Industry News

Experience Mod KPI Provides Trend Analysis, Opportunity Assessment, and Vital Management Tools

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

In January 2021, we launched the Safety Key Performance Indicator (KPI) Dashboard to provide a tool for our customers to use as a bridge between their experience mod and safety performance.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

In January 2021, we launched the Safety Key Performance Indicator (KPI) Dashboard to provide a tool for our customers to use as a bridge between their experience mod and safety performance.

Our primary goals were to:

Eliminate surprises

Simplify concepts

Track performance

Highlight the positive and negative trends

Benchmark safety performance against industry competitors

An experience mod above 100 can limit a landscape company’s ability to be awarded jobs or maintain contracts, increase insurance premiums, and have other significant financial implications.

Our dashboard is a tool companies can use to strategically manage the underlying components that directly impact the experience mod and help project future experience mod deviations. Rancho Mesa can help interpret the results and provide insights to help improve your performance.

Not a Rancho Mesa client but interested in seeing what your dashboard looks like? Complete our new KPI Dashboard quick form, to see how your company measures up.

Changes on Horizon Likely to Affect Workers’ Compensation

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Changes by the WICRB typically take place at the first of every year and can impact workers’ compensation Pure Premium Rates, Expected Loss Rates (ELR) and Wage Thresholds. However, the WCIRB has amended its filing schedule in 2021 to take effect September 1st.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Businesses in California have become accustomed to many changes in legislation and the filings from the Workers’ Compensation Insurance Rating Bureau (WCIRB).

Changes by the WICRB typically take place at the first of every year and can impact workers’ compensation Pure Premium Rates, Expected Loss Rates (ELR) and Wage Thresholds. However, the WCIRB has amended its filing schedule in 2021 to take effect September 1st.

Below are key changes that businesses should be aware of that can alter Experience Modification Rates (ExMod) and workers’ compensation renewal pricing.

Assembly Bill 1465

The proposed Assembly Bill 1465 (AB 1465) could have significant impact on workers’ compensation rates in the years to come. If passed, AB 1465 will establish the California Medical Provider Network (CAMPN), a broad and largely unregulated network run entirely by the state that would apply to the workers’ compensation system. All licensed physicians in good standing who elect to treat injured workers will be included in the network. Injured workers can choose any provider within the network and can transfer among providers multiple times without any limitation.

If this bill passes and a CAMPN is created, employers can anticipate:

Doctor shopping by injured workers and attorneys;

Increase in temporary disability and time to return to work;

Increase in permanent disability ratings;

Overall increase in medical costs per claim;

Poorer quality medical reports due to fewer controls and less oversight.

Workers’ Compensation Rates

The WCIRB recently proposed a 2.7% workers’ compensation rate increase, effective 9/1/2021. This would be the first rate increase since 2015. Updated fee schedules for med-legal review reports and physician office visits are what is driving this potential increase.

Expected Loss Rates

A characteristic of a Best Practice business is their focus on managing their ExMod. In simple terms, if a business’s ELR increases, it will have a positive effect on their ExMod. Conversely, if their industry’s ELR decreases, it will have a negative effect. While understanding what an ELR is and how it can specifically impact your ExMod is critical, this should be something your insurance advisor is explaining to you and projecting the impact it will have on your ExMod and ultimately your insurance premium.

To put this information at our clients’ finger tips, we have created a Key Performance Indicator (KPI) dashboard to not only show the impact of any changes in the ELR but also provide other key indicators like industry benchmarking, claim trending, and many other critical factors. Request your customized KPI dashboard.

To stay up to date with these topics and related insurance news, subscribe to our weekly safety and risk management newsletter and podcast. Or, contact me directly at (619) 937-0167 or sclayton@ranchomesa.com to discuss how your company may be affected.

