Industry News

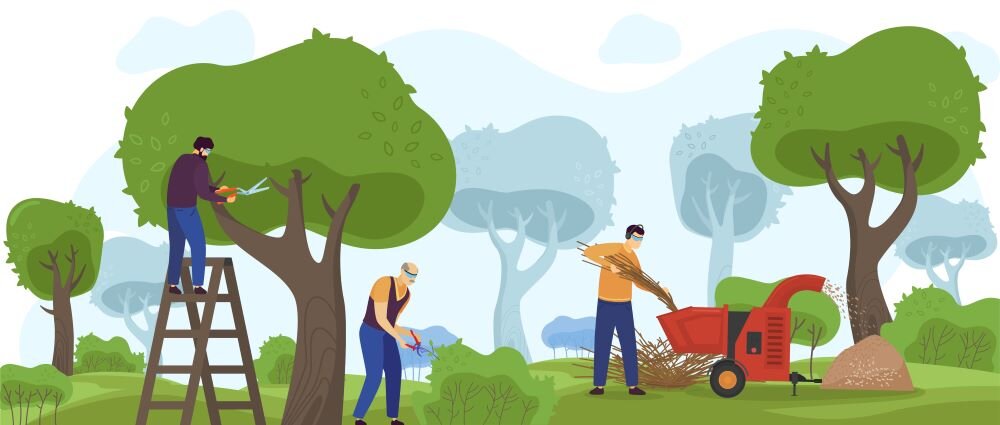

A Tree Care Company’s Guide to the Annual Workers’ Compensation Audit

Author, Rory Anderson, Account Executive, Tree Care Group, Rancho Mesa Insurance Services, Inc.

The premium for your workers’ compensation policy is based on the type of work you do, and the amount of payroll incurred. By maintaining proper payroll records, segregating the wages earned by your employees, you may reduce the cost of your workers’ compensation insurance. The final audit is the process that calculates the last premium due. It compares the estimated payrolls to actual wages paid during the policy year. The audit may result in a refund or additional premium due. Workers’ compensation audits also determine if the classification codes quoted at inception accurately reflect the scope of work performed during the policy period. Insurance carriers charge more premium for higher risk operations, like tree trimming.

Author, Rory Anderson, Account Executive, Tree Care Group, Rancho Mesa Insurance Services, Inc.

The premium for your workers’ compensation policy is based on the type of work you do, and the amount of payroll incurred. By maintaining proper payroll records, segregating the wages earned by your employees, you may reduce the cost of your workers’ compensation insurance. The final audit is the process that calculates the last premium due. It compares the estimated payrolls to actual wages paid during the policy year. The audit may result in a refund or additional premium due. Workers’ compensation audits also determine if the classification codes quoted at inception accurately reflect the scope of work performed during the policy period. Insurance carriers charge more premium for higher risk operations, like tree trimming.

In my last article, we looked at how it may be possible for a tree care company to use the 0042 landscape classification code at specific times, if they are trimming hedges or trees from the ground. We noted, however, that when any of the tree care company’s operations are off the ground, at any elevation, that payroll would be classified in 0106 tree trimming. Also, any type of work that is associated with the tree trimming (e.g., clean-up, chipping, stump grinding, etc.) would also be included as 0106.

The basis of premium is the payroll earned during the policy period. Payroll includes regular wages, salaries, overtime, bonuses, vacation pay, sick pay, commissions, cash payments, and other substitutes for money. Summarizing and segregating wages allows for the possible reduction of exposures and lower premium charges. Consider the following for potential adjustments at final audit:

If employees are engaged in both landscape construction/maintenance work, and tree trimming, you can segregate wages between operations and utilize both classifications. Earnings can be split by classification if time cards are maintained showing hours worked by activity, and payroll reports summarize hours and wages earned for each class. Segregation is based on records of actual hours worked; you cannot split earnings by percentages or projected bid calculations.

The wages for miscellaneous employees can be split by class if timecards segregate earnings by type of work performed. If no segregation is maintained, payroll will be assigned to the highest rated class.

Premium overtime is excludable if records document the hours and remuneration earned for regular hours and overtime hours. This includes earnings paid over and above the straight time earnings. If overtime is paid at one and one-half times the regular rate of pay, 1/3 of the total overtime pay can be excluded. If double time is paid, ½ of the overtime pay is excludable.

California allows the exclusion of deductions which are part of a Section 125 Cafeteria Plan. This might include medical, dental, and vision premiums. If these deductions are summarized by employee and by classification, they can be excluded from the workers comp wages.

Severance pay and tips are excludable. Maintain severance agreement letters documenting final payment agreements.

Depending on the type of entity insured, the earnings of sole proprietors, partners, and corporate officers may be excludable. Talk with your agent regarding qualifications and endorsements which can be issued as adjustments to your policy.

Workers’ compensation exposures may include costs for additional earnings paid outside of payroll. This could include bonuses, flat auto allowances, cash payments, casual labor, and subcontractors who could be considered employees. If subcontractors are hired, be sure to use licensed contractors who operate their own business. Always obtain and keep copies of the certificates of insurance from subcontractors to confirm independent coverage.

To prepare for final audit, maintain proper payroll records segregating and summarizing wages earned by your employees. The Auditor will:

Advise you on which reports to prepare for final audit. This typically includes payroll records and summaries, quarterly payroll tax reports, general ledger, cash disbursements, and/or 1099 reports.

Assist you in identifying cost saving measures. They will help to recognize and explain how to take advantage of all potential credits, such as premium overtime, severance, Cafeteria 125 plan deductions, etc.

Ask for a description of the business, and the job duties of employees to verify classification assignments.

Review all findings and suggestions, and address any additional questions you may have.

For questions about your annual audit, contact me at (619) 486-6437 or randerson@ranchomesa.com

Get Your Bond Account in Shape for 2021 – A Surety Company Perspective

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

As we wind down the 2020 year, it is important for our contractor clients and prospects to start planning how the 12/31/2020 fiscal year end financial statement will look. The bond companies will use this information to set your 2021 Bond Credit Line for approval of your projects.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

As we wind down the 2020 year, it is important for our contractor clients and prospects to start planning how the 12/31/2020 fiscal year end financial statement will look. The bond companies will use this information to set your 2021 Bond Credit Line for approval of your projects.

I recently sat down with two industry executives from Argonaut Surety, Steve Parnas, Vice President and Contract Practice Leader, and James Bluzard, Vice President and Chief Underwriting Officer-Contract to discuss the required financial information to ensure our contractors maximize their available bond credit going into 2021. Listen to the entire podcast Episode 56 “How to Get Your Surety Bond Account in Shape for 2021” on your favorite app.

