Industry News

Contractor Strategies to Maximize Your Bank Line of Credit

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Some of my most successful bond clients opened their construction business with a good amount of working experience on their resume, but only a minimal amount of cash and capital. Unfortunately, bond companies like to see a strong amount of cash and capital. Therefore, my goal, as their bond agent, is to work with what they have at the present time to explain why they are a “good risk” now for bid, performance, and payment bonds - along with ideas on how to overcome the initial cash and capital constraints.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Some of my most successful bond clients opened their construction business with a good amount of working experience on their resume, but only a minimal amount of cash and capital. Unfortunately, bond companies like to see a strong amount of cash and capital. Therefore, my goal, as their bond agent, is to work with what they have at the present time to explain why they are a “good risk” now for bid, performance, and payment bonds - along with ideas on how to overcome the initial cash and capital constraints.

As a contractor grows and is looking at larger single and aggregate bond programs, I make it a point to work with the contractor on upgrading their financial presentation along with the goal to qualify for a Bank Line of Credit. It can sometimes be difficult to qualify for that “first” bank line of credit.

We want to help! On Friday, September, 28th, we will be inviting a local bank professional to cover "Contractor Strategies to Maximize their Bank Line of Credit." Our goal is to answer some of the following questions to prepare the contractor for a favorable submission process with the banker:

a) What is the typical information needed from the Contractor to apply for a Bank Line?

b) How do I determine what size Line of Credit I should ask for?

c) What are the “key” underwriting areas you will concentrate on?

d) How long after we provide you the information should we expect an answer?

e) To qualify for a line of credit – do we need to move our checking account to your Bank?

The seminar will allow us to pull back the curtain with the banker to make this process as seamless and painless as possible. The seminar will provide the contractor an opportunity to ask the questions you might have avoided because you assumed you did not qualify.

If interested, please register online or contact Rancho Mesa Insurance at (619) 937-0164.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 1)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

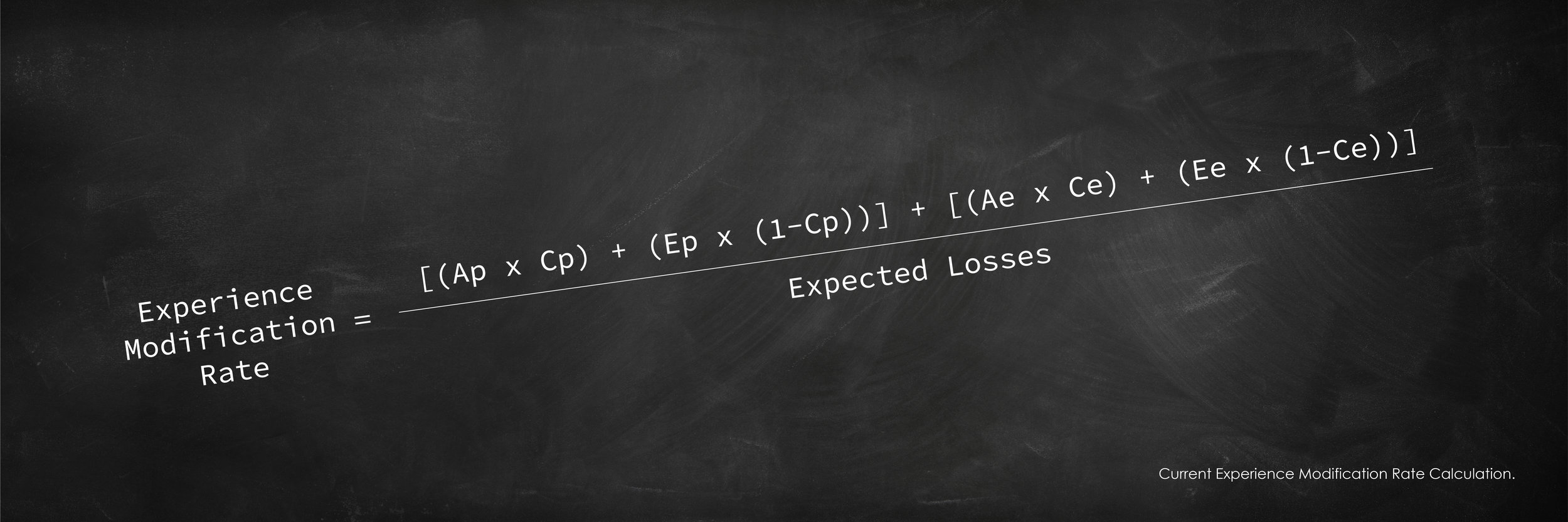

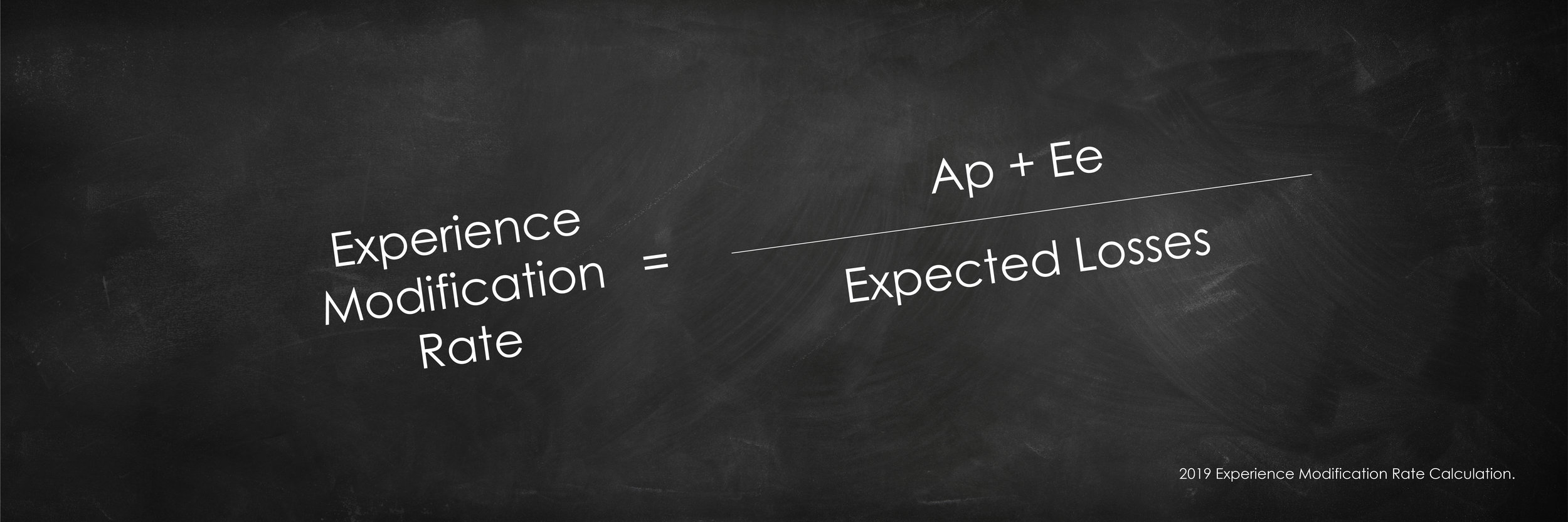

Before we breakdown the changes to the 2019 EMR formula, we must first have a strong understanding of the two critical components that directly affect the outcome of the EMR. This article will be broken out into 2 parts. Part 1 will describe the Primary Threshold and Expected Loss Rate. In Part 2, I will provide an overview of the changes to the EMR calculation.

