Industry News

Managing Working Capital is Key as Markets Tighten

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Contractors often ask us what bond companies are looking for when they are reviewing balance sheets and income statements. The answer isn’t a simple one, because there are many items that underwriters look at when determining if they will write a bond for a contractor. Typically, the first thing an underwriter will do is calculate a contractor’s working capital.

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Contractors often ask us what bond companies are looking for when they are reviewing balance sheets and income statements. The answer isn’t a simple one, because there are many items that underwriters look at when determining if they will write a bond for a contractor. Typically, the first thing an underwriter will do is calculate a contractor’s working capital.

Simply put, working capital is calculated by subtracting a contractor’s current liabilities from their current assets on the balance sheet. Current liabilities are any obligations due within one year, while current assets are the most liquid like cash, accounts receivable, and items that can be converted to cash within a fiscal year. This calculation measures what is available for a company to pay its current debts, finance its current operations, and provides an indication of a company’s overall health.

With bond companies placing an emphasis on working capital and tightening their underwriting guidelines through these uncertain times, it is critical that contractors pay close attention to their balance sheet. Managing their working capital can ensure a contractor receives the bond credit that they need. One specific area a company can focus on to accomplish this is being more diligent with collecting receivables.

Accounts receivable are listed as a current asset. However, bond companies will review the aging of a company’s accounts receivable and likely deduct any that are 90 days or more past due from the amount listed on the balance sheet. These are viewed as not likely to be received and will lower a company’s total current assets, which lowers working capital. This can directly affect the amount of credit that a bond company is willing to offer and possibly lead to bond requests being denied.

With so much remaining uncertainty in the economy, it is more important than ever for contractors to re-visit their balance sheets and take an aggressive stance with collecting receivables. These techniques can quickly build or re-build a strong risk profile to secure the level of surety credit a contractor may need for their bond program.

As you develop your financial strategy and look to strengthen bonding options, consider Rancho Mesa’s Surety team of advisors. Contact Andy Robert at (619) 937-0166 or email him directly at aroberts@ranchomesa.com.

The Importance of Timely Workers’ Compensation Claims Reporting

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Best Practices would demand that all claims get reported within 24 hours, if at all possible. By doing this, it provides the best possible outcome and will impact the claim in several positive ways:

Reducing Fraudulent Claims

One of the biggest frustrations in the workers’ compensation industry for most employers are the number of fraudulent claims that find their way into the system. Immediate accident investigation, witness statements and pictures followed by reporting the claim to the carrier within 24 hours of the injury, will give the employer and the carrier the best opportunity to deny a claim. The insurance carrier only has 90 days from the date of injury (not from the date reported) to deny a claim. This shortens that time-frame and allows more fraudulent claims into the system.

Lowering Litigation Rates

Another area employers find both frustrating and costly are the number of litigated claims that occur within the workers’ compensation system. Litigated claims on average will add 30% to 35% to the ultimate cost of a claim. While there are many ways employers can impact this area, perhaps the most controllable is the timely reporting of any injury. To further support this, it has been proven that the litigation rate for claims goes up 300% if the claim is reported 5 or more days after the injury occurred.

Identifying Claim Trends Early

By not reporting all claims or by reporting them late, employers can develop unreliable data in their effort to identify claim trends and root causes. Without this information, businesses in all sectors run the risk of a severe injury occurring from an area that could have been addressed if all claim data was accurate and analyzed.

When an injury occurs, do a thorough accident investigation that details all events that caused the injury and immediately call your workers’ compensation carrier. This one habit alone will help you lower claim costs and manage your EMR.

To learn more about this process, including benchmarking and analytics that can help control your loss ratio and lower premiums, please reach out to me, Casey Craig at (619) 438-6900 or ccraig@ranchomesa.com.

Court Agrees Temporary COVID-19 Standards Are Not Needed

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

As a volunteer labor union group that works to improve the lives of the U.S. workforce, the AFL-CIO wants OSHA to issue a temporary worker safety standard addressing the risks of COVID-19 in the workplace. However, an Emergency Temporary Standard is authorized by OSHA under certain limited conditions. It must be determined that workers are in danger of exposure to toxic substances or agents that can be physically harmful. Plus, a temporary standard then serves as a proposed permanent standard.

The D.C. Circuit Court denied the lawsuit against OSHA due to the fact that government officials are learning new information about COVID-19 weekly, if not daily. An appropriate response to the union’s concern is not a fixed rule, at this time. And, a standard specific to COVID-19 would likely not need to become a permanent standard in the future.

Furthermore, the U.S. Department of Labor states, "We are pleased with the decision from the D.C. Circuit, which agreed that OSHA reasonably determined that its existing statutory and regulatory tools are protecting America's workers and that an emergency temporary standard is not necessary at this time.”

While a new standard to combat COVID-19 isn’t necessary because of existing standards, OSHA has provided many resources for employers to assist in maintaining worker safety. Their “Guidance on Preparing Workplaces for COVID-19” provides information on the virus, how it could affect a workplace, steps employers can take to reduce the risk to employees, and additional services and programs available to employers. The “Guidance on Returning to Work” offers steps for reopening, applicable OSHA Standards, and a frequently asked questions section. In addition, employers can find news updates and resources on OSHA’s COVID-19 webpage.

Landscape Companies with Low Experience MODs Do These 5 Things

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

The XMOD/EMR is a unique number assigned to a business that is made up of their historical loss figures and audited payroll information vs. the same information for companies involved in the company’s same industry. Generally, if your business has experienced more claim activity than the industry average, you will have a XMOD/EMR above 1.00. The opposite is true; if you have had less claim activity, your XMOD/EMR will be below 1.00. The XMOD/EMR impacts the rates you pay for workers’ compensation by crediting (XMOD/EMR below 1.00) or applying a surcharge (XMOD/EMR above 1.00).

Here are the 5 best practices used by landscape companies who have an XMOD/EMR) below 1.00.

1. An Aggressive Return to Work Program

If you heard our podcast episode with Roscoe Klausing of Klausing Group, you will hear him coin the phrase an “aggressive return to work program” which was a key component to his company, of more than 70 employees, going 3 years without a lost time accident.

Aggressively finding a way to help bring an injured employee back on modified work restrictions has long been proven to provide positive outcomes for everyone involved. Benefits of bringing an employee back on modified duties include:

Eliminating temporary disability payments from the claim cost.

Lower the dollar amount of medical treatments.

Reduce the overall cost of the claim.

Lower the potential impact the claim would have on your XMOD/EMR.

Improve injured employee morale.

2. Timely Reporting and Accident Detail

It is critical to constantly remind your front line supervisors and employees that they must report all injuries no matter the severity as soon as possible. Studies have shown that work related injuries reported with the first 5 days have a dramatically lower average claim cost and litigation rates than those reported after 5 days.

Two measurable statistics for you to keep an eye on are:

The lag time between when an injury is reported to you from an employee.

