Industry News

Trends Shaping the 2025 Insurance Marketplace and What’s on the Horizon for Rancho Mesa

As we enter the New Year, Rancho Mesa's Alyssa Burley sat down with President Dave Garcia to review the past year. They analyzed the state of the commercial insurance marketplace, reflected on Rancho Mesa’s accomplishments, and discussed what’s to come in 2025.

As we enter the New Year, Rancho Mesa's Alyssa Burley sat down with President Dave Garcia to review 2024. In the episode, Dave shares insight on the state of the commercial insurance marketplace, reflects on Rancho Mesa’s accomplishments, and discusses what’s to come in 2025.

Alyssa Burley: You’re listening to Rancho Mesa’s StudioOne™ podcast, where each week we break down complex insurance and safety topics to help your business thrive.

I’m your host, Alyssa Burley, and today I’m joined by Dave Garcia, President of Rancho Mesa, and we’re going to discuss the state of the insurance marketplace and a little bit about what’s new at Rancho Mesa.

Dave, welcome to the show.

Dave Garcia: Good morning, Alyssa. I'm excited to be back in StudioOne™.

AB: Well we're happy that you're here.

Now, in a few days, Greg Garcia and I are doing an episode where we’ll discuss the auto and workers’ compensation marketplace specifically for the landscape and tree care industries. But, I want to get your take on the state of the commercial insurance marketplace as a whole.

So with regards to the typical commercial lines like property, auto, general liability and excess, are you forecasting the hardening marketing to continue and if so, what can business owners do to mitigate the market trends?

DG: Yeah, you know, Alyssa, one of the principles that we operate on here is that we're just going to tell the truth and not just tell the audience or people what they want to hear. So the truth really is that the insurance marketplace is continuing to remain hard, and it doesn't seem like any time in the foreseeable future we're going to see any real decline in that. So I think it's important that we get together and really strategize on what are some of the things businesses can do to try to mitigate this, because I would say across the lines, property auto, general liability, and then excess coverage, the arrows are all still indicating upward movement.

AB: All right. So what do you think the workers' compensation market will do in 2025?

DG: So we track the WCRB, the Workers' Compensation Insurance Rating Bureau. They publish some information quarterly that gives some really good insightful market trends. And this last quarter, we noticed for the first time in 15 years that the average cost of workers' compensation in California has risen. And it's a composite rate, so it's taken all the premium and it's taken all the all the rates and blending them as if they're one. And for the first time it showed an increase. And this is something that I think I've been anticipating.

I'm fortunate to sit on a couple of National Workers' Compensation Carrier Councils and kind of being behind the curtain with them, seeing some of the trends coming, it's coming to fruition now. So I do feel like the Workers' Compensation Market is going to show signs of hardening, but not dramatically like the other lines have done. So it looks like the average increases in the two to three percent range, which most businesses could absorb.

And what that means is that there's still going to be some rate decreases for certain businesses, but those that are not really managing their safety program well, their experience modifications are trending upward, they could see significant rate increases. So it's time to really start to address those issues.

AB: So what are some of the things that people can do to help mitigate this?

DG: Yeah, so I think it's a time, and we would always encourage this ongoing, is really to take a look at your safety programs and try to tighten them up in any areas where maybe there's some insufficiencies. And you may be listening and saying, “Well, I'm not really sure. I think mine's pretty strong. Where do I begin?”

And I would start with working with your insurance consultant, your broker, and the carriers that you're with and asking them what are the areas that they feel like you could use some help. We do a number of things here that we would encourage different people to take a look at and have access to. So for us, we do 60 or so different workshops throughout the year, directed specifically to areas in all lines of insurance that are causing problems relative to workers' compensation.

I think it's time to really evaluate both the services that you receive from your broker as well as the services that you can be receiving from the insurance carrier. It's very varied. The common denominator that many people choose to make decisions on is a simply price and not value. And I think in most people's personal lives, they value value over price sometimes. And that's not to say that the more expensive it is, the better it is. That's not always the case, but to true value to your dollar. So it could be the same price, but the value is just much greater.

So I would look at looking at evaluating, having your broker ask the questions about services the carrier can provide in workers' compensation, like do they offer nurse triage? Do they have any re-employability programs? Do they actually produce a medical cost containment report? What are loss control services like? Are there any loss sensitive options? Things like that, where if you're not aware of those things, you're probably not accessing those things, and that's going to drive up claim costs. And the whole goal is to lower claim costs, because that's what will protect you as the market starts to rise. So ask your broker about accident year loss ratios of carriers. If they're unfamiliar with that term, call us and we'll explain the differences.

But that's a trend that we're seeing that's rising. That is more of an actual number. And for the last four years, the carrier's accident year combined ratios are above 100%. And what that means is currently they're at 107. So that means for every dollar in premium they're collecting, they're paying out $1.07 in costs, and any business understands that's not going to be sustainable. And the only way to correct that is to lower costs or increase revenue, which in the carrier's case is premium. So I think it's time to really roll up your sleeves, get your broker to roll up their sleeves, and get to work and see if you can't help mitigate some of these exposures.

AB: Yeah, absolutely. And I appreciate you explaining all of that and where you see the market changing in 2025. So let's talk about Rancho Mesa and what everyone can expect in 2025.

DG: Wow, my favorite subject other than my family.

AB: You get to talk about us.

DG: Yeah, exactly. So don't ask me about my family because we'd be talking for like two days. But Rancho Mesa is my second family and I'm super excited really to just be a part of us. We just had a fantastic year. It was just unbelievable. Really strong results, tremendous growth. We're looking to add the right people, more people, but the right people. I'm just super excited about some of the other services that we're being able to bring to our clients. Our Safety One platform, so that's our online safety platform, as well as our safety app that we use for our clients in their fields. Both of those have been added tremendous more capabilities this year. We're really excited about that and we're looking forward to seeing, you know, where it goes from here. So those are the kinds of things that just, I'm excited to see what 2025 holds for us.

AB: Yeah, and I'm glad you brought up Safety One. We've added functionality and streamlined processes over the last 12 months, and I know that we'll continue to onboard more and more clients, and it's only going to get better and better.

DG: Yeah, and I think that's just a great tool. You know, we use that tool in several different ways. One way it's certainly going to improve the safety programs of the clients that use it, there's no question about that. But what it also does when we go to negotiate their terms in the marketplace, we point to the tools that they're using, the trainings that they've completed, we have all that at our fingertips now. And it's our job really to negotiate in our client's behalf, but we need substance. We don't need cotton candy. We need substance that we can take to the carrier and fight for those scheduled credits to keep these costs down. So SafetyOne™ and the SafetyOne™ app are just huge components of us being able to do that.

AB: Yeah, absolutely. So what else do you want to share with our listeners?

DG: Well, let me tell you, we had to delay this podcast a little bit today because exciting news, we're growing, as I mentioned earlier, and we're taking on more space here in the building. So we're now going to take over the remainder of the floor and that contract was just signed a week or so ago and the construction, the demolition of that space has started. And as I said, we had to stop the podcast for a minute while they were hammering away in there. So we're going to add about an additional 5,500 square feet or put us real close to 20,000. So I'm super excited about that, not because of the numbers, but because what it means and the capabilities that that extra space and more people are going to be able to allow us to offer to our clients moving forward. So just keep looking for updates, we're going to be posting pictures as the progress of the new space develops. And then we'll probably have a second open house when we can show it off a little bit. So that's really exciting.

