Industry News

Cracking the Code: Deciphering the Primary Threshold’s Impact

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Every business owner understands the correlation between their Experience MOD (XMOD) and what they will pay in workers’ compensation premiums. When the XMOD increases, there is a good chance that the workers’ compensation rates or premiums will rise as well. This is why it is so crucial to really hone in on company safety procedures to limit work-related injuries as much as possible. The reality is that even the safest company that does everything the right way is going to run into a workers’ compensation claim from time to time.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Every business owner understands the correlation between their Experience MOD (XMOD) and what they will pay in workers’ compensation premiums. When the XMOD increases, there is a good chance that the workers’ compensation rates or premiums will rise as well. This is why it is so crucial to really hone in on company safety procedures to limit work-related injuries as much as possible. The reality is that even the safest company that does everything the right way is going to run into a workers’ compensation claim from time to time.

So, when the inevitable workers’ compensation claim happens, what are you supposed to do? What impact will this have on the XMOD? The first component that business owners need to understand is that there is a cap to how much any single workers’ compensation claim can impact the XMOD. That cap is called the primary threshold. The primary threshold varies from company to company and is based off of the company’s payroll. The more payroll a company has the higher the primary threshold.

For this example, a company has a primary threshold of $15,000 where the maximum number of points that any one claim can impact the XMOD once reaching the threshold is 10 points. This means that a claim that costs $15,000 and a claim that cost $150,000 will have the same impact (10 points against the XMOD). However, this does not mean that claims that exceed the primary threshold can be disregarded, because the higher claim cost you have will impact your current and 5-year loss ratio (incurred claim cost/premium paid). Additionally, if a claim that was reserved higher than the primary threshold and can be closed or decreased lower than the primary threshold, XMOD points can be shaved off of that claim.

Knowing the importance of the primary threshold, we designed our proprietary the KPI dashboard that allows our clients to see their primary threshold number and corresponding maximum impact to the XMOD any one primary threshold claim would have.

If you have any questions about your XMOD or would like us to create a KPI for your company, please feel free to reach out to me at (619) 438-6905 or ggarcia@ranchomesa.com.

Properly Utilizing Tailgate Meetings

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

For many foremen and superintendents, weekly tailgate meetings can feel like a task that just needs to be checked off the list. However, while the purpose of these meetings is critical for the health and well-being of fellow field employees, the time required and repetitive nature of them can create challenges. To maximize the benefits of these meetings, construction firms must be proactive and thoughtful as they develop an inventory of topics.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

For many foremen and superintendents, weekly tailgate meetings can feel like a task that just needs to be checked off the list. However, while the purpose of these meetings is critical for the health and well-being of fellow field employees, the time required and repetitive nature of them can create challenges. To maximize the benefits of these meetings, construction firms must be proactive and thoughtful as they develop an inventory of topics.

Identifying Tailgate Meeting Topics

Take ample time with your sales team to understand the scope of your backlog to see where hazards may appear within these projects. Plan training topics with an eye on the weather, paying close attention to historically warm or cold months. Consider connecting with your insurance broker as well on recent injury trends that you can address with the crew.

This will be pertinent as your company approaches their renewal window with underwriters looking at claims history. They commonly ask, “what has the insured done to make sure these claims don’t happen again?” Learning from your past is key to being proactive. Knowing you will have certain exposures coming up and addressing those with preventative training topics begins to build a Best Practice Safety Program.

Accessing Content for Training

Locating “Toolbox” trainings can be time consuming and, in some cases, costly. And very often, the trainings may not be applicable to your operation and/or the trends you may need to focus on. With an eye to the future, Rancho Mesa has recently introduced a proprietary SafetyOne™ App. Safety managers will be able to document safety inspections from their mobile device and assign required fixes to employees, while also tracking when they have been completed. Meeting content can also be distributed to supervisors through their mobile device all with a focus of making safety meetings more efficient and effective. These same supervisors can now access a vast library that can be customized to their operation.

