Industry News

Implementing Technology and Other Safety Tactics to Protect Your Fleet

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

One of the most important practices for any landscape professional is fleet safety. Whether you have 10 trucks or 100, the exposure and risk remain the same. Explore a prior podcast episode, Episode #251, in which I delve into compelling statistics that shed light on the increasing frequency and severity of auto accidents each year.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

One of the most important practices for any landscape professional is fleet safety. Whether you have 10 trucks or 100, the exposure and risk remain the same. Explore a prior podcast episode, Episode #251, in which I delve into compelling statistics that shed light on the increasing frequency and severity of auto accidents each year.

Here are a few ways landscape professionals can improve their fleet safety:

1. GPS/Telematics Systems

A written fleet safety program is a must have for every organization, but how can you take that a step further? Some landscape professionals are turning to technology and installing GPS tracking systems in all of their trucks. These systems have the capabilities of tracking speeding, hard breaking, sharp turning, proper seat belt usage and other metrics. Not to mention, if a truck were ever stolen, they have the capabilities to track down and locate the stolen vehicle.

I was at the National Association of Landscape Professionals’ (NALP) ELEVATE conference a few weeks back in Dallas and spoke with a landscaper who uses GPS on their trucks. I asked how they use the data that is collected. Their response was that each month they sit down and look at the data. They identify any glaring issues and work to get them resolved. For example, if a certain driver has been tracked speeding multiple times, they will sit that driver down and explain the importance of not speeding. They may even have them do a specific driver training course to help that individual become a better driver. Having GPS is a great start to improving fleet safety, but actually using the data collected and being proactive with that data is what the elite landscape company do.

2. Regular routine maintenance checks on vehicles

GPS tracks a vehicle while it’s driven, but what can be done before the vehicle even hits the road to help prevent accidents? Routinely checking vehicles and performing maintenance on them can really have a impact on fleet safety. For example, regularly checking tire pressure, making sure oil changes are up to date, inspecting the brakes and monitoring tire wear are a few things that every landscape company should do to keep their vehicles running in tip top condition.

3. Company Roll Out Procedure

Implementing a mandatory company roll-out check can have a significant impact. I have actually seen a few of these performed in person and it’s impressive. As the trucks leave the yard to head out for the day’s work, the driver signals both blinkers, flashes the headlights, cleans the windshield and mirrors, and performs a small brake check, all the while, an inspector is outside making sure all signals are working before the truck heads out.

Finally, if a trailer is being used, check to make sure the trailer is properly hitched and the equipment in the trailer is tied down or stored securely. Taking time and performing these checks will certainly help prevent auto accidents in the future.

If you would like more information on putting together or updating your Fleet Safety program, reach out to me at ggarcia@ranchomesa.com or (619) 438-6905.

Pure Premium Increase for Landscape (0042) in Consecutive Years

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

When my baseball career ended in 2021, it was time for me to do something new with my life. For me the decision was easy and one that I am very grateful for. My dad, Dave Garcia started Rancho Mesa 25 years ago and throughout the years he and many others have contributed into what Rancho Mesa is today, a 16-time National Best Practices Agency. I was fortunate enough to get an opportunity to join such an amazing organization.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

In September 2022, the Workers’ Compensation Insurance Rating Bureau (WCIRB) recommended a 9% increase in the pure premium rate for landscape class code 0042. Effective September of 2023, a 4% increase was recently approved, totaling 13% over the two-year span.

Pure Premium Rates arise from losses sustained and payroll submitted to the WCIRB from all workers’ compensation insurance companies. Per the California Department of Insurance (CDI), “Pure Premium Rates” are defined as “the cost of workers' compensation benefits and the expense to provide those benefits.” The WCIRB evaluates each individual class code and determines what the recommended rates will be for the upcoming year. This recommendation is made to the CDI who ultimately needs to reject or approve the recommendation. Once the pure premium rates are approved, each workers’ compensation insurance carrier will apply their individual least common multiple (LCM) which is an adjustment to the pure premium rate that takes into consideration business expenses and profit for the carrier, thus creating their individual base rates for each class code.

What does this all mean? The claim activity and claim cost as a whole have been increasing over the last two years for landscapes companies in California. This may signal the beginning of a hardening workers’ compensation market resulting in higher premium cost.

What can be done to help combat these potential increases in premium? An increased attention to safety practices to reduce claims, a robust return to work program to mitigate cost of existing claims, proactive claim management, and consistent, documented safety training are a few of the ways that will help a landscape business remain best in class.

Take control of your future costs and look to your existing risk management partners to help you accomplish your goals. For Rancho Mesa landscape clients, we do this through our customized and proprietary programs and tools, including:

Key Performance Indicator (KPI) for workers’ compensation

These pure premium changes will take place on workers’ compensation insurance renewals after September of this year. Don’t be caught by surprise or unprepared. We are here to help you proactively navigate through this. If you have any questions, want to learn more about our programs and tools, please feel free to reach out to me at ggarcia@ranchomesa.com or 619-438-6905.

California Insurance Commissioner Leaves Workers’ Comp Rates Flat

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Ricardo Lara released a statement that he is rejecting the Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommended 7.6% increase in the workers’ compensation pure premium rates as well as the add-on to cover COVID-19 claim costs. The Commissioner also rejected a more modest 2.8% increase recommended by the Department of Insurance’s actuaries and the 1.4% decrease recommended by an independent actuary for the public members of the Bureau’s governing committee.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Ricardo Lara released a statement that he is rejecting the Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommended 7.6% increase in the workers’ compensation pure premium rates as well as the add-on to cover COVID-19 claim costs. The Commissioner also rejected a more modest 2.8% increase recommended by the Department of Insurance’s actuaries and the 1.4% decrease recommended by an independent actuary for the public members of the Bureau’s governing committee.