The single most important number to my EMR is not my final rating?

Primary Threshold

Rancho Mesa has long taken a stance on the importance of a business owner knowing their primary threshold as it relates to the EMR. Proactive business owners should monitor their primary threshold annually as it is subject to change due to payroll fluctuations, operations, and the annual regulatory filing of the expected loss rate. In general terms, the more payroll associated with your governing class (the class code with the preponderance of your payroll) the higher your primary threshold will be. The primary threshold is unique to every business. The 2019 EMR formula is heavily weighted by the company's actual primary losses, the claim cost (both paid and reserved) that goes into the calculation up the primary threshold amount. Controlling claim cost and knowing your company's primary threshold is the first step to understanding the EMR.

Expected Loss Rates

The expected loss rate is the factor used to anticipate a class code's claim cost per $100 for the experience rating period. The expected loss rate (ELR) is not to be confused with the pure premium rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

The ELR changes, annually. It’s important to monitor the change; if your expected loss rates go down (from our analysis this is the direction most are going) and if nothing else changes, your EMR will go up. Why is this? Again, without going too deep, in simple terms, your EMR is a ratio of actual losses to expected losses. If your expected losses go down, but your actual losses remain the same, then your EMR will go up.

To illustrate this, consider the following. Actual losses are $25,000 and your expected losses are $25,000 your EMR would be 100. Now, if your actual losses stay the same at $25,000, but your expected losses drop to $20,000, your EMR would now be 125%. (There are other factors that would go into the actual calculation, so your actual EMR would be different – this was just to illustrate the expected losses impact to the EMR.)

In Part 2 of this article, will cover the actual changes to the EMR calculation.

For more information about the EMR, contact Rancho Mesa Insurance Services at (619) 937-0164.

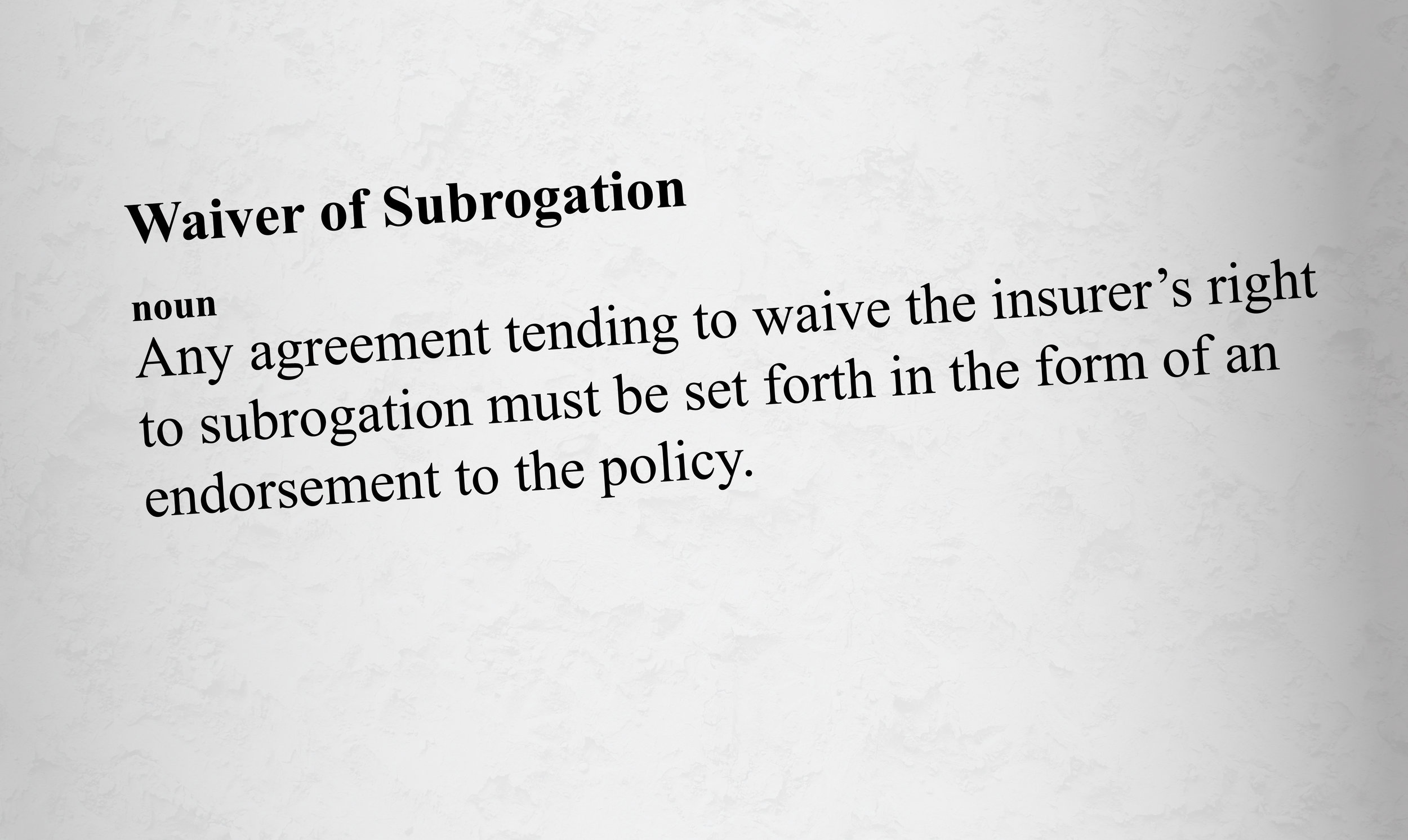

Understanding Waivers of Subrogation for Contractors

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

In an era where general contractors commonly require a Waiver of Subrogation from its sub-contractors before they are allowed to step foot on the jobsite, it is important to understand how a Waiver of Subrogation functions. Most companies simply tell their agent they need the waiver added to their contract, but what does this mean? How does it affect the policy?

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

In an era where general contractors commonly require a Waiver of Subrogation from its sub-contractors before they are allowed to step foot on the jobsite, it is important to understand how a Waiver of Subrogation functions. Most companies simply tell their agent they need the waiver added to their policy, but what does this mean? How does it affect the policy?

Subrogration is "the legal process by which an insurance company, after paying for a loss, seeks to recover all or a portion of the loss from another party who is legally wholly or partially liable for that loss," according to the Workers' Compensation Insurance Rating Bureau of California (WCIRB). So, a Waiver of Subrogration prevents your insurance carrier from recovering funds paid on a claim from the named party requesting the waiver.

When subrogating, three things must be established:

1) The defendant was negligent (or that a product was defective),

2) Negligence proximately caused the damages for which the carrier paid, and

3) The amount and nature of the damages.

