Industry News

The Critical Importance of Nonprofit Executive Transition Planning

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

In the world of nonprofit management, the departure of an executive director can cause a time of uncertainty. This kind of challenge is why all nonprofits need a well-crafted executive transition plan. This plan is not just a roadmap for navigating the change in leadership but a tool for sustaining and growing the nonprofit's mission. In this article, we will dive into the importance of having an executive transition plan, the key components that make up an effective plan, and the benefits it brings to the nonprofit sector.

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

In the world of nonprofit management, the departure of an executive director can cause a time of uncertainty. This kind of challenge is why all nonprofits need a well-crafted executive transition plan. This plan is not just a roadmap for navigating the change in leadership but a tool for sustaining and growing the nonprofit's mission. In this article, we will dive into the importance of having an executive transition plan, the key components that make up an effective plan, and the benefits it brings to the nonprofit sector.

Understanding the Role of the Executive Director

The executive director's role is crucial in shaping the nonprofit's direction, culture, and public image. These leaders have many roles from strategic planning and fundraising to staff morale and community engagement. Therefore, the departure of an executive can leave a void that is difficult to fill without a transition plan in place.

A well thought out executive transition plan begins with a deep understanding of the executive director role within their nonprofit. It involves evaluating the organization's current needs, future plans, and the specific qualities in a new leader that will allow them to successfully fulfil the nonprofit’s mission moving forward.

Alignment and Visioning

The next step is to make sure that the organization’s future plans align with the board’s vision. In order for the organization to continue to be successful, everyone needs to be on the same page and have a deep understanding of the organization’s goals.

Developing a transition plan that is prepared for different types of departures like planned, unplanned, or strategic, shows your level of preparedness. Whether the transition is expected or sudden, having a clear plan in place minimizes disruptions and allows the organization to focus on its mission.

Cultivating Internal Leadership

One of the plan's key components is the focus on internal leadership development. By identifying and training potential future executives within the organization, this will create qualified employees ready to step into a leadership role when needed. Also, internal employees bring a deeper understanding of the nonprofit’s culture and operations, making the transition period much smoother than hiring from outside the organization.

The Search for New Leadership

Finding the right executive to guide the nonprofit through its next phase is the most important part of the transition plan. This process involves setting clear criteria for the ideal candidate, conducting a thorough search, and the selection process itself. The plan should outline the steps for advertising the position, screening candidates, and holding interviews, while keeping the organization’s mission on the forefront.

Also, finalizing the transition does not simply involve the selection of a new executive director but also ensures that they are fully integrated into the organization. This would involve a detailed onboarding process where the new leader is introduced to the team and understands the nonprofit's operations.

The importance of having a comprehensive executive transition plan cannot be overstated for nonprofits. By thoroughly understanding the role of the executive director, aligning the transition with the nonprofit's vision, cultivating internal leaders, selecting and integrating a new leader, nonprofit organizations can successfully navigate the executive transition with confidence and ease. This approach not only protects the organization's mission during times of change but also sets it up for future success.

With a strong presence representing the insurance needs of nonprofits throughout California, Rancho Mesa prides itself on understanding both the risk management and operational components within this important space. For questions on this article or to learn more about how Rancho Mesa can help your organization, contact me at jmarrs@ranchomesa.com or (619) 486-6569.

Resources

https://alysterling.com/nonprofit-executive-director-transition/

https://www.philanthropy.com/article/the-great-nonprofit-leadership-turnover

https://boardsource.org/fundamental-topics-of-nonprofit-board-service/executive-transition/

https://buildingmovement.org/reports/the-leadership-in-leaving/

Risk Bow Tie Exercise

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Rancho Mesa’s non-profit clients successfully serve their communities in changing economic and political climates. In part, their success is due to managing risk for an organization’s employees, clients, finances, and mission. Just as important, but less discussed than risk management, is risk analysis. This article offers one helpful tool non-profit leaders can use to facilitate risk analysis, the Risk Bow Tie Exercise.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Rancho Mesa’s non-profit clients successfully serve their communities in changing economic and political climates. In part, their success is due to managing risk for an organization’s employees, clients, finances, and mission. Just as important, but less discussed than risk management, is risk analysis. This article offers one helpful tool non-profit leaders can use to facilitate risk analysis, the Risk Bow Tie Exercise.

Introduced to Rancho Mesa by the Nonprofit Risk Management Center’s book World-Class Risk Management for Nonprofits, the Risk Bow Tie technique helps nonprofit leaders consider an event’s positive and negative consequences in a group setting. Following the exercise, participants may feel empowered to utilize the technique in multiple departments to analyze both expected and unexpected events.

The five steps of the bow tie exercise include:

Identify a potential event.

Identify some of the underlying conditions that make the event more or less likely, more or less impactful, and more or less urgent.

Identify some of the consequences or ripple effects, both positive and negative, should the risk materialize.

Identify preventative risk management steps or controls that could make the event less likely or less detrimental.

Identify risk management steps or controls that could be planned now, but implemented after the event has occurred, to reduce the potential negative consequences.

