadline for electronically submitting 2018 Form 300A data will be March 2, 2019.

Rancho Mesa has put together a 9-minute tutorial video on how to generate the electronic Form 300A data file from the Risk Management Center, that can be uploaded to the ITA website for reporting the data.

For questions about how to track the injury and illness data in the Risk Management Center, contact Alyssa Burley at (619) 438-6869.

Important Reminder for Janitorial Business Owners: Property Service Worker Protection Act

Author, Jeremy Hoolihan, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

A few of my janitorial clients have recently asked for information on the Property Service Worker Protection Act (AB 1978) and its requirements. Below is a description of the law and instructions on registering. As a reminder, the deadline for all janitorial service providers to register for the Property Service Worker Protection Act was October 1, 2018. If you have not yet registered, I would recommend doing so, as soon as possible.

Author, Jeremy Hoolihan, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

A few of my janitorial clients have recently asked for information on the Property Service Worker Protection Act (AB 1978) and its requirements. Below is a description of the law and instructions on registering. As a reminder, the deadline for all janitorial service providers to register for the Property Service Worker Protection Act was October 1, 2018. If you have not yet registered, I would recommend doing so, as soon as possible.

AB 1978 is a law to protect janitors against wage theft and sexual harassment. The law is designed to move the janitorial industry into a modern and transparent industry. There are three main legal mechanisms: record keeping, registration with the Labor Commissioner’s Office, and sexual harassment prevention training.

Recordkeeping

Every employer must keep the following accurate records for three years, showing all of the following:

The names and addresses of all employees who perform janitorial or cleaning services.

The hours worked daily by each employee, including the start and stop times of each work period.

The wage and hourly rate paid each payroll period.

The age of all minor employees.

Any other conditions of employment.

Registration

Every employer who provides janitorial services with a least one employee and one janitor must register with the Labor Commission. An “employer” is broadly defined as any person or entity that employs at least one employee and one or more covered workers and that enters into contracts, subcontracts, or franchise arrangements to provide janitorial services must register yearly with the Labor Commissioner’s office.

To register, an employer must pay a $500 nonrefundable application fee. The registration is valid for one year and must be renewed annually by the month and day of the original registration’s issuance. The renewal fee is also $500. A janitorial employer who fails to register is subject to a civil fine of $100 for each calendar day that the employer is unregistered, not to exceed $10,000.

The documents required to register include:

Fictitious Business Name Statement(s) (doing business as (DBA) for all business name(s) you use or intend to use.

State Employer Identification Number (SEIN) or application for it.

Federal Employer Identification Number (FEIN) or application for it.

Articles of Incorporation, if you are a corporation.

Articles of Organization, if you are a limited liability company (LLC).

Certificate of Limited Partnership, if you are a limited partnership.

Secretary of State Statement of Information, if you are a corporation or LLC.

Proof of workers’ compensation coverage via one of the following:

A valid workers’ compensation insurance certificate which must include the complete and correct name of the legal entity that is the insured employer, including fictitious business names and the complete and correct address for each location.

Certificate of authority to self-insure.

If contracting with an employee leasing company, a current workers’ compensation insurance certificate that is provided to you by the employee leasing company.

Sexual Harassment Prevention Training

The Property Service Workers Protection Act requires janitorial services employers to provide training in the prevention of sexual violence and harassment at least once every two years.

Until the training requirements are established pursuant to Labor Code section 1429.5, employers may meet this obligation by giving employees the Department of Fair Employment and Housing pamphlet DFEH–185, “Sexual Harassment,” in English or Spanish, as appropriate.

Rancho Mesa clients have access to discounted Sexual Harassment Prevention training online in both English and Spanish through the Risk Management Center. Contact Alyssa Burley at (619) 438-6869 for more information.

For more information about the Property Service Workers Protection Act, visit the Department of Industrial Relations website.

Focus on preventing Back Injuries: Introducing Rancho Mesa’s A.B.L.E Lift Protocol and the “Field” Mobility & Stretch Program

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services.

Physical work is demanding on our bodies. As the employer, what are you doing to help your employees prepare for the day’s work? Collectively, the most severe injuries come from the lower back by way of strain or sprain as a result of lifting. It’s not always the heavier objects causing the injuries. In many cases, early morning “light” lifts or movements can quickly cause a strain or sprain.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services.