If you cannot establish any one of these three, there will be no subrogation.

Subrogation is used throughout various lines of insurance. It is very common in dealing with auto insurance claims. If you are in an accident and the other driver is deemed to be at fault, your insurance company will respond first by paying to have your vehicle fixed. Then, the carrier will collect from the at fault driver’s insurance company to recover the amount they had to pay to fix your car. The insured’s carrier jumps on the claim immediately so that the insured will not have to wait for the claim to be disputed and resolved before their car is repaired. Claims are handled the same for every line of insurance, unless there is a Waiver of Subrogation in place.

When a sub-contractor is hired and has signed a Waiver of Subrogation for the project owner or general contractor, they are essentially waiving their carrier's ability to recover the money that was paid out on a claim that was caused by a third party's negligence. Waivers of subrogation often come in two formats. Either, the waiver specifically names an entity that the carrier waives its’ right to subrogate against, or a Blanket Waiver of Subrogation. If a Blanket Waiver of Subrogation is provided, the carrier must obtain permission from the named insured to subrogate against a third party.

When adding a Blanket Waiver of Subrogation to a policy, there is an additional fee to offset the carrier’s ability to reclaim money from any losses that were caused by a third party's negligence. These fees can change from carrier to carrier and it is a good move to review each policy to know exactly what you are paying for waivers. Adding a blanket waiver of insurance does not increase coverage or limits, it simply absolves an owner/general contractor of their liability.

With Waivers of Subrogation becoming more prevalent, it is easy to see how important it is as a business owner to know exactly what is covered and what you are waiving.

If you have any questions or would like to understand subrogation further, please contact Rancho Mesa at (619) 937-0164.

Differentiating Solar Industry Class Codes

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Research conducted by the Solar Energy Industry Association (SEIA) shows that California benefits from roughly 3,000 solar contractors conducting business in the state. Panels are being installed at a rapid rate. In fact, statistics show that as of January 2018, over 5 million California homes have “gone solar” and that number continues to grow. There are other benefits to using solar panels to harvest energy besides just generating electricity. They can also be used to heat water in pools, spas, storage tanks and other plumbing systems using hot water solar panels.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Research conducted by the Solar Energy Industry Association (SEIA) shows that California benefits from roughly 3,000 solar contractors conducting business in the state. Panels are being installed at a rapid rate. In fact, statistics show that as of January 2018, over 5 million California homes have “gone solar” and that number continues to grow. Not only are solar panels used to generating electricity, they can also be used to heat water in pools, spas, storage tanks and other plumbing systems using hot water solar panels.

With solar installation of all kinds becoming more prevalent throughout California, contractors must understand which workers' compensation classification is most applicable for their specialty.

California’s Workers' Compensation Insurance Rating Bureau (WCIRB) breaks down solar installation into two categories: (1) Hot water solar collection panel install, service and repair, and (2) Photovoltaic (PV) solar panel install, service and repair.

Hot Water Solar Collection Panel Install, Service and Repair

Hot water solar collection panels absorb solar energy to heat water or to transfer fluid that circulates through panels. This hot water is then routed through pipes to pools, spas, storage tanks or hydraulic heating systems. The installation, service or repair of solar water panels is assigned to workers' compensation class code 5183/5187 for plumbing.

PV Solar Panel Install, Service, and Repair

This classification applies to the outside installation, service or repair of electrical machinery or auxiliary apparatus, including but not limited to automated security gates, transformers, generators, control panels, temporary power poles at construction sites, industrial fans or blowers, photovoltaic solar panels, wind powered generators and industrial x-ray machines. Contractors who are installing, servicing or repairing PV solar panels will be assigned to the class code 3724(2) in electrical machinery or auxiliary apparatus.

The workers compensation base rates for each of these two class codes can vary widely from one carrier to another. Solar installation exposures, a detailed description of operations, and appropriate safety measures utilized must be clarified with your insurance broker so that your firm is properly placed in the appropriate code. The difference can often represent significant savings.

Rancho Mesa Insurance Services, Inc. has expertise in the solar contracting arena, representing clients that cross into both categories. Consider Rancho Mesa for a policy review and audit in advance of your next insurance renewal.

Three Reasons to Read Subcontractor Warranty Endorsements

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Contractors General Liability Policies provide coverage for bodily injury and property damage for which the Named Insured is legally liable. This legal liability can result from the company’s direct operations or from other subcontractors hired by the Named Insured.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Contractors General Liability Policies provide coverage for bodily injury and property damage for which the named insured is legally liable. This legal liability can result from the company’s direct operations or from other subcontractors hired by the named insured.

Many general liability carriers will include some form of subcontractor warranty endorsement which establishes minimum requirements for subcontractors relative to insurance and other risk management benchmarks. At a minimum, these forms require written indemnification in favor of the named insured, certificates of insurance with additional insured wording, and specific insurance limits required by subcontractors.

These endorsements can vary widely from carrier to carrier; so, contractors may be faced with serious consequences in the event that requirements are not met. Below are three types of penalties policyholders may encounter:

- Coverage is DENIED relative to any loss resulting from the work of the subcontractors.

- Coverage is not altered, but a higher deductible or retained limit applies to any loss resulting from the work of the subcontractor. For example, should you fail to comply with the warranty, the deductible on the policy is amended from $5K to $25K.

- Coverage is not altered, but failure to comply will result in an additional premium charged at the final audit.

It is critical to have a strong contractual written transfer program in place with proper certificates of insurance from your subcontractors, regardless of the contract amount. Lean on your broker to interpret these endorsements and help negotiate the most favorable terms as you head into your renewal. Understanding these nuances can be the difference between a covered loss and an unexpected large capital expense.

For more information about subcontractor warranty endorsements, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Six Reasons a Company’s Experience Modification Could be Recalculated

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately California still maintains some of the highest rates in the country, often times two to three times the nations average.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately, California still maintains some of the highest rates in the country, often times two to three times the nations average.

Controlling insurance costs is vital to staying profitable and often times, staying in business. An important way business owners can control their insurance costs is by controlling their Experience Modification or X-MOD. An X-MOD is a benchmark of an individual employer against others in its industry, based on that employer's historical claim experience. This comparison is expressed as a percentage which is applied to an employer's workers' compensation premium.

The premium impact of a credit X-MOD (less than 1) vs a debit X-MOD (more than 1) can be significant. Business owners budget around their insurance costs. When there are unforeseen changes to their insurance costs it can have a dramatic effect. While it is rare, there are situations when an X-MOD can change in the middle of a policy term. Below are six circumstances when this could happen:

- If a claim that has been used in an X-MOD calculation is subsequently reported as closed mid policy term AND closed for less than 60% of the aggregate of the highest value, then the X-MOD is eligible for recalculation.

- In cases where loss values are included or excluded through mistake other than error of judgement. Basically, this rule takes into consideration the element of human error.

- Where a claim is determined non-compensable. Meaning the injury was determined to be non-work related.

- Where the insurance company has received a subrogation recovery or a portion of the claim cost is declared fraudulent.