Below are a few excerpts from our recent Podcast:

Rancho Mesa Matt Gaynor: “Although you track our contractor’s financial numbers throughout the year - how important is the 12/31 year-end financial statement?”

Arogonaut James Bluzard: “The 12/31 statement is typically a CPA-prepared statement viewed as the most important statement from the surety underwriter perspective since it is coming from an independent third party. Given the uncertain economic times we are in, and with COVID out there, getting that statement out and into your underwriters hands earlier rather than later will be really important to let the underwriters see how 2020 closed and also to get a forecast regarding 2021, as well.”

Rancho Mesa Matt Gaynor: “Within the CPA document, what are some of the specific items and schedules you are looking to analyze?”

Argonaut Steve Parnas: “We actually start our analysis at the back of the document looking at the work in progress and completed job schedules, which gives us insight into the performance of the past year along with how they are positioned going forward. Also, looking at the receivable and payable schedules to see how they are collecting their money and paying their bills.”

To get a better understanding of how the bond carriers will analyze your underwriting documents during these uncertain times, please contact me at (619) 937-0165 or mgaynor@ranchomesa.com.

CAL/OSHA Adopts Written COVID-19 Prevention Plan

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurances Services, Inc.

On November 19, 2020, California’s Occupational Safety and Health Administration (Cal/OSHA) Standards Board adopted temporary emergency standards to protect workers from COVID-19. These standards are expected to go into effect November 30, 2020, upon approval from the Office of Administrative Law.

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurances Services, Inc.

On November 19, 2020, California’s Occupational Safety and Health Administration (Cal/OSHA) Standards Board adopted temporary emergency standards to protect workers from COVID-19. These standards are expected to go into effect November 30, 2020, upon approval from the Office of Administrative Law.

Now, what does this mean for California employers? It means employers must have a written COVID-19 Prevention Plan. This written plan must include and address specific key points outlined by Cal/OSHA. These standards require employers to establish a system for communicating information about prevention, positive cases to employees, how cases will be identified and evaluated, a process for investigation and responding to cases, correction of hazards, training, physical distancing requirements, face covering, site-specific controls, reporting/recordkeeping and access, preventing the spread of the virus to other employees and a defined return-to-work criteria after a COVID-19 recovery.

Rancho Mesa Insurance has developed a COVID-19 Prevention Plan template for its clients to assist in the implementation and compliance of the new standards. Updated versions may become available as the standards are approved by the end of the month.

In addition, Rancho Mesa’s Risk Management Center offers additional tools employers can utilize to make sure they are in compliance with the new standards. Track daily COVID-19 symptoms in the Audit Track screen and deploy free online COVID-19 training for all employees from any mobile device. Our library of COVID-19 resources continues to grow and is available for our clients to access from the Risk Management Center and the RM365 HRAdvantage Portal™.

For information on how to access these resources, please reach out to your Client Services contact.

Safety Programs Can Reduce Workers’ Compensation Premiums

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

As California business owners continue incurring costs as they work their way through the maze of ever-changing COVID-19 regulations and protocols, prioritizing critical elements of your internal safety program can directly lower your insurance costs. Refocusing on key areas below will help present an effective, detailed submission to the marketplace that will lead to talking points with an underwriter for schedule credits and ultimately, lower rates and premiums.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

As California business owners continue incurring costs as they work their way through the maze of ever-changing COVID-19 regulations and protocols, prioritizing critical elements of your internal safety program can directly lower your insurance costs. Refocusing on key areas below will help present an effective, detailed submission to the marketplace that will lead to talking points with an underwriter for schedule credits and ultimately, lower rates and premiums.

Employee Benefits

Workers’ compensation underwriters pay close attention to employee benefit plans from a submission they are reviewing to quote. A deeper dive will create inquiries on overall employee participation, employer’s contribution to the plan, and whether established “wellness” plans are made available. High participation and contribution can show underwriters that employees value the benefits being offered and that the employer is investing in their most important asset, the employees. Lastly, industry professionals commonly link reduced fraudulent workers’ compensation claims to more robust, supported employee benefit programs.

Formal Safety Program

Developing a formal, documented Injury and Illness Prevention Program (IIPP) is truly just a baseline for managing risk for any business. The IIPP must be a living, changing document that contemplates random/periodic inspections, regular meeting intervals, safety orientation for new employees, and detailed investigative reports performed by field and management. Your program can be compared to a book that sits on the shelf and develops dust. Or, if you are focused on best practice techniques, it can be used as a tool for education, training, and risk mitigation. It should change as your company changes and incorporate the safety priorities instilled from the top down. Additionally, incorporating safety programs like Rancho Mesa’s RM365 Advantage Safety Star™ training program for foreman and supervisors help make your safety program go to the next level and really stand out in the insurance marketplace. Dynamic IIPPs stand out in a workers’ compensation submission process. They provide much needed detail to simple Yes/No questions on a supplemental application and show just how important safety is to the organization that is being underwritten.

Return to Work Program

Companies of all types will share that they support a return to work program when their injured employee is cleared for modified duty. That support needs to be taken a few steps further to improve your program. Create job descriptions for potential modified positions. Identify and engage with specific doctors within your network and ensure that these job descriptions are on file. This process can often help expedite employees back to the field, warehouse, office, etc. and ultimately lower temporary disability payments which can lower claim reserves. Use Rancho Mesa’s RM365 HRAdvantage™ portal to generate job descriptions and manage employee’s modified duty in the Risk Management Center.

Hiring Practices

Developing “gates” in the hiring process are often overlooked as too expensive or time consuming. But, the costs of bad hiring decisions can linger for years, impacting your bottom line and employee morale. Employers must strongly consider pre-employment physicals and drug testing, typically performed post interview and before an offer is made. As the Compliance Director for Current Consulting Group LLC, Andrew Current said, “The average cost of a pre-employment drug test is $45. The average turnover cost for an entry level employee is $6,600.” There is added benefit with workers’ compensation underwriters who view pre-employment checks as key controls to minimizing claim frequency and severity. Take advantage of the New Employee Onboarding Checklist and other resources in the RM365 HRAdvantage Portal.

Website Development

Most, if not all, workers’ compensation underwriters begin their review process by accessing the company in question’s website to learn more about their operation, exposures, risks, etc. Therefore, seeing your website through this same filter and utilizing your broker as an additional soundboard of information, consider these possible edits and/or redesign of your website:

Add a “Safety” link or tab, allowing space for sharing your company’s philosophy on managing risk.

Include a section on any safety awards or recognition that you may have received.

Remove any pictures on your website that might create confusion or concern about your operation as it relates to safety and risk.

Include examples of safety protocol that are unique to your operation (e.g. proper use of machinery, ladder usage, cleanliness of operating areas, etc).

