Industry News

2022 Workers' Compensation Expectations for CA Landscape Industry

Rancho Mesa's Alyssa Burley and Drew Garcia, Vice President of the Landscape Group set the stage for insurance expectations in 2022.

Transcript

Alyssa Burley: Welcome back, everyone. My guest is Drew Garcia, Vice President of the Landscape Group with Rancho Mesa. Today, we're going to set the stage for insurance expectations for 2022. Drew, thank you for joining us.

Drew Garcia: Alyssa, thanks for having me.

AB: Since you specialize in the landscape industry, what do you see for the insurance marketplace, for these companies as we move into 2022?

DG: Great question, and I think a lot of companies are always wondering this each year as they come up for renewal. So what I want to do is just, I'll give you a little insight to all the lines of insurance that most landscape companies are going to be renewing in 2022.

And this is basically what we do at a pre renewal, very low level. But I'll start with work comp, which has been a soft market now for four or five years where there's been pressure for rates to continue to go down as a group, as a whole.

And each company's obviously individually underwritten by a carrier, and they're looking at the losses for that particular company. But in general, the work comp market has been soft and that's led to, you know, general decreases for most businesses over the last four or five years.

We think that trend is going to continue in 2022, and we'll see if there's any change in 2023. But for the foreseeable future through this policy period, we do believe that the work comp market is going to stay relatively soft, and that just means rates are going to stay down as a whole.

Again, there could be some individual things that you're experiencing as a landscape business that's causing your pricing to increase, whether that's your ex mod or you've got claims in the current year that haven't gone into the mod calculation or you've changed operations, things like that could impact your own pricing.

But as a group, we feel like the market's going to stay relatively soft. And I'm going to share a little detail that we do individually, myself and Greg, who helps me here with the landscape group at Rancho Mesa. We track a lot of industry data and then we use that when we're having our conversations with our customers.

So one thing we like to pull is we measure every contractor that has a C-27 license in California. There's about 5,465 of those companies that have work comp policies, and that's businesses that are landscape companies that only carry that license. They don't also have other licenses so strictly landscape, which helps us keep our data clean when we're looking at it. So there's 5,465 of those companies, 125 carriers, insurance carriers for work comp, right? At least one policy for all of those companies.

So there's 125 insurance carriers writing at least one landscape policy. Now there's only 25 carriers that have more than 20 policies, so we really start to limit down, you see carriers become niche when trying to write a particular business, in this case, landscape. Of those 125, only 25 of them have more than 20 policies. So there's probably a little bit of an appetite there that's aligning for those carriers. And then when we really might it down, there's only ten carriers they have more than 150 policies, and those are the bulk of the businesses of the insurance carriers riding the business or writing work comp policies for landscape companies in California. The top five are going to be familiar names, Berkshire Hathaway, Insurance Company of the West, State Fund, Markel and then Am Trust.

Those are the top five carriers in terms of market share writing those 5,465 C-27 license landscape companies that have work comp policies. So a little bit of an insight into the market and what carriers are interested in writing business or work comp policies for landscape companies.

And then when we look at the numbers, we always like to watch the pure premium rate for the 0042 class code and just a quick refresher on pure premium. Every year the bureau, the rating bureau, will recommend a rate that the carriers should charge per $100 in payroll for every particular class code to strictly just cover claim costs. So, this rate doesn't include carrier overhead or expense. So, that number went from $4.93 last year to $4.57 this year, effective September the first of 2021. That's a 7% decrease, and when you're watching that recommendation come from the bureau to the insurance carriers, what happens next is insurance carrier’s base rates come down a little bit. Normally, the rates should come down a little bit on the base rate side, and last year, the average base rate for an insurance carrier, which is the rate that they're going to start at when they're going to underwrite a landscape business, and that rate is going to be different for every insurance carrier. The average rate that they started at was $9.92. That's down to $9.52 on average. So 4% down on the base rate for work comp carriers. Again, those are indicators to us that the market is still soft.

There's still plenty of carriers trying to write the business and that, we should see rates stay relatively down for 2022 as a whole. Again, we talked about the individual aspect of underwriting, but as a whole, those are good indicators that the market still is pretty soft.

And I'm going to share my screen really quick. This is a factor here that nobody really talks about. But California is so diverse with how work comps are handled throughout the state. So there's individual territory factors that most carriers apply when they're underwriting based on where you're doing your business and the reason why they use territory factors is because the claim outcomes, the claim activity can be higher in certain areas than in others. So the screen that you're looking at right now shows Berkshire Hathaway's territory factors based on 2021 and then 2022. And what I did is you can see, based by zip code, I've got different colors indicating the severity of territory factors that could be applied depending on where you're doing your business. So the lighter colors that you're seeing, the more yellow, lighter yellow that you see, those are the preferred areas and then the heavier, darker red that's going to be where maybe there's some territory debits that increase, and most carriers are using something like this when they're underwriting and looking at the business, but you can see some movement in some of the color from last year to this year. You can see San Diego's lightened up a little bit as a territory, so rates are probably a little bit more favorable in San Diego.

But there really is always been some heavy focus on L.A., Orange County, Riverside County, San Bernardino, where carriers really look at implying a debit on territories just because of claim outcomes and claim activity in those in those particular regions.

And then San Jose in Northern California, those have always been generally lighter intel. There's a less territory factor that that happens up there based on better claim activity and claim outcomes that are associated with the zip codes up in that area.

So I wanted to share that, I'll pull that screen down. And then now exiting work comp kind of just highlighting a couple of the other lines of insurance that we think are going to be impacted in 2022. And we've talked about it for many years with our customers, but the auto market is still very difficult.

And if you're a landscape maintenance company, you have a heavy fleet and a lot of vehicles. So it's really important for you to continue to monitor your cost per unit. And we wrote that article a few weeks back, measuring your cost per unit at each renewal so you can kind of see where your insurance has gone over the years. And so landscape companies really need to pay attention to their cost per unit because we do believe there's still more pressure on the auto market for rates to continue to increase. There's a lot of things that Rancho Mesa provides, and so many of our landscape companies are taking advantage of our Fleet Safety trainings that we have in the Risk Management Center and client services on our end has done a great job when we've had claimed activity with our customers to recommend certain driver trainings, you know, as a result of those claim outcomes - or those accidents that have occurred.

So, we've been happy with how we're helping our customers manage the auto side and then really everyone should watch out on the excess or the umbrella layer of their insurance that's really taking its toll and we've seen rate increases coming on that line in particular. A lot of carriers are limiting their capacity, so a lot of carriers usually go up to 10 million for that limit. But now it seems five is the most that any one carrier wants to go to.

So if you carry more than 5 million, you're probably going to need to stack that with multiple carriers to achieve that limit, which could be different than what you've seen in the past, and also watch out for wildfire exclusions. A lot of excess of reinsurance carriers are trying to apply a wildfire exclusion to landscape companies in California, which would be a detriment to your policy if you have it. So always pay attention for that. You can also look out for that wildfire exclusion on your general liability policy. Those are new things that are potentially coming to the liability side. There are still carriers out there that don't offer that exclusion, so you would want to make sure that you're aligned with a carrier that's doing that. But for the general liability property inland marine policies, we think rates are staying relatively flat.

So we don't see a lot of movement coming there. More of the pressures coming on the auto and excess lines. And I think we'll see that for the next couple of years, there should be should remain some pressure on those lines.