The image below, from page 152 of World-Class Risk Management for Nonprofits, is a sample Bow Tie Worksheet.

Risk Bow Ties Worksheet image provided by World-Class Risk Management for Nonprofits.

Performing the exercise in a workshop or group setting will usually provide one or more of the following insights:

The group uncovers details of an event that had not previously been discussed or observed.

Both positive and negative consequences can result from one event.

The exercise brings to light unique perspectives and experiences from multiple participants.

Identifying important underlying conditions and consequences better informs the creation of relevant controls.

Team members can perform a risk analysis in a fun, accessible and informal way.

Nonprofit leaders can use a diverse set of tools to analyze and manage risk. Rancho Mesa encourages clients to ask about various tools we have available to prepare for both the expected and unexpected.

To learn more about the Risk Bow Tie technique contact me at sbrown@ranchomesa.com or (619) 937-0175.

California Non-Profits Brace for Higher Insurance Premiums and Dramatic Changes to Coverage

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

For years, the insurance marketplace for non-profits, specifically general liability, abuse, property and management liability have been somewhat stable (subject to loss history, of course). Unfortunately, that is looking to change as the marketplace braces for significant correction.

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

For years, the insurance marketplace for non-profits, specifically general liability, abuse, property and management liability have been somewhat stable (subject to loss history, of course). Unfortunately, that is looking to change as the marketplace braces for significant correction.

The key drivers of change:

2018 Wildfire Season

An estimated $12 Billion in losses has forced carriers to offset those losses with higher premiums, regardless of the amount of property exposure. Reinsurance markets (insurance for insurance companies when a loss becomes catastrophic) suffered significant losses, as well, and have had to increase their rates on the insurance companies they insure.Increase in Harassment/Discrimination Claims

Though the exact reason is unknown, many point to the #MeToo movement as the reason for more than double the harassment and discrimination claims that have occurred the last three years. We have already seen significant increases not only to premiums, but also deductibles.Incoming Influx of Abuse Claims

With changes to California law, insurers expect an uptick in claims beginning January 2020 when the statute of limitations will be lifted for reporting child abuse. We expect to see significant increases in premium as well as coverage being reduced or even eliminated in some scenarios.

What can you do to help your organization? Get out ahead of it early and be prepared to sell your organization to the marketplace. The insurance carriers will need to have a clear picture of what your organization is doing to be different when compared to the organizations that are causing the losses. It may seem like a lot of information to present to a carrier, but failure to do so will lead to increased costs for your organization.

Contact Rancho Mesa Insurance at (619) 937-0164 if you would like to discuss how these changes may affect your organization.

OSHA Offers Grant Programs to Nonprofits

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Nonprofit leaders who want to make workplace safety training more accessible may be surprised to learn about a unique grant program through the Occupational Safety and Health Administration (OSHA). Since 1978, OSHA has offered grants to nonprofit organizations for safety training. Specifically, grants are awarded on a competitive basis to provide employees with training on the recognition and prevention of safety/health hazards in the workplace. The intent of the program is to reach audiences who might not otherwise receive safety training.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Nonprofit leaders who want to make workplace safety training more accessible may be surprised to learn about a unique grant program through the Occupational Safety and Health Administration (OSHA).

Since 1978, OSHA has offered grants to nonprofit organizations for safety training. Specifically, grants are awarded on a competitive basis to provide employees with training on the recognition and prevention of safety/health hazards in the workplace. The intent of the program is to reach audiences who might not otherwise receive safety training. OSHA renamed the program the Susan Harwood Training Grant Program, in 1997.

Grant applications in the past have typically fallen into three categories:

Capacity Building: OSHA awards these grants to help an organization grow or build its capacity to provide safety and health training to target audiences; small business employees, hard-to-reach or low-literacy workers, and workers in vulnerable and high-hazard industries.

Targeted Topic: These grants focus on occupational safety and health hazards associated with one of the OSHA selected training topics.

Training Materials Development: Grantees develop training materials on one of the OSHA selected training topics.

Although state or local government agencies are not eligible to apply, nonprofit organizations, including qualifying community and faith-based organizations, employer associations, and labor unions may submit applications.

The Harwood solicitation for grant applications can be found on the government-wide Grants.gov website.

3 Ways for Nonprofits to Opt Out of Unemployment Tax

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Nonprofit leaders who want to reduce overhead and tax burdens should consider revisiting their organizations’ unemployment tax status. More to the point, thanks to the Federal Unemployment Tax Act of 1972, nonprofits can eliminate the unemployment insurance tax and outsource the headache of claims administration. Let’s investigate further.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Nonprofit leaders who want to reduce overhead and tax burdens should consider revisiting their organizations’ unemployment tax status. More to the point, thanks to the Federal Unemployment Tax Act of 1972, nonprofits can eliminate the unemployment insurance tax and outsource the headache of claims administration. Let’s investigate further.