Mobility & Stretch Program and ABLE Lift Protocol flyers.

Physical work is demanding on our bodies. As the employer, what are you doing to help your employees prepare for the day’s work? Collectively, the most severe injuries come from the lower back by way of strain or sprain as a result of lifting. It’s not always the heavier objects causing the injuries. In many cases, early morning “light” lifts or movements can quickly cause a strain or sprain. Eliminating lifting exposures is the ultimate solution to limiting back strains; however, it is not always possible. Interactively training your employees to accurately lift material with proper technique is a preventive approach you can implement today to limit your businesses lifting exposure.

Following the success of our “Truck” Mobility and Stretch Program, Rancho Mesa is excited to announce, in conjunction with Collin Dawson CPT., A.B.L.E. “Lift” Protocol to help physically train your employees to execute proper lift decision making and establish the correct physical eliminates it takes to perform a lift. Not all lifts are the same, each one contains different variables, but the same simple body positioning and lift techniques are relevant no matter the exposure.

Our “Truck” Mobility and Stretch Program was highly received and ultimately implemented by many of our clients. Over the past nine months we have worked to address the need for a Mobility and Stretch Program to be lower back specific, but with the ability to perform the exercises without the support of a truck or wall.

We knew the Mobility and Stretch Program would be beneficial. We were surprised to see the amount of clients willing to incorporate this program and ultimately are very pleased with the results, almost one year in. We challenged Collin to create another program that could be performed in a group setting without sacrificing the main purpose of the routine, which is to flex and strengthen the core muscles surrounding the back while providing total body activation. Our “Field” Mobility and Stretch Program does just that, but also provides some opportunity for participants to slowly begin to establish a better center of balance and body awareness, which can be practically applied to the work day and life. We hope this program will be just as well received.

Register for October 25, 2018 webinar where we will detail A.B.L.E. Lift and the recently developed “Field” Mobility and Stretch Program. Only those who attend the webinar will receive the following:

A PDF Mobility and Stretch Program branded to your company (upon request, 10-15 business days to process) “Truck” and “Field” Series

PDF version of A.B.L.E. Lift (8.5x11 and Poster Size)

Recognition on Rancho Mesa website for your participation in the workshop

30-minute complimentary phone assessment with Collin Dawson about these programs and further implementation strategies.

And remember, “Only lift if you are A.B.L.E.”!

Six Proactive Steps to Prevent Heat Illness During a Scorching Summer

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Recommendation

If you have employees working outdoors, you should have an effective heat illness prevention plan in place and train your workers on it's content. Elements of the plan include:

- Making sure those toiling outside have plenty of fresh, cool water – workers need to drink at least a quart an hour. Just providing it isn’t enough, according to the heat illness prevention standard (General Industry Safety Orders section 3395). You must encourage employees to drink water.

- Providing shade when the temperature reaches 80ºF, or when employees request it.

- If an employee is in danger of developing heat illness, they must be allowed to take a rest in the shade until their symptoms disappear.

- Having emergency procedures, including effective communication with workers in remote areas.

- Designating employees at each work site to call emergency medical services if someone starts to develop heat illness.

- Keeping a close eye on workers who have been on the job for two weeks or less. They may not have the prior training to be aware of the early signs of heat illness.

In order to prepare our clients, Rancho Mesa recently conducted a Heat Illness Prevention Workshop. For those of you who were not able to attend, the training videos are available in the Risk Management Center or via the Workshop Video Request Form.

Should you have any questions or need further assistance, please contact a member of your Rancho Mesa team. Please be safe!!

WCIRB Proposed Changes Affecting Schools and Disabled Services

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

Currently the 8868 and 9101 classes, titled “schools,” consist of not only kindergarten through college schools, but also vocational schools, special education for disabled children, social services for children, and training programs for the developmentally disabled. While these businesses are similar in many ways, the claims appear to differ uniformly between these specific niches. This has a direct impact on the Experience Modifications (i.e., x-mod) of the organizations. According to the WCIRB, the average x-mod for K-12 schools and colleges is .81, vocational schools are 1.08, programs offering special education services for children are at 1.40 and training programs for developmentally disabled are at 1.30.

Average X-Mod within 8868 and 9101 Class Codes

The proposed changes will continue to include the 8868 and 9101 class codes while adding four new classifications. The theory is that this will create more homogeneous classes for the members while at the same time leveling out the X-mods for all. As the process unfolds, it could create higher insurance costs and you will want to fully understand how these changes could affect your bottom line.

