Industry News

Exploring the Self-Insured Group Alternative

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

The fabric of the California’s workers’ compensation landscape is ever changing. Most California-based subcontractors utilize what are called guaranteed cost options for their workers’ compensation needs. This is a safe option that allows for business owners to budget for their overhead costs, however, they have minimal control based on the ebbs and flows of the market. Additionally, with medical inflation and litigated claims on the rise, CA is now experiencing a hardening market as rate increases threaten 2025 and beyond.

Author, Kevin Howard, Partner, Rancho Mesa Insurance Services, Inc.

The fabric of the California’s workers’ compensation landscape is ever changing. Most California-based subcontractors utilize what are called guaranteed cost options for their workers’ compensation needs. This is a safe option that allows for business owners to budget for their overhead costs, however, they have minimal control based on the ebbs and flows of the market. Additionally, with medical inflation and litigated claims on the rise, CA is now experiencing a hardening market as rate increases threaten 2025 and beyond. This has caused many contractors to seek more control over their workers’ compensation program, especially those who have displayed best-in-class safety habits and lower loss ratios to prove it. While guaranteed cost options are widely known, Self-Insured Groups (SIG) are quickly gaining traction as a compelling alternative. By pooling resources, subcontractors can access benefits that are better suited to their specific operational needs.

Predictable Expenses with Added Benefits

A key strength of SIGs is the financial predictability they provide. Unlike traditional insurance with fixed premiums, SIGs have the flexibility to reward participants who maintain excellent safety practices with reduced contributions and the possibility of surplus return premiums that are traditionally nontaxable. This structure not only encourages proactive risk management but also helps members potentially reduce workers’ compensation costs through the hard market.

Comprehensive Risk Management Support

SIGs can often go beyond the typical insurance offering by providing members with access to advanced risk management resources. Because SIGs utilize group communication for safety needs, members can lean on each other and pool data to utilize the hive-type safety support systems. These systems can include safety training programs, compliance audits, and in-depth data analysis. These tools help subcontractors pinpoint and address potential risks, leading to safer worksites and fewer insurance claims.

Collaborative and Transparent Decision-Making

A distinctive feature of SIGs is the active role that members play in the governance of the program. Subcontractors participate in selecting providers, setting policies, and shaping the group's strategies. This cooperative approach ensures that the program aligns with the interests of the members, fostering trust and transparency.

Strength in Numbers

Joining a SIG connects subcontractors to a broader network of industry peers. This collaborative environment encourages knowledge exchange, problem-solving, and collective negotiation, ultimately contributing to mutual growth and resilience. Many SIGs also hold quarterly and/or annual meetings, offering opportunities for additional sharing and recognition when warranted.

When is a good time to consider a SIG?

When annual estimated premiums reach between $150,000 and $1,000,000, and your firm can show competitive loss ratios over a 5 to 7-year window, SIGs can become a viable alternative. More than anything, educating yourself and your management team on this loss sensitive option allows for a more proactive approach to your upcoming renewal.

If you would like to learn more about SIGs and have an interest in this type of program, reach out to me directly at khoward@ranchomesa.com or call me at (619) 438-6874.

Exploring Innovation and Problem Solving in the Commercial Construction Industry

Author, Andy Roberts, Surety Account Executive, Rancho Mesa Insurance Services, Inc.

Surety Account Executive Andy Roberts sat down and interviewed Miggs Borromeo, Commercial Surety Underwriter for Merchants Bonding, and discussed the current climate of the commercial surety world in Southern California. They also covered the bonding trends most commonly seen today, and the programs that Merchants Bonding Company offers.

Kevin Howard, Partner with Rancho Mesa, interviews Jeremy Dentt of Dentt Properties Inc. and explores a range of topics relating to innovation and problem solving in the commercial construction world.

Kevin Howard: Welcome to StudioOne™. I'm Kevin Howard, Partner here at Rancho Mesa Insurance. Very excited to have our guest today, Jeremy Dentt. Jeremy, how are you doing?

Jeremy Dentt: I'm good. Thanks for having me. First time podcaster here.

KH: First time podcaster. I feel privileged. Jeremy Dentt is the owner of Dentt Real Estate Services. He's been specializing in the development, management, leasing, and sales of commercial real estate since 2004.

Jeremy, you mind if I go through your resume really fast? Geez, Louise. 19 years of experience in commercial real estate, which officially makes you a guru. San Diego State Aztec, and I'm looking through the development and management, you just have a ton of different types, a multitude of developments: commercial, habitational, gas stations. Which one of those was your favorite?

JD: I would have to say that my favorite is industrial. It's easier, four walls, some concrete, less chaos to the mix of the development where gas stations, carwashes; lots of moving parts, lots of different subs and smaller lots to build on.

KH: Makes more sense, it's more concise, less of a busy zone. And that would be your ideal build.

Well, we're going to go over some commercial real estate topics that I think.a lot of listeners are maybe asking themselves, you know, “What’s going on out there?” There’s been a ton of change since COVID, a ton of change nationally, internationally, so, just really excited to dive into this.

Let’s start with this question; if you could solve one major challenge in the commercial real estate industry today, what would that challenge be and what would you do?

JD: Well I think the biggest challenge we're still facing in commercial real estate, and just the building industry in general, is the escalating costs. We had huge spikes during COVID and we were hoping for a softening post-COVID but, some things have slowed down. It's still challenging to get material on time, costs are still going up, specifically switch gears are a year out from manufacturing to delivery to the site which presents just a major challenge to getting a project out of the ground.

KH: So you're estimating for a project to be, you know, six months, seven months, and you're way behind just because of how the economy is just so slow right now?

JD: Yeah, the supply chains are still on a significant delay for certain parts. Most of our projects that we started in the last three years, we ordered some of the important items like the switch gear and any large equipment six, seven months before even signing up a contractor.

KH: Right, frustrating, but what would you do to solve that problem? You know, you have a magic wand and you're like, "Hey, this is the big fix."

JD: That's a great question that I don't think there's one easy answer. I think having a little bit more manufacturing in the States would help. Some of the shipping logistics was the biggest challenge, getting it across seas. If we had more opportunity to manufacture some of these products locally, I think it would be easier for us to streamline the process.

KH: Totally agree. Your career spanning, you know, 20 plus years, what was the defining moment if you could just name one in your career so far, as far as a commercial real estate developer?

JD: Yeah, I think for me, I started my own project in 2019. It's an industrial complex, seven buildings in total, broken up into two phases. In the first phase, we got out of the ground in early 2019. And as you know, in 2020, March, we hit COVID and the world shut down. And I specifically remember the moment in this development when I was sitting there looking at my Excel spreadsheet with all my costs; my loan, which was a personal guaranteed loan of over $6 million and the world shutting down and wondering, what do I do next? And there's actually a funny picture of me laying in my backyard face down in, you know, March, where it's still 75 degrees here, I'm outside lying face down with a Patagonia jacket on just contemplating the decisions I've made.

KH: Yeah. “Where do we go from here?” Perfect timing, right?

JD: Yeah. I think for the defining moment side of it, it made me realize that I'd worked on this project since 2012 and we timed everything as best as we could. But there's so many factors in real estate and just anything you do that can come out of nowhere, that blindside you. And so having important economics to the deal is more important than ever because tomorrow something can change. And in that instance it was a global pandemic that I did not factor in my investment performance. But it was still a great project in a great location and luckily things turned and we did just fine but it was certainly one of those moments where it constantly changes your risk assumptions and how much risk you're willing to take on given that nothing's guaranteed.

KH: Right. Nothing is guaranteed. And obviously, that project is done. I've seen it. It's beautiful.

JD: It's done. It's insured by you, which is great. It's financed. So, yeah, it turned out to be a really good project for us.

KH: It worked out. Let's switch over to some innovation conversations. What innovations are you most excited about? I know there's just so much change with AI and, you know, remote workers What are you excited about when it comes to innovation?

