Industry News

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

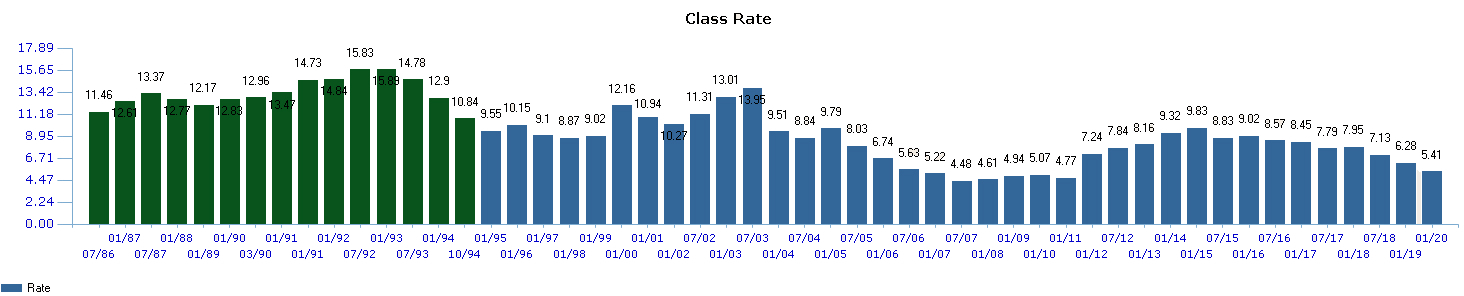

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

California Workers' Comp Carriers React to Commissioner's COVID-19 Amendment Approval

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

The amendments address accounting for employees whose job duties have changed to clerical work, which is typically a less expensive workers’ compensation insurance classification than the jobs they were performing prior to Governor Newsom’s March 19, 2020 Stay-at-Home Executive Order. It also excludes payroll for furloughed employees who are not working, but collecting a paycheck. It creates a way to identify COVID-19 cases within the California workers’ compensation system and excludes the cases from the Experience Modification Rate (XMOD) calculation.

When asked about the amendments scheduled to take effect July 1, 2020, Margaret Hartmann, Senior Vice President and Chief Marketing Officer at Berkshire Hathaway Homestate Companies, California’s second largest workers’ compensation insurance carrier, said “Lara’s approval of the WCIRB [Workers’ Compensation Insurance Rating Bureau] proposal was not surprising. These are not unreasonable, at least from the perspective of ratemaking and predicting future experience of employers once COVID passes.”

Bryan Anderson, Senior Vice President at The Zenith explained the WCIRB’s amendments to the California Unit Statistical Reporting Plan and XMOD calculation were “not likely to change under any normal circumstances but the Bureau made these recommendations to address the unique pandemic situation that California (and the world’s) businesses find themselves in."

Another industry leader Paul Zamora, ICW Group’s Senior Vice President for Workers’ Compensation Underwriting said, “We support Commissioner Lara’s decision to approve the recommended changes by the WCIRB. We believe the rule modifications accurately reflect changes in exposures created by COVID-19 and will provide the appropriate relief needed by California businesses.”

The changes were expected by California’s workers’ compensation insurance carriers as a mechanism to adjust employers’ insurance rates, since COVID-19 claims aren’t necessarily an indicator of a company’s safety record.

“Under normal situations,” Anderson explained, “workers’ compensation covers only those occupational illnesses that are created from the work environment. In this instance, that understanding changed with the Governor’s Executive Order requiring employers to accept compensability for Covid-19 claims unless they can prove they are not work-related.”

Hartmann added, “This is clear cost-shifting to the industry, which we expected. The combination of a broad WC presumption, possible additional legislation extending these presumptions past July 5th, excluding COVID from ratemaking and XMODs, means that the insurance industry will absorb the lion’s share of COVID costs that can be assigned to WC.”

Zamora points out “it’s imperative that business owners understand the rule changes and adopt new practices, particularly with respect to the record keeping criteria associated with two of the changes. By adopting new record keeping procedures to apply to the new rules, policyholders will have the necessary audit documentation to realize the full value of Commissioner Lara’s decision.”

