Industry News

Employer’s Guide to Handling Cumulative Trauma Claims

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

A growing thorn in employers’ sides has been the rise of worker’s compensation cumulative trauma (CT) claims. Cumulative trauma refers to the ongoing psychological and physical injuries that accumulate over time, often resulting from repetitive stress or exposure to adverse conditions. Employees missing time can lead to larger workers’ compensation claims, lower moral and less efficiency. It can be easy as an employer to take a defensive stance and fight every one of these but there are a few factors that need to be taken into consideration prior to deciding if you should settle or challenge these claims.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

A growing thorn in employers’ sides has been the rise of worker’s compensation cumulative trauma (CT) claims. Cumulative trauma refers to the ongoing psychological and physical injuries that accumulate over time, often resulting from repetitive stress or exposure to adverse conditions. Employees missing time can lead to larger workers’ compensation claims, lower moral, and less efficiency. It can be easy as an employer to take a defensive stance and fight each one of these, but there are a few factors that must be taken into consideration prior to deciding if you should settle or challenge these claims.

Not every CT claim should to be fought. As hard as it is to hear, you can win the battle but lose the war. Sometimes the cost of gathering information, medical reviews, time spent away from operations and litigation can add up to more than it would have cost to settle these claims. This is extremely tough to achieve in construction as the burden is on the employer to prove that there is no way that their stated injuries could have happened while working for you.

Employers can proactively fight CT claims by staying ahead of the exposure as much as possible. This means making sure your workers have the safest, most ergonomic-friendly environment possible. Stress and repetitive motion are two of the largest causes of CT claims. Trying to keep your employees from doing the same repetitive task over and over is extremely important in keeping both moral high and frequency of claims lower. However, this can be difficult for most construction companies with the need to perform the same motion over and over, but it is necessary to have your employees switch up tasks if at all possible.

This does not mean that every cumulative trauma claim should be settled either. We are seeing younger and younger employees filing these once they have been let go or have chosen to leave. These post termination claims typically come attached with an applicant attorney and can include multiple body parts being named that appear initially as fraudulent statements. If it is determined that there truly was no record of injury and they are able to perform all normal duties, fighting the claim may make sense.

Each claim is unique and needs to be handled as such. Relying on your insurance broker and carrier claim consultant for guidance is critical in staying focused on the facts, not the frustration and emotions that often accompany these types of claims. While settling a claim that could be fraudulent can be frustrating and does have an impact on your experience modification rate, it can often be the best path towards minimizing costs and maintaining lower loss ratios that lead directly to lower renewal premiums, which is the ultimate goal.

If you have any questions about how to handle cumulative trauma claims, reach out to me at ccraig@ranchomesa.com or (619)438-6900.

Cracking the Code: Deciphering the Primary Threshold’s Impact

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Every business owner understands the correlation between their Experience MOD (XMOD) and what they will pay in workers’ compensation premiums. When the XMOD increases, there is a good chance that the workers’ compensation rates or premiums will rise as well. This is why it is so crucial to really hone in on company safety procedures to limit work-related injuries as much as possible. The reality is that even the safest company that does everything the right way is going to run into a workers’ compensation claim from time to time.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

Every business owner understands the correlation between their Experience MOD (XMOD) and what they will pay in workers’ compensation premiums. When the XMOD increases, there is a good chance that the workers’ compensation rates or premiums will rise as well. This is why it is so crucial to really hone in on company safety procedures to limit work-related injuries as much as possible. The reality is that even the safest company that does everything the right way is going to run into a workers’ compensation claim from time to time.

So, when the inevitable workers’ compensation claim happens, what are you supposed to do? What impact will this have on the XMOD? The first component that business owners need to understand is that there is a cap to how much any single workers’ compensation claim can impact the XMOD. That cap is called the primary threshold. The primary threshold varies from company to company and is based off of the company’s payroll. The more payroll a company has the higher the primary threshold.

For this example, a company has a primary threshold of $15,000 where the maximum number of points that any one claim can impact the XMOD once reaching the threshold is 10 points. This means that a claim that costs $15,000 and a claim that cost $150,000 will have the same impact (10 points against the XMOD). However, this does not mean that claims that exceed the primary threshold can be disregarded, because the higher claim cost you have will impact your current and 5-year loss ratio (incurred claim cost/premium paid). Additionally, if a claim that was reserved higher than the primary threshold and can be closed or decreased lower than the primary threshold, XMOD points can be shaved off of that claim.

Knowing the importance of the primary threshold, we designed our proprietary the KPI dashboard that allows our clients to see their primary threshold number and corresponding maximum impact to the XMOD any one primary threshold claim would have.

If you have any questions about your XMOD or would like us to create a KPI for your company, please feel free to reach out to me at (619) 438-6905 or ggarcia@ranchomesa.com.

What Does the Employer Do After a Work Injury?

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

A work related injury can be a very traumatic event for the injured worker, but also for their co-workers, employer, family and friends. Some injuries occur from a specific event when everybody knows the injury occurred. Other times, incidents occur during the work day, or repeatedly over time, where the employee needs to report these incidents, accidents or developing symptoms to his supervisor, manager, or human resource manager according to company protocol.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

A work related injury can be a very traumatic event for the injured worker, but also for their

co-workers, employer, family and friends. Some injuries occur from a specific event when everybody knows the injury occurred. Other times, incidents occur during the work day, or repeatedly over time, where the employee needs to report these incidents, accidents or developing symptoms to his supervisor, manager, or human resource manager according to company protocol.

Prompt reporting of a work injury is very important for the employer and their continued responsibilities. The employee reports the injury or accident to his supervisor, manager, or appropriate employer representative. The employer than has 5 days to report the incident to the insurance carrier.

Once reported, the employer can examine the scene of the accident and verify the mechanism of injury. Witnesses can be identified and their statements can be obtained. If the cause of the accident was another person, that person can be identified and their information can be obtained. If caused by a tool or apparatus, that tool or item can be removed from the work place and kept in a secure area for future reference. If caused by a dangerous condition, the condition can be corrected or barricaded to prevent additional injury.