Commissioner Lara’s decision was based on California’s still recovering economy. With businesses trying to recover to pre-pandemic levels and the uncertainty still of COVID-19 disruptions, the Commissioner decided to keep the benchmark rate of $1.45 per $100 of payroll. Keep in mind that the pure premium rate is only advisory as the Commissioner does not have rate setting authority over workers’ compensation rates. In fact, the rate level of $1.45 is actually 18% lower than the industry filed average pure premium rate of $1.77 as of January 1, 2022.

“We’re working hard to get California back to business as usual as people return to work,” said Lara. “This year’s rate is on par with normal, pre-pandemic levels while still reflecting the long-term benefits of workers’ compensation reform passed by the State Legislature and signed by the Governor to reduce costs.”

With signs of a hardening market such as increased carrier combined ratios, increased cost on indemnity claims, medical inflation, and future costs of COVID-19 claims, it will be interesting to see how carriers will respond to this decision. Now, more than ever, it is critical to work with your broker and carrier to improve your risk management program so that your business is positioned well for the future.

If you are interested in how this process works and how it can improve your bottom line, please reach out to me at (619) 937-0174 or jhoolihan@ranchomesa.com. In the meantime, Rancho Mesa will keep close tabs on what the future holds and communicate updates regularly.

Proposal to Include COVID-19 Claims in EMR Calculation is Denied

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

It appears the COVID-19 pandemic has finally entered an endemic stage and most companies have fully re-opened and/or are offering their employees some type of a hybrid work schedule. With this being the case, the California Workers’ Compensation Insurance Rating Bureau (WCIRB) proposed to amend the rule that excludes COVID-19 claims from the calculation of experience modifications for only claims with incident dates from December 1, 2019 through August 31, 2022.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

It appears the COVID-19 pandemic has finally entered an endemic stage and most companies have fully re-opened and/or are offering their employees some type of a hybrid work schedule. With this being the case, the California Workers’ Compensation Insurance Rating Bureau (WCIRB) proposed to amend the rule that excludes COVID-19 claims from the calculation of experience modifications for only claims with incident dates from December 1, 2019 through August 31, 2022. In addition, the WCIRB proposed that effective September 1, 2022, any new COVID-19 claims occurring after this date would be factored into the calculation of an employer’s experience modification rate.

The WCIRB’s rationale for this recommendation was that current circumstances have greatly changed since the rule to exclude COVID-19 claims from the experience rating were initially adopted in 2020. COVID-19 is no longer a temporary short-term phenomenon and the risk of infection will be present in the general population for the foreseeable future.

With workplace safety standards in place, personal protective equipment and vaccinations available, employers who are diligent in protecting their employees would in turn have a lower experience modification than less safety-conscious employers in the same industry.

Fortunately, in late June 2022, this change was not approved by Commissioner Lara, but employers should still actively try to prevent the spread of COVID-19 within the workplace by having a written COVID-19 prevention program in place and follow the requirements set by the state and local health department.

While employers don’t have to worry that COVID-19 cases will affect their experience modification rate, they should still be concerned about the effects on their employees and bottom line. Having employees miss work because of COVID-19 puts extra strain on other employees and can effect productivity, and thus profitability.

Rancho Mesa has updated its COVID-19 Prevention Program Template designed for California businesses. Request your COVID-19 Prevention Plan template online or contact me at sclayton@ranchomesa.com or (619)937-0167.

CA Insurance Bureau Recommends 7.6% Rate Increase

Author, Jack Marrs, Associate Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau of California (WCIRB) voted to submit a September 1, 2022 Pure Premium Rate Filing to California’s Insurance Commissioner Lara.

Author, Jack Marrs, Associate Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau of California (WCIRB) voted to submit a September 1, 2022 Pure Premium Rate Filing to California’s Insurance Commissioner Lara.

The filing will suggest a 7.6% average rate increase above last year’s approved September 1, 2021 pure premium rates.

There are multiple reasons for the WCIRB’s Governing Committee to suggest the rate increase. Most notably,

There is an 11% projected increase to indemnity claim cost by the end of 2024.

The industry predicts a 6.5% increase in medical costs per claim from 12/31/21 to 12/31/24.

We expect increases in frequency of injuries and claims.

Wage inflation will increase claim cost and the cost to adjust claims.

Expected future costs of COVID-19 claims are likely to increase, which were previously excluded when underwriting considers claims history.

Before the increase goes into effect, the WCIRB will submit a proposal to the Department of Insurance. Insurance Commissioner Lara will decide to either approve the rate increase, or reject it and suggest a different outcome.

Although the commissioner cannot mandate any sort of rate increase or decrease, it is common for workers’ compensation carriers to cooperate with his recommendation and follow his lead.

This news is another sign that the California workers’ compensation insurance market may be hardening. With that in mind, it is crucial that employers are implementing trainings and safety programs to ensure workplace safety.

In addition, a strong broker partner must truly understand the clients’ industry, operations, and service needs.

Please contact Rancho Mesa to understand how to better prepare for an increase in claims costs and the hardening workers’ compensation marketplace.

2022 Workers' Compensation Expectations for CA Landscape Industry

Rancho Mesa's Alyssa Burley and Drew Garcia, Vice President of the Landscape Group set the stage for insurance expectations in 2022.

Transcript

Alyssa Burley: Welcome back, everyone. My guest is Drew Garcia, Vice President of the Landscape Group with Rancho Mesa. Today, we're going to set the stage for insurance expectations for 2022. Drew, thank you for joining us.

Drew Garcia: Alyssa, thanks for having me.