The other thing that I'm looking forward to doing is kind of a kooky idea, of course, it came from me, so it's a really kooky idea. But I'd like to introduce a new podcast series next year called Dave's Dugout. And so, you listen to different radio shows or you watch a sports show on TV and right before the commercial they give you that little teaser like, "So you got to stick around so you can hear what this is all about." So I'm not going to really tell you much about Dave's Dugout today. Just understand that it's going to be something I'm really excited about and we will be producing a short Dave's Dugout podcast introduction shortly that you'll be able to tune into and get an idea of what I'm talking about there. But trust me, it's going to be a lot of fun. And I think it'll be an area where I'll certainly learn and grow from, and maybe some of the audience will do the same. So super pumped about that.

AB: Yeah, I can't wait to hear that.

DG: Yeah, I know. It's like the present under the tree that hasn't been unwrapped yet. And hopefully it's the one that everybody's excited about, not the one that goes out to the curb the day after Christmas, because it's not a present anybody wants.

AB: Well, something that I do want to mention that I'm kind of proud of this last year is about six months ago, we introduced our OneofOne™ recognition program within Rancho Mesa. And essentially what that does is it allows coworkers to acknowledge the work that their teammates are doing in the office when they go above and beyond. We have QR codes scattered throughout the office where people can scan that code. They can, you and acknowledge different people, write up a little scenario, what the situation was. And then we get to post it. We get to shoot it out on teams to everybody in the company so that they can know what their coworkers are doing and how they're supporting each other. And I think we're at like 70% in the last six months of our employees have been recognized. And those are just the people that we've documented, you know that there's a lot more people behind the scenes that are, you know, going above and beyond just helping out their co-workers. So I think that that's something that's pretty cool and not everybody does that.

DG: No, I'm really with you and behind you 100% on that. I thought it was a great idea. And the great thing about it is we're not good here at participation trophies or employee of the month where you just kind of rotate it around because, you know, who hasn't wanted this month. This is really coming from the people. And it could be the same person, it doesn't, you can be repetitive. And what it's really begun to highlight is, I'm finding out things that people are doing at different areas of the company that, unless they just happen to be walking by and talking to them that moment, I wouldn't know. And now it gets pushed out. And what I really see it doing is it's encouraging other people to try to create those OneofOne™ moments. And as the audience probably knows, we actually trademarked that word. We made OneofOne™ all one word because that's really what we're culturally trying to accomplish; provide OneofOne™ interactions between co-workers and clients and friends and vendors and different people. So to see it come to life like that has been super exciting. So I'm looking forward to seeing how many more we get in 2025 for sure.

AB: Yeah, I'm looking forward to it as well and all the exciting things that we'll be doing. Dave, thank you for joining me in StudioOne™.

DG: Yeah, me too. So Alyssa, thank you for having me today here in StudioOne™ I'm super excited about 2024 but I'm really optimistic and excited to see what 2025 has to offer. So thank you for having me in StudioOne™ today.

Digitalizing Risk Management: A Step-by-Step Guide for Getting Started

Author, Alyssa Burley, Partner, Media Communications & Client Service Group, Rancho Mesa Insurance Services, Inc.

Imagine you are working in a highly productive organization. Over many years of trial and error, the team has streamlined their operations to the point of a well-oiled machine using good ol’ paper and spreadsheets. Then, your insurance broker offers a digital risk management solution and you are faced with the prospect of transitioning your manual processes to a digital platform. This is the scenario that many Rancho Mesa clients have faced and successfully overcome.

Author, Alyssa Burley, Partner, Media Communications & Client Services Group, Rancho Mesa Insurance Services, Inc.

Imagine you are working in a highly productive organization. Over many years of trial and error, the team has streamlined their operations to the point of a well-oiled machine using good ol’ paper and spreadsheets. Then, your insurance broker offers a digital risk management solution and you are faced with the prospect of transitioning your manual processes to a digital platform. This is the scenario that many Rancho Mesa clients have faced and successfully overcome.

Mobile applications have become an integral part of daily life by streamlining everything from banking to finding a ride in the city. Manual tasks can now be completed easily from a mobile device. So, why haven’t most businesses implemented this mobile technology into their daily operations?

Planning & Support

Transitioning a manual process, like the administration and documentation of toolbox talks, safety trainings, jobsite inspections, and other risk management activities, to a digital platform does not have to be a daunting task, though it may seem that way at first. With proper planning and support from those who have helped others digitalize their manual processes, you can significantly increase the chances for success. Utilize resources like Rancho Mesa’s client services team to provide best practices for each manual process that will be replaced by a digital platform.

Where to Start

Once an organization has decided they are ready to make the move to a digital platform, they often ask how they should begin. It is a best practice to start digitalizing a process that has few barriers to implementation, yet will still have a significant impact on operations. Therefore, utilizing digital toolbox talks (e.g., tailgate talks, safety meetings, and the like) is typically the best process to tackle first.

Next, review your existing toolbox talk process and document the steps. It may be helpful to ask the following questions:

Who decides which topics will be used each week?

Where is the content sourced?

How is the topic content distributed?

Who administers the toolbox talk (e.g., tailgate talk, safety meeting, etc.)?

Where are the toolbox talks performed?

How are employees tracked who participated in the toolbox talk?

Where is the documentation stored?

The answers to these questions will help you identify who will need access to the toolbox talks in the digital platform, whether through an administrator website or a mobile application.

Then, identify one to three people in the organization who are excited about being an early adopter of the new technology. They should be excited at the prospect of streamlining the manual process of getting the toolbox talk content each week, performing the safety meeting, passing around the sign-in sheet, and making sure the signed paper makes it back to the office and in the correct file cabinet. These early adopters could be an administrator, foreman, supervisor, or safety manger, depending on who is responsible for performing portions of this task.

The early adopters will function as the organization’s initial testers, cheerleaders, and then coaches for the rest of the team. They will test the digital process by accessing toolbox talk content and documenting the meeting attendance with both pictures and signatures from their mobile devices. They will report back to their organization’s leadership on how the new process is working. This gives the organization a chance to work with their insurance broker’s client services team to offer suggestions for minor adjustments to the new digital process. Meanwhile, the early adopters will naturally promote the new technology to their co-workers and get others excited for the launch of the new process.

Once the new digital toolbox talk process is tested and adjusted as needed, it is ready to be released to the rest of the organization. There will be a learning curve, but the early adopters will be familiar with how the streamlined digital process works and will act as informal coaches for new users of the platform.

Benefits

Changing a well-established process can cause some people within the organization to question why the change is needed in the first place. So, be prepared to explain the reasoning behind the transition. Explain the benefits that will be felt by both the employee and the organization.

Employees will spend less time on paperwork, so they can get back to their other job responsibilities. No longer will a supervisor have to worry about where the sign-in sheet went from yesterday’s safety meeting. All the documentation is digitally uploaded to the cloud and instantly accessible to those who need it.

The organization can ensure compliance with the Occupational Safety and Health Administration’s (OSHA) safety meeting requirements and eliminate lost paperwork. No longer do organizations need file folders full of sign-in sheets with, unfortunately, illegible signatures. Digital records are easily accessible and filtered by date, project, topic, etc. in order to streamline the process of retrieving data.

All of these things save time, effort, and increases compliance, which ultimately translates to reduced costs.

If your organization is ready to make the transition from paper to digital, contact your Client Technology Coordinator for more information about Rancho Mesa’s proprietary SafetyOne™ mobile app and website.