- Where a closed death claim has been compromised over the sole issue of applicability of the workers’ compensation laws of California. Basically, if a person passes away at work but it was determined that the person had a pre-existing condition which caused the death, not work itself.

- Where a claim has been determined to be a joint coverage claim. This occurs mainly with cumulative trauma claims where there was no specific incident that caused an injury, but an injury that developed over time (i.e., wear and tear).

If any of the circumstances above have occurred, than a revised reporting shall be filed with the Workers’ Compensation Insurance Rating Bureau (WCIRB) and it shall be used to adjust the current and two immediately preceding experience ratings.

If you would like to discuss this topic in further detail, and learn how Rancho Mesa Insurance can audit your X-MOD worksheet for potential recalculations, please contact us at (619) 937-0164.

Six Proactive Steps to Prevent Heat Illness During a Scorching Summer

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Recommendation

If you have employees working outdoors, you should have an effective heat illness prevention plan in place and train your workers on it's content. Elements of the plan include:

- Making sure those toiling outside have plenty of fresh, cool water – workers need to drink at least a quart an hour. Just providing it isn’t enough, according to the heat illness prevention standard (General Industry Safety Orders section 3395). You must encourage employees to drink water.

- Providing shade when the temperature reaches 80ºF, or when employees request it.

- If an employee is in danger of developing heat illness, they must be allowed to take a rest in the shade until their symptoms disappear.

- Having emergency procedures, including effective communication with workers in remote areas.

- Designating employees at each work site to call emergency medical services if someone starts to develop heat illness.

- Keeping a close eye on workers who have been on the job for two weeks or less. They may not have the prior training to be aware of the early signs of heat illness.

In order to prepare our clients, Rancho Mesa recently conducted a Heat Illness Prevention Workshop. For those of you who were not able to attend, the training videos are available in the Risk Management Center or via the Workshop Video Request Form.

Should you have any questions or need further assistance, please contact a member of your Rancho Mesa team. Please be safe!!

Independent Contractor Classification Changes Expected to Impact Construction Industry

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services.

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services. Under the new test, a worker is considered to be an independent contractor only if all three of the following factors are present:

- The worker must be free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- The worker must perform work that is outside the usual course of the hiring entities business;

- The worker must be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

These new factors have major implications for contractors, or any business for that matter, where previously they had classified a worker as an independent contractor and now have to classify them as an employee. This will impact several lines of insurance, but most critically workers' compensation, general liability and employee benefits.

Workers' Compensation

Currently, if an employee is classified as an independent contractor, they would not be subject to any workers' compensation premium nor workers' compensation benefits. If their status should change to employee, they now would be entitled to workers' compensation benefits and would have their payroll accounted for in the employer’s premium. In addition, based on the work being performed, this may change the employer’s risk profile, creating negative underwriting consequences in the workers' compensation carrier marketplace, resulting in coverage not being offered or higher premiums.

General Liability

The impact to general liability insurance is very similar to that of workers' compensation. Additional payroll or sales will need to be accounted for as the employer will become directly responsible for the work being performed without the benefit of any hold harmless agreement or other risk transfer methods. This could potentially change the risk profile of the employer’s operations, which could result in the employer needing to provide additional underwriting information.

Employee Benefits

Since 1099 contract workers are not employees and are considered self-employed, they do not show on the Quarterly Wage and Withholding Report (DE9 and DE9C) to the State of California. Because of this status, they typically cannot enroll in a group health insurance plan. Many workers who are now classified as independent contractors will be considered employees in the eyes of the state and will be eligible for group benefit offerings from their employer.

Employers may need to reevaluate their group size to ensure that they remain compliant with the Affordable Care Act (ACA). Employers with 50 or more full-time employees working a minimum of 30 hours per week, and/or full-time equivalents (FTEs) must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to age 26, or be subject to penalties.

While these changes are new and just beginning to take affect, we believe your best strategy moving forward is to consult with your trusted advisors in legal, accounting and risk management. This will have a significant impact to the construction industry throughout California and we intend to take a leadership role in helping those companies with concerns and questions. So, please reach out to our Rancho Mesa Team to help you navigate these changes. Contact Alyssa Burley at aburley@ranchomesa.com for assistance.

Key Steps to Take Before, During, and After an OSHA Inspection

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

An OSHA officer can show up to your facility or worksite for any number of reasons: employee complaints, accidents, programmed inspections, sweeps, follow-up or a drive-by observation. In order to ensure a smooth inspection, we suggest you prepare before OSHA appears at your door. Here are some key steps to take before, during and after an OSHA inspection.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

An OSHA officer can show up to your facility or worksite for any number of reasons: employee complaints, accidents, programmed inspections, sweeps, follow-up or a drive-by observation. In order to ensure a smooth inspection, we suggest you prepare before OSHA appears at your door. Here are some key steps to take before, during and after an OSHA inspection.

Before the Inspection

Every company should have a formal plan in place detailing what should be done before, during and after an OSHA inspection. This procedure should be site specific and available to all supervisors. Site specific information should include company contacts for the project if OSHA arrives, location of documents like OSHA 300 logs and the Injury and Illness Prevention Program (IIPP).

Upon arrival of the OSHA inspection officer, the company should verify the officer’s credentials and try to determine why they are at the site. Before the opening conference begins, the employer should assign specific individuals to be the note taker and the photographer. It is also extremely important to remind everyone involved to be professional and treat the compliance officer with respect.

During the Inspection

Opening Conference: During the opening conference, you will want to establish the scope of the inspection, the reason for the inspection, and the protocol for any employee interviews or production of documents. If the inspection is triggered by an employee complaint, the employer may request a copy.

Physical Inspection: During the inspection, the OSHA compliance officer will conduct a tour of the worksite or facility in question to inspect for safety hazards. It is likely pictures will be taken by the compliance officer. Instruct your photographer to also take the same pictures and possibly additional pictures from different angels while the note taker should take detailed notes of the findings.

Closing Conference: At the closing conference, the OSHA compliance officer typically will explain any citations, the applicable OSHA standards and potential abatement actions and deadlines. It is important that during this process the company representative takes detailed notes and asks for explanations regarding any violations. If any of the alleged violations have been corrected, you will want to inform the OSHA compliance officer.

After the Inspection

If you are told no citations will be issued, contact the compliance officer and obtain a Notice of No Violation after Inspection (Cal/OSHA 1 AX). If you receive a citation, it is important to take immediate action because a company only has 15 working days after the inspection to notify the Appeals Board, if they choose to appeal the citation. Citations can be issued up to six months after the inspection, so it is important to watch your mail closely during this time.

For a proactive approach to OSHA inspections, contact the Consultation Services Branch for your state (i.e. Cal/OSHA) or Federal OSHA Consultation. They will be able to provide consultative assistance to you through on-site visits, phone support, educational materials and outreach, and partnership programs.

Register for the "How to Survive an OSHA Visit" webinar hosted by KPA on Monday, June 25, 2018 from 11:00 am - 12:00 pm PST to learn about what OSHA looks for during an inspection.

