Industry News

Best Practices Approach to Insuring Janitorial Companies

Author, Jeremy Hoolihan, Partner, Rancho Mesa Insurance Services, Inc.

Running a successful janitorial company in California can often be cut throat. With low profit margins, janitorial companies continue to face daily challenges like increased wages and material costs, as well as aggressive competition that continues to under bid contracts. It is natural for business owners to explore ways of cutting costs to help their bottom line, but insurance should not be one of them. In fact, they should be looking to add coverages that are unique to janitorial operations and protect the long term health and viability of the company.

Author, Jeremy Hoolihan, Partner, Rancho Mesa Insurance Services, Inc.

Running a successful janitorial company in California can often be cut throat. With low profit margins, janitorial companies continue to face daily challenges like increased wages and material costs, as well as aggressive competition that continues to under bid contracts. It is natural for business owners to explore ways of cutting costs to help their bottom line, but insurance should not be one of them. In fact, they should be looking to add coverages that are unique to janitorial operations and protect the long term health and viability of the company.

Following are a few key coverages and endorsements to consider that could help insulate a janitorial business from serious losses.

Crime Coverage (First and Third-Party)

A commercial crime policy can insure a janitorial company from an employee stealing from them (i.e., a first-party crime). These types of claims include, but are not limited to, forgery or alteration, funds transfer fraud, credit card fraud, and computer fraud.

Third-party crime includes theft of a client’s property. Many janitorial companies have employees cleaning after hours. If property on the client’s premises goes missing, it’s often the janitor that gets accused. This is when 3rd party crime coverage comes into place.

Lost Key Coverage

If you are operating a janitorial company and your employee misplaced or lost a master key for one of your client’s properties, are you prepared to replace all the keys and locks? Depending on the number of locks to replace, your business could be out tens of thousands of dollars. Lost key coverage is typically an endorsement that can be added to a general liability policy. Limits and deductibles often vary, depending on the customer’s request.

Limited Pollution Liability

With most janitors using chemicals, cleaning products, and power washers, it is highly recommended that the company has the limited pollution liability endorsement added to their policy (or better yet, a standalone pollution policy). Coverage for accidental job site pollution that may arise from chemical spills and accidental water runoff could prove extremely valuable.

Cyber Liability

Janitorial companies often store clients’ information and process payments online for their customers. This can be very enticing for hackers. Which is why business owners should consider carrying a cyber liability policy that can insure the company for data breaches, cyber-attacks, cyber extortion, business interruption, computer fraud, and much more.

Cyber-attacks can debilitate a business and bring it to a screeching halt. Cyber liability coverage can assist with keeping a business afloat during these very trying times.

Employment Practices Liability Insurance (EPLI)

EPLI insures a business when a current or former employee sues the employer for such things as wrongful termination, sexual harassment, retaliation, etc. An EPLI policy can also insure a business if a non-employee sues the business for other similar harassments. With defense costs and settlements commonly reaching well over six figures, these claims can easily put a company out of business. And to top it off, even if a company is proven innocent, the cost of defense alone could jeopardize its financial stability.

At the end of the day, insurance is simply risk transfer. Businesses elect to either transfer the risk to an insurance company or self-insure it. The key is knowing what risk transfer options are out there and what they cost. It starts with partnering with an insurance broker that has expertise in your industry.

I’ve been specializing in insurance for the janitorial and construction industries for over 20 years. If you have any insurance related questions, I am here to help! Contact me at jhoolihan@ranchomesa.com or (619) 937-0174.

Understanding Insurance Options for Tree Care Vehicles with Permanently Mounted Equipment

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

The vehicles that tree care companies are using today have become more specialized and more mechanized than ever. These specialized vehicles contribute to the overall productivity, profitability, and safety of the tree care industry.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

The vehicles that tree care companies are using today have become more specialized and mechanized than ever. These specialized vehicles contribute to the overall productivity, profitability, and safety of the tree care industry.

Many vehicles in a tree care company’s fleet have permanently mounted equipment. The crane is a great example. Both the knuckleboom and straight boom crane are permanently mounted onto the cab and chassis. Obviously, the value of the vehicle significantly increases the moment the crane is mounted.

