Industry News

Safety Evolution: General Contractors Begin Requiring Safety Helmets Over Hard Hats

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

The hard hat has long been a staple for construction-site safety. However, a new contender has entered the industry in 2023 as more and more general contractors are requiring safety helmets.

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

The hard hat has long been a staple for construction-site safety. However, a new contender has entered the industry in 2023 as more and more general contractors are requiring safety helmets.

The safety helmet, while similar in form to the normal hard hat, includes added protection such as chin strap, face shield, and ear muffs. These new features allow for the helmet to sit more securely on the head while also protecting the ears from dangerously high noise levels and the eyes from possible debris.

“Since we made the switch to the new style hard hat, our employees don’t want to go back to the old-style hard hat,” Gilbane Building Company said. “This technology successfully removes the hazard of the hard hat falling off during a task, and wearing the face shield eliminates the possibility of forgetting to wear eye protection.”

While OSHA does not officially require the switch from hard hats to safety helmets, the topic was brought up at the Nation Association of Home Builders (NAHB) Spring Leadership Meeting in June 2023 in which director of OSHA’s Office of the Directorate of Construction, Scott Ketcham, granted insight on OSHA’s plans to improve jobsite safety with elevated standards for Personal Protective Equipment (PPE) in the near future.

“One initiative shared at the meeting is a pilot program for safety helmets meant to eventually replace hardhats as the preferred head protection in construction,” NAHB’s article about the meeting said. “Ketcham noted that 20% of head injuries in construction are the result of slips, trips, and falls and that hardhats do not protect against such injuries while helmets with chinstraps may stay on the head during a fall and offer protection.”

As PPE continues to evolve in the construction industry, it's important for subcontractors to be aware of what might be required of them on their job sites. Although no current laws require safety helmets over hard hats, Rancho Mesa will continue to offer updates as standards change.

How Important is Your EMR in the Pre-Qualification Process?

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

With 2024 right around the corner, general engineering and trade contractors will be required by government agencies and general contractors to enter the annual pre-qualification process in order to bid work. These entities are looking closely at a company’s project history, including project size, bonding capacity, limits of insurance as well as a companies’ Experience Modification Rate (EMR).

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

With 2024 right around the corner, general engineering and trade contractors will be required by government agencies and general contractors to enter the annual pre-qualification process in order to bid work. These entities are looking closely at a company’s project history, including project size, bonding capacity, limits of insurance as well as a companies’ Experience Modification Rate (EMR).

An EMR is a numeric representation of a company’s audited payrolls for the three prior years (not including the current year) and your workers’ compensation claims history, compared to businesses in the same industry or standard classification. EMR’s create a baseline for business while allowing for a surcharge or debit when employers claims are worse than expected and a credit when employer’s claims are better than industry average. Companies with and EMR rate below a 1.00 are considered better than average, while greater than 1.00 are consider below average.

Pre-Qualification Process

In the highly competitive environment of construction bidding, it has become common that government agencies and general contractors will preclude contractors from the pre-qualification process if your EMR exceeds 1.00 or 1.25. In my opinion, this represent an oversight as many companies have strong will developed safety programs, yet their EMR is holding them back. Some examples of this include:

The EMR is a lagging factor. Only the last three policy periods, not including the current policy period are taken into consideration for the calculation.

EMR’s can include claims that may have been unavoidable and don’t represent a lack of safety (i.e. an employee was involved in an auto accident and was not at fault).

Large indemnity claims can have a significantly higher impact for a smaller company vs. a larger company with a similar size claim.

Rather than placing such critical importance on the contractors current EMR, government agencies and general contractors designing the pre-qualification process should include frequency indicators like incident and DART Rate (i.e. days away, restricted or transferred) or put more emphasis on a contractors’ 5 or 10-year average EMR.

Given the importance of the pre-qualification process an and the potential for contractors to be precluded from new opportunities to bid work, we’ve developed a proprietary Key Performance Indicator “KPI” Dashboard as well as our SafetyOne Desktop & Mobile App to assist companies in managing their EMR. These tools will, among many things, help you:

Benchmark your experience against your peers.

Weigh the impact of any claim to your EMR.

Project your future EMR a year in advance.

If you would like a KPI created for your company, or would like to learn more about our SafetyOne App, please email me at sclayton@ranchomesa.com.

Understanding the Importance of Subcontractor Warranty Endorsement in General Liability Policies

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In a recent podcast episode, Daniel Frazee, Executive Vice President at Rancho Mesa, sat down with fellow Agency Principal Sam Clayton to explore a crucial topic in the realm of general liability insurance policies, the subcontractor warranty endorsement. This endorsement outlines essential requirements that contractors should pay close attention to when working with subcontractors.

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In a recent podcast episode, Daniel Frazee, Executive Vice President at Rancho Mesa, sat down with fellow Agency Principal Sam Clayton to explore a crucial topic in the realm of general liability insurance policies, the subcontractor warranty endorsement. This endorsement outlines essential requirements that contractors should pay close attention to when working with subcontractors.

The subcontractor warranty endorsement in a commercial general liability policy establishes the minimum conditions that the contractor must have in place with the subcontractors they hire. Sam highlights three key requirements including the necessity for a written contract with an indemnity agreement in favor of the contractor, being named as additional insured for both ongoing and completed operations through endorsement, and ensuring that subcontractors maintain insurance coverage with limits equal to or exceeding the contractor's commercial liability policy (typically $2 million in aggregate and $1 million per occurrence).