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

How a Bank Line of Credit Can Affect Your Surety Bonding

Author, Andy Roberts, Account Executive, Surety, Rancho Mesa Insurance Services, Inc.

When a surety carrier is evaluating a bonding program for a contractor, they use many different underwriting factors to determine an acceptable amount of bond capacity. They will consider a contractor’s working capital, net worth and work in progress schedules, to name a few. Another important factor that can help increase a contractor's bonding capacity is a bank line of credit.

Author, Andy Roberts, Account Executive, Surety, Rancho Mesa Insurance Services, Inc.

When a surety carrier is evaluating a bonding program for a contractor, they use many different underwriting factors to determine an acceptable amount of bond capacity. They will consider a contractor’s working capital, net worth and work in progress schedules, to name a few. Another important factor that can help increase a contractor's bonding capacity is a bank line of credit.

The construction industry is very unpredictable and unforeseen issues can arise that may interrupt jobs and cash flow. Surety carriers place such a high value on a bank line because it provides access to cash that may be critical to continuing the day to day operations and survival of the contractor's business.

While bank lines are an important factor that underwriters use, the lines should not be depended upon for frequent use. Dependency on a line can be a sign that the contractor may have some deeper financial issues. Contractors should try to have at least 30 consecutive days during the course of the year, where they do not use their bank line at all.

If your company is interested in working on jobs that require bonding, or you are a contractor with an established surety program but interested in ways to increase the programs limits, please contact me or Matt Gaynor at Rancho Mesa Insurance Services 619-937-0164 as we can assist with any questions you may have.

Why Painting Contractors Need Pollution Liability Insurance

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

At first glance, most painting contractors don’t think they need pollution coverage. One might think that if they're not pouring sludge into a lake or toxic gasses into the atmosphere, then it wouldn’t apply to their company. Everyone sees the oil spills and thinks that this is what pollution coverage is for, but how does it apply to your smaller business? How can one event jeopardize your company’s success?

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

At first glance, most painting contractors don’t think they need pollution coverage. One might think that if they're not pouring sludge into a lake or toxic gasses into the atmosphere, then it wouldn’t apply to their company. Everyone sees the oil spills and thinks that this is what pollution coverage is for, but how does it apply to your smaller business? How can one event jeopardize your company’s success?

In reality, pollution coverage is a must have policy for all painting contractors. This is how your business could be at risk.

First, let's determine what is a pollutant. A pollutant is defined as “the discharge, dispersal, release or escape of any solid, liquid, gaseous or thermal irritant or contaminant, including, but not limited to, smoke, vapors, soot, fumes, acids, alkalis, toxic chemicals, medical waste and waste materials into or upon land, or any structure on land, the atmosphere or any watercourse or body of water, including groundwater, provided such conditions are not naturally present in the environment in the amounts or concentrations discovered.” It is shocking how often a painting contractor is exposed to mold, asbestos, bacteria, or paint fumes.

What does Contractors Pollution Liability Insurance (CPL) really cover? CPL is a contractor-based policy, offered on a claims-made or occurrence basis, that provides third-party coverage for bodily injury, property damage, defense, and cleanup as a result of pollution conditions (sudden/accidental and gradual) arising from contracting operations performed by or on behalf of the contractor.

There are countless stories of something unforeseen being the cause of a pollution claim. Here are just a couple examples that could apply to your company.

A contractor had painted a nursing home and was sued by the residents. They alleged that the fumes weren’t ventilated properly. That claim alone was over $200,000.

A painter was removing lead paint from a bridge and some flakes fell into the river below. The damages exceeded $500,000.

A pollution claim could arise from site runoff after it rains, or accidentally drilling into a water pipe in the wall that produces leakage that leads to mold exposure. While transporting paint to a jobsite, the driver could get into an accident and the paint spills out and contaminates a water source adjacent to the road.

Most businesses look at pollution risk as something that doesn’t apply to them. Obviously, they aren’t planning on releasing pollutants like bacteria, mold, or fumes while on a jobsite. But, all it takes is one claim that could cost your company. Investigation costs, medical expenses, lawsuits, cleaning up of the area properly, not to mention how important your reputation is to your success, any one of these factors could be enough to bring your business to an end.

Some contractors believe all third-party problems are covered by their general liability policy; however, most general liability policies will contain a pollution exclusion which doesn’t cover any property damage or bodily injury that comes from the result of a pollution event. Your general liability policy will not cover the cost of clean-up, either. It is easy to see how this could become a costly event, very quickly.

It is very clear to see the dangers that surround your business. Now that you know what they are, protect your business with CPL insurance. Contact me at (619)438-6900 or email me at ccraig@ranchomesa.com with any further questions. Let’s make sure you are properly prepared to protect your company’s future.

CIGA is “Back in Black” - Employers will receive 2% savings on 2019 workers' comp premium

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

The CIGA board of directors approved a zero assessment for 2019, as it moved into the black after collecting last year’s 2% assessment on workers' compensation premiums. At one point, CIGA had a workers, compensation deficit of $4 Billion. The 20 years of employer assessments, ranging from 1% to 2.6% of premium, paid off workers' compensation debt and in some years the debt payments on special bonds issued to pay claims from insurance company insolvencies.

Similar to the rest of the Industry, CIGA’s improved fortune results from positive reforms provided in SB 863, as well as the efforts of Department of Industrial Relations Director Christine Baker.

Three Question to Ask Before Enrolling in an OCIP/CCIP or Wrap Program

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Subcontractors in California regularly enroll in OCIP/CCIP or wrap programs. These programs are insurance policies that cover many of the participants in a construction project, including the owner/developer, general contractor and subcontractors. As many contractors learn the hard way, they do not control the program or the coverage terms, leaving the possibility of significant gaps that can impact the contractor in the future.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Subcontractors in California regularly enroll in OCIP/CCIP or wrap programs. These programs are insurance policies that cover many of the participants in a construction project, including the owner/developer, general contractor and subcontractors. As many contractors learn the hard way, they do not control the program or the coverage terms, leaving the possibility of significant gaps that can impact the contractor in the future.

Prior to enrolling in a wrap insurance program, consider developing a list of key questions to regularly ask the plan sponsor. Before you begin that process, subcontractors need to know what information the plan sponsor is obligated to share about the project. And, that obligation varies greatly, depending on whether the project is public, private, or residential. Additionally, the statutory disclosure requirements are inconsistent in how they appear in the contract and bid documents. The following are a summary of those disclosures.

Residential Project Contract Documents

For residential projects, the contract documents must disclose, if and to the extent known, (Civil Code section 2782.95(a)):

- Policy limits

- Scope of policy coverage

- Policy term

- The basis upon which the deductible or occurrence is triggered by the insurance carrier

- Number of units, if the policy covers more than one work improvement indicated on the application for the insurance policy

- A good faith estimate of the amount of available limits remaining under the policy as of a date indicated in the disclosure obtained from the insurer.

Public and Commercial Project Contract Documents

For public and commercial projects, subcontractors are entitled to even less information, under (Civil Code section 2782.96):

- The policy limits

- Known exclusions

- The length of time the policy is intended to remain in effect.