While there are still more details to be worked out, it’s apparent that there are significant changes heading towards those operating with the 8868 and 9101 class codes. Whether or not an employer will be positively or negatively affected will depend on their individual risk profile.

Rancho Mesa’s Human Services Group will be taking a leadership position in understanding these changes and their impacts. To learn more about how these changes will affect your organization, please Rancho Mesa at (619) 937-0164.

Four Factors When Developing a Nonprofit Agency's Youth Protection Plan

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

In A Season of Hope, authored by the staff at the Nonprofit Risk Management Center, the authors refer to these interlocking factors as the “Four P’s: Personnel, Participants, Program, and Premises. Let’s explore:

Staffing

The nature of the services offered to youth will dictate the staff’s professional background and education. Those nonprofits offering therapy and counseling will aim to hire employees with advanced degrees; whereas, some programs may feel comfortable hiring responsible teens and young adults. In each case, supervision and background checks are vital to client safety.

Participant Mix

Is the agency serving a pre-school program for kids who are relatively close in age with similar needs? Or, perhaps, it is a group home involving minors who all have differing special needs due to their unique family situations and backgrounds. What unique risks to the organization does each group present? Considering the characteristics of a nonprofit’s youth clientele will shape an organization’s approach to youth protection.

Program and Mission

An organization must consider how its mission and programs will impact youth safety. A nonprofit conducting group outings to encourage social behavior will not have the same concerns as an organization matching children with foster families. Each will present unique exposures.

Environment

Nonprofits serve youth in a wide range of venues and environments, and each present different risks. The variables can include supervision, activities at height, access to emergency care, and sleeping arrangements. Knowing this, it is vital for an organization’s leaders to identify how a venue presents risk to youth safety and then plan accordingly.

“My Risk Assessment” is a very strong tool available through Rancho Mesa Insurance Services. This interactive module allows nonprofit leaders to identify potential gaps in risk management in a number of areas, including client safety, transportation, and facilities.

Keeping young clients safe while in a nonprofit’s care is a core promise of the organization to the community. When nonprofit leaders take a careful look at the four P's, they can reduce the risk of harm while also ensuring the mission endures.

Please contact Rancho Mesa at (619) 937-0164 to learn more about sound risk management practices.

Risk Management Center Streamlines Electronic OSHA Reporting

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The Occupational Health and Safety Administration (OSHA) now require certain employers to electronically submit their completed 2016 Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Editor's Note: This post was originally published on November 9, 2017 and has been updated to reflect the latest available information.

The Occupational Health and Safety Administration (OSHA) now requires certain employers to electronically submit their completed Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file. Users of Rancho Mesa’s Risk Management Center have the ability to track incidents and generate the export file, making the electronic reporting process quick and simple.

Check federal OSHA or your state's OSHA website for specific filing date deadlines.

Prepare and Submit

Once an incident occurs, Risk Management Center users track the details within the online system. All of the required information is stored and made available through reports and an export.

Request a Risk Management Center Account.