Failure to meet these requirements can have significant consequences. Different insurance carriers may react differently, but common outcomes include higher deductibles, potentially reaching $25,000, compared to the usual $2,500 or $5,000 deductible, and, in some instances, a complete denial of coverage.

Given these potential repercussions, Sam advises contractors to carefully read and understand the subcontractor warranty endorsement in their general liability policy. Additionally, they should take proactive steps to protect themselves such as legal reviews of subcontract agreements, insurance consultations with brokers to determine adequate coverage, and implementing robust documentation and monitoring systems for certificates of insurance.

The subcontractor warranty endorsement is a vital component of general liability insurance policies for contractors. Understanding its requirements and taking the necessary steps to comply with them can help contractors avoid potentially costly consequences in the event of a claim caused by one of their subcontractors. To learn more, please listen to Episode 345 below, or on your favorite listening platform.

Digitalization in the Construction Industry: A How-To Guide

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

The construction industry stands as one of the biggest contributors to the U.S. economy. With the rapid advancements in technology, however, it still stands out as one of the least digitized industries in the world. While traditionally, construction companies have been loyal to paper methods, digitalization in construction brings many benefits such as increased efficiency, improved safety, and enhanced communication.

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

The construction industry stands as one of the biggest contributors to the U.S. economy. With the rapid advancements in technology, however, it still stands out as one of the least digitized industries in the world. While traditionally, construction companies have been loyal to paper methods, digitalization in construction brings many benefits such as increased efficiency, improved safety, and enhanced communication.

Although it might seem intimidating, making the jump from paper to pixels can help propel your company to the next level, especially in safety. Rancho Mesa offers the SafetyOne™ app to help transition companies into the digital age. Taking the first steps in this process with intention will make a huge impact in the long run, and we've outlined some key factors to get you started.

Collect the Paper

Once you have decided to ditch the paper and move to a digital format, one of the first steps is to get those papers organized. Collect all the forms, spreadsheets, and checklists you manually fill out. These include equipment inspections, training documentation, toolbox talk sign-in sheets, etc. Once you’ve gathered everything you use on a regular basis, you will be able to easily see what can be digitized.

Set Priorities and Goals

Making the switch to digital can appear intimidating especially when the goals exceed the realistic time frame. Prioritize what should be digitalized first and delegate who is responsible for completing each task. If you are using SafetyOne, the priority might be to add the names of your projects to the system and decide who will need access to the admin website and mobile app.

Start with the Easy

When you begin digitalizing your safety program, start with small switches that are easy for your employees to adopt. We recommend SafetyOne’s toolbox talks as a starting point because it only requires a few simple steps to implement.

The SafetyOne platform has a library of toolbox talks that can be accessed on the jobsite via the mobile app with ease. Once the supervisor has conducted the toolbox talk, each employee can document their attendance by signing their name on the supervisor’s mobile device. The employee doesn’t need to be added as a user nor have the app on their personal device. The documentation will automatically be filed in the system and can be reviewed back at the office.

Create Digital Versions of Paper Forms

Once you have collected the information and forms your company uses, you can begin the process of creating digital versions of them. Start with the most important forms and go from there. In SafetyOne, you can create your own forms or choose from a library of mobile forms and observations that can be filled out on the jobsite via a mobile phone or tablet.

Digitalizing your forms has several benefits. While similar to the process you have already been doing, it increases efficiency and saves time. You will no longer need to worry about misplacing the document, or bringing the physical form back to the office and filing it manually. Once a mobile form is submitted on the SafetyOne app, it will automatically be filed in the platform. Plus, digital forms can be easily accessed, edited, and shared, improving collaboration.

As technology continues to evolve, it is important for construction employers to utilize digital tools in order to stay competitive in the industry. With the potential to save time and minimize risks, and improve employee safety, the construction industry is gradually embracing digitalization. Rancho Mesa is here to offer the tools and guidance to make this transition successful.

For more information about how SafetyOne can help your company, contact your client technology coordinator or visit the SafetyOne page on ranchomesa.com.

Unraveling Residential Exclusions: Navigating General Liability in Construction

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In Episode 339 of Rancho Mesa’s StudioOne™ podcast, Vice President of the Construction Group Sam Clayton interviews Executive Vice President Daniel Frazee as they discuss the importance of Residential Exclusions in General Liability (GL) Policies for companies in the construction industry.

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In Episode 339 of Rancho Mesa’s StudioOne™ podcast, Vice President of the Construction Group Sam Clayton interviews Executive Vice President Daniel Frazee as they discuss the importance of Residential Exclusions in General Liability (GL) Policies for companies in the construction industry.

Sam and Daniel highlight how these exclusions impact coverage for various types of residential work within the construction industry, such as single-family homes, apartments, and more. Daniel emphasizes the need for construction firms to be specific about the type and location of their residential work, as different carriers have varying interpretations of residential exclusions. He also touches on Wrap/OCIP policies, which can provide broader coverage for subcontractors working on residential projects.

The episode highlights the significance of understanding existing residential exclusions for Rancho Mesa construction clients and suggests considering a policy audit to ensure proper coverage.

Overall, the podcast provides valuable insights into navigating residential exclusions and their implications for construction businesses, urging listeners to proactively manage their insurance coverage.

Episode 339 can be listened to below, or on your favorite listening platform. If you would like more information, please contact Daniel Frazee at dfrazee@ranchomesa.com, or Sam Clayton at sclayton@ranchomesa.com.