Like any potential internal investment, companies must always balance whether the time and resource commitment will ultimately benefit their company. Many of the above recommendations require minimal resources and can pay huge dividends in consistently securing the most competitive workers’ compensation pricing, often a significant line item on a profit and loss statement. You may find cost savings in areas you did not know were possible that can help your business survive and remain profitable in these difficult times.

To discuss how your company’s safety program can affect your workers’ compensation premium, contact me at (619) 937-0172 or dfrazee@ranchomesa.com.

Risk Management and the Virtual Workforce

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Cyber Crime

Prior to the pandemic, the FBI would routinely receive 1,000 cybersecurity complaints, daily. Since the COVID-19 outbreak began, the number of complaints has increased to 3,000 to 4,000 every day according to Tonya Ugoretz, deputy assistant director of cyber division of the FBI in a webinar hosted earlier this year. The most commonly targeted industries are health care, manufacturing, financial services, and public sector organizations. Stated plainly, cyber criminals are successfully exploiting weak virtual cybersecurity and poor execution on the part of remote employees.

Brett Landry of Landry IT, recently stated that 85% of employees circumvent “acceptable use” policies when using a company owned device, reinforcing the need for increased employee training.

Mr. Landry highly recommends employers update security patches on all devices, adopt a higher standard for password security, utilize two-factor authentication, and train employees how to recognize phishing and social engineering efforts.

How will a cyber liability insurance policy respond to this new threat?

Important questions to ask:

Will my policy cover a remote exposure?

Will my policy cover incidents involving personal devices?

Is Social Engineering covered?

Will my policy respond if an employee does not follow company procedures?

Workers’ Compensation

Allowing employees to work from home has resulted in some employees moving out of state. When this occurs, the employer should report the new working address to the insurance company to ensure the workers’ compensation insurance policy will cover an injury. In some cases, the insurance company can add the new location. If not, then the employer may need to purchase a separate workers’ compensation policy for that employee’s new state.

In an effort to manage the risk of employee injury, employers should design and implement work-from-home policies. Effective policies will clearly define work hours, communicate standards for a home office, train employees on ergonomics, reinforce work and safety rules, and remind employees of the claim reporting process. Establishing the above expectations may help employees avoid injury and legal disputes over compensability.

Directors & Officers Liability

Remember that a Directors & Officers Liability policy protects individuals from personal losses if sued for their role as a director or an officer of a company and not indemnified by the company. While a move to a virtual workforce doesn’t inherently put a board member at risk, big changes to company policy can result in missteps if employees do not receive proper communication and training. Ultimately, directors and officers are held accountable if company policies are not followed, highlighting the need for diligent execution of important company changes.

Rancho Mesa supports clients in developing employee manuals, work-from-home policies, and 2021 changes to labor law. Please contact me at (619) 937-0175 to discuss how Rancho Mesa can support your business or mission.

New Hires Pose Hidden Exposure

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Hiring is never an easy task, especially during a pandemic. Dealing with COVID-19 has made finding the right employees much more difficult for many business owners in the construction industry. Now is the perfect time to evaluate your hiring practices to ensure you don’t make a costly hiring mistakes that can affect your Experience Modification Rate (XMOD) and workers’ compensation premium long after the pandemic has passed.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Hiring is never an easy task, especially during a pandemic. Dealing with COVID-19 has made finding the right employees much more difficult for many business owners in the construction industry. Now is the perfect time to evaluate your hiring practices to ensure you don’t make a costly hiring mistakes that can affect your Experience Modification Rate (XMOD) and workers’ compensation premium long after the pandemic has passed.

It was not that long ago that our economy was thriving and we had an unemployment rate under 4% in California. Though, due to the shutdown, we have seen that number shoot up as high as 16.4% in April 2020 and settle back down to 11% by September 2020, according to the Bureau of Labor Statistics (BLS). So, while many industries saw massive lay-offs, the construction industry has continued to thrive, at least for the time being. That means many employers are now actively looking for both skilled and non-skilled labor in order to complete existing projects and plan for future contracts that have been awarded. That’s great news for the 11% of the population who are unemployed, but employers should still be cautious about hiring just anyone without utilizing best practices to minimize risk.

In September 2020, Rancho Mesa partnered with Culture Works to offer the “Remote Recruiting & Company Culture Webinar” where they went into detail on the best practices for remote recruiting. Watch an archived version of the webinar to learn practical steps for recruiting employees in today’s economic climate.

Finding the right employee for the job may not be as easy as it used to be. Some skilled workers may not feel comfortable working on a job site, even while safety precautions are being observed. And, others may have been offered higher wages and more benefits at other companies who are also in need of workers. So, employers are really at a disadvantage. They may weigh the benefits and risks of hiring people who are less experienced or those who don’t take job site safety very seriously.

Now is the time to implement best practices when hiring to insulate your company from potential problems. This could mean implementing drug testing, pre-hire physicals, reach out to previous employers for recommendations, and updating your employee handbook to making sure these employees are aware of exactly what the job description is that they are being hired to do and the company’s expectations.

Experience on the job and a history of safety training are indicators that a new hire is a good risk. However, we know that employees over 45 have a 23% higher chance of having a sprain, strain or tear than employees under the age of 45. They also have a 27% higher chance of having a slip, trip or fall according to BLS. This does not mean that you shouldn’t hire workers over 45. It just means that to minimize risk, provide employees with appropriate training. Implement stretch and mobility programs for your workforce to do daily to reduce the exposure.

Rancho Mesa offers clients the Field Mobility & Stretch and ABLE Lifting training that is designed to reduce strains and cumulative trauma claims. Getting your employees prepared for the work day before they pick up their tools is vital in staying ahead of claims and boosts employee morale. The best way to handle workers’ compensation claims is to prevent them from happening.

Knowing your exposure is vital in staying ahead of industry trends. If you have further questions do not hesitate to contact me at (619) 438-6900 or ccraig@ranchomesa.com.

CA Anti-Harassment Training Deadline Quickly Approaches

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Lately, we've been getting a lot of questions about California's required anti-harassment training, who has to complete it, when it's due, and how much it costs. This article will clear up any confusion; covering the history of the requirement, training conditions and deadlines, and the online training offered to Rancho Mesa clients.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Lately, we've been getting a lot of questions about California's required anti-harassment training, who has to complete it, when it's due and how much it costs.

In September 2004, Assembly Bill 1825 set in motion the sexual harassment prevention training requirement for many California supervisors. In September 2018, former California Governor Jerry Brown approved Senate Bill 1343 (SB 1343) which expanded the requirement and launched a series of anti-harassment bills that now require those who employ “five or more employees, including temporary or seasonal employees, to provide at least two hours of anti-harassment training to all supervisory employees and at least one hour of anti-harassment training to all non-supervisory employees.”

