Industry News

Pure Premium and How It Impacts Your Company

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted.. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

There are different rates generated for different classifications based on exposure and projected losses. The premium company’s pay for workers' compensation begins with multiplying the insurer's rate for the assigned classification(s) by the payroll developed in each classification. Workers' compensation rates are applied per $100 of payroll.

Pulling directly from the WCIRB website, “The WCIRB submits advisory pure premium rates to the California Department of Insurance (CDI) for approval. Insurer rates are usually derived from the advisory pure premium rates developed by the WCIRB and approved by the Insurance Commissioner. Advisory pure premium rates, expressed as a rate per $100 of payroll, are based upon loss and payroll data submitted to the WCIRB by all insurance companies. These rates reflect the amount of losses an insurer can expect to pay in benefits due to workplace injuries as well as the cost for adjusting and settling workers' compensation claims. Pure premium rates do not account for administrative and other overhead costs that an insurer will incur and, consequently, an insurer's rates are typically higher than the pure premium rates.” (WCIRB).

Of note, new pure premium rates were just released in September. Each carrier’s individual experience with all respective class codes also has an impact on these rates. Workers’ compensation has been in a soft market for the past several years with the expectation that rates will gradually start increasing. Following the change in pure premium rates is a great indication of where the marketplace is heading an effective way to better understand future costs that your company may be expecting.

With this in mind, engaging a broker that specializes in your industry and prepares you accordingly for the renewal process is a critical step in controlling workers compensation costs. Part of this process begins with understanding pure premium rates and how they ultimately will impact your MOD, carrier base rates, and your renewal pricing.

To discuss the current market or how your XMOD is affecting your workers’ compensation premium, contact me at (619) 438-6900 or ccraig@ranchomesa.com.

2019 Expected Loss Rates Published in California’s Updated Regulatory Filing – X-MOD Impact Inevitable for 0042 Class Code

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

The 2019 Expected Loss Rate (ELR) for Landscaping class code 0042 was recently published at a 15% decrease or $2.97.

The ELR is the factor used to anticipate a class code’s claim cost per $100 for the experience rating period. It is not to be confused with the Pure Premium Rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay for all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

Under most circumstances, when you hear the word decrease as associated with insurance its a good thing, but in the case of the ELR, a decrease will have a negative impact on your Experience MOD (X-MOD). In simple terms, if your losses stay the same and the ELR for your industry is down 15%, your X-MOD is going to go up.

At 15%, the landscape class code accounts for one of the largest swings in the 2019 regulatory filing for all industries. This only reinforces the importance of mitigating claim frequency, superior carrier claims handling, internal claims advocacy, claim cost consolidation efforts, and a proven system to keep all of these aspects running constantly. Fortunately, Rancho Mesa has a system in place today and it is a proven success.

Don’t be caught off guard in 2019; have a plan and always anticipate for the future. Let Rancho Mesa help manage your landscape insurance needs. For more information, call (619) 937-0164.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 2)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