Risk Tamed and Rewards Claimed: Requiring Subcontractor Bonds

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

We often receive questions from our contractor clients regarding if/when they should require a subcontractor to provide the protection of a performance & payment bond for a project. Although the premium charged for the bond will add cost to the project – on many occasions the benefit of the bond will far outweigh the cost.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

We often receive questions from our contractor clients regarding if/when they should require a subcontractor to provide the protection of a performance & payment bond for a project. Although the premium charged for the bond will add cost to the project – on many occasions the benefit of the bond will far outweigh the cost. Here are several benefits that might assist in your decision:

The subcontractor would have gone through a prequalification process of the surety. The surety will evaluate the subcontractor’s financial strength, experience, and ability to perform the work. This can be extremely valuable if you have never worked with this subcontractor on past projects.

Provides protection that the subcontractor will pay their suppliers and lower tier subcontractors. The payment bond transfers the risk of these payments to the subcontractor’s surety.

If the subcontractor has a critical role in the overall completion of the project or a special expertise - the bond can protect against additional costs or delays due to a default.

Your bond company may require you to obtain subcontractor bonds when a trade exceeds a certain parameter (for example: $500,000) as a condition of the program they provide.

We recently supported a contractor client on a project that was two times larger than any project they had completed in the past. The decision to bond back the three largest subcontractors made the bond company comfortable enough with this transfer of risk to support the project.

We have other clients that have suffered subcontractor losses in the past and now require subcontractor bonds on all their projects.

If you would like more information on the bonding of subcontractors, please contact me at 619-937-0165 or mgaynor@ranchomesa.com.

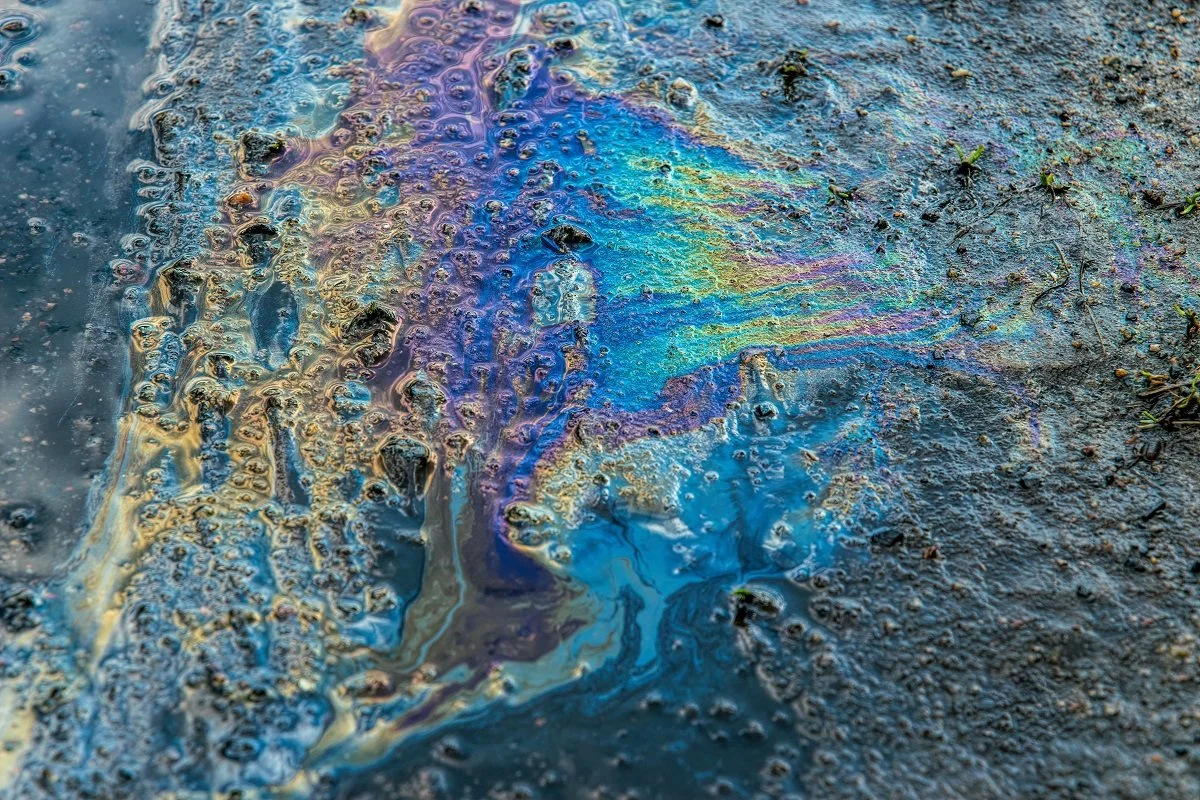

The Critical Role of Pollution Liability Insurance for Mechanical Contractors

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Mechanical HVAC contractors are essential to making sure that buildings around the globe have controlled temperatures and are energy efficient. Nationwide, the demand for mechanical HVAC contractors often keeps these businesses with full backlogs. These companies use various materials that create the potential for a pollution liability claim. Refrigerants, gases, flammable liquids, and lubricants are examples of these types of pollutants. If leaked or exposed, walls, ceilings, and floors can develop damage or mold that is not covered by standard commercial general liability policies.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Mechanical HVAC contractors are essential to making sure that buildings around the globe have controlled temperatures and are energy efficient. Nationwide, the demand for mechanical HVAC contractors often keeps these businesses with full backlogs. These companies use various materials that create the potential for a pollution liability claim. Refrigerants, gases, flammable liquids, and lubricants are examples of these types of pollutants. If leaked or exposed, walls, ceilings, and floors can develop damage or mold that is not covered by standard commercial general liability policies.