That basically wraps it all up for us, covers the basic lines that most companies are looking at. And again, kind of an overview, but hopefully it gives some insight to business as they're moving into 2022, what to expect and where to focus their attention when it comes to their renewal.

AB: Drew, if listeners have questions about their workers compensation insurance, what's the best way to get in touch with you?

DG: Email, they can email me at drewgarcia@ranchomesa.com, call my office (619) 937-0200, and then I'd also encourage them just to check out our website, we've got a ton of content that we've created, all designed for landscape companies to help them better manage their risk. And we have, you know, different tools that aren't really available online that we'd be happy to introduce to companies and let them use to better manage their risk.

AB: Drew, thank you so much for joining me in StudioOne™.

DG: Thanks for having me, Alyssa.

The Field Guide to Navigating Your Insurance in 2022

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns? During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns?

During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

COVID-19’s impacts included:

The loss of income/revenues

Labor shortages

Health concerns

Relocation of labor forces

As the year comes to a close, we now have some answers but even more questions about what challenges 2022 will bring. Below are a few remaining questions that create uncertainty.

Will Property, Auto, General Liability, Excess, Cyber, and EPL insurance continue to see pressure? The short answer is yes.

What can I do today as a business owner to prepare and better mitigate these increases?

Start your renewal process a minimum of 120 days away from your expiration date. Learn more about the pre-renewal process in our article, “3 Reasons Your Pre-Renewal Meeting is Key to your Success.”

Be willing to meet and discuss your particular situation, needs and goals.

Choose a broker that specializes in your industry and can negotiate with the marketplace from a position of expertise.

Evaluate the services that you receive from your broker’s agency to assure they align with your specific risk management needs. Are they proactive or reactive?

Where is the Workers’ Compensation Industry Going in 2022 and Beyond?

What is expected of Workers’ Compensation in 2022? The short answer is that this market will remain soft.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) has asked for a modest decrease in overall rates and most carriers’ filings have reflected that recommendation. However, these are averages and many industries will find these decreases harder to come by.

What is expected of Workers’ Compensation in 2023? There are several leading indicators that present early signs of a hardening market. Here are a few:

Wage inflation for most businesses. This will lead to higher temporary disability payments to injured workers thus increases in overall claim amounts.

Wage inflations within insurance carrier’s personnel. This will cause a rise in their overhead costs and then a subsequent rise in their combined ratios which will impact their bottom line.

The likely inclusion (September 2022 and beyond) of COVID claims in the Experience Modifier Rating formula (X-Mod). While this is not yet official, approval appears likely.

Preparing for the hard workers’ compensation market starts today with our checklist.

We will explore those at length in a series of articles beginning in January 2022. Subscribe to our newsletter to receive those articles. For now, here are a few tips:

Utilizes a Workers’ Compensation Gap Analysis and Opportunity Assessment (through the Risk Management Center).

Benchmark your performance to industry standards to look for areas of improvement. Learn more about Rancho Mesa’s KPI.

Choose your workers’ compensation carrier wisely. Learn more about selecting a carrier in the article, “How to Choose a Workers’ Compensation Carrier Partner.”

Have you ever considered performance-based programs? If not, maybe it’s time to bet on yourself. Watch the “Deductible Workers’ Compensation: Understanding performance-based insurance programs” webinar.

With workers’ compensation premiums representing a significant line item on many profit and loss statements, staying up to date on the rapidly changing environment should be a priority for all businesses. And, preparing for the expected rate increases is more important than ever with inflationary costs already choking profitability for so many operations. Our series of articles starting in January will help in this education process and allow you to better understand steps you can take now to weather this building storm.

Incorporating a clear strategy as it relates to your insurance portfolio is perhaps more critical than ever leading into 2022. With pricing increases across all lines of coverage becoming more and more common, managing this line item on your financials should be a proactive process with your broker. Start that dialogue now and develop the right plan to design and coordinate the most comprehensive and competitive program possible.

Wage Inflation’s Impact On Workers’ Compensation

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Following up on a great article by fellow construction team member Kevin Howard, about anticipated wage threshold increases coming in 2022, I wanted to highlight the building problems resulting from substantial hourly wage increases.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Following up on a great article by fellow construction team member Kevin Howard, about anticipated wage threshold increases coming in 2022, I wanted to highlight the building problems resulting from substantial hourly wage increases.

I specialize in painting, drywall and plastering contractors and have been asking my clients over the past few months about the health of their business and any new challenges. The most common answer: there is a substantial amount of work to bid on, but a labor shortage limits the possibility of growth.

Paying an employee higher wages creates new issues. Employees tend to inform co-workers when they get a raise. Employees may also try to leverage another company’s higher wage into a raise. The combination of a labor shortage and overpaying employees may result in hyperinflation, leading these employees to believe their value has skyrocketed.

Tying back into Kevin’s article, it is easy to see why these thresholds need to be increased. The wage threshold is meant to separate historically safer employees from newer employees who are less safety conscious. These increases in payroll are pushing less skilled employees into the higher wage category, resulting very likely in higher claim frequency as they are historically less experienced and safety conscious on the jobsite. This is leading to a smaller gap in workers’ compensation rates between the above and below class codes for each industry.

For example, a painter had a separation of 56% from 5474 to 5482 (painters making above or below $28) for their 2021 renewal. For 2022, they are only looking at a 46% difference. From the carrier perspective, more losses are expected in the 5482 (above $28) than the previous year, leading to a rate increase in that class code. I wish I could say that this was industry specific, but from conversations with multiple underwriters, most industries are dealing with these same employment issues and have struggled to find meaningful solutions.

It is possible these dual wage threshold increases will help restore balance by bringing the less skilled employees back into the proper class code, securing the lower rates in the over class code. Employers have shared that these threshold increases are hurting them, but should assist with workers’ comp savings for the truly elite seasoned workers. Carriers have these thresholds to help you differentiate experience from inexperience.

This is a developing issue that we are trying to stay ahead of. The time is now to meet with someone who specializes in your industry and help you formulate a strategy for 2022 to mitigate these impacts and improve your profitably. To schedule a time to talk or meet with me or you can call me directly at 619-438-6900.

Timely Reporting of Workers’ Compensation Claims Lower Overall Costs

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Leading into 2022, it is important for employers to examine their workplace injury reporting practices. Specifically, employers should report all injuries including medical-only workplace injuries to their workers’ compensation insurance company. Best practices dictate all claims should be reported within the first 24 hours in order to improve treatment to the injured worker and reduce the overall cost of the claim to the employer.

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Leading into 2022, it is important for employers to examine their workplace injury reporting practices. Specifically, employers should report all injuries including medical-only workplace injuries to their workers’ compensation insurance company. Best practices dictate all claims should be reported within the first 24 hours in order to improve treatment to the injured worker and reduce the overall cost of the claim to the employer.

A recent conversation with an underwriting manager highlighted the fact that some employers are choosing to pay for occupational clinic visits rather than filing a claim, assuming that small medical-only claims will negatively impact the Experience Modification Factor (X-mod) and ensuing workers’ compensation premiums. However, in actuality claims of $250 or less do not impact the X-mod. Not only are employers legally required to report workplace injuries, but those small claims can easily turn into something bigger, if not reported in a timely manner. Further, the reporting of all incidences can assist a company in identifying trends and root causes thereby allowing for proactive measure to be taken. Rancho Mesa’s proprietary Key Performance Indicator (KPI) dashboard helps track these trends and compare a company’s performance to that of their industry. Request a KPI dashboard for your company.