History of the Requirement

Over the last several years, additional senate bills have been passed that modifies or clarifies the SB 1343 training requirements. Instead of giving you a play-by-play on how each bill has changed the requirements, I'm just going to tell you what is required as of today, November 2020.

You've probably noticed that we now refer to this new training as “anti-harassment training” instead of the old term, “sexual harassment prevention training.” The change came as a result of several bills that expanded the required content to include abusive conduct, unlawful employment practices of discrimination, and harassment of both a sexual and non-sexual nature. So, the anti-harassment training for California managers replaces previous versions of the sexual harassment and abusive conduct prevention training, developed prior to the passage of SB 1343 and Senate Bill 1300 (SB 1300).

For more information on the progression of the current requirements, read “California SB 1343 Expands Sexual Harassment Training Requirements,” published November 15, 2018, “California SB 1343 Expands Sexual Harassment and Abusive Conduct Prevention Training Requirements,” published on January 17, 2019, “Ensuring CA Sexual Harassment and Abusive Conduct Training is SB 1343 Compliant,” published on February 7, 2019, “Rancho Mesa Offers Free CA-Required Supervisor and Employee Anti-Harassment Training” published on May 8, 2019, “Providing Anti-Harassment Training Is the Employer’s Responsibility,” published on August 22, 2019, and “Senate Bill 778 Extends Anti-Harassment Training Deadline,” published on September 12, 2019.

Training Requirements and Deadlines

To make a long story short, for employers with five or more employees, supervisory employees must take the two-hour anti-harassment training every two years and non-supervisory employees must take the one-hour anti-harassment training every two years. This sounds simple enough. However, since we had multiple bills that added content to the requirements and extended deadlines (Senate Bill 778), it's not necessarily straightforward.

For example, if you have a supervisory employee who completed the old sexual harassment and abusive conduct prevention training in 2019, their next anti-harassment training is due in 2021. However, if they took any similar trainings prior to 2019, they must complete the new anti-harassment training by January 1, 2021. This also applies to non-supervisory employees. If a non-supervisory employee took the training in 2019, their next due date will be in 2021. However, if the non-supervisory employee has not taken the training or took a similar training prior to 2019, they are required to complete the anti-harassment training no later than January 1, 2021.

New employees must be trained within six months of hire and temporary employees must be trained within 30 days of hire.

Online Training

Rancho Mesa offers its clients free 100% online anti-harassment training for both supervisory employees and non-supervisory employees.

“It’s amazing Alyssa and her team have trained nearly 7,000 of our clients’ employees over the last 24 months and have been able to do that at no cost to them,” says Dave Garcia, President of Rancho Mesa. “Yes, it’s expensive, but we just feel it’s doing the right thing for our clients.”

The online training can be accessed from a computer, tablet or smartphone. This means our clients can get their required trainings from anywhere with an internet connection.

“It’s not only the cost savings for our clients that’s important, it’s also the way we are able to do the training utilizing any internet connected device,” says Garcia. “Our clients’ productivity isn’t impacted by having to bring their workforce into a training area and out of the field, creating a loss of productivity. Additionally, with COVID-19, large training meetings would not be permitted.”

Since the anti-harassment training is completed online through the Risk Management Center, it provides automated recordkeeping and offers rescheduling to ensure as soon as an employee completes the training, they can be automatically rescheduled to complete the training again in two years. It also allows administrators to archive employee training records when an employee leaves the company and reactivate the records if they are rehired.

Recordkeeping

Recordkeeping for anti-harassment training is important when there is an allegation of harassment or if an employee reports the employer for non-compliance. The Department of Fair Employment and Housing (DFEH) “accepts complaints from employees that their employers have not complied with the law." So, make sure you are providing the training and keeping records. It is also a best practices to train all employees, regardless if they have a certificate of completion from another employer, since it's the current employer's responsibility to make sure the employee is trained.

We offer an on-demand webinar that explains how to setup your employees in the Risk Management Center and assign the anti-harassment training.

For questions about the anti-harassment training requirements or to enroll your supervisors and employees, contact Rancho Mesa’s Client Services Department at (619) 438-6869 or send an email to aburley@ranchomesa.com.

COVID-19 Workers Comp Surcharge Coming to California

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

If approved, this new COVID-19 surcharge will vary by industry and have a minimum of $0.01 and hit a maximum of $0.24 per $100.00 of payroll. The industries with less of a COVID-19 exposure can expect a lower surcharge. While industries with a higher exposure can expect a greater increase. The additional surcharge my not seem like a lot, but multiplied by a company’s payroll, it can be significant to a company’s bottom line. Additionally, this surcharge will apply to all California employers, regardless if they had any COVID-19 illnesses.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) approved the surcharge after growing concerns that the number of COVID-19-related workers’ compensation claims will continue to increase. It’s been estimated this year that 11% of all workers’ compensation claims in California have been COVID-19 related. The surcharge will help the insurance carriers mitigate the growing cost of the claims that could not have been anticipated when rates were calculated for 2020 policies. Even though COVID-19 claims will not be included in California’s companies’ Experience Modification Rates (i.e., XMOD, EMR), carriers will look to a number of variables in order to adequately price for an individual company’s premium. Those will include:

Overall claims experience

COVID-19 claims experience

The COVID-19 protocols and practices that are in place

Rancho Mesa, California union employer groups, as well as several carriers including the State Compensation Insurance Fund (State Fund), oppose the surcharge idea. Our feeling, as well as many of the others, is that most carriers are now underwriting specifically for COVID-19 by evaluating the businesses’ COVID-19 claim history and safe guards. Thus, there is no need for an additional surcharge.

In the next few weeks, we will release a follow up article that will highlight the best practices employers can implement now to minimize the COVID-19 impact to their organization and 2021 workers’ compensation renewal pricing.

For questions about workers’ compensation and the COVID-19 surcharge, contact me at (619) 937-0167 or sclayton@ranchomesa.com.

Early Warning Signs of COVID’s Impact on Surety

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

The COVID-19 pandemic will have many long and short term effects on the surety industry. While the long term effects might not be known for years, some short term changes are already occurring. Early on, we have witnessed bond companies start to tighten their underwriting guidelines, and now we are seeing an increase in General Contractors (GC) requiring performance and payment bonds from their subcontractors.

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

The COVID-19 pandemic will have many long and short term effects on the surety industry. While the long term effects might not be known for years, some short term changes are already occurring. Early on, we have witnessed bond companies start to tighten their underwriting guidelines, and now we are seeing an increase in General Contractors (GC) requiring performance and payment bonds from their subcontractors.

For contractors that do a lot of public works, or work with GCs that require bonds already, this is not an issue, as they have already established bond programs and understand the process. However, for contractors that have never been required to bond before the pandemic, they are thrust into a part of the construction insurance world that is foreign to them. So, what exactly are performance and payment bonds and why are so many contractors now being asked to provide them?