Pollution liability insurance is a separate and specific form of insurance meant to protect businesses from pollution-related claims. Pollution risks may arise from activities such as the improper disposal of hazardous materials, fuel spills, or accidental leaks from HVAC systems. Such incidents can lead to damage to the environment, neighboring properties, and public health, which could potentially result in costly legal disputes and cleanup expenses.

Below we will cover two common pollution claim examples in an effort to raise awareness and drive home the need for commercial pollution liability insurance specifically for HVAC mechanical contractors.

Claim Example 1: Contamination of Ground Water due to HVAC System Leak

In this example, XYZ Mechanical installed an HVAC system in a commercial building. The building is adjacent to a residential development. Post install, there was a leak in the refrigerant line which seeped into the dirt below the building which went undetected for weeks. The refrigerant seeped into the groundwater supply causing contamination.

Hazard - This claim example would have a significant impact on wildlife, could cause harm to residents and would need a specific extraction/clean up that would be costly to a business owner.

Protection - A pollution liability insurance policy would react to this type of claim and could offer coverage for the cleanup, any third-party injuries, and the cost for legal proceedings.

Claim Example 2: Fuel-Contaminated Environment

ABC Mechanical is hired to install an energy efficient HVAC ground unit for an apartment complex. There was an underground unmarked fuel storage tank that was accidentally drilled into and caused a leak.

Hazard - This claim example would need immediate attention for the potential risk of fuel leaking into the ground and a plan for cleanup. The leak could make its way into the groundwater contaminating wells and potentially causing contamination of water. There would also be some health hazards for residents that could become a concern.

Protection - A pollution liability policy would come to aid with emergency response, cleanup cost, third- party bodily injury and legal defense costs.

Pollution liability is very often an overlooked coverage for many HVAC mechanical contractors. In 1986, however, the total pollution exclusion (TPE) became a standard exclusion in commercial general liability policies and has since created the need to purchase commercial pollution liability policies due to the variety of exposures to risk. The cost is relatively minor and the benefit very high if and when coverage is triggered. If you have questions regarding commercial pollution liability, please contact me at khoward@ranchomesa.com or (619) 438-6874.

Cal/OSHA to Enact ETS for Silica Exposure in Artificial Stone Industry

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On July 20, 2023, the Cal/OSHA board approved a petition that requested an emergency temporary standard for respirable crystalline silica, a byproduct of manufacturing and cutting artificial stone material.

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On July 20, 2023, the Cal/OSHA board approved a petition that requested an emergency temporary standard for respirable crystalline silica, a byproduct of manufacturing and cutting artificial stone material.

The petition was submitted to Cal/OSHA by the Western Occupational and Environmental Medical Association (WOEMA). It argued that the recent increase in advanced silicosis cases documented in California hospitals made heightened silica regulations necessary.

The permissible exposure limit (PEL) at which current silica safety requirements apply, is 50 micrograms per cubic meter of air over the course of an 8-hour shift. Employees whose interactions with respirable crystalline silica surpass this limit are required to implement control measures and wear personal professional equipment (PPE) in order to reduce exposure.

WOEMA advised that workplaces using engineered stone with a silica content greater than 50% should put in place the following ETS standards.

Regulated areas to limit employee access to spaces where artificial stone is fabricated.

Restrictions on fabrication without the use of water to suppress dust.

The use of airline respirators or power air-purifying respirators (PAPRs) for all work involving fabrication of artificial stone.

Annual reporting letters from employers to the Cal/OSHA Occupational Carcinogen Control Unit on the use of silica.

Strengthened penalty structure so that violations of the ETS result in citations classified as serious.

Updated information on CT exams and other diagnostic studies, prepared by Cal/OSHA.

Requirements that physicians or other licensed health care professionals report moderate to severe silicosis diagnosis to Cal/OSHA.

The Cal/OSHA staff’s evaluation concluded that most of the petition’s requested requirements were already part of the current standard for silica in construction environments. It therefore advised the board to deny adopting an ETS and instead, update the current permanent standards where needed.

However, in a contested decision, the board ultimately went against their staff’s recommendation, and approved the request to enact an ETS.

Cal/OSHA is expected to draw up the new emergency temporary standards within the next couple months. Silica exposure occurs in industries that manufacture stone countertops, brick, concrete blocks, or ceramic products. This motion may affect construction clients who frequently work with these materials.

Further information regarding the current safety regulations for respirable crystalline silica can be found in Cal/OSHA’s Code of Regulations.

Contract Provisions to Review for Successful Projects

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

Contracts are not always the most fun to read, but certainly important for all of us in the construction industry.

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

Contracts are not always the most fun to read, but are certainly important for all of us in the construction industry.

As a subcontractor, you are bound to the contract once you have signed it whether you understand everything that is in it or not.

Let’s consider a few key provisions in a construction project agreement that can impact your bottom line more than others. With a goal of mitigating certain impacts along the way, addressing these items prior to signing your contract should be considered as a best practice in the industry, and, we hope, support your success.

Contracts are often tedious to read, to say the least. Any business owner can proceed at their own risk, of course. But, we want to share a few things for you to consider that might offer some support and protection.

Delays

What does the contract say? What is a reasonable penalty? Business owners should always confirm just what types of delay clauses they could be responsible for (e.g., liquidated and consequential come to mind), and since there are most always liquidated damages that could be charged to you for delay of a project, make sure your contract is clear about what those are.

As a subcontractor, you are bound to the terms and conditions of the prime contract between the owner (whether a public agency or private entity) and your general contractor. These can be referred to as “flow down” provisions when it comes to things like damages, warranty, etc.