Reach out to me to learn more about the SafetyOne™ App and how Rancho Mesa can partner with you and your team moving forward. You can reach me at (619) 438-6900 or email me at ccraig@ranchomesa.com

Construction Death Rate Not Decreasing as Expected

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

With the heightened safety regulations and OSHA guidelines over the past decade, many would think we are working in a much safer environment with fewer fatalities. Despite the rising number of employees and using a standard based off deaths per 100,000 employees, the data is showing that the number of fatalities are the same as they were a decade ago.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

With the heightened safety regulations and OSHA guidelines over the past decade, many would think we are working in a much safer environment with fewer fatalities. Despite the rising number of employees and using a standard based off deaths per 100,000 employees, the data is showing that the number of fatalities are the same as they were a decade ago.

With a much larger workforce, OSHA is severely understaffed compared to the previous decade. The agency does not have enough inspectors to visit nearly enough jobsites. They have been more reactive in the sense that they are imposing fines on companies after they have had losses. These fines represent a fraction of what it would take to motivate construction companies to revamp their respective safety programs. Employers have factored these fines into the cost of business to a certain extent.

OSHA is now contemplating whether it is worth doubling the jobsite inspections annually and/or increase fines drastically. There is no solid data to link an increase in jobsite inspections to fewer fatalities, so the logical answer would be heavier fines and a push for more negligent death claims to be criminally prosecuted.

Either of these options will lead to more oversite or more fines for the construction industry as a whole. One critical approach you can take is to prepare yourself as a business owner. Be proactive. Consider working with the consultation branch of OSHA to visit your operation and jobsites. This division within OSHA does not issue fines or violations. They do, however, offer recommendations and advice on how to make your operation safer. With the potential of OSHA’s fines increasing, it is time to make sure that your company is on the forefront of safety. A great first step is reaching out to your insurance broker to help you meet requirements and push you to exceed. With a potential recession looming, it is important to make sure you have insulated your company from risk, so you have the best chance at thriving.

If you have any urgent questions on this topic, you can reach me directly at (619) 438-6900 or email me at ccraig@ranchomesa.com.

The Link Between Your EMR and Primary Threshold

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

One of the biggest concerns for contractors is their Experience Modification Rating (EMR). If your EMR exceeds 1.00 or 1.25, contractors can be removed from bid lists and premiums can escalate quickly. Most decision makers have little idea what factors contribute to the EMR and just how claims can impact them.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

One of the biggest concerns for contractors is their Experience Modification Rating (EMR). If your EMR exceeds 1.00 or 1.25, contractors can be removed from bid lists and premiums can escalate quickly. Most decision makers have little idea what factors contribute to the EMR and just how claims can impact them.

All construction companies are assigned class codes that best define their operations and those class codes have expected loss rates associated with them. The more losses that occur per $100 of payroll for that class code, the larger the expected loss rate will be. So, an electrician with a much lower expected loss rate than a roofing contractor will have each claim impact their EMR more. These are variables that can have a significant impact on your company’s EMR. The variable that fluctuates amongst each company is the amount of payroll they develop in each class code. The more payroll generated, the lower your best possible EMR can be.

Consequently, as a company’s best possible EMR decreases, the Primary Threshold increases. The Primary Threshold is a cap or threshold unique to each company. The higher the primary threshold, the less that any one claim can impact your EMR. For example, a painting contractor using the 5474 class code and averaging $200,000 a year in payroll will have a best possible EMR of 83 and primary threshold of only $8,500. Each claim has the potential of contributing 40 points to their EMR. While another painter that averages $10,000,000 in payroll will have a best possible EMR of 41 and primary threshold of $49,000. Thus, the maximum any one claim can impact the company with higher payroll is just 5 points.

This certainly is a drastic difference but it makes sense as the larger company has more employees which leads to more exposure and more expected losses. The component that most companies do not know well enough is that for each company in the examples above, the WCIRB penalizes the exact same for any claim that exceeds your primary threshold. So, for the smaller company, an $8,500 claim is worth 40 points to their EMR, a $1,000,000 claim is worth the exact same amount. And, the same for the larger company with a $49,000 claim worth 5 points but any claim dollars in excess of that will not impact the EMR.