Why then does reporting lag result in higher claim costs? An insurance carrier’s ability to investigate a claim, determine compensability, and identify fraud may be hindered as details of the incident fade, witnesses may no longer be available or key evidence may not be preserved. According to Liberty Mutual, a 29-day delay in reporting an injury can lead to a 33% increase in lost time, 52% higher average claim cost, and 152% increase in litigation rates. This makes sense when one considers that a delay in seeking treatment could cause an employee’s condition to worsen, extending recovery time and temporary disability payments.

Lastly, an employer paying a medical bill will pay much more than a workers’ compensation carrier would pay for that same bill as insurance companies negotiate a reduced fee schedule for occupational injuries. Bottom line, failure to report workplace incidents in a timely manner can put any organization and its employees at risk for no benefit. Contact Rancho Mesa to learn more about our Risk Management Center and how our free trainings and webinars can improve your reporting practices.

Cal/OSHA Adopts Revised ETS Through April 2022

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

On Thursday, December 16, 2021, the Cal/OSHA Standards Board voted in favor, 6 to 1, of adopting the revised COVID-19 Prevention Emergency Temporary Standard (ETS). This is the third iteration of the ETS since it originally went into effect in November 2020 and it happens to be the second and final re-adoption that’s allowed.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

On Thursday, December 16, 2021, the Cal/OSHA Standards Board voted in favor, 6 to 1, of adopting the revised COVID-19 Prevention Emergency Temporary Standard (ETS). This is the third iteration of the ETS since it originally went into effect in November 2020 and it happens to be the second and final re-adoption that’s allowed.

The newly adopted revised ETS goes into effect on January 14, 2022 when the current ETS expires, and it will be in effect until April 14, 2022, at which time the temporary standard must expire or Cal/OSHA has to adopt a permanent standard in order to keep some sort of COVID-related standard in place.

Based on the discussions at the Cal/OSHA Standards Board’s December 16th meeting, it looks like Cal/OSHA is moving forward with proposing a permanent COVID-19 standard in March or April 2022. So, we’ll keep an eye on that.

Changes to Cal/OSHA’s COVID-19 Prevention Emergency Temporary Standard:

COVID-19 TEST

Starting January 14, 2022, there is a new definition for what is considered a “COVID-19 test” to account for over-the-counter tests that are now readily available. The new definition specifically says if you’re using an over-the-counter test, it cannot be both self-administered and self-read unless observed by the employer or an authorized telehealth proctor.

So, if an employee wants to use an over-the-counter COVID-19 rapid antigen test, they’ll need to either have the employer or an authorized telehealth proctor witness the test being performed and the results generated. This is really to prevent employees from providing false results to employers.

FACE COVERINGS

The new ETS also provides more details about what types of face coverings are now allowed and what’s not. Acceptable face coverings include surgical masks, a medical procedure mask, a respirator worn voluntarily, or a tightly woven fabric or non-woven material of at least two layers that does not let light pass through when held up to a light source. There are exceptions for clear face coverings when worn strictly for accommodations purposes. Coverings must be secured to the head with ties, ear loops or elastic bands that go behind the head.

This means many of the cloth masks that are currently being used by employees will no longer be acceptable under this new standard. Scarfs, ski masks, bandanas and other make-shift face coverings will not be permitted.

FULLY VACCCINATED

The definition of “fully vaccinated” has changed a bit. The new language recognizes those who may have gotten their first dose of a two-dose vaccine series from one manufacturer and the second dose from another manufacturer.

WORKSITE

Another change is the definition of “worksite.” The new ETS clarifies that a worksite does not include locations where the employee does not have exposure to other employees.

For example, if the employee is working from their home office, it would not be considered a worksite for ETS noticing purposes, nor would an office where the employee works by themselves and never is exposed to other employees.

TESTNG AFTER WORKSITE COVID-19 EXPOSURE

There are new requirements for testing employees after a COVID-19 exposure in the workplace. Regardless of vaccination status, employers must now offer testing to all employees who have had a close contact with a COVID-19 case in the workplace, regardless of their vaccination status.

Prior to the revised ETS, employers did not have to offer testing to vaccinated employees who were exposed. This change is a result of break through cases in those who are fully vaccinated. The only exception for not offering close contacts testing, is for those who have recovered from COVID-19 within the past 90 days and do not have symptoms.

RETURN TO WORK

Another change for vaccinated employees includes wearing a face covering in the workplace in lieu of a quarantine. While those employees who are vaccinated do not need to quarantine if they have had a close contact with a COVID-19 case, as long as they are asymptomatic and test negative, they can return to the workplace, but must wear a face covering and social distance for 14 days following the last date of close contact. This rule also applies to those who have recovered from COVID-19 within the last 90 days and are asymptomatic.

For those who are unvaccinated and have had a close contact with a COVID-19 case, as long as they test negative and are asymptomatic, they can return to the workplace after a 10-day quarantine, however, they must social distance and wear a face covering for 14 days.

There is a 7-day quarantine option for unvaccinated employees that are asymptomatic if they test negative at least five days after the close contact. In this situation, the employee must maintain social distancing and wear a face covering.

TESTING DURING AN OUTBREAK

As for changes to how to handle testing as a result of an outbreak, vaccinated employees can no longer be excluded from being offered testing if there are three or more employee COVID-19 cases within an exposed group. So, employers just need to make sure they’re offering testing to both vaccinated and unvaccinated employees if they’ve had a close contact or were in an exposed group during an outbreak.

One last thing to consider, while Cal/OSHA’s revised ETS does not take into consideration the federal vaccination or weekly testing mandates, nor other state and local requirements, we recommend that you consult your local and state health departments for additional requirements.

Rancho Mesa will make available an updated COVID-19 Prevention Program template that incorporates the modifications, as soon as possible.

Visit www.RanchoMesa.com/covid-19 for all our COVID-related articles, podcast episodes, sample COVID-19 Prevention Program Templates, and links to insurance carriers, the CDC and other agencies.

2022 Construction Dual Wage Thresholds - An Early Look

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There are 16 construction workers’ compensation class code pairs in California, each set up as dual wage classifications. The purpose of these “split” class codes allows the Workers’ Compensation Insurance Rating Bureau (WCIRB) and California insurers to better predict future risk and underwrite with more accuracy.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There are 16 construction workers’ compensation class code pairs in California, each set up as dual wage classifications. The purpose of these “split” class codes allows the Workers’ Compensation Insurance Rating Bureau (WCIRB) and California insurers to better predict future risk and underwrite with more accuracy.

To illustrate the dual wage threshold, consider a seasoned laborer with years of safety training, exposure awareness, and familiarity with jobsite protocol. This employee is going to be less of a safety risk compared to an apprentice who is still learning his or her trade, the safety techniques and all of the skill associated with a trade. As one might imagine, statistics consistently show a much higher probability of an injury occurring with an apprentice versus a seasoned veteran or journeymen. So, having a dual wage threshold allows carriers to generate pricing based on the employees’ experience and likelihood of having an injury.

Exploring how this can directly impact rates and pricing, the 2021 roofing dual wage class codes of 5552 and 5553 is a great example.