JD: Well with innovation and construction and, you know, development of commercial property I've been really tracking more of the AR technologies that are coming out. Specifically, I've been working on a lot of construction projects where I'm out there, kind of old school, with a set of plans looking at details making sure the contractor built it right and I've lately come across these Apple goggles.

KH: Apple Vision Pro, the augmented reality. So cool, right?

JD: The augmented reality. Yeah those I really like and I've been tracking some of the programs that you can get where instead of the old school way of walking around with blueprints and checking the details making sure it's getting built right, the AR goggles you can build in the architectural plans with all the overlays of all the MEP sheets. And instead of looking down, they're essentially cast in front of you in the building and so if you had questions about, you know; the structural components behind it or what's behind that drywall or is that plumbing line supposed to be there? The plans are in front of you in these Apple goggles.

And I just think about how much efficiency will be brought to the construction industry when you're essentially staring at the plans while standing at the project. I think it's going to be huge for the construction industry in terms of not missing things. For instance, like right now I've got a project that I'm really concerned about some of the waterproofing and I can't get those layers pulled out. And I'm not sure that the details perfectly followed because there's some missing elements there. So now we're going to pull back some of the panels and make sure it's all there. However, if we had these technologies at the start, it'd provide one more opportunity for them to make sure that they're getting it right.

KH: That layer of comfort for you, right? Because you can see it.

JD: Absolutely.

KH: Yeah, I think that AR is definitely, it's going to come fast. It's going to affect how we train everybody in different industries, but it's definitely going to create more accuracy. You know, you can see it. It's right in front of you.

JD: Yeah, the technology doesn't just span construction. We're seeing it every year in the property management. You know, my company is unique where we do development, we do property management as well. It actually, the property management feeds itself from the development because understanding how the building is built is as important to managing it as well.

But, the technology there is constantly changing. Just coming into your office, looking at these elevator systems that have negative air systems now post-COVID, self -cleaning buttons. The property management software is changing, the connectivity between you and the tenant is easier than ever. It's really about streamlining that connection. And I always tell my clients that we incorporate these new technologies to connect us to the tenant, to get the rents paid, to get the tenants needs taken care of, but it's not to lose that connection with the manager. These types of technologies actually free up our time more so that we can be connected to the tenant base, which is important. They want to know their manager; they want to feel like they're being heard. And these programs are to kind of get rid of the minutia and streamline whatever it is, maybe a maintenance call, getting them connected to our vendor so that we can open lines of communications for other things.

KH: Right. It frees up the opportunity cost for you to go do other things, plug in your time. I mean, those are the advancements that we're so excited about.

JD: Yeah.

KH: I'm imagining listeners that are interested in commercial real estate would have some questions for you having to do with the future. What are you seeing in 20 years from now? You know, 20 years ago, if we talked about AR, augmented reality, we'd be like, “What?”

What's on the horizon and what would be really cool?

JD: Well, I think that one's more of a challenge for guys like you and I that are born and raised in San Diego. Perfect example, 25, 30 years ago, downtown San Diego was never on my radar. I didn't think there was any opportunity to develop. As you know, when we were kids, it wasn't the safest area to go. For me, I remember going down to Old Spaghetti Factory and my pops would drive up to that front door, open the minivan, say, “Get out, go inside.” Then he'd come in hour later, said, “Wait at the door,” minivan comes around, open, jam in. That was my understanding depiction of downtown, right? And then all of a sudden this ballpark comes in and everything explodes down there.

I think it's part of what I'm talking about of what 30 years looks like, density, right? We are out of land in San Diego. Single family homes, building them is a challenge. We just don't have big tracks to put it together. You'll get your small pockets here and there, but the reality is, is most of our housing is going to come from density. And you've seen it in downtown San Diego. You see constant sky rises going up. You're seeing it more in North Park than ever before with the cities updating their community plans for denser locations near freeways. And so I think that the 20, 30-year outlook for San Diego is just a completely different sky rise. The single family huts that we grew up in East County, all those areas will have to accommodate growth, and we’re out of land. So how do you do it? You go up.

And I think that's honestly, we're seeing it even in industrial. It hasn't hit San Diego, but in markets like Seattle, Oakland, New York, they're building two and three story industrial buildings now. Those same markets are constrained with land. And so how do you create more industrial space?

KH: Go up.

JD: You go up. It's expensive, but at some point it does make sense. So I think just a vertical skyline is going to be the future of San Diego.

KH: Right, and that reminds me of the book Ready Player One that I asked you to read years ago.

JD: Sure, what a great recommendation.

KH: And that story, the stacks are stacked high because of that same problem, right?

JD: Sure, hopefully, we don't lose the social interaction that is lost in that world, but the density, I agree.

KH: We shall see. We'll listen to this podcast later on in life and say, "We were way off," or "You nailed it." So, we've talked about innovation. We've talked about the future of commercial real estate, what are you doing for risk management? What are you doing out there to really mitigate major risk?

JD: Yeah, I think that's one of the biggest things where we constantly look into. First things first is hire a good insurance agent, like you, to ensure the entire portfolio and be as cost effective as possible.

At a property level, we're encouraging all of our owners and looking at our own assets and trying to add cameras. I think from a perspective of risk for litigation, having captured more data on your building; what people are coming and going, what happens when they're at their building, I think is one of the best things that you can do. It doesn't help proactive. Of course, we got to stay proactive with getting eyes on our property, checking to make sure that everything's in good order. We don't want broken concrete. We don't want tripping hazards, all the kind of normal checks. But inevitably things are going to happen, right? And so mitigation of that risk after it happened. Well, not to say anyone lies about trip and fall on a property, however, having an understanding of what happened can be a defensible situation for us. And so having cameras at our properties to pick up on any activity of what may or may not happen is something that we're trying to roll out across our portfolio. And we do it on our large properties, which cost a little bit more because you have a bigger area to capture, all the way down to the properties that we represent that are one and two units. And this can be achieved with even installing a ring camera that has the ability to just capture an area.

And what we found is in these situations if something arises, we understand what happened so we can defend or acknowledge the situation and oftentimes it's just using it as a defense opportunity. The risk perspective is, we got to hand it over insurance and then our insurance premiums go up, right? So, doing as much to the building as possible to protect us and keep our claims low.

KH: I think it's especially very timely as far as adding a control, adding something to invest in that will just pay benefits over the long run If you do have a claim like that. It’s the same with commercial auto right now like, “Hey, so what happened?” Is it he said, she said or oh, “Here's the footage, we have it right here.” So that's really smart.

JD: Great point. Yeah, it's no different than insurance policy to us. It helps after the fact of collecting the data and understanding. And on an amenity base for tenants, they're actually finding a lot of value in it.

So we've got two high traffic buildings, one in Chula Vista and one in Escondido. And now multiple times I've provided footage for a tenant or a client of the tenant that reached out and said, "Someone backed up into my car." And I provided them the make, the model of the vehicle and they were just blown away like, "This is fantastic. This is what my insurance needed. They know it's not me.”

KH: I love it.

JD: What they do with it, I don't know, but it at least helps them on their side.

KH: Right.

JD: And so, we've been really trying to push for a lot of that.

KH: This is really innovative and can't cost too much either, right?

JD: It's coming down in price. I remember when I started, you would look at it and it just didn't make financial sense. But with the wireless connectivity, which is the most challenging part, because you don't want to be running wires 600 feet down the building, right? In a conduit, it all starts adding up. But with the new wireless capabilities and the quality of these videos, it's cheaper than it's ever been.

You know, I do all these things, right? And I put in all these checks and balances for my buildings. My most recent project, that you're aware of, is the ESFR rated fire system. The best you can get. If anything catches fire there, that fire system is going to suppress. But, the industry in general, every year, not every year, I should say the last couple of years, we've seen it premium spikes. And the comments have been, “Well, there's been a lot of wildfires, there's been floods.” Nothing that's been extremely detrimental to my properties or in my location, but my premiums continue to go up. I'm curious is why are outside events affecting my properties?

