Rancho Mesa News

Rancho Mesa Hosts From Hire to Fire Workshop

Author, Lauren Stumpf, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

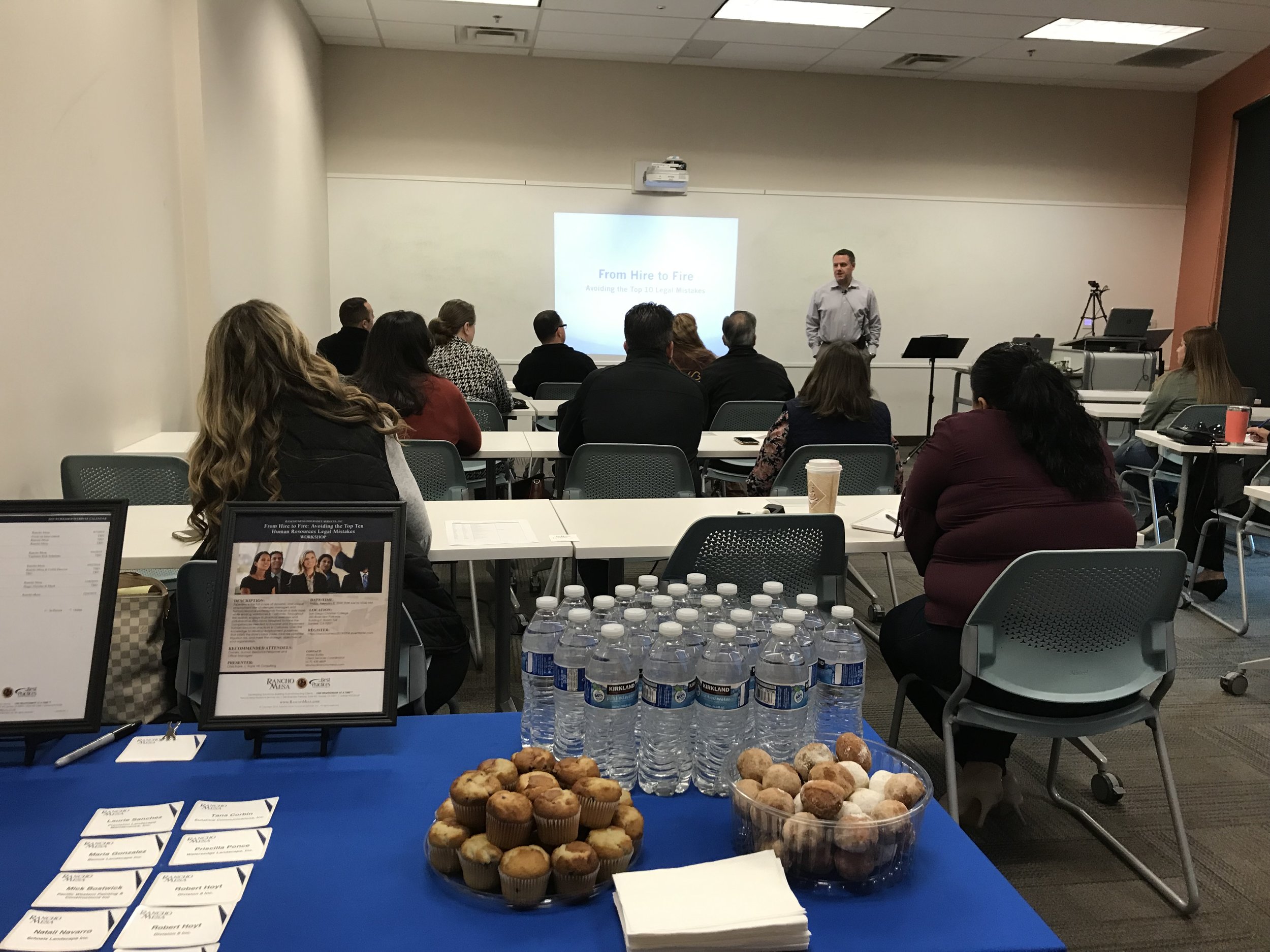