Class code 5552 is defined as roofers who make less than $27 per hour. The average California worker’s compensation insurance base rate for this class code is $40 per $100 of payroll. Class code 5553 includes roofers who make $27 or more per hour. This class code’s average California workers’ compensation insurance base rate is $20 per $100 of payroll. In this example, the workers’ compensation premium base rate is half the cost for a more experienced employee over someone with less experience.

It is crucial for any roofing contractor to be mindful of this wage threshold data knowing that the delta in the 2022 recommended increase represents a staggering 61% gap between the two base rates.

Additionally, the WCIRB has continued to increase wage thresholds. This is to keep up with inflation of the US dollar, the increase in minimum wage and the demand for labor, among other factors.

Dual Wage Classification Thresholds by Year

Shown below are the wage thresholds for all dual wage classifications. For information about these classifications, see the California Workers' Compensation Uniform Statistical Reporting Plan—1995, effective September 1, 2021.

| Classifications | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | 5027 | 5140 | 5183 | 5185 | 5201 | 5403 | 5446 | 5467 | 5474 | 5484 | 5538 | 5552 | 5632 | 6218 | 6307 | 6315 |

| 5028 | 5190 | 5187 | 5186 | 5205 | 5432 | 5547 | 5470 | 5482 | 5485 | 5542 | 5553 | 5633 | 6620 | 6308 | 6316 | |

| 9/1/2022 | $32 | $34 | $31 | $32 | $32 | $39 | $38 | $36 | $31 | $36 | $29 | $29 | $39 | $39 | $39 | $39 |

| 9/1/2021 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2021 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2020 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2019 | $27 | $32 | $26 | $27 | $25 | $32 | $34 | $32 | $26 | $29 | $27 | $25 | $32 | $31 | $31 | $31 |

| 1/1/2018 | $27 | $32 | $26 | $27 | $25 | $32 | $34 | $31 | $26 | $29 | $27 | $25 | $32 | $31 | $31 | $31 |

| 1/1/2017 | $27 | $30 | $26 | $27 | $24 | $30 | $33 | $31 | $24 | $27 | $27 | $23 | $30 | $30 | $30 | $30 |

© 2021 Workers' Compensation Insurance Rating Bureau of California. All Rights Reserved.

WCIRB’s 2022 RECOMMENDATION:

The Bureau is considering raising the hourly wage threshold for all 16 dual wage classification pairs with some codes seeing as much as a $5.00 increase. The average delta between the lower advisory rate and higher advisory rate is 48%.

Proposed Dual Wage Threshold Increases

| Dual Wage Classifications | Existing Threshold | Proposed Increase | Proposed Threshold | Low Wage Advisory Rate | High Wage Advisory Rate | % Difference From Low Wage Rate |

| 5027/5028 Masonry | $28 | $4 | $32 | $8.18 | $4.21 | -48.50% |

| 5190/5140 Electrical Wiring | $32 | $2 | $34 | $3.76 | $1.45 | -61.40% |

| 5183/5187 Plumbing | $28 | $3 | $31 | $5.31 | $2.36 | -55.60% |

| 5185/5186 Automatic Sprinkler | $29 | $3 | $32 | $4.57 | $1.00 | -57.30% |

| 5201/5205 Concrete Work | $28 | $4 | $32 | $6.64 | $1.95 | -36.30% |

| 5403/5432 Carpentry | $35 | $4 | $39 | $10.03 | $4.23 | -55.10% |

| 5446/5447 Wallboard Installation | $36 | $2 | $38 | $5.42 | $4.50 | -55.10% |

| 5467/5470 Glaziers | $33 | $3 | $36 | $7.62 | $2.65 | -59.30% |

| 5474/5482 Painting Waterproofing | $28 | $3 | $31 | $8.09 | $3.10 | -46.40% |

| 5484/5485 Plastering or Stucco | $32 | $4 | $36 | $9.98 | $4.34 | -37.40% |

| 5538/5542 Sheet Metal Work | $27 | $2 | $29 | $5.07 | $2.52 | -50.30% |

| 5552/5553 Roofing | $27 | $2 | $29 | $21.05 | $8.14 | -61.30% |

| 5632/5633 Steel Framing | $35 | $4 | $39 | $10.03 | $4.50 | -55.10% |

| 6218/6220 Grading/Land Leveling | $34 | $5 | $39 | $5.10 | $2.93 | -42.50% |

| 6307/6308 Sewer Construction | $34 | $5 | $39 | $6.98 | $2.84 | -59.30% |

| 6315/6316 Water/Gas Mains | $34 | $5 | $39 | $4.18 | $3.70 | -11.50% |

This recommendation, if approved by the insurance commissioner, would become effective September 1, 2022.

With the continuing labor shortage in the construction arena, employers have been doing everything possible to retain employees by offering richer benefits plans, pay increases and merit bonuses, when applicable. These recommended wage classification increases could potentially push employers to extend additional pay raises to employees in an effort to minimize workers’ compensation premiums.

It is best for contractors who utilize any of the 16 dual wage classification pairs to be aware of the potential increases and to do the math to see if it makes sense to consider raises prior to your 2022-2023 September 1st workers’ compensation renewal.

Rancho Mesa predicts that this info will become a major factor in payroll decisions based on overhead cost management and recommend this as a topic for discussion early so that our clients, prospects and listeners can prepare.

To discuss how the proposed dual wage threshold increases may affect your business, contact me at (619) 438-6874 or khoward@ranchomesa.com.

Top Five Workers’ Compensation Claims That Impact a MEP’s Bottom Line

Author, Amber Webb, Account Executive, Rancho Mesa Insurance Services, Inc.

If you are an MEP contractor who wants to impact both your productivity and profitably, then the following is crucial for your success. Our MEP Group at Rancho Mesa understands the importance of identifying the top five workers’ compensation claims that impact your industry while providing pertinent resources to help mitigate that risk.

Author, Amber Webb, Account Executive, Rancho Mesa Insurance Services, Inc.

If you are a Mechanical, Electrical & Plumbing (MEP) contractor who wants to impact both your productivity and profitably, then the following is crucial for your success. Our MEP Group at Rancho Mesa understands the importance of identifying the top five workers’ compensation claims that impact your industry while providing pertinent resources to help mitigate that risk. By working with leading workers’ compensation carriers and the Occupational Safety and Health Administration (OSHA), we identified the top 5 workers’ compensation claims affecting the MEP industry:

Cut/Puncture/Scrape/Lacerations

Slip/Falls from both same level and ladders/scaffolding

Strains from lifting/handling/pushing/pulling

Struck by object/Foreign Body in Eye

Motor Vehicle Accident (injured employee)

With employee safety at the forefront of your operations, understanding where the claims are likely to come from and then having the support and tools in place to address those concerns is vital to your long term success. When injuries occur on the job, it impacts not only the life of the injured worker and their family but will directly impact the productivity and profitability of the project.

For our clients to proactively mitigate these exposures, we provide them with access to specific trainings related to these top MEP claims and OSHA citations from our Risk Management Center Library. Our Client Services team then works closely with our clients to customize their trainings while meeting their specific risk management needs.

If you are not already a Rancho Mesa client, and would like a free trial of our Risk Management Center, please complete the form or contact Amber Webb at (619) 486-6562 or awebb@ranchomesa.com.