When placing insurance coverage for this unit, it is important to understand the options. The liability coverage for specialty vehicles will always be insured on the commercial auto policy. However, when insuring the physical damage to your unit, you may have a couple different options.

The commercial auto policy will value the physical damage on actual cash value, which is a depreciated value. Actual cash value equals the replacement cost minus depreciation. In the event of a physical damage claim, the commercial auto insurance carrier will factor in depreciation when determining the amount to pay out for the claim. If you have an older crane, this may be an acceptable way to provide coverage. Just be certain that your insurance broker and carrier have the total value, including the crane, for the vehicle.

You can also split the physical damage coverage between commercial auto and inland marine. Often times, you can get replacement cost valuation on the inland marine policy, which is a more robust valuation. Replacement cost is the cost of a new one today, without factoring in depreciation. You can cover the physical damage of the vehicle (cab and chassis) on the commercial auto policy, but then you can cover the crane itself on the inland marine policy and get the replacement cost valuation. This strategy might make more sense if you are insuring a new, and expensive, crane. In the event of a total loss, the difference between actual cash value and replacement cost can be staggering.

Properly insuring your assets is a fundamental aspect of your risk management program. It is crucial for protecting your company’s financial stability. It is also important to work with your insurance broker to understand how your current insurance company will handle this.

If you have any questions, please reach out to me at (619) 486-6437 or randerson@ranchomesa.com.

Mitigating Risks in the Solar Industry with Professional Liability Insurance

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Since the outset of the 21st century, the solar installation industry has been bustling with the demand to create clean sustainable energy. Based on growing political and ecofriendly needs, the solar industry is ever changing and trying to keep up with constant fluctuations when it comes to energy storage, federal and state regulations, and supply chain demands.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Since the outset of the 21st century, the solar installation industry has been bustling with the demand to create clean sustainable energy. Based on growing political and ecofriendly needs, the solar industry is ever changing and trying to keep up with constant fluctuations when it comes to energy storage, federal and state regulations, and supply chain demands. Hand in hand with this growth is the risk created for solar installation contractors who are busy creating drawings, proposals and contracts. It is common for a solar contractor to purchase general liability insurance. It is commonly mistaken as the only needed coverage besides workers’ compensation and commercial auto insurance. However, general liability coverage needs to be triggered by either property damage or bodily injury. But, what about all of the potential lawsuits outside of property damage and bodily injury? This is where professional liability becomes an essential element to any solar installation contractor’s insurance program. To dive deeper, I have provided some claim examples that should resonate with any solar contractor performing residential or commercial installation.

Design Errors

Once a rendering is made that calculates the potential savings a solar system can generate, a contract is typically signed with the proposed energy savings. A solar contractor may face a claim if there is a design error. For example, a shaded area may have been missed that does not generate enough energy or the system might have been incorrectly positioned. A professional liability insurance product would be the best risk transfer vehicle for protection against this type of claim.

Failure to Comply with Building Codes

If a customer’s home cannot pass inspection because the work does not meet building codes, there could be a lawsuit and a claim which could trigger a professional liability policy.

Failure to Obtain Permits

If there are any nominal losses created from the lack of permits or timing of permits, a customer could file a lawsuit seeking damages. Since there is no bodily or property damage, a general liability policy would deny this type of claim. A professional liability policy would offer advice through third-party council to help mitigate losses fast in a time sensitive claim scenario.

Battery Storage

The State of California has high hopes to be petroleum free by 2050. This would mean that home battery systems would become essential for energy storage. Now imagine a family is counting on this system to make sure their vehicles are charged. This creates a lot of demand and if this battery was installed incorrectly, there could be claims having to do with losses sustained by that family. The scenarios are endless when you really think about it.

Maintenance Contracts

For some large-scaled solar installations, the energy created can be critical to business or for emergency lighting. If these systems fail to produce the proposed energy, in could cause a domino effect of a loss and/or costly lawsuits. Imagine a manufacturing plant relying on solar panels and battery storage that cannot create their product due to a faulty system. A professional liability policy could help mitigate the loss by adding in defense and counsel.