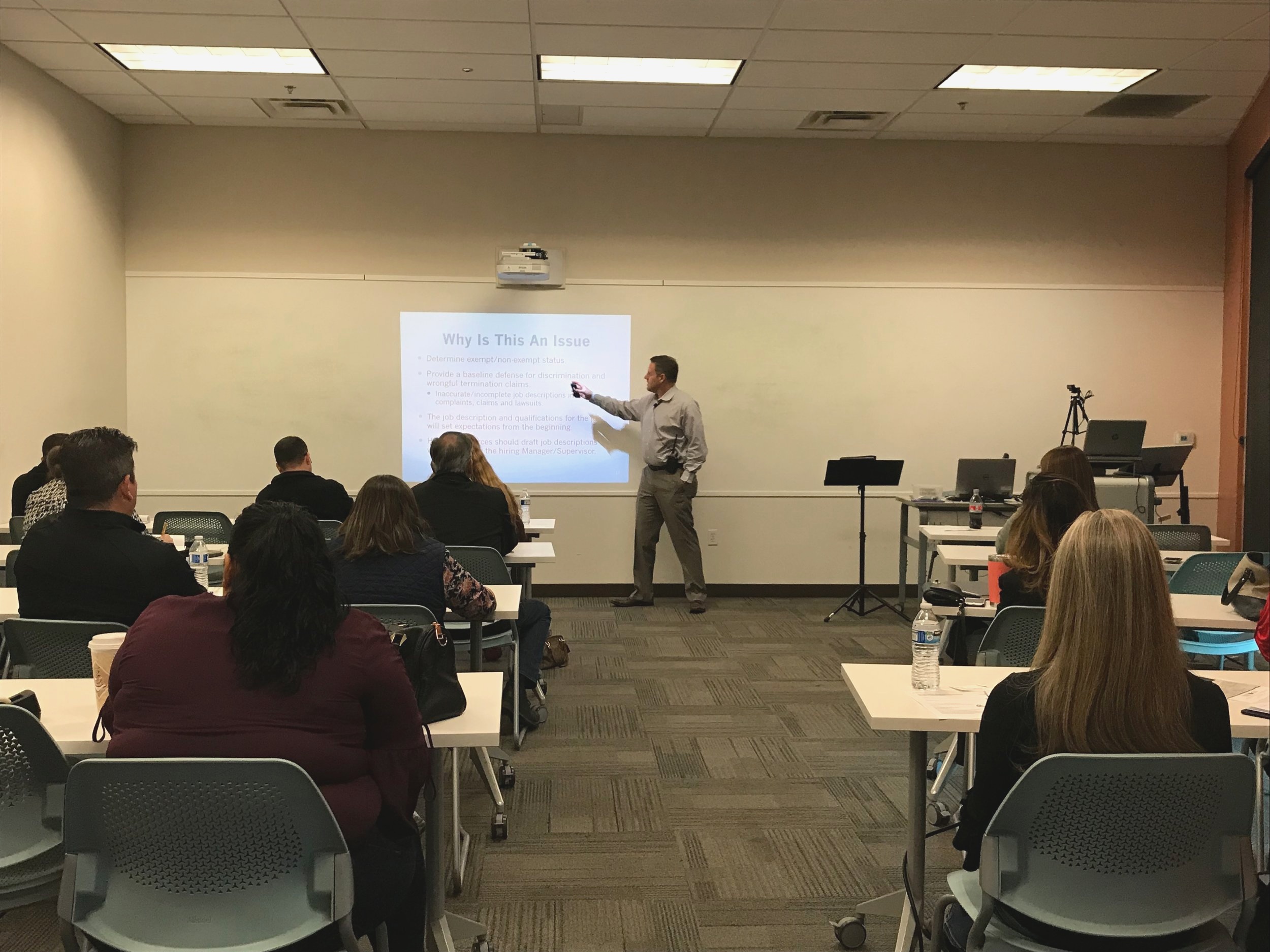

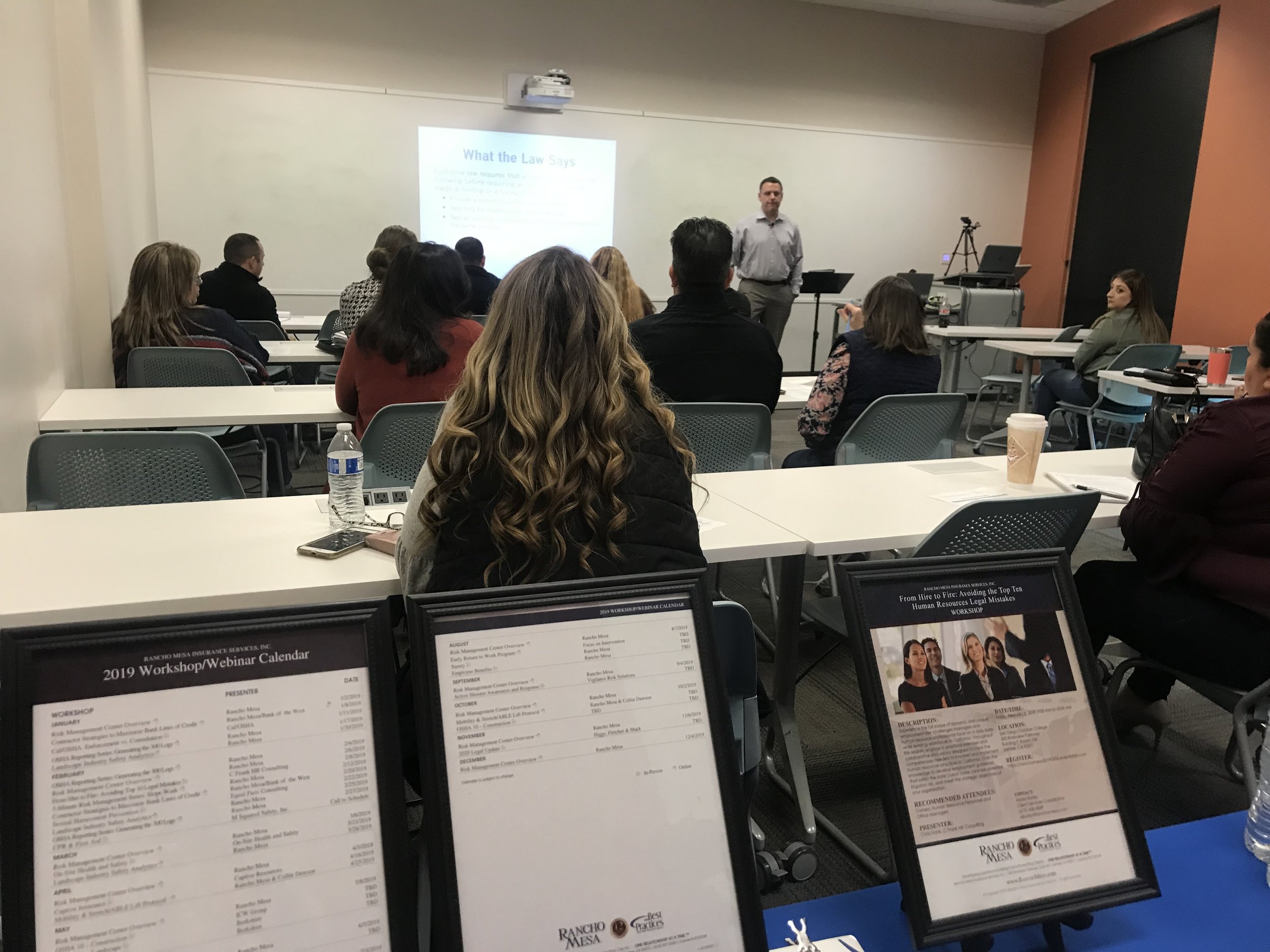

On Friday, February 8, 2019 Rancho Mesa hosted their second workshop of the year at the San Diego Christian College in Santee, CA. The informative From Hire to Fire: Avoiding the Top 10 Legal Mistakes workshop was presented by Chris Frank, the founder of C Frank HR Consulting.