Taking this information into account, we urge our clients to focus on mitigating claims before they happen as well as doing their best to reduce contributing factors such as temporary disability. Having your carrier pay for your employees missed time leads to your EMR increasing and your premiums inevitably being higher than you would like.

Understanding and implementing a return-to-work program is extremely beneficial to your company and leads to you saving money over time. Working with your broker to better understand how to properly handle claims and making sure you are doing everything possible to keep your EMR as low as possible is vital to your company’s profitability and is very much in your control.

Everyone wants a better EMR and lower premiums but the elite contractors are active in not only preventing claims from happening but understanding how important it is to keep their employees at the workplace, or at the very least, off the couch at home.

If you would like to learn more about your firm’s primary threshold or how it is impacting your company, please do not hesitate to reach out to me directly at ccraig@ranchomesa.com or call me at (619) 438-6900.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 2)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

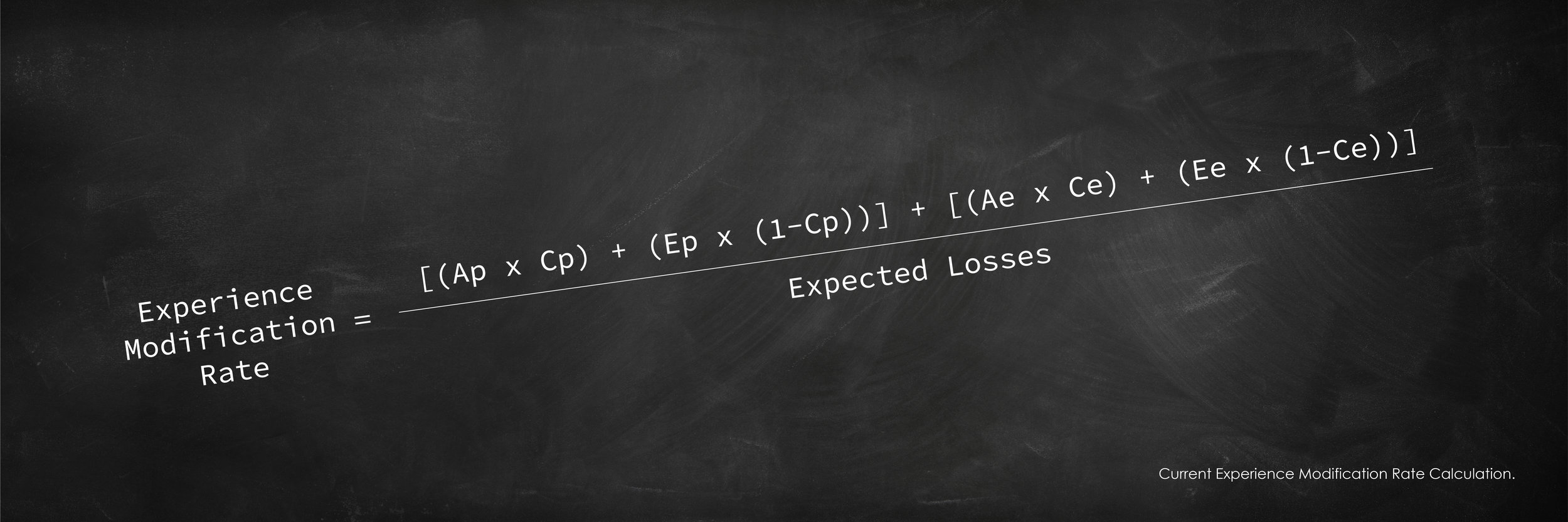

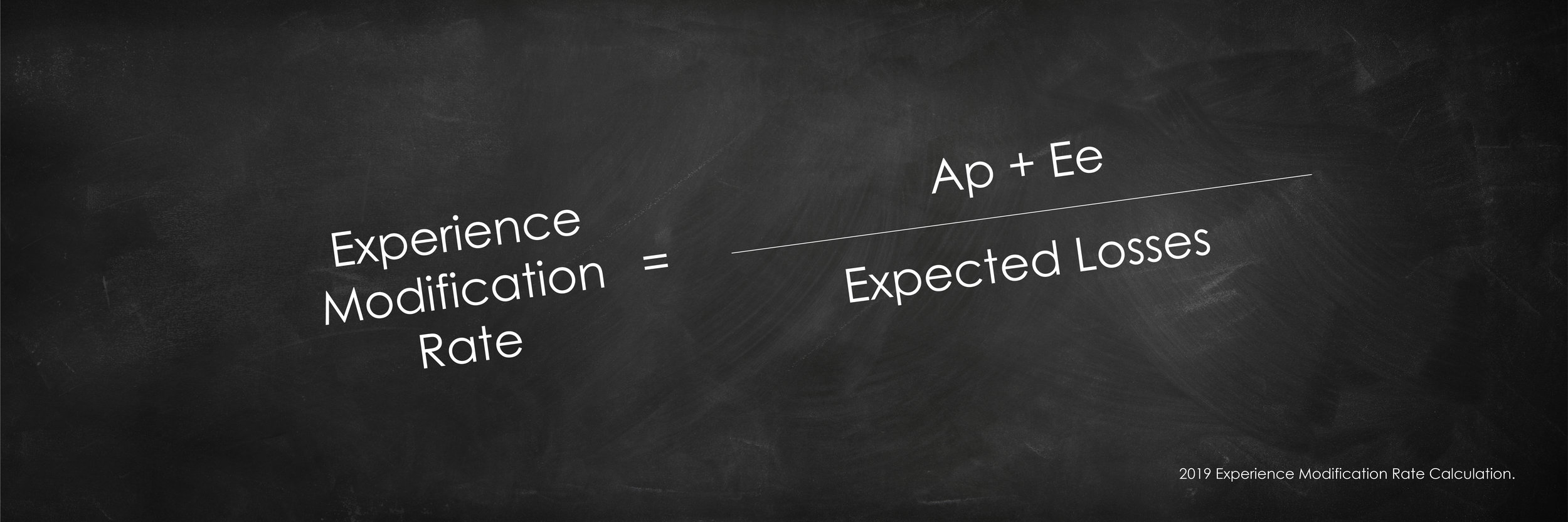

The Simplified Formula

Individual claim cost (i.e., both paid and reserved) will go into the calculation up to the primary threshold limit are considered the actual primary losses. Any claim cost that exceeds your primary threshold is considered the actual excess loss. In past experience mod formulas, the actual excess loss was used in the factoring of your EMR; in 2019, it will have no effect. However, under the new calculation, the industry expected excess losses will be considered in the 2019 simplified formula.