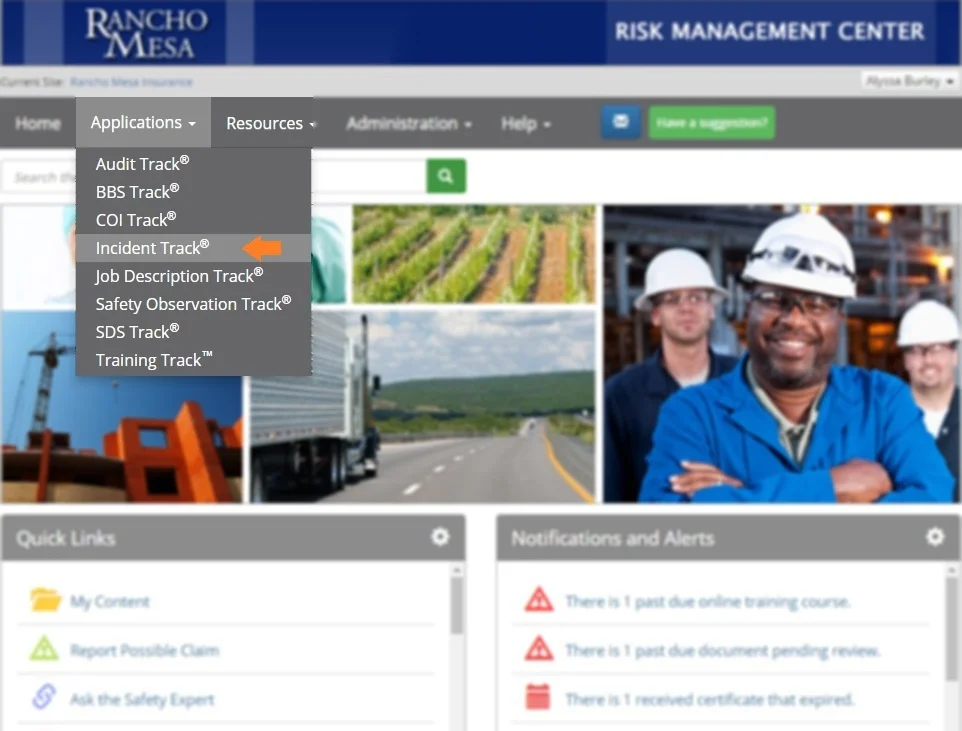

To export the OSHA 300A Report data, login to the Risk Management Center. Then, navigate to the Applications list and click on Incident Track®.

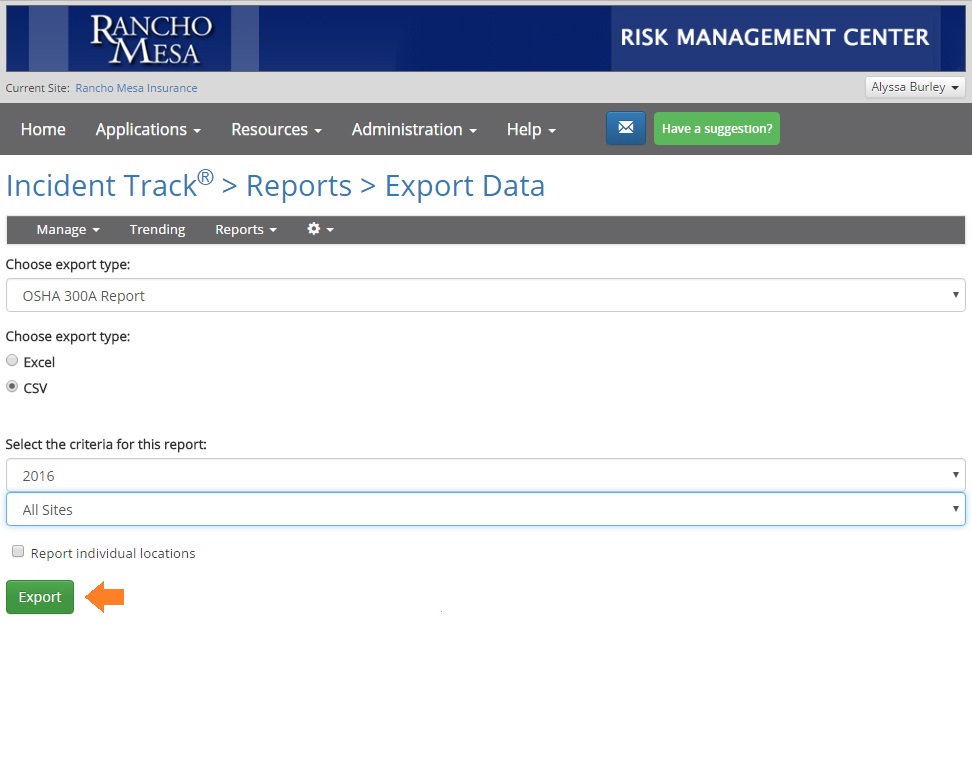

From this screen, click on the Reports menu and click the Export Data option.

Choose the report, “OSHA 300A Report” and select the export type a CSV. Choose the year and either all your sites or just one. Click the Export button and enter your email address.

The .CSV file will be generated and emailed to you. Save the file on your computer so it can be uploaded to OSHA’s Injury Tracking Application (ITA).

To upload the .CSV file, login to OSHA’s ITA and follow the instructions on the screen.

Who is Required to Submit?

According to OSHA, “establishments with 250 or more employees are currently required to keep OSHA injury and illness records and establishments that are classified in certain industries with historically high rates of occupational injuries and illnesses.” Some of those industries include construction, manufacturing, health and residential care facilities, and building services.