The amount of time it takes you to report this information to your insurance carrier.

By conducting a thorough accident investigation at the time of injury and providing a report to your insurance claim professional, you will speed up the claims process and lower costs. Eliminating the time delays caused by the claim professional waiting for details or additional information is critical in making sure your injured employee is on the fast track to recovery. To assist the landscape industry in completing this necessary step, Rancho Mesa has created a free, fillable, carrier approved accident investigation report for use by the landscape industry.

3. Communication

Keeping in constant communication with employees who are injured is vital to a positive outcome. At times, the workers’ compensation process can seem slow. Some injuries will take longer than others. This can lead injured employees to feel frustrated and uncertain. Make sure you are addressing their concerns and checking in on them, frequently.

4. Know the Basic Principles Behind the XMOD/EMR

You do not need to know the XMOD/EMR formula, but you should have an understanding of the basic concepts that leads to XMOD/EMR inflation.

You should know when your claim information will be sent to your rating bureau for next year’s XMOD/EMR calculation and make sure you are familiar with the status of each claim before the information is locked.

If your rating bureau uses a Primary Threshold or Split Point, it is good to understand how this number impacts claim cost and each claim’s impact on the XMOD/EMR.

Know your lowest possible XMOD/EMR, this would be all your payroll with zero claims. The points between your lowest possible XMOD/EMR and your current XMOD/EMR are the controllable points.

Know the policy years that are used to calculate the XMOD/EMR.

5. Relationship With Your Carrier and Claims Professional

The carrier claims professional who handles your injuries can have a huge impact on the outcome of the claim. If you are fortunate enough to have a dedicated claim adjuster assigned to your company, make it a point to call and introduce yourself before the first claim occurs. The adjuster should have a very good understanding of:

Your attitude and policy regarding return to work programs.

The level of accident information they will receive from you.

Who will be your company’s main contact throughout the claim process?

Consider these five best practices when handling your workers’ compensation claims to keep your XMOD/EMR under control and your workers’ compensation costs low.

California Workers' Comp Carriers React to Commissioner's COVID-19 Amendment Approval

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

The amendments address accounting for employees whose job duties have changed to clerical work, which is typically a less expensive workers’ compensation insurance classification than the jobs they were performing prior to Governor Newsom’s March 19, 2020 Stay-at-Home Executive Order. It also excludes payroll for furloughed employees who are not working, but collecting a paycheck. It creates a way to identify COVID-19 cases within the California workers’ compensation system and excludes the cases from the Experience Modification Rate (XMOD) calculation.

When asked about the amendments scheduled to take effect July 1, 2020, Margaret Hartmann, Senior Vice President and Chief Marketing Officer at Berkshire Hathaway Homestate Companies, California’s second largest workers’ compensation insurance carrier, said “Lara’s approval of the WCIRB [Workers’ Compensation Insurance Rating Bureau] proposal was not surprising. These are not unreasonable, at least from the perspective of ratemaking and predicting future experience of employers once COVID passes.”

Bryan Anderson, Senior Vice President at The Zenith explained the WCIRB’s amendments to the California Unit Statistical Reporting Plan and XMOD calculation were “not likely to change under any normal circumstances but the Bureau made these recommendations to address the unique pandemic situation that California (and the world’s) businesses find themselves in."

Another industry leader Paul Zamora, ICW Group’s Senior Vice President for Workers’ Compensation Underwriting said, “We support Commissioner Lara’s decision to approve the recommended changes by the WCIRB. We believe the rule modifications accurately reflect changes in exposures created by COVID-19 and will provide the appropriate relief needed by California businesses.”

The changes were expected by California’s workers’ compensation insurance carriers as a mechanism to adjust employers’ insurance rates, since COVID-19 claims aren’t necessarily an indicator of a company’s safety record.

“Under normal situations,” Anderson explained, “workers’ compensation covers only those occupational illnesses that are created from the work environment. In this instance, that understanding changed with the Governor’s Executive Order requiring employers to accept compensability for Covid-19 claims unless they can prove they are not work-related.”

Hartmann added, “This is clear cost-shifting to the industry, which we expected. The combination of a broad WC presumption, possible additional legislation extending these presumptions past July 5th, excluding COVID from ratemaking and XMODs, means that the insurance industry will absorb the lion’s share of COVID costs that can be assigned to WC.”

Zamora points out “it’s imperative that business owners understand the rule changes and adopt new practices, particularly with respect to the record keeping criteria associated with two of the changes. By adopting new record keeping procedures to apply to the new rules, policyholders will have the necessary audit documentation to realize the full value of Commissioner Lara’s decision.”

This means employers should start documenting employees’ hours worked under each class code, now, and not wait until a final audit.

“Hopefully, these measures will play a small part in helping California employers as they try to recover from the devastating impacts of this pandemic,” Hartmann concluded.

“I think this solution is a testament to the strength and objectivity of the Bureau, the companies it represents and to the integrity of the Workers’ Compensation Industry in California,” said Anderson.

Gene Simpson, CompWest’s Vice President of Underwriting and Marketing, added, “To confront the challenges presented by the COVID-19 pandemic to California employers, regulatory authorities, insurance carriers and employers must work together on effective solutions.”

While the amendments should reduce workers’ compensation premium costs for California businesses in the short-term, only time will tell how lower revenues and higher costs due to COVID-19 claims will impact California’s workers’ compensation insurance premiums in the future.

For a greater understanding of these changes and how they will impact your company, please contact our team at (619) 937-0164.