Work injuries usually result in instances where the injured worker reports the injury to their employer and they are interviewed and referred to an occupational medicine facility. There are companies that provide medical professionals that triage, the injury with the employee via telephone, or a visit to the workplace. The employee may be allowed to drive themselves to this facility or may have to be driven by a supervisor or foreman. The employee is instructed to provide the employer the Work Status form from the physician immediately after each and every examination or follow up visit. If he is released to work, his employer needs the physician’s release to allow a return to work and if they are released to modified duties, the employer then determines if modified work is available. If modified work is not available, the employer than sends the injured worker home until his next visit or until modified work becomes available.

When the injury is addressed, there are forms that need completed for the work related injury. The most important document is the DWC 1 Claim Form. This form MUST be provided to the injured worker within 1 DAY of when the employer knows of the injury. This form starts the claims process with the insurance company. It is a two part form where the employee completes the top part and the employer completes the bottom. Upon completion, the form is submitted to the insurance company and copies are provided to the injured worker and kept by the employer. The employer is then to complete the Employer’s First Report of Occupational Illness of Injury Report (ER’s 5020 form). Then, they obtain the Supervisor’s Report of Work Injury Report and any witness statements that may have been obtained. All these forms and reports are submitted to the insurance adjuster upon receipt and/or completion.

Now that the claim has been created, the employee is obtaining medical treatment, and all the forms have been completed and submitted, the employee’s progress will be monitoring during their recovery. Maintaining good communication with the employee and claims adjuster is very important for helping the employee get through this recovery process.

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Employers Beware! Ten Red Flags You May Have a Fraudulent Workers’ Comp Claim

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

While most people would agree with the idea of a workers' compensation system, unfortunately, there are people who try to defraud it in an effort to earn an extra buck. These individuals include both employers and employees. For this article, I will focus solely on the most common workers’ compensation fraud, claimant fraud (i.e., when an employee commits the fraud).

Claimant fraud includes false claims and exaggerated claims. These claims typically involve soft-tissue symptoms, such as headaches, whiplash, or muscle strain, which are all very difficult to disprove. In order to increase the value of the claim, claimants will also include multiple body parts. The most common types of claimant fraud includes reporting fake claims, injuries not received on the job, exaggerated injuries, and claimants working for another employer while collecting benefits from an injury claim.

Claimant fraud causes extreme frustration, animosity, and can lead business owners to question all claims, including those that are legitimate. Employers can feel helpless, especially when the system gives the benefit of the doubt to fraudsters. There are, however, red flags that both employers and insurance companies can pick up on to fight against these individuals seeking easy money.

Ten Red Flags

The top ten red flags employers can look for on a possible fraudulent claims are: When the claimant;

Hires an attorney the day of the alleged injury.

Has several other family members also receiving workers’ compensation benefits.

Exhibits a strong familiarity with the workers’ comp system.

Has been disciplined several times or is disgruntled and fears termination.

Was engaged in seasonal work that is about to end.

Continues to cancel or fails to keep medical appointments or refuses a diagnostic procedure to confirm an injury.

Changes doctors when the original suggests they return to work.

Is seen working at another job while collecting total temporary disability.

Is reluctant to return to work and shows very little improvement.

Has problems with workplace relationships.

Contact me to learn strategies for combating fraudulent claims before and after it is reported.

How To Lower Your Experience MOD by Understanding Your Primary Threshold

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

How do I decrease my MOD to lower my workers compensation premium?

A few factors can be addressed to reduce the workers' compensation premium. The most important is the primary threshold. Each individual employer has their own primary threshold that is determined by the class of business they operate and the amount of field payroll they accrue over a three year period. The primary threshold is the point at which any claim maximizes its negative impact on the MOD. You must be sensitive to this number because any open claim with paid amounts under the threshold, provides an opportunity to save points to the MOD. Once a claim exceeds paid amounts over your threshold, it no longer can negatively impact your MOD. However, you would still want to monitor and manage these claims to ensure your injured employee is being provided attentive care and to maintain knowledge of your loss experience.

Example

You’re a landscaping company and your primary threshold is $33,000. The most any claim can affect your MOD is $33,000 and the most points that any claim can add to your MOD is 13.

You have a claim open for $40,000 with paid amounts of $10,000 and reserved amounts of $30,000.

This claim will go into the calculation at $40,000 (Paid + Reserved) but because the total amount succeeds the primary threshold of $33,000, it will only show up on the rating sheet totaling $33,000 of primary loss and contribute 13 points to your MOD.

It would behoove you to analyze and monitor this open claim, because it has paid out amounts well below your primary threshold of $33,000.

If this same claim closes for a total paid amount of $22,000, the closed claim would go into your MOD at $22,000 with 8 points contributing to the MOD.

The difference between a $40,000 claim and a $22,000 claim is 5 points to your MOD, or, 5% to your premium!

Knowing your primary threshold is the most important piece of information when managing your XMOD. Fortunately, Rancho Mesa can help you manage your experience MOD by tracking your primary threshold and maintaining the other critical elements that go into establishing a sustainable low experience MOD.

For more information about lowering your experience MOD or a detailed analysis of your current MOD please reach out to Rancho Mesa.

Below is an example worksheet for Landscapers to determine the primary threshold.

| Annual Landscape Payroll | 2018 Primary Threshold | Max Points to MOD | Lowest MOD |

|---|---|---|---|

| $100,000 | $5,500 | 53 | .84 |

| $250,000 | $10,000 | 38 | .75 |

| $500,000 | $15,500 | 30 | .65 |

| $1,000,000 | $22,000 | 21 | .56 |

| $1,500,000 | $26,000 | 17 | .51 |

| $2,000,000 | $30,000 | 14 | .47 |

| $2,500,000 | $32,000 | 12 | .45 |

| $3,000,000 | $35,000 | 11 | .42 |

| $5,000,000 | $41,000 | 8 | .36 |

| $10,000,000 | $40,000 | 5 | .30 |

Ask the Expert: Insurance Questions from the Lawn and Landscape Industry

Author, Drew Garcia, NALP National Program Director, Rancho Mesa Insurance Services, Inc.

Drew Garcia answers common insurance questions for the landscape industry.

Author, Drew Garcia, NALP National Program Director, Rancho Mesa Insurance Services, Inc.

How can I control and/or lower my experience rating?