On April 30, 2018, OSHA announced State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.

Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

For questions about tracking and exporting OSHA reports with the Risk Management Center, contact Rancho Mesa at (619) 937-0164

The Changing Definition of Employee: What you need to know about SB 189

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

SB 189 is written to expand:

The scope of the exception from the definition of an employee to apply to an officer or member of the board of directors of a quasi-public or private corporation, except as specified, who owns at least 10% of the issued and outstanding stock, or 1% of the issued and outstanding stock of the corporation if that officer’s or member’s parent, grandparent, sibling, spouse, or child owns at least 10% of the issued and outstanding stock of the corporation and that officer or member is covered by a health care service plan or a health insurance policy, and executes a written waiver, as described above. The bill would expand the scope of the exception to apply to an owner of a professional corporation, as defined, who is a practitioner rendering the professional services for which the professional corporation is organized, and who executes a document, in writing and under penalty of perjury, both waiving his or her rights under the laws governing workers’ compensation, and stating that he or she is covered by a health insurance policy or a health care service plan. The bill would expand the scope of the exception to include an officer or member of the board of directors of a cooperative corporation, as specified. The bill would also expand the definition of an employee to specifically include a person who holds the power to revoke a trust, with respect to shares of a private corporation held in trust or general partnership or limited liability company interests held in trust, and would authorize that person to also elect to be excluded from the requirement to obtain workers’ compensation coverage, as specified. The bill would provide that an insurance carrier, insurance agent, or insurance broker is not required to investigate, verify, or confirm the accuracy of the facts contained in the waiver. (Legislative Counsel, 2018)

Once a waiver is signed and on file with the insurance carrier it will remain in effect until there is a written withdrawal. When changing insurance carriers a new waiver must be signed with the new carrier.

Effective 1/1/18

- Carriers were able to accept waivers up until 12/31/17 for policies issued in 2017 that weren't turned in on time and the officer exclusion is being honored from the inception of the policy and is being applied at final audit.

Effective 7/1/18

- Trusts will be eligible for officer exclusion.

- To be excluded, the required ownership percentage will change from 15% to 10%.

- An officer with 1%-9% ownership that is related to an excluded officer that owns 10% or more may also be excluded as long as they have health insurance.

- Waivers currently are required at the policy effective date. SB 189 provides a 15-day grace period from the effective date to turn in the waiver. The waiver may only be backdated 15 days.

Examples: With a 1/1/18 effective date, if the waiver is turned in and accepted by 1/15/18, the officer exclusion will be effective 1/1/18. With a 1/1/18 effective date, if the waiver is turned in and accepted by 2/15/18, the officer exclusion will be effective 2/1/18.

For specific questions about your workers' compensation policy, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

4 Simple Steps for Passenger Van Safety

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Many of our agency's social service and nonprofit clients serve an important function for individuals and families...transportation! Whether helping a physically challenged child get to school or embarking on a day trip to the mall with a group of adults with intellectual and developmental disabilities, it's vital to manage all risks associated with transporting clients.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Many of our agency's social service and nonprofit clients serve an important function for individuals and families...transportation! Whether helping a physically challenged child get to school or embarking on a day trip to the mall with a group of adults with intellectual and developmental disabilities, it's vital to manage all risks associated with transporting clients.

This article outlines important driver safety guidelines. You will also learn safety tips and the factors contributing to rollovers with large passenger vans.

Start from Day 1

Ensure all new hires receive a driver safety orientation. Make sure they understand the organization's safety policies as well as processes tied to safety. This must include volunteers who may perform driving duties for the organization.

Employee Screening and Incident Reports

Require new hire candidates to submit a Motor Vehicle Record (MVR) with the employment application, while also checking MVRs periodically. Candidates and employees who don't meet your insurance company's driver guidelines, or pose a liability to the organization, can be restricted from driving or be required to complete additional driver training. It is also a best practice to formalize an accident reporting and investigation process.

Establish a Written Driver Safety Policy

Document the organization's culture of safety and the need to protect clients, employees, and volunteers while on the road. Include a code of conduct with regards to seat belt use, driving while under the influence, distracted driving, incident reporting, and vehicle maintenance.

Understand the Risks of Passenger Vans

Large passenger vans, such as 15-passenger vans, are at a high risk of rollover.