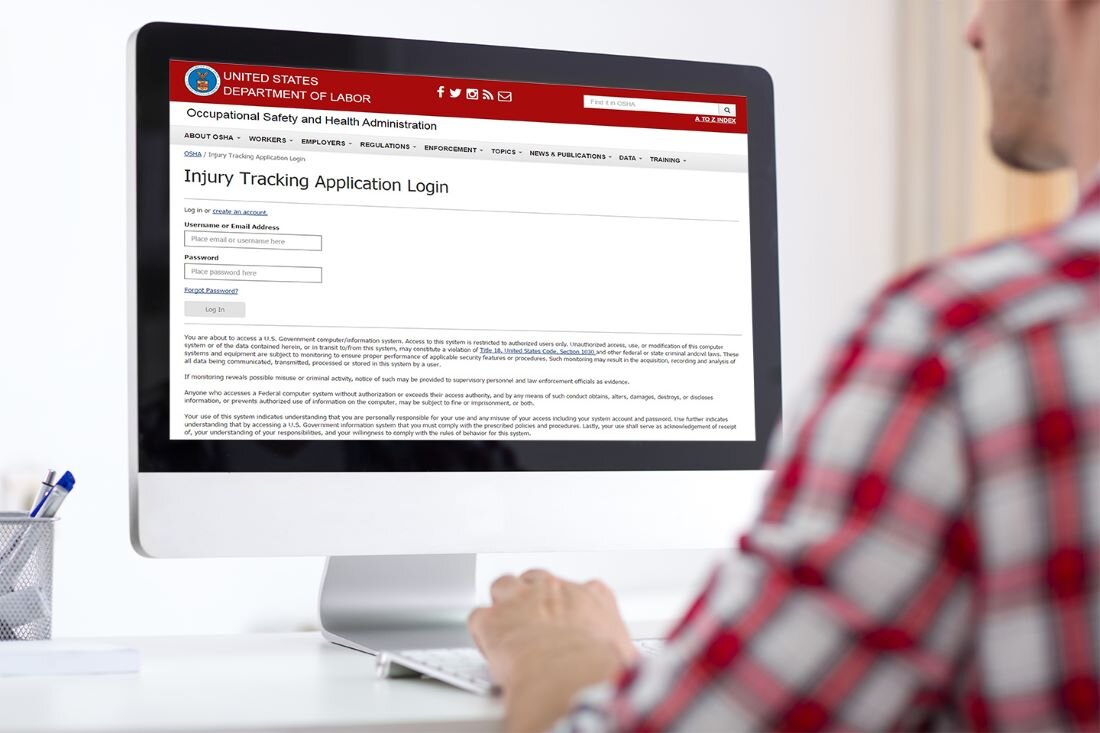

OSHA Recording Requirements for COVID-19 Cases

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

California’s Division of Occupational Safety and Health (better known as Cal/OSHA) has released information for employers on the subject and it appears they are using their existing criteria for determining the recordability of an employee COVID-19 case.

According to Cal/OSHA, “California employers that are required to record work-related fatalities, injuries and illnesses must record a work-related COVID-19 fatality or illness like any other illness.” To be recordable on the 300, 300A and 301 forms, the COVID-19 case must be work-related and result in one of the following:

Death.

Days away from work or transfer to another job.

Medical treatment beyond first aid.

Loss of consciousness.

A significant injury or illness diagnosed by a physician or other licensed health care professional.

The criteria that most employers may have a hard time determining is if the COVID-19 illness is actually work-related. Cal/OSHA addresses this in its Frequently Asked Questions webpage. First, the employer must determine if there was “an event or exposure in the work environment [that] either caused or contributed to” the COVID-19 case.

In order to determine if a case is work-related, employers should consider factors like:

The type and duration of contact the employee had at work with other people including co-workers and the general public.

With the implementation of physical distancing and other controls within the workplace, what is the likelihood of exposure?

Did the employee come in contact with anyone showing signs and symptoms of COVID-19, while working?

These considerations will help an employer determine whether or not the COVID-19 case is work-related and thus recordable. According to Cal/OSHA, it is best practices to err on the side of recordability when in doubt about how an employee was exposed to COVID-19.

If it is determined that an employee’s illness was work-related, yet, for a variety of reasons testing or the results from a test is unavailable and the employee has been determined to have COVID-19, “an employer must make a recordability determination” as to whether or not to record the case. While a positive COVID-19 test result would trigger recordability by the employer, a positive test is not always necessary to record the case in the OSHA logs.

Keep in mind, the above information is for OSHA recording of work-related COVID-19 cases only, which may be different from guidance for workers’ compensation claims.

Cal/OSHA states that “Governor Newsom’s Executive Order N-62-20 addresses eligibility for workers’ compensation benefits... The Order does not alter employers’ reporting and recording obligations under Cal/OSHA regulations.”

Rancho Mesa’s Risk Management Center offers employers the ability to track their COVID-19 cases electronically and generate the applicable OSHA 300, 300A and 301 forms along with an incident report and First Report of Jury (Form 5020).

To learn more about the Risk Management Center, contact our Clients Services Department at (619) 438-6869.

Commissioner Lara Approves WCIRB Proposed Amendments Addressing COVID-19

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follow…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follows:

New COVID-19 Rule: Clerical Office Employees

Part 3, Section III, General Classification Procedures, was amended to add Rule 7, Coronavirus Disease 2019 (COVID-19), to permit during a statewide California COVID-19 stay-at-home order the following: The division of an employee’s payroll between Classification 8810, Clerical Office Employees, and a non-standard exception classification when the employee’s work is exclusively clerical in nature and the non-standard exception classification does not include Clerical Office Employees. This amendment will conclude 60 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rule: Basis of Payroll

Part 4, Section IV, Exposure Information, Rule 1, Classification Code, and Rule 4, Exposure Amount, were amended to report payments excluded from remuneration pursuant to new Rule 7, Coronavirus Disease 2019 (COVID-19). Payments made to an employee while the employee is performing no duties of any kind in service of the employer are to be excluded from payroll when the payments are equal to or less than the employee’s regular rate of pay. This amendment will conclude 30 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rules: Claims Reporting

Part 4, Section V, Loss Information, Rule B, Loss Data Elements, Sub rule 4, Catastrophe Number, was amended to add Catastrophe Number 12 for the reporting of COVID-19 claims. Appendix III, Injury Description Codes, Section B, Nature of Injury (Positions 3-4), and Section C, Cause of Injury (Positions 5-6), were amended to add a Nature of Injury code and a Cause of Injury code for COVID-19 claims. This amendment includes claims with an accident date after December 1, 2019, reported on a Unit Statistical Report due on or after August 1, 2020, and reported with a Catastrophe Number 12.

Exclusion of COVID-19 Claims from Experience Modification

Section VI, Rating Procedure, Rule 2, Actual Losses and Actual Primary (Ap) Losses, was amended to specify that all claims directly arising from a diagnosis of Coronavirus Disease 2019 (COVID-19) shall not be reflected in the computation of an experience modification.

For a greater understanding of these changes and how they will impact your company please contact our team at (619) 937-0164.

Topics Your COVID-19 Training Should Cover

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As states begin to lift COVID-19 restrictions and move into later phases of reopening plans, and companies begin to bring back their employees, it is important to take the necessary health and safety precautions in the workplace. Your staff should be well informed about safety precautions and resources to keep one another safe. When choosing a COVID-19 employee training, make sure it is comprehensive and includes all the necessary topics recommended by local, state and federal agencies.

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As states begin to lift COVID-19 restrictions and move into later phases of reopening plans, and companies begin to bring back their employees, it is important to take the necessary health and safety precautions in the workplace. Your staff should be well informed about safety precautions and resources to keep one another safe. When choosing a COVID-19 employee training, make sure it is comprehensive and includes all the necessary topics recommended by local, state and federal agencies.

The Risk Management Center offers a 10-15 minute training designed to ensure compliance with COVID-19 safety guidelines. This general awareness course on COVID-19 covers tips on how to reduce the risk of contracting the virus by using best practices. In addition, the course covers COVID-19 characteristics and related health and safety concerns.