KH: That's a really good question. I think that, you know, we see premiums go up and we're wondering, “Hey, time out. My portfolio was not affected, you know, I'm so far away from these fire zones.” In reality, you know, I have some statistics in front of me. In 2023, 7,127 wildfires. The year prior, 7,667 wildfires. Both years ranging $10 billion to $ 15 billion and paid out insurance costs.

So, your insurance companies, they're buying reinsurance. They're buying insurance on top of insurance. Those reinsurers, they're getting killed. Hurricane Milton, for example, has an estimated $60 billion payout. So when we have these disasters internationally that are taking a huge hit and these re-insurers are taking a huge hit. The pressure passes down to the insurers and ultimately the consumer, right? So we'll see the effect of Milton and Hurricane Helene. But that's the long and short of it is you can have the best controls in place, but because of what's going on with natural disasters, Unfortunately, you're seeing the effect.

And then one more added layer is the cost of goods. Like you mentioned, you know, gas prices being up, money costs more. If there is a situation where a building has to be rebuilt, it costs way more now than it did 10 years ago.

JD: Sure.

KH: So you combine those two together and, you know, that's why we're seeing premiums go up. And the best way for us to really help you fight, you know, at commercial real estate portfolios, you know, fight down those costs, is to communicate early with your insurance agent, make sure they know everything about those controls that you're talking about. Do you have the cameras? And what else are you doing that really helps us mention that to the marketplace and find savings where we can find savings?

JD: So my mitigation of risk can transfer over to their mitigation of risk and hopefully, maybe move the needle of premiums?

KH: I mean, for example, we talked about property premiums going up. General liabilities are usually a good portion of your total insurance costs. Can we push that down? Should we raise the deductible? Are we fighting for the best rate on that? We got to fight where we can fight right now when we have no control, we're completely powerless over what's happening in the property marketplace.

Similar to homeowners right now that live in these fire zones, paying five, six, seven thousand dollars a year in premiums. They weren't expecting that. They didn't budget for that. So we have to just hold tight, be as creative as possible, and really dig deep as far as how we market your account and how we fight for credits.

JD: Yeah, I agree.

KH: We've covered a lot of ground here. We've talked about how you're mitigating risk. We've talked about the implementation of new technology. With everything that you have under your belt, who can you help right now? Who's out there that might need your services?

JD: So our focus is twofold. We're looking for clients and partners that have land or a building that has some type of value-add lift that needs someone with expertise of construction, ownership, and management. And then also over the past five years, we've added multifamily into our portfolio. Which, the landscape of San Diego has changed from a few small developers and managers to multi-billion dollar companies. And so being just focused in one silo of commercial real estate presented challenge. So we pivoted and took what we experienced in commercial real estate, which is a higher level of care and trust for a building and added that to our multifamily portfolio.

So there's a lot of families out there that are self-managing their own portfolio, whether it's a three unit, four unit or a couple hundred units that the family was doing on their own. They're reaching that point of retirement where that building--it makes a nice cash flow for them--and to give up that management fee to shed all risk and just the risk of everything that's constantly changing. They don't have to stay on top of anymore giving passing that baton over to a company that stays on top of it works with the right people, the right insurance, the right GCs to keep that building running healthy for a long time is who we're really looking for. Someone that we can form a relationship with. We're not just there for just the management. We want to be a partner to it and provide them the highest level of service that we originally started our roots in, which is commercial real estate.

KH: Right. And it sounds like you'd bring a real peace of mind in that scenario where somebody's kind of at the end of where they want to manage their property and they want to hand it over to a pro.

And I'll vouch for Jeremy. I've known Jeremy my entire life. He's such a good guy. I really truly believe in what you're doing out there in the community for San Diego. Jeremy also contributes his time to Miracle League, which is a fabulous, very important part of San Diego as far as a nonprofit. And I'm just so proud to be your friend.

JD: Appreciate that. You know, we're here to help. I understand management comes at a cost. Oftentimes there's an opportunity to offset that expense that you see from management fees. So we're really pushing for families and owners that, looking for retirement, that want to hand over their asset that they worked really hard. And we're going to honor how hard they work to make that deal and to hold it for so long and carry out that legacy of management for them.

KH: That's a good point. It's a very good point. Well Jeremy if somebody wants to reach out to you. How can they get ahold of you?

JD: Yeah, we can attach my email to this post. It's jeremy@denttprop.com Happy to help.

KH: Very cool.

JD: Thanks so much for having me.

KH: Thank you for coming to StudioOne™.

JD: Great introduction to my first podcast.

KH: There you go. Appreciate it.

JD: Thanks.

Protecting Commercial Property Investments through Vacancy Permit Endorsements

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Commercial real estate owners may face significant exposure nationally due to vacancy clauses and policy exclusions. The vacancy permit endorsement can potentially fill a major coverage gap within commercial property policies for landlords.

Author, Kevin Howard, Partner, Rancho Mesa Insurance Services, Inc.

Commercial real estate owners may face significant exposure nationally due to vacancy clauses and policy exclusions. The vacancy permit endorsement can potentially fill a major coverage gap within commercial property policies for landlords.

COVID-19 forever changed the commercial real estate industry by shutting down operations in several asset classes, including retail, office, and industrial. The shutdown created a huge spike in vacancy rates that has certainly come back to nearly normal levels but still presents issues for many landlords. For example, office buildings have seen a continued increase in the national vacancy rate from 12% in 2017 to 16.5% in Q4 of 2023 (www.statista.com).

For property managers and building owners, the risk of an insurance claim within a vacant space has increased, making a focus on coverage paramount. Most insurance policies have specific exclusions that can limit coverage for bodily injury or property damage based on the duration of a building's vacancy or the percentage of the building that is vacant. For example, some exclusions restrict coverage entirely if the building has been vacant for more than 60 days. Another common exclusion requires that at least 31% of the building be rented, leased, or owner-occupied for coverage to respond.

Vacancy Permit Endorsement

For insureds, requesting a vacancy permit endorsement is a smart move that helps eliminate any guesswork regarding coverage gaps. Most carriers will tailor this endorsement to specify the vacancy period, the coverages in place, and the conditions that need to be met by the insured. These conditions typically include maintenance disclosures, inspection reports, and security measures.

There is usually a relatively small premium adjustment for a vacancy permit endorsement, which is well worth the investment compared to the potential cost of an uninsured claim.

The risk associated with vacant properties is more pronounced than ever. Owners and managers must be proactive in securing appropriate coverage to mitigate these risks. The vacancy permit endorsement is a crucial tool in this effort, providing tailored coverage that addresses the specific challenges posed by vacant spaces. By understanding and utilizing this endorsement, property owners can ensure comprehensive protection, safeguarding their investments against unforeseen claims and maintaining peace of mind in an ever-evolving market.

Rising Reconstruction Costs and the Impact on Building Owners

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

The continuing trend of catastrophic claim activity over the last several years, rising number of nuclear settlements due to increased litigation funding, and hyperinflation are impacting all economic sectors. One of those sectors is the commercial property insurance market and the rapid increase in reconstruction costs.

Author, Kevin Howard, Partner, Rancho Mesa Insurance Services, Inc.

The continuing trend of catastrophic claim activity over the last several years, rising number of nuclear settlements due to increased litigation funding, and hyperinflation are impacting all economic sectors. One of those sectors is the commercial property insurance market and the rapid increase in reconstruction costs. Per Verisks’s recently released Reconstruction Costs Analysis, from January of 2023 to January of 2024 the total reconstruction costs have increased by 4.1%. Since the 2020 pandemic, reconstruction costs have increased over 25% nationwide. For commercial property owners, these statistics require additional due diligence with their broker when evaluating the replacement cost of their respective portfolios during the pre-renewal process.

With interest rates still elevated and the demand for quality tenants still present, the last thing a property management group or single building owner needs is an underinsured claim that compromises cash flow.