As the solar industry adapts and grows, the need for appropriate risk protection grows with it. Building an effective insurance program that includes professional liability is critical for all solar contractors considering the exposures referenced in this article. With a strong niche in this space, Rancho Mesa brings expertise and market knowledge that can help solar contractors transfer the appropriate risk, where necessary.

To discuss your risk management, please contact me at khoward@ranchomesa.com or (619) 438-6874.

Surviving the Blaze: Developing Asset Relocation Plans in Wildfire-Prone Regions

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

As a tree care company operating in wildfire-prone areas, the safety of your crew, equipment, and vehicles is paramount. Wildfires can be unpredictable and devastating, posing a significant threat to your valuable assets. To mitigate risk of potential losses, it is important to have an effective asset relocation plan in place. This plan ensures that in the event of a wildfire, your vehicles and equipment have a safe place, reducing the risk of damage or total loss. This safe relocation address should be in an urban area, surrounded by buildings – not rural vegetation. It can be a mall parking lot or any urban lot. Let’s explore the reasons why having an asset relocation plan is crucial for tree care companies.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

As a tree care company operating in wildfire-prone areas, the safety of your crew, equipment, and vehicles is paramount. Wildfires can be unpredictable and devastating, posing a significant threat to your valuable assets. To mitigate risk of potential losses, it is important to have an effective asset relocation plan in place. This plan ensures that in the event of a wildfire, your vehicles and equipment have a safe place, reducing the risk of damage or total loss. This safe relocation address should be in an urban area, surrounded by buildings – not rural vegetation. It can be a mall parking lot or any urban lot. Let’s explore the reasons why having an asset relocation plan is crucial for tree care companies.

Reduce Insurance Costs

Insurance is a critical aspect of risk management for tree care companies. While insurance can help cover losses from wildfires, having a well-executed asset relocation plan can potentially lead to reduced insurance premiums. Insurance carriers may view your proactive approach to asset protection as a lower risk, leading to more favorable terms and lower premiums. This can result in cost savings for your business.

Protect Your Investments

Tree care contractors often invest in specialized equipment and vehicles, which are essential for their operations. A wildfire can damage these valuable assets, leading to significant financial losses. An asset relocation plan allows you to move your equipment and vehicles to a safer location to protect your investment.

Ensure Business Continuity

The aftermath of a wildfire can be chaotic. Having an asset relocation plan in place ensures that your equipment and vehicles are moved to a secure location well before a wildfire strikes, keeping your assets safe. This allows your business to continue operating after the disaster with minimal disruptions. Maintaining continuity is essential for your income and reputation.

An asset relocation plan is an important component of your risk management program as a tree care company, especially if you’re located in a rural area. If your business is located in California, Cal Fire has a valuable online resource called Fire Hazard Severity Zones Maps. This resource shows the areas in your county that are considered high fire hazard severity zones. It is recommended that you make your relocation address somewhere where the fire hazard severity is considered low or moderate.

Should you have further questions on this topic, reach out to me directly at randerson@ranchomesa.com or call me on my direct line at (310) 753-6804.

The Critical Role of Pollution Liability Insurance for Mechanical Contractors

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Mechanical HVAC contractors are essential to making sure that buildings around the globe have controlled temperatures and are energy efficient. Nationwide, the demand for mechanical HVAC contractors often keeps these businesses with full backlogs. These companies use various materials that create the potential for a pollution liability claim. Refrigerants, gases, flammable liquids, and lubricants are examples of these types of pollutants. If leaked or exposed, walls, ceilings, and floors can develop damage or mold that is not covered by standard commercial general liability policies.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Mechanical HVAC contractors are essential to making sure that buildings around the globe have controlled temperatures and are energy efficient. Nationwide, the demand for mechanical HVAC contractors often keeps these businesses with full backlogs. These companies use various materials that create the potential for a pollution liability claim. Refrigerants, gases, flammable liquids, and lubricants are examples of these types of pollutants. If leaked or exposed, walls, ceilings, and floors can develop damage or mold that is not covered by standard commercial general liability policies.