Without getting into detail about the formula or governing insurance bodies, here are some key items to focus on in order to lower your experience rating (i.e., experience modification, MOD), no matter your jurisdiction.

Frequency vs. Severity (Proactively Track and Eliminate the Claim Before it Happens)

Analyze your work related injuries and near misses to search for trends that will help to prevent similar claims from occurring. Your rating will typically see more of a negative impact with multiple claims (frequency) as opposed to one large loss (severity). Frequency drives the probability for more claims to occur in the future which would make your company a higher risk to insurer.

Return to Work (Make it Mandatory)

All claims may potentially impact the experience rating in one way or another, with frequency having a large role in the mathematical formula. Another key part of managing claim costs is the focus on reducing indemnity expenses on every claim. By returning an employee to work you eliminate any claim cost that would have been allocated to temporary disability. The savings you will see on your experience MOD is remarkable. If you need help creating a return to work program, reach out to your workers compensation insurance carrier for guidance. If you decide to implement any of these strategies going forward, implement a mandatory Return to Work program.

Example:

An injured employee will earn $400 a week on temporary disability and is estimated to need three months of recovery. The claim closes three months later with a total incurred claim cost of $4,800 in indemnity (wages) and $2,000 in medical, equaling $6,800.

With a Return to Work program, the injured employee is right back to work on modified duty and earns no temporary disability. The claim closes for $2,000. Not only will the claim have less of an effect on your experience MOD, but you will also have constant communication with the injured employee, which keeps them feeling part of the team, boosts their morale, and perhaps expedites the length of the injury.

Carrier Analytics (Save a $1 Today That Will Cost You $5 in the Future)

Who is handling your insurance claims? When you purchase workers compensation insurance, you are buying a company’s ability to handle claims and how those claims are handled will determine your experience MOD, your cost, and your bottom line for years to come. Carrier benchmarking reports are becoming critical in helping to evaluate the impact each carrier will have on your claim experience. You should place your insurance with a carrier who has a history of writing policies for your specific industry and a proven track record of closing claims faster than the industry, and for less money, because that money is what drives your modifier through the roof.

What are your thoughts on a safety incentive program?

I would suggest safety recognition as opposed to safety incentive, here’s why. An incentive program might keep employees from reporting work related injuries in fear that they might “ruin” a streak of consecutive days without an injury. You do not want to make an employee fearful of reporting an injury. OSHA and the Department of Labor have started to enforce these “dis-incentive” programs in a more visible way.

Safety recognition would mean identifying an employee who has successfully executed your company’s standard safety requirements or has gone above and beyond to better the company’s safety culture. A type of recognition could be handing out raffle tickets to employees who have executed standard safety protocol and having a monthly drawing for prizes.

What is the key to having a safe company? We have all the safety programs; we do tailgates every week; and, we still have claims, routinely!

In one word, the companies that experience the best safety records all share this common trait, communication. You can have all the compliance based safety programs in place but without superior communication they will lack true execution. Proactively communicating with your team in the field, every day, is what it takes. Safety must become a common attribute employees think of when they talk about your company. It takes participation and “buy-in” on all levels from ownership to employee. Employees must understand the exposures and job hazards associated with their work, but, the culture you are trying to create within your company should generate excellent decision making, like employees who think:

- “I probably shouldn’t lift this alone.”

- “That slope looks wet."

- “I should pick this up before someone steps on it.”

You cannot buy a good safety company. Like anything in life, it is earned. With a concentrated effort, you can establish a solid safety program that becomes routine and everyone in your company will benefit from it.

California Workers Compensation 2018 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds Announced by WCIRB

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details and is attached for your review.

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details of California Workers Compensation 2018 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds. The document is available for your review.

For any questions concerning the changes, please contact your Rancho Mesa service team.

3 Topics to Discuss with Vendors, Independent Contractors, and Partner Agencies Prior to Working Together

Author, Chase Hixson, Account Executive, Human Services, Rancho Mesa Insurance Services, Inc.

Recently, a non-profit client of mine asked the question: What are the steps I should take with vendors, contracted professionals and partner agencies to make sure my organization is protected should a claim arise as a result of their work? This is a common exposure to many of our clients, and there are several steps that can be taken to protect your business.

Recently, a non-profit client of mine asked the question: What are the steps I should take with vendors, contracted professionals and partner agencies to make sure my organization is protected should a claim arise as a result of their work? This is a common exposure to many of our clients, and there are several steps that can be taken to protect your business.

1. Verify the Proper Insurance is in Place

Any person/organization that you consider working with should be fully insured and able to provide you with a Certificate of Insurance, which lists the coverages, carriers and limits of insurance they have in place. Without their own insurance in place, your company is now assuming full responsibility for anything that may occur as a result of their negligence. Depending on the nature and scope of the work being performed, different types of insurance will be required. An insurance professional can help you determine the specific coverage needed.

Example: A charter school has hired a local animal shelter to bring animals to their students and teach about conservation. One of the animals bites a student. If the animal shelter does not have the proper insurance, the charter school’s insurance will be liable for any action taken against the school.

2. Name Your Business as Additional Insured

In addition to verifying that the correct coverages and limits are in place, you should also require they name your company as an additional insured on their policy. By doing this, your organization will now be indemnified under their policy for claims arising as a result of their work, in which you are named.

Example: In the example where a charter school has hired a local animal shelter to bring animals to their students and one of the animals bites a student, by requiring the animal shelter to name the charter school as an additional insured, the school is covered under the animal shelter’s insurance.

3. Provide a Waiver of Subrogation

A waiver of subrogation means an insured (and their insurance company) are waiving their right to subrogate against another party, should their employee suffer an injury on your premises. Most independent contractors aren’t required to carry insurance, so this wouldn’t apply to them. However, if employees of another company are performing work on your premises, it is wise to have them waive their right to subrogate against your workers’ compensation carrier.

Example: A charter school has hired a local animal shelter to bring animals to their students and teach about conservation. While presenting, an employee of the shelter trips and injures their knee. A waiver of subrogation would void the animal shelter’s workers’ compensation provider from seeking subrogation against the charter school’s workers’ compensation policy. The employee will still be treated, but you won’t suffer the penalty for it.