This means employers should start documenting employees’ hours worked under each class code, now, and not wait until a final audit.

“Hopefully, these measures will play a small part in helping California employers as they try to recover from the devastating impacts of this pandemic,” Hartmann concluded.

“I think this solution is a testament to the strength and objectivity of the Bureau, the companies it represents and to the integrity of the Workers’ Compensation Industry in California,” said Anderson.

Gene Simpson, CompWest’s Vice President of Underwriting and Marketing, added, “To confront the challenges presented by the COVID-19 pandemic to California employers, regulatory authorities, insurance carriers and employers must work together on effective solutions.”

While the amendments should reduce workers’ compensation premium costs for California businesses in the short-term, only time will tell how lower revenues and higher costs due to COVID-19 claims will impact California’s workers’ compensation insurance premiums in the future.

For a greater understanding of these changes and how they will impact your company, please contact our team at (619) 937-0164.

CAL/OSHA Emergency Rule Adopted for Wildfire Smoke

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Author, Steve Hamilton, Loss Control Supervisor, Berkshire Hathaway Homestate Companies.

On Thursday, July 17 2019, the California Occupational Safety & Health Standards Board voted to adopt an emergency standard requiring employers to take action when air quality particulate matter measures greater than 150 and when there is reasonable expectation that employees will come in to contact with wildfire smoke.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Author, Steve Hamilton, Loss Control Supervisor, Berkshire Hathaway Homestate Companies.

On Thursday, July 17 2019, the California Occupational Safety & Health Standards Board voted to adopt an emergency standard requiring employers to take action when air quality particulate matter measures greater than 150 and when there is reasonable expectation that employees will come in to contact with wildfire smoke.

While this may seem new to many employers, it is technically an extension of regulations currently in place including the respiratory protection standards for employees and the need to address identified hazards in the workplace. As an employer it is critical that you follow the hierarchy of controls to ensure your employees’ safety in the field. If possible, eliminate the hazard by shutting down the workforce for the day. Employees should remain indoors until particulate levels fall to acceptable. If this is not possible, try to limit the workday by rotating employees who must work outdoors, remaining cognizant of the hazards in the air and allowing employee’s time to recover in appropriate indoor areas. If neither of these options are possible, consider providing N95 respiratory protection masks.

Please remember that any type of respiratory protection provided to employees must also be accompanied by applicable training, pulmonary exams, communication on proper usage/storage and others. Links to the applicable programs can be found at this address along with sites to help you monitor air quality: https://www.dir.ca.gov/dosh/Worker-Health-and-Safety-in-Wildfire-Regions.html

This site has additional training resources in English and Spanish, handouts on proper usage of N95 masks and the history of the standard as it has been submitted. Cal/OSHA wants you to have the resources you need to effectively address the risk potential.

At this point, the regulation is on its way to the Office of Administrative Law for approval and if deemed compliant, it will go into effect 10 days after it is received. This would mean the regulation could go into effect before August.

An advisory committee will meet August 27, 2019 to begin work on a permanent version of the regulation.

If you have any questions about ways to enhance regulatory compliance, please reach out to your local resources including your insurance agent, workers’ compensation insurance safety professionals, and Cal/OSHA Consultation.

Berkshire Hathaway's Steve Hamilton Discusses Workplace Injury Trends for the Landscape Industry in Recent Webinar

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

In this webinar, Steve Hamilton, Senior Loss Control Specialist from Berkshire Hathaway Homestate Companies, reviews workplace injury trends for the landscape industry, along with OSHA’s most cited regulatory violations.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Steve Hamilton, Senior Loss Control Specialist from Berkshire Hathaway Homestate Companies, reviews workplace injury trends for the landscape industry, along with OSHA’s most cited regulatory violations, in his Landscape Industry Injury Trends for 2017 webinar.

This information will help landscapers focus their training efforts to improve compliance and reduce the risk potential for frequency and severity.

Start the year off right with a plan to address these common injury trends!

A National Association of Landscape Professionals (NALP) login is required to view the webinar.