Understanding Single and Aggregate Surety Bond Limits

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

When we work with the bonding carriers on surety credit programs for our contractor customers, we traditionally put into place single and aggregate bond limits. This provides our contractor clients certain parameters when they are considering a maximum project size for bonding purposes.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

When we work with the bonding carriers on surety credit programs for our contractor customers, we traditionally put into place single and aggregate bond limits. This provides our contractor clients certain parameters when they are considering a maximum project size for bonding purposes.

The single limit is a guide the contractor can use on a per project basis as they consider various projects to bid or negotiate.

The aggregate limit is the total of all current projects using a “cost to complete” calculation. The cost to complete would be the estimated costs on a project (less) the costs to date. As an example, a contractor may have a $5,000,000 single / $20,000,000 aggregate bonding program.

A few important points to consider:

The limits are not set in stone. This is important to understand. The bond company will often raise the single and aggregate limit if the right type of project presents itself.

We include the bonding limits when we prepare a bondability letter for our client. If you are looking at a project that might exceed your single bonding limit, be sure that the required limit listed is sufficient to support the projected amount. For example, if your limit is typically $5,000,000 and the project requires a bondability letter for a $6,000,000 job, it is important that you secure pre-approval from your agent/bond company to increase the amount of the single limit on the letter.

The bonding limits are often determined by the contractor’s fiscal year-end financial statement. This is one of many factors to set the limit but an extremely important consideration.

One final consideration is that bonding limits listed on a letter are often just a guideline reflecting the normal size of the projects our contractor clients usually bid. Based on their financial ratios and project history, some clients, for example, will qualify for a $10,000,000 limit but only list $2,000,000 because they rarely consider projects over that amount.

If you would like more information on how your particular bond limits are determined, please contact me at 619-937-0165 or mgaynor@ranchomesa.com.

A Deep Dive into Workers’ Comp Claims in the Landscape Industry

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ compensation premiums typically represent one of the largest overhead expenses for landscape companies. Premium costs are driven by the number and severity of claims a company has had over a five-year period. Thus, fewer claims often equate to a lower premium paid for workers’ compensation insurance.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ compensation premiums typically represent one of the largest overhead expenses for landscape companies. Premium costs are driven by the number and severity of claims a company has had over a five-year period. Thus, fewer claims often equate to a lower premium paid for workers’ compensation insurance.

The National Institute for Occupational Safety and Health (NIOSH) takes a closer look at the landscape industry, detailing where claim frequency is increasing and decreasing.

When analyzing the claims data, a couple of areas stand out as contributors to higher premiums.

Most notably, 50% of all serious claims occur during the first year of an employee’s tenure. Employees under the age of 34 are also more susceptible to a serious claim occurrence. Therefore, it is best to provide new hires with immediate and comprehensive safety training when they first start and continue to emphasize a safety culture throughout their tenure to minimize claims. As employees gain experience, they become more likely to take safety seriously.

The data also shows that loading and unloading trucks and trailers causes roughly 20% of all serious claims. This includes loading and unloading materials, tools, and equipment. Although a seemingly simple task, it’s often overlooked, yet statistics confirm that improved attention to safety when performing these tasks can significantly reduce serious claims.

The industry has seen a considerable decline in claims from overexertion injuries such as back sprains and disc disorders which were once a large contributor to higher premiums. The improvement of lifting techniques and implementation of programs such as Rancho Mesa’s Mobility & Stretch/A.B.L.E. Lift Program, have played a key role in reducing these claims. Programs such as these ensure employees are lifting properly while also stretching their muscles before they begin work.

Reducing workers’ compensation claims should be a top priority for any landscape company. Not only does it protect employees from harm but it also can benefit the company’s bottom line. As an added resource to reducing workers’ compensation claims, Rancho Mesa encourages landscape businesses to take advantage of available safety trainings for new and experienced employees, implement safety measures for loading and unloading trucks, and utilize the Mobility & Stretch/A.B.L.E. Lift Protocol.

In order for you to take your safety program to another level, sign up and receive our weekly safety training tailgate talks specifically designed for the landscape industry.

To start a conversation about how Rancho Mesa can assist your company, contact me at (619) 438-6905 or ggarcia@ranchomesa.com.

OSHA Issues ETS Addressing Mandatory COVID-19 Vaccination or Testing

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Last week, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) announced a new emergency temporary standard (ETS) to protect more than 84 million workers from the spread of the coronavirus on the job.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Update: November 16, 2021 - Since the original publication of this article, OSHA announced it “has suspended activities related to the implementation and enforcement of the ETS pending future developments in the litigation.”

Recently, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) announced a new Emergency Temporary Standard (ETS) to protect more than 84 million workers from the spread of the coronavirus on the job.

Under the ETS standard, employers must develop, implement and enforce a mandatory COVID-19 vaccination policy, unless they adopt a policy requiring employees to be either vaccinated or undergo weekly COVID-19 testing and wear a face covering at work.

The emergency temporary standard covers employers with 100 or more employees and provides options for compliance. The standard also requires employers to provide paid time to workers to get vaccinated and to allow paid leave to recover from any side effects from the vaccination.

The ETS requires employers to:

Determine the vaccination status of employees, obtain acceptable proof of vaccination and maintain records and a roster of each employee’s vaccination status.

Require employees to provide prompt notice when they test positive for COVID-19 or receive a COVID-19 diagnosis. Employers must then remove the employee from the workplace, regardless of vaccination status. Employers must not allow them to return to work until they meet required criteria.

Ensure each worker who is not fully vaccinated is tested for COVID-19 at least weekly (if the employee is in the workplace at least once a week) or within 7 days before returning to work (if the employee is away from the workplace for a week or longer).

Ensure that each employee who has not been fully vaccinated wears a face covering when indoors or when occupying a vehicle with another person for work purposes.

The ETS does not require employers to pay for testing. However, employers may be required to pay for testing to comply with other laws, regulations, collective bargaining agreements. So, check with state and local jurisdictions for requirements.

The ETS is effective immediately upon its publication in the Federal Register, which took place on Friday, November 5, 2021. Employers must comply with most requirements within 30 days of publication and with testing requirements within 60 days of publication, or January 4th of 2022.

While more than half of the states are challenging the legality of federal OSHA’s ability to enforce the new ETS requirements, it is likely that individual states with their own OSHA State Plans (i.e., Alaska, Arizona, California, Hawaii, Indiana, Iowa, Kentucky, Maryland, Michigan, Minnesota, Nevada, New Mexico, North Carolina, Oregon, South Carolina, Tennessee, Utah, Vermont, Virginia, Washington, and Wyoming) will eventually adopt the new ETS as their own with or without modifications.

California’s State Plan (Cal/OSHA) implemented the most stringent COVID-19 ETS in the country months before federal OSHA released its original COVID-19 ETS that only applied to the health care industry.

Employers of all sizes should pay close attention to not only what federal OSHA’s ETS requires, but also requirements issued by state and local municipalities. Once your state adopts a COVID-19 ETS, be sure to also check your local ordinances, as some counties and cities are requiring additional measures.

If your state has not yet adopted the new federal OSHA ETS, which applies to our California clients, we recommend you start thinking about a game plan and maybe an alternate plan depending on whether your State Plan decides to adopt the ETS as it has been published or if they decide to adopt a more stringent ETS. You will want to consider the following:

Will you, as the employer, require all employees to be vaccinated?

Who will manage the vaccination records and the ongoing paperwork?

If testing is offered as an alternative to a vaccine, who will pay for testing (the employer or employee)?