Factors that have driven up reconstruction costs include:

Demolition and debris removal

Removing existing landscaping, debris and existing buildings add costs to a project. Balancing this work within the bounds of other occupants/tenants can also compromise timelines.

Site

New construction starts with a clean foundation. Reconstruction does not have a clean site, it may have foundations that need to be removed in order to add/replace plumbing, sewer, underground pipelines, etc.

Labor

The cost of labor has skyrocketed with higher wages, cost of living, medical benefits, etc. Those costs translate directly to contractor margins and have increased reconstruction project estimates.

Hyperinflation

Gas, rental equipment, and building materials have all been directly impacted by inflationary trends, further elevating reconstruction costs.

The above examples represent only some of reasons why property owners must re-evaluate and most likely increase property limits on their statement of values (SOV). Working with a broker who can utilize data analytics while also providing comparative models can help to identify appropriate coverage that complements the changing world of reconstruction.

To learn more about our detailed process for evaluating your risk exposure, contact me at khoward@ranchomesa.com or (619) 729-5173.

Navigating the Construction Labor Shortage: Factors and Strategies for Success

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Construction companies nationwide are grappling with a shared challenge: a labor shortage propelled by various factors. In this article, we will explore these factors and highlight key areas that can contribute to managing bottom lines effectively.

Author, Kevin Howard, Partner, Rancho Mesa Insurance Services, Inc.

Construction companies nationwide are grappling with a shared challenge: a labor shortage propelled by various factors. In this article, we will explore these factors and highlight key areas that can contribute to managing bottom lines effectively.

Factors Contributing to the Labor Shortage

Focus on College over Skills Training. Younger people have been opting for academic paths rather than entering the trades. For years, students have been encouraged to attend college in order to have a successful career. Therefore, fewer recent high school graduates have opted to enter trade apprenticeship programs which has significantly reduced the number of people being trained to enter these vital fields.

Retiring Workforce. The imminent retirement of the baby boomer generation (born from 1946-1964) poses a significant challenge. Skilled workers, including superintendents, project managers, and jobsite managers, form a substantial portion of those exiting the workforce. This creates a demand for skilled workers and necessitates a heightened focus on training apprentices.

Inflationary Costs and Higher Wages. Attracting and retaining skilled workers has become a budgetary challenge. Pandemic-induced wage inflation has led to an increase in payroll, resulting in both higher training costs and salaries. Additionally, prevailing wage rates have reached historic highs, contributing to a slower pace in hiring entry-level trade positions for budgetary reasons.

Strategies for Success

As the construction industry struggles with the ongoing labor shortage, business owners must strategize to protect their bottom lines. While challenges persist, focusing on key areas can help mitigate the impact on productivity and costs. Some central aspects that merit attention and investment include:

Safety Training. With an influx of new, unskilled workers, prioritizing comprehensive safety training becomes paramount. This not only helps prevent injuries but also contributes to a safer and more efficient work environment.

Rancho Mesa’s SafetyOne™ mobile app and website provides proactive safety orientation training for new hires plus ongoing safety training for all employees.

Insurance Cost Management. Implementing robust safety measures can positively influence insurance costs. By minimizing workplace accidents and demonstrating a commitment to safety, construction companies can negotiate more favorable insurance premiums.

Using Rancho Mesa’s SafetyOne™ mobile app to monitor safety on the jobsite through risk observations provides the data to show they are committed to safety.

Claim Reviews and XMOD Management. Engaging in claim reviews in regular intervals with your broker to address lingering workers' compensation claims can serve as an effective strategy for minimizing insurance costs, particularly in terms of mitigating XMOD increases and improving overall loss ratios.

Rancho Mesa’s claim advocacy approach remains a critical tool for Rancho Mesa clients. Jim Malone, the company’s claim advocate, communicates regularly with adjustors and helps advance claims to closure, thus helping insulate XMODS.

Strategic Workforce Planning. Develop long-term workforce plans that account for the aging workforce and the need for skilled labor. This may involve targeted recruitment efforts, partnerships with vocational schools, and apprenticeship programs.

While the construction industry faces substantial challenges due to the labor shortage, proactive measures in safety, insurance management, and strategic workforce planning can help businesses weather the storm and maintain a healthy bottom line.

For more information on these proactive strategies, reach out to me at (619) 438-6874 or khoward@ranchomesa.com.

Mitigating Risks in the Solar Industry with Professional Liability Insurance

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Since the outset of the 21st century, the solar installation industry has been bustling with the demand to create clean sustainable energy. Based on growing political and ecofriendly needs, the solar industry is ever changing and trying to keep up with constant fluctuations when it comes to energy storage, federal and state regulations, and supply chain demands.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Since the outset of the 21st century, the solar installation industry has been bustling with the demand to create clean sustainable energy. Based on growing political and ecofriendly needs, the solar industry is ever changing and trying to keep up with constant fluctuations when it comes to energy storage, federal and state regulations, and supply chain demands. Hand in hand with this growth is the risk created for solar installation contractors who are busy creating drawings, proposals and contracts. It is common for a solar contractor to purchase general liability insurance. It is commonly mistaken as the only needed coverage besides workers’ compensation and commercial auto insurance. However, general liability coverage needs to be triggered by either property damage or bodily injury. But, what about all of the potential lawsuits outside of property damage and bodily injury? This is where professional liability becomes an essential element to any solar installation contractor’s insurance program. To dive deeper, I have provided some claim examples that should resonate with any solar contractor performing residential or commercial installation.

Design Errors

Once a rendering is made that calculates the potential savings a solar system can generate, a contract is typically signed with the proposed energy savings. A solar contractor may face a claim if there is a design error. For example, a shaded area may have been missed that does not generate enough energy or the system might have been incorrectly positioned. A professional liability insurance product would be the best risk transfer vehicle for protection against this type of claim.

Failure to Comply with Building Codes

If a customer’s home cannot pass inspection because the work does not meet building codes, there could be a lawsuit and a claim which could trigger a professional liability policy.

Failure to Obtain Permits

If there are any nominal losses created from the lack of permits or timing of permits, a customer could file a lawsuit seeking damages. Since there is no bodily or property damage, a general liability policy would deny this type of claim. A professional liability policy would offer advice through third-party council to help mitigate losses fast in a time sensitive claim scenario.

Battery Storage

The State of California has high hopes to be petroleum free by 2050. This would mean that home battery systems would become essential for energy storage. Now imagine a family is counting on this system to make sure their vehicles are charged. This creates a lot of demand and if this battery was installed incorrectly, there could be claims having to do with losses sustained by that family. The scenarios are endless when you really think about it.

Maintenance Contracts

For some large-scaled solar installations, the energy created can be critical to business or for emergency lighting. If these systems fail to produce the proposed energy, in could cause a domino effect of a loss and/or costly lawsuits. Imagine a manufacturing plant relying on solar panels and battery storage that cannot create their product due to a faulty system. A professional liability policy could help mitigate the loss by adding in defense and counsel.

As the solar industry adapts and grows, the need for appropriate risk protection grows with it. Building an effective insurance program that includes professional liability is critical for all solar contractors considering the exposures referenced in this article. With a strong niche in this space, Rancho Mesa brings expertise and market knowledge that can help solar contractors transfer the appropriate risk, where necessary.

To discuss your risk management, please contact me at khoward@ranchomesa.com or (619) 438-6874.