Author, Lauren Stumpf, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On Friday February 8, 2019, Rancho Mesa hosted their second workshop of the year at the San Diego Christian College in Santee, CA.

The informative From Hire to Fire: Avoiding the Top 10 Legal Mistakes workshop was presented by Chris Frank, the founder of C Frank HR Consulting. The workshop sparked many questions and discussions of owners, human resource personnel, and office managers who attended.

Attendees walked away with a better understanding of current employment laws, how to minimize legal exposure for their company, and how they can apply law knowledge to effectively coach managers/supervisors and lead employees.

If you missed this workshop, a video of the presentation will be available through the Risk Management Center, along with a downloadable version of the presentation slides and handouts.

Contact Alyssa Burley at (619) 438-6869 for more information about Rancho Mesa’s upcoming workshops and webinars.

RM365 Advantage Safety Star Program™ Lights Up the Sky

Author, Dave Garcia, President & Chief Executive Officer, Rancho Mesa Insurance Services, Inc.

The response to our proprietary RM365 Advantage Safety Star Program™ has been like a rocket launch from Cape Canaveral, lighting up the sky. Countless clients from California and from as far away as Illinois have already begun the certification process, in a race to see who becomes the first Safety Star Team Member.

Author, Dave Garcia, President & Chief Executive Officer, Rancho Mesa Insurance Services, Inc.

The response to Rancho Mesa’s proprietary RM365 Advantage Safety Star Program™ has been like a rocket launch from Cape Canaveral, lighting up the sky. Countless clients from California and as far away as Illinois have already begun the certification process in a race to see who becomes the first Safety Star Team Member.

This program is designed to provide safety education to supervisors, foremen, safety coordinators and upper management in order to lower their company’s probability of work-related injuries, while promoting a safety culture. There are many reasons for completing the certification process, including improving the safety culture of the organization which:

Reduces the probability of claims.

Improves productivity by keeping your employees safely at work.

Demonstrates care about the impact a claim has on the employees’ families.

Provides a competitive advantage in the insurance marketplace.

Lowers overall costs of insurance.

Leaders in the insurance marketplace agree, stating:

“Rancho Mesa is always thinking outside the box for their clients to help them better manage risk,” said Margaret Hartmann, Senior Vice President & Chief Marketing Officer at Berkshire Hathaway Homestate Companies. “We value Rancho Mesa’s efforts as they help prepare our policy holders for the future.”

“Policyholders that recognize their employees are their most valuable asset, investing in and promoting a safety culture at their company, are Stars in our books,” said Gene Simpson, Vice President of Underwriting & Marketing at CompWest Insurance. “Businesses that strive to get their employees safely home to their families at the end of the day are valued customers at CompWest Insurance Company, because they care about their employees and understand the importance of avoiding workplace injuries.”

This program is available exclusively to Rancho Mesa clients. If you have not already registered and want to enroll in the RM365 Advantage Safety Star Program™, visit www.ranchomesa.com/rm365-advantage-safety-star-program and fill out the application.

For non Rancho Mesa clients who want to learn more, please contact Alyssa Burley at (619)438-6869 or aburley@ranchomesa.com.

Rancho Mesa Releases New Fillable Accident and Investigation Forms

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa Insurance Services, Inc. is pleased to announce the release of its new fillable accident and investigation forms to clients, in January 2019.