If testing is offered as an alternative to a vaccine, will the company specify which type of test will be acceptable (PCR or Antigen)? Either is allowed, but the antigen tests must be proctored by a medical professional (virtually is allowed) or witnessed by the employer (for the over-the-counter home test). Who will administer the weekly tests?

As we learn more, Rancho Mesa will provide guidance and resources to mitigate risk in the workplace.

For questions about mitigating your risks, contact me at (619) 937-0167 or sclayton@ranchomesa.com.

SB 606 Broadens Cal/OSHA’s Enforcement Reach

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

California Governor Gavin Newsom recently signed into law Senate Bill 606 (SB 606), greatly expanding Cal/OSHA’s enforcement powers and monetary penalty amounts. The new law will take effect January 1, 2022, so California employers have only a few months to tighten their safety practices or face steep monetary fines.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

California Governor Gavin Newsom recently signed into law Senate Bill 606 (SB 606), greatly expanding Cal/OSHA’s enforcement powers and monetary penalty amounts. The new law will take effect January 1, 2022, so California employers have only a few months to tighten their safety practices or face steep monetary fines.

The new law could be especially damaging to employers with multiple worksites. SB 606 creates a rebuttable presumption that an employer with multiple worksites has committed an “enterprise-wide” violation, if Cal/OSHA determines either of the following is true:

The employer has a non-compliant written policy or procedure.

Cal/OSHA "has evidence of a pattern or practice of the same violation or violations committed by that employer involving more than one of the employer's worksites."

This change creates the possibility that a California employer adhering to a written program applicable to all locations can be cited for each California worksite.

Cal/OSHA will also have the authority to seek a temporary restraining order and an injunction against any employer suspected to have committed an enterprise-wide violation.

The far-reaching second part of the law states that if Cal/OSHA determines an employer has “willfully and egregiously” committed a violation, the employer may receive a citation “for each egregious violation” and “each instance of any employee exposed to that violation shall be considered a separate violation for purposes of the issuance of fines and penalties.”

The law details seven bases for “egregious” conduct. Proof of only one will be sufficient to justify a citation.

California employers must prioritize a full review of safety policies, procedures, and practices to reduce the likelihood of an “enterprise-wide” or “egregious” conduct violation. Cal/OSHA’s Consultation Branch offers free on-site visits to proactively address any potential violations.

For helpful safety resources and compliance information, please contact me at (619) 937-0175 or sbrown@ranchomesa.com.

How Janitorial Firms Can Avoid OSHA Fines

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Avoiding government standards in the janitorial industry can be costly in the event of an unexpected OSHA visit or after a serious injury. In an industry that generally has lean profit margins, OSHA fines could be detrimental to the stability of the business. Knowing the most common OSHA violations and protecting your business from them can help insulate your organization from costly fines while also keeping your company safe. Here are five of the most common OSHA violations in the janitorial industry and strategies to avoid potential fines.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Avoiding government standards in the janitorial industry can be costly in the event of an unexpected OSHA visit or after a serious injury. In an industry that generally has lean profit margins, OSHA fines could be detrimental to the stability of the business. Knowing the most common OSHA violations and protecting your business from them can help insulate your organization from costly fines while also keeping your company safe. Here are five of the most common OSHA violations in the janitorial industry and strategies to avoid potential fines.

Hazard Communication Standard:

A hazard communication standard requires that all cleaning businesses provide written information to their employees about hazardous chemicals used in the course of business and stored on site. The employer is required to label all chemicals with information relating to its hazard classification, and the employer must maintain safety data sheets (SDS) at each jobsite. In addition to having this information available, the employer is also responsible for training the employees on the proper handling of each chemical before they begin using it. Having a hazard communication standard in place can help you avoid an OSHA fine while also creating a safe work environment.

Proper Use of Personal Protective Equipment (PPE):

It is critical that all janitorial staff is trained on the proper use of PPE. PPE can help protect employees against harmful exposures that occur while performing their normal duties. Examples of PPE include gloves, masks, safety glasses, and back braces. Proper training on the use of PPE should be done with each employee and documented in their employee file. Supervisors should monitor the use of PPE by employees to ensure consistent use. If employees are seen not wearing the proper PPE for the task at hand, this should be addressed verbally, and in writing to minimize future injuries. Serious injuries and OSHA fines are avoidable if the proper use of PPE is taught and monitored.

Slip, Trips, and Falls:

One of the most common injuries in the janitorial industry comes from slips and falls. Some falls can result in serious injuries, workers’ compensation claims, lawsuits, and OSHA fines. The most common slip and fall hazard is from wet floors, typically while mopping. These wet floors not only pose a problem for janitors, they are also a huge concern for the general public. Common ways to avoid these types of injuries include using caution cones to alert people of the wet surfaces, closing off areas that are being cleaned, and mopping areas after hours when there is less foot traffic. Using caution cones and proper signage can warn others of wet surfaces to avoid serious injuries and OSHA fines.

Bloodborne Pathogen Standard:

For those janitorial businesses that work within a healthcare setting, it is imperative that they follow the Bloodborne Pathogen Standard. This policy establishes an easy and safe way to handle blood and other bodily fluids. If you work in a setting where blood contact is common, it is important that you have the proper training. Otherwise, it could result in an OSHA citation.

Record Keeping:

Proper record keeping is critical if and when your firm is presented with an unexpected OSHA visit. Keeping updated records such as your injury & illness protection program, safety data sheets, documented employee training, and employee handbooks can help avoid common administrative fines.

Organizing and implementing these strategies can be overwhelming for many janitorial companies that may not have the resources for full-time human resources directors and/or safety coordinators. Through the Risk Management Center, Rancho Mesa and MaintenanceOne™ offers clients the tools and programs that can proactively manage these risks and the documentation required to be prepared when OSHA knocks on your door. Reach out Jeremy Hoolihan at jhoolihan@ranchomesa.com or 619-937-0174 to learn more about how we can assist you.

Premium Cost Per Vehicle Continues to Increase for Landscape Professionals

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Commercial auto premiums for landscape companies continue seeing heavy increases, and there is no end in sight.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Commercial auto premiums for landscape companies continue seeing heavy increases, and there is no end in sight.

Knowing your cost per unit (CPU) is a critical component landscape owners and CFO’s must follow to properly monitor, budget, and forecast fleet related premium. Landscape companies with the lowest CPU’s minimize accident frequency and severity by practicing proactive and reactive risk management techniques.

Proactive management can include routine MVR checks, continuous driver monitoring, and ongoing driver training.

Reactive management can consist of reporting, analyzing, and correcting both near miss and post-accident incidents.

Fortunately for companies working with Rancho Mesa, we offer a number of video training series in English and Spanish including accident prevention, defensive driving, distracted driving, and more.

When an auto accident occurs, Rancho Mesa’s client services department will analyze the incident and recommend specific training back to our landscape customers, encouraging proactive safety and helping to mitigate future accidents.

What is your CPU, are you addressing accidents with training, and is your program leaking premium dollars?

For more information on how to help control rising premium costs, contact Drew Garcia at (619) 937-0200 or drewgarcia@ranchomesa.com.

Pure Premium and How It Impacts Your Company

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted.. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

There are different rates generated for different classifications based on exposure and projected losses. The premium company’s pay for workers' compensation begins with multiplying the insurer's rate for the assigned classification(s) by the payroll developed in each classification. Workers' compensation rates are applied per $100 of payroll.