Cal/OSHA Releases Final COVID-19 ETS

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

On Wednesday, April 6, 2022, Cal/OSHA released its third and final version of its COVID-19 Emergency Temporary Standard (ETS) that was approved by the Standards Board at its April 21, 2022 meeting. The revised standard is expected to remain in effect from May 6, 2022 through December 31, 2022.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

On Wednesday, April 6, 2022, Cal/OSHA released its third and final version of its COVID-19 Emergency Temporary Standard (ETS) that was approved by the Standards Board at its April 21, 2022 meeting. The revised standard is expected to remain in effect from May 6, 2022 through December 31, 2022.

The third revision removes some language and requirements. Most notably:

Requirements of the ETS are the same for vaccinated and unvaccinated employees, and the definition for “fully vaccinated” has been removed.

California Department of Public Health's (CDPH) guidance governs exclusion and return-to-work criteria for those with a close contact, and when face coverings are required.

The “light test” for face coverings has been removed.

Self-administered and self-read testing is now acceptable to return to work when it includes independent verification like time-stamped photography.

A new definition for “returned case” has been added to identify those who have returned to work per the requirements in the ETS and did not develop COVID-19 symptoms.

Cleaning and disinfection procedures have been removed.

Requirements for physical distancing (except when there is a major outbreak) and barriers have been removed.

Cal/OSHA has revised several documents that may be helpful for employers:

What Employers and Workers Need to Know About COVID-19 Isolation and Quarantine

Revisions to the COVID-19 Prevention Emergency Temporary Standards

Rancho Mesa has revised its COVID-19 Prevention Program template based on the April 6, 2022 proposed revised ETS language. Download a copy of the template from within the Risk Management Center, or from the link below.

OSHA Posting and Submitting Guide

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

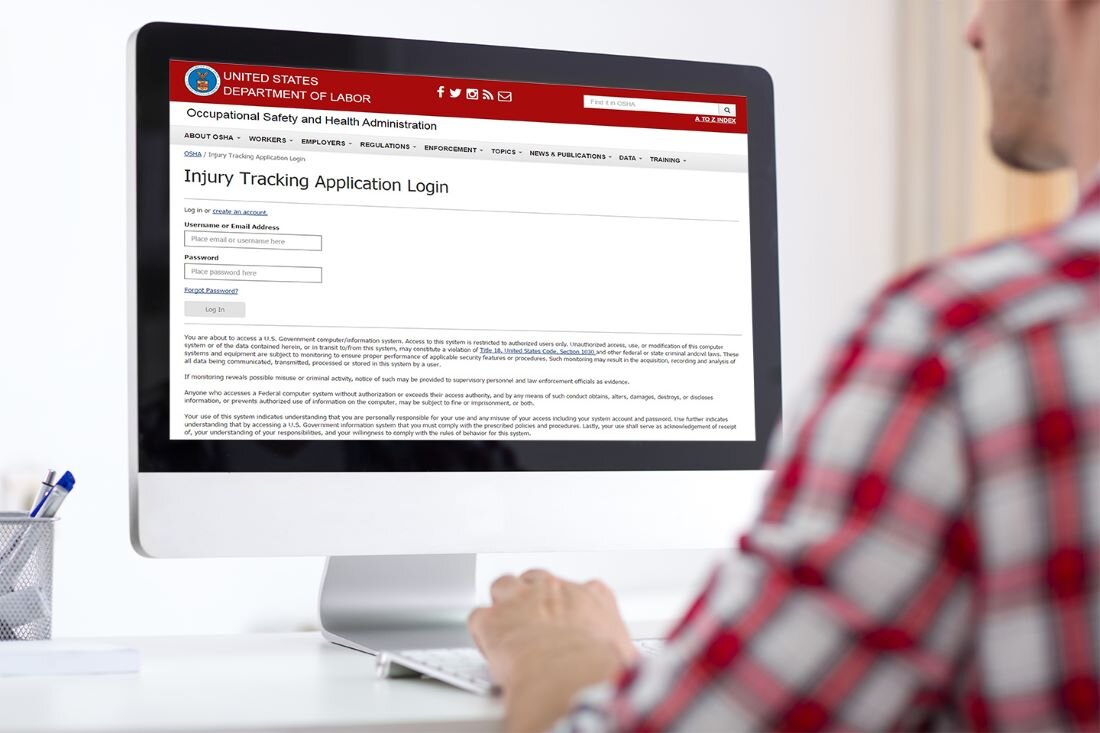

Rancho Mesa Insurance Services, Inc. would like to remind its clients that February 1, 2022 marks the start of the OSHA Form 300A Summary posting period. The OSHA Form 300A is a summary of the company's annual work-related injuries and illnesses. It must be posted from February 1, 2022 to April 30, 2022.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa Insurance Services, Inc. would like to remind its clients that February 1, 2022 marks the start of the OSHA Form 300A Summary posting period. The OSHA Form 300A is a summary of the company's annual work-related injuries and illnesses. It must be posted from February 1, 2022 to April 30, 2022.

To learn more about maintaining all the OSHA logs, listen to Rancho Mesa's StudioOne™ podcast episode 168 where Alyssa Burley and Megan Lockhart discuss the Forms 300, 300A and 301.

REQUIRED TO POST

According to Cal/OSHA, “If your company had more than ten (10) employees at any time during the last calendar year, you must keep Cal/OSHA injury and illness records unless your establishment is classified as a partially exempt industry under Section 14300.2.”

POST FORM 300A SUMMARY

The Form 300A Summary must be posted in a conspicuous place at each workplace, where notices to employees are usually displayed. Make sure that the posted annual summary is not altered, defaced, or covered by other material. Employers must send a copy of the summary to employees who do not report to the workplace on a regular weekly basis.

NO RECORDABLE INJURIES

Companies with no recordable injuries or illnesses in 2021 must post the OSHA Form 300A Summary with zeros on the “total” lines.

HOW TO GENERATE THE FORM 300A SUMMARY

Through Rancho Mesa's Risk Management Center, clients can generate the OSHA Form 300A Summary using the incident tracking feature. Individual employers are required to maintain the OSHA Forms 300, 300A and 301 throughout the year. So, when it is time to generate the Form 300A Summary, it can be printed from the Risk Management Center, as long as the employer has been documenting the information in the platform throughout the year.

To print the OSHA Form 300A Summary, login to the Risk Management Center and navigate to Incident Track. Ensure you have entered all your incident information, then go to the Reports section and choose the Form 300A Summary from the available list. You'll be able to choose the year and locations (Sites) that you want to print.

SUBMITTING THE FORM 300A SUMMARY TO FEDERAL OSHA

In addition to posting the Form 300A Summary in your workplace, the data must also be submitted to Federal OSHA by March 2, 2022. If you have entered your incident data into the Risk Management Center, you'll be able to generate the electronic .CSV file that is used to upload the data to the Federal OSHA website. Watch out short video on how to generate the electronic Form 300A Summary.

Data Entry and Generating the Electronic Form 300A Summary

There are some minor differences between Cal/OSHA and Federal OSHA requirements. Check with your state’s OSHA division for specific differences for your state.

Visit the California Recordkeeping Standard or Injury & Illness Recordkeeping Forms webpages for more information.

Revised 2022 COVID-19 Prevention Program Template Now Available

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa has revised its written COVID-19 Prevention Program Template based on the Emergency Temporary Standards (ETS) adopted by California’s Department of Industrial Relations Occupational Safety & Health Administration (Cal/OSHA) in December 2021 and effective as of January 14, 2022.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa has revised its written COVID-19 Prevention Program Template based on the Emergency Temporary Standards (ETS) adopted by California’s Department of Industrial Relations Occupational Safety & Health Administration (Cal/OSHA) in December 2021 and effective as of January 14, 2022.