The new forms are distributed as fillable PDFs, making completing the information simple and easy for clients who are at a computer, laptop, tablet or smartphone.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa Insurance Services, Inc. is pleased to announce the release of its new fillable accident and investigation forms to clients, in January 2019.

The new forms are distributed as fillable PDFs, making completing the information simple and easy for clients who are at a computer, laptop, tablet or smartphone.

The “Supervisor’s Report of Employee Accident or Near Miss” form now includes a body diagram where employees can specify exactly where the injury has occurred on the body. Identifying all injured body parts at the time of the accident is important when documenting a workplace injury. This ensures additional body parts are not added to the claim at a later time.

Each form in the library is offered in both English and Spanish. And, both versions are now combined into one PDF document, making distribution of the forms easier for employers.

Rancho Mesa clients can access the new forms through the online Risk Management Center, Accident and Investigation Center or by contacting the Client Services Department at (619) 438-6869.

Rancho Mesa Launches RM365 Advantage Safety Star Program™

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa Insurance Services, Inc. is pleased to announce the launch of its proprietary RM365 Advantage Safety Star Program™. This program is designed to provide safety education to supervisors, foremen, safety coordinators and upper management in order to lower their company’s probability of work-related injuries while promoting a safety culture. Each module provides the participant with a better understanding of the major hazards that face their industry and drive insurance premiums.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa Insurance Services, Inc. is pleased to announce the launch of its proprietary RM365 Advantage Safety Star Program™. This program is designed to provide safety education to supervisors, foremen, safety coordinators and upper management in order to lower their company’s probability of work-related injuries while promoting a safety culture. Each module provides the participant with a better understanding of the major hazards that face their industry and drive insurance premiums.

“Policyholders that recognize their employees are their most valuable asset, investing in and promoting a safety culture at their company, are Stars in our books,” said Gene Simpson, Vice President of Underwriting & Marketing at CompWest Insurance. “Businesses that strive to get their employees safely home to their families at the end of the day are valued customers at CompWest Insurance Company, because they care about their employees and understand the importance of avoiding workplace injuries.”

Currently, the RM365 Advantage Safety Star Program is offered exclusively for the construction industry; however, plans are underway to offer a program specifically designed for human services organizations, in the future.

The construction program can be completed 100% online or through a combination of online and in-person workshop modules.

All participants take the Accident Investigation and Analysis module while choosing two remaining modules from Mobility & Stretch/ABLE Lift Protocol, Fall Protection, Heat Illness Prevention, and Fleet Safety.

“Rancho Mesa is always thinking outside the box for their clients to help them better manage risk,” said Margaret Hartmann, Senior Vice President & Chief Marketing Officer at Berkshire Hathaway Homestate Companies. “We value Rancho Mesa’s efforts as they help prepare our policy holders for the future.”

“This compelling and creative service approach is an example of the differentiation that Dave Garcia and his Rancho Mesa team bring to their business partnerships,” according to Bryan Anderson Senior VP/Regional Manager at Zenith Insurance Company.

Sending management through the RM365 Advantage Safety Star Program can give the company a competitive advantage in the insurance marketplace and lower its overall insurance costs.

“This program, when rolled out and followed in its entirety, should reinforce any companies safety program, safety protocol, and safety practices,” said Stephanie Cassady, Underwriting Branch Manager at ICW Group. “As a carrier, I am excited at the positive momentum that a program like this would have on a insureds’ frequency/severity of losses.”

To enroll in the RM365 Advantage Safety Star Program, visit www.ranchomesa.com/rm365-advantage-safety-star-program and fill out the application.

For more information, please contact Alyssa Burley at (619) 438-6869.

Rancho Mesa Insurance Services, Inc. Named "Best Practices" Agency for 11th Consecutive Year

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa Insurance Services, Inc., a leading Southern California-based commercial insurance brokerage firm, for the eleventh consecutive year, has been included in the Independent Insurance Agents & Brokers of America's (IIABA) elite group of “Best Practices” agencies.

