Industry News

2019 Expected Loss Rates Published in California’s Updated Regulatory Filing – X-MOD Impact Inevitable for 0042 Class Code

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay for all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

Under most circumstances, when you hear the word decrease as associated with insurance its a good thing, but in the case of the ELR, a decrease will have a negative impact on your Experience MOD (X-MOD). In simple terms, if your losses stay the same and the ELR for your industry is down 15%, your X-MOD is going to go up.

At 15%, the landscape class code accounts for one of the largest swings in the 2019 regulatory filing for all industries. This only reinforces the importance of mitigating claim frequency, superior carrier claims handling, internal claims advocacy, claim cost consolidation efforts, and a proven system to keep all of these aspects running constantly. Fortunately, Rancho Mesa has a system in place today and it is a proven success.

Don’t be caught off guard in 2019; have a plan and always anticipate for the future. Let Rancho Mesa help manage your landscape insurance needs. For more information, call (619) 937-0164.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 2)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

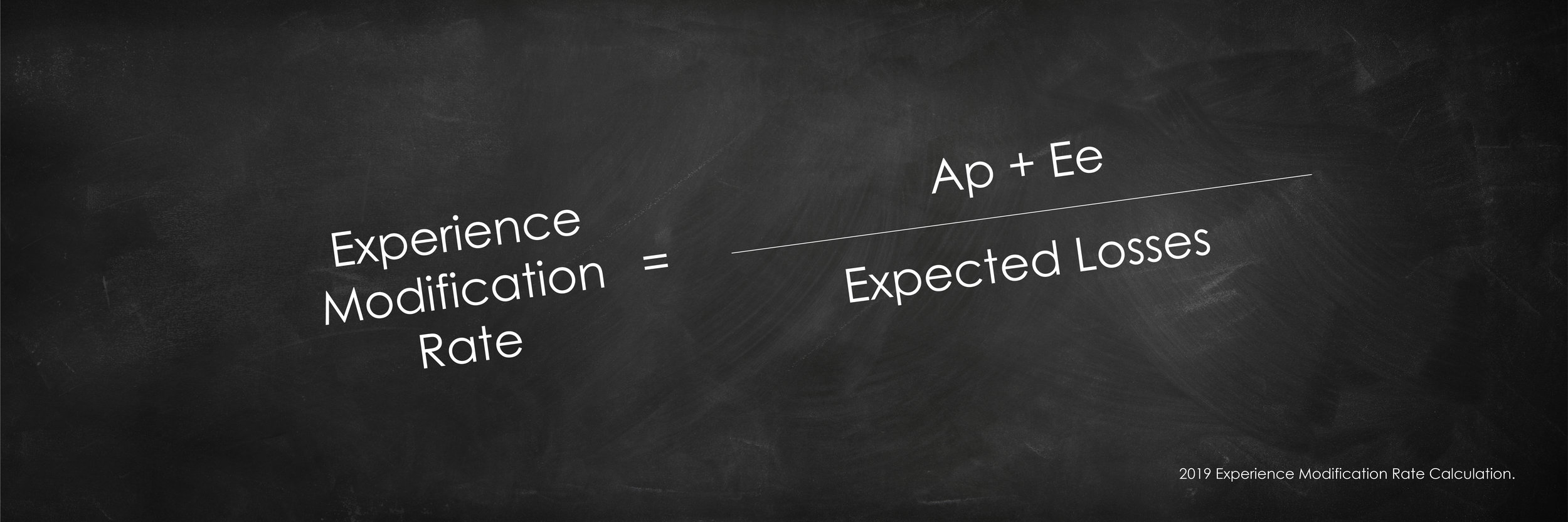

The Simplified Formula

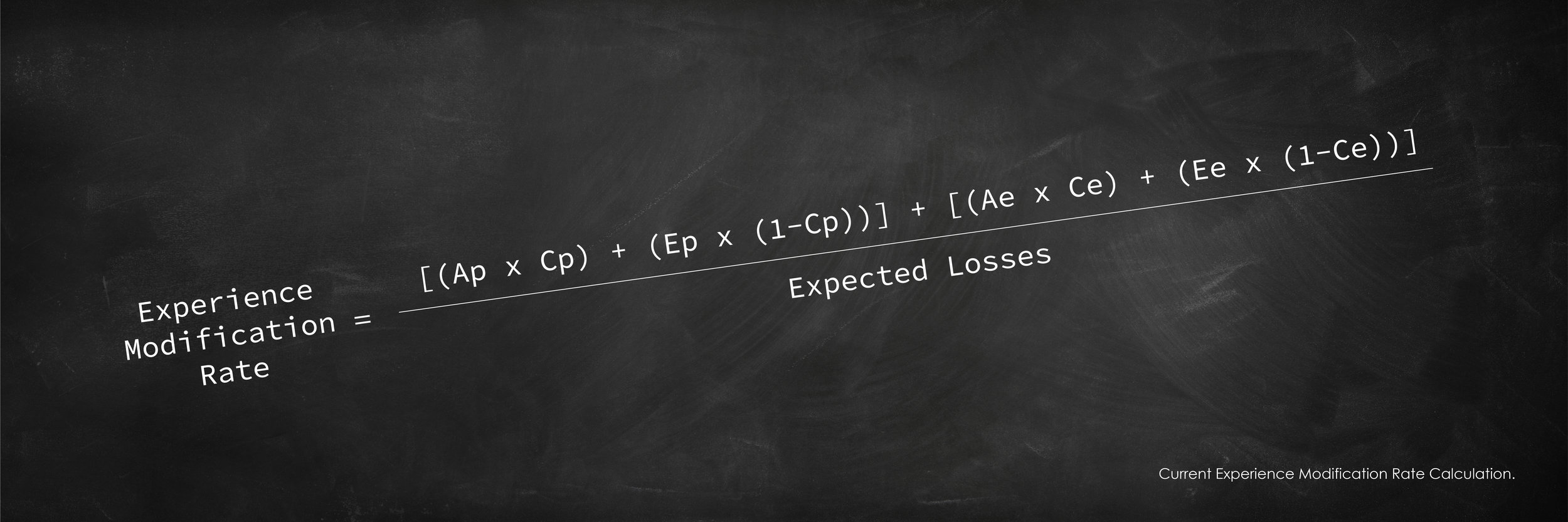

Individual claim cost (i.e., both paid and reserved) will go into the calculation up to the primary threshold limit are considered the actual primary losses. Any claim cost that exceeds your primary threshold is considered the actual excess loss. In past experience mod formulas, the actual excess loss was used in the factoring of your EMR; in 2019, it will have no effect. However, under the new calculation, the industry expected excess losses will be considered in the 2019 simplified formula.

Actual Primary Losses + Expected Excess Losses / Expected Losses

The expected excess losses are calculated by multiplying your class code’s payroll per $100 by the expected loss rate for that same class code. This number is then discounted by the “D Ratio” to determine expected primary losses and expected excess losses. There are 90 different D-Ratios for each classification based on the primary threshold. The D-Ratio is different for each classification and is determined by the severity of injuries that occur within that particular class code.

The first $250 of all claims will no longer be used in the calculation of your EMR.

This is a major change and one that was initiated in part to encourage all employers to report all claims, including those deemed first aid, without having a negative impact on the companys’ EMR. This change will affect all claims within the 2019 calculation; so yes, it will include years previously completed and reported. This will have a positive impact on EMRs in that claim dollars will be removed from the EMR calculation.

Confused – Want more details?