Pollution liability insurance is a separate and specific form of insurance meant to protect businesses from pollution-related claims. Pollution risks may arise from activities such as the improper disposal of hazardous materials, fuel spills, or accidental leaks from HVAC systems. Such incidents can lead to damage to the environment, neighboring properties, and public health, which could potentially result in costly legal disputes and cleanup expenses.

Below we will cover two common pollution claim examples in an effort to raise awareness and drive home the need for commercial pollution liability insurance specifically for HVAC mechanical contractors.

Claim Example 1: Contamination of Ground Water due to HVAC System Leak

In this example, XYZ Mechanical installed an HVAC system in a commercial building. The building is adjacent to a residential development. Post install, there was a leak in the refrigerant line which seeped into the dirt below the building which went undetected for weeks. The refrigerant seeped into the groundwater supply causing contamination.

Hazard - This claim example would have a significant impact on wildlife, could cause harm to residents and would need a specific extraction/clean up that would be costly to a business owner.

Protection - A pollution liability insurance policy would react to this type of claim and could offer coverage for the cleanup, any third-party injuries, and the cost for legal proceedings.

Claim Example 2: Fuel-Contaminated Environment

ABC Mechanical is hired to install an energy efficient HVAC ground unit for an apartment complex. There was an underground unmarked fuel storage tank that was accidentally drilled into and caused a leak.

Hazard - This claim example would need immediate attention for the potential risk of fuel leaking into the ground and a plan for cleanup. The leak could make its way into the groundwater contaminating wells and potentially causing contamination of water. There would also be some health hazards for residents that could become a concern.

Protection - A pollution liability policy would come to aid with emergency response, cleanup cost, third- party bodily injury and legal defense costs.

Pollution liability is very often an overlooked coverage for many HVAC mechanical contractors. In 1986, however, the total pollution exclusion (TPE) became a standard exclusion in commercial general liability policies and has since created the need to purchase commercial pollution liability policies due to the variety of exposures to risk. The cost is relatively minor and the benefit very high if and when coverage is triggered. If you have questions regarding commercial pollution liability, please contact me at khoward@ranchomesa.com or (619) 438-6874.

Improving Safety with Mechanization in the Tree Care Industry

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Mechanization refers to the process of introducing machinery, equipment, or automated systems to replace human labor. Today, the tree care industry is becoming more mechanized with many technological advancements that are greatly improving the productivity, profitability, and safety of the industry. Let’s focus on safety.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Mechanization refers to the process of introducing machinery, equipment, or automated systems to replace human labor. Today, the tree care industry is becoming more mechanized with many technological advancements that are greatly improving the productivity, profitability, and safety of the industry. Let’s focus on safety.

Tree care accidents can be unforgiving and can have major consequences. Here are some safety benefits that come with mechanization:

Reduces manual labor: mechanization reduces the amount of physical labor required to perform tasks. Tree care tasks are physically exhausting. Specialized machinery reduces the strain on workers, minimizing the risk of fatigue-related accidents.

Improves efficiency and reduces exposure to hazards: Mechanized equipment reduces the time workers spend in potentially hazardous situations, working at heights or in proximity to heavy tree limbs. By executing tasks more quickly and accurately, it reduces the overall exposure to potential accidents and hazards.

Reduces human error: even the most experienced arborists can make mistakes. Machines can mitigate human error by using automation. For instance, tree removal machines with automated cutting and lifting mechanisms can carry out tasks precisely as programmed.

Promotes training: the use of mechanized equipment requires special training and certification. This contributes to a higher level of competency and safety awareness within your organization.

Mechanization is the future of the tree care industry. Of course, traditional methods must always be available. However, we can limit our human footprint and liability by investing in this new-age equipment. Fewer accidents increases productivity and profitability.

For questions please contact me at (619) 486-6437 or randerson@ranchomesa.com.