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa Insurance Services, Inc., a leading Southern California-based commercial insurance brokerage firm, for the eleventh consecutive year, has been included in the Independent Insurance Agents & Brokers of America's (IIABA) elite group of “Best Practices” agencies.

Of the roughly 38,000 independent insurance agencies in the country, only 241 retained their “Best Practices” agency status in 2017. In California, Rancho Mesa is one of only fourteen agencies to earn the distinction.

An agency must first be nominated by the Independent Insurance Agents & Brokers of America (Big I); then, it must submit detailed financial and operational information which is analyzed, scored, and ranked objectively based on operational excellence, including: outstanding customer services, growth, stability, and financial management.

Each year, the IIABA publishes its "Best Practices Study" using financial and operational data collected from agencies throughout the United States. The 2017 Best Practices Study will be available later this year. It will include a list of all the Best Practices Agencies by state and the results of the study.

To learn more about what it takes to be a "Best Practices Agency," read the article "Characteristics of a Best Practices Agency Explained" published by the IIABA.

About Rancho Mesa Insurance Services, Inc.

Rancho Mesa was founded in 1998 and is regarded as a leading Southern California insurance agency with recognized expertise in construction and nonprofit/social services. They provide their clients with risk management services, comprehensive insurance programs, bonding, employee benefits, and industry specific training.

Captive Resources LLC Educates Business Owners At Rancho Mesa Workshop

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On Friday, February 24, 2017, Rancho Mesa Insurance Services, Inc. hosted a Captive Insurance Company Workshop at the TMI offices on Murphy Canyon Road in San Diego, CA.

The presenter, Doug Hayden from Captive Resources, LLC, discussed the captive model as an insurance option for local businesses.

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On Friday, February 24, 2017, Rancho Mesa Insurance Services, Inc. hosted a Captive Insurance Company Workshop at the TMI offices on Murphy Canyon Road in San Diego, CA.

The presenter, Doug Hayden from Captive Resources, LLC, discussed the captive model as an insurance option for local businesses.

A captive is designed for companies that are not only interested in controlling insurance costs and retaining investment income, but obtaining high quality coverage and insurance related services.

About Captive Resources

Captive Resources specializes in the creation and administration of member-owned captive insurance companies. They have a time-tested approach that balances potential risk, and profit, arising from businesses’ insurance programs. Recently Rancho Mesa has partnered with Captive Resources in offering their programs to our best customers.

Visit the Workshops page for information on future workshop topics.

Photos by Alyssa Burley.

Rancho Mesa Hosts Sexual Harassment Prevention Workshop

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On Thursday, February 23, 2017, Rancho Mesa Insurance Services, Inc. hosted a Sexual Harassment Prevention Workshop on the campus of San Diego Christian College in Santee, CA.

The presenter, Jeremy Dwork from Meyers Fozi, discussed harassment prevention techniques, practical examples with an open discussion, and an overview of supervisor and company response requirements.

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On Thursday, February 23, 2017, Rancho Mesa Insurance Services, Inc. hosted a Sexual Harassment Prevention Workshop on the campus of San Diego Christian College in Santee, CA.

The presenter, Jeremy Dwork from Meyers Fozi, discussed harassment prevention techniques, practical examples with an open discussion, and an overview of supervisor and company response requirements.

In California, AB 1825 requires employers with fifty or more employees to provide all employees with supervisory responsibilities with interactive training about sexual harassment prevention. The training is required every two years or within six months of someone being promoted into a supervisory role. In addition, AB 2053 now requires the training must now include discussion about abusive conduct prevention.

Visit the Workshops page for information on future workshop topics.

Photos by Alyssa Burley.

Rancho Mesa Offers Sexual Harassment Prevention Workshop

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On Thursday, February 16, 2017, Rancho Mesa Insurance Services, Inc. hosted a Sexual Harassment Prevention Workshop on the campus of San Diego Christian College in Santee, CA.