To access the revised template, clients can access the editable version from the Risk Management Center, or request to download the PDF, below.

The template is designed to assist organizations in the development of a COVID-19 Prevention Program that is specific to their organization and locations. Rancho Mesa highly recommends organizations using this template also consult their state’s Occupational Safety & Health Administration and local Public Health Department for specific requirements for their area as requirements can vary from state to state and municipalities. For example, California’s Department of Public Health’s recent guidelines supersede some of the requirements in the ETS.

A discussion on the differences between the previous version and the current version can be found in Ep. 162

Remember, this template alone is not enough to be in compliance. It must also be adapted to each organization and specific locations, as well as implemented. Organizations’ programs may require additional information if the company provides employee housing.

For current COVID-19 information, visit www.RanchoMesa.com/covid-19.

2022 Workers' Compensation Expectations for CA Landscape Industry

Rancho Mesa's Alyssa Burley and Drew Garcia, Vice President of the Landscape Group set the stage for insurance expectations in 2022.

Transcript

Alyssa Burley: Welcome back, everyone. My guest is Drew Garcia, Vice President of the Landscape Group with Rancho Mesa. Today, we're going to set the stage for insurance expectations for 2022. Drew, thank you for joining us.

Drew Garcia: Alyssa, thanks for having me.

AB: Since you specialize in the landscape industry, what do you see for the insurance marketplace, for these companies as we move into 2022?

DG: Great question, and I think a lot of companies are always wondering this each year as they come up for renewal. So what I want to do is just, I'll give you a little insight to all the lines of insurance that most landscape companies are going to be renewing in 2022.

And this is basically what we do at a pre renewal, very low level. But I'll start with work comp, which has been a soft market now for four or five years where there's been pressure for rates to continue to go down as a group, as a whole.

And each company's obviously individually underwritten by a carrier, and they're looking at the losses for that particular company. But in general, the work comp market has been soft and that's led to, you know, general decreases for most businesses over the last four or five years.

We think that trend is going to continue in 2022, and we'll see if there's any change in 2023. But for the foreseeable future through this policy period, we do believe that the work comp market is going to stay relatively soft, and that just means rates are going to stay down as a whole.

Again, there could be some individual things that you're experiencing as a landscape business that's causing your pricing to increase, whether that's your ex mod or you've got claims in the current year that haven't gone into the mod calculation or you've changed operations, things like that could impact your own pricing.

But as a group, we feel like the market's going to stay relatively soft. And I'm going to share a little detail that we do individually, myself and Greg, who helps me here with the landscape group at Rancho Mesa. We track a lot of industry data and then we use that when we're having our conversations with our customers.

So one thing we like to pull is we measure every contractor that has a C-27 license in California. There's about 5,465 of those companies that have work comp policies, and that's businesses that are landscape companies that only carry that license. They don't also have other licenses so strictly landscape, which helps us keep our data clean when we're looking at it. So there's 5,465 of those companies, 125 carriers, insurance carriers for work comp, right? At least one policy for all of those companies.

So there's 125 insurance carriers writing at least one landscape policy. Now there's only 25 carriers that have more than 20 policies, so we really start to limit down, you see carriers become niche when trying to write a particular business, in this case, landscape. Of those 125, only 25 of them have more than 20 policies. So there's probably a little bit of an appetite there that's aligning for those carriers. And then when we really might it down, there's only ten carriers they have more than 150 policies, and those are the bulk of the businesses of the insurance carriers riding the business or writing work comp policies for landscape companies in California. The top five are going to be familiar names, Berkshire Hathaway, Insurance Company of the West, State Fund, Markel and then Am Trust.

Those are the top five carriers in terms of market share writing those 5,465 C-27 license landscape companies that have work comp policies. So a little bit of an insight into the market and what carriers are interested in writing business or work comp policies for landscape companies.

And then when we look at the numbers, we always like to watch the pure premium rate for the 0042 class code and just a quick refresher on pure premium. Every year the bureau, the rating bureau, will recommend a rate that the carriers should charge per $100 in payroll for every particular class code to strictly just cover claim costs. So, this rate doesn't include carrier overhead or expense. So, that number went from $4.93 last year to $4.57 this year, effective September the first of 2021. That's a 7% decrease, and when you're watching that recommendation come from the bureau to the insurance carriers, what happens next is insurance carrier’s base rates come down a little bit. Normally, the rates should come down a little bit on the base rate side, and last year, the average base rate for an insurance carrier, which is the rate that they're going to start at when they're going to underwrite a landscape business, and that rate is going to be different for every insurance carrier. The average rate that they started at was $9.92. That's down to $9.52 on average. So 4% down on the base rate for work comp carriers. Again, those are indicators to us that the market is still soft.

There's still plenty of carriers trying to write the business and that, we should see rates stay relatively down for 2022 as a whole. Again, we talked about the individual aspect of underwriting, but as a whole, those are good indicators that the market still is pretty soft.

And I'm going to share my screen really quick. This is a factor here that nobody really talks about. But California is so diverse with how work comps are handled throughout the state. So there's individual territory factors that most carriers apply when they're underwriting based on where you're doing your business and the reason why they use territory factors is because the claim outcomes, the claim activity can be higher in certain areas than in others. So the screen that you're looking at right now shows Berkshire Hathaway's territory factors based on 2021 and then 2022. And what I did is you can see, based by zip code, I've got different colors indicating the severity of territory factors that could be applied depending on where you're doing your business. So the lighter colors that you're seeing, the more yellow, lighter yellow that you see, those are the preferred areas and then the heavier, darker red that's going to be where maybe there's some territory debits that increase, and most carriers are using something like this when they're underwriting and looking at the business, but you can see some movement in some of the color from last year to this year. You can see San Diego's lightened up a little bit as a territory, so rates are probably a little bit more favorable in San Diego.

But there really is always been some heavy focus on L.A., Orange County, Riverside County, San Bernardino, where carriers really look at implying a debit on territories just because of claim outcomes and claim activity in those in those particular regions.

And then San Jose in Northern California, those have always been generally lighter intel. There's a less territory factor that that happens up there based on better claim activity and claim outcomes that are associated with the zip codes up in that area.

So I wanted to share that, I'll pull that screen down. And then now exiting work comp kind of just highlighting a couple of the other lines of insurance that we think are going to be impacted in 2022. And we've talked about it for many years with our customers, but the auto market is still very difficult.

And if you're a landscape maintenance company, you have a heavy fleet and a lot of vehicles. So it's really important for you to continue to monitor your cost per unit. And we wrote that article a few weeks back, measuring your cost per unit at each renewal so you can kind of see where your insurance has gone over the years. And so landscape companies really need to pay attention to their cost per unit because we do believe there's still more pressure on the auto market for rates to continue to increase. There's a lot of things that Rancho Mesa provides, and so many of our landscape companies are taking advantage of our Fleet Safety trainings that we have in the Risk Management Center and client services on our end has done a great job when we've had claimed activity with our customers to recommend certain driver trainings, you know, as a result of those claim outcomes - or those accidents that have occurred.

So, we've been happy with how we're helping our customers manage the auto side and then really everyone should watch out on the excess or the umbrella layer of their insurance that's really taking its toll and we've seen rate increases coming on that line in particular. A lot of carriers are limiting their capacity, so a lot of carriers usually go up to 10 million for that limit. But now it seems five is the most that any one carrier wants to go to.

