Industry News

Changes on Horizon Likely to Affect Workers’ Compensation

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Changes by the WICRB typically take place at the first of every year and can impact workers’ compensation Pure Premium Rates, Expected Loss Rates (ELR) and Wage Thresholds. However, the WCIRB has amended its filing schedule in 2021 to take effect September 1st.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Businesses in California have become accustomed to many changes in legislation and the filings from the Workers’ Compensation Insurance Rating Bureau (WCIRB).

Changes by the WICRB typically take place at the first of every year and can impact workers’ compensation Pure Premium Rates, Expected Loss Rates (ELR) and Wage Thresholds. However, the WCIRB has amended its filing schedule in 2021 to take effect September 1st.

Below are key changes that businesses should be aware of that can alter Experience Modification Rates (ExMod) and workers’ compensation renewal pricing.

Assembly Bill 1465

The proposed Assembly Bill 1465 (AB 1465) could have significant impact on workers’ compensation rates in the years to come. If passed, AB 1465 will establish the California Medical Provider Network (CAMPN), a broad and largely unregulated network run entirely by the state that would apply to the workers’ compensation system. All licensed physicians in good standing who elect to treat injured workers will be included in the network. Injured workers can choose any provider within the network and can transfer among providers multiple times without any limitation.

If this bill passes and a CAMPN is created, employers can anticipate:

Doctor shopping by injured workers and attorneys;

Increase in temporary disability and time to return to work;

Increase in permanent disability ratings;

Overall increase in medical costs per claim;

Poorer quality medical reports due to fewer controls and less oversight.

Workers’ Compensation Rates

The WCIRB recently proposed a 2.7% workers’ compensation rate increase, effective 9/1/2021. This would be the first rate increase since 2015. Updated fee schedules for med-legal review reports and physician office visits are what is driving this potential increase.

Expected Loss Rates

A characteristic of a Best Practice business is their focus on managing their ExMod. In simple terms, if a business’s ELR increases, it will have a positive effect on their ExMod. Conversely, if their industry’s ELR decreases, it will have a negative effect. While understanding what an ELR is and how it can specifically impact your ExMod is critical, this should be something your insurance advisor is explaining to you and projecting the impact it will have on your ExMod and ultimately your insurance premium.

To put this information at our clients’ finger tips, we have created a Key Performance Indicator (KPI) dashboard to not only show the impact of any changes in the ELR but also provide other key indicators like industry benchmarking, claim trending, and many other critical factors. Request your customized KPI dashboard.

To stay up to date with these topics and related insurance news, subscribe to our weekly safety and risk management newsletter and podcast. Or, contact me directly at (619) 937-0167 or sclayton@ranchomesa.com to discuss how your company may be affected.

California’s Landscape Industry Prepares for Ex-Mod Changes

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

For the first time in several years the Expected Loss Rate for class code 0042 has increased from $2.38 to $2.42, a 2% increase.

Bottom line, although very minimal, this should help bring the experience mod down.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

For the first time in several years the Expected Loss Rate for class code 0042 has increased from $2.38 to $2.42, a 2% increase.

Bottom line, although very minimal, this should help bring the experience mod down.

This information will impact any landscape company who has a policy effective date of September 1, 2021 and beyond.

Based on a couple of projection comparisons, we have seen an impact of 1 to 4 points come off the experience mod for landscape companies.

Landscape companies working with Rancho Mesa with policy effective dates after 9/1/2021 will see updated information on their KPI Dashboard, at the next review.

For landscape companies not working with Rancho Mesa, you can request a custom KPI Dashboard today by reaching out to Drew Garcia.