To put it simply, the performance bond is an assurance to a project owner, or in this case a GC, by a surety company, that the contractor is capable and qualified to perform the contract and protects the GC from financial loss if the contractor fails to perform in accordance with the terms and conditions agreed upon. The payment bond assures that the contractor will pay certain subcontractors, workers, and materials suppliers associated with the project. While these assurances are meaningful, GCs very often do not require bonds because of the extra cost associated with obtaining them. Bonds typically cost 1-3% of the contract price with the GC in many cases paying the corresponding premium. COVID-19 has created turmoil in the financial marketplace many ways including a tightening of available money, a lengthening of account receivables, high unemployment, and an overall slowing of the economy. With so much uncertainty surrounding the effects that COVID-19 may have on an individual contractor’s financials, GCs are becoming more risk adverse and willing to absorb the cost of the bond to avoid subcontractor defaults in the middle of the project. In those situations the GC can then rely on the surety company that wrote the bond who will step in to make sure the work is completed.

For contractors that have never secured a bond before, the process can seem daunting, complex, and invasive, which makes having a good surety agent and bond company vital to help make the process seamless. At Rancho Mesa, we work with a number of high quality surety markets that provide a variety of different types of bond programs, and we have the expertise to get you set up with one that works best for your company’s surety bond needs.

For more information or for any questions regarding your surety needs, please contact me at (619) 937-0166 or aroberts@ranchomesa.com.

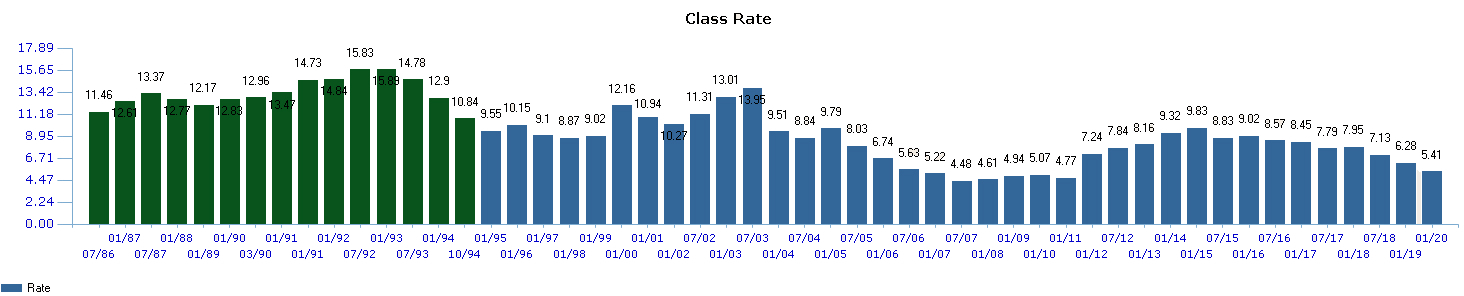

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

AB 685 Creates New Notice and Reporting Requirements

Author, Sam Brown, Vice President of the Human Services Group, Rancho Mesa Insurance Services Inc.

On September 17th, 2020 Governor Gavin Newsom signed into law Senate Bill 1159 (SB 1159) and Assembly Bill 685 (AB 685), both COVID-19 related bills. Both pieces of legislation will impact how employers respond to incidents of COVID-19 infections. This article will help business owners understand AB 685’s heightened occupational health and safety rules. Employers also need to understand how AB 685 grants California’s Occupational Safety and Health Administration (Cal/OSHA) greater enforcement powers.

Author, Sam Brown, Vice President of the Human Services Group, Rancho Mesa Insurance Services Inc.

On September 17th, 2020 Governor Gavin Newsom signed into law Senate Bill 1159 (SB 1159) and Assembly Bill 685 (AB 685), both COVID-19 related bills.

Both pieces of legislation will impact how employers respond to incidents of COVID-19 infections. This article will help business owners and officers understand AB 685’s heightened occupational health and safety rules. Employers also need to understand how AB 685 grants California’s Occupational Safety and Health Administration (Cal/OSHA) greater enforcement powers.

Posting Requirements

AB 685 requires California employers to provide the following four notices within one business day of being informed of a potential COVID-19 exposure:

Provide a written notice to all employees, and to the employers of subcontracted employees, who were at the same worksite within the infectious period, notifying the employee that they may have been exposed to COVID-19. It must be reasonable to assume the employees will receive the notice within one day, whether that is through email, text, or written notification.

If the employee population includes represented employees, then the employer must also send notice to the exclusive representative of the affected bargaining unit.

The employer must also provide notice of any COVID-19 related benefits or leave rights under federal, state, and local laws, or in accordance with employer policy. The employer must also notify employees of their protections against retaliation and discrimination.

The employer must notify all employers, the employers of subcontracted employees, and any exclusive representative, of the employer’s plan to complete a disinfection and safety plan in accordance with federal Centers for Disease Control guidelines.

Employers are required to maintain records of these notices for at least three years. Failure to comply with the notice requirements may result in a civil penalty.

If an employer learns of an “outbreak” as defined by the California Department of Public Health (“CDPH”), the employer must also notify the appropriate public health agency within 48 hours with the names, occupation, and worksite of any “qualifying individuals” related to the “outbreak.”

Two exceptions to the notice and reporting requirements:

Health facilities as defined in Section 1250 of the Health and Safety Code, are not required to report an “outbreak” within 48 hours.

The notice requirements do not apply to exposures by employees whose regular duties include COVID-19 testing and screening, or care to individuals who have or who are suspected to have COVID-19, unless the “qualifying individual” is also an employee at the same worksite.

Authorized Shutdown

Under AB 685, if Cal/OSHA determines that a workplace or operation within a workplace exposes employees to a risk of COVID-19 infection, creating an imminent hazard to employees, Cal/OSHA is authorized to prohibit entry to the workplace or the performance of operation in question.

If your organization would benefit from guidance on these new employer requirements, please contact Rancho Mesa Insurance at (619) 937-0175.

Sources:

https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201920200AB685

Safe Cloud Computing for Contractors

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Even prior to the COVID-19 pandemic, many construction companies were utilizing some form of cloud-based systems to effectively streamline business operations and increase accessibility of information. While hosting sensitive data in the cloud has many benefits like shared access to data, applications and storage, there are some risks contractors should take into account before relinquishing their data to the cloud.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Even prior to the COVID-19 pandemic, many construction companies were utilizing some form of cloud-based systems to effectively streamline business operations and increase accessibility of information. While hosting sensitive data in the cloud has many benefits like shared access to data, applications and storage, there are some risks contractors should take into account before relinquishing their data to the cloud.