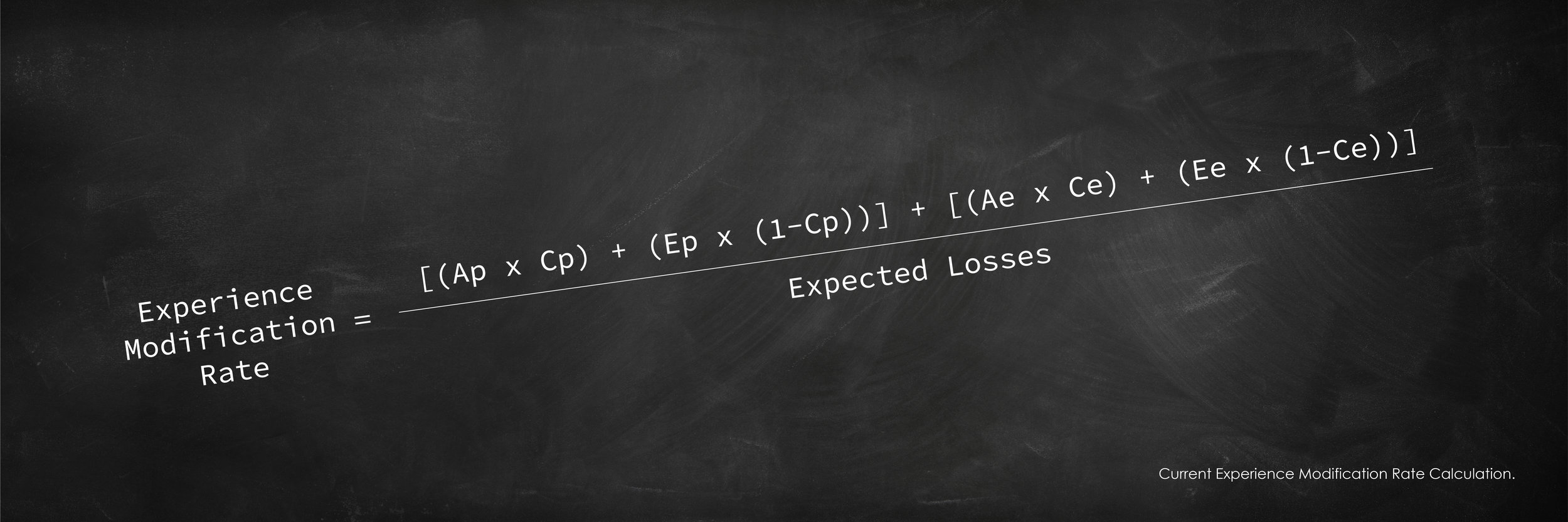

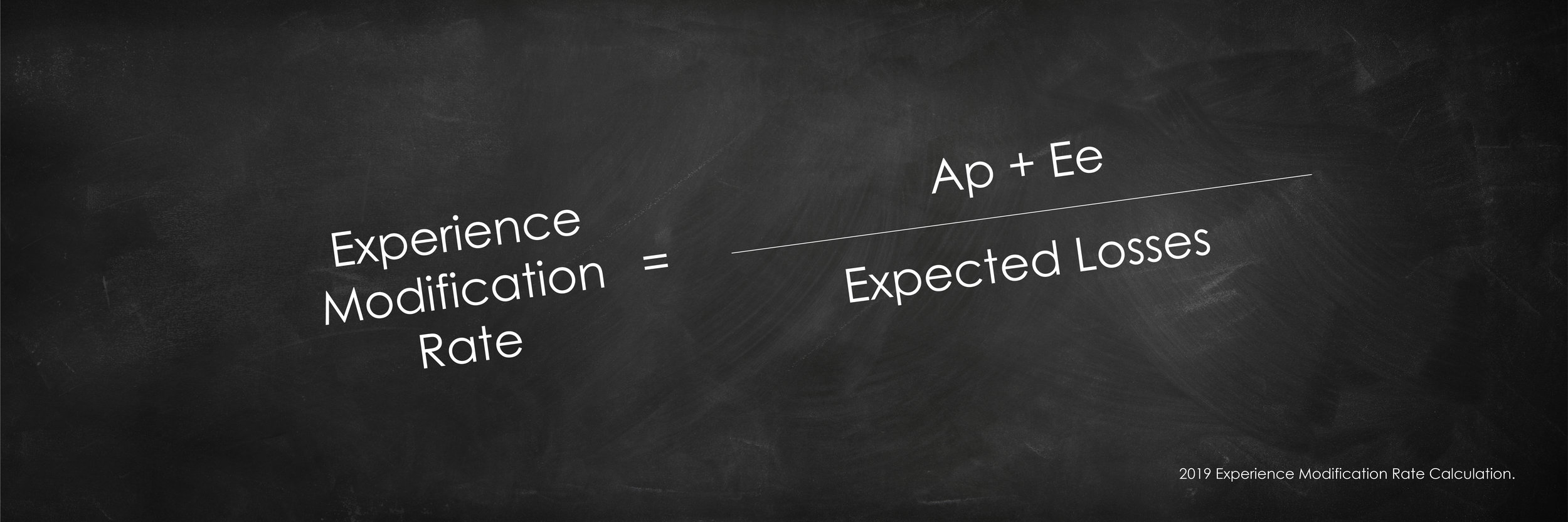

The Simplified Formula

Individual claim cost (i.e., both paid and reserved) will go into the calculation up to the primary threshold limit are considered the actual primary losses. Any claim cost that exceeds your primary threshold is considered the actual excess loss. In past experience mod formulas, the actual excess loss was used in the factoring of your EMR; in 2019, it will have no effect. However, under the new calculation, the industry expected excess losses will be considered in the 2019 simplified formula.