AB: Since you specialize in the landscape industry, what do you see for the insurance marketplace, for these companies as we move into 2022?

DG: Great question, and I think a lot of companies are always wondering this each year as they come up for renewal. So what I want to do is just, I'll give you a little insight to all the lines of insurance that most landscape companies are going to be renewing in 2022.

And this is basically what we do at a pre renewal, very low level. But I'll start with work comp, which has been a soft market now for four or five years where there's been pressure for rates to continue to go down as a group, as a whole.

And each company's obviously individually underwritten by a carrier, and they're looking at the losses for that particular company. But in general, the work comp market has been soft and that's led to, you know, general decreases for most businesses over the last four or five years.

We think that trend is going to continue in 2022, and we'll see if there's any change in 2023. But for the foreseeable future through this policy period, we do believe that the work comp market is going to stay relatively soft, and that just means rates are going to stay down as a whole.

Again, there could be some individual things that you're experiencing as a landscape business that's causing your pricing to increase, whether that's your ex mod or you've got claims in the current year that haven't gone into the mod calculation or you've changed operations, things like that could impact your own pricing.

But as a group, we feel like the market's going to stay relatively soft. And I'm going to share a little detail that we do individually, myself and Greg, who helps me here with the landscape group at Rancho Mesa. We track a lot of industry data and then we use that when we're having our conversations with our customers.

So one thing we like to pull is we measure every contractor that has a C-27 license in California. There's about 5,465 of those companies that have work comp policies, and that's businesses that are landscape companies that only carry that license. They don't also have other licenses so strictly landscape, which helps us keep our data clean when we're looking at it. So there's 5,465 of those companies, 125 carriers, insurance carriers for work comp, right? At least one policy for all of those companies.

So there's 125 insurance carriers writing at least one landscape policy. Now there's only 25 carriers that have more than 20 policies, so we really start to limit down, you see carriers become niche when trying to write a particular business, in this case, landscape. Of those 125, only 25 of them have more than 20 policies. So there's probably a little bit of an appetite there that's aligning for those carriers. And then when we really might it down, there's only ten carriers they have more than 150 policies, and those are the bulk of the businesses of the insurance carriers riding the business or writing work comp policies for landscape companies in California. The top five are going to be familiar names, Berkshire Hathaway, Insurance Company of the West, State Fund, Markel and then Am Trust.

Those are the top five carriers in terms of market share writing those 5,465 C-27 license landscape companies that have work comp policies. So a little bit of an insight into the market and what carriers are interested in writing business or work comp policies for landscape companies.

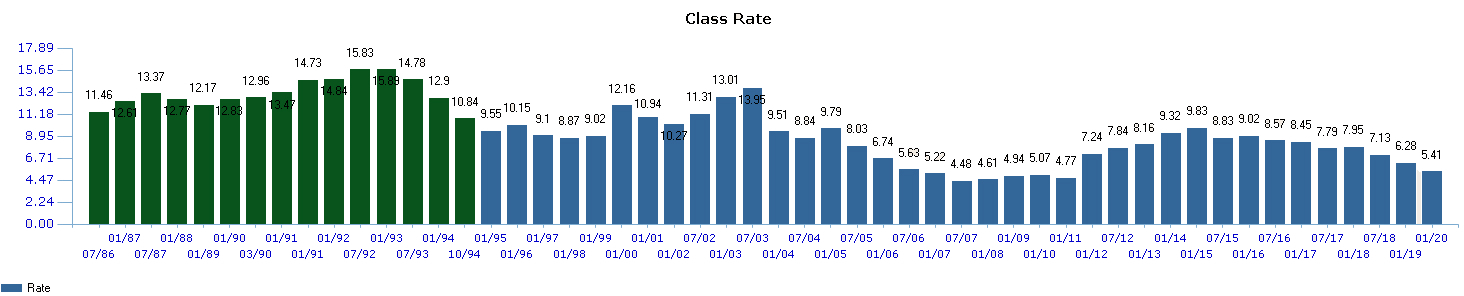

And then when we look at the numbers, we always like to watch the pure premium rate for the 0042 class code and just a quick refresher on pure premium. Every year the bureau, the rating bureau, will recommend a rate that the carriers should charge per $100 in payroll for every particular class code to strictly just cover claim costs. So, this rate doesn't include carrier overhead or expense. So, that number went from $4.93 last year to $4.57 this year, effective September the first of 2021. That's a 7% decrease, and when you're watching that recommendation come from the bureau to the insurance carriers, what happens next is insurance carrier’s base rates come down a little bit. Normally, the rates should come down a little bit on the base rate side, and last year, the average base rate for an insurance carrier, which is the rate that they're going to start at when they're going to underwrite a landscape business, and that rate is going to be different for every insurance carrier. The average rate that they started at was $9.92. That's down to $9.52 on average. So 4% down on the base rate for work comp carriers. Again, those are indicators to us that the market is still soft.

There's still plenty of carriers trying to write the business and that, we should see rates stay relatively down for 2022 as a whole. Again, we talked about the individual aspect of underwriting, but as a whole, those are good indicators that the market still is pretty soft.

And I'm going to share my screen really quick. This is a factor here that nobody really talks about. But California is so diverse with how work comps are handled throughout the state. So there's individual territory factors that most carriers apply when they're underwriting based on where you're doing your business and the reason why they use territory factors is because the claim outcomes, the claim activity can be higher in certain areas than in others. So the screen that you're looking at right now shows Berkshire Hathaway's territory factors based on 2021 and then 2022. And what I did is you can see, based by zip code, I've got different colors indicating the severity of territory factors that could be applied depending on where you're doing your business. So the lighter colors that you're seeing, the more yellow, lighter yellow that you see, those are the preferred areas and then the heavier, darker red that's going to be where maybe there's some territory debits that increase, and most carriers are using something like this when they're underwriting and looking at the business, but you can see some movement in some of the color from last year to this year. You can see San Diego's lightened up a little bit as a territory, so rates are probably a little bit more favorable in San Diego.