A leading provid//er of Cyber Liability insurance, CNA references three key risks companies utilizing cloud technology need to be aware of in an recent article, “Cloud computing 101: Getting clear about the cloud.” CNA explains data protection, data loss/disruption and inappropriate access are risks business take on in exchange for the benefits of cloud computing.

Data Protection

Protecting data is essential for any organization. Customers’ personal and payment information may be stolen by hackers once the data is stored in the cloud or even while in transit. So, your data in the cloud must be secured through encryption to prevent the data from being usable if stolen. As the cloud customer, the company should manage the encryption keys to ensure only authorized users can decrypt the data.

Data Loss / Disruption

You may be thinking about moving your data to the cloud as a way to protect it from electrical outages, fire, flood and other natural disasters. However, your cloud hosting provider can be left inoperable due to similar calamities. Before hosting your data in the cloud, review your host’s back-up and redundancies to ensure there will be a copy of your data available if something should happen to the host’s servers. Have a plan in place to help navigate your most critical information in the event something like this occurs.

Inappropriate Access

When storing data in the cloud, it is imperative the company ensures stringent and complex user authentication. This may mean passwords are changed frequently or two-factor authentication is deployed to ensure hackers can’t find their way to your data. When you manage a large user-base, the risk rises. Ensure former employees no longer have access to your data by changing security rights or disabling their account. Complex user authentication can be an effective deterrent to keep those who should not have access to your information from finding their way into your network.

Assuming your information is safe and secure in the cloud is misleading. Be proactive in protecting your information and round out your risk management program with a strong cyber liability program that can fulfill your cloud based risk needs.

For more information about the CyberOne™ program, contact Rancho Mesa.

Article edited 4/19/2021.

SB 1159 Is Now Workers’ Compensation Law

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later. Additionally, these rules will continue, unless modified, until January 2023. So, SB 1159 may be around for a while.

If an “outbreak” occurs, for the presumption of the claim to rest with the employer (meaning it will be presumed the person testing positive for COVID-19 contracted it at work and is therefore eligible for workers’ compensation benefits), there are several factors that need to be meet for that to occur.

If the employer has fewer than 100 employees and 4 employees test positive, or if the employer has more than 100 employees and 4% of their total employees test positive, during a 14-day period at an employer’s specific location, the COVID-19 case is presumed to be work-related. Thus, the 4/4/14 rule. When in doubt, call your workers’ compensation carrier and discuss the specific situation. They will help you determine whether or not it is a workers’ compensation claim.

Rob Darby, President of Berkshire Hathaway Homestate Companies, the second largest writer of workers’ compensation insurance in California and I discuss SB 1159 in a recent StudioOne™ Safety and Risk Management Network podcast episode “SB 1159 Impacts Workers' Comp Market.” A week before Governor Newsom signed the bill, Rob and I discussed the impacts of the bill to get an early insight. Take a listen - I think you will find it useful.

Now comes possible confusion with SB 1159. What is considered an outbreak? What is the definition of a specific location?

Outbreaks

The section of the law (Labor Code 3212.88) applies to any employee other than frontline workers and healthcare workers who test positive during an “outbreak” at the employer’s place of business, if the employer has 5 or more employees.

COVID-19 is presumed work-related if an employee worked at the employer’s place of business at the employer’s direction on or after July 6, 2020 and both the following elements are met:

The employee tested positive for COVID-19 within 14 days after working at the employer’s location.

The positive test occurred during an “outbreak” at the employer’s specific location.

An “outbreak” is defined as a COVID-19 occurrence at a specific employment location within a 14-day period AND meets one of the following:

If an employer has 100 employees or less at a specific location and 4 or more employees test positive for COVID-19;

If an employer has more than 100 employees at a specific location and 4% of the employees test positive for COVID-19;

The local public health department, State California Department of Public Health or Occupational Safety and Health Administration (Cal/OSHA) or school superintendent orders the specific place of employment to close due to risk of COVID-19 infection.

A specific location or place of employment is a building, store, facility or agricultural field where an employee performs work at the employer’s direction. An employee’s home is not considered a specific place of employment unless the employee provides home health care services to a client at the employee’s home. An employee may have more than one specific place of employment, if they worked in multiple locations within the 14-day period before their positive test.

There is a 45-day timeframe to determine if a positive COVID-19 case meets the above standard.

Outbreak Reporting Requirements

When an employer knows or reasonably should know that an employee has tested positive for COVID-19, they must report the incident to their workers’ compensation carrier. They should be prepared with the following information to give the carrier.

The fact that an employee has tested positive, regardless if work-related or not.

Employers should not include any personal information regarding the employee who tested positive for COVID-19 unless the employee asserts it is work-related or files a claim form.

The date the specimen was collected for the employee’s COVID-19 test.

The specific address or location of the employee’s place(s) of employment during the 14-day period preceding the date the test specimen was collected.

The highest number of employees who reported to work at the specific location(s) in the 45-day period before the last day the COVID-19 positive employee worked there.

It best practices to follow all local, state and federal guidelines for safe workplaces. However, even with the best intentions and precautions, COVID-19 may accidentally spread to employees. Again, when in doubt, report an employee COVID-19 case to your workers’ compensation carrier and allow them to determine how to proceed.

For questions about SB 1159 and how it with affect your organization’s workers’ compensation, contact your broker or reach out to Rancho Mesa at (619) 937-0164.

Excess/Umbrella Rates Experiencing Alarming Price Jump

Author, Sam Clayton, Vice President of the Construction Group, Rancho Mesa Insurance Services, Inc.

As if the 2020 business landscape has not already been challenging enough, a hard market for excess/umbrella is occurring at a concerning rate, resulting in rising premiums, limited capacity and a restriction in terms and conditions.

Author, Sam Clayton, Vice President of the Construction Group, Rancho Mesa Insurance Services, Inc.

As if the 2020 business landscape has not already been challenging enough, a hard market for excess/umbrella is occurring at a concerning rate, resulting in rising premiums, limited capacity and a restriction in terms and conditions.

A hard market can be defined by a decrease in limit and underwriting capacity, and an increase in rate and premium. While other lines of liability are seeing single-digit increases, excess/umbrella pricing is experiencing 20-30% jumps, depending on the risk. This significant increase is the result of several factors including:

Social inflation

Nuclear judgements

Third-party litigation financing

Natural and man-made catastrophes

Increase in severe distracted driving incidents

In addition to these premium increases, insurance carriers are reducing their capacity. Previously a carrier might have been comfortable in offering higher limits such as $25 million on a risk and now they are limiting their lead limits to $5 or $10 million dollars, which then require a business, in need of higher limits, to seek additional participation from other carriers to meet their needs. This creates both the need to “stack” limits and at the same time make sure policy terms stay consistent.