The COVID-19 General Awareness Online Training topics include:

COVID-19 Characteristics

CDC-Recommended Basic Precautions

Tips for Limiting Exposure

Proper Hand Washing

Social Distancing

Personal Protective Equipment (PPE)

Cross Contamination

Employer Responsibilities

Employee Temperature Checks

Face Masks

Importance of proper disinfecting and sanitation

Recommended Chemicals

What to Clean and Disinfect

Working-from-Home Ergonomics

Federal Assistance for COVID-19 Related Leave

Families First Coronavirus Response Act (FFCRA)

Paid Sick Leave

Family and Medical Leave Act (FMLA)

This online training is offered for free to Rancho Mesa clients. Contact the Client Services department at (619) 438-6869 to learn more about the COVID-19 General Awareness training.

For up-to-date COVID-19 information and HR resources please visit Rancho Mesa’s COVID-19 Information Page.

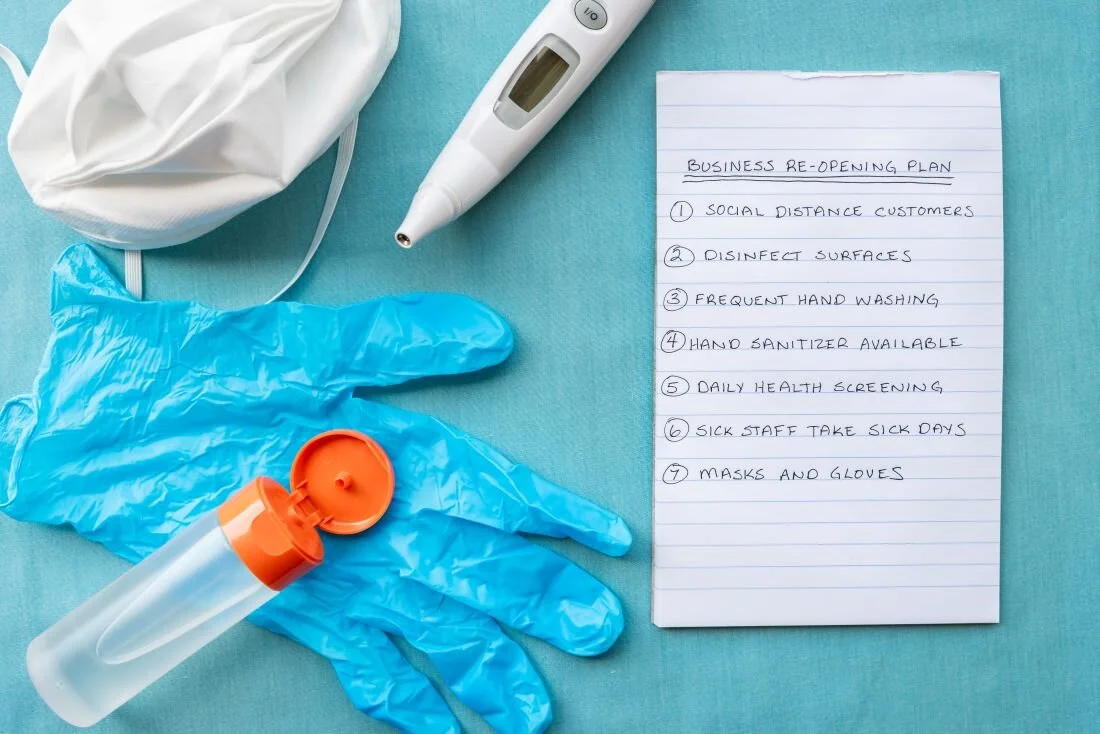

Critical Elements of a COVID-19 Safety Plan

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

The Centers for Disease Control and Prevention (CDC) recommends having a written COVID-19 Safety Plan in place. Check with your local city or county for specific Safety Plan (aka Safe Reopening Plan) requirements. A well implemented plan will assist in keeping its employees and the public safe. A Safety Plan should have three critical elements; purpose, responsibilities, and safety procedures. Below is a brief explanation of these three critical elements:

Purpose: A safety plan should provide the purpose for why it is in place.

What is Covid-19? Explain the effects of the virus and how it can spread to others.

Control Measures: Train personnel on ways of minimizing exposure of Covid-19.

Personal Protective Equipment: Maintaining recommended supplies, such as respirators, eye protection, gloves, and hand sanitizer.

Compliance: Making sure your business is in compliance with local, State, and Federal emergency response and health agencies.

Responsibilities: A Safety Plan should also provide specific responsibilities for management and staff, such as:

Training and informing all on safety procedures relating to COVID-19.

Implementing a plan across all personnel.

Monitoring the application of the plan.

Safety Procedures: A Safety Plan should have mandatory procedures in place that all personnel are trained on and are strictly adhered. A few examples include:

Practicing good hygiene.

Stop handshaking, use noncontact methods of greeting.

Guidelines on how to properly disinfect surfaces like doorknobs, tables, desks, and handrails.

Creating a COVID-19 Safety Plan which explains its purpose, the responsibilities of all personnel, and safety procedures will go a long way in minimizing COVID-19 exposure. It will also have a positive effect on employee and public moral as it shows you are doing your part to stop the spread of the virus.

As your business designs a formal COVID-19 Safety Plan, Rancho Mesa can assist you with a plethora of related safety resources available in both English and Spanish. Visit www.ranchomes.com/covid-19 for a list of available resources.

Resources:

COVID-19 Safety Plan/Return-to-Work Plan Resources

San Diego County Safe Reopening Plan Template

Imperial County Sample Agency COVID-19 Response Plan (4.27.20)

Riverside County Safe Reopening Guidelines 05212020

Aerial Lift Best Practices

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Aerial lifts have become extremely popular over the past few years in the arboriculture industry. An aerial lift is an ideal way to reach higher trees safely and securely. They can also make potentially hazardous tree removal safer and more efficient. This equipment requires extensive training to operate responsibly, and the lack of this training has led to an increase in accidents and injuries with aerial lift devices.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Aerial lifts have become extremely popular over the past few years in the arboriculture industry. An aerial lift is an ideal way to reach higher trees safely and securely. They can also make potentially hazardous tree removal safer and more efficient. This equipment requires extensive training to operate responsibly, and the lack of this training has led to an increase in accidents and injuries with aerial lift devices. According to OSHA, between 2009 and 2013 there were 47 aerial lift operator fatalities among the tree care industry in the US. To make for a safer operation, here are a few suggestions and reminders about Best Practices for working with aerial lifts:

Inspect the Lift

Visual inspections ensure that lifts remain functional and safe, while often saving potentially hours of maintenance and future medical bills. Conducting the visual inspection should include a close eye on hydraulic leaks, cracks, loose bolts, and worn or discolored hoses. It’s important to remember to always be cautious and not use your hands or any body parts to check for hydraulic-fluid leaks - always use a piece of cardboard or wood. When hydraulic fluid is under pressure, it can penetrate deep into skin and poison flesh, causing disastrous injuries. Never stick your hand around a fitting or hose to feel for a leak.