Pollution Liability for Tree Care Companies

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Most tree care companies use pesticides, herbicides, fungicides, and other chemicals as a part of their operations. Even if the company does not offer plant health care, many tree care professionals still use hydraulic fluids, gasoline, and other fluids to operate or maintain equipment and vehicles. The use of heavy equipment and chemicals, while operating exclusively outdoors, opens the company up to environmental exposure.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Most tree care companies use pesticides, herbicides, fungicides, and other chemicals as a part of their operations. Even if the company does not offer plant health care, many tree care professionals still use hydraulic fluids, gasoline, and other fluids to operate or maintain equipment and vehicles. The use of heavy equipment and chemicals, while operating exclusively outdoors, opens the company up to environmental exposure.

Pollution coverage is a standard exclusion on any general liability policy, but business owners can cover this exposure with a stand-alone contractor’s pollution liability (CPL) policy. CPL insurance is distinct in that it offers protection for contractors in the event their work, or any work done on their behalf, leads to a pollution or environment-related claim of bodily harm, property damage, cleanup and other remediation expenses. In today’s green and eco-minded society, filling this gap is more important than ever.

If the tree care company offers plant health care as a service, the herbicide/pesticide applicator coverage endorsement is an important part of your insurance program and can offer some coverage to replace damaged or dead plants/trees in the event an arborist mixes a bad batch or over sprays. However, the herbicide/pesticide applicator coverage endorsement may not pick up remediation efforts, or the business interruption losses that result from the clean-up. The best way to transfer your environmental exposure would, again, be putting a contractor’s pollution liability policy in place with at least a $1,000,000 limit.

Pollution liability insurance is an important part of the risk management strategy and can help protect tree care contractors from environmental liabilities by providing coverage for legal fees, cleanup costs, and other expenses associated with environmental pollution.

For a policy review or questions about which policies match your tree care company’s risks, please contact me at (619) 486-6437 or randerson@ranchomesa.com.

Pollution Liability for Landscape Contractors

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Most Landscape Contractors believe their exposure to pollution is limited to the herbicides, pesticides, and fertilizers they apply. In order to provide some limited coverage for this it is common to see the Herbicide/Pesticide Endorsement added to the Commercial General Liability Policy. Although the endorsement extends some coverage, Contractor’s Pollution Liability would help fill the gaps created by the General Liability Policy for all of the landscape contractor’s pollution exposures.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Most landscape contractors believe their exposure to pollution is limited to the herbicides, pesticides, and fertilizers they apply. In order to provide some limited coverage for this it is common to see the Herbicide/Pesticide Endorsement added to the Commercial General Liability Policy. Although the endorsement extends some coverage, Contractor’s Pollution Liability would help fill the gaps created by the General Liability Policy for all of the landscape contractor’s pollution exposures.

Remember, General Liability Policies do not provide coverage for pollution. Contractors Pollution is protecting your environmental liability, and in today’s world the awareness to preserve the environment has never been stronger. A landscape contractor’s exposure to environmental liability is considered “high” and classed as “high” along with drilling, subsurface, site/dirt work, paving, mechanical and electrical contractors to name a few.

Landscape contractor operations are almost exclusively performed outdoors in the environment which is the result of the high exposure. Beyond herbicide, pesticide, chemical applications and the property damage or bodily injury that may arise from such operations, other material exposures would include but are not limited to; fuel, oil, fumes, hydraulic fluids, silica, foundry sand, manure, dust, waste, water, natural gas, propane and mold.

The Herbicide Pesticide Endorsement is an essential piece to any landscape contractor’s insurance program; however, a Contractors Pollution Liability policy is the best way to transfer your environmental exposure. Not all pollution policies are the same: capacity, coverage, exclusions and deductibles need to be examined. Making sure you have a policy that fits your operations and your exposure is critical.