The area most often overlooked are new restrictions in the terms and conditions. Some to be mindful of include:

Communicable Disease Exclusions

Wildfire Exclusions

Higher Retention Limits

Now more than ever is the time for contractors to be meeting with their broker to put proactive steps in place to minimize the impacts of this hardening market. As the construction group leader here at Rancho Mesa, if you have questions or need help in navigating these turbulent times, please reach out to me at (619) 937-0167 or email at sclayton@ranchomesa.com.

Bond Companies Thoroughly Track Status of Construction Projects

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

When the bond company approves a performance and payment bond for our contractor clients, they want to keep track of the project until completion - at which time the liability for the bond is no longer on their books. One tool they use to track a construction project is the Work In Progress Report (WIP) which the bonding company analyzes on a quarterly or six-month basis to track the profitability of the project on a percentage of completion basis. When the bond company sees that a project is 100% complete on the WIP or Completed Contract Report, they will mark the bond file as “closed,” once the warranty period has expired.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

When the bond company approves a performance and payment bond for our contractor clients, they want to keep track of the project until completion - at which time the liability for the bond is no longer on their books. One tool they use to track a construction project is the Work In Progress Report (WIP) which the bonding company analyzes on a quarterly or six-month basis to track the profitability of the project on a percentage of completion basis. When the bond company sees that a project is 100% complete on the WIP or Completed Contract Report, they will mark the bond file as “closed,” once the warranty period has expired.

Additionally, several bond companies will also use a Contract Bond Status Inquiry Form to track the projects. This form is mailed to the obligee (i.e., the owner or general contractor on the bonded project) and requests project information is completed on the form, then returned to the bond company via mail, email, or fax. The questions posed on the form include, “Is the contract completed, and if so, what was the completion date and final contract amount?” In the event the contract is on-going, the form requests a percentage of completion or approximate dollar amount of the work completed to date. The form also asks the owner if they are aware of any unpaid bills for labor or material on the project.

The final area of the status inquiry form provides space for the obligee to fill in remarks. This can be a good or bad thing for the contractor. We have seen responses from owners and general contractors that range from “great subcontractor – excellent to work with” to “I will never hire this contractor again.” Other times, this area is left blank.

While the primary goal of the status inquiry is to understand if a project is closed or remains open, the remarks section will grab the bond underwriters attention (positive or negative) and that will become part of their underwriting analysis, going forward.

If you would like more information on how the contract bond status inquiry might influence the underwriting of your bond program, feel free to reach out to me at (619) 937-0165 or mgaynor@ranchomesa.com and ask any questions to ensure your bond program is getting the proper attention.

Strengthen Your Risk Profile During COVID-19

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 continues to have a stronghold on the US economy and it is likely that we will see the impact for many years to come. While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. Understand that this recommended rate increase comes against a backdrop of record profits in workers’ compensation prior to COVID-19. There are also three COVID-19 presumption Bills (AB 196, AB 644, and SB 1159) that could create presumptions that cases of COVID-19 are a compensable consequence of work, which will likely cause additional turmoil in the marketplace.

With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Improve the Safety Program

Now is not the time to take your focus off of safety in the workplace. In fact, I would argue that there should be even more focus on safety. Some items to focus on relating to a safety program include:

Update your Injury and Illness Protection Program (IIPP) and have it reviewed by a labor attorney.

Establish a safety committee consisting of ownership, supervisors, managers, your insurance broker, and insurance company (i.e., loss control representative). This will assist with identifying workplace hazards, discussing claims or near misses that have occurred and creating safety meeting topics that can be discussed at future employee safety meetings.

Ensure that safety meetings are occurring at least every 10 working days, but preferably weekly. Using safety topics identified by the safety committee, managers can pinpoint proper trainings for employees.

Update Employee Handbook

With employment requirements, policies and procedures continually changing, it’s easy to fall behind on new regulations like adding an Emergency Paid Sick Leave Policy or Expanded Family and Medical Leave Policy, in your employee handbook. Rancho Mesa offers access to a living handbook builder through the RM365 HRAdvantage™ portal. By creating a living employee handbook through the portal, updating the document with new policies is as easy as reviewing and approving the suggested changes provided by experienced human resources professionals.

Continue Your Risk Management Education and Certifications

With many businesses slowing during COVID-19, consider filling that down time with required accreditations and continued education courses. Some examples include:

Anti-harassment Training: By the end of 2020, businesses with 5 or more employees are required to provide Anti-harassment training to all employees. Owners, supervisors, and management are required to complete the two-hour course, while all other employees must complete a one-hour course. Rancho Mesa offers free online Anti-harassment training for both supervisors/managers and employees. The courses can be accessed by computer, tablet, and a smart phone.

Continued education or achieving professional designations: It’s also a good time to consider working on continued education courses such as renewing forklift certifications, OSHA trainings, as well as any professional designations. To reinvest your efforts in continued education, now, while business is still slow due to COVID-19, could position your business to hit the ground running when the economy opens up again.

Safety Star Certification – With underwriting guidelines tightening and worker’s compensation premiums expected to increase due to COVID-19, Rancho Mesa’s RM365 Advantage Safety Star Program™ can build your risk profile and differentiate your business from others. The program is designed for supervisors, foreman, safety coordinators, upper management, administrators, and directors of human resources. To earn the Safety Star certification in Construction Safety, you must complete the required Incident Investigation and Analysis online module plus at least two other modules of your choice from the approved list. This certification is also a marketing tool your broker can use to show your commitment to safety.

Proactively improving your safety program, employee handbook, and continuing education during the pandemic will allow you to hit the ground running once COVID-19 restrictions are lifted. It can also position your business to mitigate increasing premiums with the ever tightening workers’ compensation marketplace.

If you need any assistance in implementing a sound risk management program, please reach out to me at (619) 937-0174.

Choosing the Right Classcode: A Guide to Distinguishing Tree Trimming from Landscape Work

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are…

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are:

What is the difference between the two class codes?

I’ve always only used 0106-Tree Trimming, is it possible for me to use 0042-Landscape Gardening as well?

How can I differentiate which specific operations are considered landscape gardening and which are considered tree trimming?

When more than one classification applies to operations that are closely related, it is important to understand the boundaries of each classification. Let’s take a look at how the California Workers’ Compensation Insurance Rating Board (WCIRB) defines both class codes:

0106 Tree Pruning, Repairing or Trimming

This classification applies to pruning, repairing or trimming trees or hedges when any portion of the operations requires elevation, including but not limited to using ladders, lifts or by climbing. This classification includes clean-up, chipping or removal of debris; stump grinding or removal; and tree spraying or fumigating that are performed in connection with tree pruning, repairing or trimming. This classification also applies to the removal of trees that retain no timber value.