I strongly recommend reviewing your processes regarding vendor, independent contractors and partner agencies to see what is currently in place. Far too often steps are skipped and businesses are unaware of the liability they are assuming. If you have any question about a specific circumstance, please don’t hesitate to give Rancho Mesa a call at (619) 937-0164, we are happy to assist.

5 Steps to Avoiding Workers’ Compensation Claim Litigation

Author, Jeremy Hoolihan, CRIS, Janitorial Group Leader, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation claims can cost a company time, money, employee productivity, and morale. Litigation is one of the most costly results of a workers’ compensation claim. Once an employee hires an attorney, the time and money it takes for the claim to close drastically increases.

Author, Jeremy Hoolihan, CRIS, Janitorial Group Leader, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation claims can cost a company time, money, employee productivity, and morale. Litigation is one of the most costly results of a workers’ compensation claim. Once an employee hires an attorney, the time and money it takes for the claim to close drastically increases.

There are several reasons why an employee will find the need to hire an attorney. Practicing a sound Risk Management Program can dramatically reduce the likelihood of litigation. Here are some ways you can prevent most workers’ compensation claims from ever reaching that point:

- Acknowledge why employees hire attorneys. The employee/employer relationship is a critical factor in determining if a workers’ compensation claim results in litigation. Employees who feel threatened in some way are more likely to hire an attorney. A few key reasons are:

a. The employee is concerned they will be fired because of the injury and/or ownership or management doesn’t truly feel the injury was work related.

b. The employee feels they will face retaliation for reporting the claim.

c. There is a lack of understanding of the workers’ compensation claim process. For those employees that are faced with a workers’ compensation injury, it can be a very stressful time.

d. There is a fear the claim will be denied or they will be treated unfairly. Attorneys can prey on vulnerable injured employees. Radio and television ads imply injured employees need their assistance in order to get proper treatment and/or a huge settlement they deserve.

- Keep lines of communication open with your employee. Reassure the employee that he or she will have a job when they are able to return to work. In addition, show some compassion and stay in regular contact with the individual. An employee is far more likely to hire an attorney if they are concerned about losing their job or no longer of value to the company.

- Consider the ramifications before firing an injured employee. Termination of an employee after they have been injured on the job can put the company at risk of a lawsuit (Section 132 claim). In addition, terminating an injured worker could cost the company more in wage loss benefits; an injured employee will continue to draw from the workers’ compensation policy if they are unable to return to work, regardless if the company continues to employ them or not. Often, employees are released to modified duty (Return To Work Program). If an employer can accommodate the work restrictions, the employee’s temporary benefits are reduced or eliminated. This can significantly reduce the total cost of the claim.

- Act before a problem employee becomes injured. Once an injury has been reported, it becomes extremely risky to discipline or terminate a problem employee. Address and deal with the employee immediately and be consistent with your documentation.

- Train your supervisors!!!! It is vital that supervisors are trained in reporting and handling claims. They are your first line of defense in preventing claim litigation. Businesses should have a formalized Accident Investigation Program in place. Rancho Mesa provides a Supervisor’s Report of Accident or Near Miss form and a Witness’ Accident Statement form to assist in the investigation process. In addition to all the formal documentation, there are other key strategies a supervisor can use:

a. Do not accuse the injured employee of fraud, even if you know fraud is involved. Supervisors should simply document the facts. If there is suspicion of fraud, make sure you document any supporting evidence in the report and inform the adjuster.

b. Do not negotiate the injured worker’s treatment or return to work schedule. Leave that determination to the claims adjuster.

c. Keep in touch. Instruct the supervisor to check on the injured worker from time to time. Show some compassion and build trust. Assure the employee that their job is secure.

While there is no surefire way to eliminate litigated claims, by following these five steps you should see results. With the average litigated claim costing 30% more than a non-litigated claim, the savings over time could be significant. To discuss implementing this strategy within your company’s Risk Management Program, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

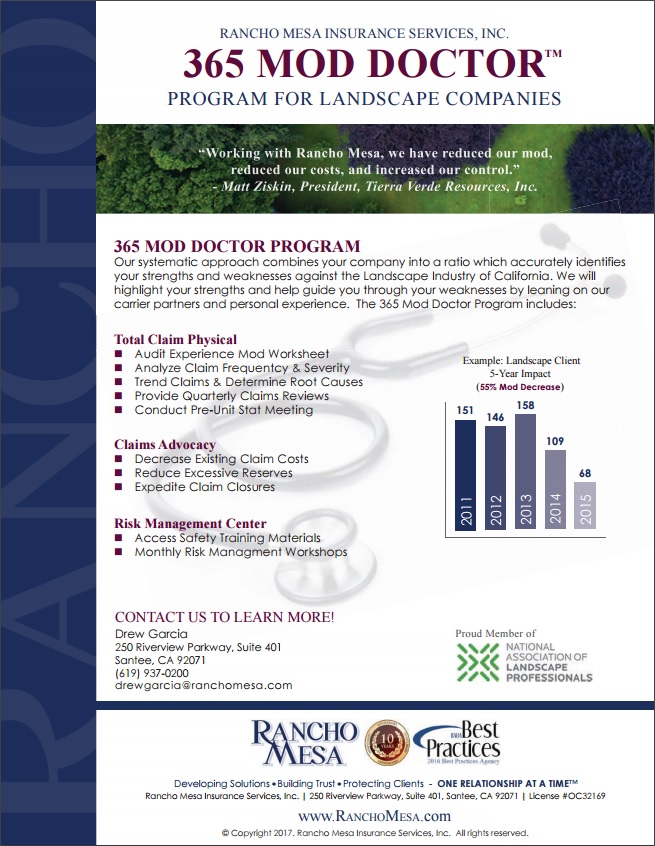

Control your Experience MOD through the MOD Doctor Process.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Successfully maintaining low and predictable workers' compensation costs is a product of establishing a routine that constantly “checks and balances” your all-encompassing insurance program. Our "MOD Doctor" technique lays out a road map so we can guide you throughout the year to gain more control, become more efficient, and ultimately drive down your insurance cost; at no extra expense. What can you expect from this process?

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Successfully maintaining low and predictable workers' compensation costs is a product of establishing a routine that constantly “checks and balances” your all-encompassing insurance program. Our MOD Doctor™ technique lays out a road map so we can guide you throughout the year to gain more control, become more efficient, and ultimately drive down your insurance cost; at no extra expense. What can you expect from this process?