But there really is always been some heavy focus on L.A., Orange County, Riverside County, San Bernardino, where carriers really look at implying a debit on territories just because of claim outcomes and claim activity in those in those particular regions.

And then San Jose in Northern California, those have always been generally lighter intel. There's a less territory factor that that happens up there based on better claim activity and claim outcomes that are associated with the zip codes up in that area.

So I wanted to share that, I'll pull that screen down. And then now exiting work comp kind of just highlighting a couple of the other lines of insurance that we think are going to be impacted in 2022. And we've talked about it for many years with our customers, but the auto market is still very difficult.

And if you're a landscape maintenance company, you have a heavy fleet and a lot of vehicles. So it's really important for you to continue to monitor your cost per unit. And we wrote that article a few weeks back, measuring your cost per unit at each renewal so you can kind of see where your insurance has gone over the years. And so landscape companies really need to pay attention to their cost per unit because we do believe there's still more pressure on the auto market for rates to continue to increase. There's a lot of things that Rancho Mesa provides, and so many of our landscape companies are taking advantage of our Fleet Safety trainings that we have in the Risk Management Center and client services on our end has done a great job when we've had claimed activity with our customers to recommend certain driver trainings, you know, as a result of those claim outcomes - or those accidents that have occurred.

So, we've been happy with how we're helping our customers manage the auto side and then really everyone should watch out on the excess or the umbrella layer of their insurance that's really taking its toll and we've seen rate increases coming on that line in particular. A lot of carriers are limiting their capacity, so a lot of carriers usually go up to 10 million for that limit. But now it seems five is the most that any one carrier wants to go to.

So if you carry more than 5 million, you're probably going to need to stack that with multiple carriers to achieve that limit, which could be different than what you've seen in the past, and also watch out for wildfire exclusions. A lot of excess of reinsurance carriers are trying to apply a wildfire exclusion to landscape companies in California, which would be a detriment to your policy if you have it. So always pay attention for that. You can also look out for that wildfire exclusion on your general liability policy. Those are new things that are potentially coming to the liability side. There are still carriers out there that don't offer that exclusion, so you would want to make sure that you're aligned with a carrier that's doing that. But for the general liability property inland marine policies, we think rates are staying relatively flat.

So we don't see a lot of movement coming there. More of the pressures coming on the auto and excess lines. And I think we'll see that for the next couple of years, there should be should remain some pressure on those lines.

That basically wraps it all up for us, covers the basic lines that most companies are looking at. And again, kind of an overview, but hopefully it gives some insight to business as they're moving into 2022, what to expect and where to focus their attention when it comes to their renewal.

AB: Drew, if listeners have questions about their workers compensation insurance, what's the best way to get in touch with you?

DG: Email, they can email me at drewgarcia@ranchomesa.com, call my office (619) 937-0200, and then I'd also encourage them just to check out our website, we've got a ton of content that we've created, all designed for landscape companies to help them better manage their risk. And we have, you know, different tools that aren't really available online that we'd be happy to introduce to companies and let them use to better manage their risk.

AB: Drew, thank you so much for joining me in StudioOne™.

DG: Thanks for having me, Alyssa.

The Field Guide to Navigating Your Insurance in 2022

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns? During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As a business owner preparing for 2022, what areas of insurable risk should cause you the biggest concerns?

During the 2021 year, we experienced a hardening insurance market. All lines of insurance were negatively impacted as a result of the catastrophic events we experienced such as wildfires, flooding, hurricanes, and the emergence of COVID-19. Large national and worldwide crises like these caused underwriting losses in the billions of dollars to both front line insurers and reinsurers.

COVID-19’s impacts included:

The loss of income/revenues

Labor shortages

Health concerns

Relocation of labor forces

As the year comes to a close, we now have some answers but even more questions about what challenges 2022 will bring. Below are a few remaining questions that create uncertainty.

Will Property, Auto, General Liability, Excess, Cyber, and EPL insurance continue to see pressure? The short answer is yes.

What can I do today as a business owner to prepare and better mitigate these increases?

Start your renewal process a minimum of 120 days away from your expiration date. Learn more about the pre-renewal process in our article, “3 Reasons Your Pre-Renewal Meeting is Key to your Success.”

Be willing to meet and discuss your particular situation, needs and goals.

Choose a broker that specializes in your industry and can negotiate with the marketplace from a position of expertise.

Evaluate the services that you receive from your broker’s agency to assure they align with your specific risk management needs. Are they proactive or reactive?

Where is the Workers’ Compensation Industry Going in 2022 and Beyond?

What is expected of Workers’ Compensation in 2022? The short answer is that this market will remain soft.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) has asked for a modest decrease in overall rates and most carriers’ filings have reflected that recommendation. However, these are averages and many industries will find these decreases harder to come by.

What is expected of Workers’ Compensation in 2023? There are several leading indicators that present early signs of a hardening market. Here are a few:

Wage inflation for most businesses. This will lead to higher temporary disability payments to injured workers thus increases in overall claim amounts.

Wage inflations within insurance carrier’s personnel. This will cause a rise in their overhead costs and then a subsequent rise in their combined ratios which will impact their bottom line.

The likely inclusion (September 2022 and beyond) of COVID claims in the Experience Modifier Rating formula (X-Mod). While this is not yet official, approval appears likely.

Preparing for the hard workers’ compensation market starts today with our checklist.