In both cases above, the information that the plan sponsor is required to provide is far less than subcontractors need to truly make an informed decision on the coverage terms. Knowing now that enrollees have the right to ask for these insurance requirements before bidding the job, we will prioritize three important questions to begin the framework for your due diligence.

What are the Limits of Coverage?

Work inside OCIP/CCIP or wrap programs is commonly excluded on all contractor’s general liability policies. As a result, coverage is found almost entirely within the policy limits in place for the wrap program. That leaves key questions for your team to explore before stepping foot on a jobsite. What are the total costs of construction relative to policy limits? Are there any other projects being covered under the Wrap policy? Are the limits of insurance reinstated after a large loss? Do defense costs reduce the policy limits? While there are certainly more questions inside this vertical, knowing these initial answers and being familiar with what impact they may have on your business are a solid first step in your process.

What is Covered and What is Excluded?

Wrap programs, as many subcontractors know, can provide coverage for both general liability and workers' compensation. In the last few years, Wrap policies have focused more on general liability. Many can also include builder’s risk, professional and/or pollution liability. Each project, and therefore each wrap policy, is very unique. Be prepared to negotiate the removal of certain exclusions that often relate to some, but not all, subcontractors:

- Subsidence (earth movement)

- Professional Liability (also referred to as errors & omissions - typically a separate policy)

- Pollution Liability (typically a separate policy)

- Offsite work

What Deductible or Self-Insured Retention (SIR) is Required?

There are limited protections for wrap participants regarding the amount of self-insured retentions and/or deductibles, particularly with public or commercial projects. Subcontractors must identify, for example, the size of the deductible and whether that contribution is shared or individual. Deductibles within wrap policies can be as high as $25,000 - $50,000 per claim, which can represent significant impacts to a subcontractor’s balance sheet when unprepared.

Whenever you are considering a project that requires you to enroll within a OCIP/CCIP or wrap program, your due diligence in understanding the full scope of the insurance being offered is of the utmost importance. Discuss this in detail with your broker or reach out to one of us in our constructions group to help you navigate your way through the process.

Case Study: First-Time Bonding for Landscape Professional

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

I recently had the opportunity to work with a new client who is a landscape professional. He wanted to bid on a maintenance project for a local municipality and wasn’t sure if he would qualify for the required performance bond.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

I recently had the opportunity to work with a new client who is a landscape professional. He wanted to bid on a maintenance project for a local municipality and wasn’t sure if he would qualify for the required performance bond.

After a brief discussion of how bonding differs from insurance, we decided to collect some basic information to determine if he would “pre-qualify” for the bond before putting together a full submission. The bond company ran the personal credit of the owner and determined that they would support single bonded projects up to $500,000.

After a careful review of the project specifications, the client decided not to bid on the project. We mutually decided he should provide additional information to the bond company in the event he wanted to bid on a larger project that was going to be released in the following month. The information requested by the bond company included:

a.) Completed contractor questionnaire

b.) Two year-end financial statements or tax returns for the company

c.) A personal financial statement for the owner(s)

Based on the additional information provided, we were able to negotiate a $1,000,000 single project / $3,000,000 aggregate bonding program for this particular landscape professional. The client executed the bond company general indemnity agreement and was off and running to bid the larger projects.

Make sure you work with a professional surety agent who can help assist with the bonding process if you are considering bidding on public works projects. It can save you a lot of time and effort.

Contact Rancho Mesa at (619) 937-0165 if you have any bonding questions.

Employers Beware! Ten Red Flags You May Have a Fraudulent Workers’ Comp Claim

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

While most people would agree with the idea of a workers' compensation system, unfortunately, there are people who try to defraud it in an effort to earn an extra buck. These individuals include both employers and employees. For this article, I will focus solely on the most common workers’ compensation fraud, claimant fraud (i.e., when an employee commits the fraud).

Claimant fraud includes false claims and exaggerated claims. These claims typically involve soft-tissue symptoms, such as headaches, whiplash, or muscle strain, which are all very difficult to disprove. In order to increase the value of the claim, claimants will also include multiple body parts. The most common types of claimant fraud includes reporting fake claims, injuries not received on the job, exaggerated injuries, and claimants working for another employer while collecting benefits from an injury claim.

Claimant fraud causes extreme frustration, animosity, and can lead business owners to question all claims, including those that are legitimate. Employers can feel helpless, especially when the system gives the benefit of the doubt to fraudsters. There are, however, red flags that both employers and insurance companies can pick up on to fight against these individuals seeking easy money.

Ten Red Flags

The top ten red flags employers can look for on a possible fraudulent claims are: When the claimant;

Hires an attorney the day of the alleged injury.

Has several other family members also receiving workers’ compensation benefits.

Exhibits a strong familiarity with the workers’ comp system.

Has been disciplined several times or is disgruntled and fears termination.

Was engaged in seasonal work that is about to end.

Continues to cancel or fails to keep medical appointments or refuses a diagnostic procedure to confirm an injury.

Changes doctors when the original suggests they return to work.

Is seen working at another job while collecting total temporary disability.

Is reluctant to return to work and shows very little improvement.

Has problems with workplace relationships.

Contact me to learn strategies for combating fraudulent claims before and after it is reported.

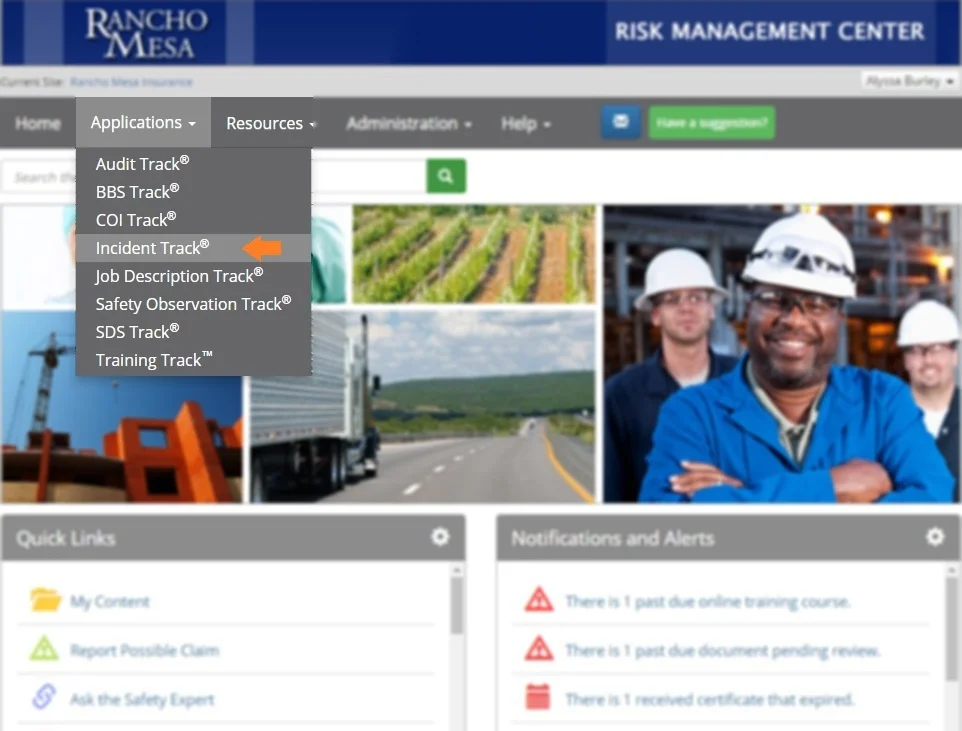

Risk Management Center Streamlines Electronic OSHA Reporting

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The Occupational Health and Safety Administration (OSHA) now require certain employers to electronically submit their completed 2016 Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Editor's Note: This post was originally published on November 9, 2017 and has been updated to reflect the latest available information.