Audit Experience MOD Worksheet. Our team analyzes your experience MOD worksheet to ensure the information is accurate with payrolls, claim information, and class codes.

Analyze Claim Frequency, Severity, and Trends. It’s important to analyze your company’s loss information and specifically look for trends in order to prevent further claim activity with similar causes. Furthermore, we compare your loss experience against the landscape industry, in your state, to determine whether you are outperforming or underperforming your industry.

Claims Meetings. The largest companies maintain claim review meetings on a consistent basis. We bring this service to you and adjust the frequency of the meeting to fit your needs. It’s important to have updated information on your open claims, without sacrificing your time or your employee’s time tracking down this data.

Pre-Unit Stat. Your experience MOD is calculated on claims information which is sent into the governing bureau roughly six months into your policy period. Knowing this information, we can accurately project your MOD six months in advance giving you the information you need to begin budgeting for future work,while considering where your insurance cost will be headed.

Claims Advocacy. Our team is your advocate in helping to seek information on your claims, both in the current year and in the past. Our goal through this process is to decrease existing claim costs, reduce excessive reserves, and expedite claim closure, all while considering your unit stat date.

Risk Management Center. We know maintaining up to date and accurate information for tailgate topics, safety procedures, and incident tracking is important. The Risk Management Center streamlines these functions by making them accessible to our clients online.

Contact our Rancho Mesa staff to learn more about how the MOD Doctor can help you control your workers' compensation costs.

Uninsured and Underinsured Motorists Coverage - Are Your Limits Adequate? - Be Careful!

Author, David J. Garcia, A.A.I., CRIS, Rancho Mesa Insurance Services, Inc.

Earlier in the year, we published the article "Commercial Auto Premiums Are Rising - What’s Driving the Increases?," which addresses how insurance companies are all experiencing adverse loss experience within their commercial automobile books of business. The result of these mounting losses is causing a dramatic rise in commercial Auto premiums for most policyholders.

Author, David J. Garcia, A.A.I., CRIS, Rancho Mesa Insurance Services, Inc.

Earlier in the year, we published the article "Commercial Auto Premiums Are Rising - What’s Driving the Increases?," which addresses how insurance companies are all experiencing adverse loss experience within their commercial automobile books of business. The result of these mounting losses is causing a dramatic rise in commercial Auto premiums for most policyholders.

As a result of this trend, we are seeing many carriers and brokers reducing coverage limits and terms on certain lines of automobile coverage. This represents a major concern for any business owner that has any size fleet of vehicles. Reducing limits and/or modifying terms of coverage simply transfers more claim exposure directly to the business owner. And, unfortunately, in many cases, business owners are unaware of the change or ill informed.

One specific line of coverage that we are seeing this occur, and creates great concern, is uninsured/underinsured motorist coverage. The number of uninsured motorists nationwide is alarming and here in California there are between 3.6 million and 4.1 million uninsured drivers, or 14.7 percent of all drivers. Additionally, the minimum limit of insurance in California is only $15,000. So, while many motorists may have insurance, they are woefully “underinsured.” These factors pose potential catastrophic exposures to any business. To illustrate this point, we will briefly define these coverage’s and then look further into how these lower limits of coverage terms may impact the health of your business.

Uninsured Motorists Coverage

Uninsured Motorist Coverage (UM) helps pay your, your employees and your passenger’s medical expenses, lost wages and related property damages if you're in an accident caused by a driver who doesn't have liability insurance.

Underinsured Motorist Coverage

Underinsured Motorist Coverage (UIM) helps pay your, your employees and your passenger’s medical expenses, lost wages, and related property damages, if any of you are hurt in a car accident caused by someone with liability insurance, but whose coverage limits are lower than those you choose for this coverage, and aren't high enough to pay the damages.

Best practices suggests anything less than $1,000,000 limit for uninsured/underinsured coverage is inadequate and puts the business at extreme financial risk. Let me explain by sharing just two, of many real-world, examples of how this could occur. The following examples assume the accident is the fault of an uninsured or underinsured driver:

Example 1. If one of your employees is involved in an automobile accident by either an uninsured or underinsured motorist and it involved the use of a vehicle for business purposes, the resulting medical and indemnity costs would be covered under your company’s workers' compensation policy. Two negative consequences to your overall insurance program develop as a result of this incident. First, your workers' compensation claims experience (loss ratio and EMR) will be negatively impacted. Second, since the “at fault” driver is either uninsured or underinsured, subrogation (or the recovery of the claim dollars from the responsible party) is ruled out as a viable option to your workers' compensation carrier.

Therefore, the auto loss described above would not only negatively affect your auto insurance experience but also your workers' compensation experience, as well. By having a minimum of $1,000,000 UM/UIM limits, you would have allowed you workers' compensation carrier to subrogate the costs of the claim to the auto carrier and thereby reduce the impact to your workers' compensation loss ratio and EMR

Example 2. Let’s assume you have a non-employee in the vehicle and they are involved in an accident involving an uninsured/underinsured motorist and they are injured. Since this is a non-employee, their injuries would not be eligible for coverage under your workers' compensation policy and rest solely on your automobile insurance limits and coverages. Thus, these injuries, once the uninsured/underinsured limit of your automobile policy is exhausted, would become the responsibility of the business. By having a minimum of $1,000,000 UM/UIM limits, you would fill the gap created by the uninsured/underinsured motorist's lack of coverage and protect your business from this catastrophic loss.

These examples have only touched on the medical and indemnity portion of the loss. Consider there may be property damage involved as well, which only further increases the potential of out of pocket expenses a business might be responsible for paying. Additionally, keep in mind that any excess liability policy you may have in place does not cover uninsured/underinsured motorist claims.

In summary we recommend that you review your coverage limits and terms for adequacy concerning these critical coverages. At a minimum, you should have a limit of no less than a $1,000,000 for these coverages. The premium savings by lowering this limit or modifying its coverage terms is insignificant to the catastrophic loss you are exposing your business to. Do not allow one terrible incident to take your business from you when the cost to transfer this risk is marginal.