So if you carry more than 5 million, you're probably going to need to stack that with multiple carriers to achieve that limit, which could be different than what you've seen in the past, and also watch out for wildfire exclusions. A lot of excess of reinsurance carriers are trying to apply a wildfire exclusion to landscape companies in California, which would be a detriment to your policy if you have it. So always pay attention for that. You can also look out for that wildfire exclusion on your general liability policy. Those are new things that are potentially coming to the liability side. There are still carriers out there that don't offer that exclusion, so you would want to make sure that you're aligned with a carrier that's doing that. But for the general liability property inland marine policies, we think rates are staying relatively flat.

So we don't see a lot of movement coming there. More of the pressures coming on the auto and excess lines. And I think we'll see that for the next couple of years, there should be should remain some pressure on those lines.

That basically wraps it all up for us, covers the basic lines that most companies are looking at. And again, kind of an overview, but hopefully it gives some insight to business as they're moving into 2022, what to expect and where to focus their attention when it comes to their renewal.

AB: Drew, if listeners have questions about their workers compensation insurance, what's the best way to get in touch with you?

DG: Email, they can email me at drewgarcia@ranchomesa.com, call my office (619) 937-0200, and then I'd also encourage them just to check out our website, we've got a ton of content that we've created, all designed for landscape companies to help them better manage their risk. And we have, you know, different tools that aren't really available online that we'd be happy to introduce to companies and let them use to better manage their risk.

AB: Drew, thank you so much for joining me in StudioOne™.

DG: Thanks for having me, Alyssa.

Surety Keith Clements from Tokio Marine HCC

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa's Director of Surety Matt Gaynor interviewed Vice President of Tokio Marine HCC Surety, Keith Clements on Wednesday, September 15, 2021 to learn about his background, his role with Tokio Marine HCC and how the company fits into the surety marketplace.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa's Director of Surety Matt Gaynor interviewed Vice President of Tokio Marine HCC Surety, Keith Clements on Wednesday, September 15, 2021 to learn about his background, his role with Tokio Marine HCC and how the company fits into the surety marketplace.

As a college student in Iowa, Keith had career options. Companies visited the college looking to recruit new grads. He jokes that he had a choice to either go into surety bonds, or sell Oscar Meyer wieners. He chose surety.

“I started looking around and thought, you know what? I like numbers… I think this bonding thing might sound pretty good,” Keith tells Matt.

After over 20 years in the industry, “I’m still trying to figure out if I like it,” Keith says jokingly.

Matt and Keith reminisced about processing bonds in the early 1980s and compare the old technology to today’s high-tech methods of getting the bonds issued.

Keith explains the types of surety bonds Tokio Marine HCC writes as an A++ XV rated company.

Listen to the full Ep. 135 to learn more about Keith and the Tokio Marine HCC Surety.

Californians Wait for Revised COVID-19 Prevention Emergency Temporary Standards

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Over the past few weeks, Californians have eagerly awaited news from the State’s Occupational Safety and Health Standards Board (Standards Board) on revisions to Cal/OSHA’s COVID-19 Prevention Emergency Temporary Standards after the Centers for Disease Control (CDC) released its latest guidance that ease mask wearing for those who are fully vaccinated.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Over the past few weeks, Californians have eagerly awaited news from the State’s Occupational Safety and Health Standards Board (Standards Board) on revisions to Cal/OSHA’s COVID-19 Prevention Emergency Temporary Standards after the Centers for Disease Control (CDC) released its latest guidance that ease mask wearing for those who are fully vaccinated.

On June 3, 2021, the seven-member Standards Board first voted to deny a revised set of standards that would place additional requirements on business owners and most notably prevent fully vaccinated employees from being able to take off their masks in the workplace if everyone in the room was not vaccinated. However, in the same meeting, the Standards Board voted a second time which led to the approval of the revised standards which were set to go into effect no later than June 15, 2021 when the State is scheduled to fully reopen.

With pressure from businesses, community groups and California Governor Gavin Newsom, the Standards Board held an emergency meeting on June 9, 2021, where they unanimously voted to rescind the proposed standards previously approved on June 3, 2021.

If all of this sounds confusing, you are not alone.

As of the publication of this article on June 15, 2021, business owners should be following the COVID-19 Prevention Emergency Temporary Standards that were adopted in November 2020 and May 3, 2021’s Executive Order N-84-20 which allows for fully vaccinated people who have been exposed to a COVID-19 case, but show no symptoms, to remain in the workplace. Rancho Mesa has created a COVID-19 Prevention Plan template based on those requirements. It is available for download.

The Standards Board is scheduled to meet on June 17, 2021 where it is expected they will propose new standards that are more in line with the CDC’s masking recommendations. The agenda provides information on how to attend the virtual meeting.

When changes are made to the COVID-19 Prevention Emergency Temporary Standards, Rancho Mesa will update its COVID-19 Prevention Plan template and make it available to the public.

Stay up to date on this issue and others that affect California businesses by subscribing to our weekly Risk Management Newsletter and podcast.

CA Anti-Harassment Training Deadline Quickly Approaches

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Lately, we've been getting a lot of questions about California's required anti-harassment training, who has to complete it, when it's due, and how much it costs. This article will clear up any confusion; covering the history of the requirement, training conditions and deadlines, and the online training offered to Rancho Mesa clients.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Lately, we've been getting a lot of questions about California's required anti-harassment training, who has to complete it, when it's due and how much it costs.

In September 2004, Assembly Bill 1825 set in motion the sexual harassment prevention training requirement for many California supervisors. In September 2018, former California Governor Jerry Brown approved Senate Bill 1343 (SB 1343) which expanded the requirement and launched a series of anti-harassment bills that now require those who employ “five or more employees, including temporary or seasonal employees, to provide at least two hours of anti-harassment training to all supervisory employees and at least one hour of anti-harassment training to all non-supervisory employees.”

History of the Requirement

Over the last several years, additional senate bills have been passed that modifies or clarifies the SB 1343 training requirements. Instead of giving you a play-by-play on how each bill has changed the requirements, I'm just going to tell you what is required as of today, November 2020.

You've probably noticed that we now refer to this new training as “anti-harassment training” instead of the old term, “sexual harassment prevention training.” The change came as a result of several bills that expanded the required content to include abusive conduct, unlawful employment practices of discrimination, and harassment of both a sexual and non-sexual nature. So, the anti-harassment training for California managers replaces previous versions of the sexual harassment and abusive conduct prevention training, developed prior to the passage of SB 1343 and Senate Bill 1300 (SB 1300).

For more information on the progression of the current requirements, read “California SB 1343 Expands Sexual Harassment Training Requirements,” published November 15, 2018, “California SB 1343 Expands Sexual Harassment and Abusive Conduct Prevention Training Requirements,” published on January 17, 2019, “Ensuring CA Sexual Harassment and Abusive Conduct Training is SB 1343 Compliant,” published on February 7, 2019, “Rancho Mesa Offers Free CA-Required Supervisor and Employee Anti-Harassment Training” published on May 8, 2019, “Providing Anti-Harassment Training Is the Employer’s Responsibility,” published on August 22, 2019, and “Senate Bill 778 Extends Anti-Harassment Training Deadline,” published on September 12, 2019.

Training Requirements and Deadlines

To make a long story short, for employers with five or more employees, supervisory employees must take the two-hour anti-harassment training every two years and non-supervisory employees must take the one-hour anti-harassment training every two years. This sounds simple enough. However, since we had multiple bills that added content to the requirements and extended deadlines (Senate Bill 778), it's not necessarily straightforward.