Actual Primary Losses + Expected Excess Losses / Expected Losses

The expected excess losses are calculated by multiplying your class code’s payroll per $100 by the expected loss rate for that same class code. This number is then discounted by the “D Ratio” to determine expected primary losses and expected excess losses. There are 90 different D-Ratios for each classification based on the primary threshold. The D-Ratio is different for each classification and is determined by the severity of injuries that occur within that particular class code.

The first $250 of all claims will no longer be used in the calculation of your EMR.

This is a major change and one that was initiated in part to encourage all employers to report all claims, including those deemed first aid, without having a negative impact on the companys’ EMR. This change will affect all claims within the 2019 calculation; so yes, it will include years previously completed and reported. This will have a positive impact on EMRs in that claim dollars will be removed from the EMR calculation.

Confused – Want more details?

Help is on the way. We are going to hold a statewide webinar on Thursday, October 4th at 9:00am in order to dig deeper into this subject and answer specific questions. You may register for the webinar by contacting Alyssa Burley at (619) 438-6869 or aburley@ranchomesa.com.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 1)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Before we breakdown the changes to the 2019 EMR formula, we must first have a strong understanding of the two critical components that directly affect the outcome of the EMR. This article will be broken out into 2 parts. Part 1 will describe the Primary Threshold and Expected Loss Rate. In Part 2, I will provide an overview of the changes to the EMR calculation.

The single most important number to my EMR is not my final rating?