Help is on the way. We are going to hold a statewide webinar on Thursday, October 4th at 9:00am in order to dig deeper into this subject and answer specific questions. You may register for the webinar by contacting Alyssa Burley at (619) 438-6869 or aburley@ranchomesa.com.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 1)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Before we breakdown the changes to the 2019 EMR formula, we must first have a strong understanding of the two critical components that directly affect the outcome of the EMR. This article will be broken out into 2 parts. Part 1 will describe the Primary Threshold and Expected Loss Rate. In Part 2, I will provide an overview of the changes to the EMR calculation.

The single most important number to my EMR is not my final rating?

Primary Threshold

Rancho Mesa has long taken a stance on the importance of a business owner knowing their primary threshold as it relates to the EMR. Proactive business owners should monitor their primary threshold annually as it is subject to change due to payroll fluctuations, operations, and the annual regulatory filing of the expected loss rate. In general terms, the more payroll associated with your governing class (the class code with the preponderance of your payroll) the higher your primary threshold will be. The primary threshold is unique to every business. The 2019 EMR formula is heavily weighted by the company's actual primary losses, the claim cost (both paid and reserved) that goes into the calculation up the primary threshold amount. Controlling claim cost and knowing your company's primary threshold is the first step to understanding the EMR.

Expected Loss Rates

The expected loss rate is the factor used to anticipate a class code's claim cost per $100 for the experience rating period. The expected loss rate (ELR) is not to be confused with the pure premium rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

The ELR changes, annually. It’s important to monitor the change; if your expected loss rates go down (from our analysis this is the direction most are going) and if nothing else changes, your EMR will go up. Why is this? Again, without going too deep, in simple terms, your EMR is a ratio of actual losses to expected losses. If your expected losses go down, but your actual losses remain the same, then your EMR will go up.

To illustrate this, consider the following. Actual losses are $25,000 and your expected losses are $25,000 your EMR would be 100. Now, if your actual losses stay the same at $25,000, but your expected losses drop to $20,000, your EMR would now be 125%. (There are other factors that would go into the actual calculation, so your actual EMR would be different – this was just to illustrate the expected losses impact to the EMR.)

In Part 2 of this article, will cover the actual changes to the EMR calculation.

For more information about the EMR, contact Rancho Mesa Insurance Services at (619) 937-0164.