Industry News

New First Aid Reporting Requirements Take Effect January 1st, 2017

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

To learn more about the changes, visit WCRIB's Bulletin.

Rancho Mesa “Rocks” the Landscape Industry

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

On March 1st 2017 Rancho Mesa Insurance Services, Inc., The National Association of Landscape Professionals, and Berkshire Hathaway Homestate Companies will introduce a unique National Workers Compensation solution designed to cater the needs of Landscape Contractors and Lawn Care Professionals.

THE AGENCY

Rancho Mesa is a 10 Time National Best Practices Agency out of Santee, California with over 30 years’ experience in The Landscape Industry. As the program manager, Rancho Mesa will look to challenge and develop the growth of the program to better protect its members.

THE CARRIER

Berkshire Hathaway Homestate Companies has the Highest AM Best rating of A++(XV) “Superior” rating of financial strength, and is the one of the largest specialty Work Comp Carriers in the Country.

THE ASSOCIATION

The NALP is the only National Organization built by the collaboration of landscape and lawn care industry professionals and has pushed the boundaries for Professionalism in the Landscape Industry to new heights through; Education, Certification and Legislation. As the voice for 100,000 landscape professionals the NALP passionately advocates for the economic, social and environmental benefits of the landscape industry.

THE PROGRAM HIGHLIGHTS INCLUDE:

• 6% discounted rates for NALP members where allowable. Lowest available base rate in states that do not allow rate deviation.

• Multiple workers compensation options guaranteed cost and small to large deductible.

• Flexible payment plans including stipulated, pay as you go (zero deposit) and monthly payroll reports.

• Quarterly safety webinars specific to the injuries arising out of the landscape industry.

• Dedicated service team with experience in the landscape industry.

• Underwriting team only evaluating NALP members.

• Claims handling dedicated to NALP members with lower caseloads.

• Loss control with regional representation and managed nationally by a dedicated coordinator.

For more information contact Rancho Mesa Insurance Services at NALP@ranchomesa.com.

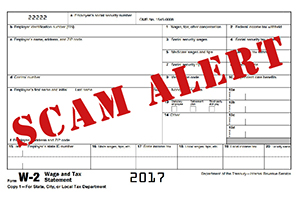

W-2 Phishing Scam – New Potential Risk to Nonprofits – Be Aware!!

There has been a recent increase in attempts of a phishing scams involving W2s in nonprofit, schools and other human services organizations. We caution any business, but particularity organizations in these sectors to be very cautious if they receive any emails requesting information regarding W2’s, earning summaries or any other employee sensitive information. In many cases these emails look like they originate from a high level employee and are sent to other high level, human resources or payroll department employees.

It has come to our attention that there has been a recent increase in attempts of phishing scams involving W-2 forms in nonprofit, schools and other human services organizations.

Rancho Mesa cautions any business, but particularity organizations in these sectors, to be very cautious if they receive any emails requesting information regarding W-2 forms, earning summaries or any other employee sensitive information. In many cases these emails look like they originated from a high level employee and are sent to other high level, human resources or payroll department employees.

We have included a link to the most recent release from the IRS concerning this issue. Please review it and call us if you have any questions.

Dangerous W-2 Phishing Scam Evolving; Targeting Schools, Restaurants, Hospitals, Tribal Groups and Others

Published February 2, 2017

www.irs.gov/uac/dangerous-w-2-phishing-scam-evolving-targeting-schools-restaurants-hospitals-tribal-groups-and-others

Court Case Endangers State Workers' Comp System

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

Seal of the Supreme Court of California

The Independent Insurance Agents & Brokers of California's (IIABCal) Legislative Update, a compilation of reports produced by IIABCal Lobbyist John Norwood of Norwood & Associates, recently published an update on the possible effects of a court case on the Workers' Compensation System.

Below is an excerpt from the February 6, 2017 Legislative Update article:

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

The brief in King v. CompPartners, Inc argues that the appellate court incorrectly found that utilization review doctors - those who look at records to decide whether a worker's treatment was appropriate, but do not examine the patient personally - have established a physician-patient relationship and therefore owe a duty of care to the injured workers.

Major Implications

If allowed to stand, the decision will create extensive future litigation and can be expected to increase costs that will put upward pressure on malpractice premium rates for all physicians, and have a chilling effect on utilization review physicians, according to the CalChamber.

Establishing potentially unlimited liability for utilization review physicians will potentially lead to higher premiums for employers and could drive future and existing business away from California.

The case also will determine whether medical malpractice claims against utilization review doctors are barred, because all workers' compensation claims are under the purview of the state Division of Workers Compensation. National and statewide insurer groups joined the CalChamber on the brief.