The Critical Role of Pollution Liability Insurance for Mechanical Contractors

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

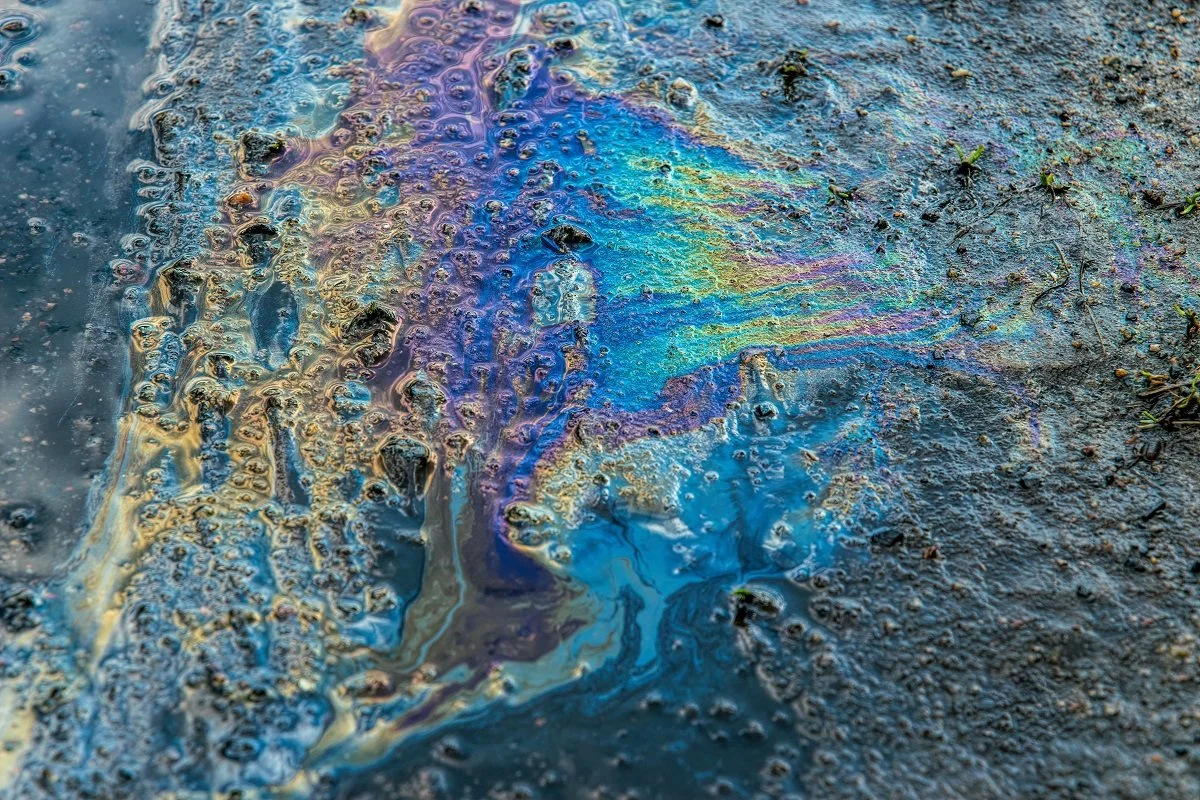

Mechanical HVAC contractors are essential to making sure that buildings around the globe have controlled temperatures and are energy efficient. Nationwide, the demand for mechanical HVAC contractors often keeps these businesses with full backlogs. These companies use various materials that create the potential for a pollution liability claim. Refrigerants, gases, flammable liquids, and lubricants are examples of these types of pollutants. If leaked or exposed, walls, ceilings, and floors can develop damage or mold that is not covered by standard commercial general liability policies.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

Mechanical HVAC contractors are essential to making sure that buildings around the globe have controlled temperatures and are energy efficient. Nationwide, the demand for mechanical HVAC contractors often keeps these businesses with full backlogs. These companies use various materials that create the potential for a pollution liability claim. Refrigerants, gases, flammable liquids, and lubricants are examples of these types of pollutants. If leaked or exposed, walls, ceilings, and floors can develop damage or mold that is not covered by standard commercial general liability policies.

Pollution liability insurance is a separate and specific form of insurance meant to protect businesses from pollution-related claims. Pollution risks may arise from activities such as the improper disposal of hazardous materials, fuel spills, or accidental leaks from HVAC systems. Such incidents can lead to damage to the environment, neighboring properties, and public health, which could potentially result in costly legal disputes and cleanup expenses.

Below we will cover two common pollution claim examples in an effort to raise awareness and drive home the need for commercial pollution liability insurance specifically for HVAC mechanical contractors.

Claim Example 1: Contamination of Ground Water due to HVAC System Leak

In this example, XYZ Mechanical installed an HVAC system in a commercial building. The building is adjacent to a residential development. Post install, there was a leak in the refrigerant line which seeped into the dirt below the building which went undetected for weeks. The refrigerant seeped into the groundwater supply causing contamination.

Hazard - This claim example would have a significant impact on wildlife, could cause harm to residents and would need a specific extraction/clean up that would be costly to a business owner.

Protection - A pollution liability insurance policy would react to this type of claim and could offer coverage for the cleanup, any third-party injuries, and the cost for legal proceedings.

Claim Example 2: Fuel-Contaminated Environment

ABC Mechanical is hired to install an energy efficient HVAC ground unit for an apartment complex. There was an underground unmarked fuel storage tank that was accidentally drilled into and caused a leak.

Hazard - This claim example would need immediate attention for the potential risk of fuel leaking into the ground and a plan for cleanup. The leak could make its way into the groundwater contaminating wells and potentially causing contamination of water. There would also be some health hazards for residents that could become a concern.

Protection - A pollution liability policy would come to aid with emergency response, cleanup cost, third- party bodily injury and legal defense costs.

Pollution liability is very often an overlooked coverage for many HVAC mechanical contractors. In 1986, however, the total pollution exclusion (TPE) became a standard exclusion in commercial general liability policies and has since created the need to purchase commercial pollution liability policies due to the variety of exposures to risk. The cost is relatively minor and the benefit very high if and when coverage is triggered. If you have questions regarding commercial pollution liability, please contact me at khoward@ranchomesa.com or (619) 438-6874.

Heat Illness Awareness Vital for California's Construction Companies

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

California faces a critical need to prioritize heat illness awareness among its workforce. The combination of Southern California's recent above average rainfall and the anticipated heatwave resulting from El Niño has created the possibility of an extremely warm summer. Construction companies must remain vigilant and adaptable, implementing appropriate measures to address these changing weather dynamics and ensuring the safety of their workers. By staying informed about weather forecasts and implementing flexible work schedules and site preparations, companies can effectively navigate these challenging conditions and prioritize the well-being of their employees. By understanding the significance of heat illness awareness, companies can ensure the safety and well-being of their workers while fostering productivity, minimizing downtime, and improving overall project efficiency.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

California faces a critical need to prioritize heat illness awareness among its workforce. The combination of Southern California's recent above-average rainfall and the anticipated heatwave resulting from El Niño has created the possibility of an extremely warm summer. Construction companies must remain vigilant and adaptable, implementing appropriate measures to address these changing weather dynamics and ensuring the safety of their workers. By staying informed about weather forecasts and implementing flexible work schedules and site preparations, companies can effectively navigate these challenging conditions and prioritize the well-being of their employees. By understanding the significance of heat illness awareness, companies can ensure the safety and well-being of their workers while fostering productivity, minimizing downtime, and improving overall project efficiency.

Recognizing the Risks

The construction industry in California is particularly vulnerable to heat-related illnesses and fatalities due to the physically demanding nature of the work and prolonged exposure to high temperatures. Heat stress, heat exhaustion, and heat stroke are severe conditions that can result in significant health complications. By acknowledging the risks associated with working in high temperatures, construction companies can proactively take measures to mitigate potential hazards.

Cultivating a Culture of Safety

Establishing a culture of safety is crucial for construction companies in California to create an environment where employee well-being is the top priority. Employers should develop comprehensive programs focused on preventing heat-related illnesses. These initiatives should include employee training, hazard assessments, access to shade and water, acclimatization procedures, and adjusted work schedules. Regular safety meetings and open lines of communication should be encouraged to address concerns, share information, and ensure that everyone is aware of the potential risks associated with working in high heat.