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

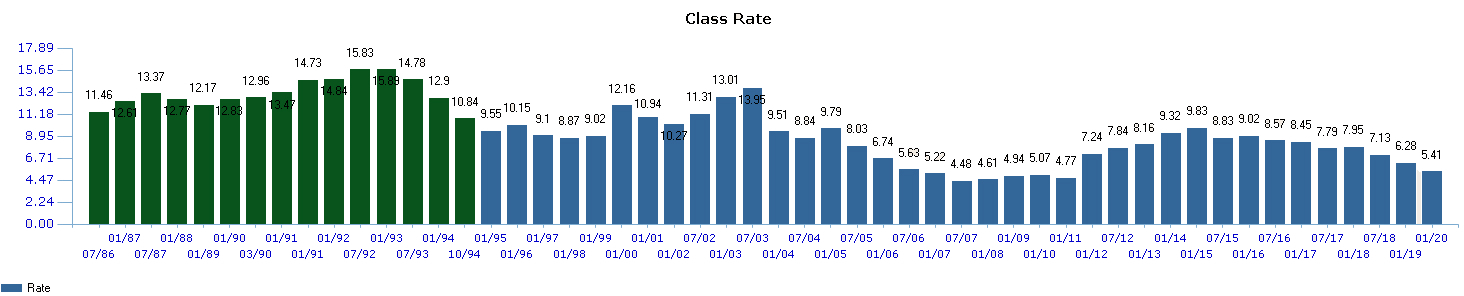

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

The Importance of Timely Workers’ Compensation Claims Reporting

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Best Practices would demand that all claims get reported within 24 hours, if at all possible. By doing this, it provides the best possible outcome and will impact the claim in several positive ways:

Reducing Fraudulent Claims

One of the biggest frustrations in the workers’ compensation industry for most employers are the number of fraudulent claims that find their way into the system. Immediate accident investigation, witness statements and pictures followed by reporting the claim to the carrier within 24 hours of the injury, will give the employer and the carrier the best opportunity to deny a claim. The insurance carrier only has 90 days from the date of injury (not from the date reported) to deny a claim. This shortens that time-frame and allows more fraudulent claims into the system.

Lowering Litigation Rates

Another area employers find both frustrating and costly are the number of litigated claims that occur within the workers’ compensation system. Litigated claims on average will add 30% to 35% to the ultimate cost of a claim. While there are many ways employers can impact this area, perhaps the most controllable is the timely reporting of any injury. To further support this, it has been proven that the litigation rate for claims goes up 300% if the claim is reported 5 or more days after the injury occurred.

Identifying Claim Trends Early

By not reporting all claims or by reporting them late, employers can develop unreliable data in their effort to identify claim trends and root causes. Without this information, businesses in all sectors run the risk of a severe injury occurring from an area that could have been addressed if all claim data was accurate and analyzed.

When an injury occurs, do a thorough accident investigation that details all events that caused the injury and immediately call your workers’ compensation carrier. This one habit alone will help you lower claim costs and manage your EMR.

To learn more about this process, including benchmarking and analytics that can help control your loss ratio and lower premiums, please reach out to me, Casey Craig at (619) 438-6900 or ccraig@ranchomesa.com.

Landscape Companies with Low Experience MODs Do These 5 Things

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

The XMOD/EMR is a unique number assigned to a business that is made up of their historical loss figures and audited payroll information vs. the same information for companies involved in the company’s same industry. Generally, if your business has experienced more claim activity than the industry average, you will have a XMOD/EMR above 1.00. The opposite is true; if you have had less claim activity, your XMOD/EMR will be below 1.00. The XMOD/EMR impacts the rates you pay for workers’ compensation by crediting (XMOD/EMR below 1.00) or applying a surcharge (XMOD/EMR above 1.00).

Here are the 5 best practices used by landscape companies who have an XMOD/EMR) below 1.00.

1. An Aggressive Return to Work Program

If you heard our podcast episode with Roscoe Klausing of Klausing Group, you will hear him coin the phrase an “aggressive return to work program” which was a key component to his company, of more than 70 employees, going 3 years without a lost time accident.