Primary Threshold

Rancho Mesa has long taken a stance on the importance of a business owner knowing their primary threshold as it relates to the EMR. Proactive business owners should monitor their primary threshold annually as it is subject to change due to payroll fluctuations, operations, and the annual regulatory filing of the expected loss rate. In general terms, the more payroll associated with your governing class (the class code with the preponderance of your payroll) the higher your primary threshold will be. The primary threshold is unique to every business. The 2019 EMR formula is heavily weighted by the company's actual primary losses, the claim cost (both paid and reserved) that goes into the calculation up the primary threshold amount. Controlling claim cost and knowing your company's primary threshold is the first step to understanding the EMR.

Expected Loss Rates

The expected loss rate is the factor used to anticipate a class code's claim cost per $100 for the experience rating period. The expected loss rate (ELR) is not to be confused with the pure premium rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

The ELR changes, annually. It’s important to monitor the change; if your expected loss rates go down (from our analysis this is the direction most are going) and if nothing else changes, your EMR will go up. Why is this? Again, without going too deep, in simple terms, your EMR is a ratio of actual losses to expected losses. If your expected losses go down, but your actual losses remain the same, then your EMR will go up.

To illustrate this, consider the following. Actual losses are $25,000 and your expected losses are $25,000 your EMR would be 100. Now, if your actual losses stay the same at $25,000, but your expected losses drop to $20,000, your EMR would now be 125%. (There are other factors that would go into the actual calculation, so your actual EMR would be different – this was just to illustrate the expected losses impact to the EMR.)

In Part 2 of this article, will cover the actual changes to the EMR calculation.

For more information about the EMR, contact Rancho Mesa Insurance Services at (619) 937-0164.

How To Lower Your Experience MOD by Understanding Your Primary Threshold

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

How do I decrease my MOD to lower my workers compensation premium?

A few factors can be addressed to reduce the workers' compensation premium. The most important is the primary threshold. Each individual employer has their own primary threshold that is determined by the class of business they operate and the amount of field payroll they accrue over a three year period. The primary threshold is the point at which any claim maximizes its negative impact on the MOD. You must be sensitive to this number because any open claim with paid amounts under the threshold, provides an opportunity to save points to the MOD. Once a claim exceeds paid amounts over your threshold, it no longer can negatively impact your MOD. However, you would still want to monitor and manage these claims to ensure your injured employee is being provided attentive care and to maintain knowledge of your loss experience.

Example

You’re a landscaping company and your primary threshold is $33,000. The most any claim can affect your MOD is $33,000 and the most points that any claim can add to your MOD is 13.

You have a claim open for $40,000 with paid amounts of $10,000 and reserved amounts of $30,000.

This claim will go into the calculation at $40,000 (Paid + Reserved) but because the total amount succeeds the primary threshold of $33,000, it will only show up on the rating sheet totaling $33,000 of primary loss and contribute 13 points to your MOD.

It would behoove you to analyze and monitor this open claim, because it has paid out amounts well below your primary threshold of $33,000.

If this same claim closes for a total paid amount of $22,000, the closed claim would go into your MOD at $22,000 with 8 points contributing to the MOD.

The difference between a $40,000 claim and a $22,000 claim is 5 points to your MOD, or, 5% to your premium!

Knowing your primary threshold is the most important piece of information when managing your XMOD. Fortunately, Rancho Mesa can help you manage your experience MOD by tracking your primary threshold and maintaining the other critical elements that go into establishing a sustainable low experience MOD.

For more information about lowering your experience MOD or a detailed analysis of your current MOD please reach out to Rancho Mesa.

Below is an example worksheet for Landscapers to determine the primary threshold.

| Annual Landscape Payroll | 2018 Primary Threshold | Max Points to MOD | Lowest MOD |

|---|---|---|---|

| $100,000 | $5,500 | 53 | .84 |

| $250,000 | $10,000 | 38 | .75 |

| $500,000 | $15,500 | 30 | .65 |

| $1,000,000 | $22,000 | 21 | .56 |

| $1,500,000 | $26,000 | 17 | .51 |

| $2,000,000 | $30,000 | 14 | .47 |

| $2,500,000 | $32,000 | 12 | .45 |

| $3,000,000 | $35,000 | 11 | .42 |

| $5,000,000 | $41,000 | 8 | .36 |

| $10,000,000 | $40,000 | 5 | .30 |