For example, if you have a supervisory employee who completed the old sexual harassment and abusive conduct prevention training in 2019, their next anti-harassment training is due in 2021. However, if they took any similar trainings prior to 2019, they must complete the new anti-harassment training by January 1, 2021. This also applies to non-supervisory employees. If a non-supervisory employee took the training in 2019, their next due date will be in 2021. However, if the non-supervisory employee has not taken the training or took a similar training prior to 2019, they are required to complete the anti-harassment training no later than January 1, 2021.

New employees must be trained within six months of hire and temporary employees must be trained within 30 days of hire.

Online Training

Rancho Mesa offers its clients free 100% online anti-harassment training for both supervisory employees and non-supervisory employees.

“It’s amazing Alyssa and her team have trained nearly 7,000 of our clients’ employees over the last 24 months and have been able to do that at no cost to them,” says Dave Garcia, President of Rancho Mesa. “Yes, it’s expensive, but we just feel it’s doing the right thing for our clients.”

The online training can be accessed from a computer, tablet or smartphone. This means our clients can get their required trainings from anywhere with an internet connection.

“It’s not only the cost savings for our clients that’s important, it’s also the way we are able to do the training utilizing any internet connected device,” says Garcia. “Our clients’ productivity isn’t impacted by having to bring their workforce into a training area and out of the field, creating a loss of productivity. Additionally, with COVID-19, large training meetings would not be permitted.”

Since the anti-harassment training is completed online through the Risk Management Center, it provides automated recordkeeping and offers rescheduling to ensure as soon as an employee completes the training, they can be automatically rescheduled to complete the training again in two years. It also allows administrators to archive employee training records when an employee leaves the company and reactivate the records if they are rehired.

Recordkeeping

Recordkeeping for anti-harassment training is important when there is an allegation of harassment or if an employee reports the employer for non-compliance. The Department of Fair Employment and Housing (DFEH) “accepts complaints from employees that their employers have not complied with the law." So, make sure you are providing the training and keeping records. It is also a best practices to train all employees, regardless if they have a certificate of completion from another employer, since it's the current employer's responsibility to make sure the employee is trained.

We offer an on-demand webinar that explains how to setup your employees in the Risk Management Center and assign the anti-harassment training.

For questions about the anti-harassment training requirements or to enroll your supervisors and employees, contact Rancho Mesa’s Client Services Department at (619) 438-6869 or send an email to aburley@ranchomesa.com.

California Workers' Comp Carriers React to Commissioner's COVID-19 Amendment Approval

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

The amendments address accounting for employees whose job duties have changed to clerical work, which is typically a less expensive workers’ compensation insurance classification than the jobs they were performing prior to Governor Newsom’s March 19, 2020 Stay-at-Home Executive Order. It also excludes payroll for furloughed employees who are not working, but collecting a paycheck. It creates a way to identify COVID-19 cases within the California workers’ compensation system and excludes the cases from the Experience Modification Rate (XMOD) calculation.

When asked about the amendments scheduled to take effect July 1, 2020, Margaret Hartmann, Senior Vice President and Chief Marketing Officer at Berkshire Hathaway Homestate Companies, California’s second largest workers’ compensation insurance carrier, said “Lara’s approval of the WCIRB [Workers’ Compensation Insurance Rating Bureau] proposal was not surprising. These are not unreasonable, at least from the perspective of ratemaking and predicting future experience of employers once COVID passes.”

Bryan Anderson, Senior Vice President at The Zenith explained the WCIRB’s amendments to the California Unit Statistical Reporting Plan and XMOD calculation were “not likely to change under any normal circumstances but the Bureau made these recommendations to address the unique pandemic situation that California (and the world’s) businesses find themselves in."

Another industry leader Paul Zamora, ICW Group’s Senior Vice President for Workers’ Compensation Underwriting said, “We support Commissioner Lara’s decision to approve the recommended changes by the WCIRB. We believe the rule modifications accurately reflect changes in exposures created by COVID-19 and will provide the appropriate relief needed by California businesses.”

The changes were expected by California’s workers’ compensation insurance carriers as a mechanism to adjust employers’ insurance rates, since COVID-19 claims aren’t necessarily an indicator of a company’s safety record.

“Under normal situations,” Anderson explained, “workers’ compensation covers only those occupational illnesses that are created from the work environment. In this instance, that understanding changed with the Governor’s Executive Order requiring employers to accept compensability for Covid-19 claims unless they can prove they are not work-related.”

Hartmann added, “This is clear cost-shifting to the industry, which we expected. The combination of a broad WC presumption, possible additional legislation extending these presumptions past July 5th, excluding COVID from ratemaking and XMODs, means that the insurance industry will absorb the lion’s share of COVID costs that can be assigned to WC.”

Zamora points out “it’s imperative that business owners understand the rule changes and adopt new practices, particularly with respect to the record keeping criteria associated with two of the changes. By adopting new record keeping procedures to apply to the new rules, policyholders will have the necessary audit documentation to realize the full value of Commissioner Lara’s decision.”

This means employers should start documenting employees’ hours worked under each class code, now, and not wait until a final audit.

“Hopefully, these measures will play a small part in helping California employers as they try to recover from the devastating impacts of this pandemic,” Hartmann concluded.

“I think this solution is a testament to the strength and objectivity of the Bureau, the companies it represents and to the integrity of the Workers’ Compensation Industry in California,” said Anderson.

Gene Simpson, CompWest’s Vice President of Underwriting and Marketing, added, “To confront the challenges presented by the COVID-19 pandemic to California employers, regulatory authorities, insurance carriers and employers must work together on effective solutions.”

While the amendments should reduce workers’ compensation premium costs for California businesses in the short-term, only time will tell how lower revenues and higher costs due to COVID-19 claims will impact California’s workers’ compensation insurance premiums in the future.

For a greater understanding of these changes and how they will impact your company, please contact our team at (619) 937-0164.

OSHA Recording Requirements for COVID-19 Cases

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

California’s Division of Occupational Safety and Health (better known as Cal/OSHA) has released information for employers on the subject and it appears they are using their existing criteria for determining the recordability of an employee COVID-19 case.

According to Cal/OSHA, “California employers that are required to record work-related fatalities, injuries and illnesses must record a work-related COVID-19 fatality or illness like any other illness.” To be recordable on the 300, 300A and 301 forms, the COVID-19 case must be work-related and result in one of the following:

Death.

Days away from work or transfer to another job.

Medical treatment beyond first aid.

Loss of consciousness.

A significant injury or illness diagnosed by a physician or other licensed health care professional.

The criteria that most employers may have a hard time determining is if the COVID-19 illness is actually work-related. Cal/OSHA addresses this in its Frequently Asked Questions webpage. First, the employer must determine if there was “an event or exposure in the work environment [that] either caused or contributed to” the COVID-19 case.

In order to determine if a case is work-related, employers should consider factors like:

The type and duration of contact the employee had at work with other people including co-workers and the general public.

With the implementation of physical distancing and other controls within the workplace, what is the likelihood of exposure?

Did the employee come in contact with anyone showing signs and symptoms of COVID-19, while working?

These considerations will help an employer determine whether or not the COVID-19 case is work-related and thus recordable. According to Cal/OSHA, it is best practices to err on the side of recordability when in doubt about how an employee was exposed to COVID-19.

If it is determined that an employee’s illness was work-related, yet, for a variety of reasons testing or the results from a test is unavailable and the employee has been determined to have COVID-19, “an employer must make a recordability determination” as to whether or not to record the case. While a positive COVID-19 test result would trigger recordability by the employer, a positive test is not always necessary to record the case in the OSHA logs.

Keep in mind, the above information is for OSHA recording of work-related COVID-19 cases only, which may be different from guidance for workers’ compensation claims.