The Occupational Health and Safety Administration (OSHA) now requires certain employers to electronically submit their completed Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file. Users of Rancho Mesa’s Risk Management Center have the ability to track incidents and generate the export file, making the electronic reporting process quick and simple.

Check federal OSHA or your state's OSHA website for specific filing date deadlines.

Prepare and Submit

Once an incident occurs, Risk Management Center users track the details within the online system. All of the required information is stored and made available through reports and an export.

Request a Risk Management Center Account.

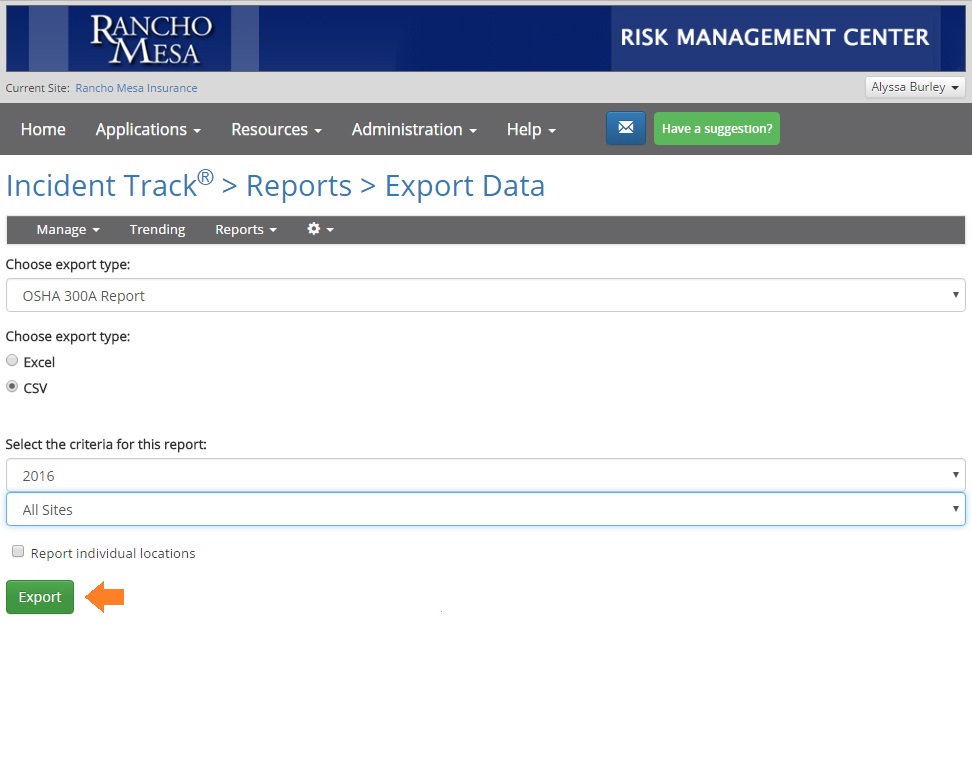

To export the OSHA 300A Report data, login to the Risk Management Center. Then, navigate to the Applications list and click on Incident Track®.

From this screen, click on the Reports menu and click the Export Data option.

Choose the report, “OSHA 300A Report” and select the export type a CSV. Choose the year and either all your sites or just one. Click the Export button and enter your email address.

The .CSV file will be generated and emailed to you. Save the file on your computer so it can be uploaded to OSHA’s Injury Tracking Application (ITA).

To upload the .CSV file, login to OSHA’s ITA and follow the instructions on the screen.

Who is Required to Submit?

According to OSHA, “establishments with 250 or more employees are currently required to keep OSHA injury and illness records and establishments that are classified in certain industries with historically high rates of occupational injuries and illnesses.” Some of those industries include construction, manufacturing, health and residential care facilities, and building services.

On April 30, 2018, OSHA announced State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.

Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

For questions about tracking and exporting OSHA reports with the Risk Management Center, contact Rancho Mesa at (619) 937-0164

Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers Across All States

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Federal OSHA has determined that Section 18(c)(7) of the Occupational Safety and Health Act requires employers in State-administered OSHA plans “to make reports to the Secretary in the same manner and to the same extent as if the plan were not in effect.” Therefore, federal OSHA’s statement asserts “employers must submit injury and illness data in the Injury Tracking Application (ITA) online portal, even if the employer is covered by a State Plan that has not completed adoption of their own state rule.”

According to the announcement, State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.”

“Even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA’s directive to provide Form 300A data covering calendar year 2017.”

This announcement comes on the heels of a March 2018 report by Bloomberg Environment that indicated federal OSHA anticipated more than 350,000 worksites to submit Form 300A reports via the online portal, yet nearly 200,000 weren’t submitted by the December 31, 2017 deadline. That means only 153,653 Form 300A reports were submitted and another 60,992 worksites submitted reports that were not required.

In May 2017, Cal/OSHA published a statement indicating “California employers are not required to follow the new requirements and will not be required to do so until ‘substantially similar’ regulations go through formal rulemaking, which would culminate in adoption by the Director of the Department of Industrial Relations and approval by the Office of Administrative Law." However, with the recent announcement from federal OSHA, Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

Rancho Mesa’s Incident Track® is an effective way to manage incidents and maintain required OSHA logs. As just one of the many “tracks” inside the Agency’s “Risk Management Center,” Incident Track can also generate electronic report files that can be uploaded into the Federal OSHA’s ITA online portal.

Contact Alyssa Burley with follow up questions about these OSHA requirements and/or an interest in learning more about tracking incidents through our client based portal.

The Changing Definition of Employee: What you need to know about SB 189

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

SB 189 is written to expand:

The scope of the exception from the definition of an employee to apply to an officer or member of the board of directors of a quasi-public or private corporation, except as specified, who owns at least 10% of the issued and outstanding stock, or 1% of the issued and outstanding stock of the corporation if that officer’s or member’s parent, grandparent, sibling, spouse, or child owns at least 10% of the issued and outstanding stock of the corporation and that officer or member is covered by a health care service plan or a health insurance policy, and executes a written waiver, as described above. The bill would expand the scope of the exception to apply to an owner of a professional corporation, as defined, who is a practitioner rendering the professional services for which the professional corporation is organized, and who executes a document, in writing and under penalty of perjury, both waiving his or her rights under the laws governing workers’ compensation, and stating that he or she is covered by a health insurance policy or a health care service plan. The bill would expand the scope of the exception to include an officer or member of the board of directors of a cooperative corporation, as specified. The bill would also expand the definition of an employee to specifically include a person who holds the power to revoke a trust, with respect to shares of a private corporation held in trust or general partnership or limited liability company interests held in trust, and would authorize that person to also elect to be excluded from the requirement to obtain workers’ compensation coverage, as specified. The bill would provide that an insurance carrier, insurance agent, or insurance broker is not required to investigate, verify, or confirm the accuracy of the facts contained in the waiver. (Legislative Counsel, 2018)

Once a waiver is signed and on file with the insurance carrier it will remain in effect until there is a written withdrawal. When changing insurance carriers a new waiver must be signed with the new carrier.