Traditionally, the state charges a nonprofit employer payroll tax to fund the state unemployment insurance program. Each nonprofit’s tax rate adjusts each year depending on employee turnover and unemployment claims. According to several sources, nonprofits pay an average of $2.00 in taxes for every $1.00 in paid claims. So how do we reduce this overage?

Now for the good news; nonprofits are not required to pay the state unemployment tax. Provision 3309a of the Federal Unemployment Tax Act allows 501(c)(3)s to choose whether to pay into the state program at the prescribed tax rate, or to pay into the program an amount equal to the actual unemployment benefits paid out by the state program. In other words, a nonprofit employer may “opt out” and reimburse the state.

Below are three “opt out” and administrative solutions a nonprofit should consider depending on its desired level of risk.

First Dollar Insurance: A private insurance company provides a fixed rate based on the nonprofit’s individual claims history and expected future claims. This option provides budgetary certainty with a low-risk product. If unemployment claims exceed expectations, there is no additional cost to the employer.

Customized Stop-Loss Insurance: For nonprofit leaders who want to accept more risk and realize higher savings, the employer pays an agreed upon self-insured retention, after which point the insurance company pays all benefits.

Nonprofit Unemployment Trust: For nonprofit organizations with high employee retention or low unemployment claims frequency, a trust can offer a high return in exchange for higher risk. In most cases, the trust protects the employer against unexpected, catastrophic charges. The nonprofit employer has a high retention that must be met before the protection is triggered.

Each solution presented above provides services to further reduce risk and unemployment expenses. These services include claims management, hearing representation, unemployment cost management training, and transparent billing and accounting.

Whether the nonprofit pays unemployment taxes or reimburses the state, there are advantages and disadvantages. Nonprofit leaders who understand these details and the nuances of each solution will have the confidence to move forward in the direction that best suits the organization.

Four Factors When Developing a Nonprofit Agency's Youth Protection Plan

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

In A Season of Hope, authored by the staff at the Nonprofit Risk Management Center, the authors refer to these interlocking factors as the “Four P’s: Personnel, Participants, Program, and Premises. Let’s explore:

Staffing

The nature of the services offered to youth will dictate the staff’s professional background and education. Those nonprofits offering therapy and counseling will aim to hire employees with advanced degrees; whereas, some programs may feel comfortable hiring responsible teens and young adults. In each case, supervision and background checks are vital to client safety.

Participant Mix

Is the agency serving a pre-school program for kids who are relatively close in age with similar needs? Or, perhaps, it is a group home involving minors who all have differing special needs due to their unique family situations and backgrounds. What unique risks to the organization does each group present? Considering the characteristics of a nonprofit’s youth clientele will shape an organization’s approach to youth protection.

Program and Mission

An organization must consider how its mission and programs will impact youth safety. A nonprofit conducting group outings to encourage social behavior will not have the same concerns as an organization matching children with foster families. Each will present unique exposures.

Environment

Nonprofits serve youth in a wide range of venues and environments, and each present different risks. The variables can include supervision, activities at height, access to emergency care, and sleeping arrangements. Knowing this, it is vital for an organization’s leaders to identify how a venue presents risk to youth safety and then plan accordingly.

“My Risk Assessment” is a very strong tool available through Rancho Mesa Insurance Services. This interactive module allows nonprofit leaders to identify potential gaps in risk management in a number of areas, including client safety, transportation, and facilities.

Keeping young clients safe while in a nonprofit’s care is a core promise of the organization to the community. When nonprofit leaders take a careful look at the four P's, they can reduce the risk of harm while also ensuring the mission endures.

Please contact Rancho Mesa at (619) 937-0164 to learn more about sound risk management practices.

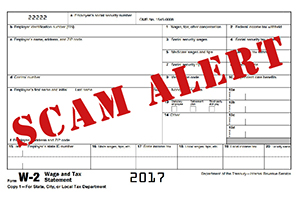

W-2 Phishing Scam – New Potential Risk to Nonprofits – Be Aware!!

There has been a recent increase in attempts of a phishing scams involving W2s in nonprofit, schools and other human services organizations. We caution any business, but particularity organizations in these sectors to be very cautious if they receive any emails requesting information regarding W2’s, earning summaries or any other employee sensitive information. In many cases these emails look like they originate from a high level employee and are sent to other high level, human resources or payroll department employees.

It has come to our attention that there has been a recent increase in attempts of phishing scams involving W-2 forms in nonprofit, schools and other human services organizations.

Rancho Mesa cautions any business, but particularity organizations in these sectors, to be very cautious if they receive any emails requesting information regarding W-2 forms, earning summaries or any other employee sensitive information. In many cases these emails look like they originated from a high level employee and are sent to other high level, human resources or payroll department employees.

We have included a link to the most recent release from the IRS concerning this issue. Please review it and call us if you have any questions.

Dangerous W-2 Phishing Scam Evolving; Targeting Schools, Restaurants, Hospitals, Tribal Groups and Others

Published February 2, 2017

www.irs.gov/uac/dangerous-w-2-phishing-scam-evolving-targeting-schools-restaurants-hospitals-tribal-groups-and-others