Actual Primary Losses + Expected Excess Losses / Expected Losses

The expected excess losses are calculated by multiplying your class code’s payroll per $100 by the expected loss rate for that same class code. This number is then discounted by the “D Ratio” to determine expected primary losses and expected excess losses. There are 90 different D-Ratios for each classification based on the primary threshold. The D-Ratio is different for each classification and is determined by the severity of injuries that occur within that particular class code.

The first $250 of all claims will no longer be used in the calculation of your EMR.

This is a major change and one that was initiated in part to encourage all employers to report all claims, including those deemed first aid, without having a negative impact on the companys’ EMR. This change will affect all claims within the 2019 calculation; so yes, it will include years previously completed and reported. This will have a positive impact on EMRs in that claim dollars will be removed from the EMR calculation.

Confused – Want more details?

Help is on the way. We are going to hold a statewide webinar on Thursday, October 4th at 9:00am in order to dig deeper into this subject and answer specific questions. You may register for the webinar by contacting Alyssa Burley at (619) 438-6869 or aburley@ranchomesa.com.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 1)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Before we breakdown the changes to the 2019 EMR formula, we must first have a strong understanding of the two critical components that directly affect the outcome of the EMR. This article will be broken out into 2 parts. Part 1 will describe the Primary Threshold and Expected Loss Rate. In Part 2, I will provide an overview of the changes to the EMR calculation.

The single most important number to my EMR is not my final rating?

Primary Threshold

Rancho Mesa has long taken a stance on the importance of a business owner knowing their primary threshold as it relates to the EMR. Proactive business owners should monitor their primary threshold annually as it is subject to change due to payroll fluctuations, operations, and the annual regulatory filing of the expected loss rate. In general terms, the more payroll associated with your governing class (the class code with the preponderance of your payroll) the higher your primary threshold will be. The primary threshold is unique to every business. The 2019 EMR formula is heavily weighted by the company's actual primary losses, the claim cost (both paid and reserved) that goes into the calculation up the primary threshold amount. Controlling claim cost and knowing your company's primary threshold is the first step to understanding the EMR.

Expected Loss Rates

The expected loss rate is the factor used to anticipate a class code's claim cost per $100 for the experience rating period. The expected loss rate (ELR) is not to be confused with the pure premium rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

The ELR changes, annually. It’s important to monitor the change; if your expected loss rates go down (from our analysis this is the direction most are going) and if nothing else changes, your EMR will go up. Why is this? Again, without going too deep, in simple terms, your EMR is a ratio of actual losses to expected losses. If your expected losses go down, but your actual losses remain the same, then your EMR will go up.

To illustrate this, consider the following. Actual losses are $25,000 and your expected losses are $25,000 your EMR would be 100. Now, if your actual losses stay the same at $25,000, but your expected losses drop to $20,000, your EMR would now be 125%. (There are other factors that would go into the actual calculation, so your actual EMR would be different – this was just to illustrate the expected losses impact to the EMR.)

In Part 2 of this article, will cover the actual changes to the EMR calculation.

For more information about the EMR, contact Rancho Mesa Insurance Services at (619) 937-0164.

Six Reasons a Company’s Experience Modification Could be Recalculated

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately California still maintains some of the highest rates in the country, often times two to three times the nations average.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately, California still maintains some of the highest rates in the country, often times two to three times the nations average.

Controlling insurance costs is vital to staying profitable and often times, staying in business. An important way business owners can control their insurance costs is by controlling their Experience Modification or X-MOD. An X-MOD is a benchmark of an individual employer against others in its industry, based on that employer's historical claim experience. This comparison is expressed as a percentage which is applied to an employer's workers' compensation premium.

The premium impact of a credit X-MOD (less than 1) vs a debit X-MOD (more than 1) can be significant. Business owners budget around their insurance costs. When there are unforeseen changes to their insurance costs it can have a dramatic effect. While it is rare, there are situations when an X-MOD can change in the middle of a policy term. Below are six circumstances when this could happen:

- If a claim that has been used in an X-MOD calculation is subsequently reported as closed mid policy term AND closed for less than 60% of the aggregate of the highest value, then the X-MOD is eligible for recalculation.