Berkshire Hathaway Homestate Companies and Rancho Mesa Participate in Nationally Renowned LANDSCAPES 2017

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Berkshire Hathaway Homestate Companies and Rancho Mesa Insurance Services NALP Program Team

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

The group consisted of Senior Vice President Margaret Hartmann, NALP Assistant Director of Underwriting Valerie Contreras, NALP Program Underwriter Davis Cooper, NALP Client Services Coordinator Emily Docuyanan, and NALP Senior Loss Control Specialist Steve Hamilton from BHHC, and agency Principal Dave Garcia and NALP Program Director Drew Garcia from RMI.

Davis Cooper, NALP Program Underwriter, Berkshire Hathaway Homestate Companies

The BHHC and RMI group participated in a multitude of event programs as speakers, ambassadors, and audience. BHHC and RMI championed four breakfast table topics, a breakout education session based on risk mitigation and cost savings, and took time to speak with association members about the program within National Association of Landscape Professionals' (NALP) booth at the expo.

NALP Program Board Presentation

Sam Steel, NALP Safety Advisor & Steve Hamilton, BHHC

Membership Meeting

“The event was a great success," said Dave Garcia. "It’s amazing to see so many like-minded people dedicated to improving themselves and their companies while building upon the professionalism this industry holds as standard. We are so proud to be a part of this amazing industry and look forward to a long lasting partnership with NALP for years to come.”

NALP Group

Davis Cooper and Drew Garcia at the booth

Davis Cooper speaking with attendees at the booth

I really enjoyed connecting with NALP members and learning about their individual companies. LANDSCAPES provides an environment for motivated industry professionals to share ideas, learn, and form long lasting relationships. The overwhelming commonality is this identified desire for industry veterans to give back to the community that helped them succeed. It’s easy to build off that energy and puts into perspective that our Work Comp Program is providing the level of specialized attention this industry deserves. I'm excited to keep the momentum going while constantly looking for ways to improve our product so that we can provide more to lawn and landscape professionals.

For more information about the NALP Workers' Compensation Program, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

NALP Launches New Discounted Workers' Compensation Insurance Program

The National Association of Landscape Professionals (NALP) is partnering with Rancho Mesa Insurance Services and Berkshire Hathaway Homestate Companies to offer NALP members a competitive workers’ compensation option backed by specialized landscape industry expertise and a dedicated service team.

Article originally published in "The Landscape Professional" March/April 2017 issue.

The National Association of Landscape Professionals (NALP) is partnering with Rancho Mesa Insurance Services and Berkshire Hathaway Homestate Companies to offer NALP members a competitive workers’ compensation option backed by specialized landscape industry expertise and a dedicated service team.

NALP created this program as a member benfit aimed at providing landscape-specific expertise at a discounted rate. A portion of the combined premium is re-invested

back into the association to help fund industry growth and the many programs that benefit NALP members.

The program includes:

- Multiple workers’ compensation options with guaranteed cost and small to large deductibles.

- 6 percent discounted rates for NALP members where allowable. Lowest available base rate in states that do not allow rate deviation.

- Flexible payment plans including stipulated, pay as you go (zero deposit) and monthly payroll reports.

- Quarterly safety webinars specific to the injuries arising out of the landscape industry.

- Dedicated service team with landscape industry specific experience in the workers’ compensation claims, injuries and exposures.

- Underwriting team evaluating only NALP members.

- Claims handling dedicated to NALP members with lower caseloads and the statistically proven ability to close claims faster than the industry.

- Loss control with regional representation for on-site visits managed nationally by a dedicated coordinator.

“Protecting your business, your employees and your bottom line is so important, so we are pleased to bring this highly competitive and tailored workers’ compensation insurance program to landscape and lawn care companies through this new partnership with Rancho Mesa and Berkshire Hathaway,” NALP CEO Sabeena Hickman, CAE, said.

The program is managed by Rancho Mesa Insurance Services, which has 10 consecutive years as a National Best Practices Agency, and policies are underwritten by Berkshire Hathaway, an A++XV rated financial services firm.

For more information, visit bit.ly/nalpworkerscomp. If you have further questions or want to sign up, email nalp@ranchomesa.com or call program manager Drew Garcia at 619-937-0200.

Reproduced with permission from the National Association of Landscape Professionals.