We will explore those at length in a series of articles beginning in January 2022. Subscribe to our newsletter to receive those articles. For now, here are a few tips:

Utilizes a Workers’ Compensation Gap Analysis and Opportunity Assessment (through the Risk Management Center).

Benchmark your performance to industry standards to look for areas of improvement. Learn more about Rancho Mesa’s KPI.

Choose your workers’ compensation carrier wisely. Learn more about selecting a carrier in the article, “How to Choose a Workers’ Compensation Carrier Partner.”

Have you ever considered performance-based programs? If not, maybe it’s time to bet on yourself. Watch the “Deductible Workers’ Compensation: Understanding performance-based insurance programs” webinar.

With workers’ compensation premiums representing a significant line item on many profit and loss statements, staying up to date on the rapidly changing environment should be a priority for all businesses. And, preparing for the expected rate increases is more important than ever with inflationary costs already choking profitability for so many operations. Our series of articles starting in January will help in this education process and allow you to better understand steps you can take now to weather this building storm.

Incorporating a clear strategy as it relates to your insurance portfolio is perhaps more critical than ever leading into 2022. With pricing increases across all lines of coverage becoming more and more common, managing this line item on your financials should be a proactive process with your broker. Start that dialogue now and develop the right plan to design and coordinate the most comprehensive and competitive program possible.

Pure Premium and How It Impacts Your Company

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted.. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

There are different rates generated for different classifications based on exposure and projected losses. The premium company’s pay for workers' compensation begins with multiplying the insurer's rate for the assigned classification(s) by the payroll developed in each classification. Workers' compensation rates are applied per $100 of payroll.

Pulling directly from the WCIRB website, “The WCIRB submits advisory pure premium rates to the California Department of Insurance (CDI) for approval. Insurer rates are usually derived from the advisory pure premium rates developed by the WCIRB and approved by the Insurance Commissioner. Advisory pure premium rates, expressed as a rate per $100 of payroll, are based upon loss and payroll data submitted to the WCIRB by all insurance companies. These rates reflect the amount of losses an insurer can expect to pay in benefits due to workplace injuries as well as the cost for adjusting and settling workers' compensation claims. Pure premium rates do not account for administrative and other overhead costs that an insurer will incur and, consequently, an insurer's rates are typically higher than the pure premium rates.” (WCIRB).

Of note, new pure premium rates were just released in September. Each carrier’s individual experience with all respective class codes also has an impact on these rates. Workers’ compensation has been in a soft market for the past several years with the expectation that rates will gradually start increasing. Following the change in pure premium rates is a great indication of where the marketplace is heading an effective way to better understand future costs that your company may be expecting.

With this in mind, engaging a broker that specializes in your industry and prepares you accordingly for the renewal process is a critical step in controlling workers compensation costs. Part of this process begins with understanding pure premium rates and how they ultimately will impact your MOD, carrier base rates, and your renewal pricing.

To discuss the current market or how your XMOD is affecting your workers’ compensation premium, contact me at (619) 438-6900 or ccraig@ranchomesa.com.

Changes on Horizon Likely to Affect Workers’ Compensation

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Changes by the WICRB typically take place at the first of every year and can impact workers’ compensation Pure Premium Rates, Expected Loss Rates (ELR) and Wage Thresholds. However, the WCIRB has amended its filing schedule in 2021 to take effect September 1st.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Businesses in California have become accustomed to many changes in legislation and the filings from the Workers’ Compensation Insurance Rating Bureau (WCIRB).

Changes by the WICRB typically take place at the first of every year and can impact workers’ compensation Pure Premium Rates, Expected Loss Rates (ELR) and Wage Thresholds. However, the WCIRB has amended its filing schedule in 2021 to take effect September 1st.

Below are key changes that businesses should be aware of that can alter Experience Modification Rates (ExMod) and workers’ compensation renewal pricing.

Assembly Bill 1465

The proposed Assembly Bill 1465 (AB 1465) could have significant impact on workers’ compensation rates in the years to come. If passed, AB 1465 will establish the California Medical Provider Network (CAMPN), a broad and largely unregulated network run entirely by the state that would apply to the workers’ compensation system. All licensed physicians in good standing who elect to treat injured workers will be included in the network. Injured workers can choose any provider within the network and can transfer among providers multiple times without any limitation.

If this bill passes and a CAMPN is created, employers can anticipate:

Doctor shopping by injured workers and attorneys;

Increase in temporary disability and time to return to work;

Increase in permanent disability ratings;

Overall increase in medical costs per claim;

Poorer quality medical reports due to fewer controls and less oversight.

Workers’ Compensation Rates

The WCIRB recently proposed a 2.7% workers’ compensation rate increase, effective 9/1/2021. This would be the first rate increase since 2015. Updated fee schedules for med-legal review reports and physician office visits are what is driving this potential increase.

Expected Loss Rates

A characteristic of a Best Practice business is their focus on managing their ExMod. In simple terms, if a business’s ELR increases, it will have a positive effect on their ExMod. Conversely, if their industry’s ELR decreases, it will have a negative effect. While understanding what an ELR is and how it can specifically impact your ExMod is critical, this should be something your insurance advisor is explaining to you and projecting the impact it will have on your ExMod and ultimately your insurance premium.

To put this information at our clients’ finger tips, we have created a Key Performance Indicator (KPI) dashboard to not only show the impact of any changes in the ELR but also provide other key indicators like industry benchmarking, claim trending, and many other critical factors. Request your customized KPI dashboard.

To stay up to date with these topics and related insurance news, subscribe to our weekly safety and risk management newsletter and podcast. Or, contact me directly at (619) 937-0167 or sclayton@ranchomesa.com to discuss how your company may be affected.