Pulling directly from the WCIRB website, “The WCIRB submits advisory pure premium rates to the California Department of Insurance (CDI) for approval. Insurer rates are usually derived from the advisory pure premium rates developed by the WCIRB and approved by the Insurance Commissioner. Advisory pure premium rates, expressed as a rate per $100 of payroll, are based upon loss and payroll data submitted to the WCIRB by all insurance companies. These rates reflect the amount of losses an insurer can expect to pay in benefits due to workplace injuries as well as the cost for adjusting and settling workers' compensation claims. Pure premium rates do not account for administrative and other overhead costs that an insurer will incur and, consequently, an insurer's rates are typically higher than the pure premium rates.” (WCIRB).

Of note, new pure premium rates were just released in September. Each carrier’s individual experience with all respective class codes also has an impact on these rates. Workers’ compensation has been in a soft market for the past several years with the expectation that rates will gradually start increasing. Following the change in pure premium rates is a great indication of where the marketplace is heading an effective way to better understand future costs that your company may be expecting.

With this in mind, engaging a broker that specializes in your industry and prepares you accordingly for the renewal process is a critical step in controlling workers compensation costs. Part of this process begins with understanding pure premium rates and how they ultimately will impact your MOD, carrier base rates, and your renewal pricing.

To discuss the current market or how your XMOD is affecting your workers’ compensation premium, contact me at (619) 438-6900 or ccraig@ranchomesa.com.

ADR Workers' Compensation Programs Reduce Litigation

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Workers’ compensation rates have fallen steadily over the last ten years, but businesses in California still pay the highest rates in the country. In addition, California has the highest frequency of permanent disability clams, the highest medical cost per claim and the highest litigation rates per claim.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Workers’ compensation rates have fallen steadily over the last ten years, but businesses in California still pay the highest rates in the country. In addition, California has the highest frequency of permanent disability claims, the highest medical cost per claim, and the highest litigation rates per claim.

To mitigate the friction within the workers’ compensation system, California and several other state legislatures in the early 1990s developed legislation that would permit unions and management to jointly develop an Alternative Dispute Resolution (ADR) program or “carve-out” agreement that resolves disputes outside the state workers’ compensation system with benefits that are at least equal to the benefits required by the Labor Code.

ADR is an alternative to the traditional approach to workers’ compensation claims. With ADR, an injured worker will report the injury and then use the services of a neutral ombudsmen hired by the union trust who is knowledgeable in workers’ compensation law to quickly determine if the injury is work related. The ombudsmen will recommend to the injured worker the appropriate treatment and other benefits owed within the carve-out agreement.

Union ADR provides employers with flexibility to manage the overall cost for their workers’ compensation program by promoting voluntary agreement early on with the injured worker on effective medical treatment to reduce litigation over the scope of medical treatment. ADR can also provide an accelerated claims resolution, faster medical treatment and potentially quicker return to work for the injured employee.

This process limits litigation with the services of an ombudsman and, if needed, mediation and arbitration procedures designed to resolve the claim quickly and appropriately. Since this is a very specialized arena, workers’ compensation carriers typically have a separate claims division that are well versed in the nuances of ADR claims.

To find out if your workers’ compensation carrier offers ADR programs or to learn more, I can be reached at 619-937-0167 or sclayton@ranchomesa.com.

Surety Keith Clements from Tokio Marine HCC

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa's Director of Surety Matt Gaynor interviewed Vice President of Tokio Marine HCC Surety, Keith Clements on Wednesday, September 15, 2021 to learn about his background, his role with Tokio Marine HCC and how the company fits into the surety marketplace.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa's Director of Surety Matt Gaynor interviewed Vice President of Tokio Marine HCC Surety, Keith Clements on Wednesday, September 15, 2021 to learn about his background, his role with Tokio Marine HCC and how the company fits into the surety marketplace.

As a college student in Iowa, Keith had career options. Companies visited the college looking to recruit new grads. He jokes that he had a choice to either go into surety bonds, or sell Oscar Meyer wieners. He chose surety.

“I started looking around and thought, you know what? I like numbers… I think this bonding thing might sound pretty good,” Keith tells Matt.

After over 20 years in the industry, “I’m still trying to figure out if I like it,” Keith says jokingly.

Matt and Keith reminisced about processing bonds in the early 1980s and compare the old technology to today’s high-tech methods of getting the bonds issued.

Keith explains the types of surety bonds Tokio Marine HCC writes as an A++ XV rated company.

Listen to the full Ep. 135 to learn more about Keith and the Tokio Marine HCC Surety.

Best Practice Controls for Solar Contractors

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As we continually build broad and competitive insurance programs for solar contractors in southern California, we recently interviewed a Senior Underwriter from a national workers’ compensation carrier in an effort to learn best practice controls for these types of risks. To our delight, this underwriter provided the top five controls their team looks for while reviewing a submission to quote. Having these controls in place can show an underwriter that your company deserves the best possible pricing available in the insurance marketplace…

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As we continually build broad and competitive insurance programs for solar contractors in southern California, we recently interviewed a Senior Underwriter from a national workers’ compensation carrier in an effort to learn best practice controls for these types of risks. To our delight, this underwriter provided the top five controls their team looks for while reviewing a submission to quote. Having these controls in place can show an underwriter that your company deserves the best possible pricing available in the insurance marketplace:

1. Fall Protection

A written fall protection plan is in place and available for review

Employee training is documented

A competent person is able to assess fall hazards through a written hazard assessment prior to installation

There is familiarity with all fall arrest systems (e.g., yo-yos, ropes, lanyards, harnesses, and guardrails)

Rescue procedures and training on rescuing is in place

Assembly, maintenance, inspection, handling and storage of fall protection equipment is documented and organized

2. Responsive and Thorough Claim Reporting

Claims are reported same day

Claims are documented for future training opportunities

Witness statements from co-workers are documented

3. Outsourcing Delivery of Solar Panels to a Third Party

Minimizes the driving exposure to and from the jobsite

Lowers the material handling exposure

Reduces any potential lifting exposure while on a jobsite

4. Create a Smaller Radius of Work

Lessening of your company’s driving exposure, which in turn can lower the probability of any car accident leading to a claim

Company vehicles to return the same day which reduces any after-hours driving by employees

Allows for vehicles to be monitored more easily

5. Health Benefits are Provided

Lowers the probability of employees filing fraudulent claims

Increases overall employee wellness.

Some of these controls may be difficult or unrealistic to implement with your current business model. With workers’ compensation representing such a large line item on so many solar contractor’s profit and loss statements, engaging a forward-thinking insurance broker who can provide you additional resources and a clear renewal strategy is critical. At Rancho Mesa, we bring both of those tools to our relationships, utilizing our Risk Management Center to properly implement controls and our 20+ year history as leaders in the construction insurance marketplace.

To start a conversation about how we can assist your company, contact me at (619) 438-6874 or khoward@ranchomesa.com.

Performance-Based Workers’ Compensation Programs – Are Retros In Your Future?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance-based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

While we have previously discussed several of these programs in detail (i.e., captives and deductibles), another option that is often overlooked; Retrospective Rating Plan (retros), could possibly be the right next step for many businesses to explore.

Typically, these plans begin to make sense once a company’s annualized premiums exceed $500,000. They contain many elements and variables that must be analyzed and understood before inception, including:

maximum, basic, and minimum premiums

required letters of credit (LOC)

loss cost factor (LCF)

losses based on incurred or paid

potential return of premium

number and frequency of recalculation of the premium/losses

recapture of premium in future calculation if claims develop

claim buyouts

Are you a candidate for a performance based program?