For questions about which policies may match your company’s risk, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Optimizing Risk Management While Reducing Gaps in Coverage

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Working within the construction unit at Rancho Mesa for over 15 years, I have developed strong long-term business relationships with my clients. As an insurance advisor, I have an obligation to insulate clients from exposures and liabilities. Many of which may remain the same from year to year. However, it is vital that business owners meet with their insurance advisor frequently, especially prior to an insurance renewal, to avoid potential gaps in coverage. Below are a few key topics that should be reviewed on a regular basis by a company’s insurance advisor.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Working within the construction unit at Rancho Mesa for over 15 years, I have developed strong long-term business relationships with my clients. As an insurance advisor, I have an obligation to insulate clients from exposures and liabilities. Many of which may remain the same from year to year. However, it is vital that business owners meet with their insurance advisor frequently, especially prior to an insurance renewal, to avoid potential gaps in coverage. Below are a few key topics that should be reviewed on a regular basis by a company’s insurance advisor.

Review and Discuss Business Operations

It’s always a good business practice to have the insurance advisor review the business’s operations to see if there have been any changes that could affect its risk profile. For example, I once had a client in the construction industry that specialized in commercial tenant improvement work. The company wanted to start a residential construction division. By understanding this change before it actually took place it provided us the time to adequately access the differences in the insurance exposures between the commercial and residential marketplace. As a result, we were able to proactively and affordably place their coverage with an insurance carrier that was comfortable with both exposures.

Review Financial Projections

With the economy fluctuating year to year, it is vital that you meet with your insurance advisor and go over your financial projections for the coming policy term. These items should include projected; annual sales, payrolls, subcontract costs and any changes in your surety requirements. These factors will help in not only negotiating the most favorable renewal terms for you but help to avoid any unforeseen expenses like a large final audit

Discuss Business Assets

Businesses routinely buy, sell, and upgrade their tools, equipment, and vehicles. While most are conditioned to notify their insurance advisor of any changes, it is always a good business practice to review assets with the insurance advisor at each pre-renewal meeting. It is common that there are items that were either sold (that need to be removed) or new (that need to be added to policies). By reviewing the assets on a regular basis, it minimizes the chance that items are missed and you either are paying premium on an item you no longer have or have an uninsured loss.

Discuss and Revisit Recommended Coverages

Recommended coverages may include an Umbrella, Pollution Liability, Professional Liability, Employment Practices Liability, and Cyber Liability policies. Even if you have discussed these coverages in the past with your insurance advisor and have declined them, they should not assume you will do so again in the future. The business climate is constantly changing; therefore, so are the risks you are facing. Understanding where you have gaps in your risk management profile and making informed decisions to either transfer the risk to an insurance carrier (purchase insurance) or retain the risk yourself (don’t purchase insurance) is always a Best Practices standard.

If you would like to discuss and learn more about Rancho Mesa’s proprietary risk management tools and explore our help in developing a Risk Management program based on your specific business needs, you can reach out to me at 619-937-0174.