Implementing Worksite Modifications

Modifying the worksite environment can reduce the impact of heat-related illnesses. Construction companies should establish shaded rest areas where workers can take breaks, cool down, and hydrate. Access to potable water should be readily available to prevent dehydration, and regular hydration breaks should be scheduled throughout the day. Additionally, adjusting work schedules to avoid the hottest periods, utilizing cooling fans or misting systems, and implementing rotational job assignments can help reduce heat stress and improve worker safety.

Monitoring and Supervision

Supervisors and management play an important role in ensuring heat illness awareness on construction sites. Regular monitoring of weather conditions and temperature provides valuable information for determining appropriate work practices and scheduling. Close supervision enables the early detection of signs of heat-related illness and allows for immediate intervention. Encouraging workers to prioritize their own well-being and empowering them to report any symptoms promptly is equally important.

Heat illness awareness is vital for construction companies operating in California. By prioritizing worker safety and implementing comprehensive programs to prevent heat-related illnesses, employers can safeguard their employees from the risks associated with high temperatures. Moreover, such initiatives enhance productivity, avoid worker’s compensation claims, reduce downtime due to illness or injuries, and improve overall project efficiency. By cultivating a safety culture, providing necessary PPE, implementing worksite modifications, and maintaining close supervision, construction companies can establish a healthy and safe working environment that ensures the well-being of their workers.

Rancho Mesa’s Upcoming Heat Illness Prevention Workshop

Lastly, Rancho Mesa Insurance is hosting our annual Heat Illness Prevention workshop on June 2nd at the Mission Valley library from 10:00 AM to 11:30 AM. This workshop will provide valuable insights, best practices, and resources to help construction companies and their employees effectively address and prevent heat-related illnesses. Be sure to join this workshop to stay informed and proactive in ensuring the health and safety of your workforce.

Insurance Benefits of GPS Systems in Commercial Vehicles

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

For businesses that rely on a fleet of commercial vehicles, insurance costs can be a significant expense. Insurance carriers calculate premiums based on a variety of factors, including the age and condition of the vehicles, driver experience and record, and the frequency and distance of trips. One factor that can positively impact insurance costs is the use of global positioning systems (GPS) in commercial vehicles. Below, we will explore some of the insurance benefits of installing GPS systems in commercial vehicles.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

For businesses that rely on a fleet of commercial vehicles, insurance costs can be a significant expense. Insurance carriers calculate premiums based on a variety of factors, including the age and condition of the vehicles, driver experience and record, and the frequency and distance of trips. One factor that can positively impact insurance costs is the use of global positioning systems (GPS) in commercial vehicles. Below, we will explore some of the insurance benefits of installing GPS systems in commercial vehicles.

Improved Safety

GPS systems in commercial vehicles can help improve safety by providing real-time tracking of vehicles and drivers. This can help businesses identify and address unsafe driving behaviors such as speeding, sudden braking, and hard cornering. By addressing these behaviors, businesses can reduce the risk of accidents and insurance claims which can result in lower insurance premiums.

Reduced Theft Risk

GPS systems can also help reduce the risk of vehicle theft. If a commercial vehicle is stolen, GPS tracking can help businesses locate the vehicle quickly and notify law enforcement. This can help reduce the risk of property loss and insurance claims related to vehicle theft.

Faster Claims Processing

In the event of an accident or other incidents involving a commercial vehicle, GPS systems can provide valuable data to insurance carriers. This can include information on the location, speed, and direction of travel of the vehicle at the time of the incident. This data can help insurance carriers process claims more quickly and accurately, which can help reduce costs and improve the overall claims experience for businesses.

Lower Insurance Premiums

GPS in vehicles can lower the loss ratio which is a key factor that underwriters use. Furthermore, the disclosure to insurance underwriters that GPS is installed and properly utilized could help insurance brokers negotiate lower premiums based on this added safety feature.

Improved Business Operations

In addition to insurance benefits, GPS systems can also help businesses improve their operations. Real-time tracking and reporting can help businesses optimize their routes, reduce fuel costs, and improve overall efficiency. By improving operations, businesses can reduce costs and improve profitability, which can have a positive impact on insurance costs and premiums.

GPS Systems have a multitude of benefits. These systems can save lives because drivers pay more attention to detail when GPS is on the vehicle. They can lower insurance premiums which can improve the return on investment. Lastly, the ability to track a stolen vehicle is a control that creates major benefits knowing that the cost of vehicles and the time needed to locate a replacement is at an all-time high.

To learn more about how GPS on your commercial vehicles can be implemented as part of your risk management plan, contact me at (619)438-6874 or khoward@ranchomesa.com.

Key Elements of a Lessor’s Risk Policy

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As a landlord and owner of commercial property, you have exposures like fire, theft and bodily injury that must be addressed to protect your investment and, in many cases, a family asset from risk. As you look to finance these properties, most lenders will require checks and balances to ensure that your property is properly insured and that the mutual investment is protected.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As a landlord and owner of commercial property, you have exposures like fire, theft and bodily injury that must be addressed to protect your investment and, in many cases, a family asset from risk. As you look to finance these properties, most lenders will require checks and balances to ensure that your property is properly insured and that the mutual investment is protected.

The Building and Property Area Must Be Protected

A lessor’s risk insurance policy, also known as an LRO, is set up to protect the replacement value of the building from fire, theft, and damage caused by a vehicle, third party, water/burst pipe and vandalism to name some common areas of coverage. There are extensions that will add ample benefits to LRO policies for building owners like ordinance and law coverage which would cover any needed updates required based on city code when rebuilding. Or an “Increased replacement cost limit up to 125%” which would protect a building owner from inflationary costs. There are several solid options for lessor’s risk policies but it is always wise to speak with a broker that can guide you through the process.

Liability Insurance in Case You Are Sued as the Building Owner

The second and equally important part of a lessor’s risk policy is the business liability portion. As a landlord/building owner, if someone were to slip and fall in front of your building or in your parking lot, you may be named in a lawsuit. The second key component to a lessor’s risk policy should include business liability. LRO policies will typically offer $1,000,000 per occurrence and $2,000,000 aggregate. If you are a landlord who is renting your building to a business, you would need this liability policy in the event you are sued for injuries sustained by your tenant as the builder owner.

If you own a Building, Avoid this Mistake

Do not only rely on the sole procurement of a standalone property insurance policy. If you own a building, it is critical that you procure a lessor’s risk policy. A lessor’s risk policy is the best alternative in protecting your family asset through the risk transfer process.

Rancho Mesa has access to several A+ rated lessor’s risk carrier options. So, if you have any questions or need help securing this coverage, reach out to me at (619) 438-6874 or khoward@ranchomesa.com.

Roofing Contractors Prepare for the Dual Wage Threshold Increase

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There is a lot at stake for roofing contractors in California. Many of us recall playing the game “would you rather” as kids. Would you rather jump into a freezing cold pool in December or eat the world’s hottest chili pepper with no milk available?

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There is a lot at stake for roofing contractors in California. Many of us recall playing the game “would you rather” as kids. Would you rather jump into a freezing cold pool in December or eat the world’s hottest chili pepper with no milk available?

For roofers across the state, the question for them is, “would you rather give strategic pay raises to key employees or pay higher than necessary worker’s compensation premiums?” The ideal solution would be to give appropriate pay raises to help retain quality employees and to pay less for worker’s compensation.

To get into the math, the Workers’ Compensation Rating Bureau (WCIRB) has increased the dual wage threshold for the roofing class codes 5552 and 5553 by $2. The prior wage threshold was $27 per hour. The change that went into effect September 1, 2022 adjusted the new wage threshold to $29 for these same codes.

So, any roofers renewing on or after September 1, 2022 will need to explore what makes the most sense regarding the hourly wages of their employees.

This increase for roofing contractors is critical to understand because of the massive rate difference between class code 5553 ($29 or more per hour) and (under $29 per hour).

To drill down further, we analyzed the base rates for class codes 5552 and 5553 from 10 different worker’s compensation carriers. The average delta in base rates was 65%. That is a huge swing in cost for any roofing contractor who is not familiar with the cost benefit analysis that must take place.