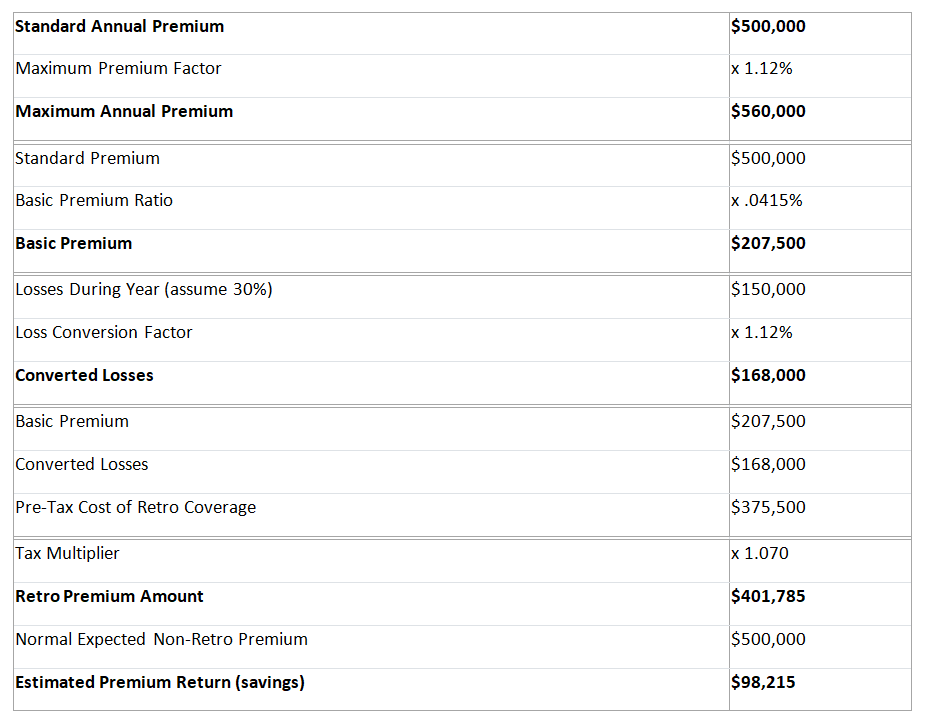

Example of a Retro Workers’ Compensation Program

Assumes a $500,000 premium with a 30% incurred loss ratio

If you would like us to create a performance model for you and your team members to evaluate, contact Rancho Mesa at (619) 937-0164 or via our website. Or, complete our performance based insurance spreadsheet and submit to Alyssa Burley at aburley@ranchomesa.com

Risk Bow Tie Exercise

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Rancho Mesa’s non-profit clients successfully serve their communities in changing economic and political climates. In part, their success is due to managing risk for an organization’s employees, clients, finances, and mission. Just as important, but less discussed than risk management, is risk analysis. This article offers one helpful tool non-profit leaders can use to facilitate risk analysis, the Risk Bow Tie Exercise.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Rancho Mesa’s non-profit clients successfully serve their communities in changing economic and political climates. In part, their success is due to managing risk for an organization’s employees, clients, finances, and mission. Just as important, but less discussed than risk management, is risk analysis. This article offers one helpful tool non-profit leaders can use to facilitate risk analysis, the Risk Bow Tie Exercise.

Introduced to Rancho Mesa by the Nonprofit Risk Management Center’s book World-Class Risk Management for Nonprofits, the Risk Bow Tie technique helps nonprofit leaders consider an event’s positive and negative consequences in a group setting. Following the exercise, participants may feel empowered to utilize the technique in multiple departments to analyze both expected and unexpected events.

The five steps of the bow tie exercise include:

Identify a potential event.

Identify some of the underlying conditions that make the event more or less likely, more or less impactful, and more or less urgent.

Identify some of the consequences or ripple effects, both positive and negative, should the risk materialize.

Identify preventative risk management steps or controls that could make the event less likely or less detrimental.

Identify risk management steps or controls that could be planned now, but implemented after the event has occurred, to reduce the potential negative consequences.

The image below, from page 152 of World-Class Risk Management for Nonprofits, is a sample Bow Tie Worksheet.

Risk Bow Ties Worksheet image provided by World-Class Risk Management for Nonprofits.

Performing the exercise in a workshop or group setting will usually provide one or more of the following insights:

The group uncovers details of an event that had not previously been discussed or observed.

Both positive and negative consequences can result from one event.

The exercise brings to light unique perspectives and experiences from multiple participants.

Identifying important underlying conditions and consequences better informs the creation of relevant controls.

Team members can perform a risk analysis in a fun, accessible and informal way.

Nonprofit leaders can use a diverse set of tools to analyze and manage risk. Rancho Mesa encourages clients to ask about various tools we have available to prepare for both the expected and unexpected.

To learn more about the Risk Bow Tie technique contact me at sbrown@ranchomesa.com or (619) 937-0175.

Mitigate Janitorial Industry’s Employee Theft Exposure

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Employee theft can be detrimental to any business and can come in many forms. Janitorial businesses, in particular, have an inherent risk of employee theft as employees often work alone at the client’s property with little to no supervision and access to valuables. Employee theft can start with smaller items that are easily overlooked and can quickly escalate. These types of losses are not only a financial burden, but can also tarnish the business’ reputation.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Employee theft can be detrimental to any business and can come in many forms. Janitorial businesses, in particular, have an inherent risk of employee theft as employees often work alone at the client’s property with little to no supervision and access to valuables. Employee theft can start with smaller items that are easily overlooked and can quickly escalate. These types of losses are not only a financial burden, but can also tarnish the business’ reputation.

Insurance companies typically break employee theft into two categories: 1st party and 3rd party theft or crime. When an employee steals directly from the employer, it is called 1st party crime. Examples of this include embezzlement, inventory theft, theft of supplies, and more. Third party crime occurs when an employee steals property from the employer’s client or vendor. Examples of this would include stealing property from a client’s premises such as laptops, cash, etc.

It is important to note that most insurance policies do not automatically cover employee theft. Those that extend coverage typically only offer 1st party crime via an endorsement and provide lower limits than stand-alone policies.

Janitorial companies can protect themselves from theft exposure by securing a fidelity bond or business services bond, a commercial crime policy, or through obtaining a specialty enhancement endorsement which adds 1st and 3rd party crime coverage to a package policy.

A fidelity bond protects a company if employees commit theft, fraud, or other dishonest acts. Most insurance policies exclude dishonest and malicious acts which includes employee theft.

A commercial crime policy and fidelity bond are similar in some respects, but they differ in that commercial crime insurance covers a wider range of threats, while fidelity bonds offer more targeted coverage. In addition to the offerings listed above, a commercial crime policy could cover crimes by people outside of the company, including burglary, theft, and forgery.

As mentioned, a third option is purchasing a 1st and 3rd party crime enhancement endorsement to the package policy. This is typically the most cost effective; however, these endorsements are usually only available through specialty programs specific to niche industries like janitorial and typically have limited access. Rancho Mesa’s MaintenanceOne™ Janitorial Program has access to markets that provide these specific endorsements.

To discuss these options in further detail, please reach out to me at 619-937-0174 or at jhoolihan@ranchomesa.com.