Aggressively finding a way to help bring an injured employee back on modified work restrictions has long been proven to provide positive outcomes for everyone involved. Benefits of bringing an employee back on modified duties include:

Eliminating temporary disability payments from the claim cost.

Lower the dollar amount of medical treatments.

Reduce the overall cost of the claim.

Lower the potential impact the claim would have on your XMOD/EMR.

Improve injured employee morale.

2. Timely Reporting and Accident Detail

It is critical to constantly remind your front line supervisors and employees that they must report all injuries no matter the severity as soon as possible. Studies have shown that work related injuries reported with the first 5 days have a dramatically lower average claim cost and litigation rates than those reported after 5 days.

Two measurable statistics for you to keep an eye on are:

The lag time between when an injury is reported to you from an employee.

The amount of time it takes you to report this information to your insurance carrier.

By conducting a thorough accident investigation at the time of injury and providing a report to your insurance claim professional, you will speed up the claims process and lower costs. Eliminating the time delays caused by the claim professional waiting for details or additional information is critical in making sure your injured employee is on the fast track to recovery. To assist the landscape industry in completing this necessary step, Rancho Mesa has created a free, fillable, carrier approved accident investigation report for use by the landscape industry.

3. Communication

Keeping in constant communication with employees who are injured is vital to a positive outcome. At times, the workers’ compensation process can seem slow. Some injuries will take longer than others. This can lead injured employees to feel frustrated and uncertain. Make sure you are addressing their concerns and checking in on them, frequently.

4. Know the Basic Principles Behind the XMOD/EMR

You do not need to know the XMOD/EMR formula, but you should have an understanding of the basic concepts that leads to XMOD/EMR inflation.

You should know when your claim information will be sent to your rating bureau for next year’s XMOD/EMR calculation and make sure you are familiar with the status of each claim before the information is locked.

If your rating bureau uses a Primary Threshold or Split Point, it is good to understand how this number impacts claim cost and each claim’s impact on the XMOD/EMR.

Know your lowest possible XMOD/EMR, this would be all your payroll with zero claims. The points between your lowest possible XMOD/EMR and your current XMOD/EMR are the controllable points.

Know the policy years that are used to calculate the XMOD/EMR.

5. Relationship With Your Carrier and Claims Professional

The carrier claims professional who handles your injuries can have a huge impact on the outcome of the claim. If you are fortunate enough to have a dedicated claim adjuster assigned to your company, make it a point to call and introduce yourself before the first claim occurs. The adjuster should have a very good understanding of:

Your attitude and policy regarding return to work programs.

The level of accident information they will receive from you.

Who will be your company’s main contact throughout the claim process?

Consider these five best practices when handling your workers’ compensation claims to keep your XMOD/EMR under control and your workers’ compensation costs low.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 2)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