If you have any questions or need help in accessing your exposures, please call our Rancho Mesa Team. We offer full policy audits as part of our RM365 Advantage Program that helps you to identify any gaps in coverage and provide you with Best Practices risk management recommendations.

Timely Claim Reporting Lowers Work Comp Claims Costs and Improves Your Bottom Line

Author, David J. Garcia, A.A.I., CRIS, President, Rancho Mesa Insurance Services, Inc.

Studies have shown, by reporting your workers compensation claims in a timely basis, not only will your injured employee receive better medical treatment, it will boost company morale. Both the injured worker, as well as other employees, will see your sincere concern for their wellbeing. In addition, timely reporting practices will also improve your risk profile through reducing the overall cost of the claim, which leads to lower loss ratios and lower experience modifiers, thus, resulting in lower premiums and improvement in your bottom line.

Author, David J. Garcia, A.A.I., CRIS, President, Rancho Mesa Insurance Services, Inc.

Studies have shown, by reporting your workers compensation claims in a timely basis, not only will your injured employee receive better medical treatment, it will boost company morale. Both the injured worker, as well as other employees, will see your sincere concern for their wellbeing. In addition, timely reporting practices will also improve your risk profile through reducing the overall cost of the claim, which leads to lower loss ratios and lower experience modifiers, thus, resulting in lower premiums and improvement in your bottom line.

The following are four areas that support the early and timely reporting of claims:

- Manage Claims More Efficiently Reporting a claim quickly allows the claims examiner:

- To determine whether or not the claim is compensable.

- To meet state regulations that prohibit denial of claims after a specified time period.

- To secure appropriate treatment for the injured worker.

- To conduct an investigation and determine if fraud is suspected.

- To receive timely witness statements and pictures of the incident.

- Keep The Claim Costs Down – Improve Loss Ratio – Improve Experience Modifier Delayed reporting can significantly increase workers’ compensation claim costs, according the National Council on Compensation Insurance.

- Claims reported after 2 weeks of occurrence are 18% more expensive than those reported within 1 week of occurrence.

- Claims reported after 3-4 weeks of occurrence are 30% more expensive than those reported within 1 week of occurrence.

- Claims reported 1 month of occurrence are 45% more expensive than those reported within 1 week of occurrence.

- Most significantly, back injuries, as a group, are 35% more expensive if not reported within the first 7 days post-injury.

- Reduce Litigated Claims

- 47% of all claims reported after 4 weeks become litigated, which on average increase claims costs by 30%.

Source: NCCI’s Detailed Claim Information data for Report Years 2010 and 2011 case incurred losses valued as of 18 months after report date; not developed to ultimate - Close Claims Faster

- 50% of claims that are reported within the first two weeks close within 18 months.

- Only 29% of claims that are reported more than a month after the accident close within the same timeframe.

Source: NCCI’s Detailed Claim Information data for Report Years 2010 and 2011 case incurred losses valued as of 18 months after report date; not developed to ultimate.

| Reporting (Lag) Time | Expense Increase |

|---|---|

| 2 Weeks | 18% |

| 3 Weeks | 29% |

| 4 Weeks | 31% |

| 4 Weeks | 31% |

| 5 Weeks | 45% |

If you’re not currently reporting your claims timely, we strongly encourage you to adopt this “Best Practice” and make it a part of your company’s overall risk management program. Reporting your claims on a timely basis will get your injured employee the proper treatment quicker, provide your carrier the controls they need to manage the claim effectively, improve your risk profile, and lower your insurance costs.

NALP Launches New Discounted Workers' Compensation Insurance Program

The National Association of Landscape Professionals (NALP) is partnering with Rancho Mesa Insurance Services and Berkshire Hathaway Homestate Companies to offer NALP members a competitive workers’ compensation option backed by specialized landscape industry expertise and a dedicated service team.

Article originally published in "The Landscape Professional" March/April 2017 issue.

The National Association of Landscape Professionals (NALP) is partnering with Rancho Mesa Insurance Services and Berkshire Hathaway Homestate Companies to offer NALP members a competitive workers’ compensation option backed by specialized landscape industry expertise and a dedicated service team.

NALP created this program as a member benfit aimed at providing landscape-specific expertise at a discounted rate. A portion of the combined premium is re-invested

back into the association to help fund industry growth and the many programs that benefit NALP members.

The program includes:

- Multiple workers’ compensation options with guaranteed cost and small to large deductibles.

- 6 percent discounted rates for NALP members where allowable. Lowest available base rate in states that do not allow rate deviation.

- Flexible payment plans including stipulated, pay as you go (zero deposit) and monthly payroll reports.

- Quarterly safety webinars specific to the injuries arising out of the landscape industry.

- Dedicated service team with landscape industry specific experience in the workers’ compensation claims, injuries and exposures.

- Underwriting team evaluating only NALP members.

- Claims handling dedicated to NALP members with lower caseloads and the statistically proven ability to close claims faster than the industry.

- Loss control with regional representation for on-site visits managed nationally by a dedicated coordinator.

“Protecting your business, your employees and your bottom line is so important, so we are pleased to bring this highly competitive and tailored workers’ compensation insurance program to landscape and lawn care companies through this new partnership with Rancho Mesa and Berkshire Hathaway,” NALP CEO Sabeena Hickman, CAE, said.

The program is managed by Rancho Mesa Insurance Services, which has 10 consecutive years as a National Best Practices Agency, and policies are underwritten by Berkshire Hathaway, an A++XV rated financial services firm.

For more information, visit bit.ly/nalpworkerscomp. If you have further questions or want to sign up, email nalp@ranchomesa.com or call program manager Drew Garcia at 619-937-0200.

Reproduced with permission from the National Association of Landscape Professionals.

Closing the "Gaps in Coverage" When Using Temporary or Leased Labor

Author, Dave Garcia, AAI, CRIS, is the President and CEO of Rancho Mesa Insurance Services, Inc.

It has become more common for construction companies to use temporary or leased labor in order to meet the demands of their work. While this is a useful tool it can create some unintended gaps in coverage for the contractor hiring the temporary or leased labor. These gaps potentially exist for on-the-job injury claims suffered by the temporary or leased workers.

Author, Dave Garcia, AAI, CRIS, is the President and CEO of Rancho Mesa Insurance Services, Inc.