Contributing factors

- Number of occupants: vehicles with less than 10 passengers are three times less likely to rollover

- Speed: The odds of rollover are 5x greater when traveling on high speed roads (+50mph)

- Road curvature: The odds of rolling over double on curved roads vs. straight roads

- Tire inflation: An NHTSA study found that 74% of 15-passenger vans have at least one tire underinflated by 25% or more. Underinflated tires are at a higher risk of blowout.

Safety Tips

- Never allow more passengers than allotted seats. Fill seats from front to back of the vehicle if you have open seats.

- Only allow experienced and trained drivers to operate 15-passenger vans.

- Load cargo forward of the rear axle to enhance stability and control.

- Inspect vehicles for wear and tire pressure. Maintain an accurate log.

- Replace tires on a regular basis

- Keep the vehicle within the Gross Vehicle Weight Rating (GVWR).

The risk associated with transporting clients is important to recognize and manage. With close attention to safety and written procedures any social service or nonprofit organization can successfully help move around town. Be safe out there.

For more information about transportation safety, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Resources:

Safety is Not a Luxury: Understanding the Risks of Passenger Vans, https://www.nonprofitrisk.org/app/uploads/2016/12/1222-NRM-16-Summer-Newsletter-D3

Before You Hit the Road: Stepping Stones of Driver Safety, https://www.nonprofitrisk.org/resources/articles/before-you-hit-the-road-stepping-stones-of-driver-safety/

Highlights of the New Tax Reform Law

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Individuals

Drops of individual income tax rates ranging from 0 to 4 percentage points (depending on the bracket) to 10%, 12%, 22%, 24%, 32%, 35% and 37% — through 2025

Near doubling of the standard deduction — through 2025

Elimination of personal exemptions — through 2025

Doubling of the child tax credit to $2,000 — through 2025

Elimination of the individual mandate under the Affordable Care Act — effective for months beginning after December 31, 2018

Reduction of the adjusted gross income (AGI) threshold for the medical expense deduction to 7.5% for regular and AMT purposes — for 2017 and 2018

New $10,000 limit on the deduction for state and local taxes (on a combined basis for property and income taxes; $5,000 for separate filers) — through 2025

Reduction of the mortgage debt limit for the home mortgage interest deduction to $750,000 ($375,000 for separate filers), with certain exceptions — through 2025

Elimination of the deduction for interest on home equity debt — through 2025

Elimination of miscellaneous itemized deductions subject to the 2% — through 2025

Elimination of the AGI-based reduction of certain itemized deductions — through 2025

Expansion of tax-free Section 529 plan distributions to include those used to pay qualifying elementary and secondary school expenses, up to $10,000 per student per tax year

AMT exemption increase — through 2025

Doubling of the gift and estate tax exemptions to $10 million (expected to be $11.2 million for 2018 with inflation indexing) — through 2025

Businesses

Replacement of graduated corporate tax rates ranging from 15% to 35% with a flat corporate rate of 21%

Repeal of the 20% corporate AMT

New 20% qualified business income deduction for owners of flow-through entities (such as partnerships, limited liability companies and S corporations) and sole proprietorships — through 2025

Doubling of bonus depreciation to 100% — effective for assets acquired and placed in service after September 27, 2017, and before January 1, 2023

Doubling of the Section 179 expensing limit to $1 million

New disallowance of deductions for net interest expense in excess of 30% of the business’s adjusted taxable income (exceptions apply)

New limits on net operating loss (NOL) deductions

Elimination of the Section 199 deduction, also commonly referred to as the domestic production activities deduction or manufacturers’ deduction — effective for tax years beginning after December 31, 2017, for noncorporate taxpayers and for tax years beginning after December 31, 2018, for C corporation taxpayers

New rule limiting like-kind exchanges to real property that is not held primarily for sale

New tax credit for employer-paid family and medical leave — through 2019

New limitations on excessive employee compensation

New limitations on deductions for employee fringe benefits, such as entertainment and, in certain circumstances, meals and transportation

More to Consider

This is just a brief overview of some of the most significant TCJA provisions. There are additional rules and limits that apply, and the law includes many additional provisions. Contact your tax advisor to learn more about how these and other tax law changes will affect you in 2018 and beyond.

OSHA Accepting Electronic Form 300A Data Submissions Through End of Year

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

According to a statement released by the DOL, as of January 1, 2018, the Injury Tracking System "will no longer accept the 2016 data."