Why Painting Contractors Need Pollution Liability Insurance

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

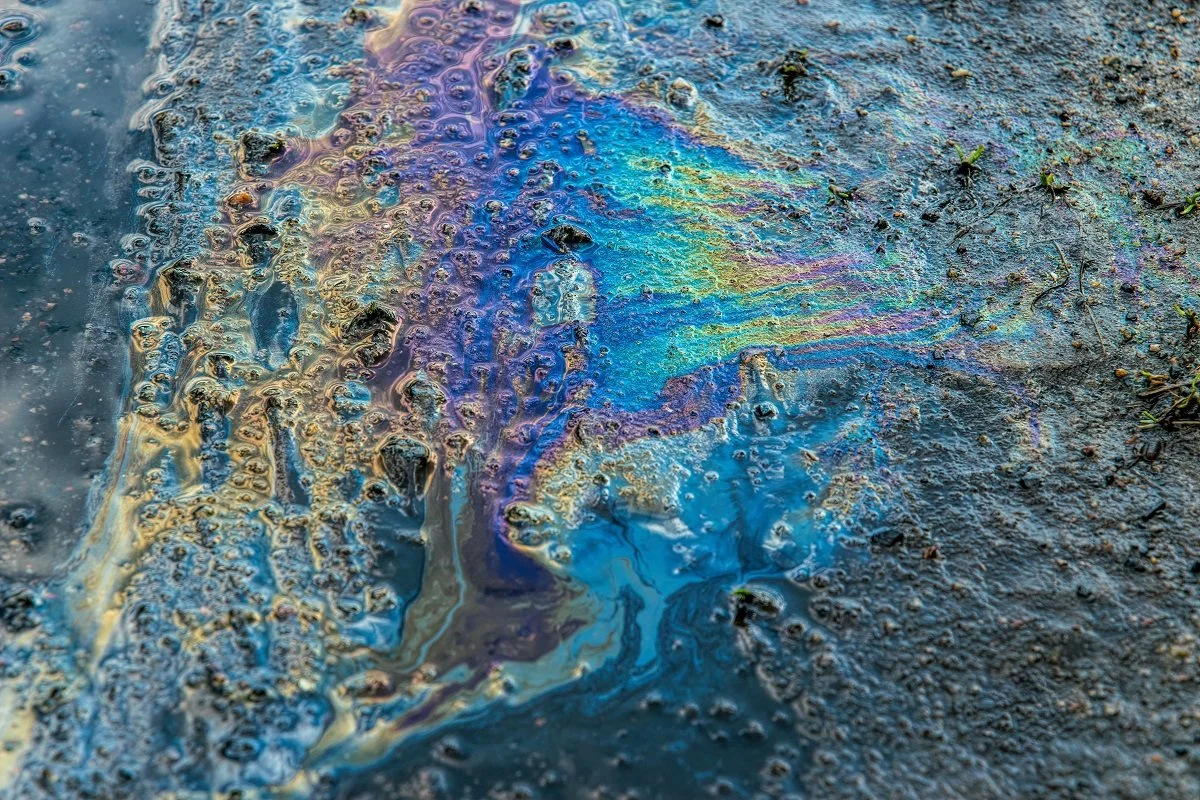

At first glance, most painting contractors don’t think they need pollution coverage. One might think that if they're not pouring sludge into a lake or toxic gasses into the atmosphere, then it wouldn’t apply to their company. Everyone sees the oil spills and thinks that this is what pollution coverage is for, but how does it apply to your smaller business? How can one event jeopardize your company’s success?

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

At first glance, most painting contractors don’t think they need pollution coverage. One might think that if they're not pouring sludge into a lake or toxic gasses into the atmosphere, then it wouldn’t apply to their company. Everyone sees the oil spills and thinks that this is what pollution coverage is for, but how does it apply to your smaller business? How can one event jeopardize your company’s success?

In reality, pollution coverage is a must have policy for all painting contractors. This is how your business could be at risk.

First, let's determine what is a pollutant. A pollutant is defined as “the discharge, dispersal, release or escape of any solid, liquid, gaseous or thermal irritant or contaminant, including, but not limited to, smoke, vapors, soot, fumes, acids, alkalis, toxic chemicals, medical waste and waste materials into or upon land, or any structure on land, the atmosphere or any watercourse or body of water, including groundwater, provided such conditions are not naturally present in the environment in the amounts or concentrations discovered.” It is shocking how often a painting contractor is exposed to mold, asbestos, bacteria, or paint fumes.

What does Contractors Pollution Liability Insurance (CPL) really cover? CPL is a contractor-based policy, offered on a claims-made or occurrence basis, that provides third-party coverage for bodily injury, property damage, defense, and cleanup as a result of pollution conditions (sudden/accidental and gradual) arising from contracting operations performed by or on behalf of the contractor.

There are countless stories of something unforeseen being the cause of a pollution claim. Here are just a couple examples that could apply to your company.

A contractor had painted a nursing home and was sued by the residents. They alleged that the fumes weren’t ventilated properly. That claim alone was over $200,000.

A painter was removing lead paint from a bridge and some flakes fell into the river below. The damages exceeded $500,000.

A pollution claim could arise from site runoff after it rains, or accidentally drilling into a water pipe in the wall that produces leakage that leads to mold exposure. While transporting paint to a jobsite, the driver could get into an accident and the paint spills out and contaminates a water source adjacent to the road.