It has become more common for construction companies to use temporary or leased labor in order to meet the demands of their work. While this is a useful tool, it can create some unintended gaps in coverage for the contractor hiring the temporary or leased labor. These gaps potentially exist for on-the-job injury claims suffered by the temporary or leased workers.

The question for all construction companies is: if you use workers from staffing or leasing agencies to supplement your workforce, how adequately do your current insurance policies protect your company in the event that one of these individuals is injured on the job?

Following are two recommendations in order to better protect your interest and help close those gaps.

Alternate Employer Endorsement

(WC00 03 01 A)

It is recommended that an endorsement is added to a workers' compensation policy that provides an entity scheduled as an alternate employer, with primary workers compensation and employers liability coverage, as if it were an insured under the policy. This endorsement is commonly used when a temporary help agency (the insured) is required by its customer (the alternate employer) to protect the alternate employer from claims brought by the insured's employees.

Businesses may find themselves short staffed on occasion, and will seek out the services of a temporary staffing or leasing agency to fill the gaps. Workers that are employed through the temporary staffing or leasing agency are covered under the workers' compensation policy that the temporary staffing or leasing agency has purchased. When these workers are hired out to an outside firm, the firm that hires them should seek an “alternate employer endorsement” from the temporary staffing or leasing agency, in order to protect it from any lawsuits brought by the temporary employee for injuries they may suffer.

For example, a construction company needs some additional labor in order to complete a job on time. It hires some temporary labor. If a temporary employee injures themselves or has to go to an emergency room, they would be covered under the temporary staffing or leasing agency’s workers' compensation policy, thus, prohibiting them from making a claim against the construction company’s liability policy.

When an alternate employer endorsement is added to a policy’s endorsement schedule, the employer (contractor in this example) is often required to assist in any claims investigations. This scenario typically means reporting any injuries suffered by temporary or leased staff, ensure that the temporary employee is given proper medical treatment when the injury is suffered; and provide any documentation related to the injury to the policyholder (temporary staffing or leasing agency). If the policy is canceled for any reason, the insurance company is not obligated to tell the alternate employer (contractor) because the alternate policyholder (contractor) is not the primary party on the policy.

Coverage for Injury to Leased Workers Endorsement

(CG 04 24)

A second way to help close this potential gap is by adding the above endorsement to your (the contractors) existing general liability policy. However before filling this gap it is first important to understand how the gap is created. A gap in coverage arises from the way the CGL policy defines "temporary" and "leased" workers. Following are those definitions.

“Leased Worker” is a person leased to you by a labor leasing firm under an agreement between you and the labor leasing firm, to perform duties related to the conduct of your business. "Leased worker" does not include "temporary worker."

"Temporary worker" means a person who is furnished to you to substitute for a permanent "employee" on leave or to meet seasonal or short-term workload conditions.

Under the terms of a CGL policy, "employee" includes a leased worker, but does not include a temporary worker. The distinction is important, because the CGL policy's Exclusion e: employers liability, excludes from coverage bodily injury claims made by an employee of the insured. Thus, if your CGL policy definitions consider the worker to be an "employee"- even though that worker is provided by a staffing agency - the policy will not cover any bodily injury claims by that worker.

If the worker is not specifically substituting for a permanent employee who is on leave, or meeting a seasonal need or short-term workload conditions, the worker is not a "temporary worker" in the eyes of the insurer, and instead is considered your employee for purposes of Exclusion e.

To be a "temporary worker," that individual must have a specific end date to his or her employment with you. A temporary employee who is hired for an indefinite period of time simply does not meet the criteria stated above, and is therefore considered an employee, and subject to Exclusion e if they are injured on the job.

Adding the Coverage for Injury to Leased Workers (CG 04 24) endorsement to your CGL policy will help you fill this coverage gap. This endorsement states that the term "employee" does not include a "leased worker" or "temporary worker," making the employers liability exclusion of the CGL policy inapplicable to the claims for injuries to a leased or temporary worker.

Without the right coverage in place, on-the-job injuries to temporary workers can present a significant potential liability to your company. Examine your current CGL policy and arrangements with any staffing or leasing firms you use to make sure your company is adequately protected.

4 Factors That Shape Your Insurance Risk Profile

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

Ever wonder why your insurance rates high when your competitors are low? There are reasons for that including, frequency of claims, severity of claims, experience rating, average claim cost incurred, operations, trends, loss ratio etc. If you evaluate your risk profile you can take action to lower your premiums.

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

Ever wonder why your insurance rates high when your competitors are low? There are reasons for that including, frequency of claims, severity of claims, experience rating, average claim cost incurred, operations, trends, loss ratio etc. If you evaluate your risk profile you can take action to lower your premiums.

Here are 4 factors that help shape your risk profile.

Frequency of Claim

The number of workers’ compensation claims you average per million dollars in payroll.

Calculation = # of claims / (annual payroll/$1,000,000)

Evaluate – How often are you having workers’ compensation claims and how does that compare to other landscape companies in your region or state? You can expect your insurance premiums to be higher if your frequency rate of claim is higher than the average.

Action – If you are having a frequency issue, you need to assess;

- Trends (back, hand, wrist, knee…)

- Cause (lifting, punctures, slips…)

- Implement corrective actions to help mitigate the risks associated with your claims.

Take it to the next level and evaluate “near misses.” Treat a “near miss” as if it were a claim and strategize a corrective action to prevent it from happening in the future.

Lost Time Claims (Indemnity)

The number of “lost time” claims your company has per million dollars in payroll. These are the claims in which your employee loses time away from work.

Calculation = # of lost time claims / (annual payroll/$1,000,000)

Evaluate – How often are you having workers’ compensation claims that result in lost time and how does that compare to other landscape companies in your region or state? You can expect your insurance premiums to be higher if your Indemnity rate of claim is higher than the average.

Action – If you are having an indemnity issue, you need to assess;

– Trends (back, hand, wrist, knee…)

– Cause (lifting, punctures, slips…)

– Implement corrective actions to help mitigate the risks associated with your claims.

Establish a “return to work program” which allows your injured employees an opportunity to come back to work on limited duty. This will help you monitor your employee’s progress and keep them feeling a part of the team.