Cal/OSHA states that “Governor Newsom’s Executive Order N-62-20 addresses eligibility for workers’ compensation benefits... The Order does not alter employers’ reporting and recording obligations under Cal/OSHA regulations.”

Rancho Mesa’s Risk Management Center offers employers the ability to track their COVID-19 cases electronically and generate the applicable OSHA 300, 300A and 301 forms along with an incident report and First Report of Jury (Form 5020).

To learn more about the Risk Management Center, contact our Clients Services Department at (619) 438-6869.

Healthcare Insurance Carriers Respond to COVID-19 Threat

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As Rancho Mesa continues building resources for our clients and their employees across all sectors, we have compiled a list of healthcare insurance providers and their enhanced benefits designed to respond to the COVID-19 virus. Listed below is information related to COVID-19 testing when ordered by a physician.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As Rancho Mesa continues building resources for our clients and their employees across all sectors, we have compiled a list of healthcare insurance providers and their enhanced benefits designed to respond to the COVID-19 virus. Listed below is information related to COVID-19 testing when ordered by a physician.

Health insurers are responding to the Coronavirus threat by offering members no-cost screening and diagnostic testing.

| Carrier | Enhanced Benefits1 |

|---|---|

| Aetna | Screening/diagnostic testing provided at no cost. $0 copay telemedicine (for next 90 days2). Members diagnosed with COVID-19 will receive a care package with over-the-counter medications and cleaning supplies. CVS Health will help Aetna members that may be experiencing anxiety related to COVID-19 by: • opening Crisis Response Lines • providing plan sponsors with a Resources for Living toolkit • expanding 24/7 access to the Aetna Nurse Medical Line |

| Anthem Blue Cross | Screening/diagnostic testing provided at no cost. |

| Blue Shield of California | Screening/diagnostic testing provided at no cost. |

| Health Net | Screening/diagnostic testing provided at no cost. |

| Kaiser Permanente | Screening/diagnostic testing provided at no cost. |

| MediExcel Health Plan | Screening/diagnostic testing provided at no cost. |

| Oscar Health | Screening/diagnostic testing provided at no cost. Continuing to offer $0 telemedicine through Doctor on Call for most members. |

| Sharp Health Plan | Screening/diagnostic testing will be covered under the member's standard plan benefits. |

| Sutter Health Plan | Screening/diagnostic testing provided at no cost. |

| United Healthcare | Screening/diagnostic testing provided at no cost. Free Emotional-Support Help Line available for members suffering from fear or stress due to COVID-19, open 24/7. |

| Western Health Advantage | Screening/diagnostic testing provided at no cost. |

1 Screening/diagnostic testing when ordered by the physician.

2 Aetna’s website states a 90-day window as of March 2020, but the page is posted without a start/end date. Check with Aetna before receiving services

For additional resources and telemedicine information for each carrier, download the full PDF document.

Senate Bill 778 Extends Employee Anti-Harassment Training Deadline

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Newly passed Senate Bill 778 (SB 778) extends the deadline set in Senate Bill 1343 for California’s mandatory Anti-Harassment Training from January 1, 2020 to January 1, 2021. The bill also addresses concerns about supervisory employees and clarifies when temporary workers must be trained. California Governor Newsom signed the bill into law on August 30, 2019, which included an urgency clause that allows the bill to go into effect immediately.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Newly passed Senate Bill 778 (SB 778) extends the deadline set in Senate Bill 1343 for California’s mandatory Anti-Harassment Training from January 1, 2020 to January 1, 2021. The bill also addresses concerns about supervisory employees and clarifies when temporary workers must be trained. California Governor Newsom signed the bill into law on August 30, 2019, which included an urgency clause that allows the bill to go into effect immediately.

What SB 778 Means to CA Employers

The changes made by SB 778 not only extends the deadline for non-supervisory employee Anti-Harassment training, but also allows supervisory employees to stay on their existing two-year training schedule. For example, if a supervisory employee completed Anti-Harassment training in 2018, their next training, with the SB 1343 compliant content, will be due in 2020 - two years from their last training date, which is before the new deadline. Likewise, if a supervisory employee was trained in 2019, their next training due date will be in 2021.

Non-supervisory employees will need to complete their initial 1-hour Anti-Harassment training by January 1, 2021. For those who have already taken the training in 2019, we recommend they maintain their two-year schedule, and complete the training again in 2021.

Both supervisory and non-supervisory employees must be trained within six months of hire. However, temporary or seasonal workers who are hired for less than six months must be trained within 30 days of hire.

For questions about this training requirement or to learn how to enroll your supervisors and employees, register for the “How to Enroll Supervisors and Employees in the Online Anti-Harassment Training” webinar or contact Rancho Mesa’s Client Services Department at (619) 438-6869.

Providing Anti-Harassment Training Is the Employer’s Responsibility

Author, Alyssa Burely, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Many industries like construction utilize a semi-transient workforce that can shift from company to company as labor needs change throughout the project’s life cycle. Employees may work a few months for one employer, then move on to another employer when the project is completed. This scenario poses a dilemma for California employers looking to comply with Senate Bill 1343 (SB 1343). Providing training to an ever-changing workforce can be a challenge.

Editor’s Note: This article was originally published on August 22, 2019 and has been updated for accuracy on September 12, 2019.

Author, Alyssa Burely, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Many industries like construction utilize a semi-transient workforce that can shift from company to company as labor needs change throughout the project’s life cycle. Employees may work a few months for one employer, then move on to another employer when the project is completed. This scenario poses a dilemma for California employers looking to comply with Senate Bill 1343 (SB 1343). Providing training to an ever-changing workforce can be a challenge.

“The current employer must provide the Anti-Harassment training to new employees within six months of hire, regardless if the employee was trained and has a certificate of completion provided by a previous employer or labor union.”

SB 1343 requires California employers with five or more employees to provide Anti-Harassment training to all supervisors and employees. The passing of Senate Bill 778, on August 30, 2019, extends the deadline for this training to January 1, 2021. The training must be completed every two years. For example, if an employee was trained in 2019, their next training due date will be in 2021. New employees must be trained within six months of hire. This means the current employer must provide the Anti-Harassment training to new employees within six months of hire, regardless if the employee was trained and has a certificate of completion provided by a previous employer or labor union. Every time a worker begins employment at a new company, they should expect to receive Anti-Harassment training within the first six months. However, temporary or seasonal workers who are hired for less than six months must be trained within 30 days of hire. This requirement ensures the current employer is able to maintain accurate training records.

Recordkeeping for Anti-Harassment training is important when there is an allegation of harassment or if an employee reports the employer for non-compliance. The Department of Fair Employment and Housing (DFEH) “accepts complaints from employees that their employers have not complied with the law…If DFEH finds that the law has been violated, it will work with employers to obtain compliance with the law,” according to the DFEH’s “Sexual Harassment and Abusive Conduct Prevention Training Information for Employers” document.

Rancho Mesa offers free online Anti-Harassment training for supervisors and employees to all of its clients. The training can be accessed from a computer, tablet or smartphone. The online platform provide automated recordkeeping and rescheduling to ensure as soon as an employee completes the training, they are automatically scheduled to complete it in two years. It also allows administrators to archive employee training records when an employee leaves the company and reactivate the records when/if they are rehired. To learn more about the trainings, visit our website or contact the client services department at (619) 438-6869.

SB 1343 requires employers take responsibility for providing Anti-Harassment training to all of their employees and supervisors. Take advantage of Rancho Mesa’s Anti-Harassment training and ensure your company stays compliant.

