Industry News

Help Control Your Workers’ Compensation Claim Costs through Accident Investigation

Authors, Dave Garcia, AAI, CRIS, President and CEO, and Drew Garcia, NALP Program Director from Rancho Mesa Insurance Services, Inc.

When a workers’ compensation claims occurs, in order to both control the costs of the claim and look for preventive measures to reduce or eliminate similar claims from reoccurring, it is vital that a thorough accident investigation report is completed.

Authors, Dave Garcia, AAI, CRIS, President and CEO, and Drew Garcia, NALP Program Director from Rancho Mesa Insurance Services, Inc.

When a workers’ compensation claims occurs, in order to both control the costs of the claim and look for preventive measures to reduce or eliminate similar claims from reoccurring, it is vital that a thorough accident investigation report is completed. The accident investigation report should be completed at the time of the accident, by the supervisor overseeing the injured employee, and contain the following information:

- Employee name, date, time and location of the accident,

- A description of how the injury occurred and the job duties the employee was performing when they were injured,

- The employee’s body part(s) that were reported as injured,

- If witnesses were present when the accident occurred, document their names and statements using the Witness’ Statement of Employee Accident or Near Miss Report,

- Pictures of the injury and accident area,

- Recommendations or changes that could be made to eliminate or reduce the potential for a similar claim in the future.

The goals of this process are:

- To have a timely and accurate record of the accident or incident that allows the claim to be reported to the insurance carrier in a timely manner.

- To help you to reduce the chance of fraudulent claims through documentation, pictures and witness statements.

- To analyze the root cause of the accident or near miss and implement the needed recommendations to reduce or eliminate the likelihood of future claims.

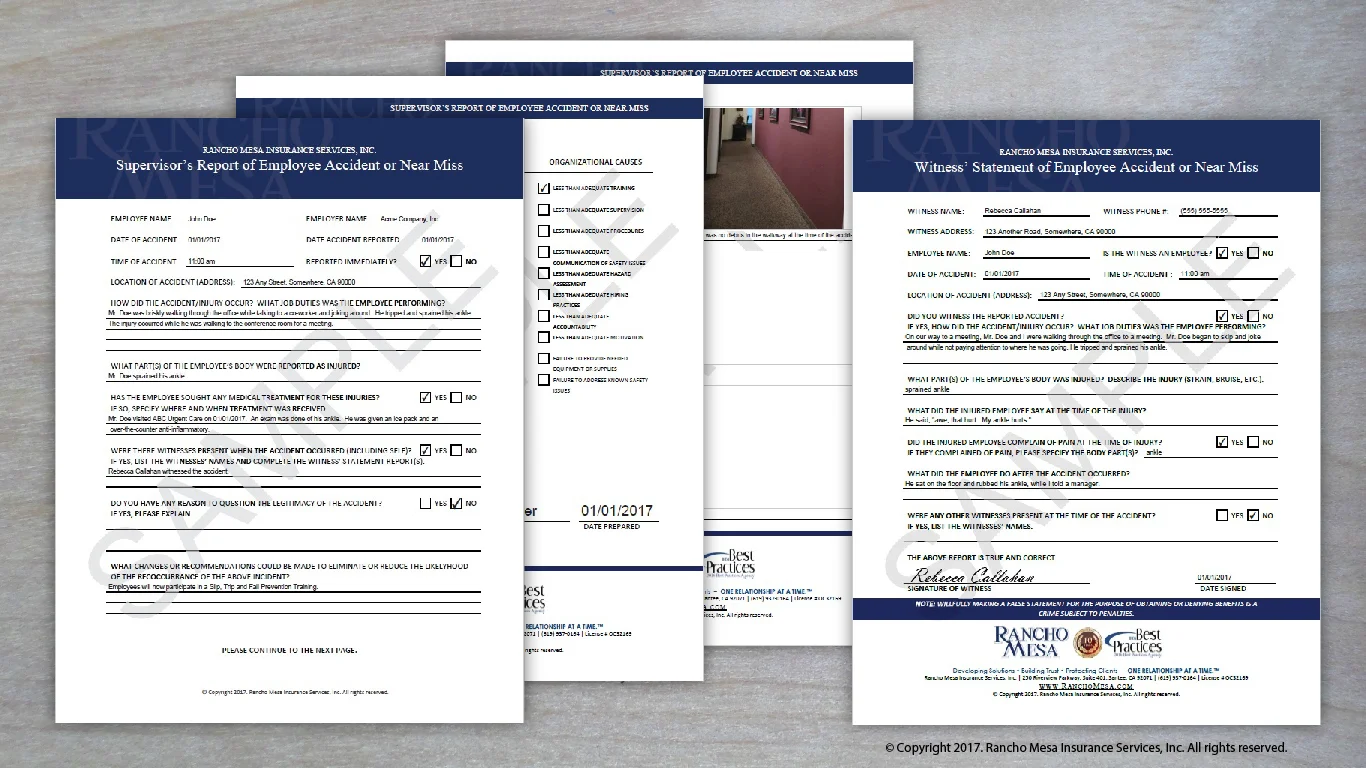

As a 10-time National Best Practices Agency, Rancho Mesa Insurance Services, Inc. understands the importance of implementing the highest standards of Risk Management practices for our clients. So, as part of our RM365 Advantage™ program, we have developed our own proprietary Employee Accident Report and Witness Statement to assist our clients with documentation of their accidents or near misses.