Best Practice: Always ask for a copy of the prime contract if you are a subcontractor. Make sure you read that, too, for anything that could impact you.

Mobilization

What can you bill for, and when?

Sequencing of Scope of Work

What happens when another trade interferes with your work? What are your rights and responsibilities of putting your client on notice when you have these impacts? Can you be compensated for any additional costs relating to these impacts?

Material Cost Escalations (and lead times)

Does your contract allow for cost escalations? How do supply chain issues affect you and how can you mitigate some of that exposure?

Change Orders

What can you reasonably expect to achieve to cover OH&P?

The best practice for change orders is documentation from day one and early communication to your client. When everyone bunches up at the end of the job with a ton of change orders, the owner may have less of a pool of funds to draw from (for contingencies, etc.) than they may have at earlier stages of the project.

It’s important to know that the surety companies and underwriters are contract savvy as well and we do our best to understand what the obligations are within the contracts. You should expect some questions about some of these contract provisions which, at the end of the day, are intended to make sure you are best protected along the job’s progression.

There just may be something about the surety’s relationship with their principal and communication about these contracts which results in bonded jobs being more successful than non-bonded jobs. But, that’s a topic for another article and podcast!

A Deeper Dive Into Professional Liability

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In Episode 315 of Rancho Mesa’s StudioOne™ podcast, Executive Vice President Daniel Frazee and Vice President of the Construction Group Sam Clayton discuss pollution liability, and why virtually all general liability policies exclude this coverage.

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In Episode 319 of Rancho Mesa’s StudioOne™ podcast, Vice President of the Construction Group Sam Clayton interviews Executive Vice President Daniel Frazee as they continue their conversation on general liability policies and move deeper into a key exclusion that is often seen as they negotiate terms and conditions on behalf of their clients and prospective clients.

During the episode, Frazee explains what professional liability is and why it is excluded on general liability policies. He gives a summary of what types of contractors typically have professional liability exposure and reasons for why they may have it. Frazee also describes specific options contractors can look at when it comes to securing stand-alone policies.

Episode 319 can be listened to below, or on your favorite listening platform. If you would like more information, please contact Daniel Frazee at dfrazee@ranchomesa.com, or Sam Clayton at sclayton@ranchomesa.com.

A Brief Discussion on Pollution Liability

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In Episode 315 of Rancho Mesa’s StudioOne™ podcast, Executive Vice President Daniel Frazee and Vice President of the Construction Group Sam Clayton discuss pollution liability, and why virtually all general liability policies exclude this coverage.

Author, Lauren Stumpf, Marketing & Media Communications Specialist, Rancho Mesa Insurance Services, Inc.

In Episode 315 of Rancho Mesa’s StudioOne™ podcast, Executive Vice President Daniel Frazee and Vice President of the Construction Group Sam Clayton discuss pollution liability, and why virtually all general liability policies exclude this coverage.

Frazee and Clayton talk about general liability policies and delve deeper into some key exclusions they often see as they negotiate terms and conditions with underwriters.

Clayton also explains the specific options contractors can look at when it comes to securing stand-alone policies.

Please listen to the full episode below, or on your favorite listening platform. If you would like more information, please contact Daniel Frazee at dfrazee@ranchomesa.com, or Sam Clayton at sclayton@ranchomesa.com.

Heat Illness Awareness Vital for California's Construction Companies

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

California faces a critical need to prioritize heat illness awareness among its workforce. The combination of Southern California's recent above average rainfall and the anticipated heatwave resulting from El Niño has created the possibility of an extremely warm summer. Construction companies must remain vigilant and adaptable, implementing appropriate measures to address these changing weather dynamics and ensuring the safety of their workers. By staying informed about weather forecasts and implementing flexible work schedules and site preparations, companies can effectively navigate these challenging conditions and prioritize the well-being of their employees. By understanding the significance of heat illness awareness, companies can ensure the safety and well-being of their workers while fostering productivity, minimizing downtime, and improving overall project efficiency.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

California faces a critical need to prioritize heat illness awareness among its workforce. The combination of Southern California's recent above-average rainfall and the anticipated heatwave resulting from El Niño has created the possibility of an extremely warm summer. Construction companies must remain vigilant and adaptable, implementing appropriate measures to address these changing weather dynamics and ensuring the safety of their workers. By staying informed about weather forecasts and implementing flexible work schedules and site preparations, companies can effectively navigate these challenging conditions and prioritize the well-being of their employees. By understanding the significance of heat illness awareness, companies can ensure the safety and well-being of their workers while fostering productivity, minimizing downtime, and improving overall project efficiency.

Recognizing the Risks

The construction industry in California is particularly vulnerable to heat-related illnesses and fatalities due to the physically demanding nature of the work and prolonged exposure to high temperatures. Heat stress, heat exhaustion, and heat stroke are severe conditions that can result in significant health complications. By acknowledging the risks associated with working in high temperatures, construction companies can proactively take measures to mitigate potential hazards.

Cultivating a Culture of Safety

Establishing a culture of safety is crucial for construction companies in California to create an environment where employee well-being is the top priority. Employers should develop comprehensive programs focused on preventing heat-related illnesses. These initiatives should include employee training, hazard assessments, access to shade and water, acclimatization procedures, and adjusted work schedules. Regular safety meetings and open lines of communication should be encouraged to address concerns, share information, and ensure that everyone is aware of the potential risks associated with working in high heat.