Experience Rating

Your experience rating is a combination of your loss data and total payroll when compared to your industry typically but not always, over a three year period. Your experience rating has the ability to credit or debit pricing accordingly based on your history.

Action – Controlling your frequency and indemnity claims will ultimately be reflected in your experience rating.

Operations

Heavier operations would include hardscape construction, tree trimming, and snow removal in which generally heavier machinery and product is used thus a higher exposure to injury. Compare these types of landscape operations to a lighter exposure such as landscape maintenance; mowing, edging and pruning.

Action – Identifying the exposures that are unique to your operations and then implementing safety programs catered to your exposures will help protect your employees. Although your operations might consist of heavier exposures, you have the ability to implement tactics to mitigate the claims from happening and subjectively making your risk profile more appealing. Don’t wait for the injury to occur, be proactive and stop the claim before it transpires.

Your risk profile has already been created whether you know it or not. The opportunity for you to own it and improve it is always available. To look at lowering your workers compensation insurance, take a look at NALP’s new program.

For more information, there will be a free webinar on March 22. Sign up here.

New First Aid Reporting Requirements Take Effect January 1st, 2017

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

To learn more about the changes, visit WCRIB's Bulletin.

Rancho Mesa “Rocks” the Landscape Industry

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

THE AGENCY

Rancho Mesa is a 10 Time National Best Practices Agency out of Santee, California with over 30 years’ experience in The Landscape Industry. As the program manager, Rancho Mesa will look to challenge and develop the growth of the program to better protect its members.

THE CARRIER

Berkshire Hathaway Homestate Companies has the Highest AM Best rating of A++(XV) “Superior” rating of financial strength, and is the one of the largest specialty Work Comp Carriers in the Country.

THE ASSOCIATION

The NALP is the only National Organization built by the collaboration of landscape and lawn care industry professionals and has pushed the boundaries for Professionalism in the Landscape Industry to new heights through; Education, Certification and Legislation. As the voice for 100,000 landscape professionals the NALP passionately advocates for the economic, social and environmental benefits of the landscape industry.

THE PROGRAM HIGHLIGHTS INCLUDE:

• 6% discounted rates for NALP members where allowable. Lowest available base rate in states that do not allow rate deviation.

• Multiple workers compensation options guaranteed cost and small to large deductible.

• Flexible payment plans including stipulated, pay as you go (zero deposit) and monthly payroll reports.

• Quarterly safety webinars specific to the injuries arising out of the landscape industry.

• Dedicated service team with experience in the landscape industry.

• Underwriting team only evaluating NALP members.

• Claims handling dedicated to NALP members with lower caseloads.

• Loss control with regional representation and managed nationally by a dedicated coordinator.

For more information contact Rancho Mesa Insurance Services at NALP@ranchomesa.com.

Court Case Endangers State Workers' Comp System

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

Seal of the Supreme Court of California

The Independent Insurance Agents & Brokers of California's (IIABCal) Legislative Update, a compilation of reports produced by IIABCal Lobbyist John Norwood of Norwood & Associates, recently published an update on the possible effects of a court case on the Workers' Compensation System.

Below is an excerpt from the February 6, 2017 Legislative Update article:

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

The brief in King v. CompPartners, Inc argues that the appellate court incorrectly found that utilization review doctors - those who look at records to decide whether a worker's treatment was appropriate, but do not examine the patient personally - have established a physician-patient relationship and therefore owe a duty of care to the injured workers.

Major Implications

If allowed to stand, the decision will create extensive future litigation and can be expected to increase costs that will put upward pressure on malpractice premium rates for all physicians, and have a chilling effect on utilization review physicians, according to the CalChamber.

Establishing potentially unlimited liability for utilization review physicians will potentially lead to higher premiums for employers and could drive future and existing business away from California.

The case also will determine whether medical malpractice claims against utilization review doctors are barred, because all workers' compensation claims are under the purview of the state Division of Workers Compensation. National and statewide insurer groups joined the CalChamber on the brief.

California Workers Compensation 2017 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds Announced by WCIRB

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details and is attached for your review.

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details of

California Workers Compensation 2017 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds. The document is available for your review.

For any questions concerning the changes, please contact your Rancho Mesa service team.

AB 2883: Change in California Workers Compensation Law

Earlier this year, we reached out regarding California Assembly Bill 2883 (AB 2883), which drastically changed the legal requirements that allow an employer to exclude its corporate officers and the members of its board of directors from workers' compensation insurance coverage. As a result, this change will now affect ALL policies inforce as of January 1, 2017.

AB 2883 Change in California Workers Compensation Law- Officer, Director, Partner, LLC Member Exclusions Effective January 1, 2017

Earlier this year, we reached out regarding California Assembly Bill 2883 (AB 2883), which drastically changed the legal requirements that allow an employer to exclude its corporate officers and the members of its board of directors from workers' compensation insurance coverage. As a result, this change will now affect ALL policies inforce as of January 1, 2017.

Below are key details to note:

- A Corporate Officer/Director must own 15% or more of the corporation’s issued and outstanding stock to be eligible to elect exclusion from WC coverage.

- A General Partner of a Partnership, or a Managing-Member of a LLC, is eligible to elect exclusion from the WC policy (Note – the 15% ownership requirement does not apply to General Partners and Managing Members).

- Grantors of Revocable Trusts are no longer deemed shareholders and are no longer eligible for exclusion.

- Each eligible Corporate Officer/Corporate Director/General Partner/Managing-Member must sign a new waiver attesting to his/her qualification to be excluded, under penalty of perjury. The new waiver(s) will replace any current Exclusion Letter.

- AB 2883 has eliminated the requirement that 100% of the stock must be held by titled Officers/Directors in order for a Corporate Officer/Director to be eligible for exclusion.

What next?

You will receive notification from your current workers compensation carrier explaining these changes. Keep in mind that in order to exclude a Corporate Officer, Member of a Board of Directors, General Partner, or Managing Member of an LLC, each individual to be excluded must sign a written waiver of workers’ compensation benefits certifying under penalty of perjury that he/she is a qualifying Officer, Director, General Partner, or Managing Member of an LLC.

Once a waiver is accepted, new waivers will only be required if there is a change in status or individual wishes to change their status.

If you have any questions please don’t hesitate to call us at (619) 937-0164.