Most businesses look at pollution risk as something that doesn’t apply to them. Obviously, they aren’t planning on releasing pollutants like bacteria, mold, or fumes while on a jobsite. But, all it takes is one claim that could cost your company. Investigation costs, medical expenses, lawsuits, cleaning up of the area properly, not to mention how important your reputation is to your success, any one of these factors could be enough to bring your business to an end.

Some contractors believe all third-party problems are covered by their general liability policy; however, most general liability policies will contain a pollution exclusion which doesn’t cover any property damage or bodily injury that comes from the result of a pollution event. Your general liability policy will not cover the cost of clean-up, either. It is easy to see how this could become a costly event, very quickly.

It is very clear to see the dangers that surround your business. Now that you know what they are, protect your business with CPL insurance. Contact me at (619)438-6900 or email me at ccraig@ranchomesa.com with any further questions. Let’s make sure you are properly prepared to protect your company’s future.

Why All Trade Contractors Must Consider Pollution Liability

Authors Sam Clayton, ARM, CRIS, Vice President, Construction Group and Daniel Frazee, ARM, CRIS, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Contractor’s Pollution Liability (CPL), once viewed as expensive and unnecessary, has now become an integral part of every trade and environmental contractor’s insurance program. The industry is seeing requirements for this coverage from a combination of building owners, developers and general contractors for projects of all sizes.

Authors Sam Clayton, ARM, CRIS, Vice President, Construction Group and Daniel Frazee, ARM, CRIS, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Contractor’s Pollution Liability (CPL), once viewed as expensive and unnecessary, has now become an integral part of every trade and environmental contractor’s insurance program. The industry is seeing requirements for this coverage from a combination of building owners, developers and general contractors for projects of all sizes.

Protecting contractors from pollution exposure by transferring this risk to a CPL policy supports a best practice approach. Contractors' pollution liability insurance provides coverage for third party bodily injury, property damage and pollution clean-up costs as a result of pollution conditions for which the contractor may be responsible. A pollution condition can include the discharge of pollutants brought to the job site, a release of pre-existing pollutants at the site or other pollution conditions due to the performance of the contractor’s or a lower tier subcontractor’s operations. In addition to the potential loss of reputation, often overlooked expenses that can negatively impact a profit & loss statement are the costs incurred to defend a company involved in a pollution claim.

Contractors who choose not to purchase Contractor’s Pollution Liability Insurance generally fall into two categories. Many believe that their operations do not have a pollution exposure. And countless others assume that their Commercial General Liability (CGL) policies offer protection in the event a pollution claim arises. Neither of these assumptions is accurate. Pollution coverage is not commonly found in CGL policies by virtue of the Total Pollution Exclusion. This form excludes pollution coverage for any bodily injury, property damage and/or the clean-up costs. Examples of pollution incidents apply to many different types of trade contractors, in addition to traditional environmental contractors. A handful of those are listed below:

- An HVAC system is installed improperly which, over time, causes moisture and ultimately mold to spread throughout a residential building, causing bodily injury and property damage

- A painting contractor accidentally disposes paint thinner through a public drain causing polluted water to a local community

- Dirt being excavated from one area of a job site to another is contaminated with arsenic and lead. The chemicals are then spread to a larger area which is later found by a soils expert

- Construction equipment on a project site has hydraulic fuel lines cut by vandals, causing fuel to leak out and contaminate the soil

- A contractor punctures an underground storage tank during excavation, causing the product to spill into the soil and groundwater.

- A gas line ruptures during excavation causing a gas leak into a neighboring building that leads to an explosion

The common thread seen above describes how contractors are causing some type of “contamination” on a job site. And, contamination is the operative word in all pollution exclusions. With such a broad definition extending to so many types of construction, beginning your search now for CPL options is just simply good business.

And, with a multitude of insurance companies aggressively pricing CPL policies, securing competitive quotes to compliment your current insurance program can fill significant gaps at more reasonable costs than you think.

Take time to consult with your broker and learn more about how pollution liability impacts your firm.

For more information, contact Sam Clayton at (619) 937-0167 or Daniel Frazee at (619) 937-0172.