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

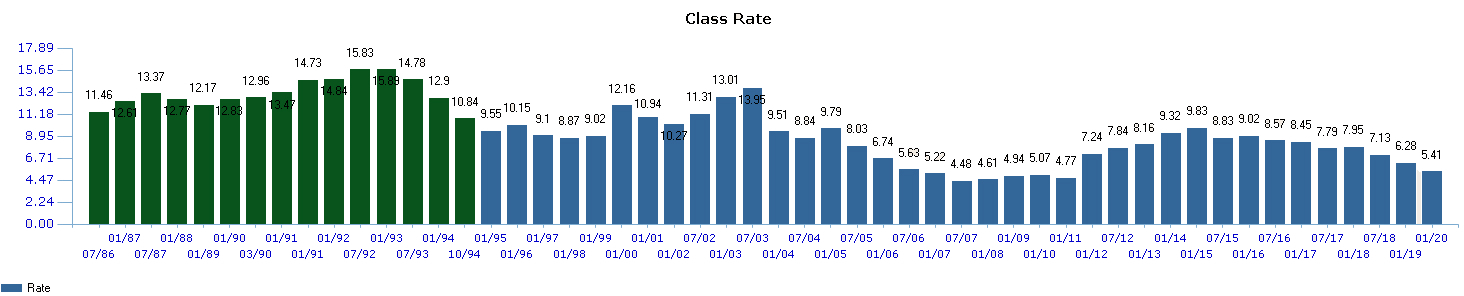

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

Post COVID-19 XMODs Threaten a Double Whammy

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Whammy #1 - Lower Payrolls

With the economy screeching to a halt in March of this year due to the shelter in place restrictions, payrolls and employee counts have been dramatically reduced. Since the XMOD calculation is based on a rolling three years of payroll and claims, should the year dropping out of the calculation have larger payrolls than the year entering and assuming the same claim amounts for each year, the XMOD would increase.

Whammy #2 – Lower Expected Loss Rates (ELR)

ELRs are the factors used to anticipate a class code’s claim cost per $100 for the experience rating period. Stated simply, it’s a rate per, $100 of payroll by class code that projects the claim amounts the WCIRB believes should occur for that class code. Thus, should ELRs decrease; it would have the effect, given no change in the claims, of raising the XMOD.

California businesses should pay close attention to their individual ELRs as the WCIRB annually recommends updated rates during their June regulatory filing period. The 2021 rates were recently proposed on June 25, 2020 by the WCIRB and will be waiting approval in September by Insurance Commissioner Ricardo Lara.

Below is a breakdown of the 2021 proposed ELRs by class code with notable double digit increases highlighted:

2021 Proposed ELRs

| Class Code | 2020 ELRs | 2021 Proposed ELRs | Increase/Decrease % |

|---|---|---|---|

| 3724 Solar/Millwright | 1.74 | 1.81 | 4% |

| 5187 Plumbing > $28 | 1.18 | 1.13 | -4% |

| 5183 Plumbing < $28 | 2.6 | 2.6 | 0% |

| 5542 Sheet Metal > $27 | 1.4 | 1.35 | -3% |

| 5538 Sheet Metal < $27 | 2.3 | 2.39 | -12% |

| 6258 Foundation Prep | 2.65 | 2.48 | 2% |

| 0042 Landscape Gardening | 2.59 | 2.38 | -8% |

| 0106 Tree Pruning | 3.91 | 4.11 | 5% |

| 5140 Electrical Wiring > $23 | 0.81 | 0.73 | -10% |

| 5190 Electrical Wiring < $23 | 1.89 | 1.82 | -4% |

| 5470 Glaziers > $33 | 1.63 | 1.81 | 11% |

| 5467 Glaziers < $33 | 4.3 | 3.81 | -11% |

| 5028 Masonry > $28 | 2.17 | 2.13 | -1.8% |

| 5027 Masonry < $28 | 4.73 | 4.03 | -14% |

| 5482 Painting/ Waterproofing > $28 | 1.42 | 1.57 | 10% |

| 5474 Painting/ Waterproofing < $28 | 3.68 | 4.08 | 10% |

| 5186 Automatic Sprinkler Install > $29 | 1.11 | 1.14 | 3% |

| 5185 Automatic Sprinkler Install < $29 | 2.45 | 2.2 | -10% |

| 5205 Concrete/Cement work > $28 | 1.95 | 1.71 | -12% |

| 5201 Concrete/Cement work < $28 | 3.95 | 3.45 | -12% |

| 5432 Carpentry > $35 | 2.01 | 2.05 | 2% |

| 5403 Carpentry < $35 | 5.27 | 4.91 | -7% |

| 5447 Wallboard Application > $36 | 1.34 | 1.14 | -14% |

| 5446 Wallboard Application < $36 | 2.76 | 2.67 | -3% |

| 5485 Plastering or Stucco >$32 | 2.66 | 2.55 | -4% |

| 5484 Plastering or Stucco < $32 | 4.78 | 4.41 | -8% |

| 5443 Lathing | 2.37 | 2.23 | -6% |

| 5553 Roofing > $27 | 3.9 | 3.89 | -2% |

| 5552 Roofing < $27 | 9.85 | 9.23 | -6% |

| 6220 Excavation/Grading > $34 | 1.24 | 1.08 | -12% |

| 6218 Excavation/Grading < $34 | 2.34 | 2.59 | 10% |

| 5436 Hardwood Flooring | 2.03 | 2.01 | -1% |

| 3066 Sheet Metal Prod Mfg. | 1.94 | 2.00 | 3% |

| 8018 Stores - Wholesale | 2.67 | 2.81 | 5% |

| 8804 Shelter/Social Rehab | 1.25 | 1.30 | 4% |

| 8827 Hospice and Homecare | 1.72 | 1.54 | -10% |

| 9059 Childcare | 0.99 | 1.07 | 8% |

| 8834 Physicians | 0.34 | 0.34 | 0% |

| 8868 Colleges/ Professors Private-Teachers | 0.36 | 0.37 | 3% |

| 9101 Colleges/Schools Private-Other | 2.50 | 2.13 | -14% |

Should Commissioner Lara approve the ELR changes in September, a majority of class codes will be seeing a decrease which can lead to higher XMOD’s in many cases. That possibility, combined with lower incoming payrolls, requires proactive risk mitigation, claim management and detailed planning with your broker.

If you are seeking a partner with the tools to address these needs, please reach out to Kevin Howard at Rancho Mesa Insurance Services, Inc. at (619) 438-6874.

Contractors Brace for Impact of 2020 Expected Loss Rates

Author, Kevin Howard, CRIS, Account Executive, Rancho Mesa Insurance Services, Inc.

California contractors focused on their experience modification are paying close attention to the soon to be published 2020 Expected Loss Rates (ELRs).

Author, Kevin Howard, CRIS, Account Executive, Rancho Mesa Insurance Services, Inc.

California contractors focused on their experience modification are paying close attention to the soon to be published 2020 Expected Loss Rates (ELRs).

ELRs determine the expected claim cost per $100 in pay roll for each class code during an Experience Modification (Ex-Mod) period. These rates are updated annually. The 2020 rates were recently approved on September 5, 2019. Changes in each specific class code’s ELR can positively or negatively impact a contractor’s Ex-Mod calculation.

In a nutshell, if an expected loss rate drops from one year to another with no material changes to payroll or claims, Ex-Mod’s will increase. Additionally, if an expected loss rate increases, Ex-Mod’s will decrease using the same example.

Below is a breakdown of the 2020 ELRs per class code with notable double digit increases highlighted:

| Class Code | 2020 ELR | Increase/Decrease % |

|---|---|---|

| 3724 Solar/ Millwright | 1.74 | -4% |

| 5187 Plumbing > $28 | 1.18 | -8% |

| 5183 Plumbing < $28 | 2.6 | -5% |

| 5542 Sheet Metal > $27 | 1.40 | -4% |

| 5538 Sheet Metal < $27 | 2.30 | -12% |

| 6258 Foundation Prep | 2.65 | -3% |

| 0042 Landscape Gardening | 2.59 | -15% |

| 0106 Tree Pruning | 3.91 | -21% |

| 5140 Electrical Wiring > $23 | .81 | -6% |

| 5190 Electrical Wiring < $23 | 1.89 | +2% |

| 5470 Glaziers > $33 | 1.63 | +7% |

| 5467 Glaziers < $33 | 4.30 | -2% |

| 5028 Masonry > $28 | 2.17 | -9% |

| 5027 Masonry < $28 | 4.73 | -18% |

| 5482 Painting/ Waterproofing > $28 | 1.42 | -15% |

| 5474 Painting/ Waterproofing < $28 | 3.68 | -7% |

| 5186 Automatic Sprinkler Install > $29 | 1.11 | +5% |

| 5185 Automatic Sprinkler Install < $29 | 2.45 | -18% |

| 5205 Concrete/Cement work > $28 | 1.95 | -5% |

| 5201 Concrete/Cement work < $28 | 3.95 | -4% |

| 5432 Carpentry > $35 | 2.01 | -7% |

| 5403 Carpentry < $35 | 5.27 | -9% |

| 5447 Wallboard Application > $36 | 1.34 | -12% |

| 5446 Wallboard Application < $36 | 2.76 | -21% |

| 5485 Plastering or Stucco >$32 | 2.66 | -6% |

| 5484 Plastering or Stucco < $32 | 4.78 | -27% |

| 5443 Lathing | 2.37 | -18% |

| 5553 Roofing > $27 | 3.90 | -14% |

| 5552 Roofing < $27 | 9.85 | -4% |

| 6220 Excavation/Grading > $34 | 1.24 | -24% |

| 6218 Excavation/Grading < $34 | 2.34 | -5% |

The data above shows that a majority of class codes will be seeing a decrease in ELRs which will cause higher Ex-Mods in many cases. That reality creates a heightened need for loss control, claim management and post claim strategies. If you are seeking a partner with the tools to address these needs, please reach out to Rancho Mesa Insurance and our team of professionals at (619) 438-6874.