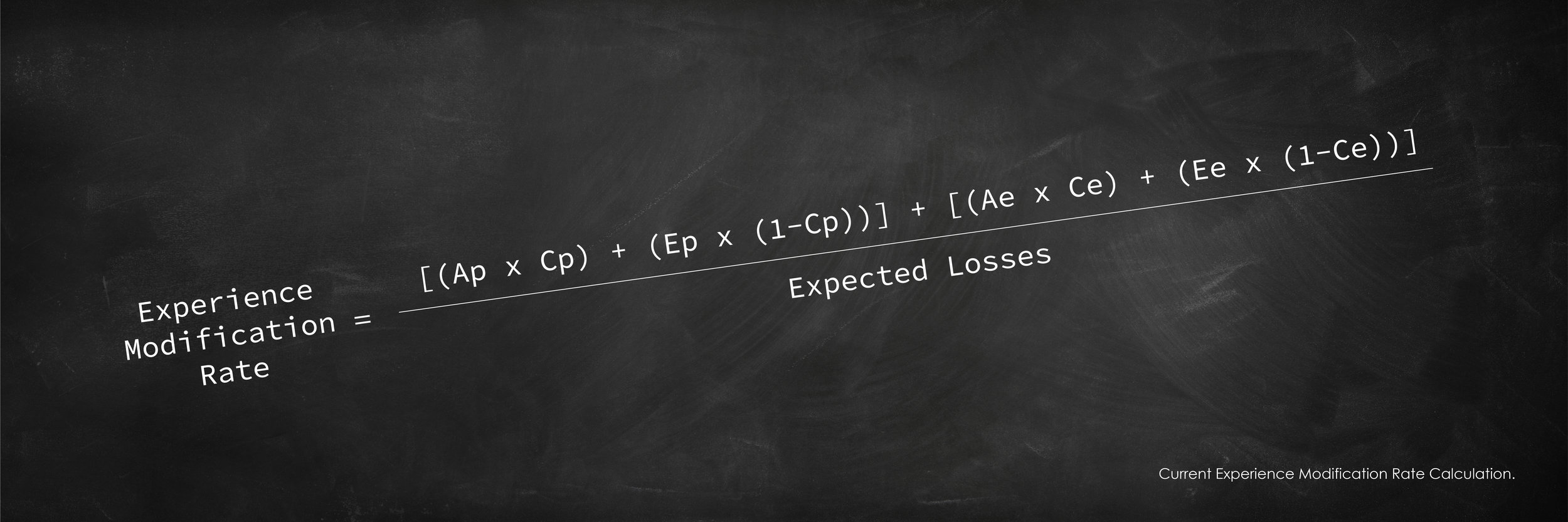

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

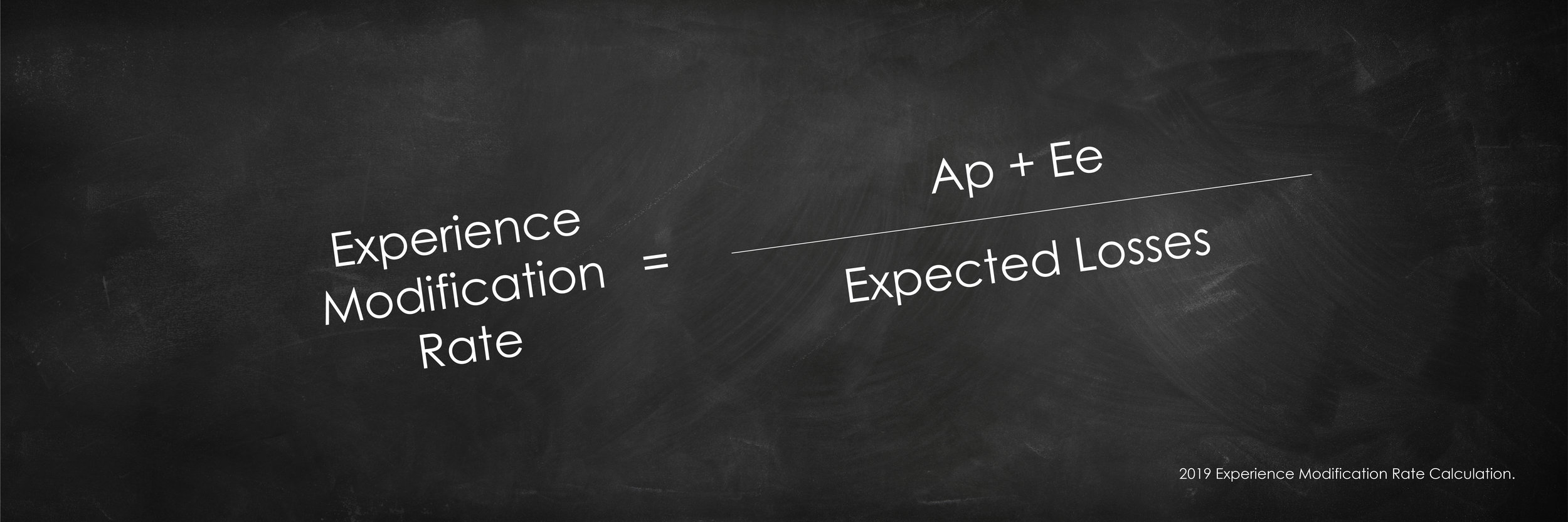

The Simplified Formula

Individual claim cost (i.e., both paid and reserved) will go into the calculation up to the primary threshold limit are considered the actual primary losses. Any claim cost that exceeds your primary threshold is considered the actual excess loss. In past experience mod formulas, the actual excess loss was used in the factoring of your EMR; in 2019, it will have no effect. However, under the new calculation, the industry expected excess losses will be considered in the 2019 simplified formula.

Actual Primary Losses + Expected Excess Losses / Expected Losses

The expected excess losses are calculated by multiplying your class code’s payroll per $100 by the expected loss rate for that same class code. This number is then discounted by the “D Ratio” to determine expected primary losses and expected excess losses. There are 90 different D-Ratios for each classification based on the primary threshold. The D-Ratio is different for each classification and is determined by the severity of injuries that occur within that particular class code.

The first $250 of all claims will no longer be used in the calculation of your EMR.

This is a major change and one that was initiated in part to encourage all employers to report all claims, including those deemed first aid, without having a negative impact on the companys’ EMR. This change will affect all claims within the 2019 calculation; so yes, it will include years previously completed and reported. This will have a positive impact on EMRs in that claim dollars will be removed from the EMR calculation.

Confused – Want more details?

Help is on the way. We are going to hold a statewide webinar on Thursday, October 4th at 9:00am in order to dig deeper into this subject and answer specific questions. You may register for the webinar by contacting Alyssa Burley at (619) 438-6869 or aburley@ranchomesa.com.

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 1)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Before we breakdown the changes to the 2019 EMR formula, we must first have a strong understanding of the two critical components that directly affect the outcome of the EMR. This article will be broken out into 2 parts. Part 1 will describe the Primary Threshold and Expected Loss Rate. In Part 2, I will provide an overview of the changes to the EMR calculation.

The single most important number to my EMR is not my final rating?

Primary Threshold