As an example, we will use $1 million in payroll for 3 different scenarios to help paint a picture of this wage threshold change.

SCENARIO #1:

ABC Roofing has $1 million in payroll and all employees make $27 per hour. Using a hypothetical net rate of $40 for class code 5552, the insurance premium for scenario #1 would be $400,000.

SCENARIO #2:

XYZ Roofing has $1 million in payroll and all employee make $29 per hour. Using a hypothetical net rate of $14 (which is 65% less than $40), the projected workers’ compensation annual estimated premium would be $140,000.

SCENARIO #3:

ABC’s insurance agent made them aware of the new wage threshold increase well in advance of their renewal. They gave appropriate wage increases to 75% of employees and now have $250,000 of payroll in class code 5552 and $750,000 in class code 5553. Using the same hypothetical net rates from scenarios #1 and #2, the worker’s compensation annual estimated premium would be $205,000.

In conclusion, the massive delta in base and net rates for the roofing class codes 5552 and 5553 requires a proactive approach with your broker in advance of your upcoming workers’ compensation renewal. Laying out options that can include strategic pay increases can and will ultimately bring significant premium savings to your roofing company. With inflationary costs across all trades trending upward, build a plan now to help offset these rising costs.

To learn more about this topic or have a conversation with us, please email me at khoward@ranchomesa.com or call (619) 438-6874.

Work-Related Automobile Accidents and Their Correlation With Workers’ Compensation Claims

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

In California, motor vehicle accidents are among the leading cause of severe injuries on a daily basis. From a risk management perspective, a company’s fleet safety program has a primary goal of keeping employees safe while driving which lowers the amount of annual auto premiums paid.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

In California, motor vehicle accidents are among the leading cause of severe injuries on a daily basis. From a risk management perspective, a company’s fleet safety program has a primary goal of keeping employees safe while driving which lowers the amount of annual auto premiums paid.

What is not typically discussed when talking about fleet safety is the impact a work-related auto incident has on a workers’ compensation policy and experience modification. This article will discuss some of those impacts.

EXPERIENCE MODIFICATION IMPACT

When broken down, workers’ compensation premiums are driven by many factors. A main factor for pricing is the experience modification. Experience modifications are a measure of safety for a company when compared to others in the same field. Workers’ compensation claims adversely affect experience modifications.

Typically, business owners invest time, energy and resources into their safety program in the form of personal protective equipment (PPE), stretching before labor, tailgate meetings and job hazard analysis. But, the “big claim” businesses are doing so much to avoid could come from an auto incident. A heavy dose of fleet safety training should be mixed into the safety topic agenda, tailgate meetings and discussions regarding minimal driving record requirements for employees to drive on behalf of a company.

Businesses in California are required to offer no-fault workers’ compensation insurance which means it doesn’t matter who is at fault, the injury will be covered by a worker’s compensation carrier.

When a work-related auto accident occurs and there is an injury involved with an employee, the experience modification will be affected adversely based on the incurred cost of the claim as well as the loss ratios.

SUBROGATION

If another party is at fault regarding a workers’ compensation claim, the insurance carrier who is tending to the claim can subrogate and try to recoup the paid amount from the responsible party.

The issue workers’ compensation carriers deal with regarding subrogating auto claims is that the California minimum required auto liability limit is only $5,000. This amount would not cover most injuries suffered by an employee in an auto accident. Also, there is a high percentage of drivers who are uninsured which makes subrogation impossible in a claim scenario.

Overall, subrogation is pretty difficult in this specific area of workers’ compensation. The best defense is to avoid auto incidents as much as possible.

MULTIPLE EMPLOYEE IN ONE VEHICLE

Especially with gas prices soaring, carpooling to jobsites can be a popular method of getting employees from one location to the next. Regardless of fault, this could create multiple workers’ compensation injuries at once. Multiple workers’ compensation claims will adversely affect experience modifications, loss ratios and DART rates.

These factors should be considered when creating a car pool scenario for employees travel from jobsite to jobsite.

Important factors to consider if you do utilize carpooling to jobsites could be:

Does the driver meet out company standards with his or her driving record?

Is the vehicle’s maintenance up to date? (e.g., tires, windshield wipers, etc.)

Are there multiple high wage earners traveling in the same vehicle?

TEMPORARY DISIBILITY COST ON THE RISE

With a major labor shortage occurring in California, wages have risen in order to attract and retain labor and highly qualified employees. A severe motor vehicle accident which creates a worker’s compensation claim could adversely affect an employer’s experience modification because two-thirds of the amount of the injured workers’ pay is a larger dollar amount on average than it has been in the past.

This could create a larger claim because of the amount of temporary disability being paid while an employee is hospitalized or unable to come back to work with or without restrictions.

FLEET SAFTEY CONTROLS

When budgeting for an overall safety program, business owners should factor in the multitude of impacts that an auto claim can have on a business. Controls like GPS/telematics, drug testing kits, MVR pull programs, and vehicle maintenance programs are examples of investing in fleet safety.

Fleet safety programs can save lives, save money and can create a stronger culture of safety throughout a business.

Rancho Mesa’s Risk Management Center has a searchable safety library with fleet safety materials that can be used to train employees. Register online for Rancho Mesa’s Fleet Safety webinar on May 26, 2022 from 9:00 am PDT – 10:00 am PDT. Or, contact me at khoward@ranchomesa.com or (619) 438-6874 if you have questions about your auto policy.

California Prepares to Restore COVID-19 Paid Sick Leave

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

On January 25, 2022, California Governor Gavin Newsom announced he had made a deal with legislative leaders on a framework that would provide up to two weeks of supplemental paid sick leave to those who are unable to work due to COVID-19, quarantining or experiencing side effects from the vaccine. As of February 7, 2022, the California legislature passed the bill and we are waiting for the governor to sign it into law.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

On January 25, 2022, California Governor Gavin Newsom announced he had made a deal with legislative leaders on a framework that would provide up to two weeks of supplemental paid sick leave to those who are unable to work due to COVID-19, quarantining or experiencing side effects from the vaccine. As of February 7, 2022, the California legislature passed the bill and we are waiting for the governor to sign it into law.

Previously, the federal government’s Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which expired September 30, 2021, had provided supplemental sick pay for workers.

California’s proposed employee COVID-19 paid sick leave law would retroactively apply to employers of more than 25 employees from January 1, 2022 through September 30, 2022.

The law would replace wages for:

People who are unable to work or telecommute because they either have COVID-19 or have symptoms and are seeking a diagnosis,

Individuals caring for a child or family member who is required to quarantine or self-isolate, and,

People experiencing vaccine-related side effects.

With the recent wave from the Omicron variant, employees are wondering if and when they will be paid. The proposed law would allow employers to be reimbursed for wages paid to employees who need to stay home due to COVID-19 and prevent the further spread of the virus to co-workers.

The governor announced employers would likely be reimbursed for wages through business tax credits and funding through a small business COVID-19 relief grant program.

Providing a state-sponsored mechanism for employee COVID-19 supplemental sick pay should be welcomed by California employers and employees who may otherwise be tempted to file COVID-19 workers’ compensation claims as a way to replace some wages. Keeping non-work-related COVID-19 cases out of the workers’ compensation system benefits everyone involved by keeping costs, and ultimately premiums, down.

Visit Rancho Mesa’s COVID-19 page for the latest Cal/OSHA COVID-19 Prevention Program Template, articles, podcasts and other resources.

For questions about your workers’ compensation insurance, contact me at khoward@ranchomesa.com or (619) 438-6874.

2022 Construction Dual Wage Thresholds - An Early Look

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There are 16 construction workers’ compensation class code pairs in California, each set up as dual wage classifications. The purpose of these “split” class codes allows the Workers’ Compensation Insurance Rating Bureau (WCIRB) and California insurers to better predict future risk and underwrite with more accuracy.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

There are 16 construction workers’ compensation class code pairs in California, each set up as dual wage classifications. The purpose of these “split” class codes allows the Workers’ Compensation Insurance Rating Bureau (WCIRB) and California insurers to better predict future risk and underwrite with more accuracy.