Employers in California, Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming are currently not required to submit their OSHA reports electronically. However, it is likely it will be a requirement in the future.

Update: 5/3/18 For updated information on State requirements, read "Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers across All States."

For additional information about the OSHA electronic reporting, read "Risk Management Center Streamlines Electronic OSHA Reporting," "DHS Alerts OSHA of Possible Electronic Reporting Security Breach," "OSHA Launched Electronic Reporting System."

OSHA Pushes Back Electronic Reporting Deadline

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) announced it has extended its electronic reporting deadline from December 1, 2017 to December 15, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) announced it has extended its electronic reporting deadline from December 1, 2017 to December 15, 2017.

The extension was made "to allow affected employers additional time to become familiar with the new electronic reporting system launched on August 1, 2017," according to the statement issed by the DOL's OSHA.

Employers in California, Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming are currently not required to submit their OSHA reports electronically. However, it is likely it will be a requirement in the future.

Update: 5/3/18 For updated information on State requirements, read "Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers across All States."

For additional information about the OSHA electronic reporting, read "Risk Management Center Streamlines Electronic OSHA Reporting," "DHS Alerts OSHA of Possible Electronic Reporting Security Breach," "OSHA Launched Electronic Reporting System."

Berkshire Hathaway Homestate Companies and Rancho Mesa Participate in Nationally Renowned LANDSCAPES 2017

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Berkshire Hathaway Homestate Companies and Rancho Mesa Insurance Services NALP Program Team

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

The group consisted of Senior Vice President Margaret Hartmann, NALP Assistant Director of Underwriting Valerie Contreras, NALP Program Underwriter Davis Cooper, NALP Client Services Coordinator Emily Docuyanan, and NALP Senior Loss Control Specialist Steve Hamilton from BHHC, and agency Principal Dave Garcia and NALP Program Director Drew Garcia from RMI.

Davis Cooper, NALP Program Underwriter, Berkshire Hathaway Homestate Companies

The BHHC and RMI group participated in a multitude of event programs as speakers, ambassadors, and audience. BHHC and RMI championed four breakfast table topics, a breakout education session based on risk mitigation and cost savings, and took time to speak with association members about the program within National Association of Landscape Professionals' (NALP) booth at the expo.

NALP Program Board Presentation

Sam Steel, NALP Safety Advisor & Steve Hamilton, BHHC

Membership Meeting

“The event was a great success," said Dave Garcia. "It’s amazing to see so many like-minded people dedicated to improving themselves and their companies while building upon the professionalism this industry holds as standard. We are so proud to be a part of this amazing industry and look forward to a long lasting partnership with NALP for years to come.”

NALP Group

Davis Cooper and Drew Garcia at the booth

Davis Cooper speaking with attendees at the booth

I really enjoyed connecting with NALP members and learning about their individual companies. LANDSCAPES provides an environment for motivated industry professionals to share ideas, learn, and form long lasting relationships. The overwhelming commonality is this identified desire for industry veterans to give back to the community that helped them succeed. It’s easy to build off that energy and puts into perspective that our Work Comp Program is providing the level of specialized attention this industry deserves. I'm excited to keep the momentum going while constantly looking for ways to improve our product so that we can provide more to lawn and landscape professionals.

For more information about the NALP Workers' Compensation Program, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

NALP Announces 2017 Safety Award Recipients

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Rancho Mesa would like to congratulate all 263 National Association of Landscape Professionals (NALP) members who achieved recognition for their safety efforts in 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Rancho Mesa would like to congratulate all 263 National Association of Landscape Professionals (NALP) members who achieved recognition for their safety efforts in 2017.

"The National Association of Landscape Professionals Safety Recognition Awards Program is designed to reward landscape industry professionals who consistently demonstrate their commitment to safety, and reflects the dedication of these individuals and their companies to creating and maintaining safe work environments," according to the NALP website.

Companies are evaluated in the following categories:

- No vehicle accidents

- No injuries or illness

- No days away from work

We would like to encourage all professional lawn and landscape companies to partake in NALP’s safe company program because participation as a group will continue to evolve and strengthen safety within the industry as whole.

I’m looking forward to supporting the association and these individual achievements in Louisville on October 19th at the annual awards ceremony.

On behalf of Rancho Mesa, congratulations to the participants!