Function Testing and Drift Testing

Before climbing into the bucket, lift operators should check the lower controls and run the lift through a full range of motion. These controls are critical as they could very well come into use while rescuing a lift operator from the bucket in an emergency situation.

After the lower controls have been tested, a drift test should also be performed to make sure there are no issues with the hydraulics. To test for drift, set a traffic cone off to the side of the lift and move the bucket over the top of the cone, leaving a few inches in between. Turn the truck off and wait five minutes to make sure the boom doesn't drift down and touch the cone. If it does drift, take the truck out of service until it can be repaired.

Suiting Up

It is now time to put on your fall-protection harness. Make sure your harness fits properly and has a dorsal attachment. Once your harness is on, attach your fall restraint system to the harness and then to the life support attachment on the lift. It is virtually impossible to fall out of an aerial lift device if you wear proper fall protection and make sure it’s attached to the lift, every time.

When used correctly, aerial lifts can be effective and efficient tools for Arborists. When properly set up and tested, they can move easily on the jobsite and provide safe access in hard to reach areas. Their design allows for mobility and flexibility which can increase the crew’s safety, production and profitability.

Rancho Mesa’s Risk Management Center offers training materials covering aerial lifts, elevated work platforms and fall protection as online courses, tailgate talks and posters, as well as sample evaluation forms and policies. For additional information on the use of aerial lifts or other Best Practice safety measures for the arborist industry, please reach out to me, Rory Anderson at randerson@ranchomesa.com and learn more about our TreeOne Program.

Special COVID-19 Workers' Compensation Filing and Executive Order Imminent

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would:

Exclude COVID-19 claims from the experience rating formula.

Exclude from premium calculations payroll paid to employees who are continuing to be paid while not working.

Allow the assignment of Classification 8810 on a temporary basis to employees who are now working from home whose temporary duties meet the definition of a clerical office employee.

Each of these changes will have their own nuances and it remains to be seen how exactly their implementation, auditing and tracking will be put into practice.

Separately, but equally important, Governor Newsom is considering an executive order that would create a “conclusive presumption” that COVID-19 illnesses and deaths sustained by “essential workers” are work related and therefore covered under workers’ compensation policies. The potential scope and impact of the order are not yet known, but on April 20, 2020, the WCIRB released a projection that the annual cost of COVID-19 claims on “essential critical infrastructure” workers, under a conclusive presumption, ranges from $2.2 billion to $33.6 billion.

These decisions, should they be implemented, will create significant disruption in the workers’ compensation marketplace and to all insurable businesses in California. As these decisions are rendered, Rancho Mesa will continue to provide resources and implementation strategies to help businesses adjust through these uncertain times. If you have questions or want to discuss this in greater detail please reach out to your broker or account manager.

How COVID-19 Might Create a Non-Owned Auto Liability Gap

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

As landscape businesses continue to adapt operating protocol due to COVID – 19, they may also be creating new risk. Newly formed “work from home” policies for the office staff and direct reporting to job sites for workers in the field can create more of a non-owned auto liability exposure.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

As landscape businesses continue to adapt operating protocol due to COVID-19, they may also be creating new risk. Newly formed “work from home” policies for the office staff and direct reporting to job sites for workers in the field can create more of a non-owned auto liability exposure.

In the event someone is using their personal vehicle for the benefit of the company and were to be involved in an accident, the liability might fall partially or completely on the employer. A non-owned vehicle is not owned, leased, rented, hired, or borrowed by the company.

In order to ensure you have non-owned auto liability, you would want to confirm that you have symbol 9 under the liability portion of your Commercial Auto Insurance Liability Policy, found in the declarations page. You should confirm that you have non-owned liability coverage with your insurance agent, broker, or carrier.

Your company should establish driver qualification requirements that must be maintained and met for each driver. It is best practices that you run motor vehicle reports annually, at minimum, for all drivers including those with non-owned driving exposure. For those states where it’s available, contact the Department of Motor Vehicles and inquire about a Pull Program where they’ll notify you of any violation on any driver that you have set up in the program. It is also best practices to have those employees who drive non-owned company vehicles for business use to increase their personal auto policy limits at minimum to $100,000 per person, $300,000 per occurrence and $100,000 property damage. If using a combined single limit, $300,000 should be required at minimum.

Manage Your COVID-19 Risk With These Tools

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

While most of the country is under shelter-in-place orders, many of our clients work in essential industries that must continue to provide vital services to the community. Therefore, it is imperative that they have the tools they need to keep their employees safe.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

While most of the country is under shelter-in-place orders, many of our clients work in essential industries that must continue to provide vital services to the community. Therefore, it is imperative that they have the tools they need to keep their employees safe.

For those who must continue to operate, we’ve complied resources employers can use to implement COVID-19-specific written safety programs, provide employee training, and signage that can be posted in the workplace. Many of these resources are available in both English and Spanish.

Our goal is to provide the tools our clients’ needs to protect their employees.

Program Administration

Our risk management and safety partners have developed templates that employers can use, today.

COVID-19 Guide (English/Spanish)

This document should be reviewed by ownership and management for clarification on how to implement the COVID-19 Written Program.COVID-19 Guide Amendment A: Employee Has Tested Positive for COVID-19, Now What?

Amendment A provides instructions on what to do if your employee tests positive for the COVID-19 virus.

COVID-19 Health Screening Form (English/Spanish)

Each employee, should complete this form daily before performing any work. Foremen and supervisors should send these completed forms to management for record keeping purposes.COVID-19 Written Program (English/Spanish)

This program should be reviewed by all employees including ownership, management and workers in the field.COVID-19 Written Program Acknowledgement Form (English/Spanish)

All staff members must acknowledge they have read and understand the new program by signing the acknowledgement form.COVID-19 Checklist for Management (English/Spanish)

This checklist should be used daily for management to evaluate safety within the office for employees and identify any areas of concern.COVID-19 Checklist for Jobsites (English/Spanish)

This checklist should be used daily by foreman to evaluate the safety within the jobsite for employees and identify any areas of concern.COVID-19 Site-Specific Safety Plan

This site-specific safety plan may be required by a general contractor or site owner. It is a template employers can use to develop COVID-19 safety plans for specific jobsites where employees are working.

Training Staff

We have complied training that teach staff how to prevent the spread of the COVID-19 virus in the workplace through proper hygiene.

COVID-19 How to Prevent Catching & Spreading Coronavirus (English/Spanish)

Coronavirus and Workplace Hygiene (English/Spanish)

Safety Signage

In addition to proper training, signage is another way to remind employees of proper ways to prevent the spread of the COVID-19 virus within the workplace and among their co-workers.