How Rising Pure Premium Rates Will Impact the Tree Care Industry

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

In California, each workers’ compensation insurance company has its own set of base rates for each class of business. In order to come up with their base rate for each class code, the insurance carrier applies their Loss Cost Multiplier (LCM) to the Workers’ Compensation Insurance Rating Bureau’s (WCIRB) pure premium rates.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

In California, each workers’ compensation insurance company has its own set of base rates for each class of business. In order to come up with their base rate for each class code, the insurance carrier applies their Loss Cost Multiplier (LCM) to the Workers’ Compensation Insurance Rating Bureau’s (WCIRB) pure premium rates.

Pure premium rates are determined by the WCIRB and include the loss cost of claims for that particular class of business. Those costs include:

The cost of the claim itself (i.e., indemnity, medical and expense payments)

Loss adjustment expenses

Future loss adjustment expenses (e.g., fees for expert witnesses and salary/overhead for outside legal counsel)

A pure premium rate reflects the amount of losses that an insurance carrier can expect to pay out in claims for that class of business. Every 6 months, the WCIRB submits pure premium rates to the California Department of Insurance for approval. These pure premium rates are based on loss and payroll data submitted to the WCIRB by all the insurance companies in California.

A carrier’s LCM will include those additional expenses separate of the pure premium rate considerations. These would include a carrier’s:

General overhead expenses (e.g., rent, payroll, employee benefits, etc.)

Sales and Marketing

Taxes, licenses and fees

Profit

The 2021 pure premium rate in the tree care industry (class code 0106) has increased to $10.50 per $100 in payroll, which is roughly a 3.5% increase from last year’s $10.15. This means that the overall workers’ compensation claim activity in the tree care industry is up about 3.5%, and the WCIRB is recommending that workers’ compensation insurance carriers increase their base rates to address this change.

As a tree care professional, what can your company do to prepare for this change and mitigate the impact to your business? Reviewing your claims experience, benchmarking your company with the tree care industry, looking for root causes of the claims, and then implementing best practices safety trainings will go a long way in providing you a path to insulate you from future changes like these.

As part of our proprietary TreeOne™ program, we have created a Key Performance Indicator (KPI) dashboard for the tree care industry that puts this information at your fingertips. To see how you compare with your peers, request the KPI Dashboard for your company.

For more information on rising pure premium rates, contact me at (619) 486-6437 or randerson@ranchomesa.com.

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

Strengthen Your Risk Profile During COVID-19

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 continues to have a stronghold on the US economy and it is likely that we will see the impact for many years to come. While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. Understand that this recommended rate increase comes against a backdrop of record profits in workers’ compensation prior to COVID-19. There are also three COVID-19 presumption Bills (AB 196, AB 644, and SB 1159) that could create presumptions that cases of COVID-19 are a compensable consequence of work, which will likely cause additional turmoil in the marketplace.

With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Improve the Safety Program

Now is not the time to take your focus off of safety in the workplace. In fact, I would argue that there should be even more focus on safety. Some items to focus on relating to a safety program include:

Update your Injury and Illness Protection Program (IIPP) and have it reviewed by a labor attorney.

Establish a safety committee consisting of ownership, supervisors, managers, your insurance broker, and insurance company (i.e., loss control representative). This will assist with identifying workplace hazards, discussing claims or near misses that have occurred and creating safety meeting topics that can be discussed at future employee safety meetings.

Ensure that safety meetings are occurring at least every 10 working days, but preferably weekly. Using safety topics identified by the safety committee, managers can pinpoint proper trainings for employees.

Update Employee Handbook

With employment requirements, policies and procedures continually changing, it’s easy to fall behind on new regulations like adding an Emergency Paid Sick Leave Policy or Expanded Family and Medical Leave Policy, in your employee handbook. Rancho Mesa offers access to a living handbook builder through the RM365 HRAdvantage™ portal. By creating a living employee handbook through the portal, updating the document with new policies is as easy as reviewing and approving the suggested changes provided by experienced human resources professionals.

Continue Your Risk Management Education and Certifications

With many businesses slowing during COVID-19, consider filling that down time with required accreditations and continued education courses. Some examples include:

Anti-harassment Training: By the end of 2020, businesses with 5 or more employees are required to provide Anti-harassment training to all employees. Owners, supervisors, and management are required to complete the two-hour course, while all other employees must complete a one-hour course. Rancho Mesa offers free online Anti-harassment training for both supervisors/managers and employees. The courses can be accessed by computer, tablet, and a smart phone.

Continued education or achieving professional designations: It’s also a good time to consider working on continued education courses such as renewing forklift certifications, OSHA trainings, as well as any professional designations. To reinvest your efforts in continued education, now, while business is still slow due to COVID-19, could position your business to hit the ground running when the economy opens up again.

Safety Star Certification – With underwriting guidelines tightening and worker’s compensation premiums expected to increase due to COVID-19, Rancho Mesa’s RM365 Advantage Safety Star Program™ can build your risk profile and differentiate your business from others. The program is designed for supervisors, foreman, safety coordinators, upper management, administrators, and directors of human resources. To earn the Safety Star certification in Construction Safety, you must complete the required Incident Investigation and Analysis online module plus at least two other modules of your choice from the approved list. This certification is also a marketing tool your broker can use to show your commitment to safety.

Proactively improving your safety program, employee handbook, and continuing education during the pandemic will allow you to hit the ground running once COVID-19 restrictions are lifted. It can also position your business to mitigate increasing premiums with the ever tightening workers’ compensation marketplace.

If you need any assistance in implementing a sound risk management program, please reach out to me at (619) 937-0174.