Rancho Mesa has long taken a stance on the importance of a business owner knowing their primary threshold as it relates to the EMR. Proactive business owners should monitor their primary threshold annually as it is subject to change due to payroll fluctuations, operations, and the annual regulatory filing of the expected loss rate. In general terms, the more payroll associated with your governing class (the class code with the preponderance of your payroll) the higher your primary threshold will be. The primary threshold is unique to every business. The 2019 EMR formula is heavily weighted by the company's actual primary losses, the claim cost (both paid and reserved) that goes into the calculation up the primary threshold amount. Controlling claim cost and knowing your company's primary threshold is the first step to understanding the EMR.

Expected Loss Rates

The expected loss rate is the factor used to anticipate a class code's claim cost per $100 for the experience rating period. The expected loss rate (ELR) is not to be confused with the pure premium rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

The ELR changes, annually. It’s important to monitor the change; if your expected loss rates go down (from our analysis this is the direction most are going) and if nothing else changes, your EMR will go up. Why is this? Again, without going too deep, in simple terms, your EMR is a ratio of actual losses to expected losses. If your expected losses go down, but your actual losses remain the same, then your EMR will go up.

To illustrate this, consider the following. Actual losses are $25,000 and your expected losses are $25,000 your EMR would be 100. Now, if your actual losses stay the same at $25,000, but your expected losses drop to $20,000, your EMR would now be 125%. (There are other factors that would go into the actual calculation, so your actual EMR would be different – this was just to illustrate the expected losses impact to the EMR.)

In Part 2 of this article, will cover the actual changes to the EMR calculation.

For more information about the EMR, contact Rancho Mesa Insurance Services at (619) 937-0164.

Six Reasons a Company’s Experience Modification Could be Recalculated

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately California still maintains some of the highest rates in the country, often times two to three times the nations average.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately, California still maintains some of the highest rates in the country, often times two to three times the nations average.