CDC – Don’t’ Spread Germs at Work (English/Spanish)

CDC – Handwashing Sign (English/Spanish)

CDC – Handwashing: A Corporate Activity

COVID-19 – Do Not Enter If You Have Symptoms

COVID-19 – Eliminate the Spread Workday Flowchart

COVID-19 – How in infects and Spreads

COVID-19 – Prevention Practices – Why is soap better?

COVID-19 – Wash Hands Upon Entry Sign

To access these resources, login to the Risk Management Center and type in “COVID-19” or “Coronavirus” into the search box. If you already have an account but do not remember your login information, click the “Forgot Username or Password” link on the login screen.

We’ll continue to provide COVID-19 resources as they become available. Please visit www.ranchomesa.com/covid-19 for human resources content, insurance carrier statements and more.

3 Reasons Your Pre-Renewal Meeting Is the Key to Your Success

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

Business leaders across the country head into each year with questions regarding the upcoming business insurance renewal process. Owners and officers alike rely on their insurance broker to help them navigate these uncertainties. What should a best practice renewal process look like?

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

Business leaders across the country head into each year with questions regarding the upcoming business insurance renewal process. Owners and officers alike rely on their insurance broker to help them navigate these uncertainties. Why should owners and officers expect a pre-renewal meeting?

Discuss important changes to your business

Between 120 and 90 days prior to the insurance renewal, expect your broker to produce a renewal packet designed to facilitate a face-to-face conversation. This important exchange is the perfect setting to update insurance applications, discuss additional coverages and explore any changes to the business. Without this crucial meeting, changes within your business may not be reflected in the documentation presented to the insurance carrier. And, that can be costly.

“When I met with Rancho Mesa three months prior to our insurance renewal, we game-planned a strategy to address a changing market as well as potential new programs and exposures,” comments Florence Andres, Director of Human Resources for North County Lifeline. “I feel comfortable that our broker strives to understand our business and mission. Every year, important decisions are made and questions are answered.”

Create a target premium and renewal strategy

In addition to application updates, it’s important to discuss a detailed review of losses, the current carrier’s performance and changes in the marketplace that will affect the renewal terms. During this meeting, the two parties agree on a proactive plan to approach the marketplace, target the renewal pricing and agree to a meeting 3 to 4 weeks prior to the renewal date to insure no last minute surprises.

How is this possible? By using industry benchmarking like Rancho Mesa’s StatTrac™ program, we are able to compare our client’s performance to their industry peer group.

“Benchmarking a client’s claims performance over five years provides important insight,” reflects Dave Garcia, Rancho Mesa’s President. “In addition to helping us set aggressive renewal pricing objectives, it also assists us in discovering underlining trends and root causes that help us create the appropriate service plan moving forward to correct those areas of need.”

Prepare for the hardening market

As we enter into a hardening property and casualty insurance market with the potential for escalating premiums, the need for a formal renewal meeting, done well in advance of the policy expiration date, should be expected by all business owners and officers. With the marketplace leading to increasing rates, higher retentions, and lower limit options, leaving an underwriter’s interpretation to chance is not an option. Your broker must paint an accurate picture of your company for the underwriter in a way that justifies the appropriate pricing.

If you have questions about the hardening insurance market or wish to learn more about Rancho Mesa and our “Above and Beyond” approach to customer satisfaction, please call me at (619)937-0175 or sbrown@ranchomesa.com.

What Employers Need to Know Before a Serious Injury Occurs in the Workplace

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Timely reporting of an employee’s work-related serious injury, illness or death can pose a challenge to the employer. As of January 1, 2020, these incidents (including any hospitalizations, unless the injured worker is admitted for medical observation or diagnostic testing) must be reported immediately to Cal/OSHA. Immediately means as soon as practically possible but not longer than 8 hours after the employer knows or, with diligent inquiry, would have known of the serious injury, illness or death.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Timely reporting of an employee’s work-related serious injury, illness or death can pose a challenge to the employer. As of January 1, 2020, these incidents (including any hospitalizations, unless the injured worker is admitted for medical observation or diagnostic testing) must be reported immediately to Cal/OSHA. Immediately means as soon as practically possible but not longer than 8 hours after the employer knows or, with diligent inquiry, would have known of the serious injury, illness or death.

Monitoring the employee’s status at a hospital can be difficult if the employer has not put in place procedures and policies that will authorize a healthcare provider to disclose information that is covered by the Health Insurance Portability and Accountability Act (HIPAA). For example, the employer must follow-up with the hospital providing care to the injured employee to determine if the incident must be reported to Cal/OSHA. The employer will need to know if the employee has been moved from the emergency room and admitted to the hospital for in-patient treatment.

Ensuring policies and procedures are developed and implemented to restrict the use and disclosure of protected health information (PHI), are important elements of HIPAA compliance. If health information is used for purposes not permitted by the HIPAA Privacy Rule, or is deliberately disclosed to individuals not authorized to receive the information, there are possible penalties for the covered entity or individual responsible.

HIPAA permits PHI to be used for healthcare operations, treatment purposes, and in connection with payment for healthcare services. It can be argued that employers need this information to comply with State and Federal OSHA laws. Information may be disclosed to third parties for said purposes, provided an appropriate relationship exists between the disclosing covered entity (i.e., the hospital) and the recipient’s covered entity or business associate (i.e., the employee or employer). A covered entity can only share PHI with another covered entity if the recipient had previously or currently has a treatment relationship with the patient. The PHI has to relate to that relationship. In the case of a disclosure to a business associate, a Business Associate Agreement must have been obtained. Disclosures must be restricted to the minimum necessary information that will allow the recipient to accomplish the intended purpose of use.

Prior to any use or disclosure of health information that is not expressly permitted by the HIPAA Privacy Rule, one of two steps must be taken:

A HIPAA authorization must be obtained from a patient, in writing, permitting the covered entity or business associate to use the data for a specific purpose not otherwise permitted under HIPAA.

The health information must be stripped of all information that allows a patient to be identified.

Employers may consider obtaining signed business associate agreements or HIPAA authorizations from their employees before any injury or accident occurs. This will ensure they are able to get the appropriate protected medical information from the hospitals so they can report “serious injury or illness” accurately and timely to Cal/OSHA.

Therefore, it is extremely important for employers to learn the existing laws and new changes to these laws and have a plan of action in place to address these concerns before the next serious injury, illness, or death occurs.

Currently, reporting to Cal/OSHA can be made by telephone or e-mail. With these reporting changes, Cal/OSHA has also been directed to establish an on-line mechanism for reporting these injuries. It is always important to document when these incidents are reported to Cal/OSHA. Until an online mechanism is established, use of e-mail would be such method for documentation. Monitoring of the Cal/OSHA website for implementation of the on-line mechanism of reporting is also suggested.

For more information on how to report serious injuries and illnesses to Cal/OSHA, please reference “Cal/OSHA Updates: AB 1804 Changes How Injuries and Illnesses Are Reported.”