Closing the "Gaps in Coverage" When Using Temporary or Leased Labor

Author, Dave Garcia, AAI, CRIS, is the President and CEO of Rancho Mesa Insurance Services, Inc.

It has become more common for construction companies to use temporary or leased labor in order to meet the demands of their work. While this is a useful tool it can create some unintended gaps in coverage for the contractor hiring the temporary or leased labor. These gaps potentially exist for on-the-job injury claims suffered by the temporary or leased workers.

Author, Dave Garcia, AAI, CRIS, is the President and CEO of Rancho Mesa Insurance Services, Inc.

It has become more common for construction companies to use temporary or leased labor in order to meet the demands of their work. While this is a useful tool, it can create some unintended gaps in coverage for the contractor hiring the temporary or leased labor. These gaps potentially exist for on-the-job injury claims suffered by the temporary or leased workers.

The question for all construction companies is: if you use workers from staffing or leasing agencies to supplement your workforce, how adequately do your current insurance policies protect your company in the event that one of these individuals is injured on the job?

Following are two recommendations in order to better protect your interest and help close those gaps.

Alternate Employer Endorsement

(WC00 03 01 A)

It is recommended that an endorsement is added to a workers' compensation policy that provides an entity scheduled as an alternate employer, with primary workers compensation and employers liability coverage, as if it were an insured under the policy. This endorsement is commonly used when a temporary help agency (the insured) is required by its customer (the alternate employer) to protect the alternate employer from claims brought by the insured's employees.

Businesses may find themselves short staffed on occasion, and will seek out the services of a temporary staffing or leasing agency to fill the gaps. Workers that are employed through the temporary staffing or leasing agency are covered under the workers' compensation policy that the temporary staffing or leasing agency has purchased. When these workers are hired out to an outside firm, the firm that hires them should seek an “alternate employer endorsement” from the temporary staffing or leasing agency, in order to protect it from any lawsuits brought by the temporary employee for injuries they may suffer.

For example, a construction company needs some additional labor in order to complete a job on time. It hires some temporary labor. If a temporary employee injures themselves or has to go to an emergency room, they would be covered under the temporary staffing or leasing agency’s workers' compensation policy, thus, prohibiting them from making a claim against the construction company’s liability policy.

When an alternate employer endorsement is added to a policy’s endorsement schedule, the employer (contractor in this example) is often required to assist in any claims investigations. This scenario typically means reporting any injuries suffered by temporary or leased staff, ensure that the temporary employee is given proper medical treatment when the injury is suffered; and provide any documentation related to the injury to the policyholder (temporary staffing or leasing agency). If the policy is canceled for any reason, the insurance company is not obligated to tell the alternate employer (contractor) because the alternate policyholder (contractor) is not the primary party on the policy.

Coverage for Injury to Leased Workers Endorsement

(CG 04 24)

A second way to help close this potential gap is by adding the above endorsement to your (the contractors) existing general liability policy. However before filling this gap it is first important to understand how the gap is created. A gap in coverage arises from the way the CGL policy defines "temporary" and "leased" workers. Following are those definitions.

“Leased Worker” is a person leased to you by a labor leasing firm under an agreement between you and the labor leasing firm, to perform duties related to the conduct of your business. "Leased worker" does not include "temporary worker."

"Temporary worker" means a person who is furnished to you to substitute for a permanent "employee" on leave or to meet seasonal or short-term workload conditions.

Under the terms of a CGL policy, "employee" includes a leased worker, but does not include a temporary worker. The distinction is important, because the CGL policy's Exclusion e: employers liability, excludes from coverage bodily injury claims made by an employee of the insured. Thus, if your CGL policy definitions consider the worker to be an "employee"- even though that worker is provided by a staffing agency - the policy will not cover any bodily injury claims by that worker.

If the worker is not specifically substituting for a permanent employee who is on leave, or meeting a seasonal need or short-term workload conditions, the worker is not a "temporary worker" in the eyes of the insurer, and instead is considered your employee for purposes of Exclusion e.

To be a "temporary worker," that individual must have a specific end date to his or her employment with you. A temporary employee who is hired for an indefinite period of time simply does not meet the criteria stated above, and is therefore considered an employee, and subject to Exclusion e if they are injured on the job.

Adding the Coverage for Injury to Leased Workers (CG 04 24) endorsement to your CGL policy will help you fill this coverage gap. This endorsement states that the term "employee" does not include a "leased worker" or "temporary worker," making the employers liability exclusion of the CGL policy inapplicable to the claims for injuries to a leased or temporary worker.

Without the right coverage in place, on-the-job injuries to temporary workers can present a significant potential liability to your company. Examine your current CGL policy and arrangements with any staffing or leasing firms you use to make sure your company is adequately protected.