Controlling insurance costs is vital to staying profitable and often times, staying in business. An important way business owners can control their insurance costs is by controlling their Experience Modification or X-MOD. An X-MOD is a benchmark of an individual employer against others in its industry, based on that employer's historical claim experience. This comparison is expressed as a percentage which is applied to an employer's workers' compensation premium.

The premium impact of a credit X-MOD (less than 1) vs a debit X-MOD (more than 1) can be significant. Business owners budget around their insurance costs. When there are unforeseen changes to their insurance costs it can have a dramatic effect. While it is rare, there are situations when an X-MOD can change in the middle of a policy term. Below are six circumstances when this could happen:

- If a claim that has been used in an X-MOD calculation is subsequently reported as closed mid policy term AND closed for less than 60% of the aggregate of the highest value, then the X-MOD is eligible for recalculation.

- In cases where loss values are included or excluded through mistake other than error of judgement. Basically, this rule takes into consideration the element of human error.

- Where a claim is determined non-compensable. Meaning the injury was determined to be non-work related.

- Where the insurance company has received a subrogation recovery or a portion of the claim cost is declared fraudulent.

- Where a closed death claim has been compromised over the sole issue of applicability of the workers’ compensation laws of California. Basically, if a person passes away at work but it was determined that the person had a pre-existing condition which caused the death, not work itself.

- Where a claim has been determined to be a joint coverage claim. This occurs mainly with cumulative trauma claims where there was no specific incident that caused an injury, but an injury that developed over time (i.e., wear and tear).

If any of the circumstances above have occurred, than a revised reporting shall be filed with the Workers’ Compensation Insurance Rating Bureau (WCIRB) and it shall be used to adjust the current and two immediately preceding experience ratings.

If you would like to discuss this topic in further detail, and learn how Rancho Mesa Insurance can audit your X-MOD worksheet for potential recalculations, please contact us at (619) 937-0164.

How To Lower Your Experience MOD by Understanding Your Primary Threshold

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

How do I decrease my MOD to lower my workers compensation premium?

A few factors can be addressed to reduce the workers' compensation premium. The most important is the primary threshold. Each individual employer has their own primary threshold that is determined by the class of business they operate and the amount of field payroll they accrue over a three year period. The primary threshold is the point at which any claim maximizes its negative impact on the MOD. You must be sensitive to this number because any open claim with paid amounts under the threshold, provides an opportunity to save points to the MOD. Once a claim exceeds paid amounts over your threshold, it no longer can negatively impact your MOD. However, you would still want to monitor and manage these claims to ensure your injured employee is being provided attentive care and to maintain knowledge of your loss experience.

Example

You’re a landscaping company and your primary threshold is $33,000. The most any claim can affect your MOD is $33,000 and the most points that any claim can add to your MOD is 13.

You have a claim open for $40,000 with paid amounts of $10,000 and reserved amounts of $30,000.

This claim will go into the calculation at $40,000 (Paid + Reserved) but because the total amount succeeds the primary threshold of $33,000, it will only show up on the rating sheet totaling $33,000 of primary loss and contribute 13 points to your MOD.

It would behoove you to analyze and monitor this open claim, because it has paid out amounts well below your primary threshold of $33,000.

If this same claim closes for a total paid amount of $22,000, the closed claim would go into your MOD at $22,000 with 8 points contributing to the MOD.

The difference between a $40,000 claim and a $22,000 claim is 5 points to your MOD, or, 5% to your premium!

Knowing your primary threshold is the most important piece of information when managing your XMOD. Fortunately, Rancho Mesa can help you manage your experience MOD by tracking your primary threshold and maintaining the other critical elements that go into establishing a sustainable low experience MOD.

For more information about lowering your experience MOD or a detailed analysis of your current MOD please reach out to Rancho Mesa.