Choosing the Right Classcode: A Guide to Distinguishing Tree Trimming from Landscape Work

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are…

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are:

What is the difference between the two class codes?

I’ve always only used 0106-Tree Trimming, is it possible for me to use 0042-Landscape Gardening as well?

How can I differentiate which specific operations are considered landscape gardening and which are considered tree trimming?

When more than one classification applies to operations that are closely related, it is important to understand the boundaries of each classification. Let’s take a look at how the California Workers’ Compensation Insurance Rating Board (WCIRB) defines both class codes:

0106 Tree Pruning, Repairing or Trimming

This classification applies to pruning, repairing or trimming trees or hedges when any portion of the operations requires elevation, including but not limited to using ladders, lifts or by climbing. This classification includes clean-up, chipping or removal of debris; stump grinding or removal; and tree spraying or fumigating that are performed in connection with tree pruning, repairing or trimming. This classification also applies to the removal of trees that retain no timber value.

0042 Landscape Gardening

This classification applies to the construction, maintenance, repair or installation of landscape systems or facilities designed for public or private gardens or other areas in order to aesthetically, architecturally, horticulturally or functionally improve the grounds within or surrounding a structure or a tract or plot of land. This classification includes the preparation and grading of plots or areas of land for the installation of landscaping; pruning, repairing or trimming trees or hedges when none of the operations at a particular job or location require elevation, including but not limited to using ladders, lifts or by climbing; or chipping operations performed in connection with landscape gardening. This classification also applies to spraying or spreading lawn fertilizers or herbicides, or weed abatement for fire hazard control purposes.

According to these definitions, a tree company may be able to use the 0042 landscape class code at specific times. However, when any of the operations are off the ground, that payroll would be classified in tree trimming 0106. Also, any type of work that is associated with the tree trimming (e.g., clean-up, chipping, stump grinding, etc.) will also be included as 0106. Here is a quick real-world example that will help to clarify.

A tree company has 10 employees that worked on a specific job to trim a large Eucalyptus tree. There were only two workers that actually climbed and trimmed the tree, and all the rest of the employees worked on the ground to clean up the limbs and branches that were being cut and fell from the tree. All 10 employees must be classified into the 0106 class code because the ground crew operations were in connection with the tree trimming, where the climbers were operating off of the ground.

The next day, on a completely different job site, the same tree company with 10 employees worked on a new job to trim a handful of 8 ft Japanese maple trees. For this job, all of the work was performed from the ground and there was never a point where any of the workers operated from elevation (e.g., ladders, lifts, climbing, etc.). Three of the workers trimmed with pole saws from the ground, while the other seven employees cleaned-up the debris and used the chipper. All 10 of the employees could be classified into the 0042 landscape class code because there was never a time where a worker left the ground to trim.

Properly documenting and maintaining valid records is critical in order for your company to utilize both class codes properly. Without proper documentation, you could be setting your company up for a large additional premium owed at audit.

Stay tuned to my follow up article and podcast as I share how to prepare for and execute a successful audit when both of these two class codes are applicable to your operations.

Post COVID-19 XMODs Threaten a Double Whammy

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Whammy #1 - Lower Payrolls

With the economy screeching to a halt in March of this year due to the shelter in place restrictions, payrolls and employee counts have been dramatically reduced. Since the XMOD calculation is based on a rolling three years of payroll and claims, should the year dropping out of the calculation have larger payrolls than the year entering and assuming the same claim amounts for each year, the XMOD would increase.

Whammy #2 – Lower Expected Loss Rates (ELR)

ELRs are the factors used to anticipate a class code’s claim cost per $100 for the experience rating period. Stated simply, it’s a rate per, $100 of payroll by class code that projects the claim amounts the WCIRB believes should occur for that class code. Thus, should ELRs decrease; it would have the effect, given no change in the claims, of raising the XMOD.

California businesses should pay close attention to their individual ELRs as the WCIRB annually recommends updated rates during their June regulatory filing period. The 2021 rates were recently proposed on June 25, 2020 by the WCIRB and will be waiting approval in September by Insurance Commissioner Ricardo Lara.

Below is a breakdown of the 2021 proposed ELRs by class code with notable double digit increases highlighted:

2021 Proposed ELRs

| Class Code | 2020 ELRs | 2021 Proposed ELRs | Increase/Decrease % |

|---|---|---|---|

| 3724 Solar/Millwright | 1.74 | 1.81 | 4% |

| 5187 Plumbing > $28 | 1.18 | 1.13 | -4% |

| 5183 Plumbing < $28 | 2.6 | 2.6 | 0% |

| 5542 Sheet Metal > $27 | 1.4 | 1.35 | -3% |

| 5538 Sheet Metal < $27 | 2.3 | 2.39 | -12% |

| 6258 Foundation Prep | 2.65 | 2.48 | 2% |

| 0042 Landscape Gardening | 2.59 | 2.38 | -8% |

| 0106 Tree Pruning | 3.91 | 4.11 | 5% |

| 5140 Electrical Wiring > $23 | 0.81 | 0.73 | -10% |

| 5190 Electrical Wiring < $23 | 1.89 | 1.82 | -4% |

| 5470 Glaziers > $33 | 1.63 | 1.81 | 11% |

| 5467 Glaziers < $33 | 4.3 | 3.81 | -11% |

| 5028 Masonry > $28 | 2.17 | 2.13 | -1.8% |

| 5027 Masonry < $28 | 4.73 | 4.03 | -14% |

| 5482 Painting/ Waterproofing > $28 | 1.42 | 1.57 | 10% |

| 5474 Painting/ Waterproofing < $28 | 3.68 | 4.08 | 10% |

| 5186 Automatic Sprinkler Install > $29 | 1.11 | 1.14 | 3% |

| 5185 Automatic Sprinkler Install < $29 | 2.45 | 2.2 | -10% |

| 5205 Concrete/Cement work > $28 | 1.95 | 1.71 | -12% |

| 5201 Concrete/Cement work < $28 | 3.95 | 3.45 | -12% |

| 5432 Carpentry > $35 | 2.01 | 2.05 | 2% |

| 5403 Carpentry < $35 | 5.27 | 4.91 | -7% |

| 5447 Wallboard Application > $36 | 1.34 | 1.14 | -14% |

| 5446 Wallboard Application < $36 | 2.76 | 2.67 | -3% |

| 5485 Plastering or Stucco >$32 | 2.66 | 2.55 | -4% |

| 5484 Plastering or Stucco < $32 | 4.78 | 4.41 | -8% |

| 5443 Lathing | 2.37 | 2.23 | -6% |

| 5553 Roofing > $27 | 3.9 | 3.89 | -2% |

| 5552 Roofing < $27 | 9.85 | 9.23 | -6% |

| 6220 Excavation/Grading > $34 | 1.24 | 1.08 | -12% |

| 6218 Excavation/Grading < $34 | 2.34 | 2.59 | 10% |

| 5436 Hardwood Flooring | 2.03 | 2.01 | -1% |

| 3066 Sheet Metal Prod Mfg. | 1.94 | 2.00 | 3% |

| 8018 Stores - Wholesale | 2.67 | 2.81 | 5% |

| 8804 Shelter/Social Rehab | 1.25 | 1.30 | 4% |

| 8827 Hospice and Homecare | 1.72 | 1.54 | -10% |

| 9059 Childcare | 0.99 | 1.07 | 8% |

| 8834 Physicians | 0.34 | 0.34 | 0% |

| 8868 Colleges/ Professors Private-Teachers | 0.36 | 0.37 | 3% |

| 9101 Colleges/Schools Private-Other | 2.50 | 2.13 | -14% |

Should Commissioner Lara approve the ELR changes in September, a majority of class codes will be seeing a decrease which can lead to higher XMOD’s in many cases. That possibility, combined with lower incoming payrolls, requires proactive risk mitigation, claim management and detailed planning with your broker.

If you are seeking a partner with the tools to address these needs, please reach out to Kevin Howard at Rancho Mesa Insurance Services, Inc. at (619) 438-6874.

Potential Workers’ Compensation Changes Due to COVID-19 Claims

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are:

Experience Rating Calculations

Dave Bellusci, Chief Actuary at the WCIRB, indicated that they are “leaning toward excluding COVID-19 claims from the calculation.” This would entail setting up new nature of injury and cause of injury codes that would identify these claims.

They are also leaning towards excluding the payrolls for workers who are not working because of the pandemic and shelter-in-place orders but who are still receiving all or a portion of their salaries or are being paid through sick leave benefits.

Class Code Classifications

Those sheltered-in-place workers who are being paid and either not working their customary jobs or not working at all has created a question about how that payroll should be classified for premium purposes. Should that payroll be classified in its usual class code or be adjusted into another class code such as clerical or a code specific to COVID-19. These are all questions being considered.

Any potential changes like these in question would be temporary and require that employers document how the employees in question were not working their customary jobs during this time and were performing clerical functions.

Our Answer

Rancho Mesa is collaborating with several regional and national workers’ compensation carriers on a form that will be able to capture this information for businesses affected by these new work restrictions. Accurate and accessible documentation will help both businesses and their workers’ compensation carrier make the necessary adjustments at audit.

At this point, these are only preliminary responses that are being discussed. While nothing has been passed into law, it seems highly likely that the WCIRB and the Insurance Commissioner will agree on some type of new legislation. When and if this occurs, we will provide full details and specific strategies to assist.

If you want to be kept informed of any changes and are not currently on our weekly newsletter list, please subscribe to our email distribution list.

Work Comp Unit Stat: The Meeting That Saves You Money

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) defines the process of receiving loss and payroll information by classification as the Unit Statistical Report. The information is reported to the WCIRB by insurance carriers at specific intervals based on your company’s policy effective date. The information is valued for the first time 18 months after the inception of your policy and every 12 months thereafter.

A policy that incepts in January 2020 will be valued for the first time in July of 2021 (18 month mark). This information will remain in your XMOD calculation for the valuations at 30 months and 42 months.

Once this information has been received by the WCIRB, from the respective carriers, it cannot be altered or changed until the following year’s unit stat. Thus, you may have a positive outcome on an existing open claim (reserve reduction or closure) but not see the benefit until the following year. Revisions to the XMOD once published are limited to a few circumstances; more information about revisions can be found here.

The loss information, sent to the WCIRB from the insurance carriers, will be evaluated at the paid (closed claim) or reserved (open claim) amounts. Typically, a claim that has been open for longer than 18 months signifies severity, litigation, lost time, permanent disability, or a combination of the group. For this reason it is absolutely critical that as a part of your risk management process you execute a

pre-unit stat meeting.

When should I schedule my Unit Stat meeting?

What should I do at this meeting?

Who needs to be involved?

How will this meeting save me money?

As a client of Rancho Mesa, we build this meeting into your annual service plan and take care of engaging the parties who need to be involved for the betterment of your XMOD.

Ready to learn more about Unit Stat? Join us for a complimentary 25-minute webinar where we will discuss the process in greater detail and take time for Q&A.

Still not sure if further learning is necessary, ask yourself these questions:

Have you ever been surprised by your XMOD being higher than you would have thought?

Have you ever had an XMOD above 1.00?

Has your XMOD ever caused your premium to increase?

The webinar can be viewed on-demand by clicking the link below.