For more information about what is considered a serious injury or illness under Cal/OSHA, please reference “Cal/OSHA Updates: AB 1805 Changes Definition of Serious Injury or Illness.”

Strategies Employers Can Use to Combat the Coronavirus

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

According to the U.S. Center for Disease Control and Prevention (CDC), there is no evidence of widespread transmissions of COVID-19 (commonly known as Coronavirus) in the United States, at this time. But, business owners should ask themselves, would my company be prepared in the event of an outbreak? Employers should be ready to implement strategies to protect their workforce while ensuring some semblance of business operations. The CDC has recommended the following strategies that employers can use, today.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

According to the U.S. Center for Disease Control and Prevention (CDC) there is no evidence of widespread transmissions of COVID-19 (commonly known as Coronavirus) in the United States, at this time. For the general American public, such as workers in non-healthcare settings, where it is unlikely that work tasks create an increased risk of exposure to COVID-19, the immediate health risk from the virus is considered low. Business owners should ask themselves, would my company be prepared in the event of an outbreak? The CDC recommends creating an Infectious Disease Outbreak Response Plan.

Employers should be ready to implement strategies to protect their workforce in the event of an outbreak of COVID-19 while ensuring some semblance of business operations. The CDC has recommended the following strategies that employers can use, today.

Actively encourage sick employees to stay home.

Employees who have symptoms of acute respiratory illness are recommended to stay home and not come back to work until they are free of a fever (100.4° or greater) without the use of fever reducing medicines. Employees should notify their supervisor and stay home if they are sick.

Ensure that your sick leave policies are flexible and consistent with public health guidelines and that employees are aware of these policies.

If your business utilizes contract of temporary employees, make sure the company you work with implements the same strategies as your business and recommends sick employees stay home.

Separate sick employees:

The CDC recommends that employees who appear to have acute respiratory illness symptoms (i.e. cough, shortness of breath) upon arrival to work or become sick during the day should be separated from other employees and be sent home immediately. Sick employees should cover their noses and mouths with a tissue when coughing or sneezing.

Emphasize staying home when sick, respiratory etiquette and hand hygiene by all employees:

Place posters that encourage staying home when sick, cough and sneezing etiquette, and hand hygiene at the entrance to your workplace and in other workplace areas where they are likely seen.

Provide tissue and no-touch disposal receptacles for use by employees.

Provide and encourage the use of alcohol-based hand sanitizer that contains at least 60-95% alcohol, or wash hands with soap and water for at least 20 seconds.

Perform routine environmental cleaning:

Routinely clean all frequently touched surfaces in the workplace, such as workstations, countertops, and doorknobs.

Provide disposable wipes so that commonly used surfaces can be wiped down by employees before each use.

Advise employees before traveling to take certain precautions:

Check the CDC’s Traveler’s Health Notices for the latest guidelines and recommendations for each country to which you will travel.

Advise employees to check themselves for symptoms of acute respiratory illness before starting travel and notify their supervisor and stay home, if they are sick.

Ensure employees who become sick while traveling or on temporary assignment understand that they should notify their supervisor and promptly call a healthcare provider for advice, if needed.

Additional measures in response to currently occurring sporadic importations of the COVID-19:

Employees who are well but who have a sick family member at home with COVID-19 should notify their supervisor and refer to CDC guidance for how to conduct a risk assessment of their potential exposure.

If an employee is confirmed to have the COVID-19 infection, employers should notify fellow employees of their possible exposure to COVID-19 in the workplace but maintain confidentiality as required by the Americans with Disabilities Act (ADA). Employees exposed to a co-worker with confirmed COVID-19 should refer to CDC guidance for how to conduct a risk assessment of their potential exposure.

Engage state and local health departments to confirm channels of communication and methods for dissemination of local outbreak information.

It is extremely important for business owners to know what they can do to minimize the spread of an infectious disease. It is equally as important to be prepared for an outbreak (whether it’s COVID-19 or any other potential infectious disease). Having an Infectious Disease Outbreak Response Plan can guide a business during these trying times. Rancho Mesa Insurance’s RM365 HR Advantage™ online portal offers instructions on “How to Handle an Infectious Disease Outbreak.” If you have any questions relating to this subject matter please feel free to reach out to Rancho Mesa Insurance.

Don’t Trim Down Your Safety Procedures

Author, Rory Anderson, Account Executive, Landscape Group, Rancho Mesa Insurance Services, Inc.

Trees require regular maintenance to ensure their health and safety. Dead or diseased trees must be cut down in order to prevent injuries to people or damage to nearby structures. Maintaining trees through trimming is a dangerous task, even for experienced professionals. Unfortunately, accidents do occur. The three most common types of serious accidents experienced by tree trimmers are…

Author, Rory Anderson, Account Executive, Landscape Group, Rancho Mesa Insurance Services, Inc.

Trees require regular maintenance to ensure their health and safety. Dead or diseased trees must be cut down in order to prevent injuries to people or damage to nearby structures. Maintaining trees through trimming is a dangerous task, even for experienced professionals. Unfortunately, accidents do occur. The three most common types of serious accidents experienced by tree trimmers are falls, electrocution, and being struck by falling objects.

Falls

Falls are a common accident for tree trimmers. They can occur by slipping off of a ladder, falling from a roof, or falling out of a tree. The typical fall victim is unsecured or not properly secured. Using proper personal protective equipment is essential in preventing falls.

Electrocution

The risk of electrocution is very high when working around power lines. Some trees are planted near overhead power lines and there is a risk of electrocution to anyone trimming branches. The worker may accidentally touch the wires, or a falling branch could knock down the wires resulting in a tree trimmer touching the lines. The most common type of victim violates minimum approach distances and makes contact with the power lines through a conductive tool/object such as pruning shears. Training employees on minimum approach distances and proper trimming techniques when working around power lines can help prevent electrocution.

Falling Objects

According to the Centers for Disease Control, being struck by a falling object is the most reported tree trimming accident. A falling object is typically an entire tree or its branches/limbs, but it could also be loose equipment like a chain saw. Most victims are struck by a tree or tree limb after it falls in an unexpected direction; however, careless accidents do occur in specified drop zones. Communication between employees in the tree and on the ground is imperative to ensure the safety of all.

Tree trimming professionals face dangerous hazards on a daily basis and it is extremely important to take precautionary safety measures to make sure that they are doing everything they can to reduce risk. Safety training materials for tree trimmers are available through the Risk Management Center.

For information about Rancho Mesa's TreeOne™ program, contact Rory Anderson at (619) 937-0164.

Managing the Inherent Risks of Personal Vehicle Use Within Your Company

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While costs associated with auto liability continue rising across the country, there are risks within existing fleet safety programs that often get overlooked. If your business allows employees to use personal vehicles to conduct business even just occasionally, you could be exposing your firm to considerably more risk.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While costs associated with auto liability continue rising across the country, there are risks within existing fleet safety programs that often get overlooked. If your business allows employees to use personal vehicles to conduct business, even just occasionally, you could be exposing your firm to considerably more risk. You can ignore this potential gap in coverage or closely examine the exposure while simultaneously developing a risk mitigation plan.