The presenter, Michael Valenzano from Equal Parts Consulting, discussed harassment prevention techniques, practical examples with an open discussion, and an overview of supervisor and company response requirements.

Author Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On Thursday, February 16, 2017, Rancho Mesa Insurance Services, Inc. hosted a Sexual Harassment Prevention Workshop on the campus of San Diego Christian College in Santee, CA.

The presenter, Michael Valenzano from Equal Parts Consulting, discussed harassment prevention techniques, practical examples with an open discussion, and an overview of supervisor and company response requirements.

In California, AB 1825 requires employers with fifty or more employees to provide all employees with supervisory responsibilities with interactive training about sexual harassment prevention. The training is required every two years or within six months of someone being promoted into a supervisory role. In addition, AB 2053 now requires the training must now include discussion about abusive conduct prevention.

Visit the Workshops page for information on future workshop topics.

Photos by Alyssa Burley.

Rancho Mesa “Rocks” the Landscape Industry

Author Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

Author Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

The Agency

Rancho Mesa is a 10 Time National Best Practices Agency out of Santee, California with over 30 years’ experience in The Landscape Industry. As the program manager, Rancho Mesa will look to challenge and develop the growth of the program to better protect its members.

The Carrier

Berkshire Hathaway Homestate Companies has the Highest AM Best rating of A++(XV) “Superior” rating of financial strength, and is the one of the largest specialty Work Comp Carriers in the Country.

The Association

The NALP is the only National Organization built by the collaboration of landscape and lawn care industry professionals and has pushed the boundaries for Professionalism in the Landscape Industry to new heights through; Education, Certification and Legislation. As the voice for 100,000 landscape professionals the NALP passionately advocates for the economic, social and environmental benefits of the landscape industry.

The Program Highlights include:

- 6% discounted rates for NALP members where allowable. Lowest available base rate in states that do not allow rate deviation.

- Multiple workers compensation options guaranteed cost and small to large deductible.

- Flexible payment plans including stipulated, pay as you go (zero deposit) and monthly payroll reports.

- Quarterly safety webinars specific to the injuries arising out of the landscape industry.

- Dedicated service team with experience in the landscape industry.

- Underwriting team only evaluating NALP members.

- Claims handling dedicated to NALP members with lower caseloads.

- Loss control with regional representation and managed nationally by a dedicated coordinator.

For more information contact Drew Garcia, the Program Director at NALP@ranchomesa.com.

Rancho Mesa's Sam Brown Presents at Accounting and Financial Women's Alliance

On Thursday, February 16, Sam Brown, Vice President, Human Services Group at Rancho Mesa Insurance Services, presented2017 Workers’ Comp Updates, How it Affects CA Employers to the Accounting and Financial Women’s Alliance, San Diego Chapter (AFWA) at the Bali Hai Restaurant.

On Thursday, February 16, Sam Brown, Vice President, Human Services Group at Rancho Mesa Insurance Services, presented2017 Workers’ Comp Updates, How it Affects CA Employers to the Accounting and Financial Women’s Alliance, San Diego Chapter (AFWA) at the Bali Hai Restaurant.

Mr. Brown covered the most prominent changes to the California Workers’ Compensation system to help decision makers navigate their policy renewals and plan 2017 safety efforts. Such topics included AB 2883’s changes to the definition of “employee”, First Aid reporting requirements, the 2017 Experience Modification Formula change, and the impact of Proposition 64 (recreational Marijuana) in the workplace.

The AFWA was formed in 1938 originally as the American Society of Women Accountants (ASWA) with the goal of increasing the opportunities for women in all fields of accounting and finance. The first chapter was chartered in Indianapolis, Indiana.

The mission of the San Diego chapter of AFWA is to enable women in all accounting and related fields to achieve their full personal, professional and economic potential and to contribute to the future development of their profession.

Please contact Sam Brown at Rancho Mesa Insurance Services if you have questions about the presentation topics or wish to inquire about future speaking engagements.