Employers Prepare As Reports of Sexual Harassment Spike

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Americans are all too familiar with the #MeToo movement that has shed light on sexual harassment in the workplace. Outspoken celebrities and prominent public figures have brought this topic to the forefront in the media. With all the publicity surrounding sexual harassment allegations, people are empowered to speak out and report unwanted behaviors in the workplace. This leaves many employers asking what they can do to prevent harassment and prepare for possible harassment allegations.

Editor’s Note: This article was originally published on June 27, 2019 and has been updated for accuracy on September 12, 2019.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Americans are all too familiar with the #MeToo movement that has shed light on sexual harassment in the workplace. Outspoken celebrities and prominent public figures have brought this topic to the forefront in the media. With all the publicity surrounding sexual harassment allegations, people are empowered to speak out and report unwanted behaviors in the workplace. This leaves many employers asking what they can do to prevent harassment and prepare for possible harassment allegations.

Charges Alleging Sexual Harassment FY 2010 - FY 2018

- Reports

- Reports

The United States Equal Employment Opportunity Commission (EEOC) released its “Charges Alleging Sexual Harassment FY 2010 - FY 2018” report. The data shows from 2010 to 2017 reports of alleged sexual harassment incidents actually declined 15.7%, over the seven-year span. However, based on the data, it is difficult to know if incidents of sexual harassment declined or just the reporting of incidents declined.

However, during 2018 there was an increase of 13.6% in alleged sexual harassment incidents, which accounted for over 7,600 claims at a cost of $56.6 million dollars in damages.

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|

| Percentage Change Over Previous Year Number of Charges |

NA 7,944 |

-1.4% 7,809 |

-3% 7,571 |

-4.2% 7,256 |

-5.7% 6,862 |

-0.6% 6,822 |

-0.9% 6,758 |

-0.9% 6,696 |

13.6% 7,609 |

| Percentage Change Over Previous Year Damages (In Millions) |

NA $41.2 |

9.5% $45.1 |

-4.7% $43 |

3.7% $44.6 |

-21.5% $35 |

31.4% $46 |

-11.5% $40.7 |

13.8% $46.3 |

22.2% $56.6 |

EEOC. Charges Alleging Sexual Harassment FY 2010 - FY 2018. https://www.eeoc.gov/eeoc/statistics/enforcement/sexual_harassment_new.cfm.

California’s Senate Bill 1343 (SB 1343) now requires employers with 5 or more employees to provide 2-hour Anti-Harassment training to supervisors and 1-hour training to employees, every two years. As part of this new requirement, the initial training must be completed for all employees and supervisors by January 1, 2021, according to Senate Bill 778, approved on August 30, 2019, which extends the training due date. The changes made by SB 778 not only extends the due date to January 1, 2021, but also addresses concerns about supervisory employees and clarifies when temporary workers must be trained. Read about the changes here.

It’s our belief that as more people are trained to recognize harassment in its many forms, we expect to see the number of reported alleged harassment incidents increase in the coming years. So, what should California employers do to mitigate this increased risk?

Course of Action

For employers, the best course of action is two-fold. Make sure you are compliant by training your employees and supervisors; second, make sure you have Employment Practices Liability Insurance (EPLI) as part of your risk management portfolio.

Training Supervisors and Employees

Understanding the confusion, time and financial burden SB 1343 puts on all California employers, Rancho Mesa offers its clients SB 1343-compliant free online supervisor and employee Anti-Harassment training. Supervisor and employee trainings can be completed 100% online via a computer, tablet or mobile device.

California employers who are not clients of Rancho Mesa can find this training through 3rd party vendors that work in the Human Resource arena and will need to contract with them directly to meet this requirement.

Employment Practices Liability Insurance (EPLI)

EPLI is “a type of liability insurance covering wrongful acts arising from the employment process. The most frequent types of claims covered under such policies include: wrongful termination, discrimination, sexual harassment, and retaliation,” according to the International Risk Management Institute, Inc.

If your organization currently does not have EPLI, or you are unsure about what is covered in your policy, we recommend you contact your insurance broker or call us to get clarification. With the projected increase in these types of claims, not having this vital coverage in place could expose your company to severe negative financial impacts.

Whether the increase in reported alleged sexual harassment incidents is a result of more incidents or simply more people feeling comfortable reporting the harassment, every employer should be prepared to properly train their employees and supervisors, while actively working to prevent and stop all forms of harassment in the workplace.

Contact the Rancho Mesa Insurance Services Client Services Department at (619) 438-6869 or aburley@ranchomesa.com for more information about free anti-harassment training for supervisors and employees, or learn more through our other articles on the topic.

Alyssa Burley is NOT a licensed insurance professional. Informational statements regarding insurance coverage are for general description purposes only. Contact a licensed insurance professional for specific questions.

4 Essential Tools For Managing Your Company's Risk

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Risk Management is the identification, analysis, assessment, control, and avoidance, minimization, or elimination of unacceptable risks. Companies manage their risk through what is known as an Injury and Illness Prevention Program (IIPP). As a business owner, supervisor or manager, there are tools available to assist in risk management endeavors.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Risk Management is the identification, analysis, assessment, control, and avoidance, minimization, or elimination of unacceptable risks. Companies manage their risk through what is known as an Injury and Illness Prevention Program (IIPP). As a business owner, supervisor or manager, there are tools available to assist in risk management endeavors.

“Injury and illness prevention programs are systems that can substantially reduce the number and severity of workplace injuries and illnesses while reducing costs to employers,” according to OSHA.

Below are four tools your company can use to proactively manage the IIPP.

Training

Access to a robust bilingual database of both online and offline trainings is essential to ensuring employees are up to date on required and supplemental training. Weekly training shorts (e.g., tailgate topics, safety shorts) that are industry specific and relevant keeps employees focused on safety and reinforces a safety culture within the company.

“Training in the safe way for workers to do their jobs well is an investment that will pay back over and over again in fewer injuries and illnesses, better morale, lower insurance premiums and more,” according to OSHA’s training requirements document.

Tracking of Employee Training

Maintaining employee training documentation is vital for ensuring employees are trained on required topics and in regular intervals. Having an electronic tracking system can streamline the process and allow management to generate reports and search records from any device with internet access.

According to OSHA’s documentation, “it is a good idea to keep a record of all safety and health training. Documentation can also supply an answer to one of the first questions an incident investigator will ask: ‘Did the employee receive adequate training to do the job?’”

To learn more about OSHA training requirements, review Training Requirements in OSHA Standards.

Incident Tracking and OSHA Reporting

Documenting near-misses, injuries, and accidents can keep your company OSHA compliant while helping to prevent incidents in the future. Making sure supervisors complete a thorough investigation and collect witness statements at the time of the incident can also ensure hazards are addressed immediately. Electronic documentation of a near-miss or incident creates a standardization of data that is collected, allows for trend reporting, and electronic submission of OSHA 300A Summary data.

Written Job Hazard Analysis

A job hazard analysis (JHA) identifies the dangers of specific tasks in order to reduce the risk of injury to workers. JHAs are important for managing risk because they help to identify hazards which can be reduced or eliminated before an employee is hurt. Once a JHA is established, management should observe and document their findings and any remedies that are made.

Risk Management starts with a written IIPP, but it is up to management to implement and utilize the available tools to make it effective. Contact Rancho Mesa’s Client Services Department at (619) 438-6869 to learn more about the Risk Management Center platform.

California SB 1343 Expands Sexual Harassment Training Requirements

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc,

On September 30, 2018, California Governor Jerry Brown, approved Senate Bill 1343 (SB 1343), which expands rules for required sexual harassment prevention training for businesses.