0042 Landscape Gardening

This classification applies to the construction, maintenance, repair or installation of landscape systems or facilities designed for public or private gardens or other areas in order to aesthetically, architecturally, horticulturally or functionally improve the grounds within or surrounding a structure or a tract or plot of land. This classification includes the preparation and grading of plots or areas of land for the installation of landscaping; pruning, repairing or trimming trees or hedges when none of the operations at a particular job or location require elevation, including but not limited to using ladders, lifts or by climbing; or chipping operations performed in connection with landscape gardening. This classification also applies to spraying or spreading lawn fertilizers or herbicides, or weed abatement for fire hazard control purposes.

According to these definitions, a tree company may be able to use the 0042 landscape class code at specific times. However, when any of the operations are off the ground, that payroll would be classified in tree trimming 0106. Also, any type of work that is associated with the tree trimming (e.g., clean-up, chipping, stump grinding, etc.) will also be included as 0106. Here is a quick real-world example that will help to clarify.

A tree company has 10 employees that worked on a specific job to trim a large Eucalyptus tree. There were only two workers that actually climbed and trimmed the tree, and all the rest of the employees worked on the ground to clean up the limbs and branches that were being cut and fell from the tree. All 10 employees must be classified into the 0106 class code because the ground crew operations were in connection with the tree trimming, where the climbers were operating off of the ground.

The next day, on a completely different job site, the same tree company with 10 employees worked on a new job to trim a handful of 8 ft Japanese maple trees. For this job, all of the work was performed from the ground and there was never a point where any of the workers operated from elevation (e.g., ladders, lifts, climbing, etc.). Three of the workers trimmed with pole saws from the ground, while the other seven employees cleaned-up the debris and used the chipper. All 10 of the employees could be classified into the 0042 landscape class code because there was never a time where a worker left the ground to trim.

Properly documenting and maintaining valid records is critical in order for your company to utilize both class codes properly. Without proper documentation, you could be setting your company up for a large additional premium owed at audit.

Stay tuned to my follow up article and podcast as I share how to prepare for and execute a successful audit when both of these two class codes are applicable to your operations.

Employers Enlist Assistance from HR Experts while Navigating Perils of COVID-19

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

The COVID-19 pandemic has brought a slew of unknowns to employers across the country, especially as it relates to human resources questions and Employment Practices Liability (EPLI). Rancho Mesa’s RM365 HRAdvantage™ Portal has been a favorite of our clients ever since its release in 2019. The portal continues to grow in popularity as employers face new challenges as workplace standards and employee interaction changes, almost daily.

The COVID-19 pandemic has brought a slew of unknowns to employers across the country, especially as it relates to human resources questions and Employment Practices Liability (EPLI). Rancho Mesa’s RM365 HRAdvantage™ Portal has been a favorite of our clients ever since its release in 2019. The portal continues to grow in popularity as employers face new challenges as workplace standards and employee interaction changes, almost daily.

The most popular tool in the portal gives clients access to live certified Senior Professionals in Human Resources (SPHR) and Professionals in Human Resources (PHR) advisors via phone or through the portal’s messaging tool. Not only will the HR experts answer human resources questions, they will also follow-up with written documentation of the advice so you can refer back to their recommendations.

If an effort to ensure compliance and reduce the chance of an EPLI claim, Rancho Mesa clients are reaching out to our experts for advice on how to navigate human resource issues before they turn into a legal nightmare.

A recent client inquiry included a question about: “required postings and notifications regarding COVID-19 and how to deliver them to remote employees.” The HR experts provided guidance on how to address the client’s specific situation like getting state notices to employees who are working from home.

Another client asked “what to do if an employee refuses to come to work when restrictions are lifted.” The advice pointed to the federal Families First Coronavirus Response Act (FFCRA) and possible city ordinances or state law that may dictate how to handle the specific situation. In addition, other factors were highlighted that take into account the employee’s personal risk factors and the Occupational Safety and Health Administration (OSHA) rules for safe workplaces.

Additionally, our team is answering questions like “Can employers require employees to get tested for COVID?” or “What accommodations am I required to make for employees working from home?”

Getting reliable answers to important human resources questions quickly can mean the difference between a happy and healthy workforce, and a possible EPLI claim.

With so much uncertainty facing our clients, many have found comfort and confidence in knowing they have reliable human resources experts available to advise them as they navigate these uncharted waters.

If you have any further questions about EPLI coverage, please contact Rancho Mesa Insurance Services at (619) 937-0164.

Common Sense Strategies for Lowering Risk and Managing Liability

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While business owners spend thousands of hours becoming experts in their own field, most know very little about the intricacies of purchasing commercial insurance. Consider exploring these topics further as you prepare for your upcoming renewal cycle.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While business owners spend thousands of hours becoming experts in their own field, most know very little about the intricacies of purchasing commercial insurance. Consider exploring these topics further as you prepare for your upcoming renewal cycle.

Buying Too Little Property Insurance

Property coverage can often be the least expensive piece of a comprehensive insurance program. Yet the impact financially to a business or property owner can be devastating if you are under-insured. Take time to understand any coinsurance clause that may exist within your policy and the real world impacts that could occur if any penalty is imposed by the carrier if you have failed to maintain a minimum amount of insurance. Ensuring that your property limits are more than adequate can truly be a cost-effective approach when there is a significant loss.

Overlooking Potential Savings of Higher Deductibles

In layman terms, purchasing insurance simply transfers risk from one party to the other in exchange for premium dollars. Deductibles are a form of self-insurance that represents the costs you are responsible for before your coverage starts. Typically, the higher your policy’s deductible, the lower annual premium because you are absorbing more financial risk if and when a claim occurs. With this in mind, discussing your risk tolerance with your leadership team and your broker can allow for healthy dialogue leading into rate negotiation.

Not Buying Enough Liability Limits

A common term circling around the insurance industry is Social Inflation. This generally refers to the rising costs of insurance claims that are a result of societal trends and views toward increased litigation, plaintiff friendly legal decisions, and large jury awards. As W. Robert Berkley Jr., chief executive officer of commercial property and casualty insurer W.R. Berkley Corp told analysts, “Social inflation is real. It is here and the industry is beginning to pay attention.” This is a waving red flag that insurance buyers should begin considering higher liability limits by adding an Umbrella policy or increasing existing limits. Businesses can implement plans to mitigate risk. But, lawsuits and the amount of damages plaintiffs will seek remain unpredictable.

The Impacts of “Carrier Jumping”

Building a strong, viable business is centered on relationships. It is those relationships that you lean on most when you need an insurance carrier to come through for you, a consultant to solve a problem, or a key partner to deliver when times are difficult. That philosophy applies more than business owners might realize in the insurance industry. Jumping from carrier to carrier, year to year, to get the cheapest policy might save on the short-term, but this approach can negatively impact your marketability in the long-term.