Implementing Worksite Modifications

Modifying the worksite environment can reduce the impact of heat-related illnesses. Construction companies should establish shaded rest areas where workers can take breaks, cool down, and hydrate. Access to potable water should be readily available to prevent dehydration, and regular hydration breaks should be scheduled throughout the day. Additionally, adjusting work schedules to avoid the hottest periods, utilizing cooling fans or misting systems, and implementing rotational job assignments can help reduce heat stress and improve worker safety.

Monitoring and Supervision

Supervisors and management play an important role in ensuring heat illness awareness on construction sites. Regular monitoring of weather conditions and temperature provides valuable information for determining appropriate work practices and scheduling. Close supervision enables the early detection of signs of heat-related illness and allows for immediate intervention. Encouraging workers to prioritize their own well-being and empowering them to report any symptoms promptly is equally important.

Heat illness awareness is vital for construction companies operating in California. By prioritizing worker safety and implementing comprehensive programs to prevent heat-related illnesses, employers can safeguard their employees from the risks associated with high temperatures. Moreover, such initiatives enhance productivity, avoid worker’s compensation claims, reduce downtime due to illness or injuries, and improve overall project efficiency. By cultivating a safety culture, providing necessary PPE, implementing worksite modifications, and maintaining close supervision, construction companies can establish a healthy and safe working environment that ensures the well-being of their workers.

Rancho Mesa’s Upcoming Heat Illness Prevention Workshop

Lastly, Rancho Mesa Insurance is hosting our annual Heat Illness Prevention workshop on June 2nd at the Mission Valley library from 10:00 AM to 11:30 AM. This workshop will provide valuable insights, best practices, and resources to help construction companies and their employees effectively address and prevent heat-related illnesses. Be sure to join this workshop to stay informed and proactive in ensuring the health and safety of your workforce.

Contractor Strategic Planning with Kevin Brown of RBTK, LLP

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

In my recent StudioOne™ podcast episode with Kevin Brown, Of Counsel with the CPA Firm RBTK, LLP, we discuss the anatomy and considerations that go into strategic planning for your business.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

In my recent StudioOne™ podcast episode with Kevin Brown, Of Counsel with the CPA Firm RBTK, LLP, we discuss the anatomy and considerations that go into strategic planning for your business.

The podcast addresses questions, such as:

What do you want your business to accomplish?

What steps will help my company achieve its goal(s)?

The episode includes a discussion of the importance of developing a succession plan.

If you would like more information on Episode 309, please contact Kevin Brown at kbrown@rbtk-cpa.com.

Implementing Best Practices when Hiring in the Construction Industry

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

With unemployment rates settling near 4 percent, it is becoming increasingly difficult to find the right employees to help grow your construction company. With most able-bodied workers having secure employment, this leads to having either apprentice-type employees that come with unique challenges or pulling from an aging workforce that can bring cumulative injuries and risks. Navigating these issues can be complex and there is not a perfect solution, but employer’s hiring practices need to change in order to keep up with the current state of the industry.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

With unemployment rates settling near 4%, it is becoming increasingly difficult to find the right employees to help grow your construction company. With most able-bodied workers having secure employment, this leads to having either apprentice-type employees that come with unique challenges or pulling from an aging workforce that can bring cumulative injuries and risks. Navigating these issues can be complex and there is not a perfect solution, but employer’s hiring practices need to change in order to keep up with the current state of the industry.

When hiring new employees, consider:

Pre-hire drug testing

Pre-hire physicals

Targeted job postings with accurate description of daily work

Multiple levels of interviews

Simulating work at your office that potential new hires would be performing in the field

The US saw a unique shift in the workplace as a result of COVID-19 where employees felt their value skyrocket as fewer people were willing to work in-person. Employers were forced to increase wages to get bodies on jobsites. In prior years, it may have been enough to just rely on word of mouth and referrals to get new hires. Too often now, we are seeing new hires suffer “ghost injuries” that are quickly followed with letters of representation. These and similar types of cumulative trauma claims can have long term impacts on your experience rating (EMR). While these situations are difficult to prevent, using best practices and conducting thorough interviews with your prospective employees will allow you to make educated decisions which typically lead to better hires.

Taking advantage of the best practices listed above can help insulate your company from poor hiring decisions. Obviously, we would love for new hires to turn into long term employees, as onboarding and proper training can be a costly expense in both other employee’s time and payroll. In a recent survey conducted by Traveler’s Insurance, it was shown that 34% of workplace injuries occurred during the worker’s first year on the job. This can be from a combination of inexperience, overexertion, and/or lack of safety knowledge.

Consider these hiring and onboarding processes to assist in mitigating the glaring number of claims that are emanating from newer employees or employees that have limited experience on jobsites. The financial impact they can have on your company will impact your balance sheet for years and can be potentially avoided with implementing some of our recommended techniques

To learn more about improving your hiring practices or how Rancho Mesa can help to improve your process, reach out at (619) 438-6900 or ccraig@ranchomesa.com.

Understanding General Liability Forms and Endorsements

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

Two agency leaders within Rancho Mesa Insurance Services, Inc. made a special appearance in a recent episode of the StudioOne™ Safety & Risk Management Podcast. During episode 293, Executive Vice President Daniel Frazee and Vice President of the Construction Group Sam Clayton discussed the important forms and endorsements in general liability policies.

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

Two agency leaders within Rancho Mesa Insurance Services, Inc. made a special appearance in a recent episode of the StudioOne™ Safety & Risk Management Podcast. During episode 293, Executive Vice President Daniel Frazee and Vice President of the Construction Group Sam Clayton discussed the important forms and endorsements in general liability policies.

Sam and Daniel highlighted 3 key terms they commonly see within the construction insurance space. Sam started out with explaining residential work, and how it is defined within the scope of general liability underwriting.