Review and Examine Liability Coverage

Before developing any guidelines, we encourage clients to identify those drivers that are using personal vehicles. Again, the pool here should include regular and non-regular drivers who are using personal vehicles. Once that list is finalized, request current declaration pages and/or certificates of insurance showing coverage periods and limits. As you examine this information, ensure that coverage is in force and pay close attention to the limits as many state minimum coverage requirements will be much lower than typical commercial auto policy limits (Example: $10,000 to $15,000 for bodily injury). Working to develop company standard minimum limits for personal use of vehicles is something you can establish with and through recommendations from your broker partner and carrier.

Hiring with Auto Exposure in Mind

Just as many managers do when hiring employees who will drive company vehicles, consider requiring the same guidelines for potential new hires who may use their own vehicles. These guidelines may include a current Motor Vehicle Report (MVR) which allows you to review accidents and track behavior. You may also enroll drivers in the Employer Pull Notice (EPN) Program which notifies businesses when employees have any type of driving activity in or out of the workplace. Lastly, be prepared with documented steps to take when your drivers exhibit unsafe driving behavior. This can include additional training, a suspension, or even termination depending on the frequency.

Written Expectations and Usage Guidelines for Drivers

Vehicle use agreements have become commonly used documents for employers. Depending on the layout, usage guidelines can help establish clear expectations and encourage real buy-in from the employee. As a reference point, Rancho Mesa offers an example of a usage guideline form available within the Risk Management Center.

Creating and Maintaining a Culture of Safety

Evaluating your respective safety programs is a process that takes time. Many employers are unfamiliar where to even start and perhaps which areas of their operation pose the greatest risk to their business’ financial health. With auto liability, in general, the potential for direct loss can impact balance sheets of all sizes. Part of our role as commercial insurance brokers is tying in years of experience seeing these gaps within programs, like personal vehicle use. We recommend first how to mitigate them and then tailor an insurance program that further reduces or eliminates the exposure. The points listed above represent only the start to your process in revamping your Fleet Safety Program. Call or email Rancho Mesa Insurance for a complete “all lines” safety review and coverage audit. Your company’s financial future could depend on it.

Have You Brushed Up on Your ABC’s?

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

California Assembly Bill 5 (AB 5), better known as the “Gig Worker’s Bill” became law on January 1st 2020 and is designed to reclassify many independent contractors as employees for purposes of wages and benefits. What does this bill mean and how does it affect you?

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

California Assembly Bill 5 (AB 5), better known as the “Gig Worker’s Bill” became law on January 1, 2020 and is designed to reclassify many independent contractors as employees for purposes of wages and benefits. What does this bill mean and how does it affect you??

Previously, employers used the “Borello test” to identify someone as either an independent contractor or employee. In most cases, AB 5 changes the standards to the new “ABC test,” which makes it much more challenging for a person to be classified as an independent contractor. Both the Borello test and the new ABC test assume that the worker is an employee and the employer must prove that the worker is actually an independent contractor.

According to the new law, “a person providing labor or services for remuneration shall be considered an employee rather than an independent contractor unless the hiring entity demonstrates that all of the following conditions are satisfied:

(A) The person is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

(B) The person performs work that is outside the usual course of the hiring entity’s business.

(C) The person is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.”

If you have hired an independent contractor who does not pass the ABC test, they likely will now be classified as an employee with minimum wage, unemployment insurance, sick leave, and income tax and social security withholdings. Independent contractors are not entitled to these benefits.

Doctors, lawyers, hair stylists, and insurance agents are just some of the more common independent contractor jobs that are not affected by AB 5. At this time, independent contractors such as architects and engineers are exempt from the ABC Test, but truck owner-operators, surveyors, and geologists are not exempt. In January 2022, contractors will not be able to hire owner-operators truck drivers. They will have to work with a company that has drivers who are employees.

AB 5 is intended to reduce the misclassification of workers and bring equality to the workplace. Although the bill has good intentions, it could negatively affect the way many companies operate. The ABC test has strict guidelines to be considered an independent contractor. With the reins tightening, it will be difficult for companies to enlist independent contractors to supplement their workforce when needed. Employers will be forced to hire actual employees or hold off on hiring employees all together.

For specific questions about AB 5 and how it will affect your business, contact our HR Experts via the RM365 HRAdvantage™ portal.

Skilled Labor Shortages Prompt Subcontractors to Provide Performance Guaranty

Author, Andy Roberts, Account Executive, Surety Division, Rancho Mesa Insurance Services, Inc.

The construction industry is currently booming. According to a survey conducted by the AGC of America, and a recent article written by Rancho Mesa’s Kevin Howard, the industry shows no signs of slowing down, as 80% of contractors predict growth in 2020. While that’s great news for the industry, we are starting to see some trends that can cause some issues for contractors.

Author, Andy Roberts, Account Executive, Surety Division, Rancho Mesa Insurance Services, Inc.

The construction industry is currently booming. According to a survey conducted by the AGC of America, and a recent article written by Rancho Mesa’s Kevin Howard, the industry shows no signs of slowing down, as 80% of contractors predict growth in 2020. While that’s great news for the industry, we are starting to see some trends that can cause some issues for contractors.

With an abundance of work, contractors are finding it more difficult to find the skilled labors required to complete a project on schedule. This is causing more and more general contractors, who historically didn’t require their subcontractors to provide a bond, to now require their subcontractors to bond back to them on contracts over a certain amount.

Bonding back is when a general contractor requires a subcontractor to obtain a performance and payment bond, even though the general contractor is already carrying a bond for the entire project. The bonds from the subcontractor operate in the same way as the bonds that the general contractor provided to the project owner, but now the general contractor has a performance guaranty from the subcontractor. This gives the general contractor an avenue to pursue recourse, should the subcontractor default or fail to perform up to the standards required by the contract, which is something that can happen if the subcontractor is having issues finding enough skilled labor.

Furthermore, this can present a problem for subcontractors who aren’t accustomed to bonding. They would need to get a bonding program put into place in order to work with a general contractor that they may have a long relationship with, who they previously never required a bond back. This makes it very important for subcontractors to have the discussion with the general contractor about potential bond requirements. An upfront conversation with the general contractor can help you avoid getting into a situation where you win a bid, but don’t have the ability to meet the bond requirement.

Fortunately, for contractors that are new to bonds or maybe don’t bond frequently, there are a variety of programs that the different sureties offer, whether it be credit-based, or a more traditional program. We can help navigate those programs and find the solution that works best for their company’s bonding needs.

If you have additional questions or would like to explore all the different options that each surety offers, please contact Andy Roberts at (619) 937-0166.