- In cases where loss values are included or excluded through mistake other than error of judgement. Basically, this rule takes into consideration the element of human error.

- Where a claim is determined non-compensable. Meaning the injury was determined to be non-work related.

- Where the insurance company has received a subrogation recovery or a portion of the claim cost is declared fraudulent.

- Where a closed death claim has been compromised over the sole issue of applicability of the workers’ compensation laws of California. Basically, if a person passes away at work but it was determined that the person had a pre-existing condition which caused the death, not work itself.

- Where a claim has been determined to be a joint coverage claim. This occurs mainly with cumulative trauma claims where there was no specific incident that caused an injury, but an injury that developed over time (i.e., wear and tear).

If any of the circumstances above have occurred, than a revised reporting shall be filed with the Workers’ Compensation Insurance Rating Bureau (WCIRB) and it shall be used to adjust the current and two immediately preceding experience ratings.

If you would like to discuss this topic in further detail, and learn how Rancho Mesa Insurance can audit your X-MOD worksheet for potential recalculations, please contact us at (619) 937-0164.

Experience Modification Factors and the Pre-Qualification Process

Author Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

As we enter 2018, government agencies, project owners and general contractors often require subcontractors to enter their pre-qualification process. Many of these entities will look closely at your Experience Modification Rate (EMR).

Author Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

As we enter 2018, government agencies, project owners and general contractors often require subcontractors to enter their pre-qualification process. Many of these entities will look closely at your Experience Modification Rate (EMR).

EMR is a numeric representation of a company’s payroll and claims history, compared to businesses in the same industry or standard industry classification. EMRs create a common baseline for businesses while allowing for a surcharge when employers' claims are worse than expected and credit when employers' claims are better than the industry average. More specifically, companies with an EMR rate of 1.00 are considered to have an average loss experience. Factors greater than 1.00 are considered worse than average, while less than 1.00 are considered better than average.

Pre-Qualification Process

In the highly competitive world of construction bidding, it has become more common that contractors can be precluded from the pre-qualification process due solely to above average EMRs. This represents an oversight as many companies have strong, well-developed safety programs, yet their EMR is holding them back. Some examples of this are:

- EMRs are lagging factors. They only factor the last three policy periods, not including the current policy period.

- EMRs can include claims that may have been unavoidable and do not represent a lack of safety (i.e. an employee is rear ended by an uninsured motorist).

- Large severity claims from smaller sized companies can impact the EMR much more negatively than a similar sized claims at a larger firm.

- The effectiveness of claims handling may vary from one insurance company to another, thus impacting certain employers when cases remain open with high reserves.

Rather than placing such a critical importance on the EMR Rate, owners and contractors designing the pre-qualification document should include frequency indicators like incident and DART Rate (i.e., days away, restricted or transferred) forms. These measuring tools incorporate current year totals and can provide up to 5 years of historical data. Incident Rate calculations indicate how many employees per 100 have been injured under OSHA rules within the specific time period. The DART rate looks at the amount of time an injured employee is away from his or her regular job. Lastly, contractors attempting to become pre-qualified should have the ability to provide a detailed explanation should their EMR exceed 100. This can include loss data, a summary of the company’s Illness and Injury Prevention Plan (IIPP) and code of safe practices, and more information on what exactly the company is doing to reduce future exposure to loss.

Given the importance of the pre-qualification process and the potential for contractors to be precluded from new opportunities to bid work, we’ve developed a “Best Practices” approach to assist companies in managing their EMR.

Managing Your EMR with Best Practices

The Best Practices approach to high EMRs includes a total claim physical, claims advocacy, and implementation of the Risk Management Center.

Total Claim Physical

The total claim physical accurately identifies your company's strengths and weaknesses, and then scores the company against others in the industry. It includes an audit of the EMR, analysis of claim frequency and severity, claim trends and determine root causes, provide quarterly claims reviews, and conduct pre-unit stat meetings.

Claims Advocacy

Utilizing a claims advocate can decrease existing claim costs, reduce excessive reserves, and expedite claim closures, which can reduce the EMR.

Risk Management Center

The Risk Management Center provides access to safety training materials and tracking, analysis of incidents and OSHA reporting, monthly risk management workshops and webinars.

For more information on managing your EMR before the pre-qualification process, contact Rancho Mesa Insurance Services at (619) 937-0164.