Next he explained subcontractor’s warranty endorsement, a term that is recognized by insurance professionals, but may confuse trade and general contractors. Sam dives into the term, explaining the importance of knowing how the warranty on one’s policy actually reads.

Lastly, Sam explains what minimum and earned premium is and how contractors’ can use it to their advantage when negotiating terms through their broker.

The pair wrapped up their conversation educating listeners on first steps contractors can take to learn more about the policies they currently have in place.

Daniel and Sam’s episode, Ep. 293 General Liability Forms and Endorsements, can be listened to below, or via your favorite podcast listening platform.

Plan Your SafetyOne™ App to Best Suit Your Organization’s Needs

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa aims to provide clients with tools that are flexible in order to best fit their individual needs, including our proprietary SafetyOne™ application. SafetyOne’s features are systemized based on “Projects.” However, projects are highly adaptable to the way each individual organization works.

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa aims to provide clients with tools that are flexible in order to best fit their individual needs, including our proprietary SafetyOne™ application. SafetyOne’s features are systemized based on “Projects.” However, projects are highly adaptable to the way each individual organization works.

Below are best practices for utilizing projects depending on your organization’s industry and structure.

Construction (Project or Job)

As the name suggests, construction companies will most likely assign their policies, mobile forms and users to their individual construction projects or job sites. Project managers and foremen can access job-specific content based on the projects they are assigned.

This system works well for both short-term and long-term projects that need to manage safety within unique worksites.

Landscape, Tree Care and Janitorial (Service Crew)

Many landscape, tree care and janitorial companies organize their employees in the SafetyOne application into crews. These crews are employees who stay grouped together from one worksite to the next. Companies can name their projects based on a crew number, truck, or team name and assign content, such as toolbox talks to individual crews.

This system works well for companies providing on-going services to multiple accounts that aren’t necessarily tied to one worksite.

Human Services (Client or Program)

Human services organizations like non-profits, home healthcare, and schools can use projects for their different office locations, facilities, programs, or campuses. These organizations may choose to make policies and forms available to employees based on their office, clients, facility, program or campus.

There may be different ways to utilize the projects organization structure in the SafetyOne application. Through the dynamicity of the platform, Rancho Mesa is happy to help clients best meet their organization’s risk management needs.

For more information about how to set up projects in SafetyOne™, please contact your client services coordinator or watch our Administrator Website Overview Training.

Best Practices for Growing Your Surety Program

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

You may know that the surety client/agent/underwriter relationship is different from other lines of insurance.

Whether you are new to the bonding process, or have been doing bonded work for years, there are a handful of important items that can assist with securing the best relationship for your bonding needs. It really boils down to a few key areas: timely information, accurate information, and regular communication.

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

You may know that the surety client/agent/underwriter relationship is different from other lines of insurance.

Whether you are new to the bonding process, or have been doing bonded work for years, there is a handful of important items that can assist with securing the best relationship for your bonding needs. It boils down to a few key areas: timely information, accurate information, and regular communication.

For contractors who only need small or infrequent bonds, communication may be very basic and minimal. For example, if we establish your support with a surety who has an “express program,” these programs are based on clean, personal credit and perhaps some track record of completed projects. So, there may not be a need for as much communication as there would be if an account is in a more “standard” or “preferred” program. We always want to understand and share details on the jobs you are looking to do, and have completed, but there’s generally no need for a personal relationship with the underwriter in these types of programs.

Once you are established with a more standard surety relationship, the timely information the surety expects to receive is key. However, with regular and clear communication, we also hope to add value to the relationship between our clients and the underwriter in support of the contractor’s needs.

Communication about financial information will ensure that proper attention is given to the accurate details that confirm important benchmarks. Questions like: does equity track? is the operation profitable? how is the cash looking? are percentage of completion entries noted and match what’s on the work in progress report (WIP)?

Regular communication will not only include this financial information, but also conversations about the work you have completed and the work you will complete. Be prepared to provide trends from year to year, profitability year-to-date, and specific information on current or completed jobs noted on the WIP (whether certain jobs are bonded or not). All of this information is designed to better understand your operational processes and goals, thus presenting the most complete information to the surety.

Being proactive in this relationship is always our goal. We will do our best to facilitate the information that is needed, and work to share the information that will facilitate the best support for you.

We are your advocate with the surety underwriter – and happy to facilitate these conversations and/or meetings to ensure that your surety needs are adequately addressed and met.

Regular and open communication with your surety agent and underwriter, like any relationship, is a Best Practice that will serve us all well.

To discuss your surety program, contact me at awright@ranchomesa.com or (619) 486-6570.

Insurance Benefits of GPS Systems in Commercial Vehicles

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

For businesses that rely on a fleet of commercial vehicles, insurance costs can be a significant expense. Insurance carriers calculate premiums based on a variety of factors, including the age and condition of the vehicles, driver experience and record, and the frequency and distance of trips. One factor that can positively impact insurance costs is the use of global positioning systems (GPS) in commercial vehicles. Below, we will explore some of the insurance benefits of installing GPS systems in commercial vehicles.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

For businesses that rely on a fleet of commercial vehicles, insurance costs can be a significant expense. Insurance carriers calculate premiums based on a variety of factors, including the age and condition of the vehicles, driver experience and record, and the frequency and distance of trips. One factor that can positively impact insurance costs is the use of global positioning systems (GPS) in commercial vehicles. Below, we will explore some of the insurance benefits of installing GPS systems in commercial vehicles.