Effective 1/1/18

- Carriers were able to accept waivers up until 12/31/17 for policies issued in 2017 that weren't turned in on time and the officer exclusion is being honored from the inception of the policy and is being applied at final audit.

Effective 7/1/18

- Trusts will be eligible for officer exclusion.

- To be excluded, the required ownership percentage will change from 15% to 10%.

- An officer with 1%-9% ownership that is related to an excluded officer that owns 10% or more may also be excluded as long as they have health insurance.

- Waivers currently are required at the policy effective date. SB 189 provides a 15-day grace period from the effective date to turn in the waiver. The waiver may only be backdated 15 days.

Examples: With a 1/1/18 effective date, if the waiver is turned in and accepted by 1/15/18, the officer exclusion will be effective 1/1/18. With a 1/1/18 effective date, if the waiver is turned in and accepted by 2/15/18, the officer exclusion will be effective 2/1/18.

For specific questions about your workers' compensation policy, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Workplace Violence Insurance Surges in Aftermath of Shootings

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

U.S. employers have an obligation for duty of care for the safety, health, and security of employees (see Occupational Safety and Health Administration (OSHA) Act of 1970). Duty of care requires protection against workplace violence hazards.

A mass shooting is an attack resulting in 4 or more.

| Year | # of Incidents |

|---|---|

| 2017 | 327 |

| 2016 | 385 |

| 2015 | 333 |

It is the employer's obligation to protect its employees from violence. Homeland Security defines an active shooter as “an individual actively engaged in killing or attempting to kill people in a confined and populated area.” While OSHA describes workplace violence as “any act or threat of physical violence, harassment, intimidation, or other threatening disruptive behavior that occurs at the work site.” What is your organization doing to protect its people from these types of events?

Over the last three years, the United States recorded an average of 348 mass shootings per year.

| Description | Cost |

|---|---|

| Support for survivors and families of victims | $2.7 million |

| Cleanup, renovations, and other facility changes | $6.4 million |

| Settlement payments and other legal costs | $4.8 million |

Costs to Consider

As victims, families, and co-workers struggle to heal after losing friends and loved ones, the costs continue to mount.

Aside from treating survivors, consider some of the costs from the Virginia Tech University shooting: survivor support, cleanup, renovations, facility changes, settlement payouts and legal costs.

How would your organization absorb the cost of such an event?

Workplace Violence Policy Coverage

In addition to providing a consultant to guide businesses through an emergency event, a covered event will trigger legal liability coverage to address legal expenses. These expenses may be related to the following:

- Business interruption expense

- Defense and indemnity expenses

- Public relations counsel

- Psychiatric care

- Medical or dental care

- Employee counseling

- Temporary security measures

- Rehabilitation expenses

- Limits start at $1,000,000 with $0 deductible

Among other underwriting considerations, when pricing workplace violence policies, carriers factor in operations like exchanging money with the public, working with volatile or unstable people, providing services and care to the public, and working where alcohol is served. Take a look at your organization's operations to see if there is a risk.

Please contact Rancho Mesa Insurance Services to discuss whether this insurance is right for your organization.

Information sourced from McGowan Program Administrators.

The Rising Risk of Metal Theft from Jobsites

Author, Kevin Howard, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Metal theft is one of the fastest growing crimes in the country. Copper, aluminum, nickel, stainless steel and scrap iron have become the desired target of thieves looking to make a quick buck.

Author, Kevin Howard, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Metal theft is one of the fastest growing crimes in the country. Copper, aluminum, nickel, stainless steel and scrap iron have become the desired target of thieves looking to make a quick buck.

Of particular concern is copper, which is found in gutters, flashings, downspouts, water lines and electrical wiring – all of which can be quickly stripped from vacant buildings, industrial facilities, commercial buildings and construction sites. Air conditioning units are especially attractive, and are often tampered with or stolen for their copper coils and pipes that connect to HVAC systems. The metal is then sold to recycling companies and scrap yards for a tidy profit.

Common Targets

Subcontractors who store material on jobsites overnight are a common target for metal theft. Typically, subcontractors are designated specific areas on jobsites for their product waiting to be installed. And, it remains common for this material to be stored over multiple nights. Electricians often leave copper wiring; HVAC contractors can store duct work; and, plumbing contractors may store valuable fixtures. Exposure to theft can come from employees of other trade contractors on the site, as well as professionals who monitor the job, picking the right time and place to strike.

Preventing Metal Theft

To combat theft of materials, many states and municipalities have passed laws tightening the restrictions on scrap dealers. In some instances, purchases of scrap metal are required to be held in reserve for a week or more before being resold in case they have been stolen. In other instances, states require dealers to record the seller’s name, address and driver's license.

Another approach to prevent metal theft involves reducing exposure to risk at the jobsite. Examples can include:

Installing security cameras with video recordings that are maintained for sufficient periods of time.

Securing all equipment and scrap metals in locked buildings or in properly lit areas secured by fencing.

Posting "No Trespassing" placards or signs indicating the presence of a surveillance or security system.

Removing access to buildings and roofs, such as trees, ladders, scaffolding, dumpsters and accumulated materials such as pallet piles.

Securing your building access with deadbolts on doors and window locks.

Increasing exterior lighting and protecting fixtures (such as AC units) with locked metal cages.

Protecting Contractors’ Equipment on the Jobsite

Insurance for contractors that wish to transfer risk of theft at jobsites is commonly seen with Installation Floaters and Builder’s Risk policies.

Installation Floaters cover business personal property and materials that will be installed, fabricated or erected by a contractor while away from their premises. They extend coverage to the property until the installation work is accepted by the purchaser or when the insured's interest in the installed property ceases.

Builder’s Risk policies protect insurable interest in materials, fixtures and/or equipment being used in the construction or renovation of a building. While trade contractors can be held responsible for securing a Builder’s Risk policy, it is more typical that general contractors and/or building owners carry these policies during the course of construction. As a result, these policy terms fluctuate based on the length and scope of each project.

Rely on your insurance advisor to discuss these and other exposures to risk on jobsites. In advance, consider the amount of product stored at any jobsite at one time, the amount of product that can be at risk in transit, the value of product stored offsite (i.e., storage units) and the protections in place that secure your product. These will offer your broker, and ultimately the underwriter, key information in developing the right program for coverage.

For more information, contact Rancho Mesa at (619) 937-0164.