Below is an example worksheet for Landscapers to determine the primary threshold.

| Annual Landscape Payroll | 2018 Primary Threshold | Max Points to MOD | Lowest MOD |

|---|---|---|---|

| $100,000 | $5,500 | 53 | .84 |

| $250,000 | $10,000 | 38 | .75 |

| $500,000 | $15,500 | 30 | .65 |

| $1,000,000 | $22,000 | 21 | .56 |

| $1,500,000 | $26,000 | 17 | .51 |

| $2,000,000 | $30,000 | 14 | .47 |

| $2,500,000 | $32,000 | 12 | .45 |

| $3,000,000 | $35,000 | 11 | .42 |

| $5,000,000 | $41,000 | 8 | .36 |

| $10,000,000 | $40,000 | 5 | .30 |

Experience Modification Factors and the Pre-Qualification Process

Author Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

As we enter 2018, government agencies, project owners and general contractors often require subcontractors to enter their pre-qualification process. Many of these entities will look closely at your Experience Modification Rate (EMR).

Author Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

As we enter 2018, government agencies, project owners and general contractors often require subcontractors to enter their pre-qualification process. Many of these entities will look closely at your Experience Modification Rate (EMR).

EMR is a numeric representation of a company’s payroll and claims history, compared to businesses in the same industry or standard industry classification. EMRs create a common baseline for businesses while allowing for a surcharge when employers' claims are worse than expected and credit when employers' claims are better than the industry average. More specifically, companies with an EMR rate of 1.00 are considered to have an average loss experience. Factors greater than 1.00 are considered worse than average, while less than 1.00 are considered better than average.

Pre-Qualification Process

In the highly competitive world of construction bidding, it has become more common that contractors can be precluded from the pre-qualification process due solely to above average EMRs. This represents an oversight as many companies have strong, well-developed safety programs, yet their EMR is holding them back. Some examples of this are:

- EMRs are lagging factors. They only factor the last three policy periods, not including the current policy period.

- EMRs can include claims that may have been unavoidable and do not represent a lack of safety (i.e. an employee is rear ended by an uninsured motorist).

- Large severity claims from smaller sized companies can impact the EMR much more negatively than a similar sized claims at a larger firm.

- The effectiveness of claims handling may vary from one insurance company to another, thus impacting certain employers when cases remain open with high reserves.

Rather than placing such a critical importance on the EMR Rate, owners and contractors designing the pre-qualification document should include frequency indicators like incident and DART Rate (i.e., days away, restricted or transferred) forms. These measuring tools incorporate current year totals and can provide up to 5 years of historical data. Incident Rate calculations indicate how many employees per 100 have been injured under OSHA rules within the specific time period. The DART rate looks at the amount of time an injured employee is away from his or her regular job. Lastly, contractors attempting to become pre-qualified should have the ability to provide a detailed explanation should their EMR exceed 100. This can include loss data, a summary of the company’s Illness and Injury Prevention Plan (IIPP) and code of safe practices, and more information on what exactly the company is doing to reduce future exposure to loss.

Given the importance of the pre-qualification process and the potential for contractors to be precluded from new opportunities to bid work, we’ve developed a “Best Practices” approach to assist companies in managing their EMR.

Managing Your EMR with Best Practices

The Best Practices approach to high EMRs includes a total claim physical, claims advocacy, and implementation of the Risk Management Center.

Total Claim Physical

The total claim physical accurately identifies your company's strengths and weaknesses, and then scores the company against others in the industry. It includes an audit of the EMR, analysis of claim frequency and severity, claim trends and determine root causes, provide quarterly claims reviews, and conduct pre-unit stat meetings.

Claims Advocacy

Utilizing a claims advocate can decrease existing claim costs, reduce excessive reserves, and expedite claim closures, which can reduce the EMR.

Risk Management Center

The Risk Management Center provides access to safety training materials and tracking, analysis of incidents and OSHA reporting, monthly risk management workshops and webinars.

For more information on managing your EMR before the pre-qualification process, contact Rancho Mesa Insurance Services at (619) 937-0164.