Improved Safety

GPS systems in commercial vehicles can help improve safety by providing real-time tracking of vehicles and drivers. This can help businesses identify and address unsafe driving behaviors such as speeding, sudden braking, and hard cornering. By addressing these behaviors, businesses can reduce the risk of accidents and insurance claims which can result in lower insurance premiums.

Reduced Theft Risk

GPS systems can also help reduce the risk of vehicle theft. If a commercial vehicle is stolen, GPS tracking can help businesses locate the vehicle quickly and notify law enforcement. This can help reduce the risk of property loss and insurance claims related to vehicle theft.

Faster Claims Processing

In the event of an accident or other incidents involving a commercial vehicle, GPS systems can provide valuable data to insurance carriers. This can include information on the location, speed, and direction of travel of the vehicle at the time of the incident. This data can help insurance carriers process claims more quickly and accurately, which can help reduce costs and improve the overall claims experience for businesses.

Lower Insurance Premiums

GPS in vehicles can lower the loss ratio which is a key factor that underwriters use. Furthermore, the disclosure to insurance underwriters that GPS is installed and properly utilized could help insurance brokers negotiate lower premiums based on this added safety feature.

Improved Business Operations

In addition to insurance benefits, GPS systems can also help businesses improve their operations. Real-time tracking and reporting can help businesses optimize their routes, reduce fuel costs, and improve overall efficiency. By improving operations, businesses can reduce costs and improve profitability, which can have a positive impact on insurance costs and premiums.

GPS Systems have a multitude of benefits. These systems can save lives because drivers pay more attention to detail when GPS is on the vehicle. They can lower insurance premiums which can improve the return on investment. Lastly, the ability to track a stolen vehicle is a control that creates major benefits knowing that the cost of vehicles and the time needed to locate a replacement is at an all-time high.

To learn more about how GPS on your commercial vehicles can be implemented as part of your risk management plan, contact me at (619)438-6874 or khoward@ranchomesa.com.

Properly Utilizing Tailgate Meetings

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

For many foremen and superintendents, weekly tailgate meetings can feel like a task that just needs to be checked off the list. However, while the purpose of these meetings is critical for the health and well-being of fellow field employees, the time required and repetitive nature of them can create challenges. To maximize the benefits of these meetings, construction firms must be proactive and thoughtful as they develop an inventory of topics.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

For many foremen and superintendents, weekly tailgate meetings can feel like a task that just needs to be checked off the list. However, while the purpose of these meetings is critical for the health and well-being of fellow field employees, the time required and repetitive nature of them can create challenges. To maximize the benefits of these meetings, construction firms must be proactive and thoughtful as they develop an inventory of topics.

Identifying Tailgate Meeting Topics

Take ample time with your sales team to understand the scope of your backlog to see where hazards may appear within these projects. Plan training topics with an eye on the weather, paying close attention to historically warm or cold months. Consider connecting with your insurance broker as well on recent injury trends that you can address with the crew.

This will be pertinent as your company approaches their renewal window with underwriters looking at claims history. They commonly ask, “what has the insured done to make sure these claims don’t happen again?” Learning from your past is key to being proactive. Knowing you will have certain exposures coming up and addressing those with preventative training topics begins to build a Best Practice Safety Program.

Accessing Content for Training

Locating “Toolbox” trainings can be time consuming and, in some cases, costly. And very often, the trainings may not be applicable to your operation and/or the trends you may need to focus on. With an eye to the future, Rancho Mesa has recently introduced a proprietary SafetyOne™ App. Safety managers will be able to document safety inspections from their mobile device and assign required fixes to employees, while also tracking when they have been completed. Meeting content can also be distributed to supervisors through their mobile device all with a focus of making safety meetings more efficient and effective. These same supervisors can now access a vast library that can be customized to their operation.

Reach out to me to learn more about the SafetyOne™ App and how Rancho Mesa can partner with you and your team moving forward. You can reach me at (619) 438-6900 or email me at ccraig@ranchomesa.com

Take Advantage of Contractor Express Bond Programs

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Several years ago, I put together an article on various credit driven surety bond offerings that require a one-page application to qualify for bonding. Quick and simple! At that time, the maximum limits offered by various carriers was $350,000 for a single bond.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Several years ago, I put together an article on various credit driven surety bond offerings that require a one-page application to qualify for bonding. Quick and simple! At that time, the maximum limits offered by various carriers was $350,000 for a single bond.

Last week, I received separate emails from two of our partner surety carriers offering single bond programs of $600,000 and $750,000, respectfully. Again, these quick and easy bond offers are solely based on personal credit scoring. In other words, if the owner of a construction company pays their personal bills, then they most likely will have the ability to qualify for a decent-sized bond.

There is no need for company financial statements to qualify for bonding in these programs. Instead, the contractor completes a “fast” application requesting personal financial information about the owner(s). The bond company will run the personal credit of the owner(s). If the personal credit is decent, the bond will be approved. A response is provided within 24 hours of submission.

The program responds to requests for bid bonds, performance and payment bonds, and letters of bondability. Several carriers provide a “pre-qualification” feature so you can determine if you will qualify for the bond before you bid or negotiate a project that will require a bond. This pre-qualification feature is helpful for owners that are concerned they may have low credit scores.

The standard premium rate for these programs is 3% of the contract amount. Based on the strength of your personal credit, and the type of work you are looking to bond, we have seen this lowered to 2%.

Therefore, if you are considering a project that requires a bond and you are not a big fan of collecting a lot of paperwork for one project – don’t fret. We may have a solution to help you win that job.

If you would like more information on how to qualify for these programs, please contact me at (619)937-0165 or mgaynor@ranchomesa.com.