To illustrate the dual wage threshold, consider a seasoned laborer with years of safety training, exposure awareness, and familiarity with jobsite protocol. This employee is going to be less of a safety risk compared to an apprentice who is still learning his or her trade, the safety techniques and all of the skill associated with a trade. As one might imagine, statistics consistently show a much higher probability of an injury occurring with an apprentice versus a seasoned veteran or journeymen. So, having a dual wage threshold allows carriers to generate pricing based on the employees’ experience and likelihood of having an injury.

Exploring how this can directly impact rates and pricing, the 2021 roofing dual wage class codes of 5552 and 5553 is a great example.

Class code 5552 is defined as roofers who make less than $27 per hour. The average California worker’s compensation insurance base rate for this class code is $40 per $100 of payroll. Class code 5553 includes roofers who make $27 or more per hour. This class code’s average California workers’ compensation insurance base rate is $20 per $100 of payroll. In this example, the workers’ compensation premium base rate is half the cost for a more experienced employee over someone with less experience.

It is crucial for any roofing contractor to be mindful of this wage threshold data knowing that the delta in the 2022 recommended increase represents a staggering 61% gap between the two base rates.

Additionally, the WCIRB has continued to increase wage thresholds. This is to keep up with inflation of the US dollar, the increase in minimum wage and the demand for labor, among other factors.

Dual Wage Classification Thresholds by Year

Shown below are the wage thresholds for all dual wage classifications. For information about these classifications, see the California Workers' Compensation Uniform Statistical Reporting Plan—1995, effective September 1, 2021.

| Classifications | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | 5027 | 5140 | 5183 | 5185 | 5201 | 5403 | 5446 | 5467 | 5474 | 5484 | 5538 | 5552 | 5632 | 6218 | 6307 | 6315 |

| 5028 | 5190 | 5187 | 5186 | 5205 | 5432 | 5547 | 5470 | 5482 | 5485 | 5542 | 5553 | 5633 | 6620 | 6308 | 6316 | |

| 9/1/2022 | $32 | $34 | $31 | $32 | $32 | $39 | $38 | $36 | $31 | $36 | $29 | $29 | $39 | $39 | $39 | $39 |

| 9/1/2021 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2021 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2020 | $28 | $32 | $28 | $29 | $28 | $35 | $36 | $33 | $28 | $32 | $27 | $27 | $35 | $34 | $34 | $34 |

| 1/1/2019 | $27 | $32 | $26 | $27 | $25 | $32 | $34 | $32 | $26 | $29 | $27 | $25 | $32 | $31 | $31 | $31 |

| 1/1/2018 | $27 | $32 | $26 | $27 | $25 | $32 | $34 | $31 | $26 | $29 | $27 | $25 | $32 | $31 | $31 | $31 |

| 1/1/2017 | $27 | $30 | $26 | $27 | $24 | $30 | $33 | $31 | $24 | $27 | $27 | $23 | $30 | $30 | $30 | $30 |

© 2021 Workers' Compensation Insurance Rating Bureau of California. All Rights Reserved.

WCIRB’s 2022 RECOMMENDATION:

The Bureau is considering raising the hourly wage threshold for all 16 dual wage classification pairs with some codes seeing as much as a $5.00 increase. The average delta between the lower advisory rate and higher advisory rate is 48%.

Proposed Dual Wage Threshold Increases

| Dual Wage Classifications | Existing Threshold | Proposed Increase | Proposed Threshold | Low Wage Advisory Rate | High Wage Advisory Rate | % Difference From Low Wage Rate |

| 5027/5028 Masonry | $28 | $4 | $32 | $8.18 | $4.21 | -48.50% |

| 5190/5140 Electrical Wiring | $32 | $2 | $34 | $3.76 | $1.45 | -61.40% |

| 5183/5187 Plumbing | $28 | $3 | $31 | $5.31 | $2.36 | -55.60% |

| 5185/5186 Automatic Sprinkler | $29 | $3 | $32 | $4.57 | $1.00 | -57.30% |

| 5201/5205 Concrete Work | $28 | $4 | $32 | $6.64 | $1.95 | -36.30% |

| 5403/5432 Carpentry | $35 | $4 | $39 | $10.03 | $4.23 | -55.10% |

| 5446/5447 Wallboard Installation | $36 | $2 | $38 | $5.42 | $4.50 | -55.10% |

| 5467/5470 Glaziers | $33 | $3 | $36 | $7.62 | $2.65 | -59.30% |

| 5474/5482 Painting Waterproofing | $28 | $3 | $31 | $8.09 | $3.10 | -46.40% |

| 5484/5485 Plastering or Stucco | $32 | $4 | $36 | $9.98 | $4.34 | -37.40% |

| 5538/5542 Sheet Metal Work | $27 | $2 | $29 | $5.07 | $2.52 | -50.30% |

| 5552/5553 Roofing | $27 | $2 | $29 | $21.05 | $8.14 | -61.30% |

| 5632/5633 Steel Framing | $35 | $4 | $39 | $10.03 | $4.50 | -55.10% |

| 6218/6220 Grading/Land Leveling | $34 | $5 | $39 | $5.10 | $2.93 | -42.50% |

| 6307/6308 Sewer Construction | $34 | $5 | $39 | $6.98 | $2.84 | -59.30% |

| 6315/6316 Water/Gas Mains | $34 | $5 | $39 | $4.18 | $3.70 | -11.50% |

This recommendation, if approved by the insurance commissioner, would become effective September 1, 2022.

With the continuing labor shortage in the construction arena, employers have been doing everything possible to retain employees by offering richer benefits plans, pay increases and merit bonuses, when applicable. These recommended wage classification increases could potentially push employers to extend additional pay raises to employees in an effort to minimize workers’ compensation premiums.

It is best for contractors who utilize any of the 16 dual wage classification pairs to be aware of the potential increases and to do the math to see if it makes sense to consider raises prior to your 2022-2023 September 1st workers’ compensation renewal.

Rancho Mesa predicts that this info will become a major factor in payroll decisions based on overhead cost management and recommend this as a topic for discussion early so that our clients, prospects and listeners can prepare.

To discuss how the proposed dual wage threshold increases may affect your business, contact me at (619) 438-6874 or khoward@ranchomesa.com.

Best Practice Controls for Solar Contractors

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As we continually build broad and competitive insurance programs for solar contractors in southern California, we recently interviewed a Senior Underwriter from a national workers’ compensation carrier in an effort to learn best practice controls for these types of risks. To our delight, this underwriter provided the top five controls their team looks for while reviewing a submission to quote. Having these controls in place can show an underwriter that your company deserves the best possible pricing available in the insurance marketplace…

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As we continually build broad and competitive insurance programs for solar contractors in southern California, we recently interviewed a Senior Underwriter from a national workers’ compensation carrier in an effort to learn best practice controls for these types of risks. To our delight, this underwriter provided the top five controls their team looks for while reviewing a submission to quote. Having these controls in place can show an underwriter that your company deserves the best possible pricing available in the insurance marketplace:

1. Fall Protection

A written fall protection plan is in place and available for review

Employee training is documented

A competent person is able to assess fall hazards through a written hazard assessment prior to installation

There is familiarity with all fall arrest systems (e.g., yo-yos, ropes, lanyards, harnesses, and guardrails)

Rescue procedures and training on rescuing is in place

Assembly, maintenance, inspection, handling and storage of fall protection equipment is documented and organized

2. Responsive and Thorough Claim Reporting

Claims are reported same day

Claims are documented for future training opportunities

Witness statements from co-workers are documented

3. Outsourcing Delivery of Solar Panels to a Third Party

Minimizes the driving exposure to and from the jobsite

Lowers the material handling exposure

Reduces any potential lifting exposure while on a jobsite

4. Create a Smaller Radius of Work